Bank Reconciliation Statement (Part - 2) - Commerce PDF Download

Question 9:

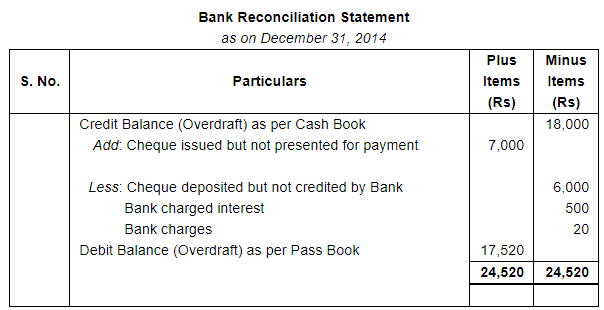

On 31st December, 2014 the Cash Book of Basu showed an overdraft of ₹ 18,000 with the Bank of India. The balance did not agree with balance as shown by the Bank Pass Book and you find that Basu had paid into the Bank on 26th December four cheques for ₹ 10,000; ₹ 12,000; ₹ 6,000 and ₹ 8,000. Of these the cheque for ₹ 6,000 was credited by the bank in January, 2015. Basu had issued on 24th December three cheques for ₹ 15,000, ₹ 12,000, and ₹ 7,000. The first two cheques were presented to the bank for payment in December and the third in January, 2015.

You also find that on 31st December, 2014, the bank had debited Basu's Account for ₹ 500 for interest and ₹ 20 for charges but Basu has not recorded these amounts in his books.

You are required to prepare a Bank Reconciliation Statement as on 31st December, 2014 and ascertain the balance as per bank Pass Book.

ANSWER:

Page No 15.31:

Question 10:

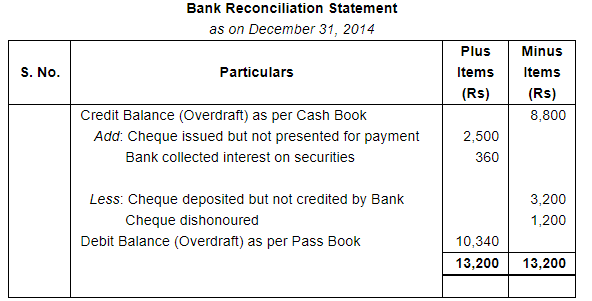

On 31st December, 2014 my Cash Book showed a credit balance of ₹ 8,800. I had paid into Bank three cheques amounting to ₹ 6,000 on 24th December of which I found ₹ 3,200 have been credited in the Pass Book under date 5th January 2015. I had issued cheques amounting to ₹ 8,000 before 31st December of which I found ₹ 2,500 have been debited in the Pass Book after 1st January 2015. I find a debit of ₹ 50 in respect of bank charges in the Pass Book which I have adjusted in the Cash Book on 31st Dec. There is a credit of ₹ 360 for interest on securities in the Pass Book which remains to be adjusted. A cheque of ₹ 1,200 deposited into bank has been dishonoured.

Prepare Bank Reconciliation Statement as on 31st Dec. 2014.

ANSWER:

Page No 15.31:

Question 11:

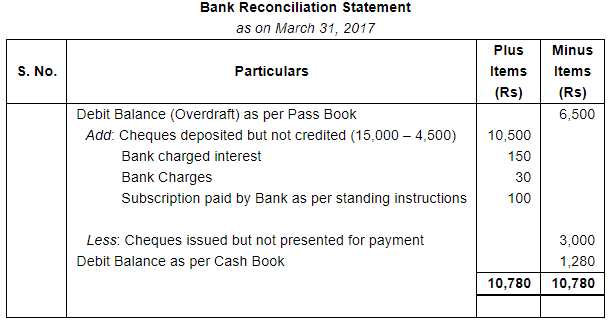

My bank Pass Book showed an overdraft of ₹ 6,500 on 31st March, 2017. This does not agree with the Cash Book balance. From the following particulars ascertain the Cash Book balance:-

Cheques amounting to ₹ 15,000 were paid into bank in March, out of which, it appears, only cheques amounting to ₹ 4,500 were credited by bank. Cheques issued during March amounted in all to ₹ 11,000. Out of these cheques for ₹ 3,000 were unpaid on 31st March, 2017. The Pass Book stands debited with ₹ 150 for interest and with ₹ 30 for bank charges. The bank had paid the annual subscription of ₹ 100 to my club according to my instructions. The entries for interest, bank charges and subscription have not yet been made in Cash Book.

ANSWER:

Page No 15.31:

Question 12:

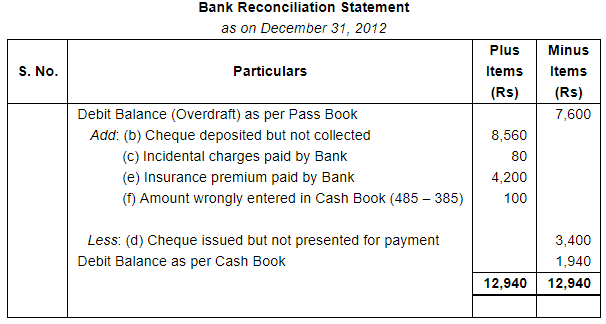

Prepare the Bank Reconciliation Statement from the following particulars for the period ending 31st December, 2012.

(a) Overdraft as per Pass Book on 31-12-2012 ₹ 7,600.

(b) Cheques deposited but not collected by the bank ₹ 8,560.

(c) Incidental charges not recorded in Cash Book ₹ 80.

(d) Cheques were issued for ₹ 7,800 but only ₹ 4,400 were presented for payment.

(e) Insurance premium paid by bank not recorded in the Cash Book ₹ 4,200.

(f) On 31st December, 2012 cash was deposited in bank ₹ 385 but the cashier debited the bank column with ₹ 485 by mistake.

ANSWER:

Page No 15.31:

Question 13:

Prepare a Bank Reconciliation Statement from the following particulars:-

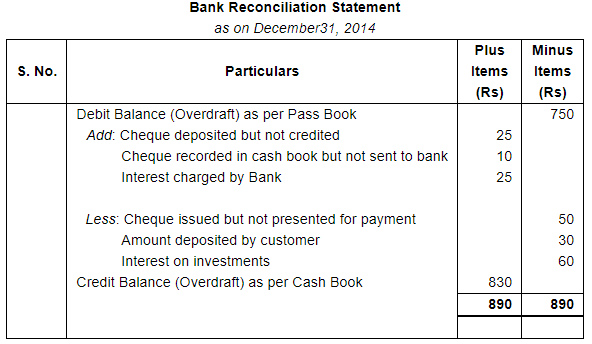

On 31st December 2014, I had an overdraft of ₹ 750 as shown by my Pass Book. I had issued cheques amounting to ₹ 250 of which ₹ 200 worth only seem to have been presented for payment. Cheques amounting to ₹ 100 had been paid in by me on 30th December, but of these only ₹ 75 were credited in the Pass Book. I also find that a cheque for ₹ 10 which I had debited to bank account in my books has been omitted to be banked. There is a debit of ₹ 25 in my Pass Book for interest.

An entry of ₹ 30 of a payment by a customer direct into the bank appears in the Pass Book. My Pass Book also shows a credit of ₹ 60 to my account for interest on investments directly collected by my bankers.

ANSWER:

Page No 15.32:

Question 14:

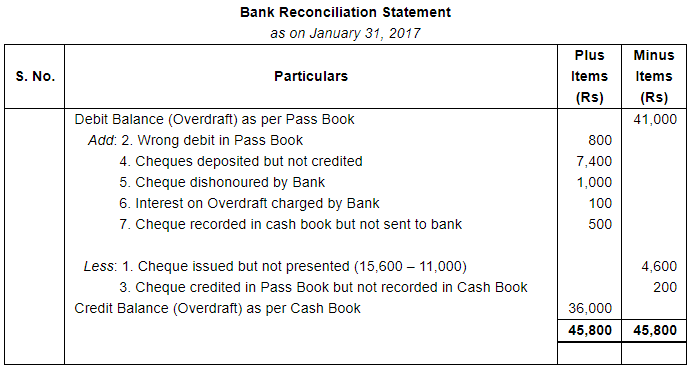

On 31st January, 2017 the Pass Book of Shri M.L. Gupta shows a debit balance of ₹ 41,000. Prepare a bank reconciliation statement from the following particulars:-

1. Cheques amounting to ₹ 15,600 were drawn on 27th January, 2017. Out of which cheques for ₹ 11,000 were encashed up to 31-1-2017.

2. A wrong debit of ₹ 800 has been given by the bank in the Pass Book.

3. A cheque for ₹ 200 was credited in the Pass Book but was not recorded in the Cash Book.

4. Cheques amounting to ₹ 21,000 were deposited for collection. But out of these, cheques for ₹ 7,400 have been credited in the Pass Book on 5th February, 2017.

5. A cheque for ₹ 1,000 was returned dishonoured by the bank and was debited in the Pass Book only.

6. Interest on overdraft and bank charges amounting to ₹ 100 were not entered in the Cash Book.

7. A cheque of ₹ 500 debited in the Cash Book omitted to be banked.

ANSWER:

Page No 15.32:

Question 15:

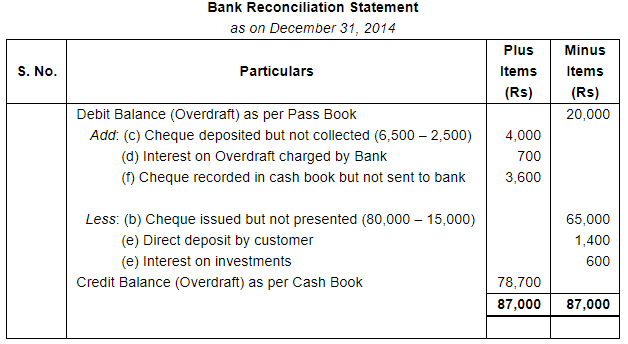

Prepare a Bank Reconciliation Statement on 31 December, 2014 from the following particulars:-

(a) A's overdraft as per Pass Book ₹ 20,000 as at 31st Dec.

(b) On 30th December, cheques had been issued for ₹ 80,000, of which cheques worth ₹ 15,000 only had been encashed up to 31st December.

(c) Cheques amounting to ₹ 6,500 had been paid into the bank for collection but of these only ₹ 2,500 had been credited in the Pass Book.

(d) The bank has charged ₹ 700 as interest on overdraft and the intimation of which has been received on 2nd January 2015.

(e) The Bank Pass Book shows credit for ₹ 2,000 representing ₹ 1,400 paid by debtor of A direct into the bank and ₹ 600 collected direct by bank in respect of interest on A,s investment. A had no knowledge of these items.

(f) A cheque for ₹ 3,600 has been debited in bank column of Cash Book by A, but it was not sent to bank at all.

ANSWER:

Page No 15.32:

Question 16:

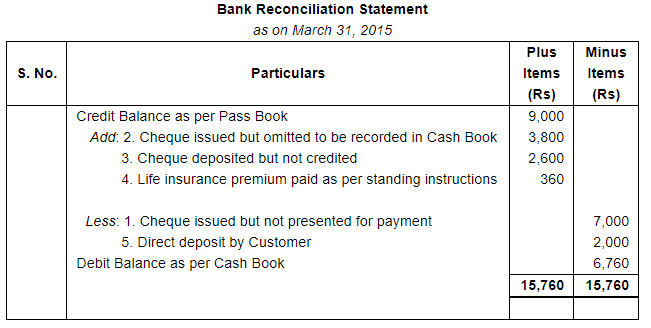

On 31st March, 2015 the Pass Book shows a credit balance of ₹ 9,000. Prepare a Bank Reconciliation Statement from the following particulars:-

| ₹ | |

| 1. Cheques issued but not yet presented for payment | 7,000 |

| 2. Cheques issued but omitted to be recorded in the Cash Book | 3,800 |

| 3. Cheques paid into bank but not yet collected by the bank | 2,600 |

| 4. Premium on Life Policy paid by the bank on standing advice | 360 |

| 5. Payments received from customers direct by the bank | 2,000 |

ANSWER:

Page No 15.33:

Question 17:

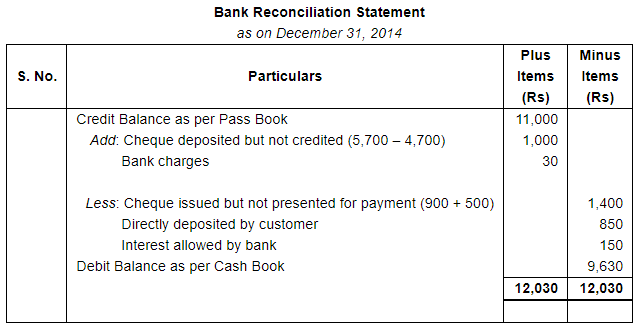

From the following particulars, prepare a Bank Reconciliation Statement of Sh. Yadav on 31st December 2014:-

Balance as per Pass Book on 31st December, 2014 is ₹ 11,000. Cheques for ₹ 6,200 were issued during the month of December but of these cheques for ₹ 900 were presented in the month of January, 2015 and one cheque for ₹ 500 was not presented for payment. Cheque and cash amounting to ₹ 5,700 were deposited in bank during December but credit was given for ₹ 4,700 only. A customer had deposited ₹ 850 into the bank directly. The bank has credited the merchant for ₹ 150 as interest and has debited him for ₹ 30 as bank charges, for which there are no corresponding entries in Cash Book.

ANSWER:

FAQs on Bank Reconciliation Statement (Part - 2) - Commerce

| 1. What is a bank reconciliation statement? |  |

| 2. Why is a bank reconciliation statement important? |  |

| 3. What are the steps involved in preparing a bank reconciliation statement? |  |

| 4. Can a bank reconciliation statement help detect fraud? |  |

| 5. How often should a bank reconciliation statement be prepared? |  |