Bank Reconciliation Statement (Part - 4) - Commerce PDF Download

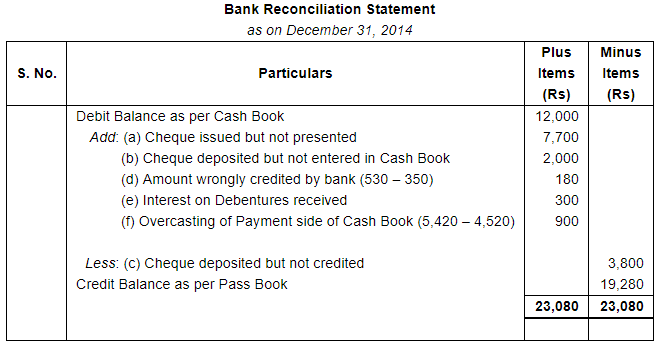

Page No 15.36:

Question 26:

On 31st December, 2014 the Cash Book of Gopal showed debit balance of ₹ 12,000. On comparing the Cash Book with the Pass Book, the following discrepancies were noted:-

(a) Cheques were issued for ₹ 15,000, but of them cheques for ₹ 7,700 have not yet been presented.

(b) Cheques for ₹ 8,000 were deposited in bank but of these cheques for ₹ 2,000 were not recorded in the Cash Book.

(c) Cheques deposited in bank but not credited ₹ 3,800.

(d) A cheque for ₹ 350 was paid into bank but bank credited the amount with ₹ 530 by mistake.

(e) Bank received interest on debentures on behalf of Gopal amounting to ₹ 300.

(f) It was also found that the total of one page on the payment side of the Cash Book was ₹ 4,520 but it was written on the next page as ₹ 5,420.

Prepare a Bank Reconciliation Statement.

ANSWER:

Page No 15.37:

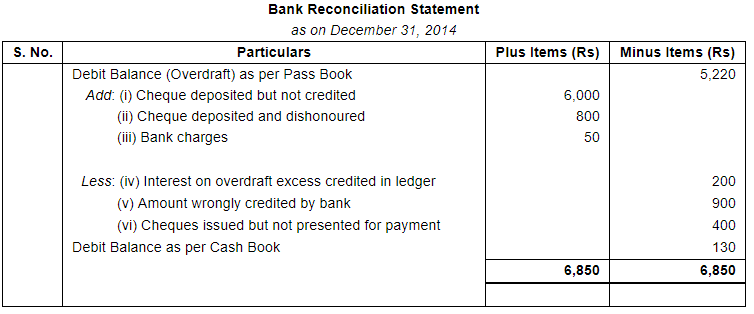

Question 27:

On checking the Bank Pass Book it was found that it showed an overdraft of ₹ 5,220 as on 31.12.2014, while as per Ledger it was different to Bank Debit. The following differences were noted:

(i) Cheques deposited but not yet credited by bank ₹ 6,000.

(ii) Cheques dishonoured and debited by bank but not given effect to it in the Ledger ₹ 800.

(iii) Bank charges debited by bank but Debit Memo not received from bank ₹ 50.

(iv) Interest on overdraft excess credited in the Ledger ₹ 200.

(v) Wrongly credited by bank to account, deposit of some other party ₹ 900.

(vi) Cheques issued but not presented for payment ₹ 400.

ANSWER:

Page No 15.37:

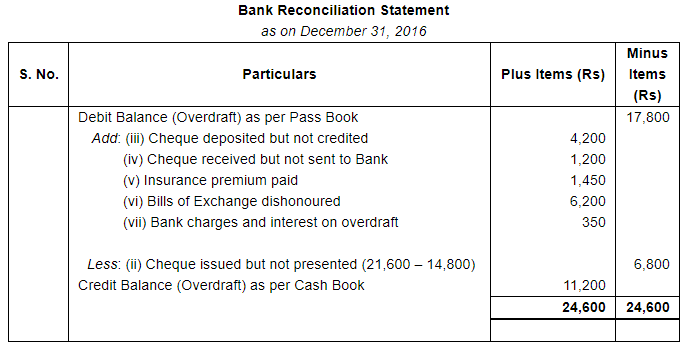

Question 28:

Following information has been given by Rajendra. Prepare a Bank Reconciliation

Statement as on 31st Dec. 2016, showing balance as per cash book:

(i) Debit balance shown by the pass book ₹ 17,800.

(ii) Cheques of ₹ 21,600 were issued in the last week of December, but of these ₹ 14,800 only were presented for payment.

(iii) Cheques of ₹ 10,750 were deposited in bank, out of them a cheque of ₹ 4,200 was credited in the first week of January, 2017.

(iv) A cheque of ₹ 1,200 was debited in the cash book but was not deposited in bank.

(v) Insurance premium paid by bank ₹ 1,450.

(vi) A bill of exchange for ₹ 6,200 which was discounted with bank, returned dishonoured but no entry was made in the cash book.

(vii) Bank charges and interest charged by bank are ₹ 350.

ANSWER:

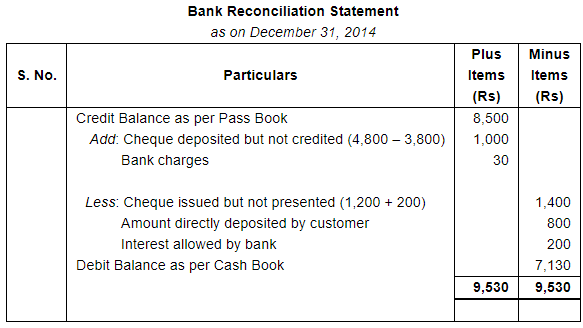

Question 29:

From the following particulars prepare a bank reconciliation statement of Govil as on 31st December, 2014.

Balance as per Pass Book on 31st December 2014 is ₹ 8,500. Cheques for ₹ 5,100 were issued during the month of December but of these cheques for ₹ 1,200 were presented in the month of January 2015 and one cheque for ₹ 200 was not presented for payment. Cheques and cash amounting to ₹ 4,800 were deposited in bank during December but credit was given for ₹ 3,800 only. A customer has deposited ₹ 800 into bank directly. The bank credited the merchant for ₹ 200 as interest and has debited him for ₹ 30 as bank charges for which there are no corresponding entries in Cash Book.

ANSWER:

Question 30:

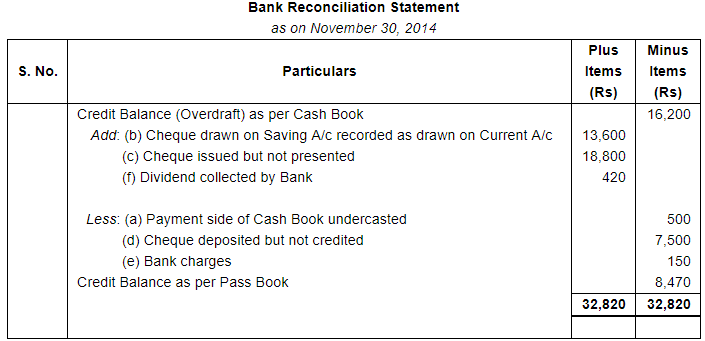

On Checking Ram's Cash Book with the bank statement of his overdraft current account for the month of November 2014, you find the following:

(a) Cash Book showed an overdraft of ₹ 16,200.

(b) The payment side of the Cash Book had been undercast by ₹ 500.

(c) A cheque for ₹ 13,600 drawn on his saving deposit account has been wrongly recorded as drawn on current account in the Cash Book.

(d) Cheques amounting to ₹ 18,800 drawn and entered in the Cash Book had not been presented.

(e) Cheques amounting to ₹ 7,500 sent to the bank for collection though entered in the Cash Book, had not been credited by the bank.

(f) Bank charge of ₹ 150 as per bank statement of account had not been taken in the Cash Book.

(g) Dividend of the amount of ₹ 420 had been paid direct to the bank and not entered in the Cash Book.

You are requested to arrive at the balance as it would appear in the bank statement as on 30th November 2014.

ANSWER:

Page No 15.38:

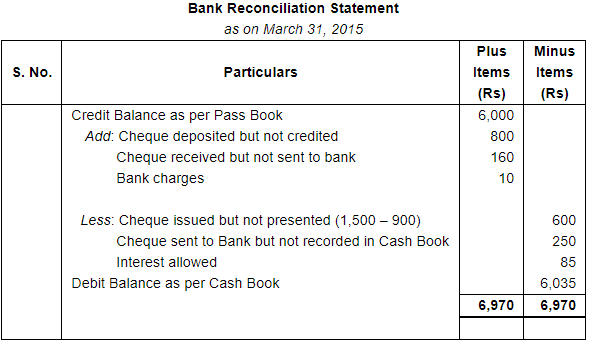

Question 31:

On 31st March 2015 your bank Pass Book showed a balance of ₹ 6,000 to your credit. Before that date you had issued cheques amounting to ₹ 1,500 of which cheques worth ₹ 900 only have been presented. You also deposited cheques worth ₹ 2,000 of which cheque of ₹ 800 paid by you into bank on 29th March is not yet credited in Pass Book. You had also received a cheque for ₹ 160 which although entered by you in the bank column of the Cash Book, was omitted to be paid into the bank. On 31st March a cheque of ₹ 250 received by you was paid into the bank but the same was omitted to be entered in the cash book. There was a credit of ₹ 85 for interest on current account and debit of ₹ 10 for bank charges. Draw up a Reconciliation Statement showing adjustment between your Cash Book and pass book.

ANSWER:

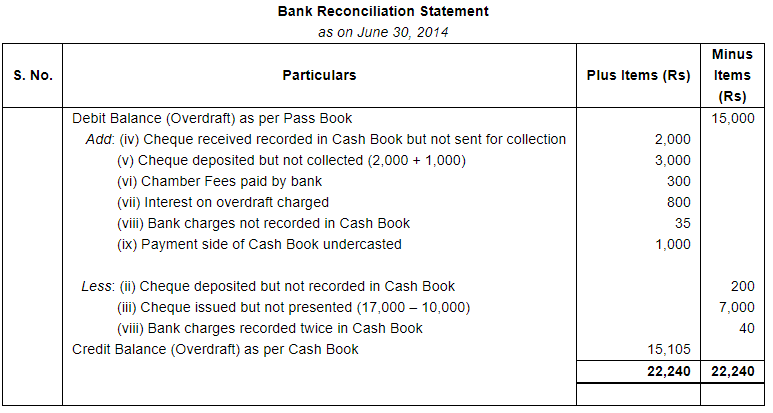

Question 32:

Prepare bank reconciliation statement of Dinesh on 30th June 2014 with following particulars:

(i) Pass Book showed an overdraft of ₹ 15,000 on 30th June 2014.

(ii) A cheque of ₹ 200 was deposited in bank but not recorded in Cash Book.

(iii) Cheques of ₹ 17,000 were issued but cheques worth only ₹ 10,000 were presented for payment up to 30th June 2014.

(iv) Cheques of ₹ 2,000 were received and recorded in Cash Book but not sent to bank.

(v) Cheques of ₹ 10,000 were sent to bank for collection; out of these cheques of ₹ 2,000 and of ₹ 1,000 were credited respectively on 8th July and 10th July and the remaining cheques were credited before 30th June 2014.

(vi) Bank paid ₹ 300 fee of Chamber of Commerce on behalf of Dinesh, which was not recorded in Cash Book.

(vii) Bank charged interest on overdraft ₹ 800 which was not recorded in Cash Book.

(viii) ₹ 40 for bank charges were recorded two times in Cash Book and bank expenses of ₹ 35 were not at all recorded in Cash Book.

(ix) Total of credit side of bank column of Cash Book was undercast by ₹ 1,000 by mistake.

ANSWER:

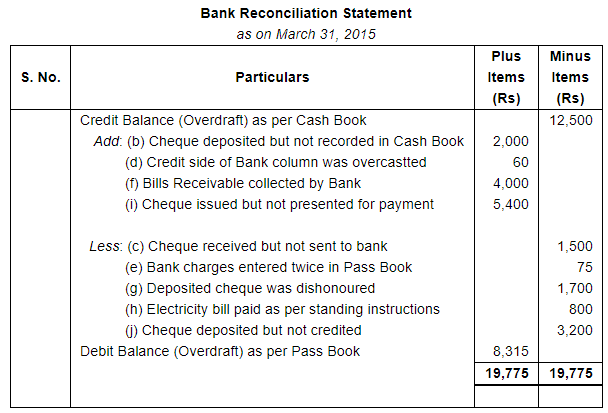

Question 33:

Prepare a Bank Reconciliation Statement as on 31st March 2015 from the following informations:

| ₹ | |

| (a) Cash Book Balance (Overdraft) | 12,500 |

| (b) Cheques deposited but not recorded in Cash Book | 2,000 |

| (c) Cheque received but not sent to Bank | 1,500 |

| (d) Credit side of the Bank Column has been overcast | 60 |

| (e) Bank charges entered in Pass Book twice | 75 |

| (f) Bills Receivable directly collected by the Bank | 4,000 |

| (g) Deposited cheques returned dishonoured by Bank | 1,700 |

| (h) Electricity Bill paid by Bank as per instruction | 800 |

| (i) Cheques issued but not presented for payment | 5,400 |

| (j) Cheques deposited but not cleared | 3,200 |

ANSWER:

Page No 15.39:

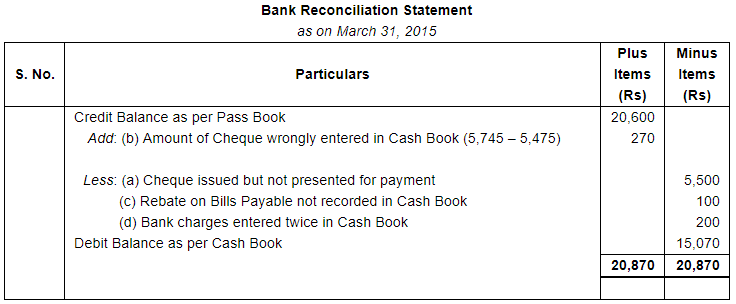

Question 34:

On 31st March, 2015 the Pass Book of Mr. Janaki Dass showed a credit balance of ₹ 20,600. Prepare a Bank Reconciliation Statement from the following information:

(i) Cheques amounting to ₹ 15,000 were drawn in March 2015, out of which cheques for ₹ 5,500 were presented for payment on 3rd April.

(ii) A cheque for ₹ 5,475 was deposited into the bank, but wrongly entered in the Cash Book as ₹ 5,745.

(iii) A cheque of ₹ 5,000 which was received from a customer was entered in the cash column of the Cash Book in March 2015 but was omitted to be banked in the month of March.

(iv) A B/P of ₹ 10,000 was retired by the bank under a rebate of ₹ 100 but the full amount of the bill was credited in the Cash Book.

(v) Bank charges entered in the Cash Book twice ₹ 200.

ANSWER:

Note: Transaction no. (iii) will have no effect on the bank balance as the cheque was recorded in the cash column and was not banked till the date of preparation of Bank Reconciliation Statement.

FAQs on Bank Reconciliation Statement (Part - 4) - Commerce

| 1. What is a bank reconciliation statement? |  |

| 2. Why is a bank reconciliation statement important for businesses? |  |

| 3. How often should a bank reconciliation statement be prepared? |  |

| 4. What are the common reasons for differences between the bank statement balance and the company's cash balance? |  |

| 5. How can businesses reconcile the differences between the bank statement balance and the company's cash balance? |  |