Depreciation (Part - 2) - Commerce PDF Download

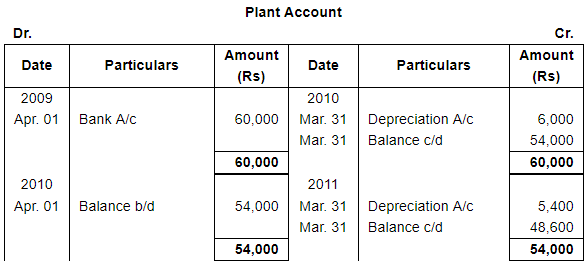

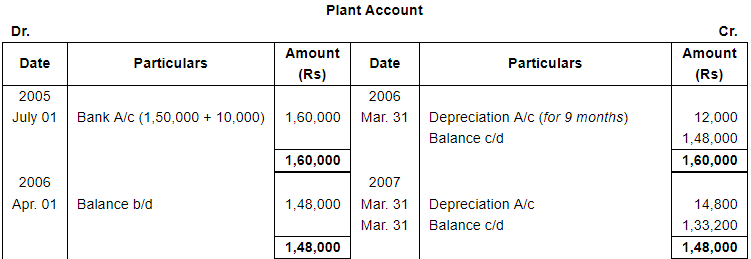

Page No 16.55:

Question 11:

A plant is purchased for ₹ 60,000 on 1st April, 2009. It is estimated that the residual value of this plant at the end of its working life of 10 years will be ₹ 20,920. Depreciation is to be provided at 10% p.a. on diminishing balance method.

You are required to show the Plant Account for 4 years, assuming that the books are closed on 31st March every year.

ANSWER:

Note: When deprecation is charged as per written down value method, scrap value of asset is ignored.

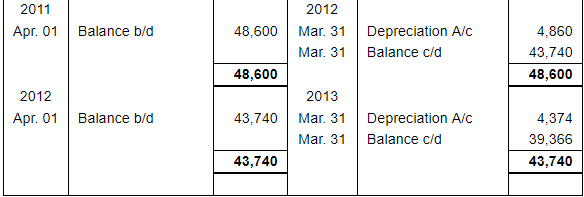

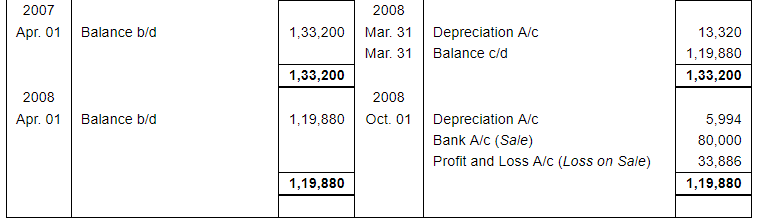

Question 12:

On 1st July, 2005, Geeta Paper Limited purchased a Plant for ₹ 1,50,000 and paid ₹ 10,000 as freight on its carriage. Depreciation was provided at 10% p.a. on the Written Down Value Method on this plant. On 1st Oct., 2008, this plant was sold for ₹ 80,000.

Prepare Plant A/c for 4 years, assuming that the books are closed on 31st March every year.

ANSWER:

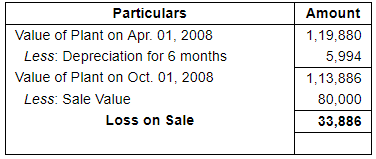

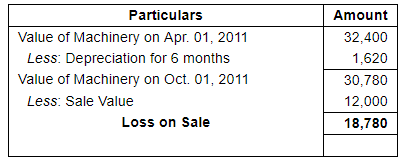

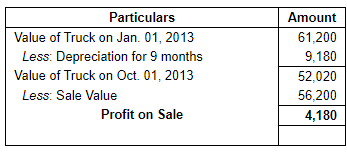

Working Note: Calculation of Profit or Loss on Sale

Question 13:

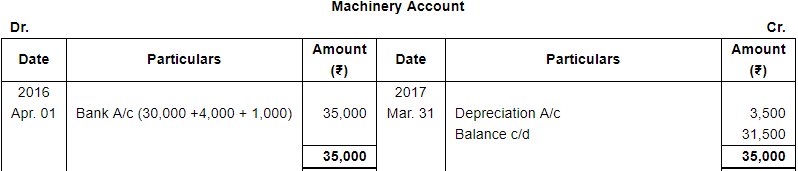

A Company purchased a second-hand machine on 1st April, 2016, for ₹ 30,000 and immediately spent ₹ 4,000 on its repair and ₹ 1,000 on its installation. On Oct. 1, 2018, the machine was sold for ₹ 25,000. Prepare Machine Account after charging depreciation @ 10% p.a. by diminishing balance method, assuming that the books are closed on 31st March every year. IGST was charged @ 12% on purchase and sale of machine.

ANSWER:

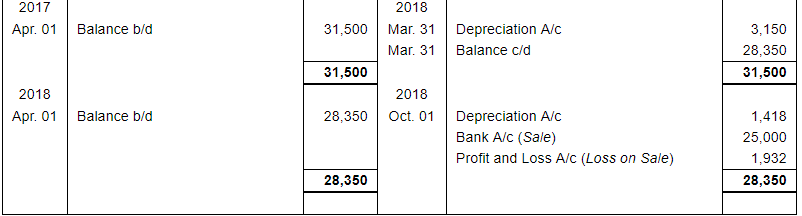

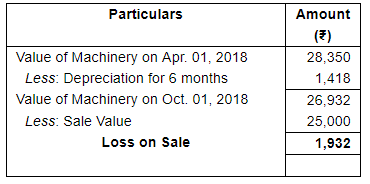

Working Note: Calculation of Profit or Loss on Sale

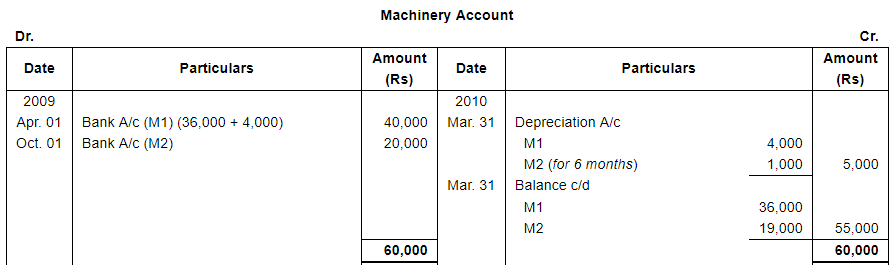

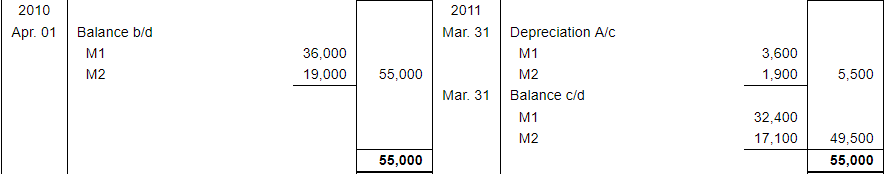

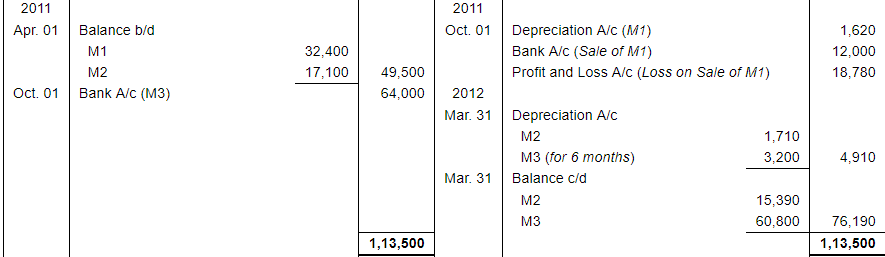

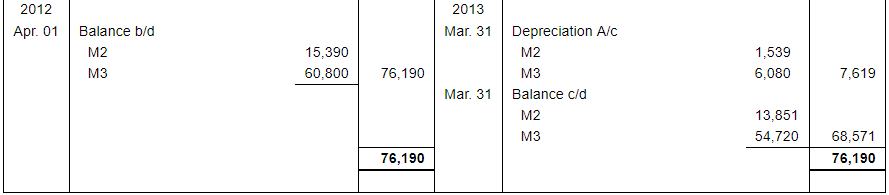

Question 14:

A firm purchased on 1st April, 2009, a second-hand Machinery for ₹ 36,000 and spent ₹ 4,000 on its installation. On 1st Oct. in the same year another Machinery costing ₹ 20,000 was purchased. On 1st Oct., 2011, the Machinery bought on 1st April, 2009 was sold off for ₹ 12,000 and on the same date a fresh Machine was purchased for ₹ 64,000. Depreciation is provided annually on 31st March, @ 10% p.a. on the Written Down Value Method. Show the Machine A/c from 1st April, 2009 to 31st March, 2013.

ANSWER:

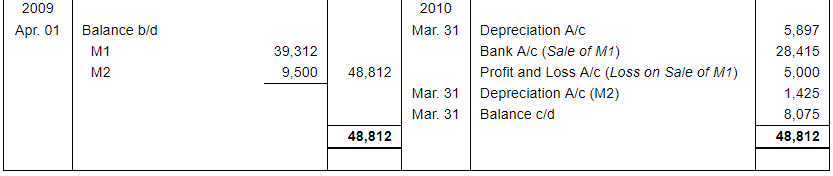

Working Note: Calculation of Profit or Loss on Sale

Page No 16.56:

Question 15(A):

State four main causes of providing depreciation.

ANSWER:

The four main causes of depreciation are as follows.

1. Constant use: Due to constant use of the fixed assets there exists normal wear and tear that leads to fall in the value of fixed assets.

2. Expiry of time: With the passage of time, whether assets are used or not, its effective life decreases. The natural forces like rain, weather, etc. lead to deterioration of the fixed assets.

3. Obsolescence: Due to the fast technological innovations and inventions today’s assets may be outdated by tomorrow’s sophisticated assets. This leads to the obsolescence of fixed assets.

4. Expiry of legal rights: If an asset is acquired for a specific period of time, then, whether the asset is put to use or not, its value becomes zero at the end of its useful life.

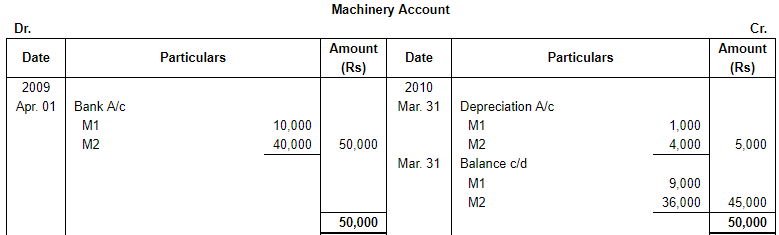

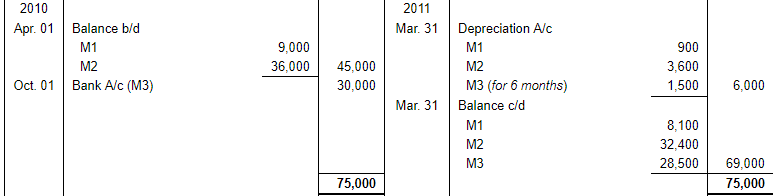

Question 15(B):

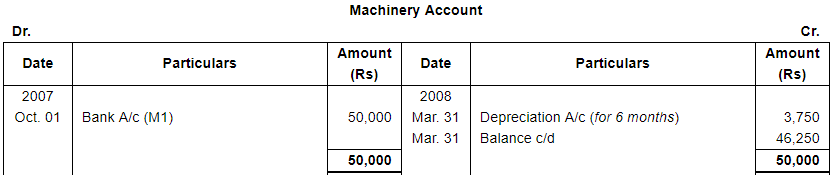

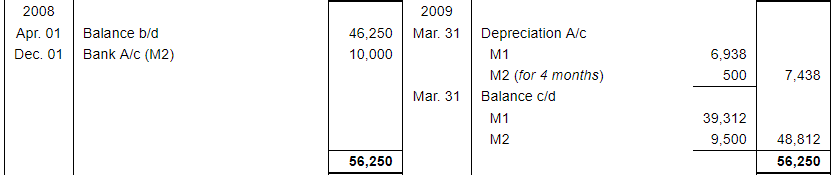

A Company purchased a machinery for ₹ 50,000 on 1st Oct., 2007. Another machinery costing ₹ 10,000 was purchased on 1st Dec., 2008. On 31st March, 2010, the machinery purchased in 2007 was sold at a loss of ₹ 5,000. The Company charges depreciation at the rate of 15% p.a. on Diminishing Balance Method. Accounts are closed on 31st March every year.

Prepare Machinery account for 3 years.

ANSWER:

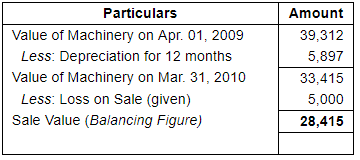

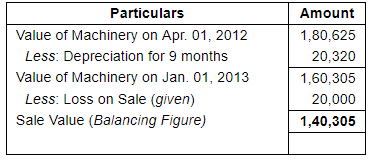

Working Note: Calculation of Sale Price of M1

Question 16:

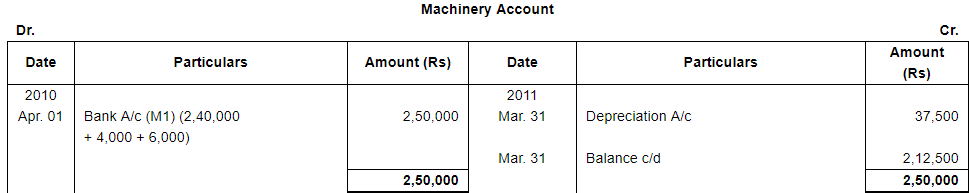

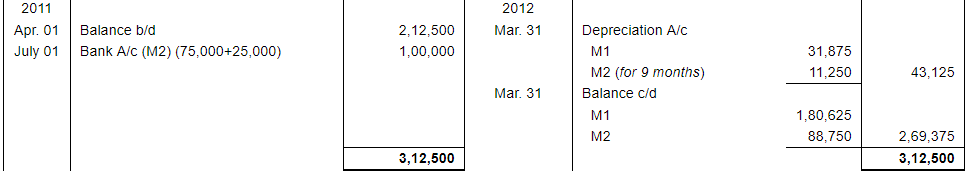

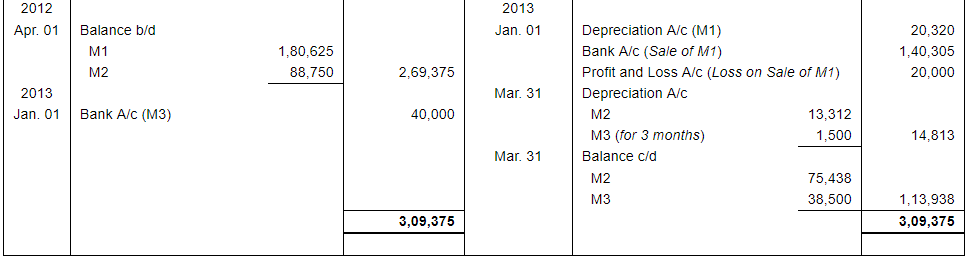

Ashoka Ltd. bought a machine on 1st April, 2010 for ₹ 2,40,000 and spent ₹ 4,000 on its carriage and ₹ 6,000 towards installation cost. On 1st July, 2011 it purchased a second hand machinery for ₹ 75,000 and spent ₹ 25,000 on its overhauling.

On 1st January, 2013 it decided to sell the machinery bought on 1st April, 2010 at a loss of ₹ 20,000. It bought another machine on the same date for ₹ 40,000. Company decided to charge depreciation @ 15% p.a. on written down value method. Prepare machinery account for 3 years. Books are closed each year on 31st March.

ANSWER:

Working Note: Calculation of Sale Price of M1

Question 17:

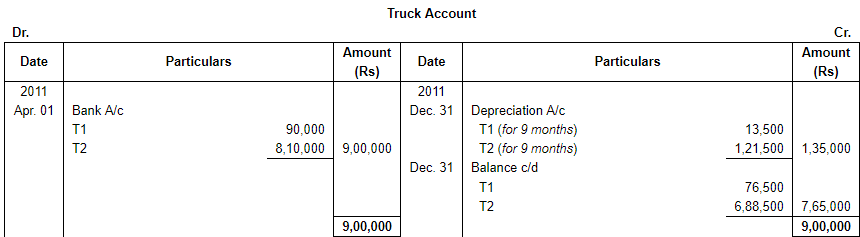

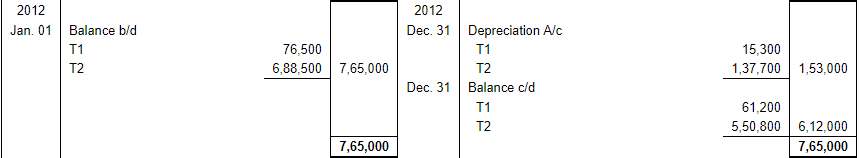

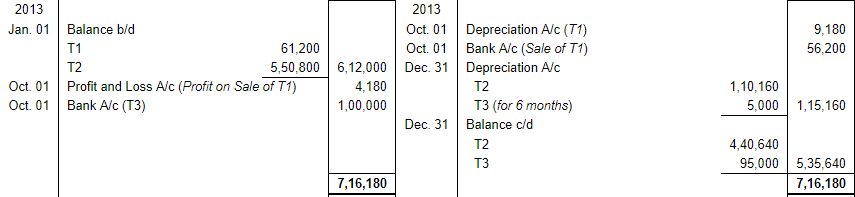

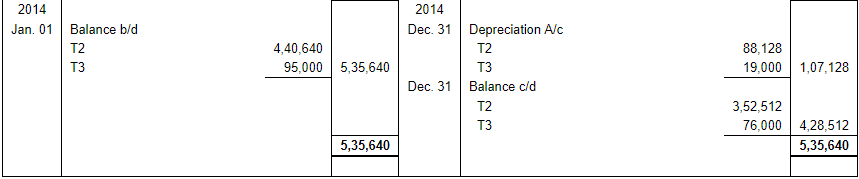

The Sameer Transport Company purchased 10 Trucks at ₹ 90,000 each on 1st April 2011. On 1st October 2013 one of the Trucks was involved in an accident and is completely destroyed. ₹ 56,200 was received from the Insurance company in full settlement. On the same date another truck was purchased by the company for the sum of ₹ 1,00,000. The company writes off 20% per annum on the Diminishing Balance Method. The company maintains the calendar year as its financial year. Show the Truck Account for four years ending 31st December, 2014.

ANSWER:

Working Note: Calculation of Profit & Loss on Sale of T1

Note: In order to make easy calculation, Truck purchased on April 01, 2011 has been divided into two parts i.e. T1 and T2.

Thus, T1: Rs 90,000 (sold for Rs 56,200)

T2: Rs 8,10,000 (includes the cost of 9 trucks)

Question 18:

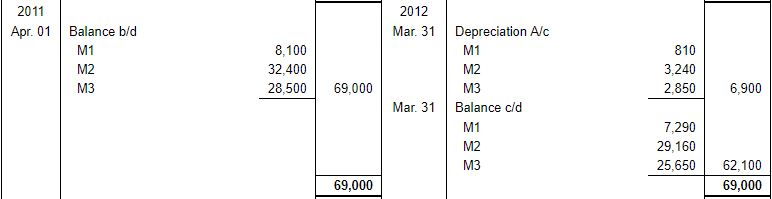

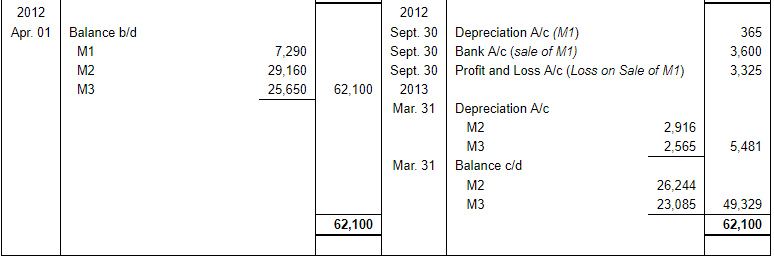

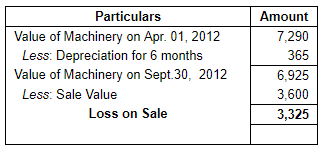

Raja Textiles Co. which closes its books on 31st March, purchased a machine on 1-4-2009 for ₹ 50,000. On 1-10-2010, it purchased an additional machine for ₹ 30,000. The part of the machine which was purchased on 1-4-2009 costing ₹ 10,000 was sold for ₹ 3,600 on 30th Sept., 2012. Prepare the Machine Account for four years, if the depreciation is provided at the rate of 10% p.a. on Diminishing Balance Method.

ANSWER:

Working Note: Calculation of Profit & Loss Sale of M1

Note: In order to make easy calculation, machinery purchased on April 01, 2009 has been divided into two parts i.e. M1 and M2.

Thus, M1: Rs 10,000 (sold for Rs 3,600)

M2: Rs 40,000

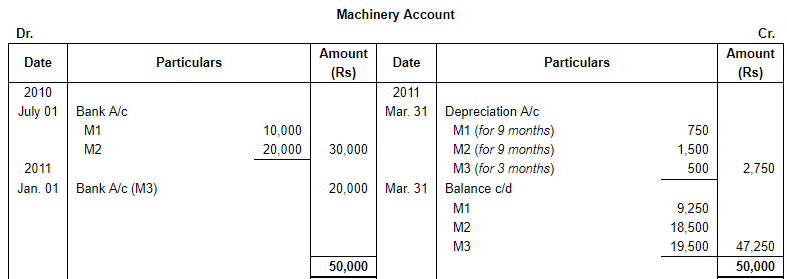

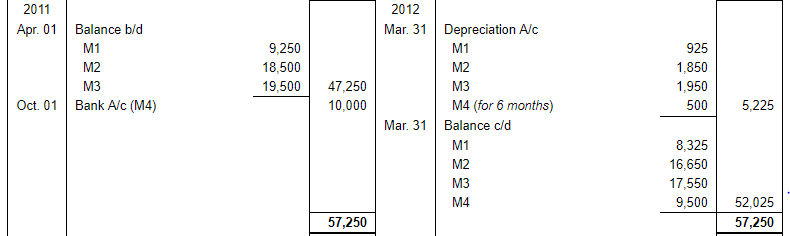

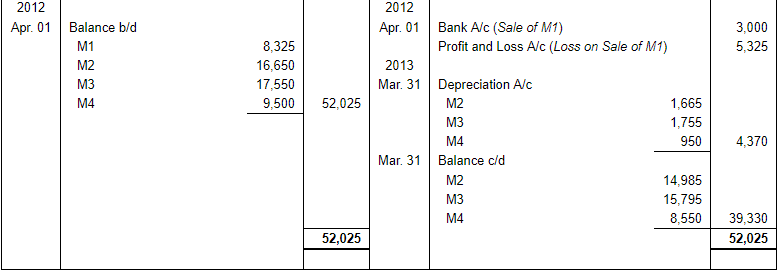

Question 19:

A Company, which closes its books on 31st March every year, purchased on 1st July, 2010, machinery costing ₹ 30,000. It purchased further machinery on 1st January, 2011, costing ₹ 20,000 and on 1st October, 2011, costing ₹ 10,000. On 1st April, 2012, one-third of the machinery installed on 1st July, 2010, became obsolete and was sold for ₹ 3,000.

Show how the machinery account would appear in the books of the Company, it being given that machinery was depreciated by Diminishing Balance Method at 10% per annum. What would be the balance of Machinery Account on 1st April, 2013?

ANSWER:

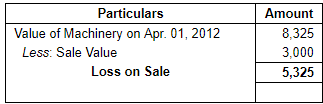

Working Note: Calculation of Profit & Loss on Sale of M1

Note: In order to make easy calculation, machinery purchased on July 01, 2010 has been divided into two parts i.e. M1 and M2.

Thus, M1: 1/3rd value i.e Rs 10,000 (sold for Rs 3,000)

M2: 2/3rd value i.e. Rs Rs 40,000 (remained in the business)

FAQs on Depreciation (Part - 2) - Commerce

| 1. What is depreciation in commerce? |  |

| 2. How is depreciation calculated? |  |

| 3. Why is depreciation important in accounting? |  |

| 4. What are the effects of depreciation on financial statements? |  |

| 5. Can depreciation be reversed or canceled? |  |