Depreciation (Part - 3) - Commerce PDF Download

Page No 16.57:

Question 20:

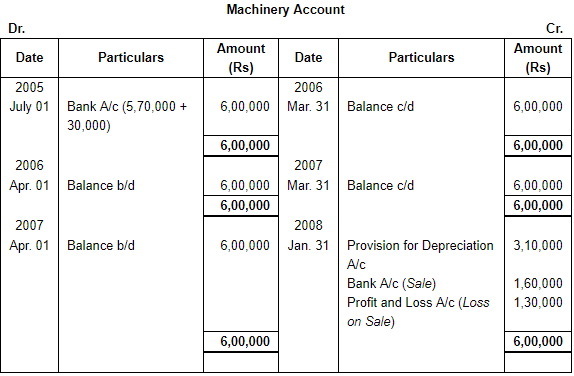

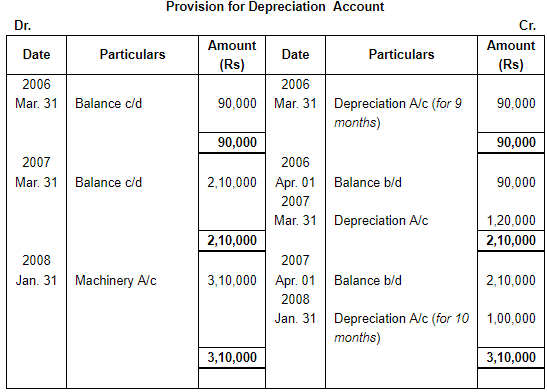

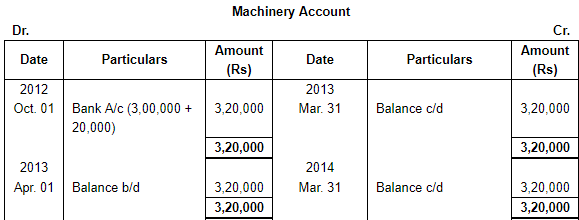

On July 1, 2005 Pushpak Ltd. purchased a machinery for ₹ 5,70,000 and paid ₹ 30,000 for its overhauling and installation. Depreciation is provided @ 20% p.a. on Original Cost Method and the books are closed on 31st March every year. The machine was sold on 31st January 2008 for a sum of ₹ 1,60,000. You are required to show the Machinery Account and Provision for Depreciation Account for three years.

ANSWER:

Working Note: Calculation of Profit & Loss on Sale

Question 21:

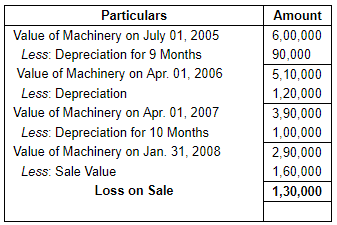

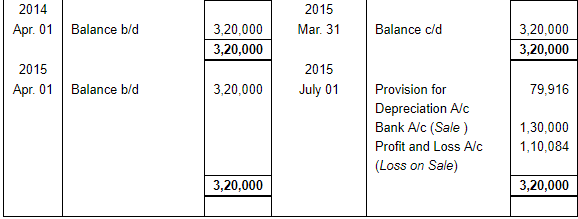

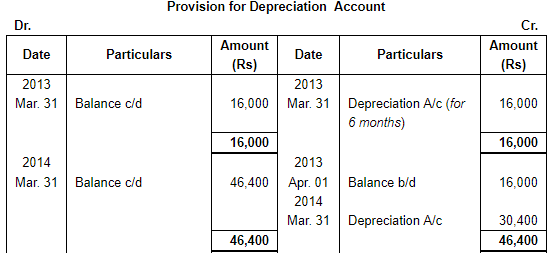

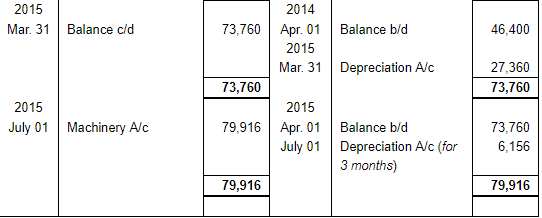

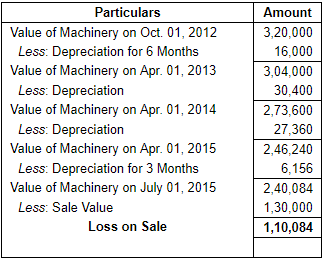

A machine as purchased on 1st October 2012 at a cost of ₹ 3,00,000 and ₹ 20,000 were spent on its installation. The depreciation is written off at 10% p.a. on the Diminishing Value Method. The books are closed on 31st March every year. The machine was sold for ₹ 1,30,000 on 1st July 2015. Show the Machinery Account and Provision for Depreciation Account for all the years.

ANSWER:

Working Note: Calculation of Profit & Loss on Sale

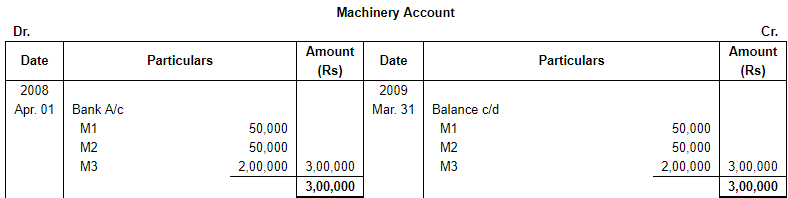

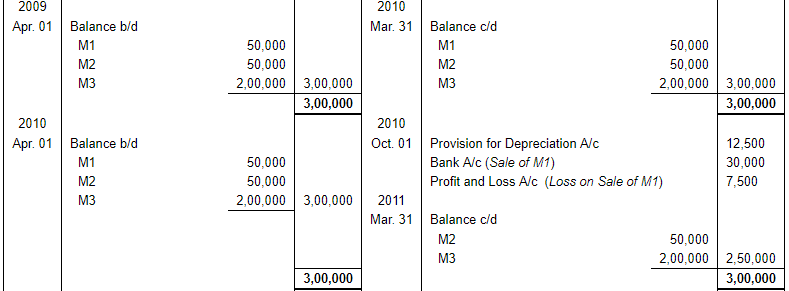

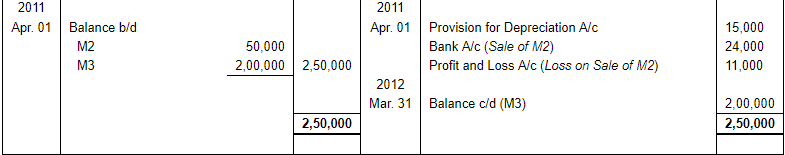

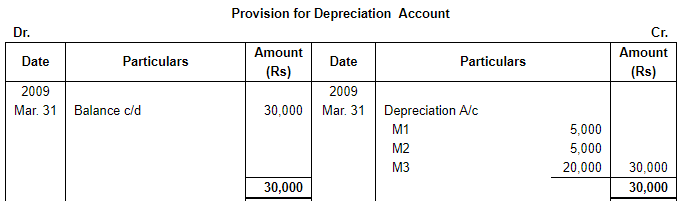

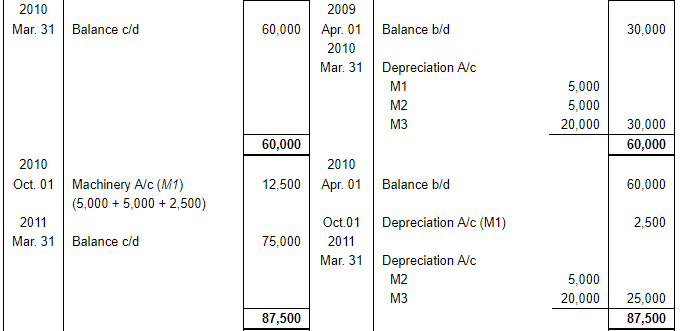

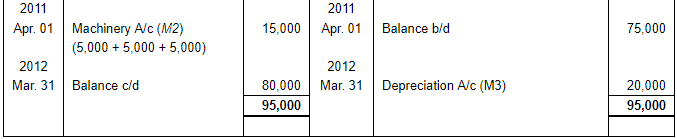

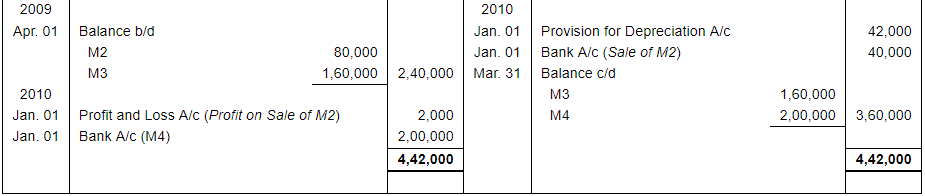

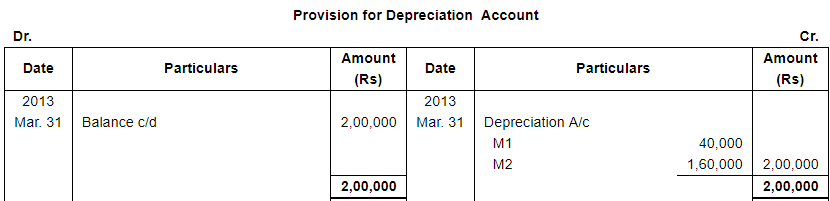

Question 22:

On 1st April 2008, a Company purchased 6 machines for ₹ 50,000 each. Depreciation at the rate of 10% p.a. is charged on Straight Line Method. The accounting year of the Company ends on 31st March and the depreciation is credited to a separate 'Provision for Depreciation Account'.

On 1st October, 2010, one machine was sold for ₹ 30,000 and on 1st April, 2011 a second machine was sold for ₹ 24,000.

You are required to prepare Machinery Account and Provision for Depreciation Account for four years ending 31st March, 2012.

ANSWER:

Working Notes:

Working Notes:

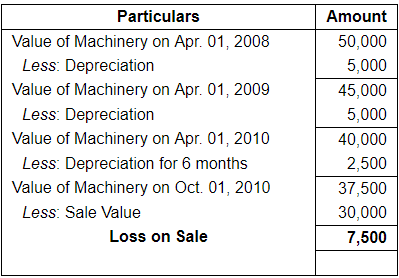

WN1: Calculation of Profit & Loss on Sale of M1

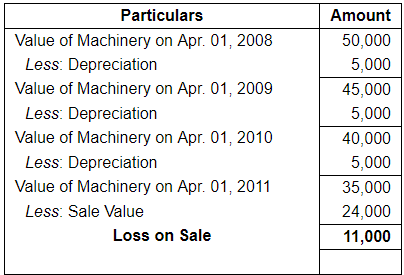

WN2: Calculation of Profit & Loss on Sale of M2

Note: For making calculation easy, Machinery purchased on April 01, 2008 has been divided into three i.e. M1, M2 and M3.

Thus, M1: Rs 50,000 (sold for Rs 30,000 on Oct. 01, 2010)

M2: Rs 50,000 (sold for Rs 24,000 on Apr. 01, 2011)

M3: Rs 2,00,000 (includes the cost of 4 machines)

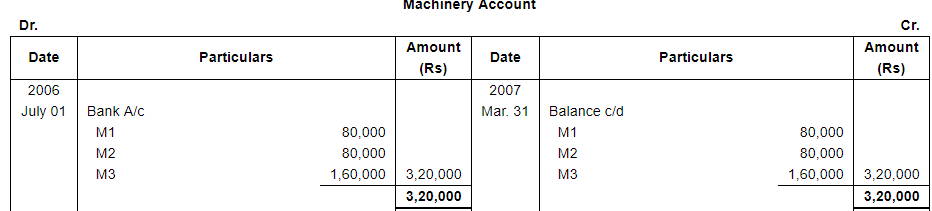

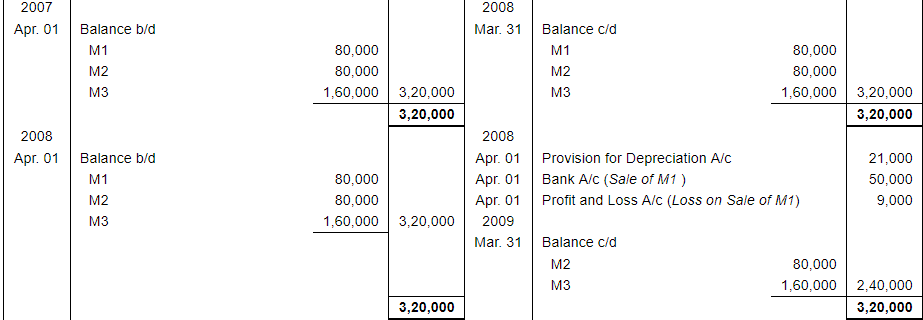

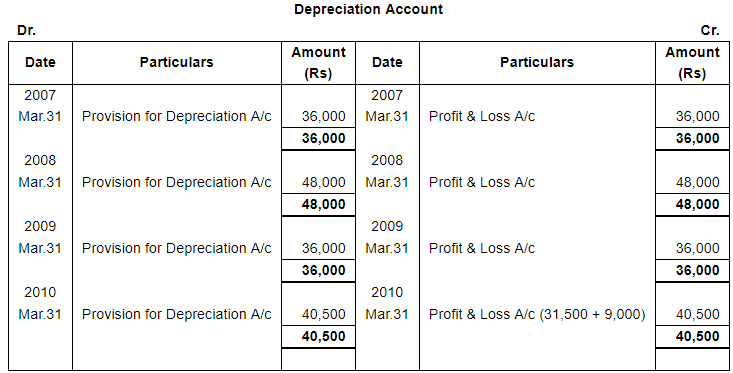

Question 23:

On 1st July 2016, ABC Ltd. purchase 4 machines for ₹ 80,000 each. The accounting year of the company ends on 31st March every year. Depreciation is provided at the rate of 15% p.a. on original cost.

On 1st April, 2008 one machine was sold for ₹ 50,000 and on 1st January, 2010 a second machine was sold for ₹ 40,000. Another machine with a higher capacity which cost ₹ 2,00,000 was purchased on 1st January, 2010.

You are required to show: (i) Machinery Account, (ii) Depreciation Account, and (iii) Provision for Depreciation Account for four years ending 31st March, 2010.

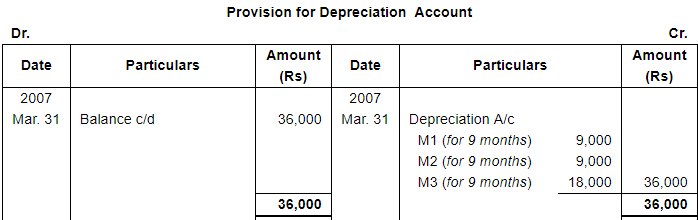

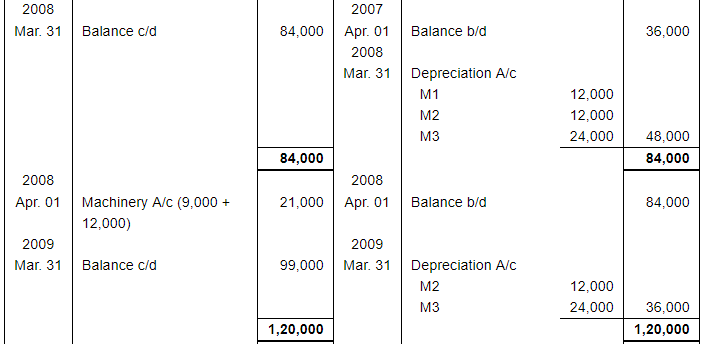

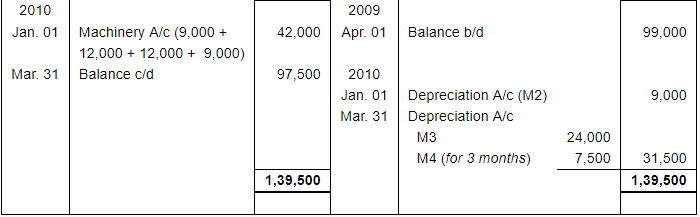

ANSWER:

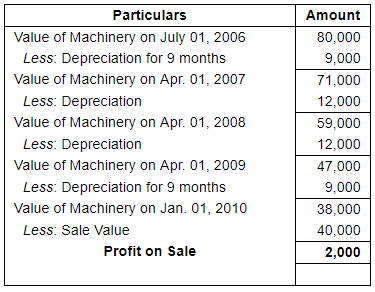

Working Notes:

Working Notes:

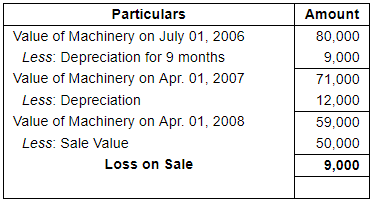

WN1: Calculation of Profit & Loss on Sale M1

WN2: Calculation of Profit & Loss on Sale of M2

Note: In order to make easy calculation, machinery purchased on July 01, 2006 has been divided into three parts i.e. M1, M2 and M3.

Thus, M1: Rs 80,000 (sold for Rs 50,000 on Apr. 01, 2008)

M2: Rs 80,000 (sold for Rs 40,000 on Jan. 01, 2010)

M3: Rs 1,60,000 (includes the cost of 2 machines)

Page No 16.58:

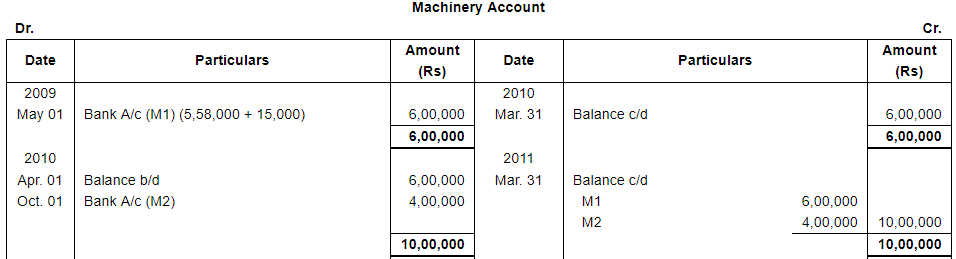

Question 24:

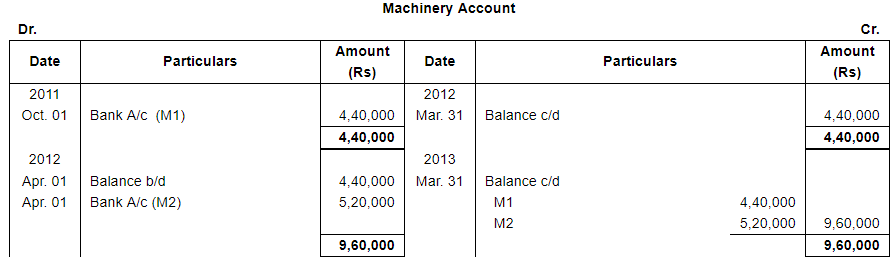

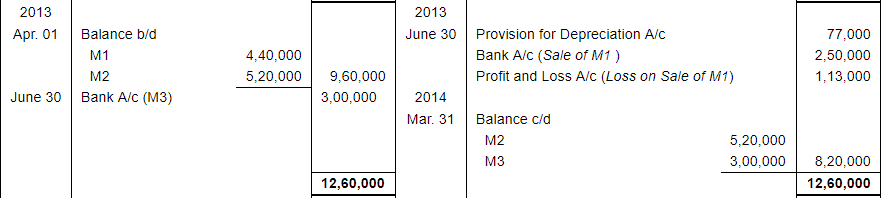

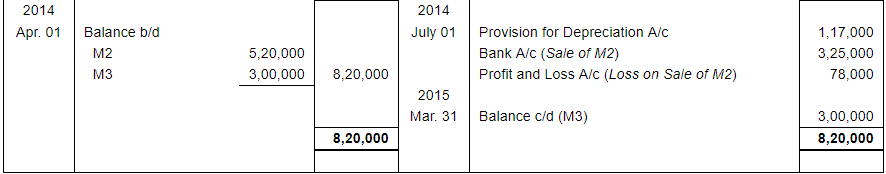

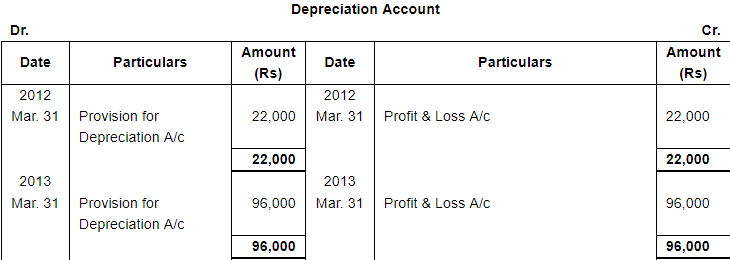

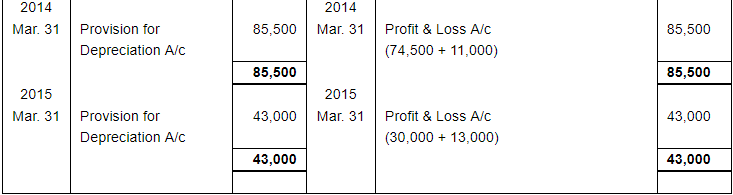

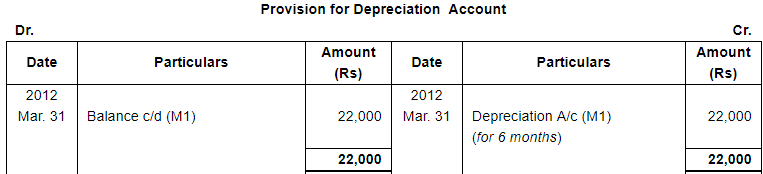

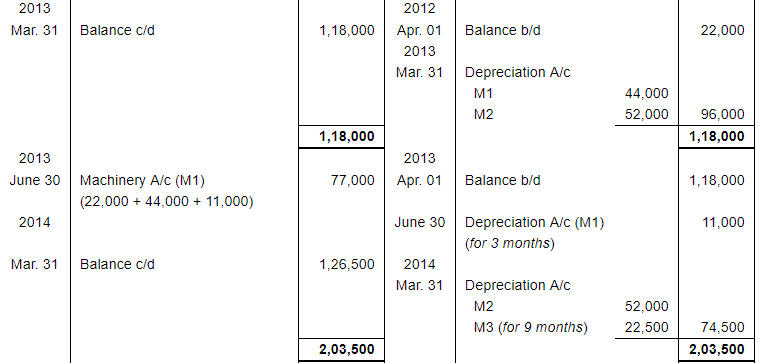

X Ltd. which closes its books of account every year on 31st March, purchased on 1st October, 2011 machinery costing ₹ 4,40,000. It purchased further machinery on 1st April, 2012 costing ₹ 5,20,000. On 30th June, 2013, the first machine was sold for ₹ 2,50,000 and on the same date a fresh machine was installed at a cost of ₹ 3,00,000. On 1st July 2014, the second machine purchased on 1st April 2012 was also sold for ₹ 3,25,000.

The company writes off depreciation at 10% p.a. on the Straight Line Method each year. Show the Machinery A/c, Depreciation A/c and Provision for Depreciation A/c for all the four years.

ANSWER:

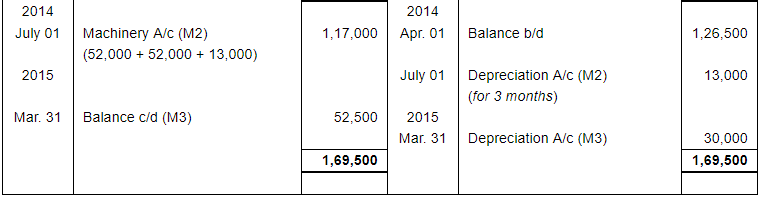

Working Notes:

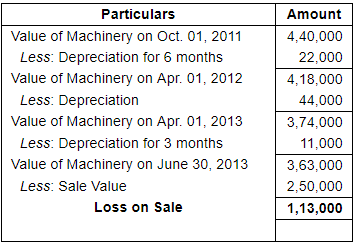

WN1: Calculation of Profit & Loss on Sale of M1

WN2: Calculation of Profit & Loss on Sale of M2

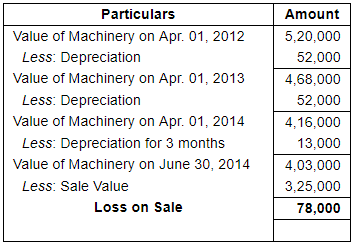

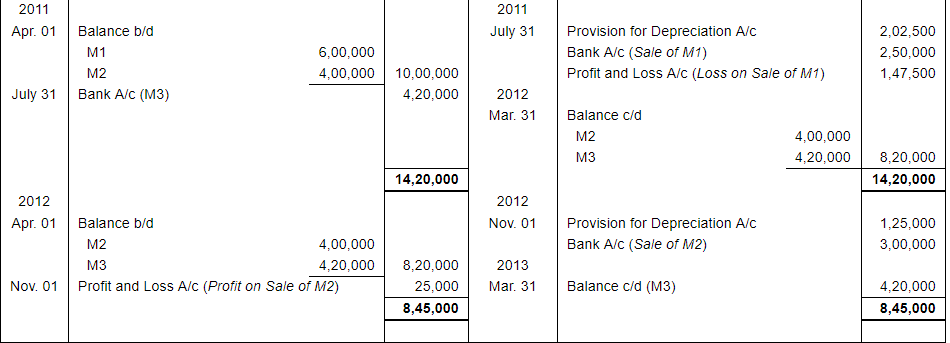

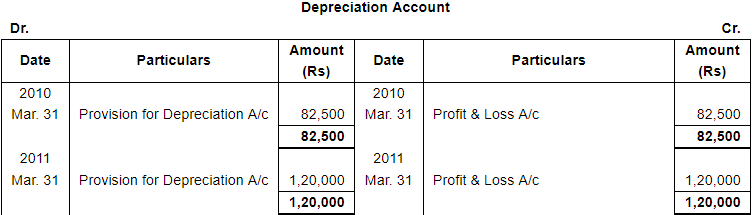

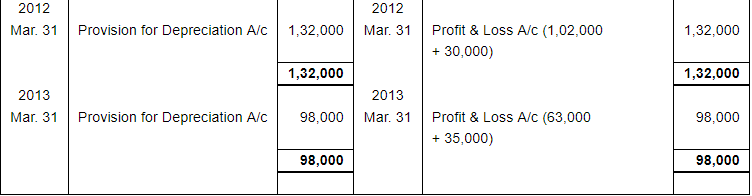

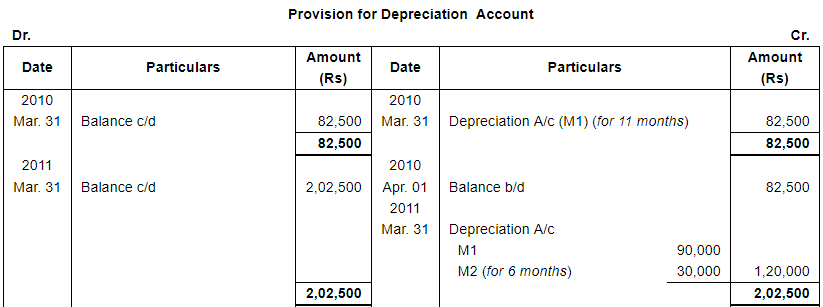

Question 25:

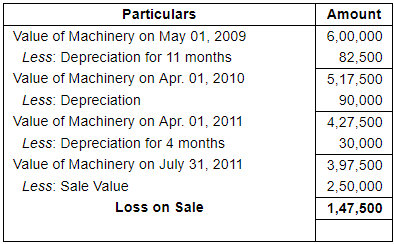

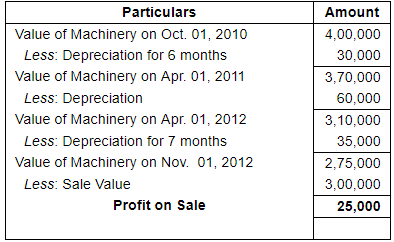

A company purchased second-hand machinery on 1st May, 2009 for ₹ 5,85,000 and immediately spent ₹ 15,000 on its erection. On 1st October, 2010, it purchased another machine for ₹ 4,00,000. On 31st July, 2011, it sold off the first machine for ₹ 2,50,000 and bought another for ₹ 4,20,000. On 1st November, 2012, the second machine was also sold off for ₹ 3,00,000. Depreciation was provided on the machinery @ 15% p.a. on Equal Instalment Method.

Show the Machinery Account, Depreciation Account and Provision for Depreciation Account assuming that the books are closed on 31st March every year.

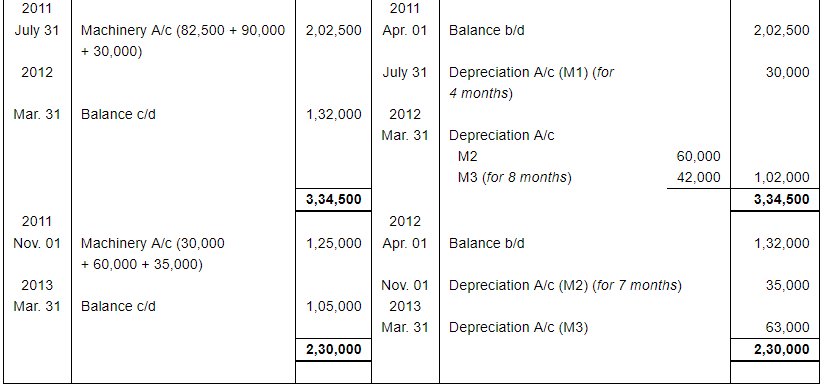

ANSWER:

Working Notes:

WN1: Calculation of Profit & Loss on Sale of M1

WN2: Calculation of Profit & Loss on Sale of M2

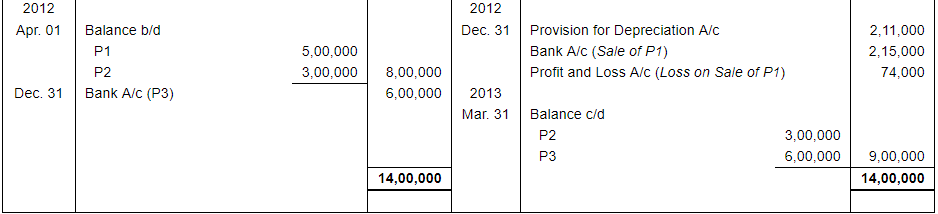

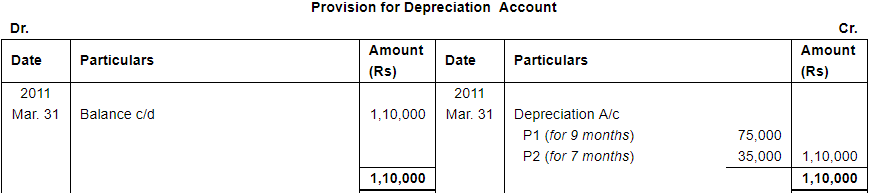

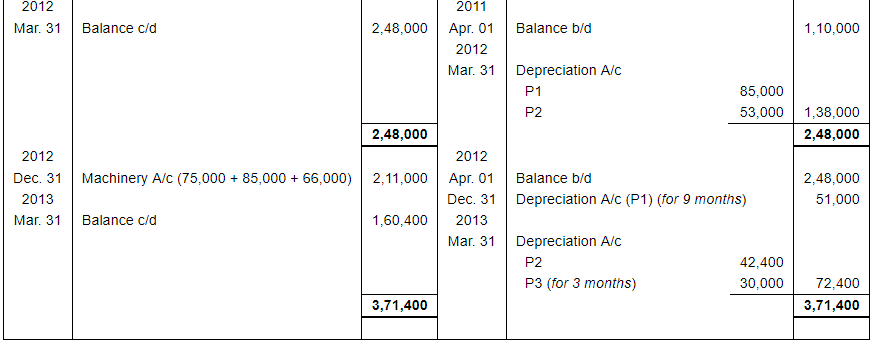

Question 26:

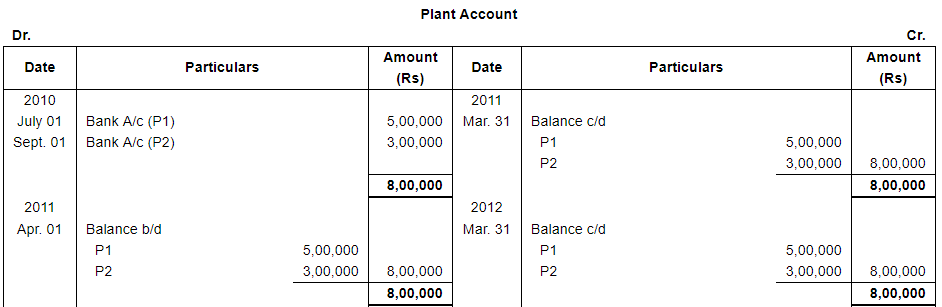

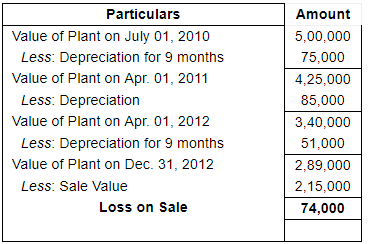

X Ltd. purchased a plant on 1st July, 2010 costing ₹ 5,00,000. It purchased another plant on 1st September, 2010 costing ₹ 3,00,000. On 31st December, 2012, the plant purchased on 1st July, 2010 got out of order and was sold for ₹ 2,15,000. Another plant was purchased to replace the same for ₹ 6,00,000. Depreciation is to be provided at 20% p.a. according to Writen Down Value Method. The accounts are closed every year on 31st March.

Show the Plant Account and Provision for Depreciation Account.

ANSWER:

Working Note: Calculation of Profit & Loss on Sale of P1

Working Note: Calculation of Profit & Loss on Sale of P1

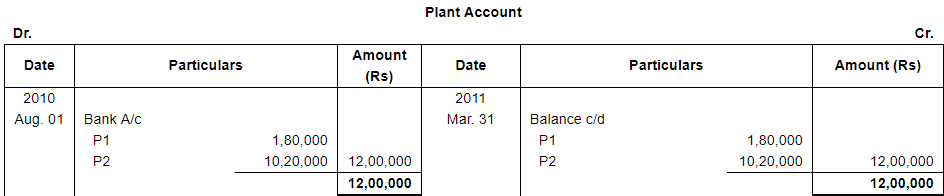

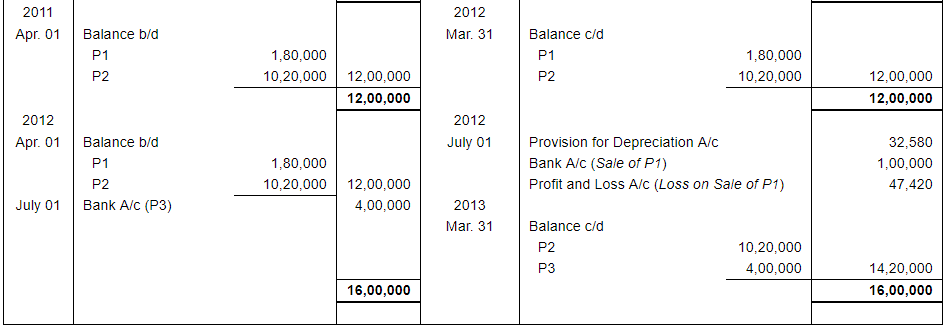

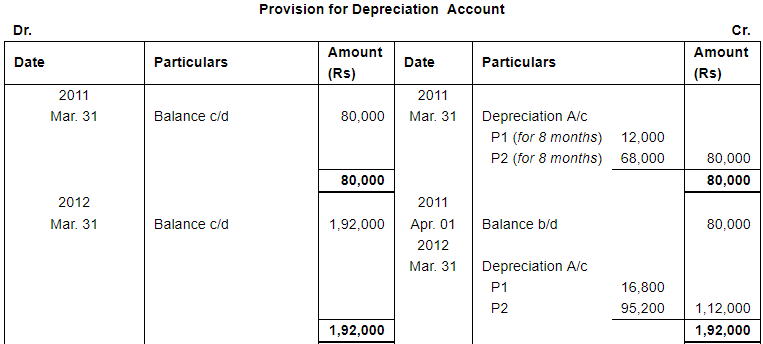

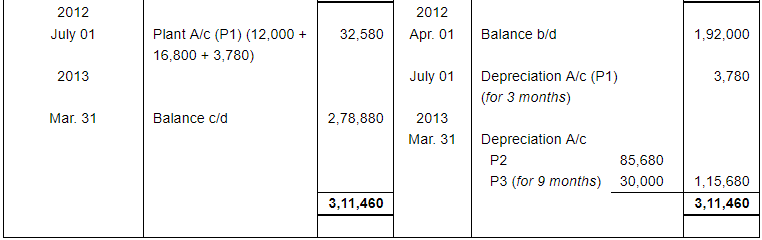

Question 27:

On 1st August, 2010, Hindustan Toys Ltd. purchased a plant for ₹ 12,00,000. The firm writes off depreciation at 10% p.a. on the diminishing balance and the books are closed on 31st March each year. On 1st July, 2012, a part of this plant of which the original cost was ₹ 1,80,000 was sold for ₹ 1,00,000 and on the same date a new plant was purchased for ₹ 4,00,000. Show the Plant Account and Provision for Depreciation Account for three years ending 31st March, 2013.

ANSWER:

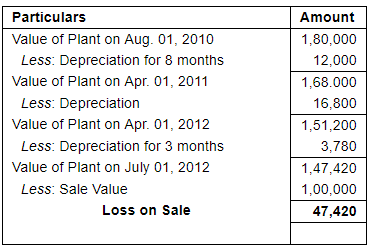

Working Note: Calculation of Profit & Loss on Sale of P1

Note: In order to make easy calculation, plant purchased on Aug. 01, 2010 has been divided into two parts i.e. P1 and P2.

Thus, P1: Rs 1,80,000 (sold for Rs 1,00,000 on July 01, 2012)

P2: Rs 10,20,000

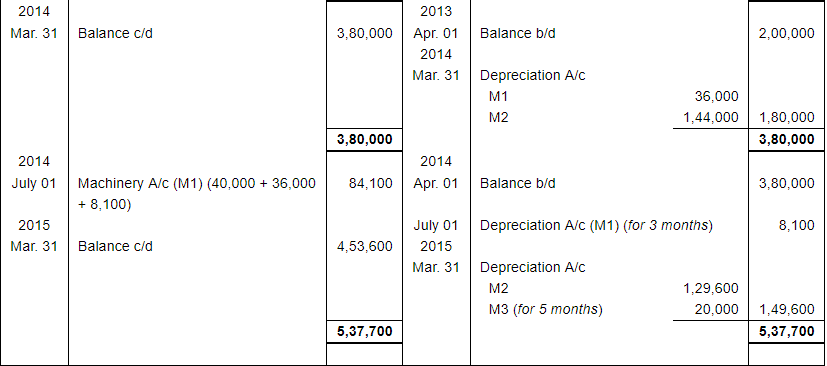

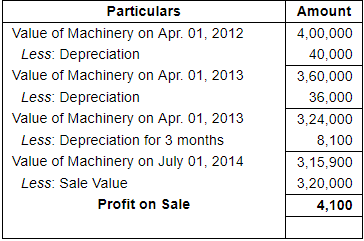

Question 28:

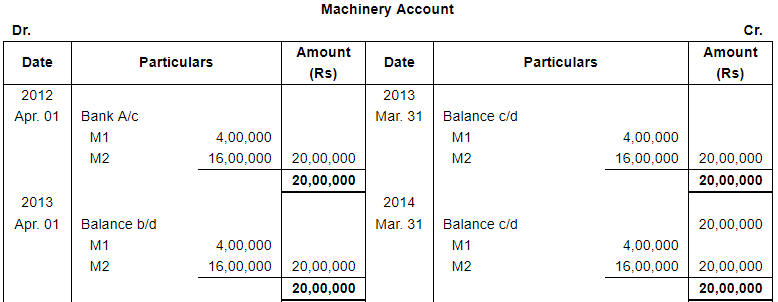

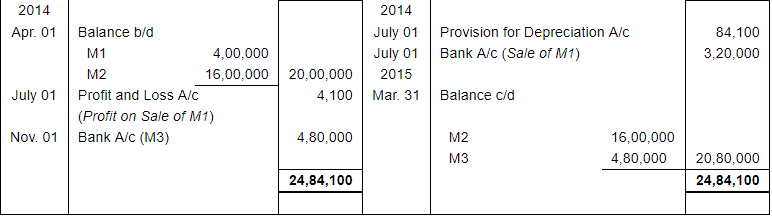

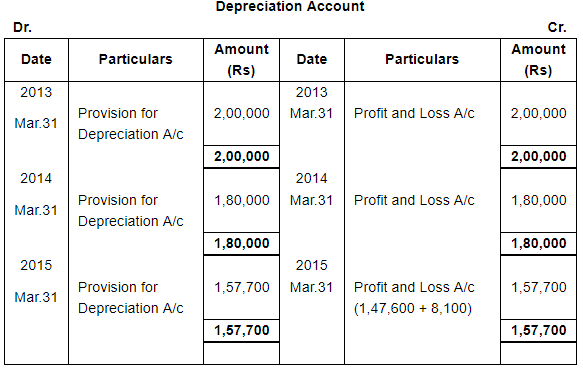

On 1st April 2012, Banglore Silk Ltd. purchased a machinery for ₹ 20,00,000. It provides depreciation at 10% p.a. on the Written Down Value Method and closes its books on 31st March every year. On 1st July 2014, a part of the machinery purchased on 1st April 2012 for ₹ 4,00,000 was sold for ₹ 3,20,000. On 1st November 2014, a new machinery was purchased for ₹ 4,80,000. You are required to prepare Machinery Account, Depreciation Account and Provision for Depreciation Account for three years ending 31st March 2015.

ANSWER:

Working Note: Calculation of Profit & Loss on Sale of M1

Note: In order to make easy calculation, machinery purchased on Apr. 01, 2012 has been divided into two parts i.e. M1 and M2.

Thus, M1: Rs 4,00,000 (sold for Rs 3,20,000 on July 01, 2014)

M2: Rs 16,00,000

FAQs on Depreciation (Part - 3) - Commerce

| 1. What is depreciation in commerce? |  |

| 2. How is depreciation calculated? |  |

| 3. What is the importance of depreciation in business? |  |

| 4. How does depreciation affect taxes? |  |

| 5. Can depreciation be reversed? |  |