Bank Reconciliation Statement (Part-1) | Accountancy Class 11 - Commerce PDF Download

Page No 12.43:

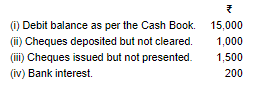

Question 1: Prepare Bank Reconciliation Statement from the following:

ANSWER:

Page No 12.43:

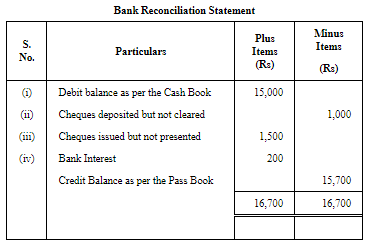

Question 2: Ramesh has his account at Punjab National Bank, Delhi. According to his Cash Book, his bank balance on 31st March, 2019 was ₹ 72,950. He sent cheques for ₹ 90,075 to his bank for collection but cheques amounted to ₹ 43,769 were not collected by that date. Out of the cheques issued by him in payment of his debts, cheques for ₹ 29,344 were not presented for payment. Prepare Bank Reconciliation Statement.

ANSWER:

Page No 12.44:

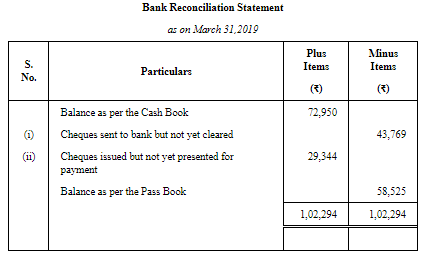

Question 3: On 31st March, 2019, Cash Book of Mahesh showed debit bank balance of ₹ 75,000. When compared with the Bank Statement, following facts were discovered. On 30th March, two cheques of ₹ 5,000 and ₹ 7,000 were deposited in the bank but were not realised till date. On 28th March, three cheques of ₹ 6,000, ₹ 8,000 and ₹ 12,000 were issued but none of these were presented to the bank for payment. On 31st March, bank credited ₹ 1,250 as interest but this was not recorded in the Cash Book. Similarly, the bank had charged ₹ 150 as bank charges but this was not recorded in the Cash Book.

7Bank paid insurance premium of ₹ 5,000 but it was recorded as ₹ 500 in Cash Book. Prepare Bank Reconcilation Statement on 31st March, 2019.

ANSWER:

Page No 12.44:

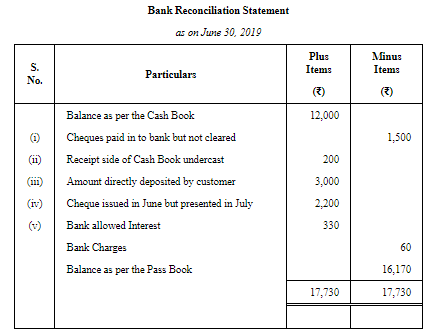

Question 4: On 30th June, 2019, bank column of the Cash Book showed balance of ₹ 12,000 but the Pass Book showed a different balance due to the following reasons:

(i) Cheques paid into the bank ₹ 8,000 but out of these only cheques of ₹ 6,500 credited by bankers.

(ii) The receipts column of the Cash Book undercast by ₹ 200.

(iii) On 29th June, a customer deposited ₹ 3,000 directly in the Bank Account but it was entered in the Pass Book only.

(iv) Cheques of ₹ 9,200 were issued of which ₹ 2,200 were presented for payment on 15th July.

(v) Pass Book shows a credit of ₹ 330 as interest and a debit of ₹ 60 as bank charges.

Prepare Bank Reconciliation Statement as on 30th June, 2019.

ANSWER:

Page No 12.44:

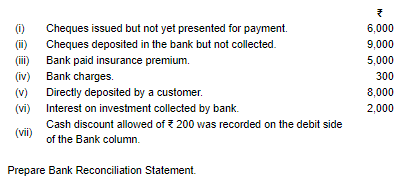

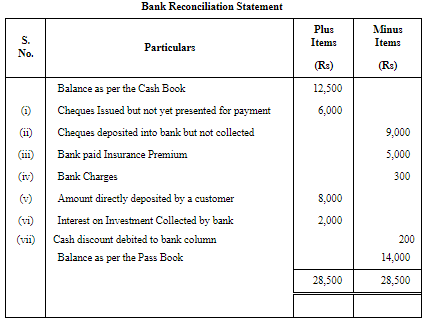

Question 5: Cash Book shows a balance of ₹ 12,500. On comparing the Cash Book with the Pass Book, following discrepancies were noted:

ANSWER:

|

64 videos|152 docs|35 tests

|

FAQs on Bank Reconciliation Statement (Part-1) - Accountancy Class 11 - Commerce

| 1. What is a bank reconciliation statement? |  |

| 2. Why is bank reconciliation important for a business? |  |

| 3. How often should bank reconciliation be performed? |  |

| 4. What are the common reasons for discrepancies in bank reconciliation? |  |

| 5. What are the steps involved in preparing a bank reconciliation statement? |  |