Bills of Exchange (Part - 1) - Commerce PDF Download

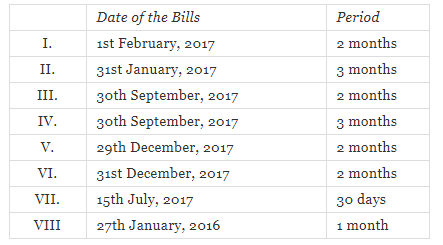

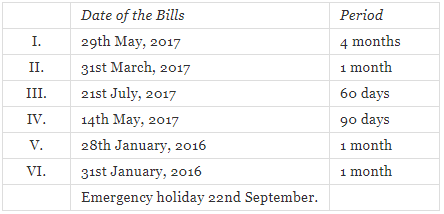

Page No 18.58:

Question 1:

Calculate the due dates of the bills in the following cases:

ANSWER:

Due Date of Bill = Date of Bill Drawn + Period + Grace Days

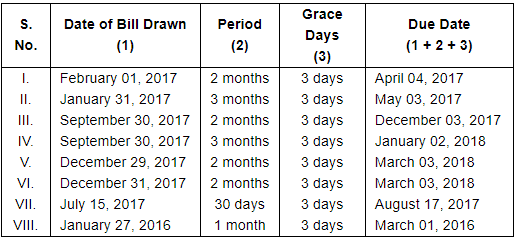

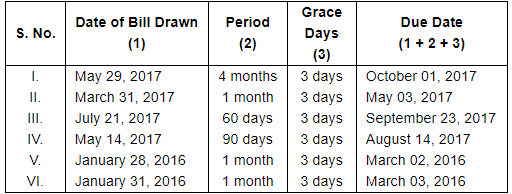

Page No 18.58:

QUESTION 2:

Find out the due dates of the bills in the following cases:

Due Date of Bill = Date of Bill Drawn + Period + Grace Days

Note: When due date falls on;

1. Public holiday (here October 2, 2017 and August 15, 2017), then due date is preceding date.

2. Emergency holiday (here September 22, 2017), then due date is succeeding date.

Page No 18.59:

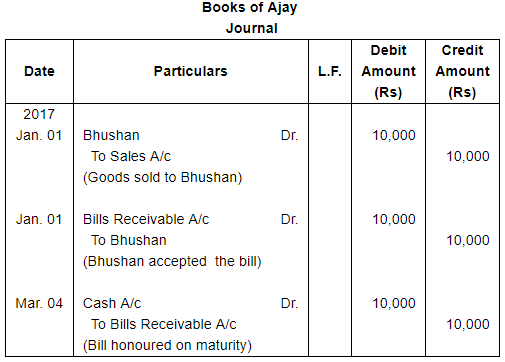

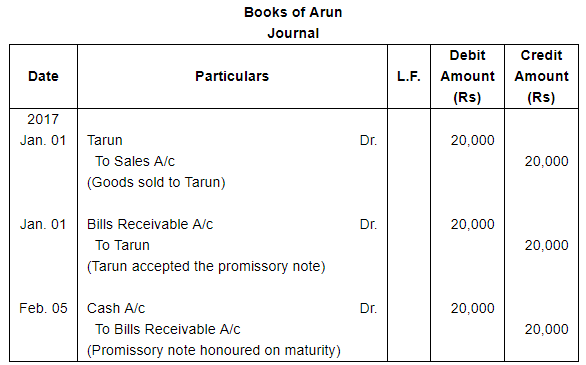

Question 3:

On 1st January, 2017, Ajay sold goods to Bhushan for ₹ 10,000. Ajay draws a bill of exchange for two months for the amount due which Bhushan accepts and returns it to Ajay, Bhushan met the bill on the due date. Pass Journal entries in the books of Ajay and Bhushan.

ANSWER:

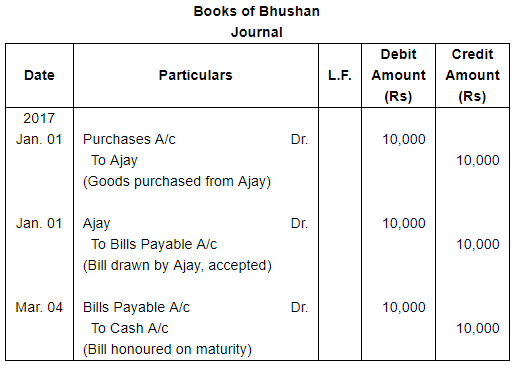

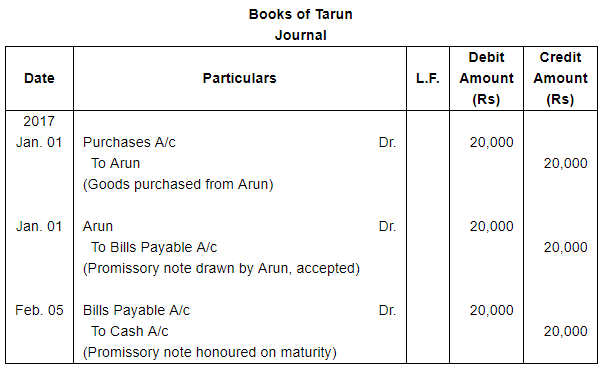

Question 4:

On Jan. 1,2017, Tarun purchased goods from Arun for ₹ 20,000 and immediately drew a promissory note in favour of Arun payable after 1 month. Date of maturity of the promissory note was declared emergency holiday by the Government of India under the Negotiable Instrument Act 1881. Tarun met the promissory note according to the provisions of law.

Pass the necessary Journal entries in the books of Arun and Tarun.

ANSWER:

Note: When due date falls on Emergency holiday (here February 04, 2017), then due date is succeeding date i.e. February 05, 2017.

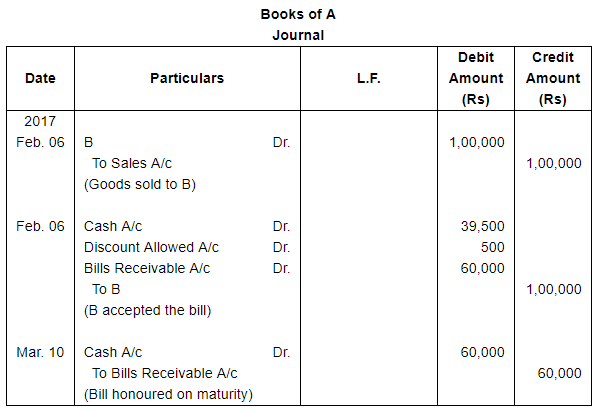

Question 5:

On Feb. 6, 2017 A sold goods for ₹ 1,00,000 to B. B paid 40% immediately on which A allowed a cash discount of ₹ 500. For the balance A drew a bill on B payable after 30 days. Due date of bill was a public holiday and the bill was met as per the provisions of Negotiable Instrument Act. Journalise the above transactions in the books of A and B.

ANSWER:

Note: When due date falls on Public holiday (here March 11, 2017), then due date is preceding date i.e. March 10, 2017.

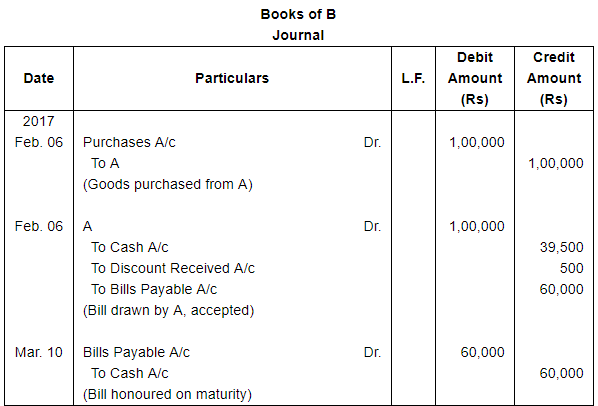

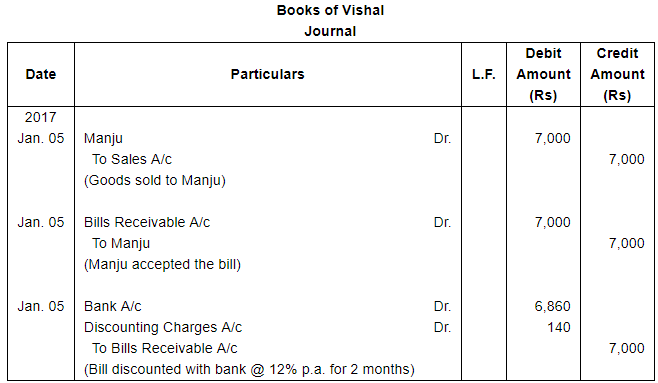

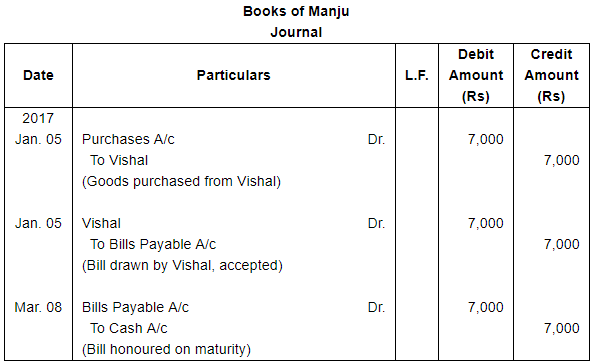

Question 6(A):

Vishal sold goods for ₹ 7,000 to Manju on Jan. 5, 2017 and drew upon her a bill of exchange payable after 2 months. Manju accepted Vishal's draft and handed over the same to Vishal after acceptance. Vishal immediately discounted the bill with his bank @ 12% p.a. On the due date Manju met her acceptance. Journalise the above transactions in the books of Vishal and Manju.

ANSWER:

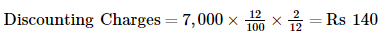

Working Note: Calculation of Discounting Charges

Question 6(B):

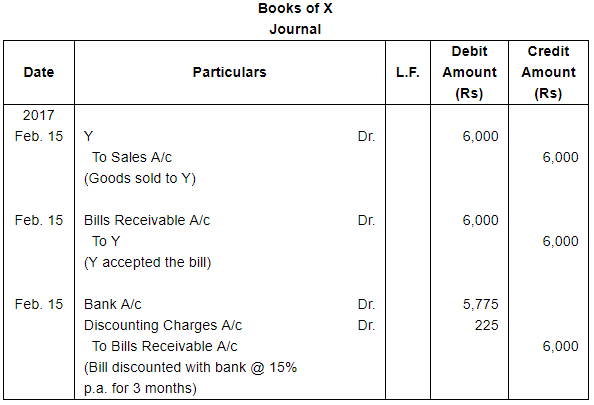

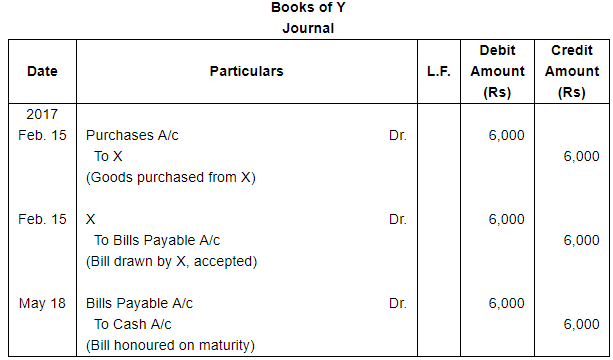

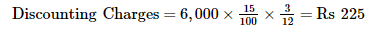

On 15th February, 2017, X sold goods to Y for ₹ 6,000. On the same day, Y accepted a bill drawn upon him by X for three months for ₹ 6,000. X immediately discounted the bill at 15% p.a. at his bank and Y met the bill on maturity. Make Journal entries in the books of both the parties.

ANSWER:

Working Note: Calculation of Discounting Charges

Question 7:

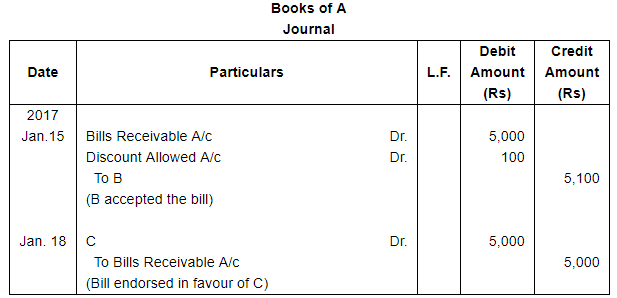

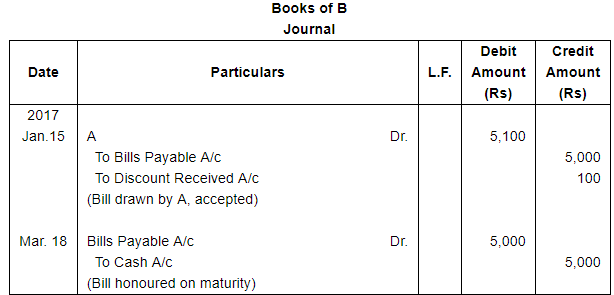

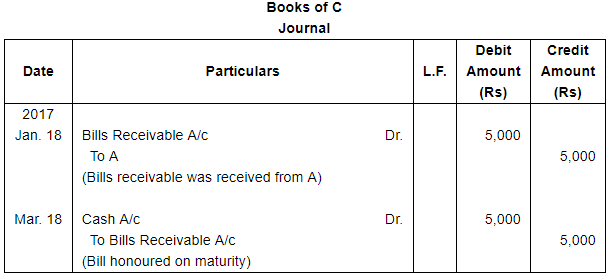

B owed ₹ 5,100 to A. On 15th January, 2017, he accepted a bill for ₹ 5,000 for two months drawn by A in full settlement of his debt. On 18th January, 2017, A endorsed the bill to his creditor C. The bill was duly met on the date of maturity. Pass Journal entries in the books of A, B and C.

ANSWER:

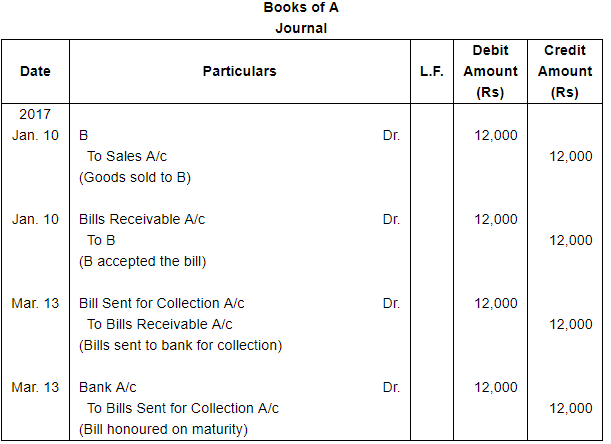

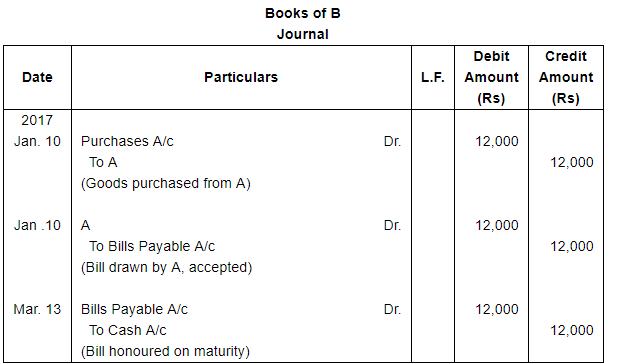

Question 8:

On 10th January, 2017, A sells goods to B for ₹ 12,000. On that date, B accepted a bill drawn upon him by A at two months for ₹ 12,000. A retains the bill till due date and on due date sends the bill to the Banker for collection. In due course, A receives the information from the Bank that the bill has been duly met.

Pass Journal Entries in the books of A and B.

ANSWER:

Page No 18.60:

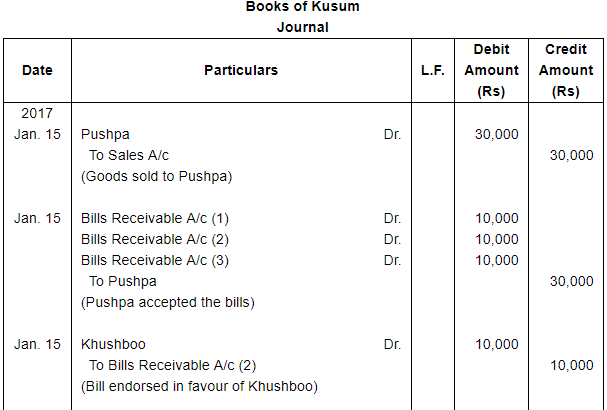

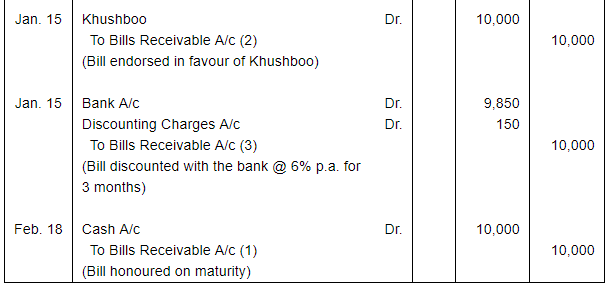

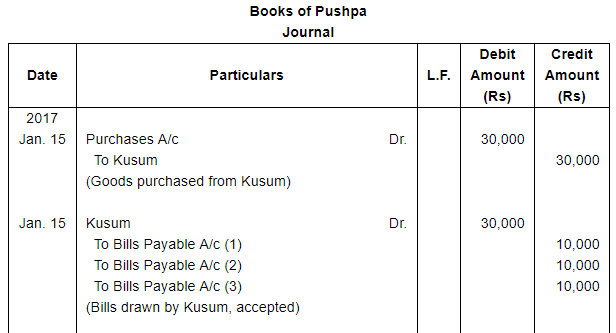

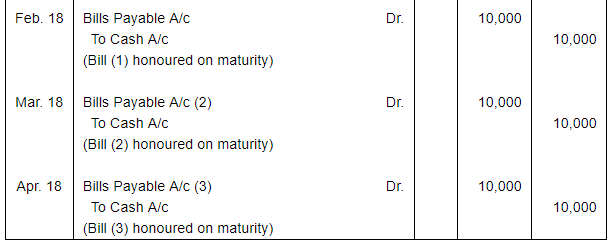

Question 9:

On Jan. 15, 2017, Kusum sold goods for ₹ 30,000 to Pushpa and drew upon her three bills of exchanges of ₹ 10,000 each payable after one month, two months and three months respectively. The first bill was retained by Kusum till its maturity. The second bill was endorsed by her in favour of her creditor Khushboo and the third bill was discounted by her immediately @ 6% p.a. All the bills were met by Pushpa. Journalise the above transactions in the books of Kusum and Pushpa.

ANSWER:

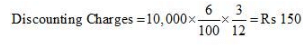

Working Note: Calculation of Discounting Charges

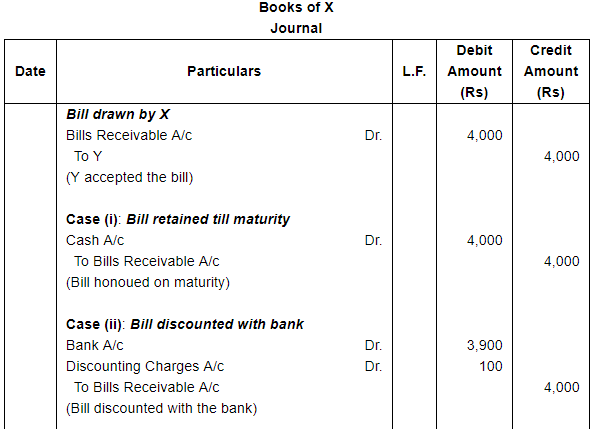

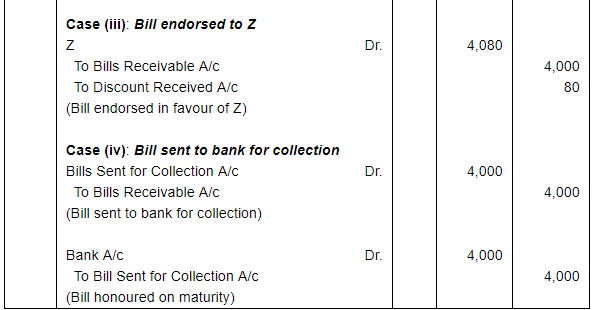

Question 10:

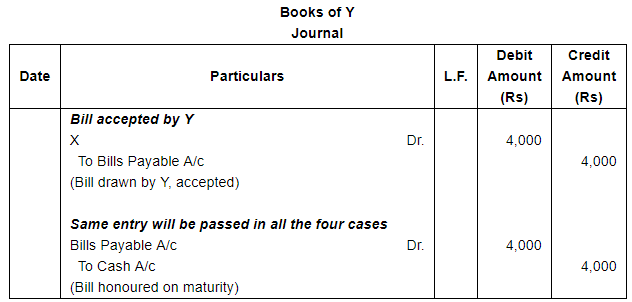

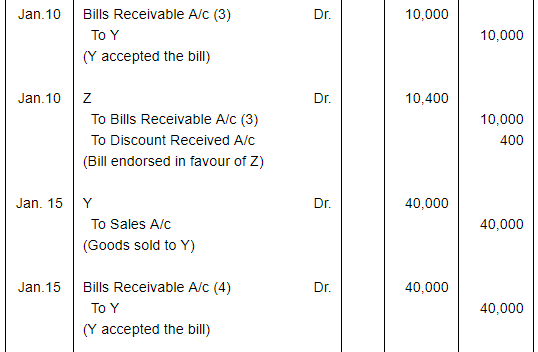

X draws on Y a bill for ₹ 4,000 which was duly accepted by Y. Y meets the bill on its due date. Show what entries would be passed in the books of X and Y under each of the following circumstances:

(i) If X retains the bill till due date.

(ii) If X discounts the same with his banker paying ₹ 100 for discount.

(iii) If X endorses the same to his creditor Z, in full settlement of his debt of ₹ 4,080.

(iv) If X sends the bill to his banker for collection.

ANSWER:

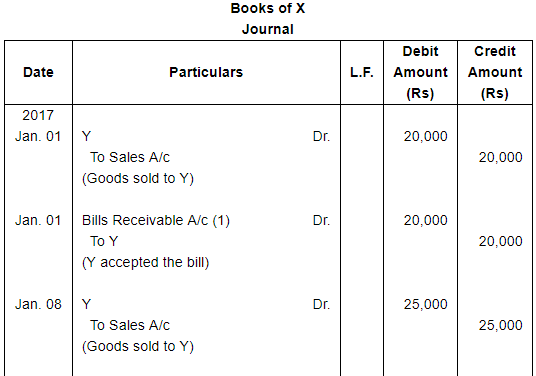

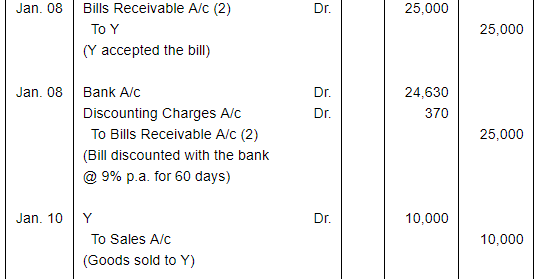

Question 11:

X made the following sales to Y:

| Date | Amount (₹) |

| Jan. 01, 2017 | 20,000 |

| Jan. 08, 2017 | 25,000 |

| Jan. 10, 2017 | 10,000 |

| Jan. 15, 2017 | 40,000 |

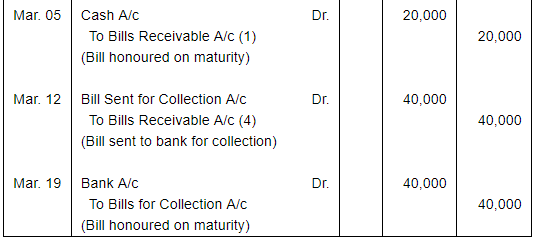

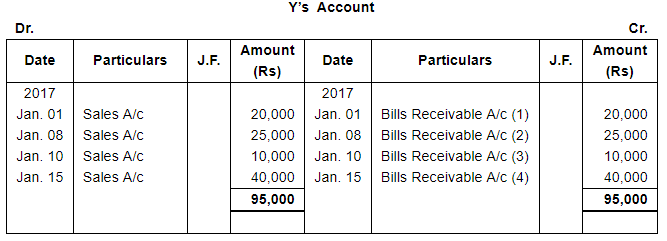

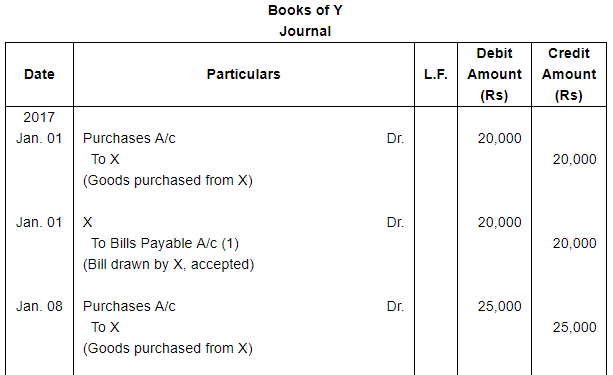

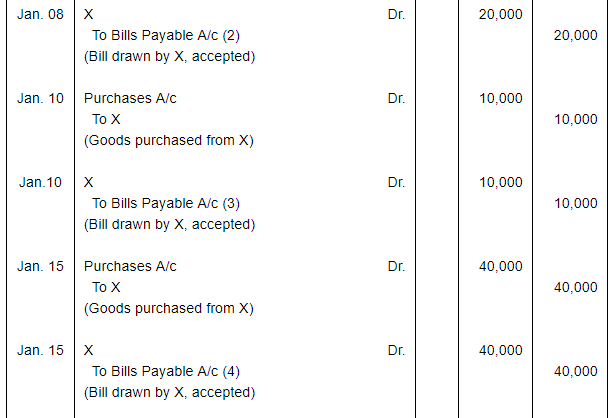

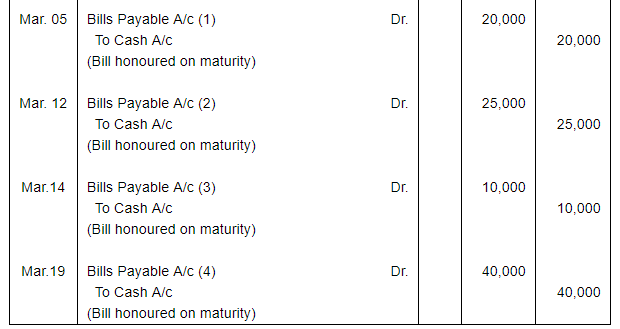

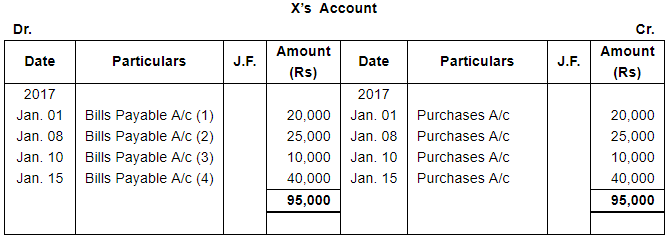

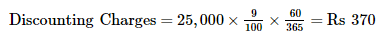

For all the sales X drew bills on Y payable after 60 days. Bill drawn on Jan. 01, 2017 was retained by X with him till its due date. The bill drawn on Jan. 08, 2017 was discounted by X from the bank at 9% p.a. The bill drawn on Jan. 10, 2017 was endorsed by X to his creditor Z in full settlement of ₹ 10,400. On March 12, 2017 X sent the bill drawn on Jan. 15, 2017 to his bank for collection. All the bills were met by Y on due dates.

Pass necessary journal entries in the books of X and Y and prepare Y' s account in the books of X and X's account in the books of Y.

ANSWER:

Working Note: Calculation of Discounting Charges

FAQs on Bills of Exchange (Part - 1) - Commerce

| 1. What is a bill of exchange? |  |

| 2. How does a bill of exchange work? |  |

| 3. What are the advantages of using bills of exchange? |  |

| 4. Can bills of exchange be dishonored? |  |

| 5. Are bills of exchange still widely used today? |  |