Page No 18.65:

Question 33:

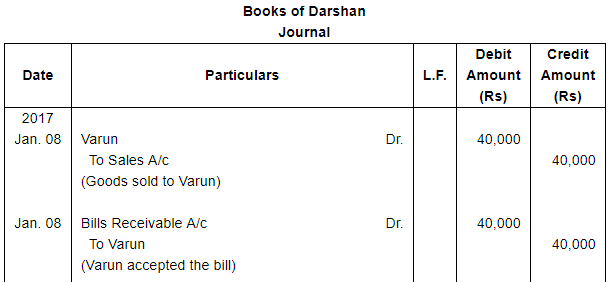

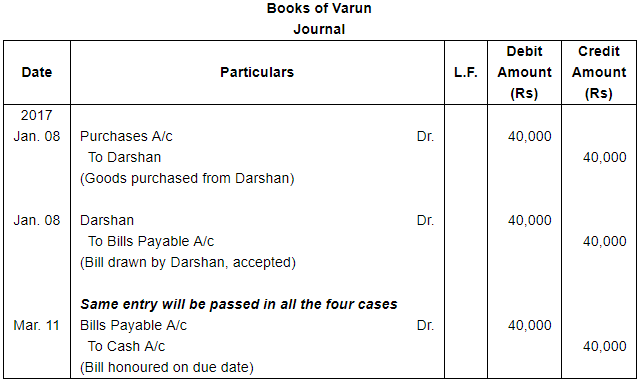

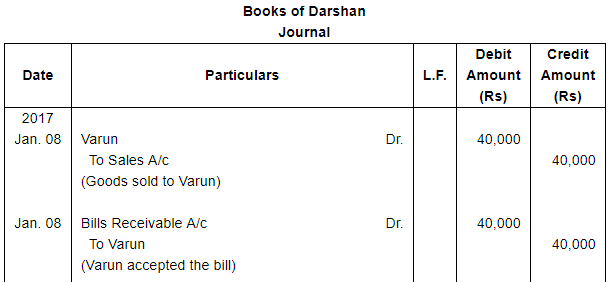

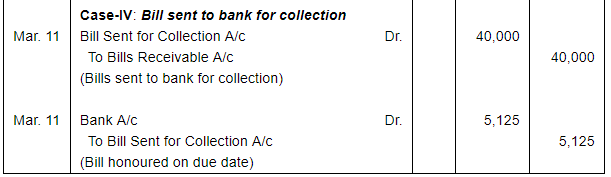

Darshan sold goods for ₹ 40,000 to Varun on 8.1.2017 and drew upon him a bill of exchange payable after two months. Varun accepted the bill and returned the same to Darshan. On the due date the bill was met by Varun. Record the necessary Journal entries in the books of Darshan and Varun in the following circumstances:

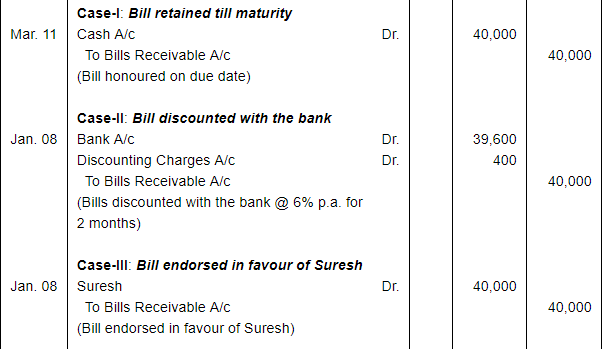

When the bill was retained by Darshan till the date of its maturity.

When Darshan immediately discounted the bill @6% p.a. with his bank.

When the bill was endorsed immediately by Darshan in favour of his creditor Suresh.

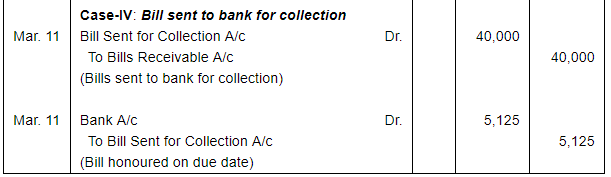

When three days before its maturity, the bill was sent by Darshan to his bank for collection.

ANSWER:

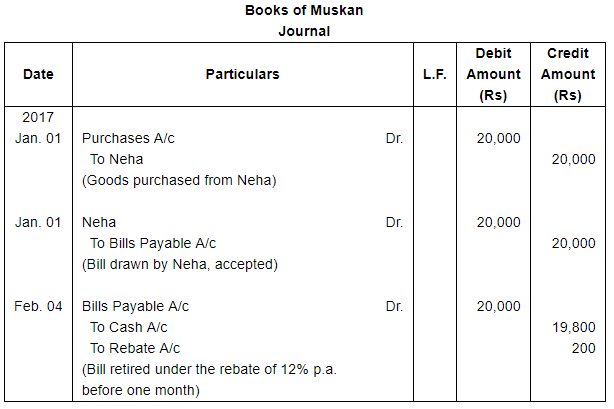

Question 34:

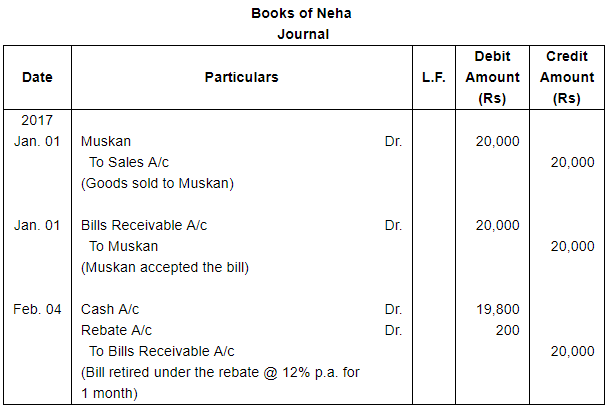

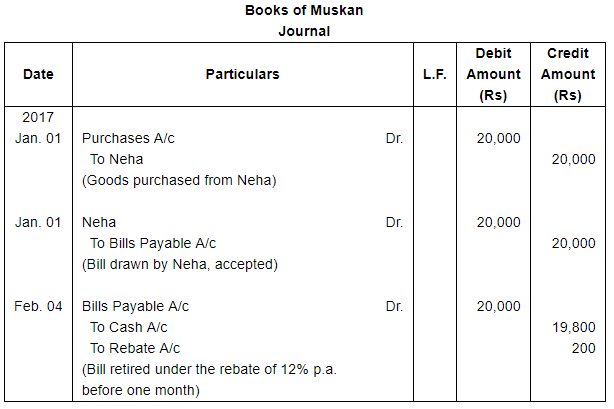

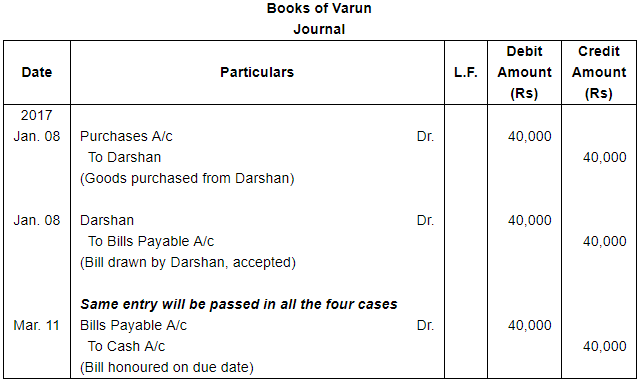

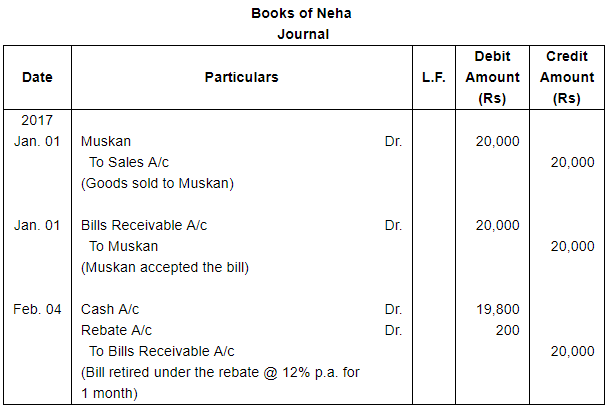

On Jan. 1, 2017 Neha sold goods for ₹ 20,000 to Muskan and drew upon her a bill of exchange payable after two months. One month before the maturity of the bill Muskan approached Neha to accept the payment against the bill at a rebate @12% p.a. Neha agreed to the request of Muskan and Muskan retired the bill under the agreed rate of rebate.

Journalise the above transactions in the books of Neha and Muskan.

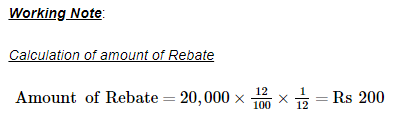

ANSWER:

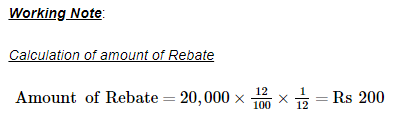

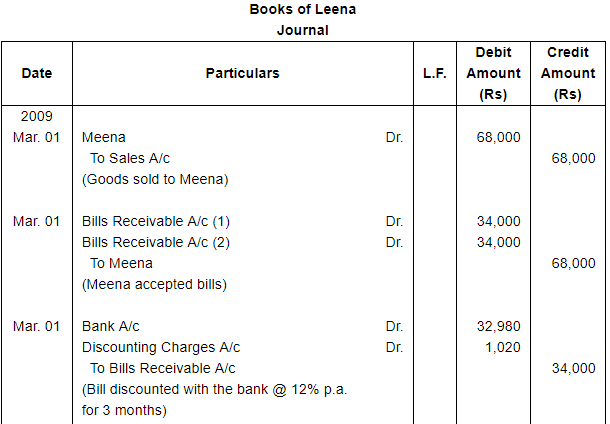

Question 35:

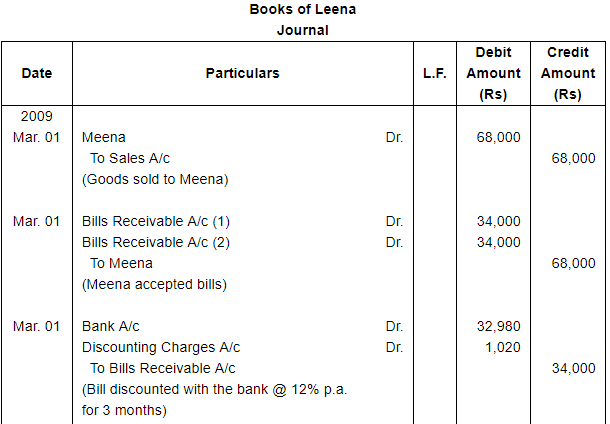

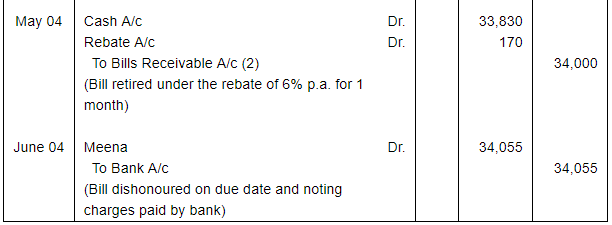

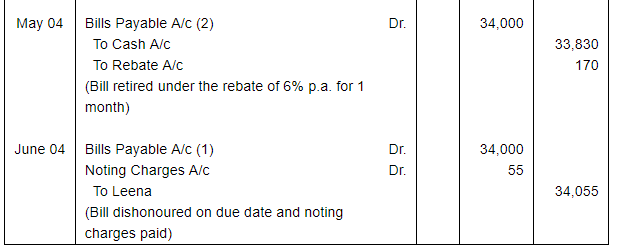

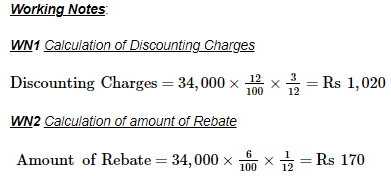

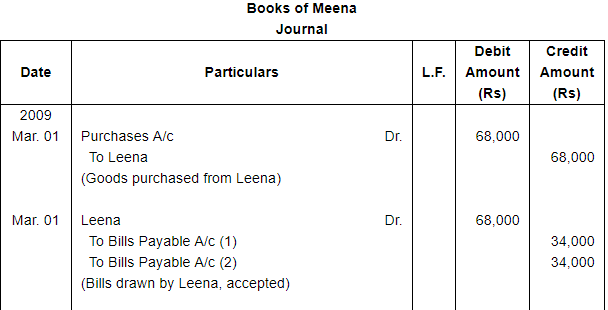

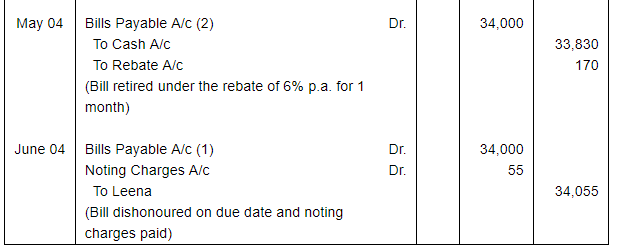

Leena sold goods to Meena on March 01, 2009 for ₹ 68,000 and drew two bills of exchange of the equal amount upon Meena payable after three months. Leena immediately discounted the first bill with her bank at 12% p.a. The bill was dishonoured by Meena and Bank paid ₹ 55 as noting charges.

The second bill was retired on May 04, 2009 under a rebate of 6% p.a. with mutual agreement.

Journalise the above in the books of Leena and Meena.

ANSWER:

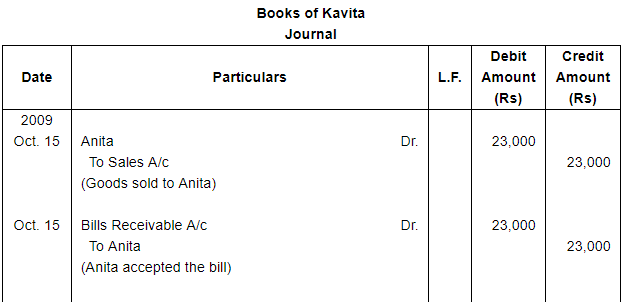

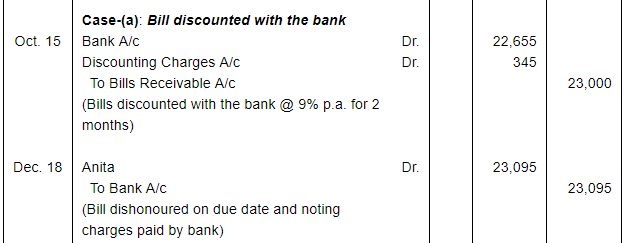

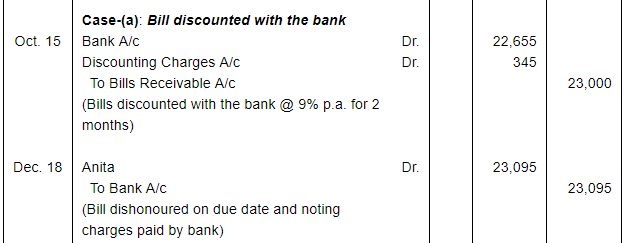

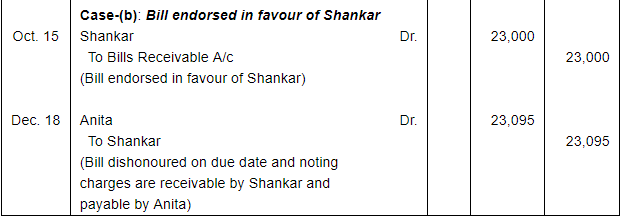

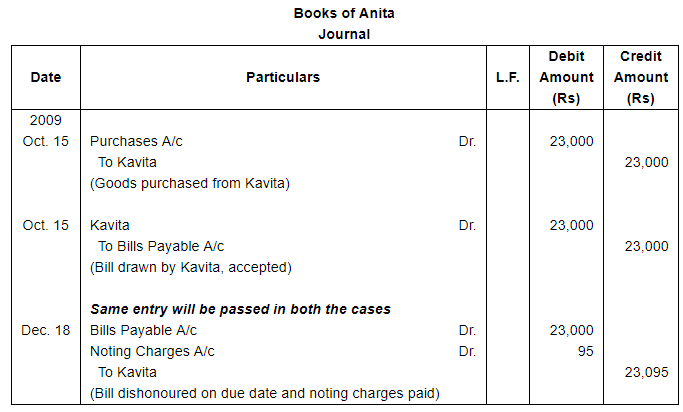

Question 36:

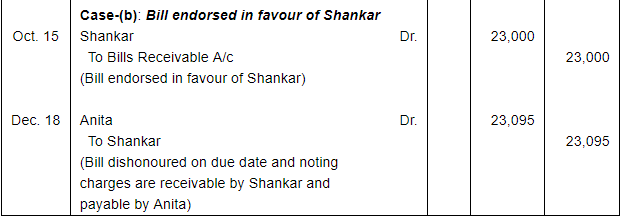

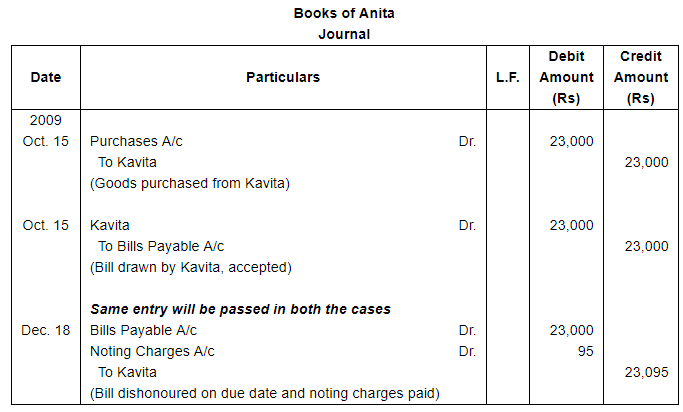

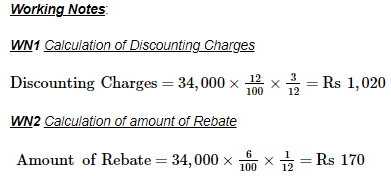

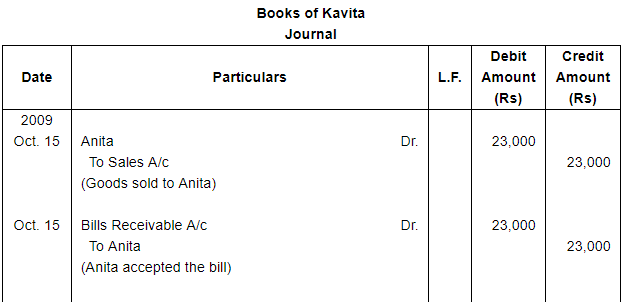

Anita purchased goods for ₹ 23,000 from Kavita on October 15, 2009 and accepted a bill of exchange drawn upon her by Kavita payable after two months. On the date of maturity the bill was duly presented for payment. Anita dishonoured the bill. The payee noted with ₹ 95 as noting charges.

Record the necessary journal entries in the books of Kavita and Anita, when (a) The bill was immediately discounted by Kavita with her Bank @ 9% p.a. (b) The bill was endorsed by Kavita in favour of her creditor Shankar after one month.

ANSWER:

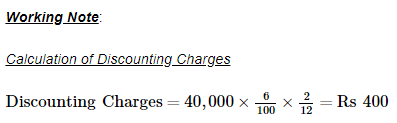

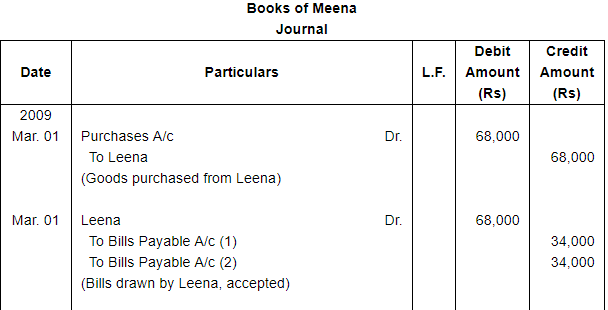

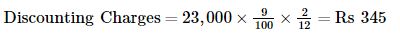

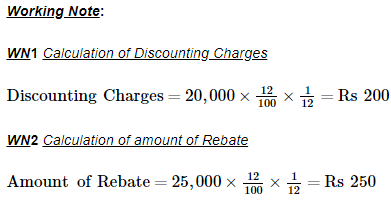

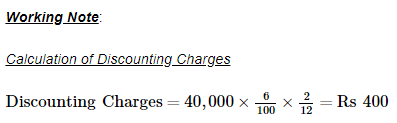

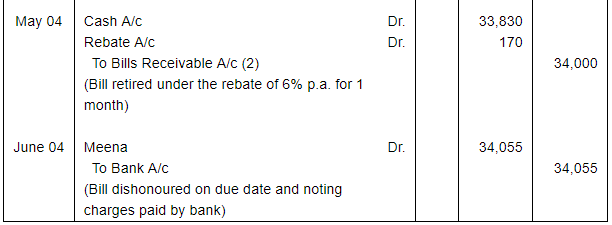

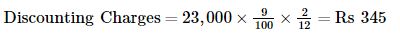

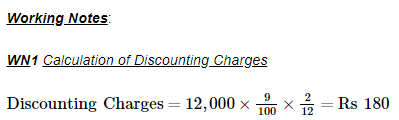

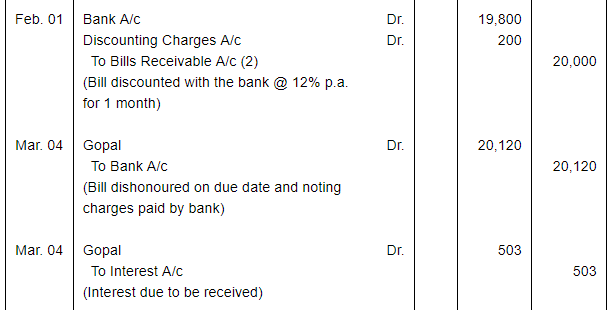

Working Note: Calculation of Discounting Charges

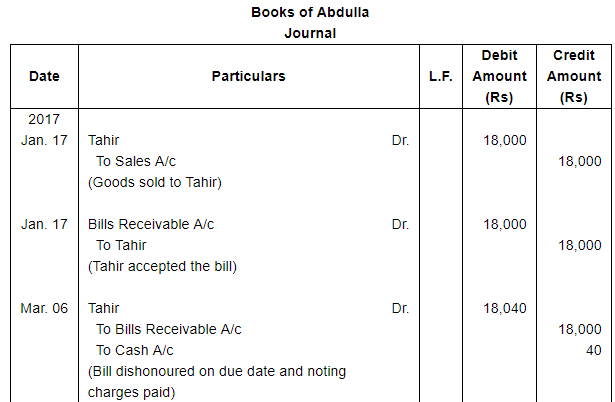

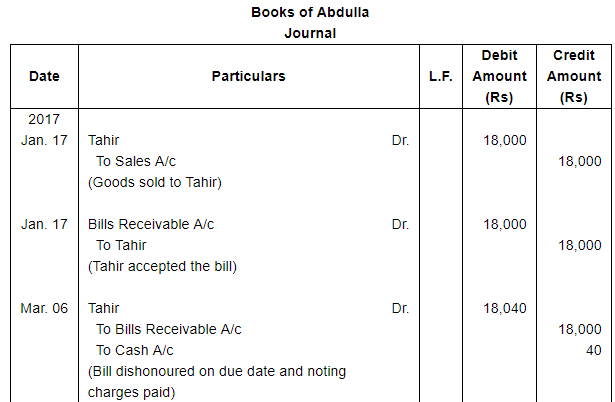

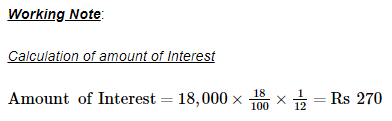

Question 37:

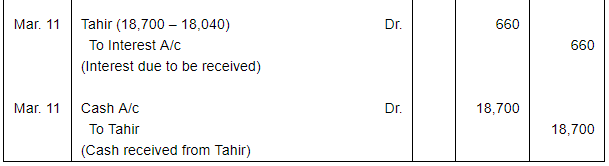

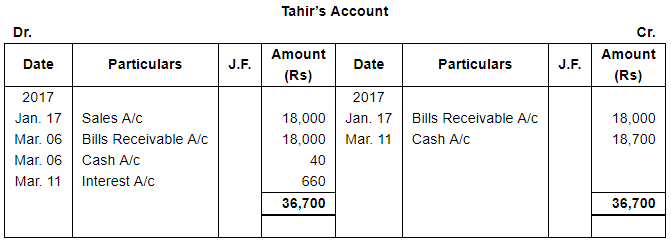

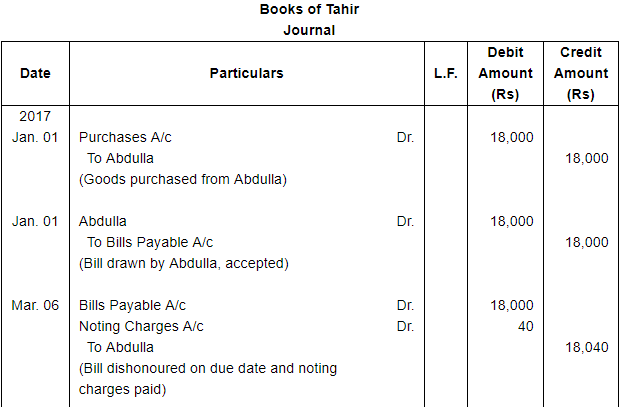

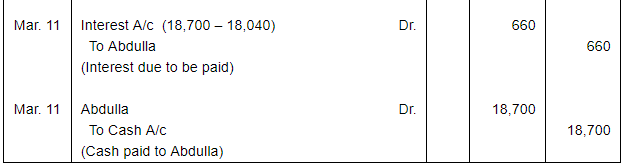

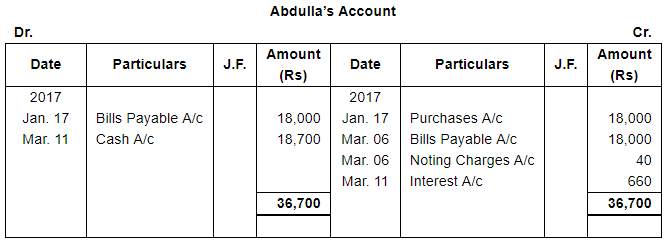

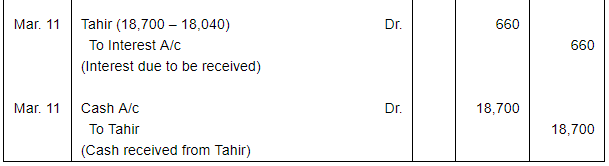

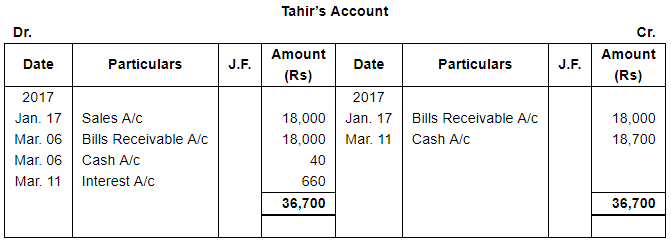

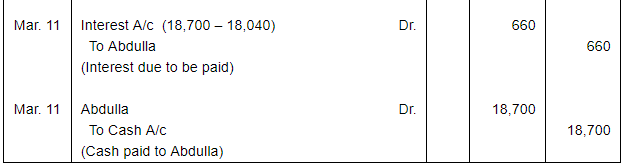

Abdulla sold goods to Tahir on Jan. 17, 2017 for ₹ 18,000. He drew a bill of exchange for the same amount on Tahir for 45 days. On the same date Tahir accepted the bill and returned it to Abdulla. On the due date Abdulla presented the bill to Tahir which was dishonoured. Abdulla paid ₹ 40 as noting charges. Five days after the dishonour of his acceptance Tahir settled his debt by making a payment of ₹ 18,700 including interest and noting charges.

Record the necessary journal entries in the books of Abdulla and Tahir. Also prepare Tahir's account in the books of Abdulla and Abdulla's account in the books of Tahir.

ANSWER:

Page No 18.66:

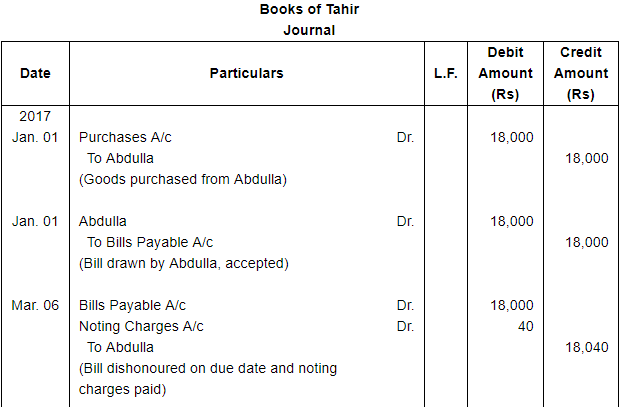

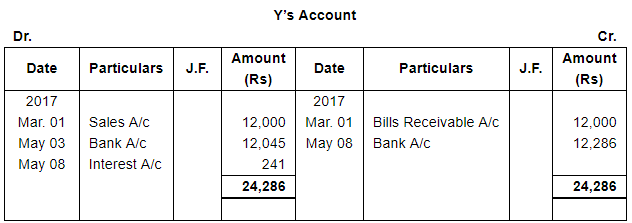

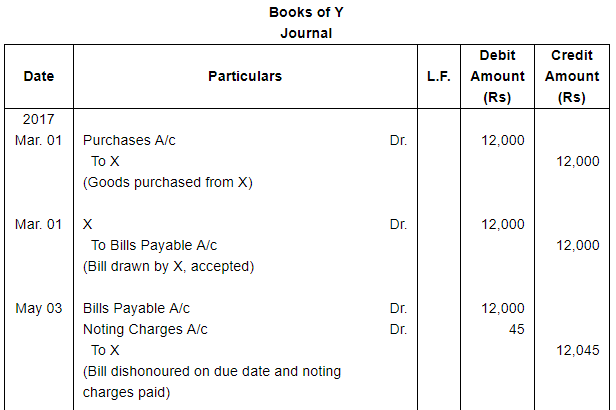

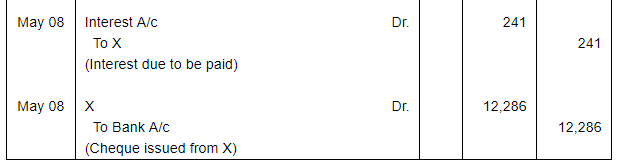

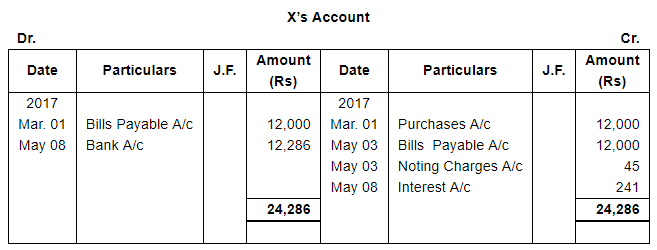

Question 38:

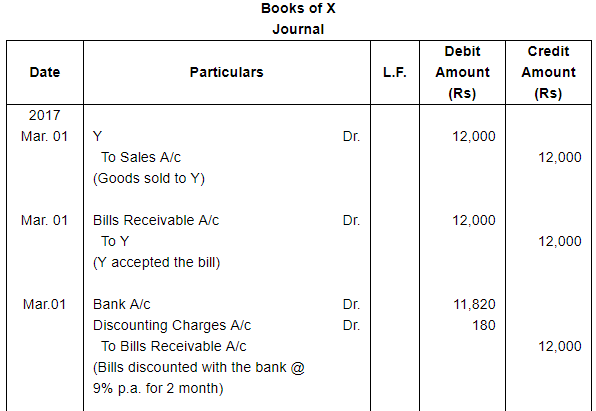

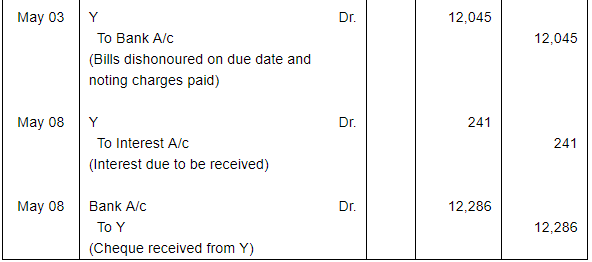

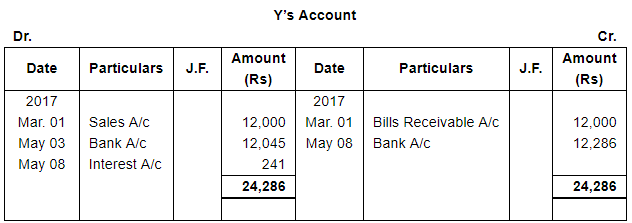

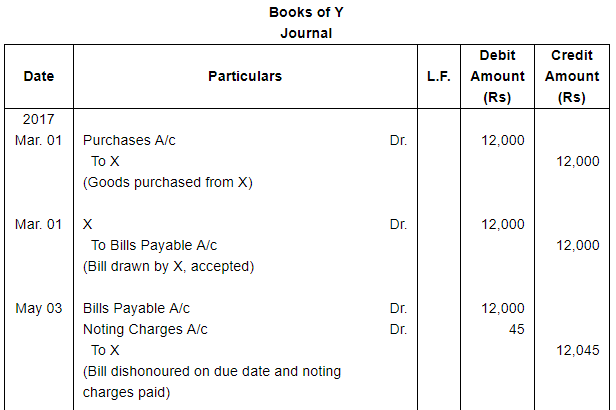

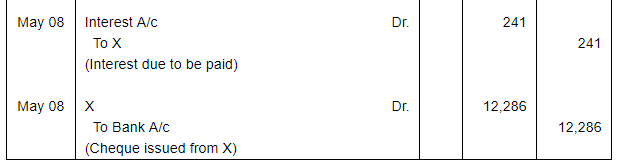

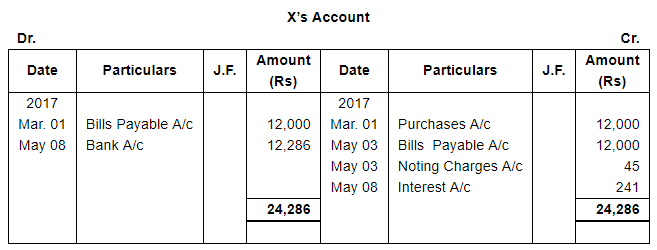

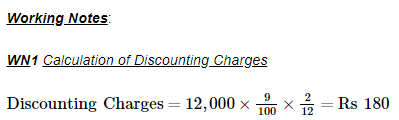

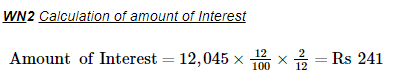

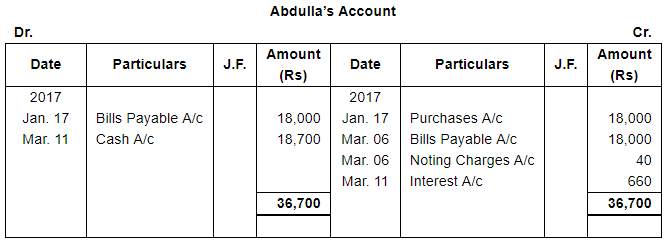

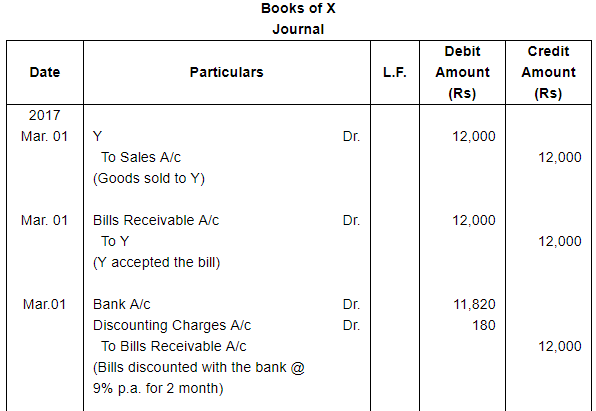

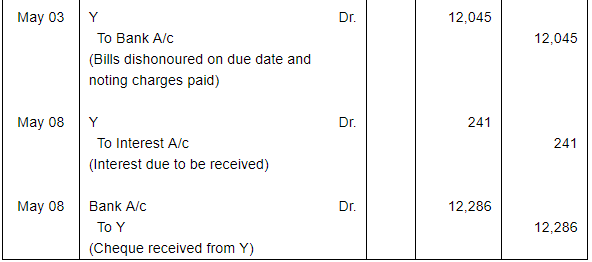

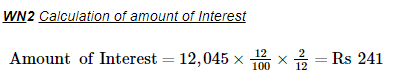

X sold goods to Y on 1.3.2017 for ₹ 12,000 and drew upon Y a bill of exchange for the same amount payable after two months. X immediately discounted the bill with his bank at 9% p.a. The maturity date of the bill was a non business day (holiday), therefore, X had to present the bill as per the provisions of the Indian Instruments Act, 1881. The bill was dishonoured by Y and X paid ₹ 45 as noting charges. Y settled the claim of X five days after the dishonour of the bill by a cheque which included interest @ 12% for the term of the bill.

Journalise the above transactions in the books of X and Y and prepare Y's account in the books of X and X's account in the books of Y.

ANSWER:

Note: When due date falls on Public holiday or Sunday or Gazetted holiday (here May 4, 2017), then due date is preceding date (here May 03, 2017).

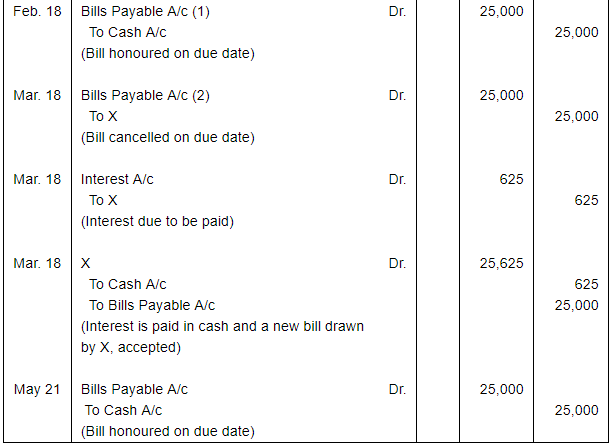

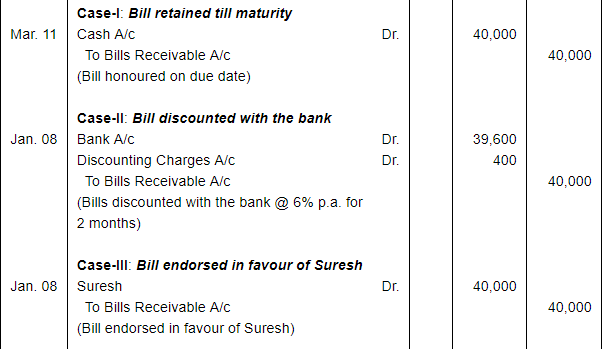

Question 39:

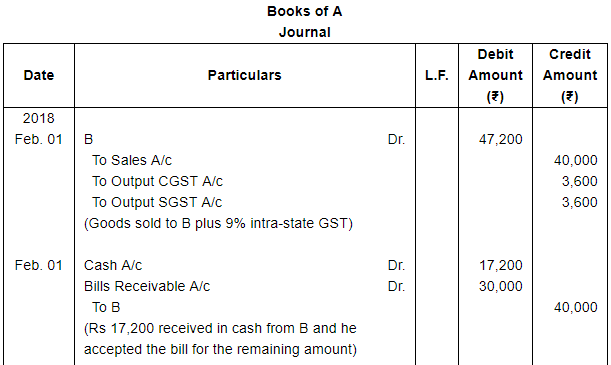

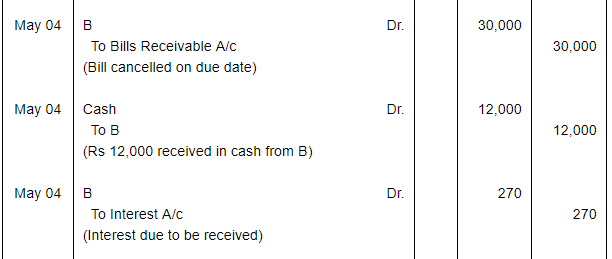

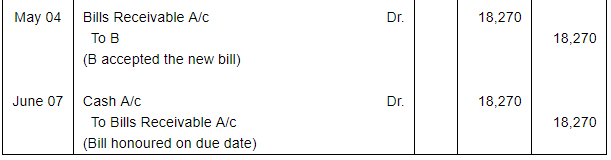

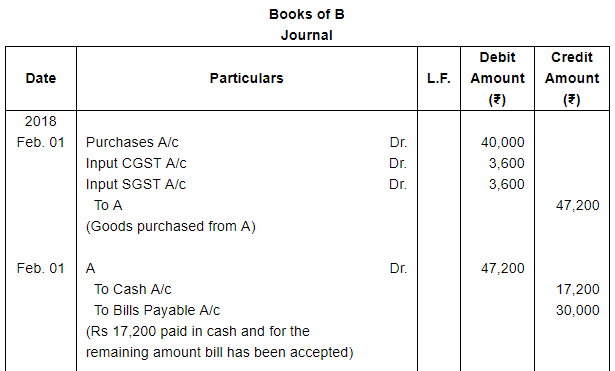

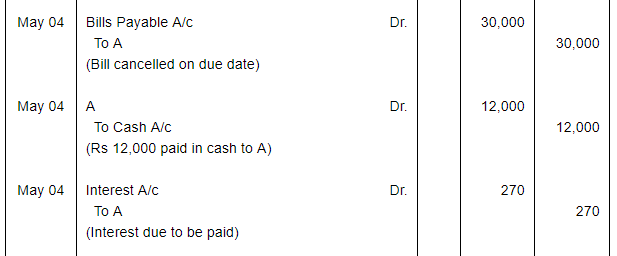

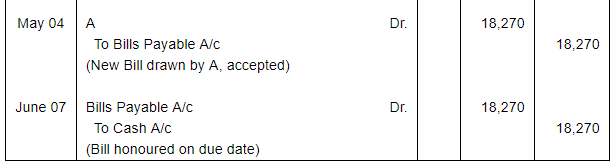

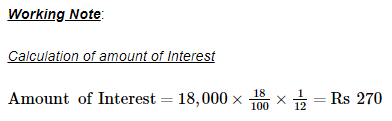

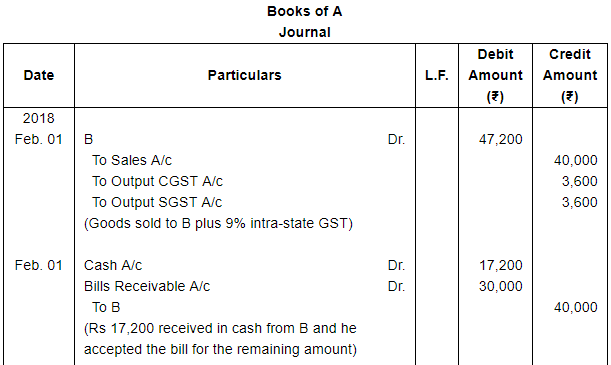

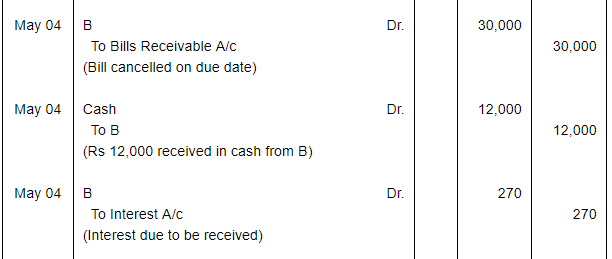

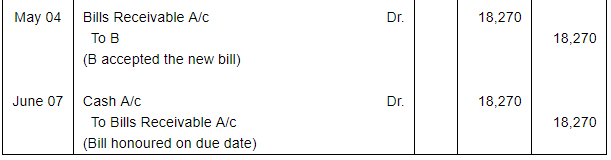

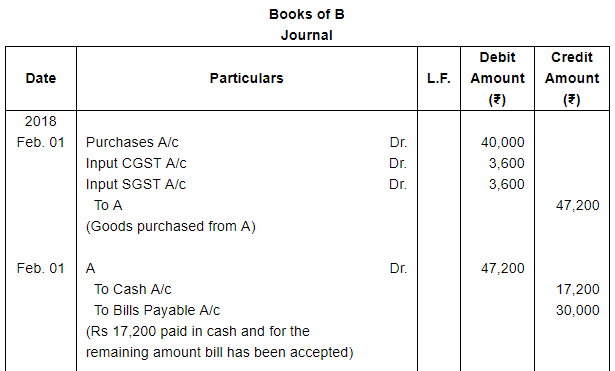

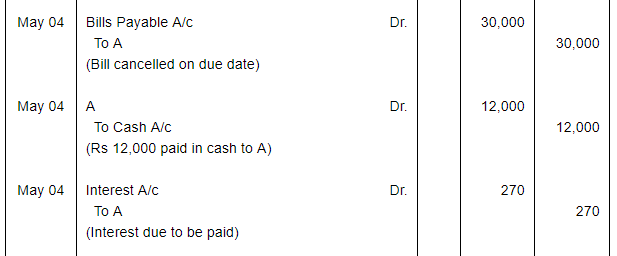

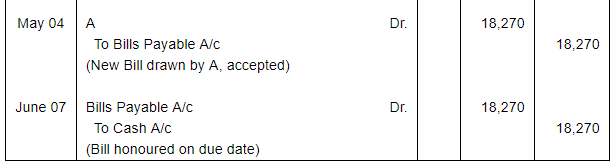

On 1st February 2018, A sold goods to B for ₹ 40,000 Charging CGST and SGST @ 9% each. B pays ₹ 17,200 in cash and accepted a three months bill for the balance. On the due date, B expressed his inability to meet the bill and offered ₹ 12,000 in cash and to accept a new bill for one month for the balance plus interest at 18% p.a. A agrees to the proposal. On the due date the bill was duly honoured by B. Pass entries in the books of A and B.

ANSWER:

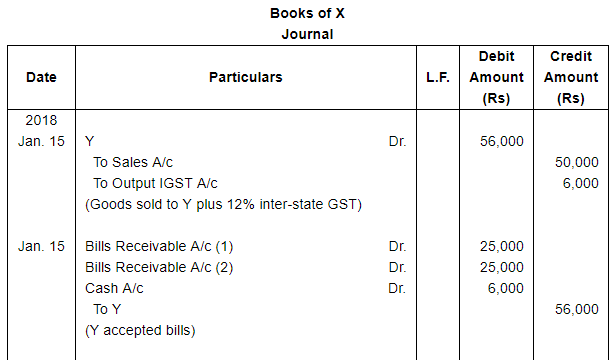

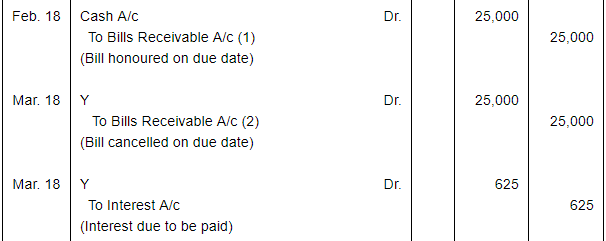

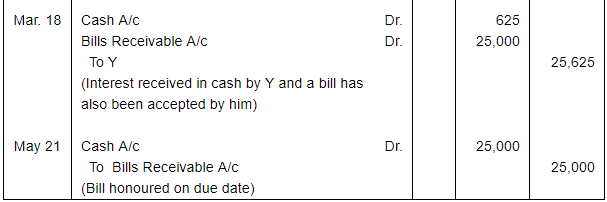

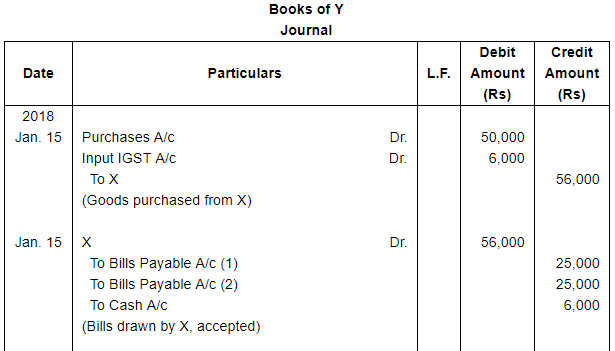

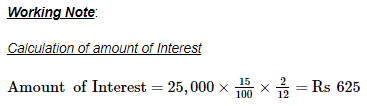

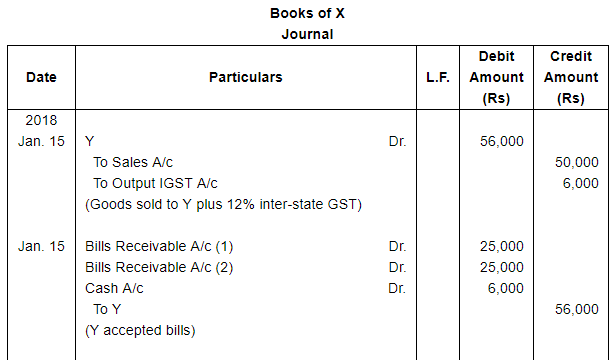

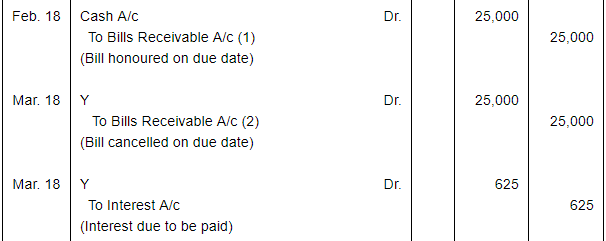

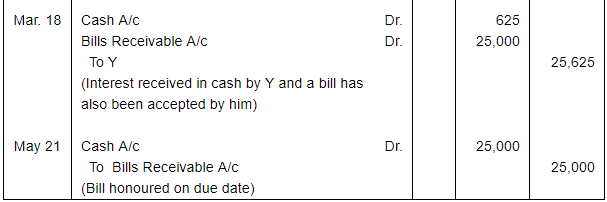

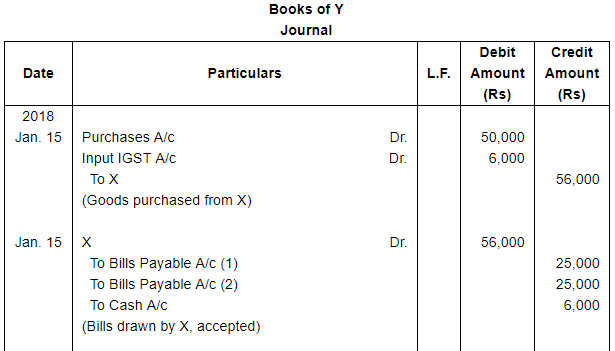

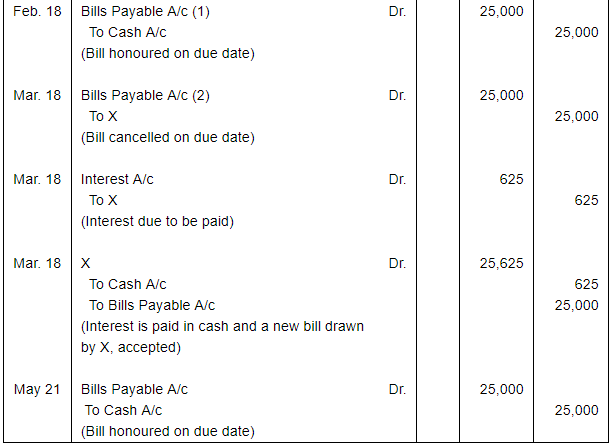

Question 40:

On 15th January 2018, X sold goods to Y for ₹ 50,000 charging IGST @ 12%. Y immediately paid ₹ 6,000 in cash and accepted two bills of equal amount, the first for one month and the second for two months. The first bill was met on due date but on the due date of the second bill, Y requested that the bill be renewed for a further period of two months. X agreed provided that interest at 15% p.a. was paid immediately in cash. Y agreed to this. The second bill was met on the due date.

Give journal entries in the books of X and Y.

ANSWER:

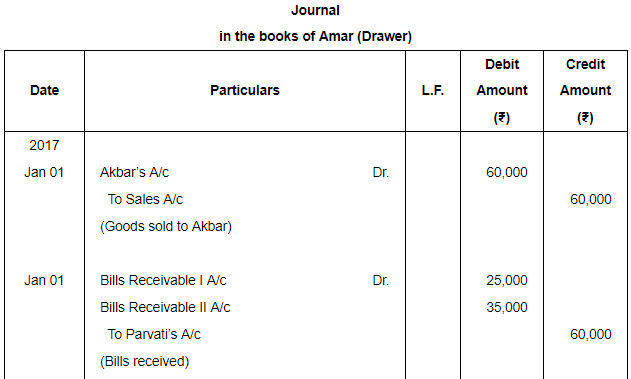

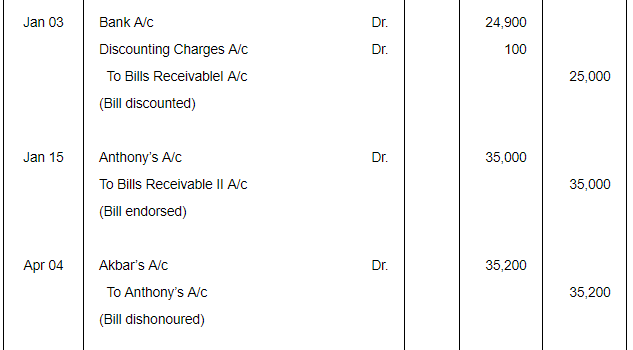

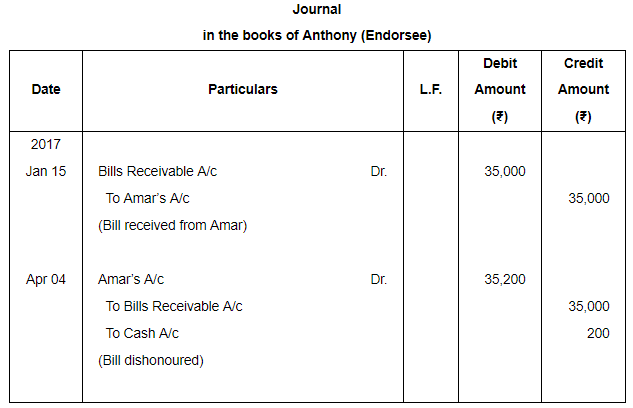

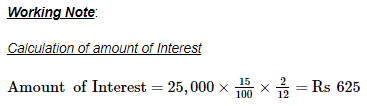

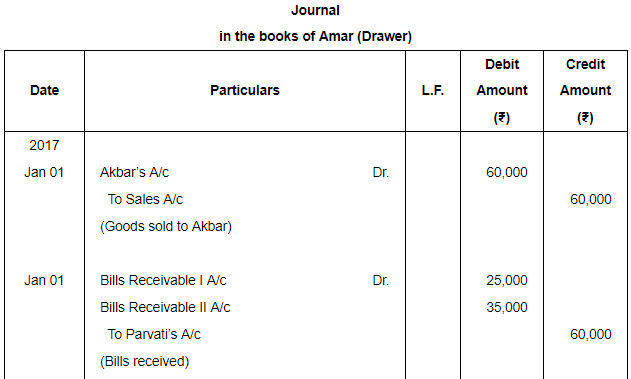

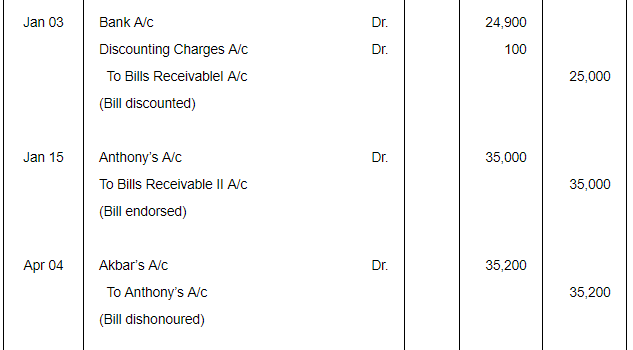

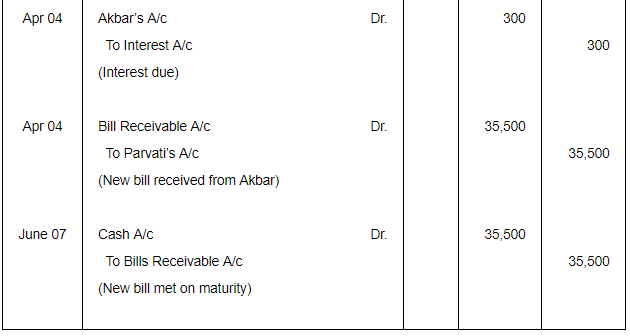

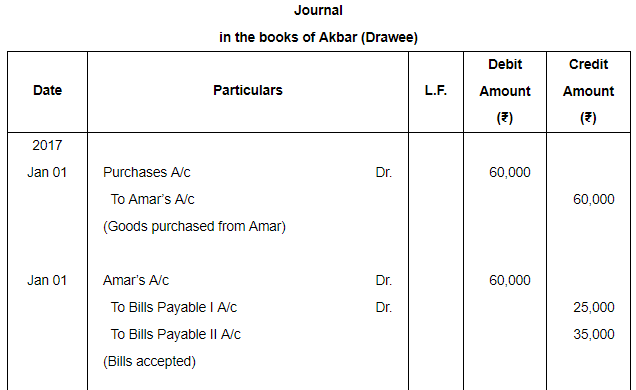

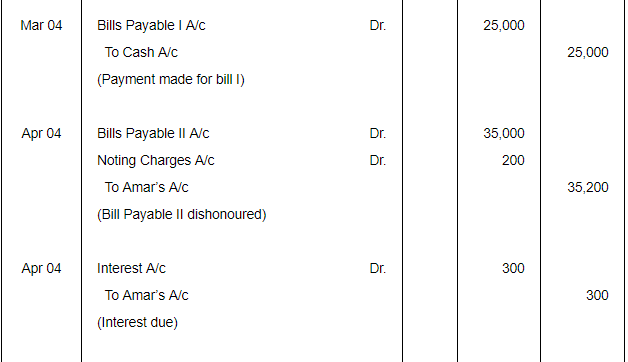

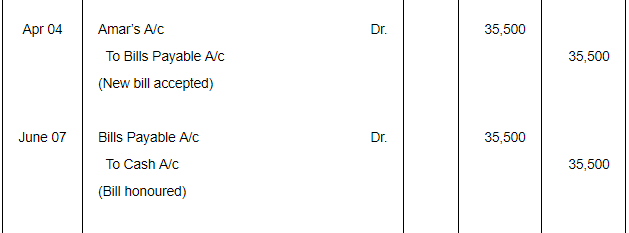

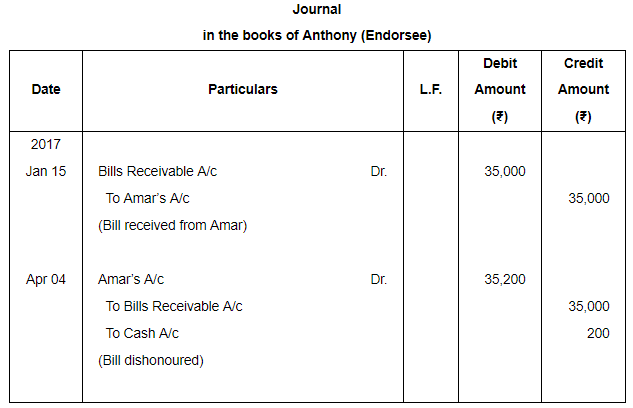

Question 41:

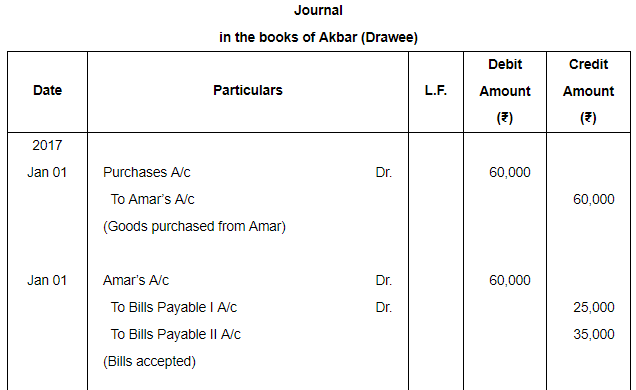

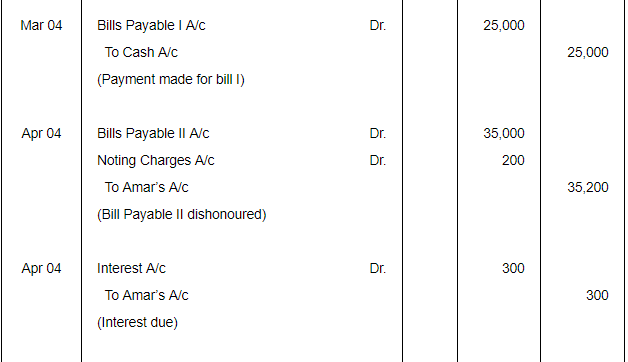

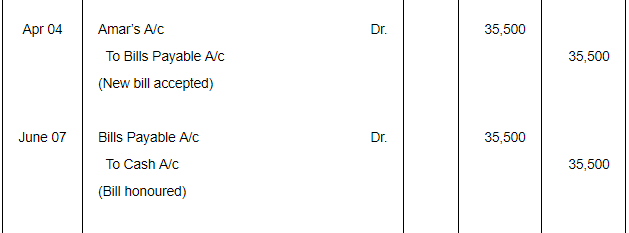

On 1st January 2017, Amar sold goods to Akbar for ₹ 60,000. Akbar accepts two bills of ₹ 25,000 for 2 months, and ₹ 35,000 for 3 months.

The first bill was discounted from bank on 3rd January 2017 for ₹ 24,900 and 2nd bill endorsed to Anthony on 15th January 2017.

First bill was met on maturity but second bill got dishonoured and noting charges of ₹ 200 being paid. Amar charged ₹ 300 as Interest and drew another bill for the amount due for further 2 months. This bill was met on maturity.

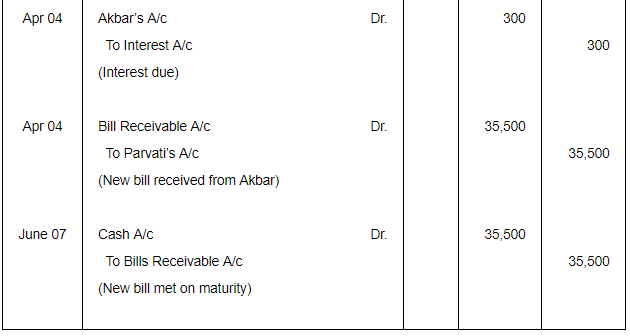

Pass the necessary Journal Entries in the books of Amar, Akbar and Anthony.

ANSWER:

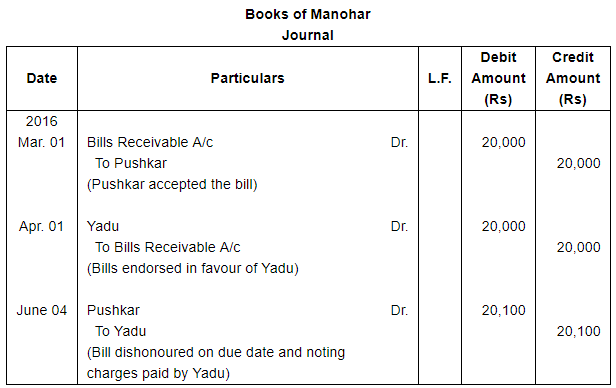

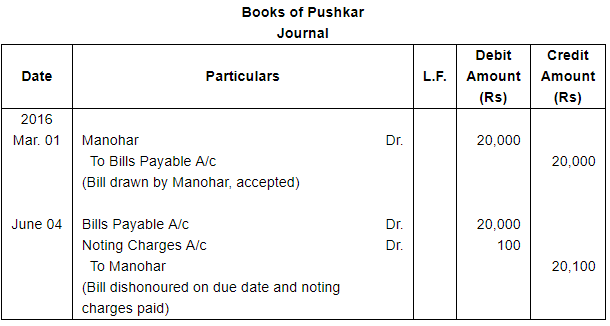

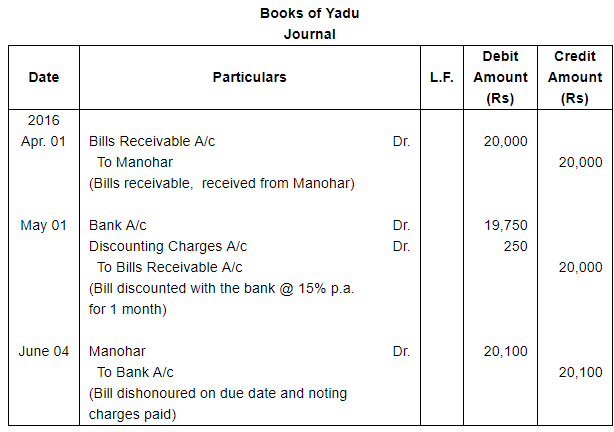

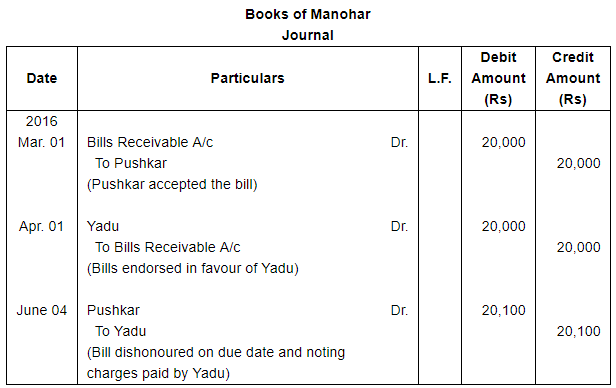

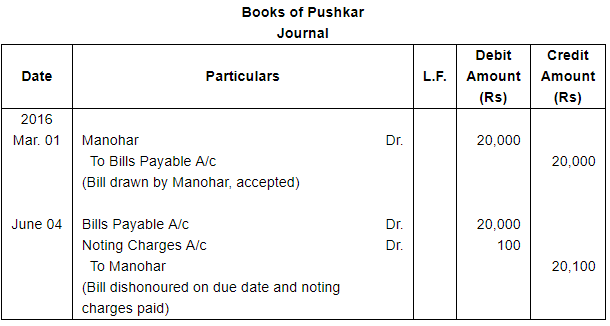

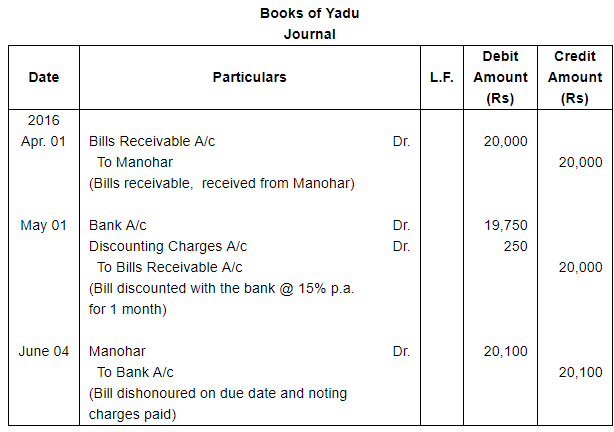

Question 42:

Manohar drew a bill of exchange on Pushkar, his debtor, for ₹ 20,000 on 1st March 2016 for 3 months. Pushkar accepted the same and returned it to the drawer. Manohar endorsed the bill to Yadu on 1st April 2016 for a debt of equal amount. Yadu discounted it with the bank at 15% p.a. on 1st May 2016. On the due date the bill was dishonoured. (Noting charges amounted to ₹ 100).

Show the journal entries in the books of :

(a) Drawer, (b) Drawee/Acceptor, and (c) Endorsee

ANSWER:

Page No 18.67:

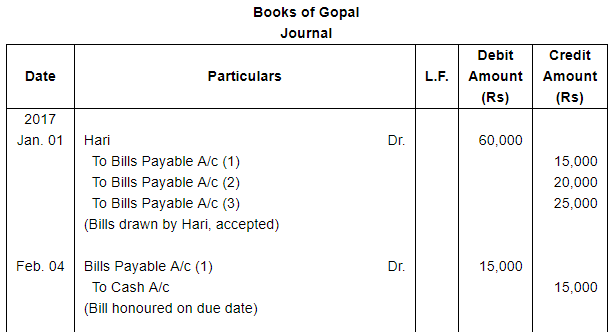

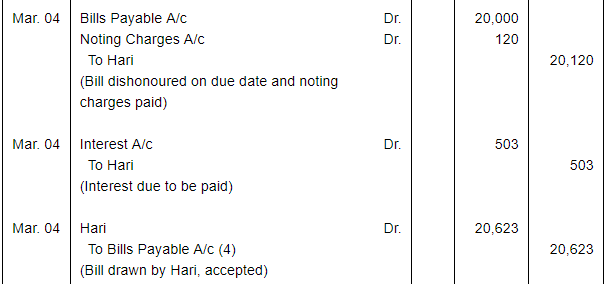

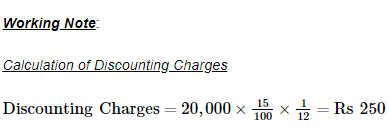

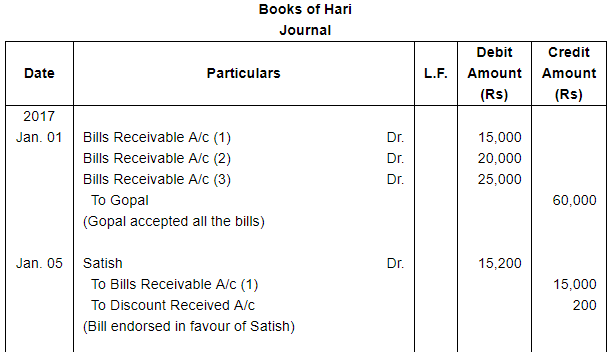

Question 43:

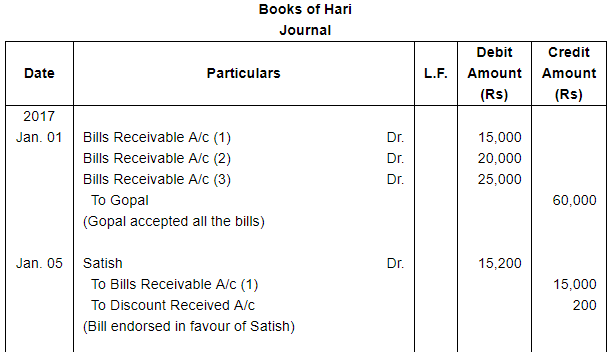

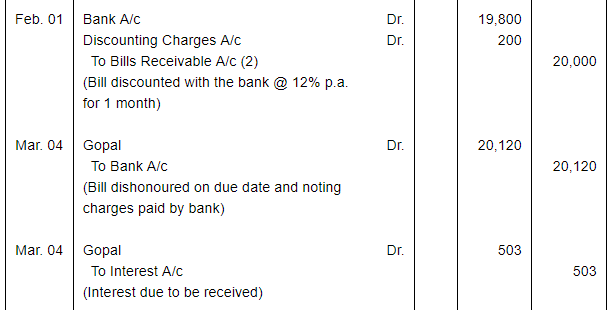

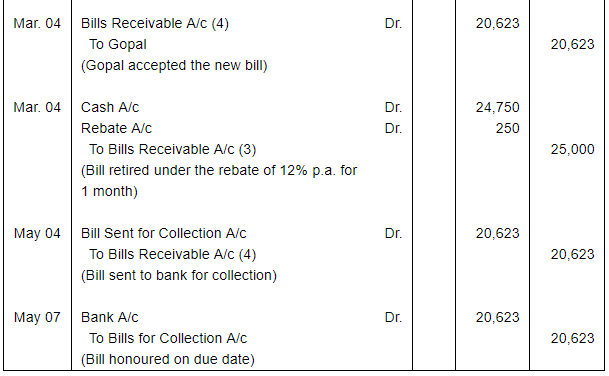

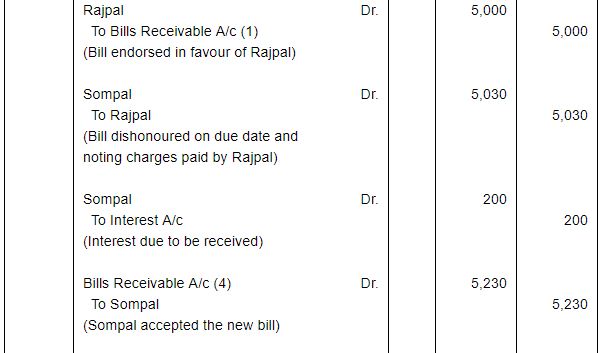

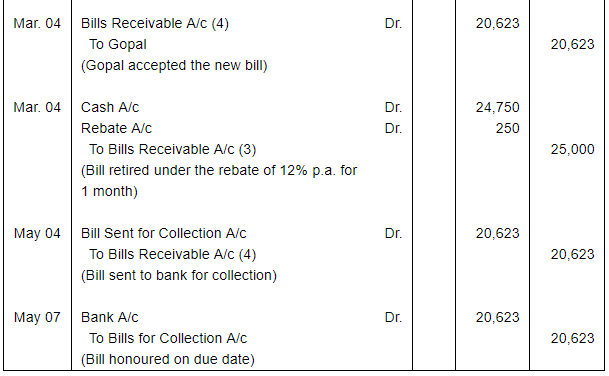

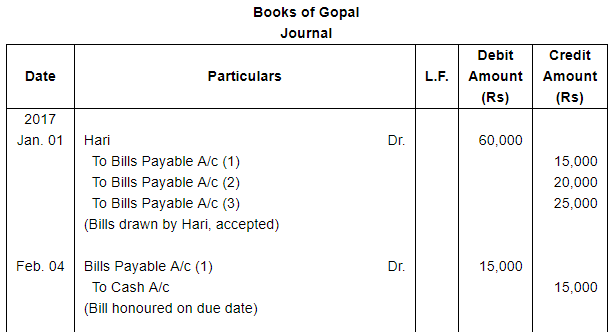

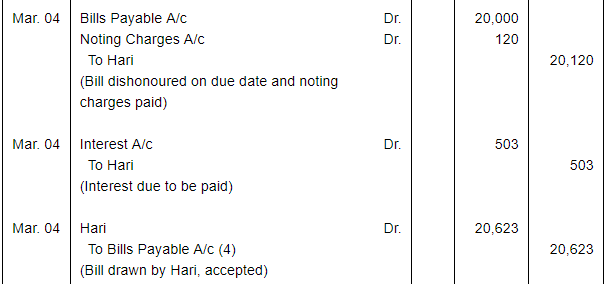

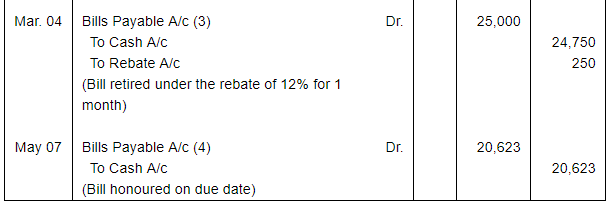

On 1st January 2017, Hari drew on Gopal, who is his debtor for ₹ 60,000 three bills of exchange: First for ₹ 15,000 at one month, Second for ₹ 20,000 at two months and third for ₹ 25,000 at three months. Gopal accepted all the three bills.

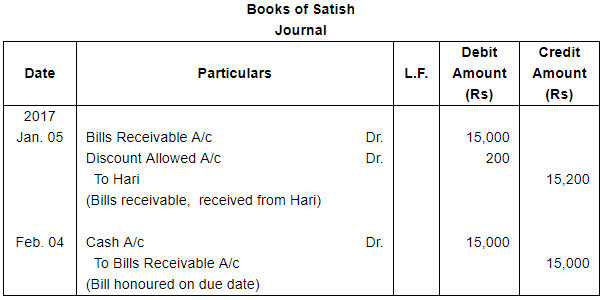

On 5th January 2017, Hari endorsed the first bill to his creditor Satish in full settlement of his account of ₹ 15,200. This bill was duly met on maturity.

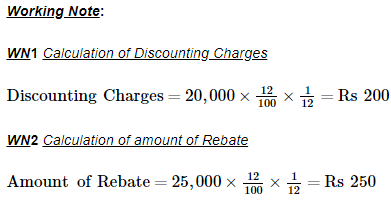

On 1st February 2017, the second bill was discounted from the bank @ 12% p.a. This bill was dishonoured on the due date and bank paid ₹ 120 as noting charges. On Gopal's request, Hari drew a fourth bill on Gopal for 2 months for the amount due plus interest @ 15% p.a.

Third bill was paid under a rebate of 12% p.a. one month before maturity. The fourth bill was sent to bank for collection on 4th May 2017 and was duly met on maturity.

Pass Journal entries in the books of Hari, Gopal and Satish.

ANSWER:

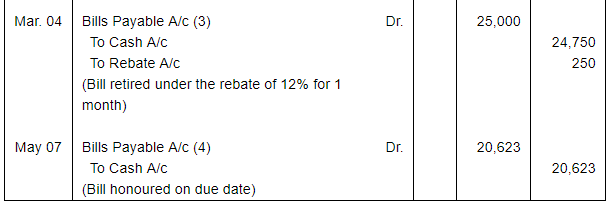

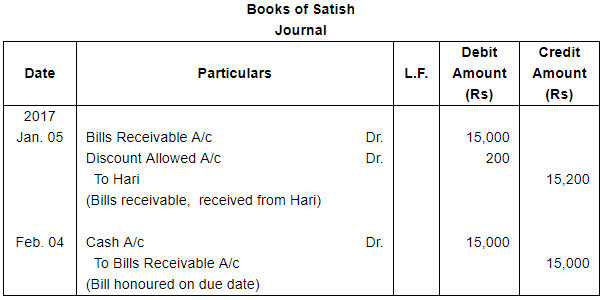

Question 44:

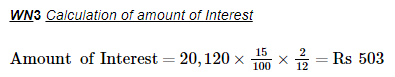

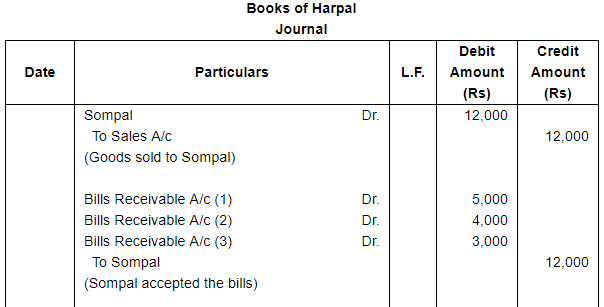

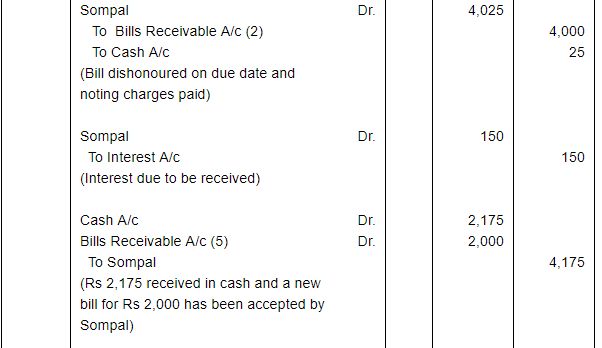

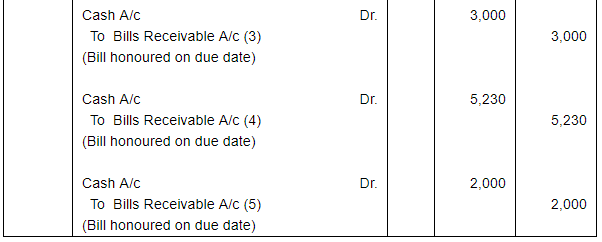

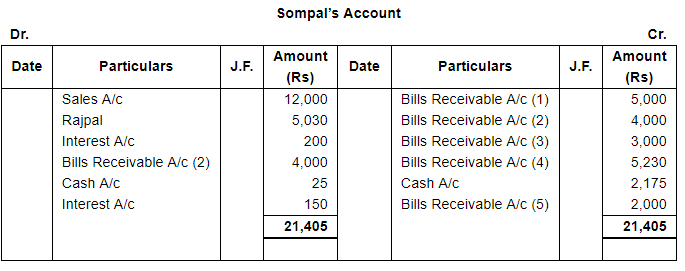

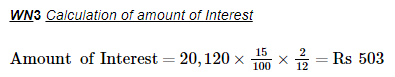

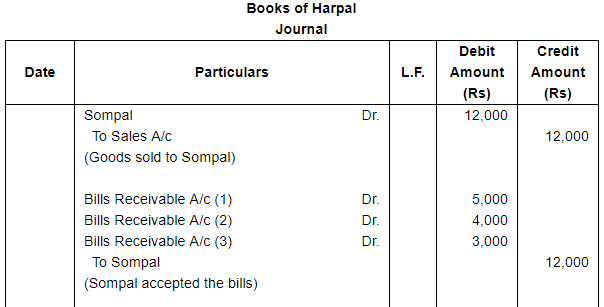

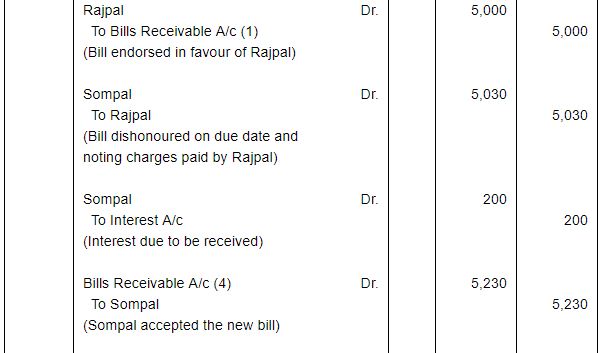

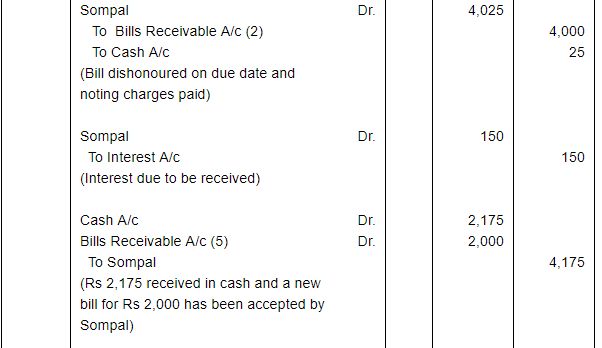

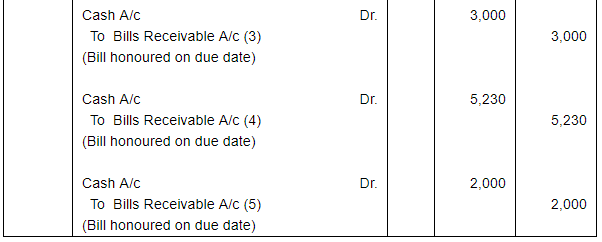

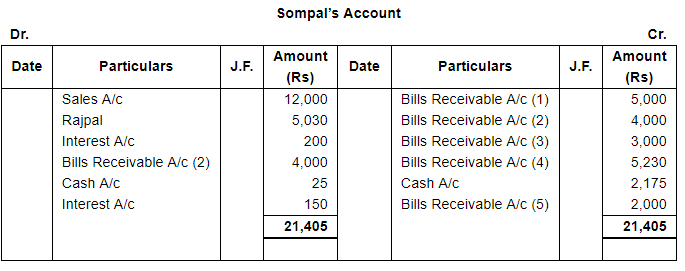

Harpal sold goods to Sompal for ₹ 12,000. Sompal accepted three bills of exchange, the first for ₹ 5,000 at one month, the second for ₹ 4,000 at two months and the third for ₹ 3,000 at three months. Harpal endorsed the first bill to Rajpal. The first bill was dishonoured. Rajpal paid ₹ 30 as noting charges. Harpal charged ₹ 200 for interest and drew on Sompal a fourth bill for ₹ 5,230. The second bill was also dishonoured, noting charges paid being ₹ 25. Harpal charged ₹ 150 as interest and accepted ₹ 2,175 in cash and drew a fifth bill for ₹ 2,000. The bill was paid on due date. The third and fourth bills were also met.

Pass Journal entries in the books of Harpal and prepare Sompal's Account in Harpal's Ledger.

ANSWER:

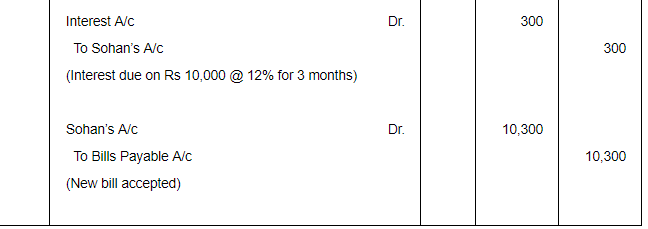

Question 45(A):

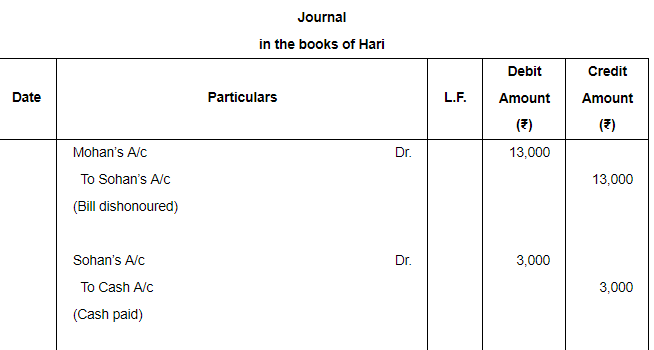

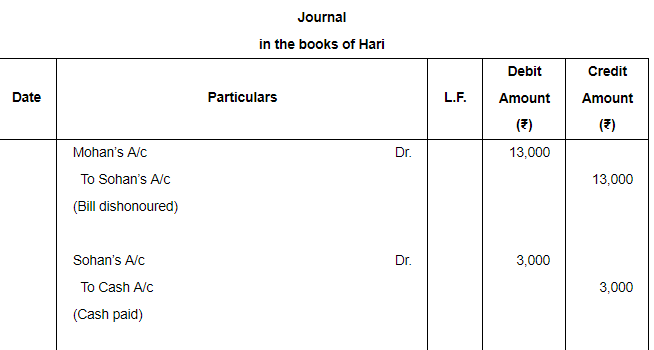

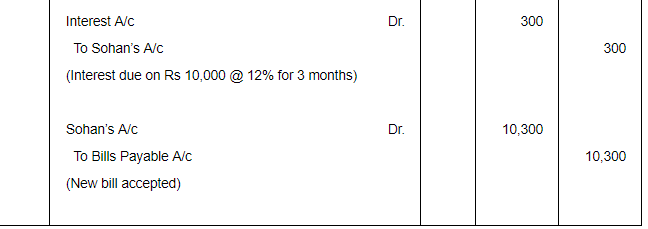

Journalise the following in the books of Hari.

Sohan informs Hari that Mohan's acceptance for ₹ 13,000, endorsed in favour of Sohan by Hari, has been dishonoured. Sohan agrees to accept ₹ 3,000 in cash and an acceptance at 3 months together with interest @ 12% per annum.

ANSWER:

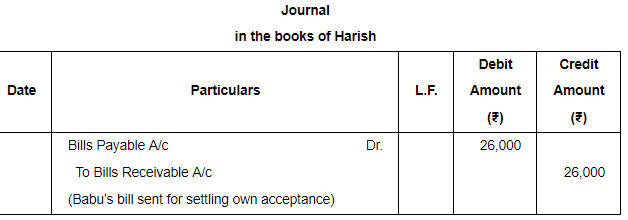

Question 45(B):

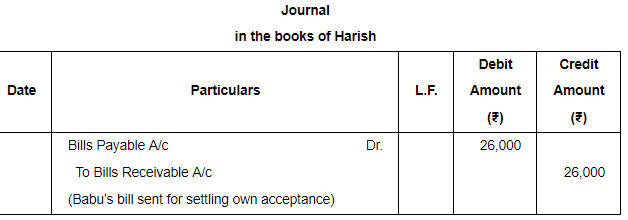

Journalise the following in the books of Harish.

Harish sends Hari's acceptance for ₹ 26,000 to Babu to meet his acceptance for the like amount in favour of Babu.

ANSWER: