Financial Statements (Part - 2) - Commerce PDF Download

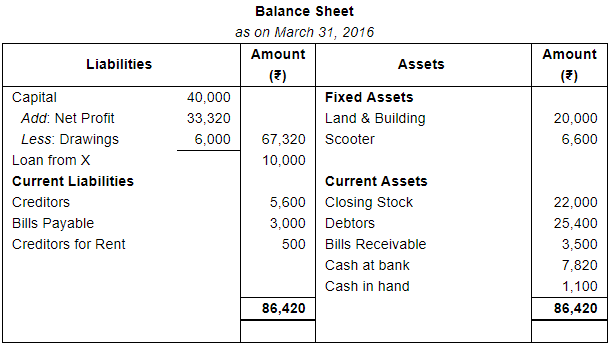

Page No 21.43:

Question 17:

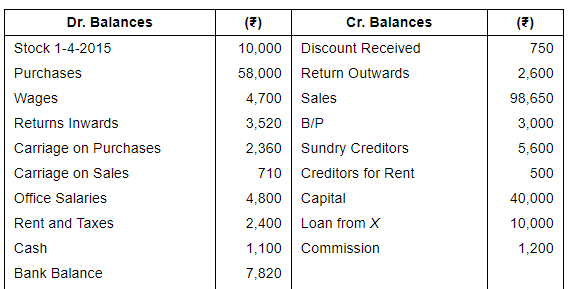

Following is the Trial Balance of Sh. Damodar Parshad as at 31st March, 2016:-

Prepare a Trading and Profit and Loss Account for the year ended on 31-3-2016 and the Balance Sheet as at that date. The Stock on 31st March, 2016 was ₹ 22,000.

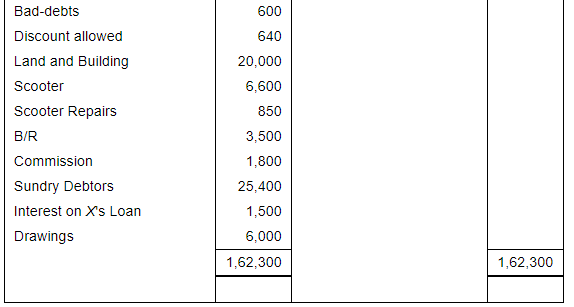

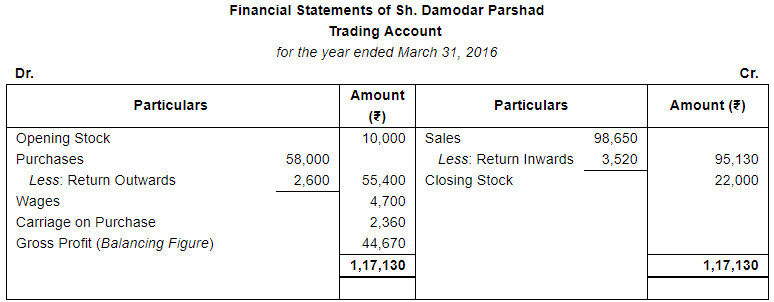

ANSWER:

Page No 21.44:

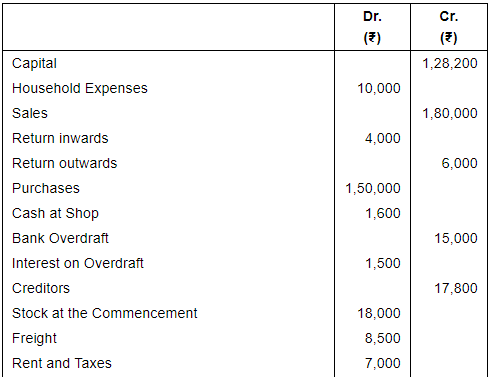

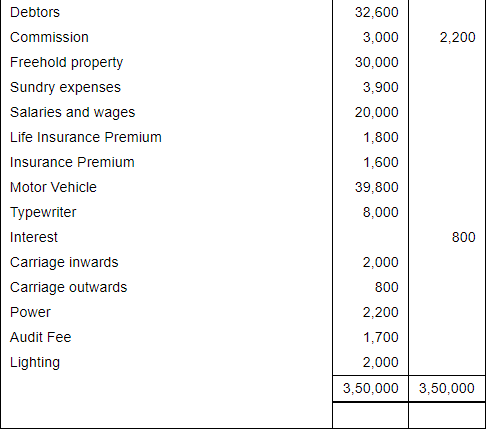

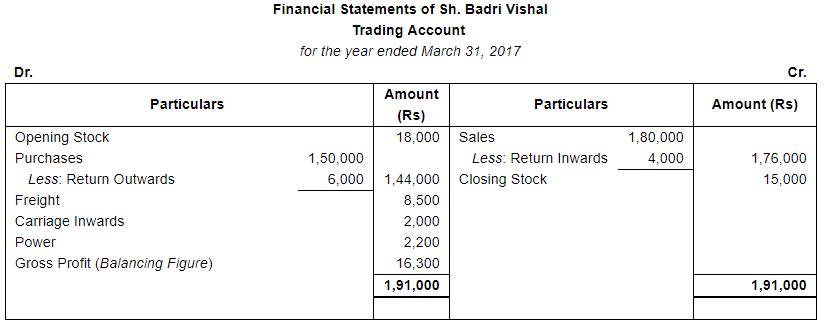

Question 18:

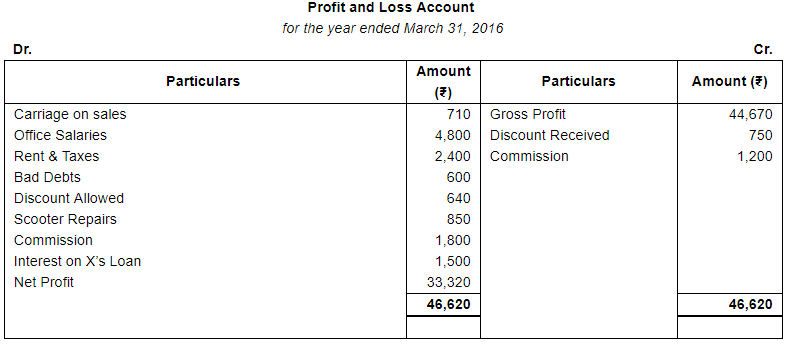

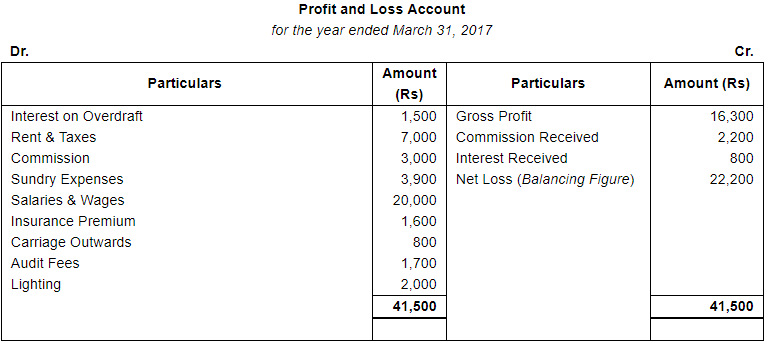

From the following balances extracted from the books of Sh. Badri Vishal on 31st March, 2017, prepare a Trading Account, P & L A/c and a Balance Sheet. Closing Stock valued on that date was ₹ 15,000.

ANSWER:

*Drawings = Household Expenses + Life Insurance Premium = 10,000 + 1,800 = Rs 11,800

Page No 21.45:

Question 19:

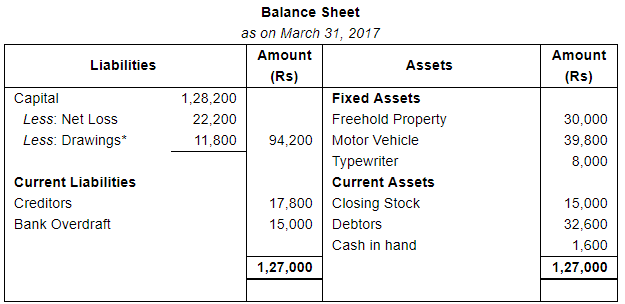

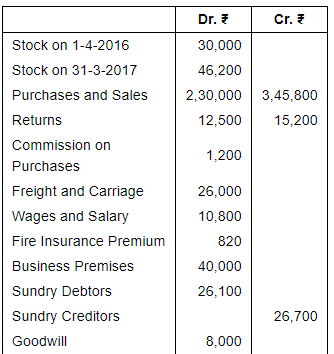

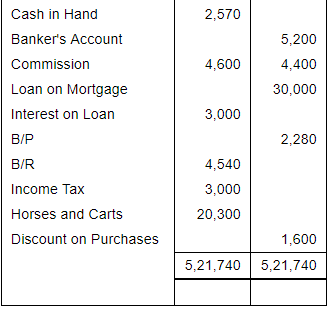

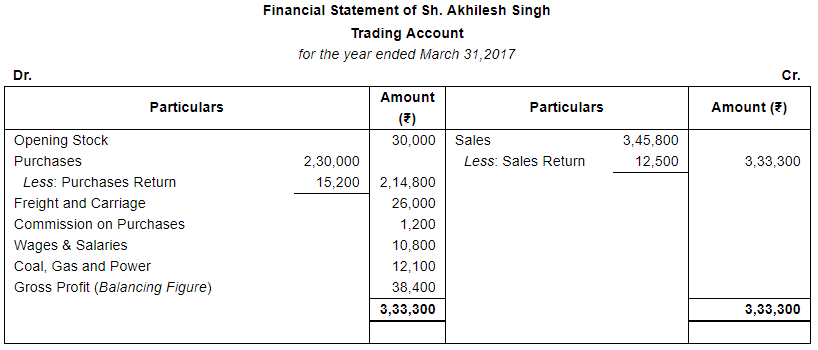

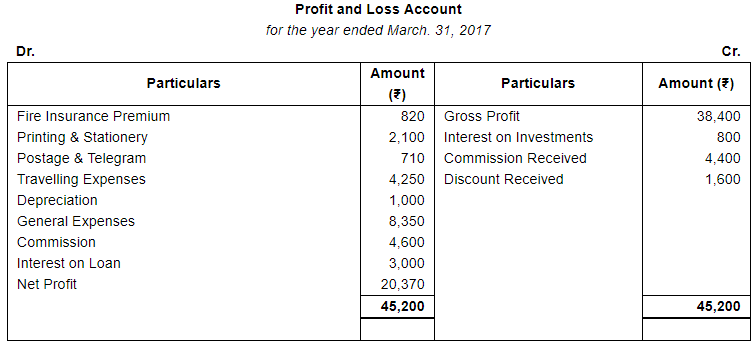

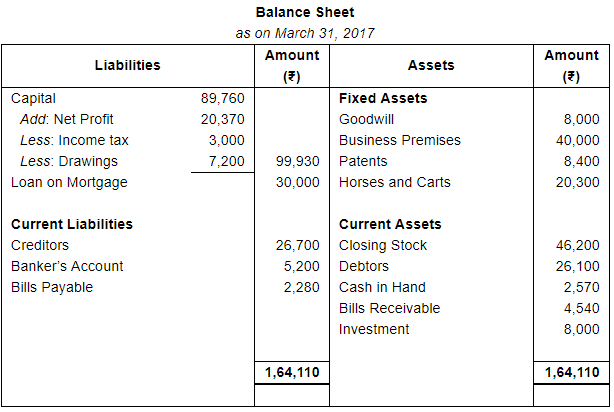

From the following balances of the Ledger of Sh. Akhileshwar Singh, prepare Trading and Profit & Loss Account and Balance Sheet:-

ANSWER:

Page No 21.46:

Question 20:

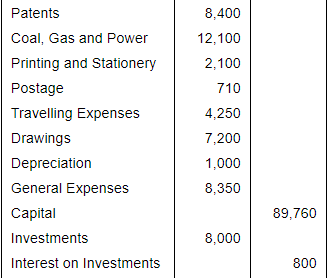

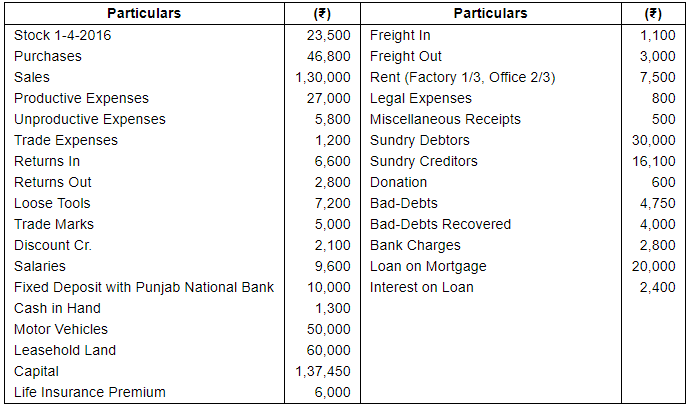

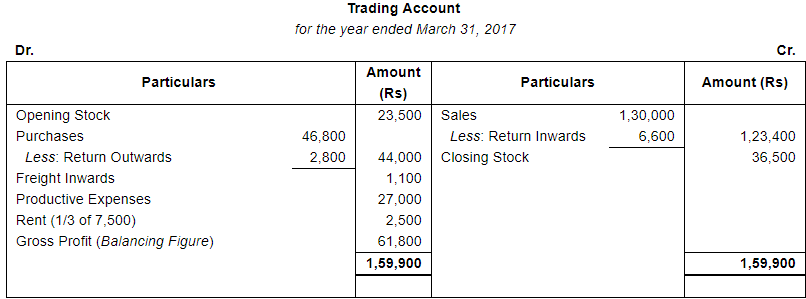

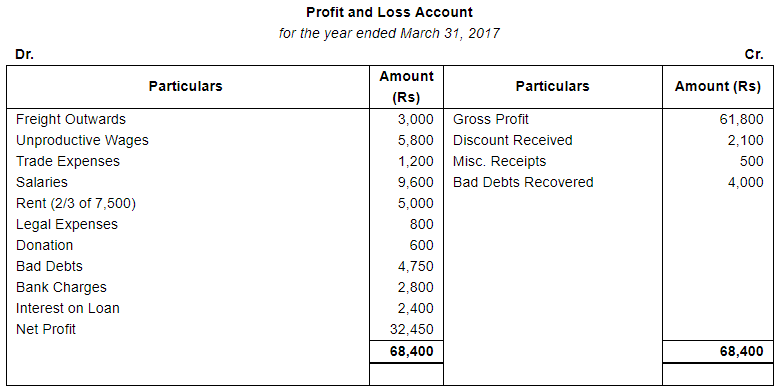

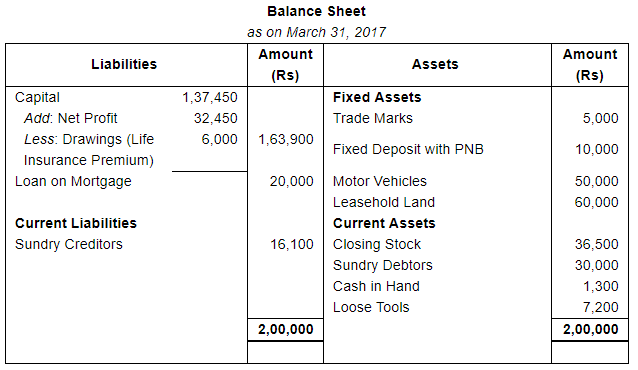

From the following balances prepare Final Accounts as at 31st March 2017:-

Value of Closing Stock was ₹ 36,500 on 31st March, 2017.

ANSWER:

Question 21:

Arrange assets in order of permanence:

Sundry Debtors, Stock, Investment, Land and Building, Cash in Hand, Motor Vehicle, Cash at Bank, Goodwill, Plant and Machinery, Furniture, Loose Tools, Marketable Securities.

ANSWER:

Assets in the order of Permanence:

1. Goodwill

2. Land and Building

3. Plant and Machinery

4. Motor Vehicle

5. Loose Tools

6. Furniture

7. Investment (Long-term)

8. Stock

9. Sundry Debtors

10. Marketable Securities (Short-term)

11. Cash at Bank

12. Cash in Hand

FAQs on Financial Statements (Part - 2) - Commerce

| 1. What are the main financial statements? |  |

| 2. How does an income statement differ from a balance sheet? |  |

| 3. What information can be derived from a cash flow statement? |  |

| 4. How are financial statements useful for investors and stakeholders? |  |

| 5. Can financial statements be used to compare the performance of different companies? |  |