Depreciation - (Part- 3) | Accountancy Class 11 - Commerce PDF Download

Page No 14.50:

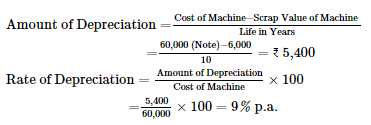

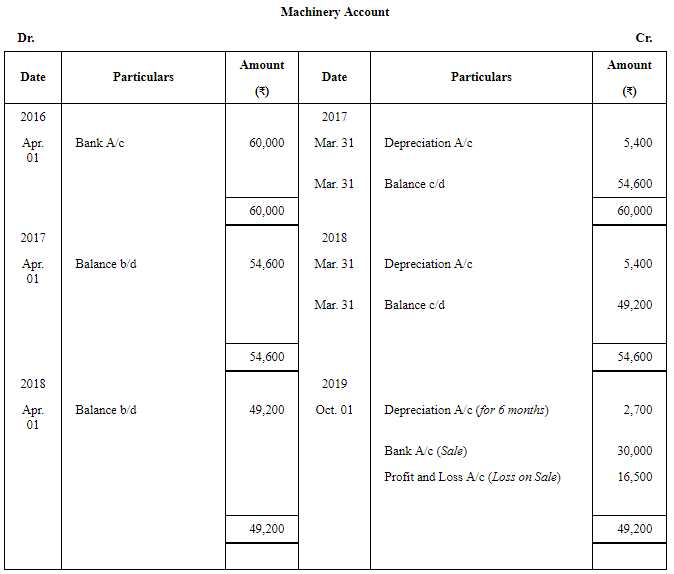

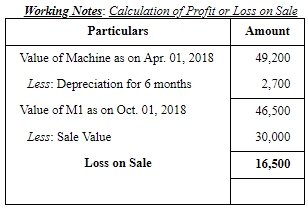

Question 11: On 1st April, 2016, Shivam Enterprise purchased a second-hand machinery for ₹ 52,000 and spent ₹ 2,000 on cartage, ₹ 3,000 on unloading, ₹ 2,000 on installation and ₹ 1,000 as brokerage of the middle man. It was estimated that the machinery will have a scrap value of ₹ 6,000 at the end of its useful life, which is 10 years. On 31st December 2016, repairs and renewals amounted to ₹ 2,500 were paid. On 1st October, 2018, this machine was sold for ₹ 30,600 and an amount of ₹ 600 was paid as commission to an agent.

Calculate the amount of annual depreciation and rate of depreciation. Also prepare the Machinery Account for first 3 years, assuming that firm follows financial year for accounting.

ANSWER:

Note:

1. All the expenses incurred up to the date at which machine is put in use will be added to cost of machine.

2. The amount spent on repairs is a recurring nature expenses. So, it will not be added to Machine A/c.

3. Cost of Machine = 52,000 + 2,000 + 3,000 + 2,000 + 1,000 = Rs 60,000

Page No 14.51:

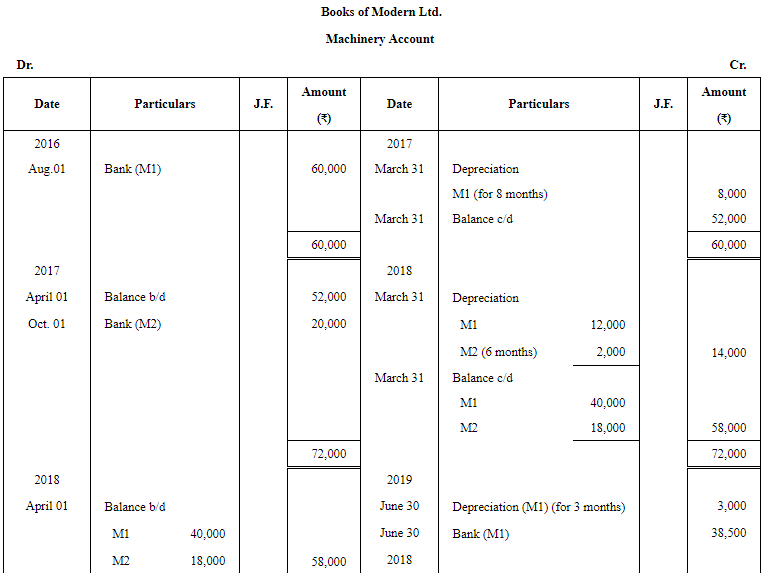

Question 12: Modern Ltd. purchased a machinery on 1st August, 2016 for ₹ 60,000. On 1st October, 2017, it purchased another machine for ₹ 20,000 plus CGST and SGST @ 6% each. On 30th June, 2018, it sold the first machine purchased in 2016 for ₹ 38,500 charging IGST @ 12%. Depreciation is provided @ 20% p.a. on the original cost each year. Accounts are closed on 31st March every year. Prepare the Machinery Account for three years.

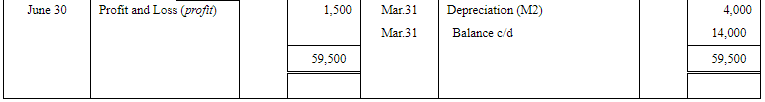

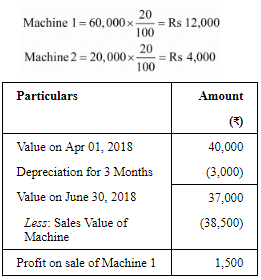

ANSWER:

Working Notes

Working Notes

1. Calculation of Annual Depreciation

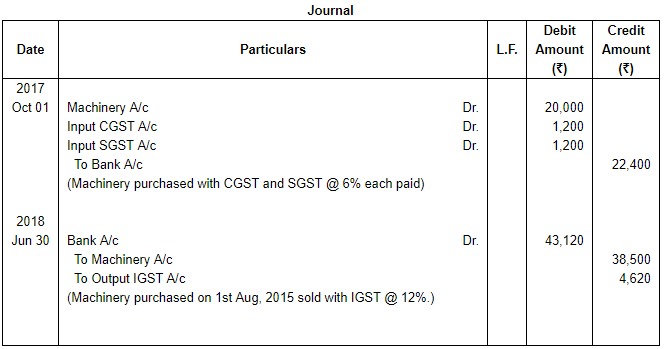

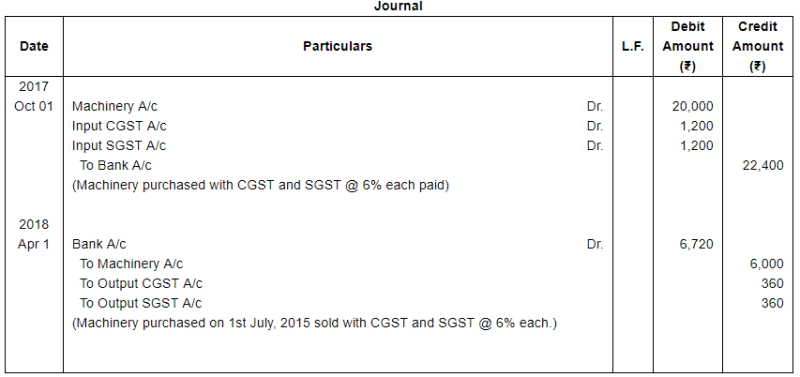

3. Journal entries for purchase and sale with GST

Page No 14.51:

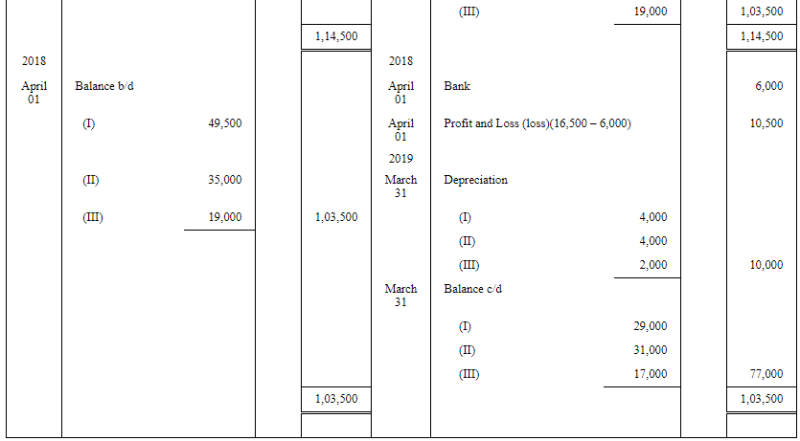

Question 13: On 1st July, 2016, Sohan Lal & Sons purchased a plant costing ₹ 60,000. Additonal plant was purchased on 1st January, 2017 for ₹ 40,000 and on 1st October, 2017, for ₹ 20,000, plus CGST and SGST @ 6% each. On 1st April, 2018, one-third of the plant purchased on 1st July, 2016, was found to have become obsolete and was sold for ₹ 6,000, charging CGST and SGST @ 6% each.

Prepare the Plant Account for the first three years in the books of Sohan Lal & Sons. Depreciation is charged @ 10% p.a. on Straight Line Method. Accounts are closed on 31st March each year.

ANSWER:

Working Notes

1. Calculation of Depreciation

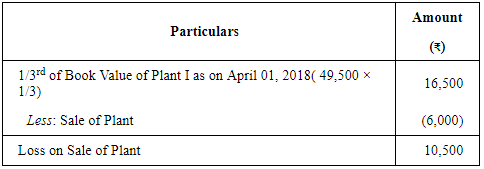

2. Calculation of profit or loss on Sale of Plant I

3. Journal entries for purchase and sale with GST

Page No 14.51:

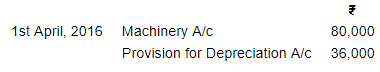

Question 14: Following balances appear in the books of Rama Bros:

On 1st April, 2016, they decided to sell a machine for ₹ 8,700. This machine was purchased for ₹ 16,000 in April, 2012. Prepare the Provision for

Depreciation Account and Machinery Account on 31st March, 2017, assuming the firm has been charging Depreciation at 10% p.a. on Straight Line Method.

ANSWER:

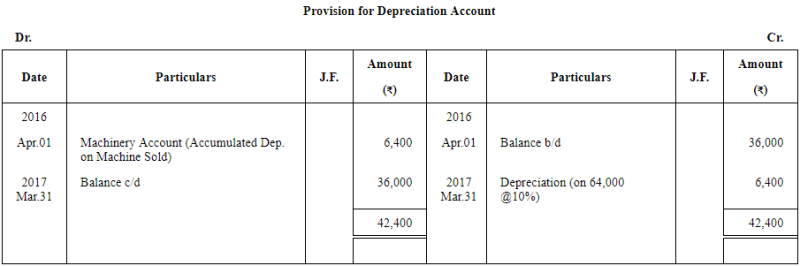

Working Notes

Working Notes

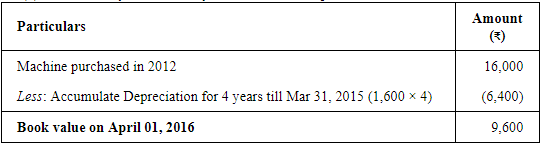

(1) Calculation of Book Value of Machine Sold on April 01, 2015

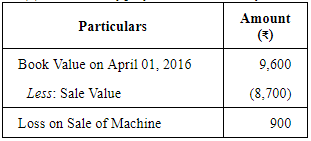

(2)Calculation of profit or loss on Sale of Machine

Page No 14.51:

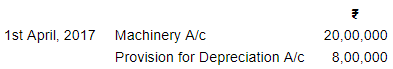

Question 15: Following balances appear in the books of Priyank Brothers:

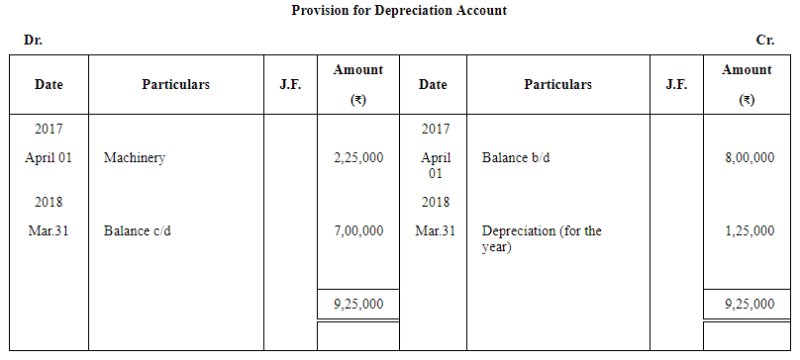

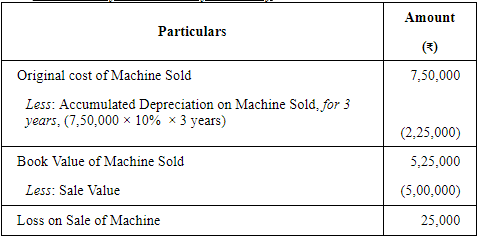

On 1st April, 2017, they decide to sell a machine for ₹ 5,00,000. This machine was purchased for ₹ 7,50,000 on 1st April, 2014. Prepare the Machinery Account and Provision for Depreciation Account for the year ended 31st March, 2018 assuming that the firm has been charging Depreciation @ 10% p.a. on the Straight Line Method.

ANSWER:

Working Notes

Working Notes

1 Calculation of Loss on Sale of Machinery

|

61 videos|227 docs|39 tests

|

FAQs on Depreciation - (Part- 3) - Accountancy Class 11 - Commerce

| 1. What is depreciation and why is it important in commerce? |  |

| 2. How is depreciation calculated for accounting purposes? |  |

| 3. What is the difference between depreciation and amortization? |  |

| 4. Can depreciation be reversed or adjusted in the future? |  |

| 5. How does depreciation impact a company's taxes? |  |