Book of Original Entry - Cash Book (Part - 2) - Commerce PDF Download

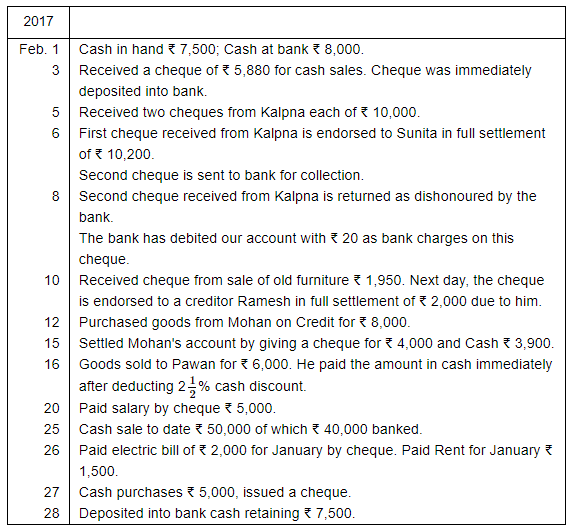

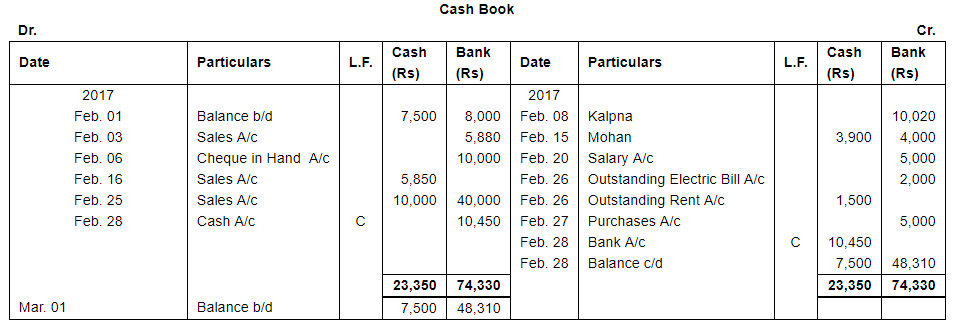

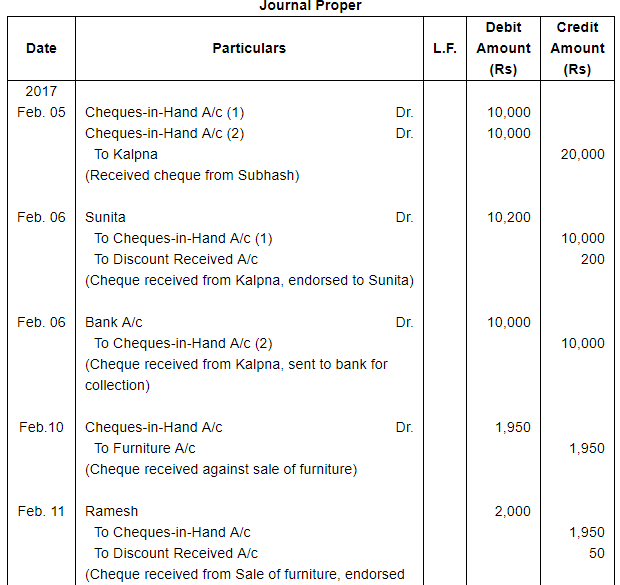

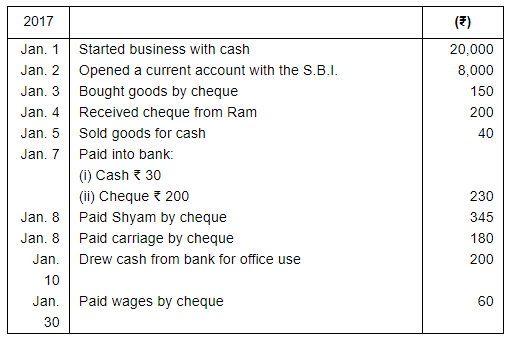

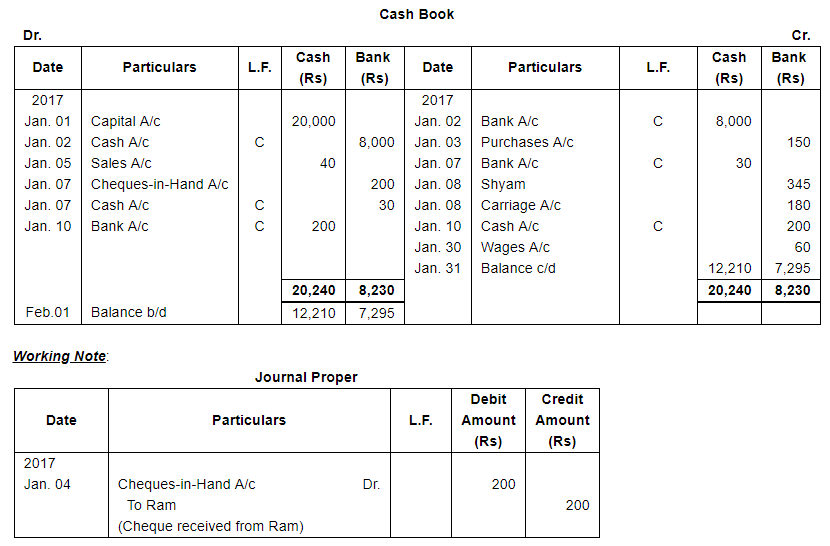

Ques 15: Compile a Two Column Cash Book from the following transactions of Kavita Garments∶−

Ans:

Working Notes:

WN1

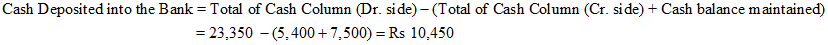

WN2 Cash Deposited into the Bank

Note: Transaction dated Feb. 12, 2017, will not be recorded in Cash Book because credit transactions will not affect the cash/bank balance.

Page No 11.63:

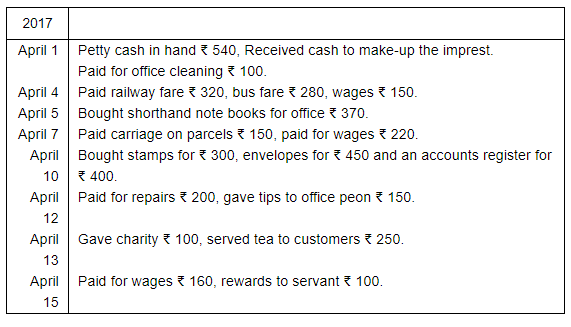

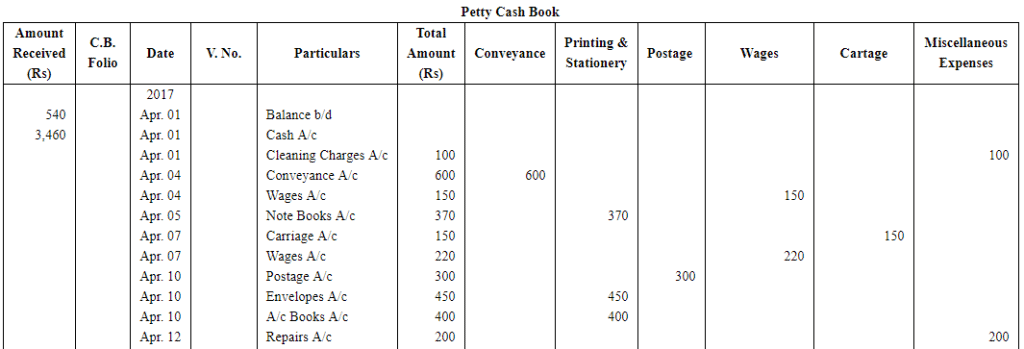

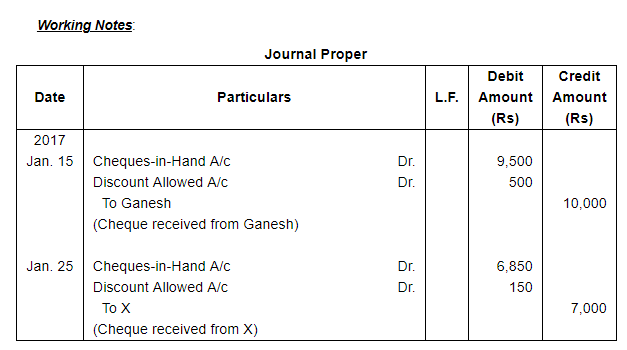

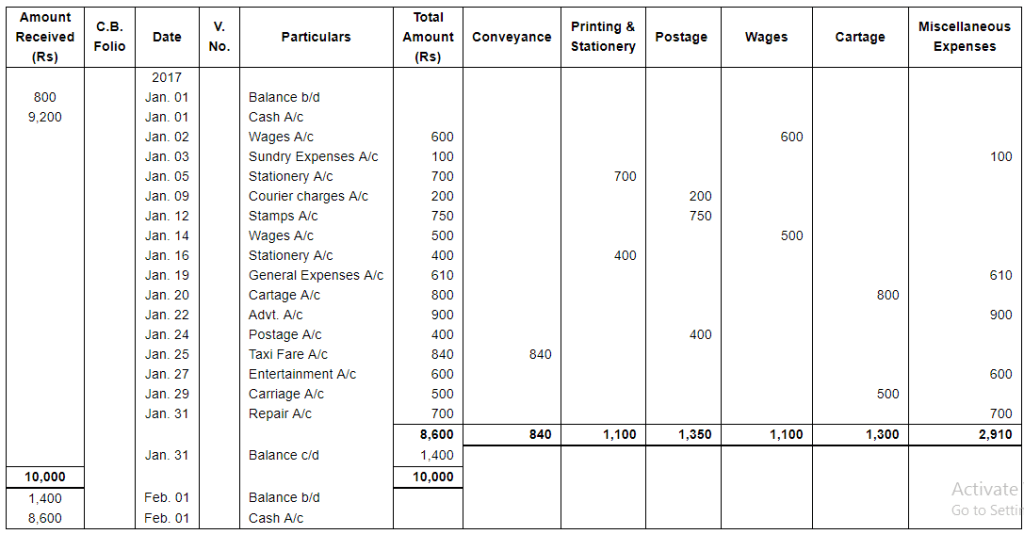

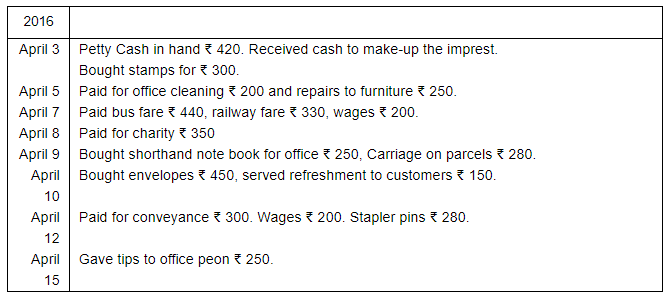

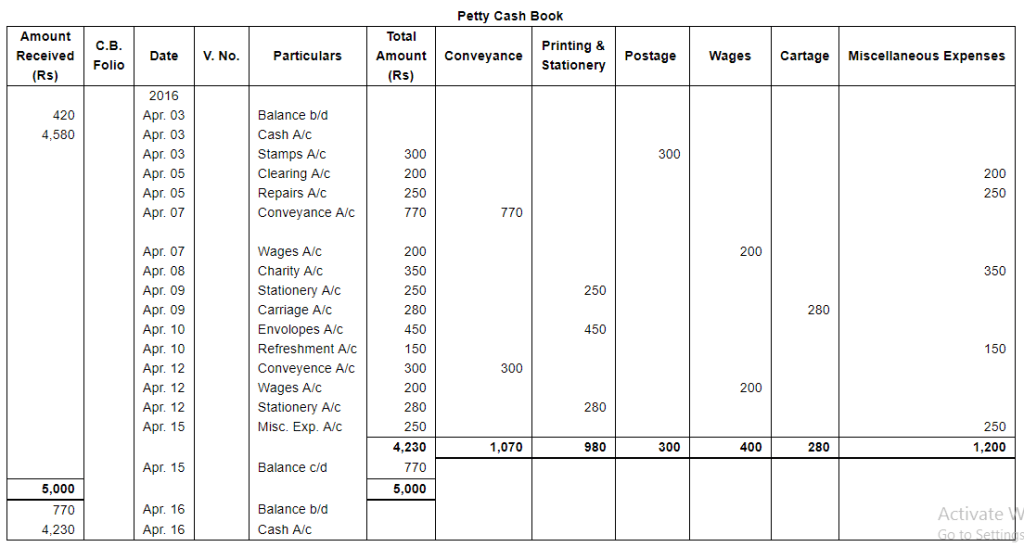

Ques 16: Prepare a Petty Cash Book on the Imprest System from the following:

Ans:

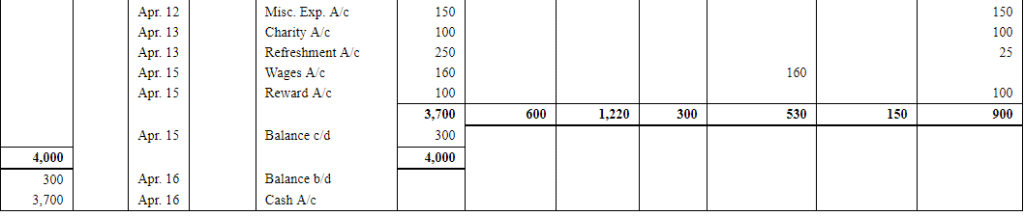

Ques 17: Record the following transactions in a Petty Cash Book with suitable columns. The book is kept on imprest system, amount of imprest being ₹ 4,000.

Ans:

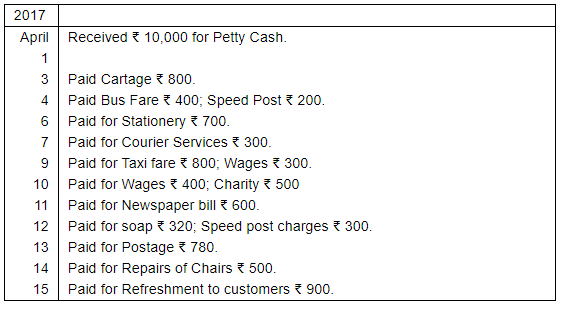

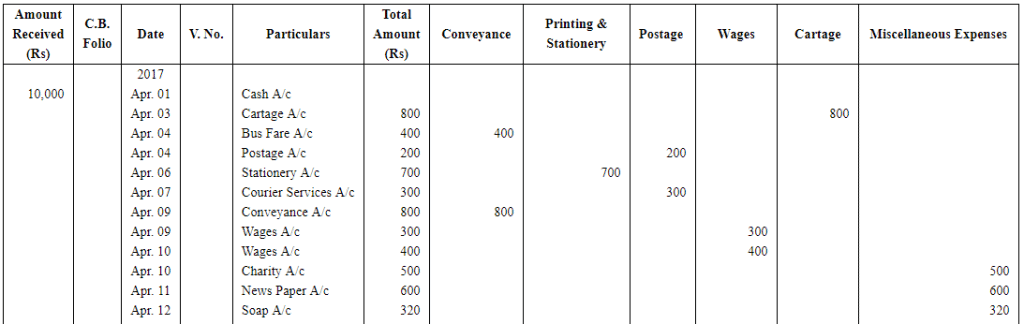

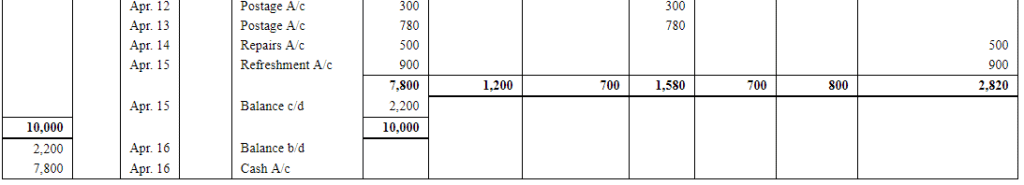

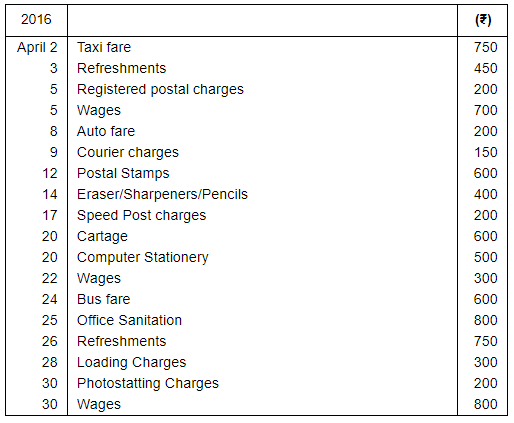

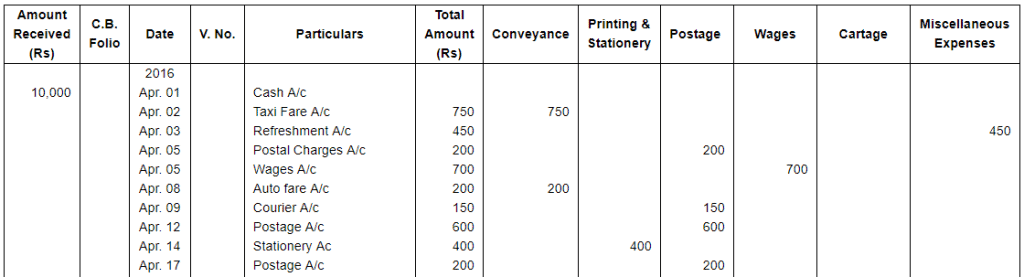

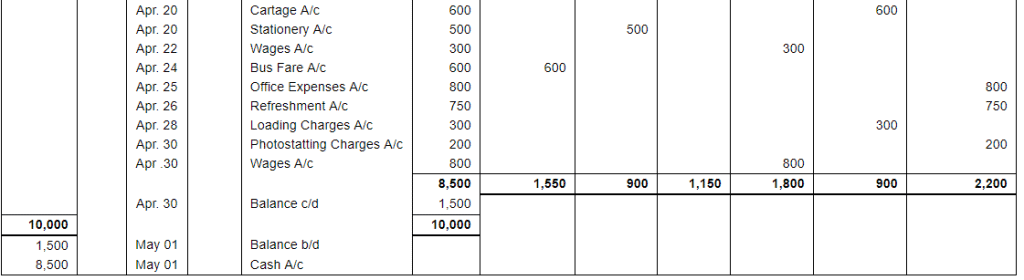

Ques 18: Mr. Yadav, the petty cashier of M/s Triputi Traders received ₹10,000 on April 1, 2016 from the Head Cashier. Following were the petty expenses :−

You are required to prepare a Petty Cash Book.

Ans:

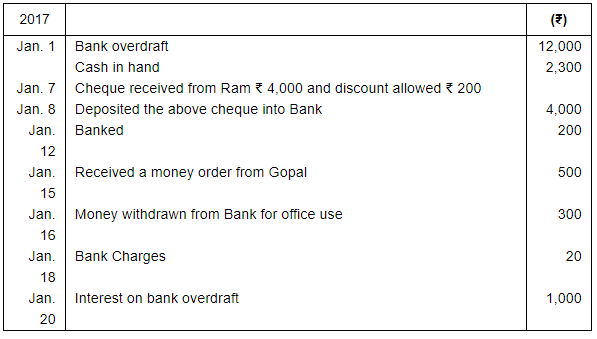

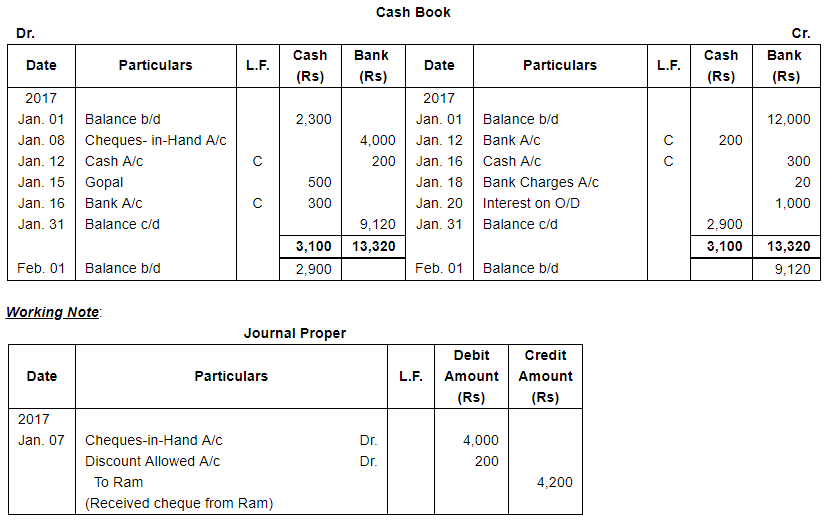

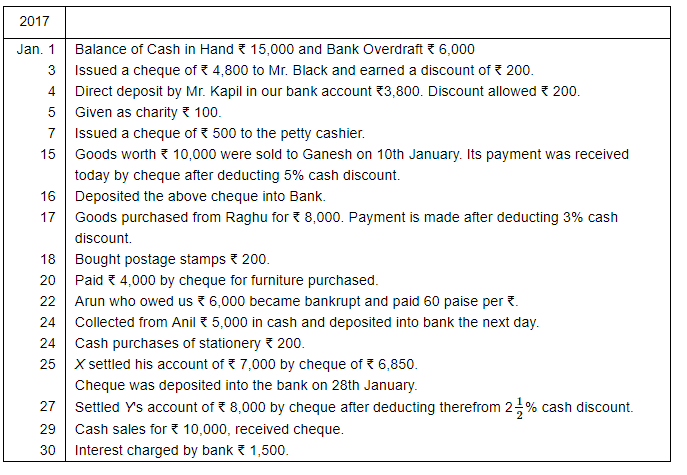

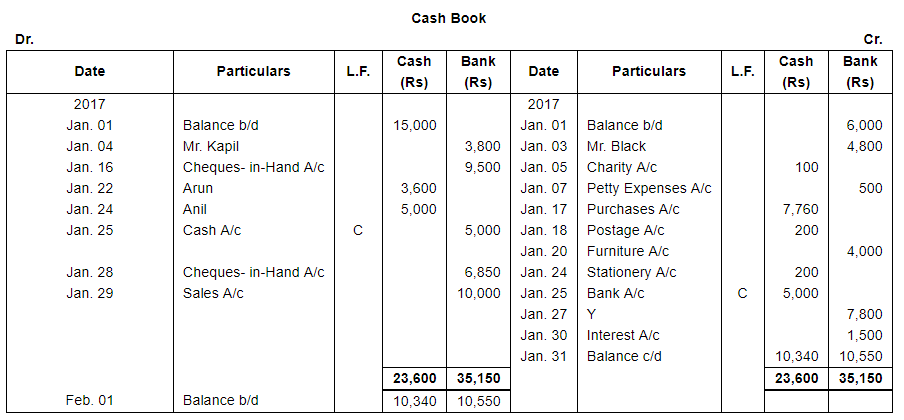

Ques 24: Record the following transactions in a cash book with cash and bank columns:

Ans:

Page No 11.65:

Ques 20: Enter the following transactions in two Column cash book and find out the cash and bank balance∶

Ans:

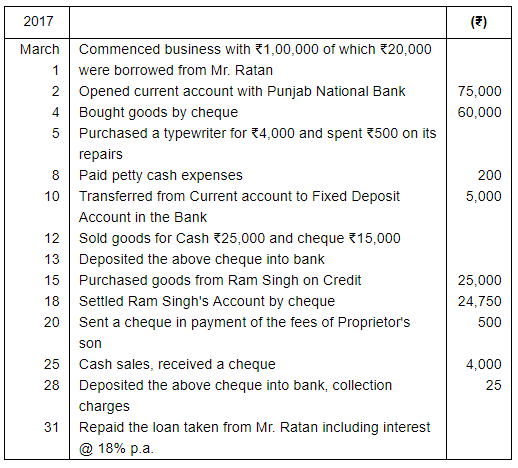

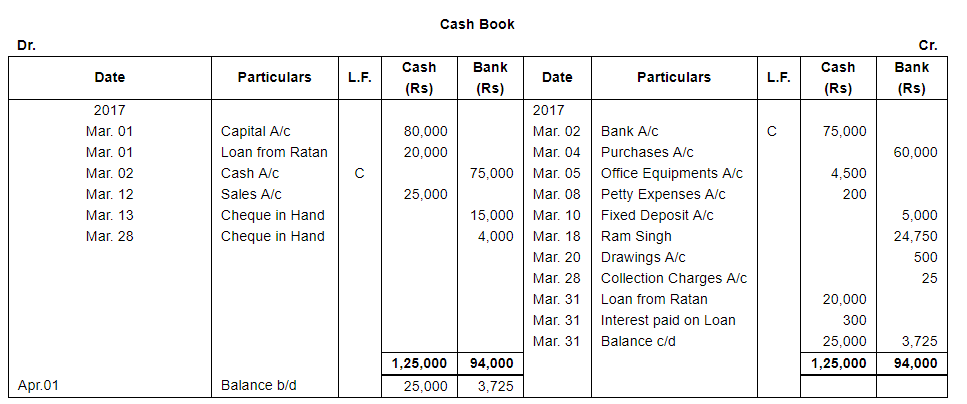

Ques 21: Enter the following transactions in a Cash Book with Cash and Bank Columns∶−

Ans:

Working Notes:

WN1

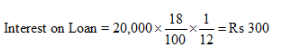

WN2 Calculation of Interest on Loan

Page No 11.66:

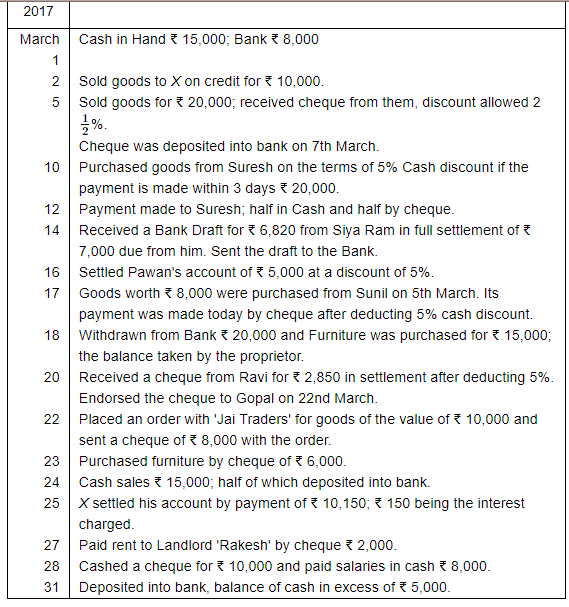

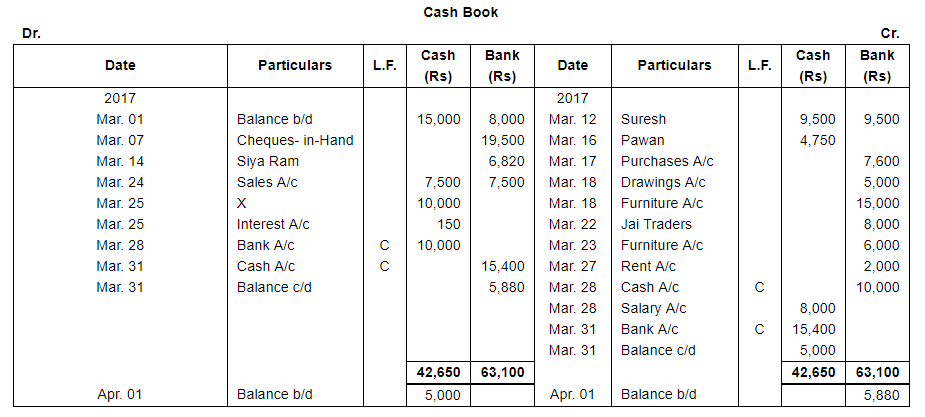

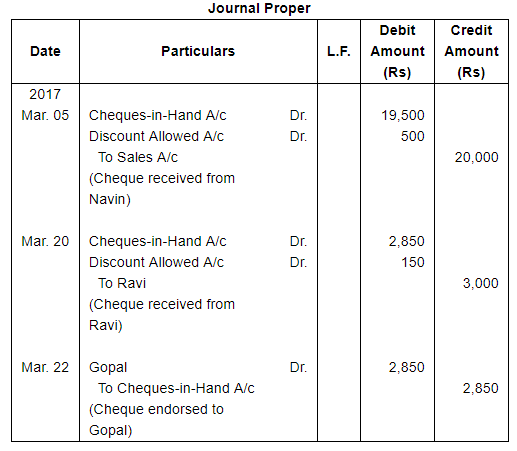

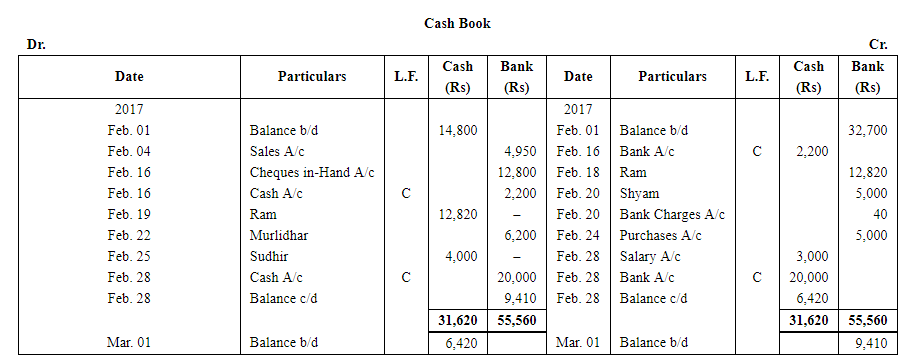

Ques 22: Enter the following transactions in a Cash Book with Cash and Bank Columns∶−

Ans:

Working Note:

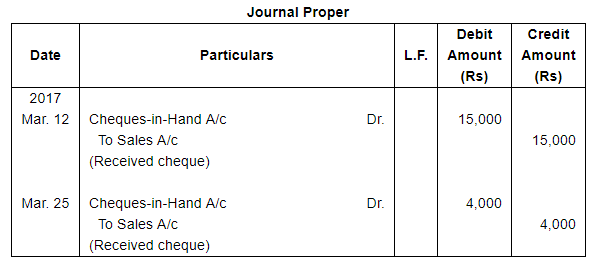

WN1

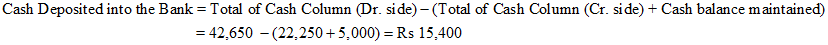

WN2 Cash Deposited into the Bank

WN2 Calculation of Discount Allowed to Ravi

Note: Transaction dated March 02, 2017 and March 10, 2017, will not be recorded in Cash Book because credit transactions will not affect the cash/bank balance.

Page No 11.67:

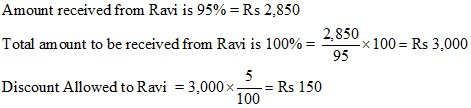

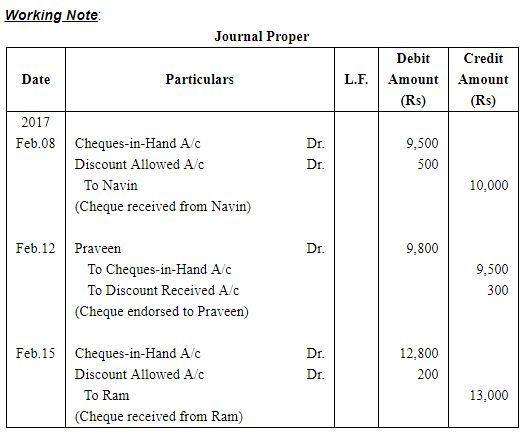

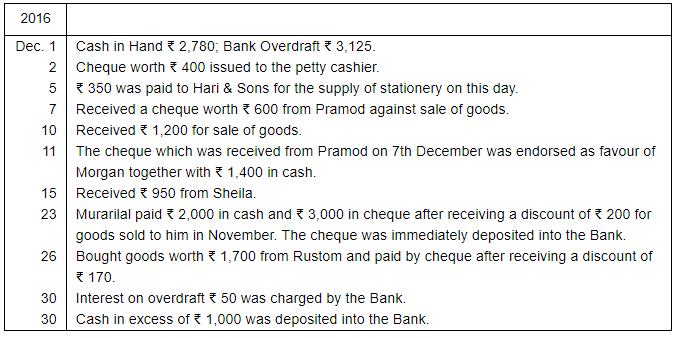

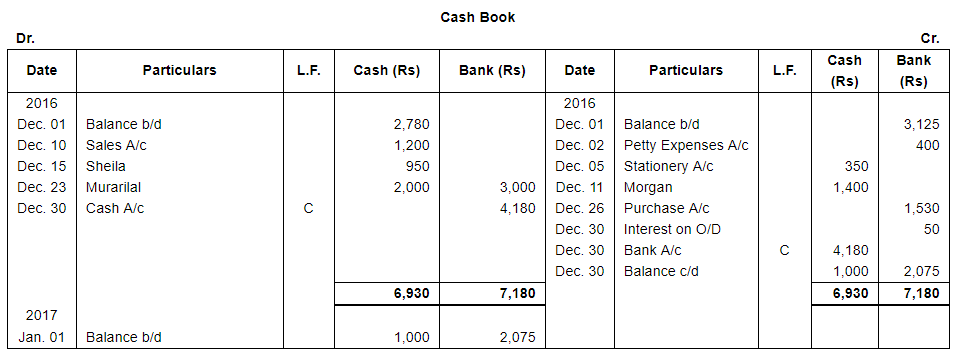

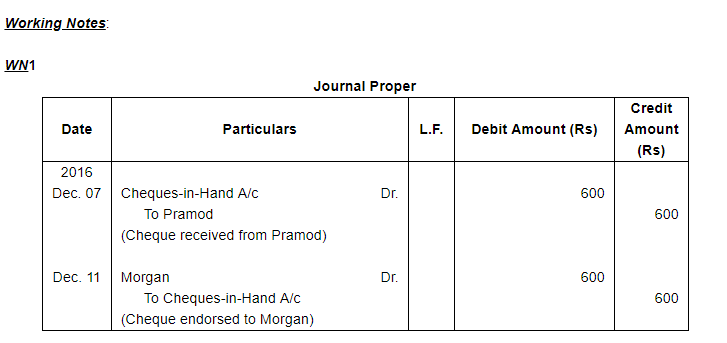

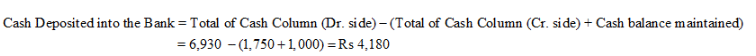

Ques 23: Prepare a Cash Book with Cash and Bank Columns from the following particulars∶−

Ans:

Note: Transaction dated February 08, 2017, February 10, 2017 and February 12, 2017, will not be recorded in Cash Book because these transactions will not affect the cash/bank balance.

Page No 11.68:

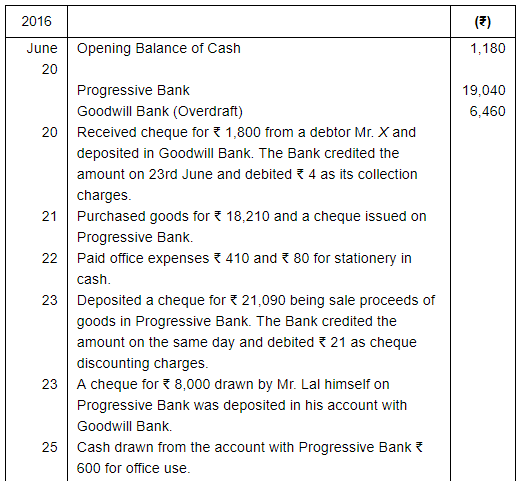

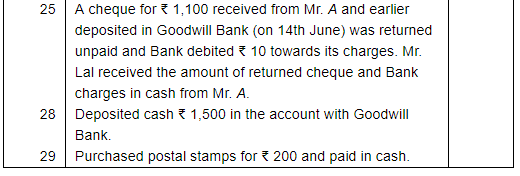

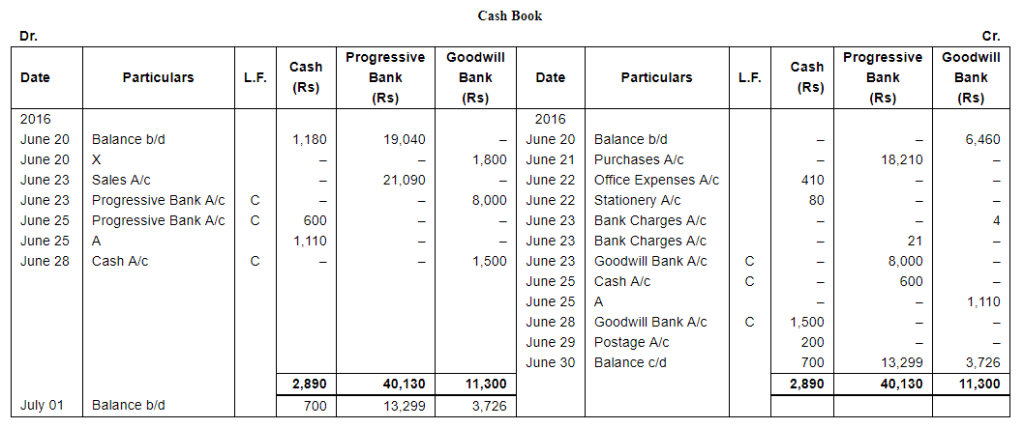

Ques 24: Mr. Lal operates two bank accounts both of which are maintained in the columnar cash book itself. You are required to prepare a proforma of the cash book, record the following transactions therein and draw the closing balances as on 30th June, 2016:

Ans:

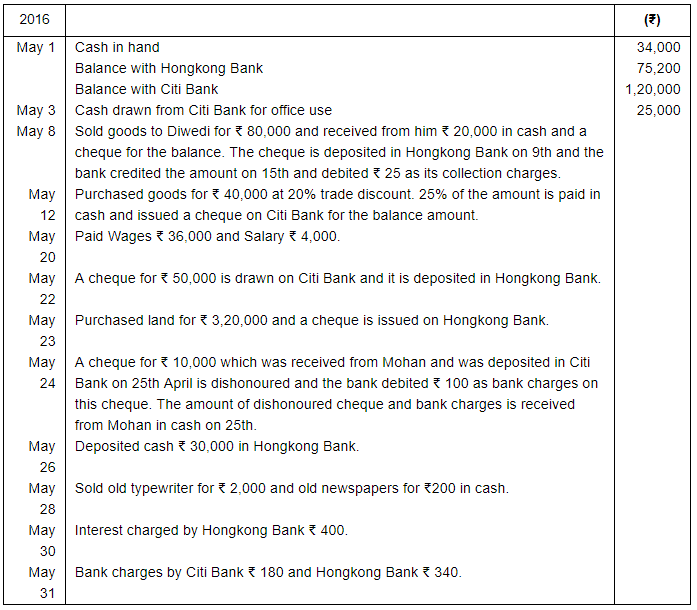

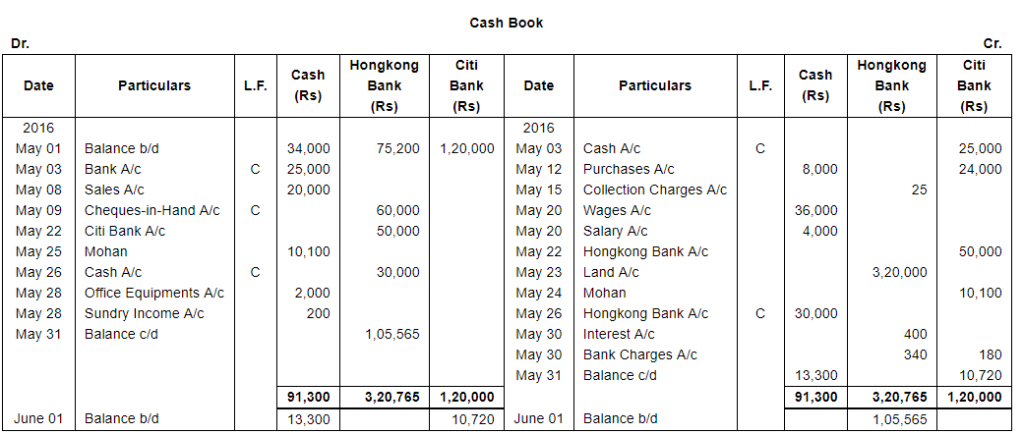

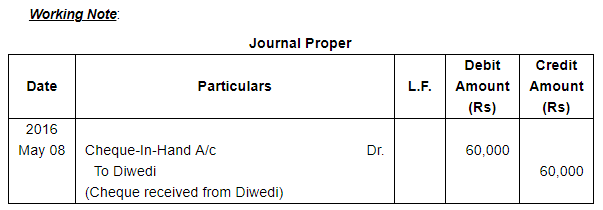

Ques 25: Mr. Chaturvedi maintains two bank accounts. Prepare his columnar cash book from the following particulars:

Ans:

Page No 11.70:

Ques 26: Prepare a Cash Book with Cash and Bank columns from the following information for the month of December 2011 in the Books of O'Neil:

Ans:

WN2 Cash Deposited into the Bank

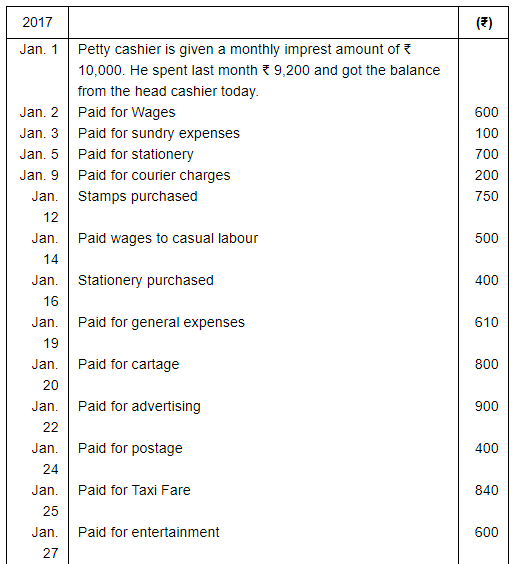

Ques 27: From the following particulars, prepare a Cash Book with Cash and Bank Columns:

Ans:

Note: Transaction dated January 29, 2017, does not contain any information regarding date of depositing the cheque, so it has been assumed that the cheque has been deposited on the same day.

Page No 11.71:

Ques 28: Record the following transactions in a Petty Cash Book drawn with suitable columns and then balance the same:

Ans:

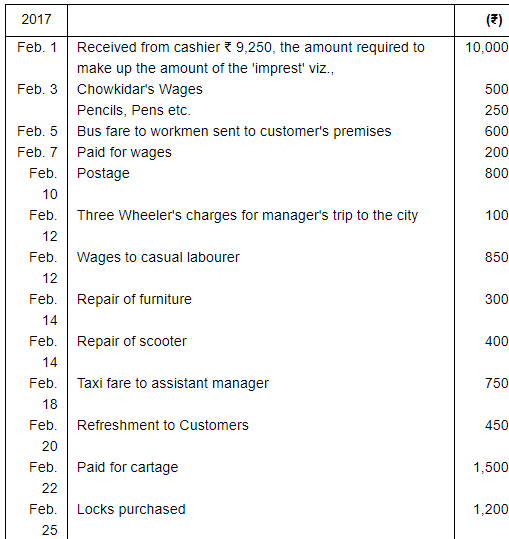

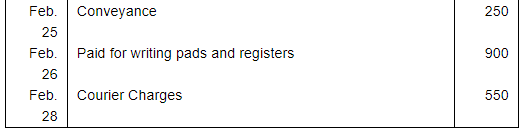

Ques 29: Enter the following transactions in the petty cash book with appropriate analysis columns:

Ans:

Page No 11.72:

Ques 30: Enter the following transactions in a petty cash book in analytical form. The book is kept on imprest system, amount of imprest being ₹ 5,000.

Ans:

FAQs on Book of Original Entry - Cash Book (Part - 2) - Commerce

| 1. What is a cash book in accounting? |  |

| 2. How is a cash book different from a bank statement? |  |

| 3. Can a cash book be used for both cash and bank transactions? |  |

| 4. How is a cash book helpful in financial analysis? |  |

| 5. What are the advantages of using a cash book in accounting? |  |