Accounts From Incomplete Records Single Entry System (Part - 2) | Accountancy Class 11 - Commerce PDF Download

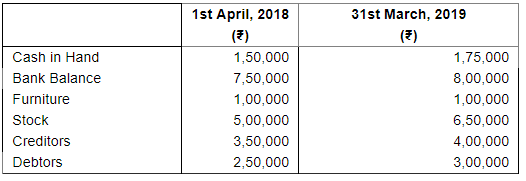

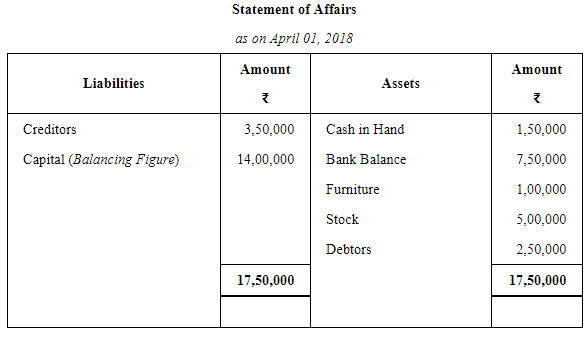

Question 12: Kuldeep, a general merchant, keeps his accounts on Single Entry System. He wants to know the results of his business on 31st March, 2019 and for that following information is available:

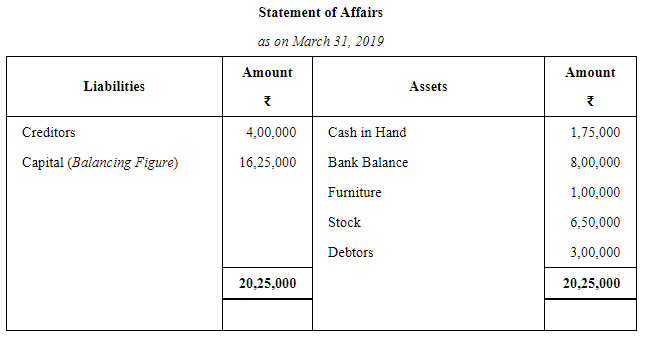

During the year, he had withdrawn ₹ 5,00,000 for his personal use and invested ₹ 2,50,000 as additional capital. Calculate his profits on 31st March, 2019 and prepare the Statement of Affairs as on that date.

ANSWER:

Page No 20.41:

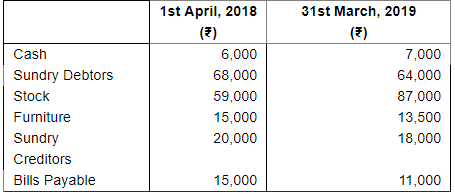

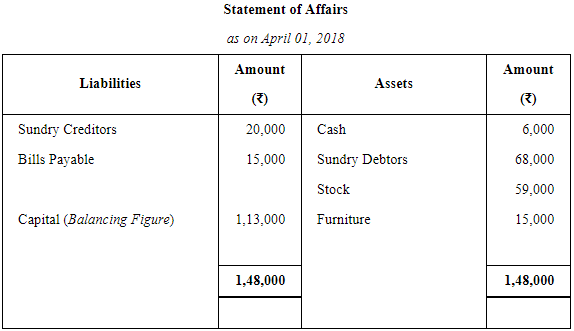

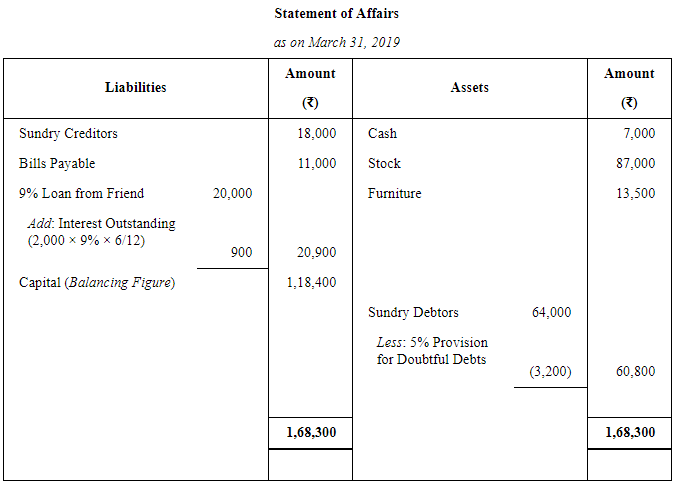

Question 13:

Following information is supplied to you by a shopkeeper:

During the year, he withdrew ₹ 2,500 per month for domestic purposes. He also borrowed from a friend at 9% a sum of ₹ 20,000 on 1st October, 2018. He has not yet paid the interest. A provision of 5% on debtors for doubtful debts is to be made.

Ascertain the profit or loss made by him during the period.

ANSWER:

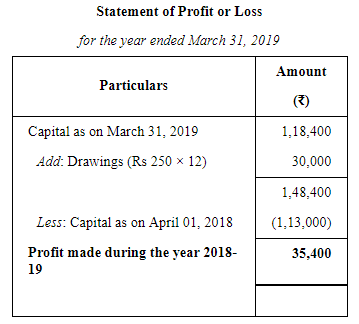

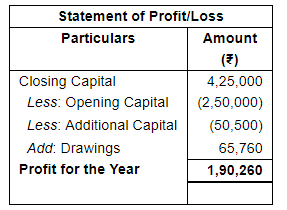

Question 14:

Vikas is keeping his accounts according to Single Entry System. His capital on 31st December, 2015 was ₹ 2,50,000 and his capital on 31st December, 2016 was ₹ 4,25,000. He further informs you that during the year he gave a loan of ₹ 30,000 to his brother on private account and withdrew ₹ 1,000 per month for personal purposes. He used a flat for his personal purpose, the rent of which @ ₹ 1,800 per month and electricity charges at an average of 10% of rent per month were paid from the business account. During the year he sold his 7% Government Bonds of ₹ 50,000 at 1% premium and brought that money into the business.

Prepare a Statement of Profit or Loss for the year ended 31st December, 2016.

ANSWER:

Note: Drawings include loan to brother, withdrawals in cash, rent and electricity charges.

Question 15:

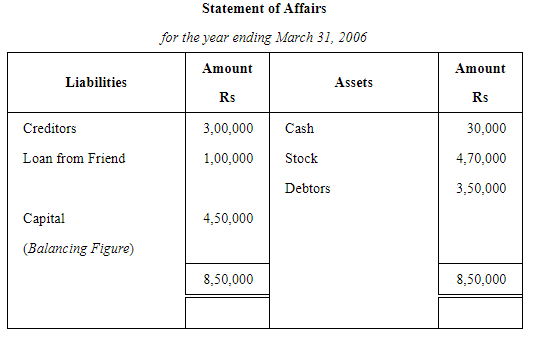

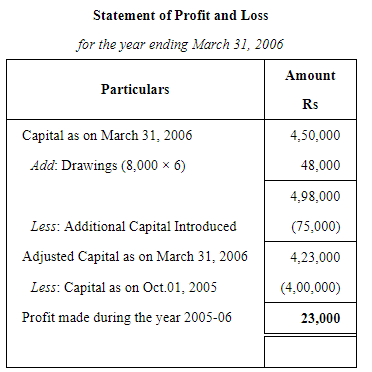

Manu started business with a capital of ₹ 4,00,000 on 1st October, 2005. He borrowed from his friend a sum of ₹ 1,00,000. He brought further ₹ 75,000 as capital on 31st March, 2006, his position was:

Cash: ₹ 30,000; Stock: ₹ 4,70,000; Debtors: ₹ 3,50,000 and Creditors: ₹ 3,00,000.

He withdrew ₹ 8,000 per month during this period. Calculate profit on loss for the period.

ANSWER:

Question 16:

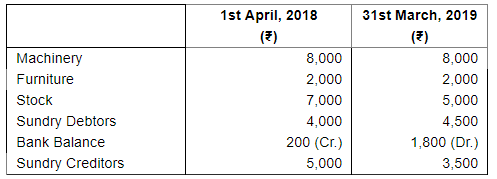

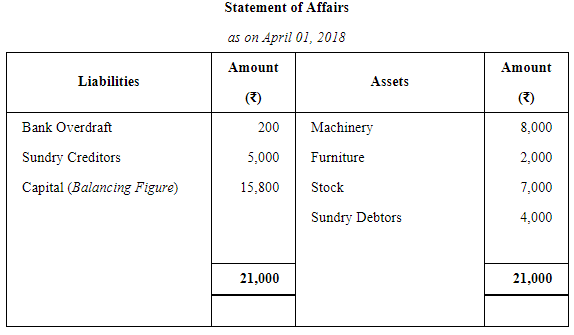

From the following information relating to the business of Abhay who keeps books on Single Entry System, ascertain the profit or loss for the year 2018–19:

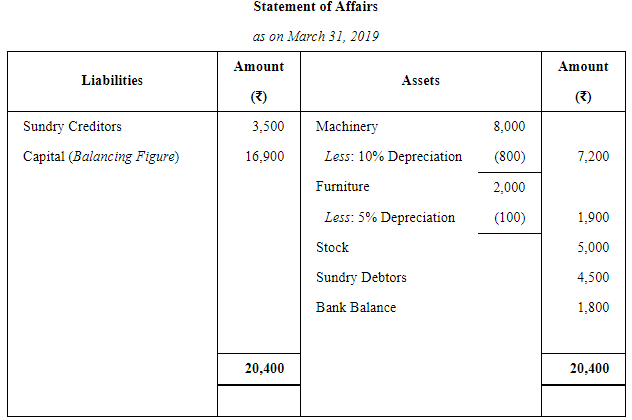

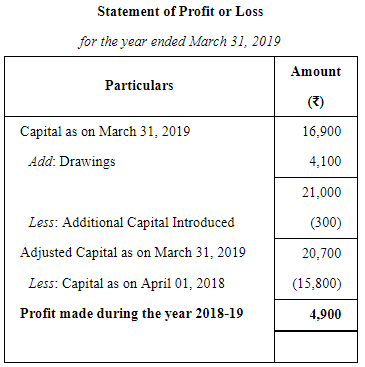

Abhay withdrew ₹ 4,100 during the year to meet his household expenses. He introduced ₹ 300 as fresh capital on 15th January, 2019. Machinery and Furniture are to be depreciated at 10% and 5% p.a. respectively.

ANSWER:

Page No 20.42:

Question 17:

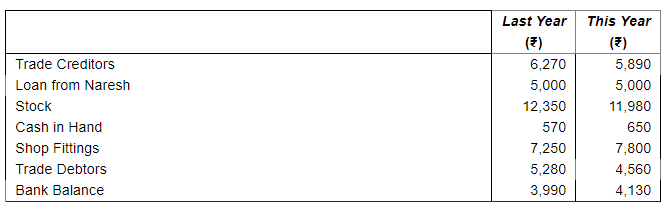

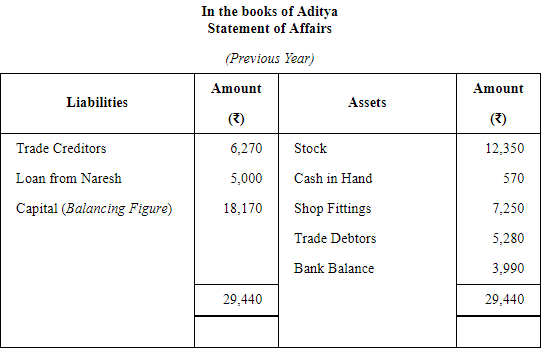

Aditya a retailer, has not maintained proper books of account but it has been possible to obtain the following details:

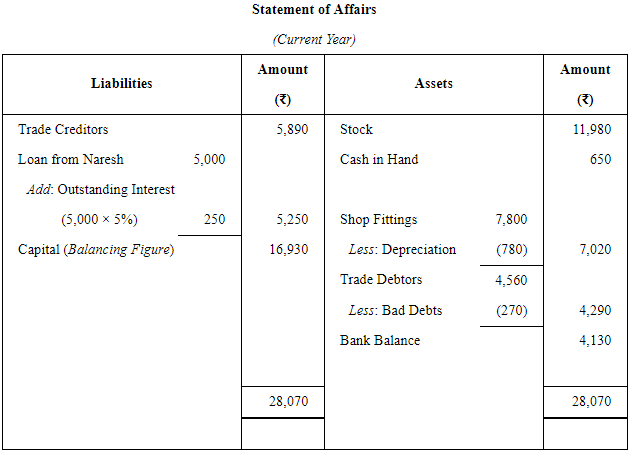

Calculate the net profit for this year and draft the Statement of Affairs at the end of the year after noting that:

(a) Shop Fittings are to be depreciated by ₹ 780.

(b) Aditya has drawn ₹ 100 per week for his own use.

(c) Included in the Trade Debtors is an irrecoverable balance of ₹ 270.

(d) Interest at 5% p.a. is due on the loan from Naresh but has not been paid for the year.

ANSWER:

Question 18:

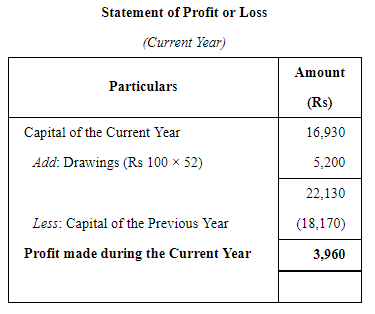

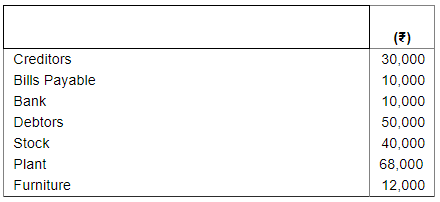

On 1st April, 2018, X started a business with ₹ 40,000 as his capital. On 31st March, 2019, his position was as follows:

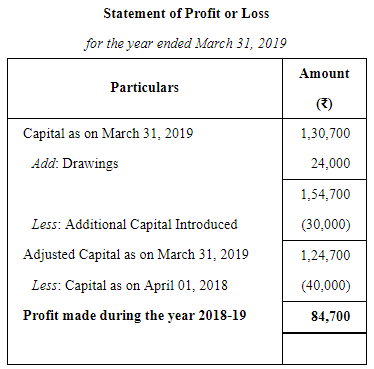

During the year 2018–19, X drew ₹ 24,000. On 1st October, 2018, he introduced further capital amounting to ₹ 30,000. You are required to ascertain profit or loss made by him during the year 2018–19.

Adjustments:

(a) Plant is to be depreciated at 10%.

(b) A provision of 5% is to be made against debtors.

Also prepare the Statement of Affairs as on 31st March, 2019.

ANSWER:

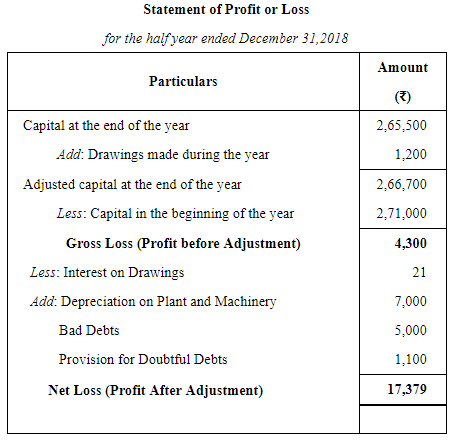

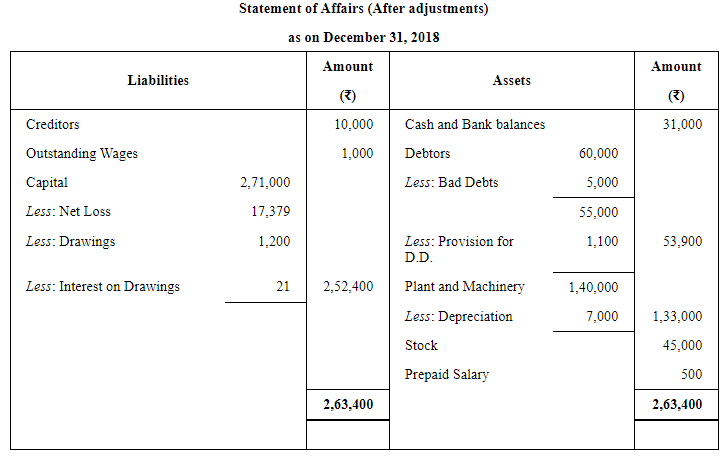

Question 19:

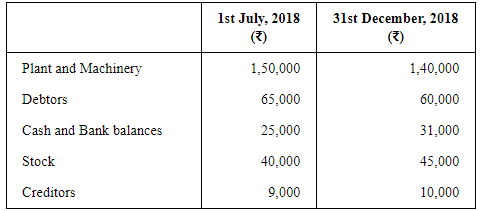

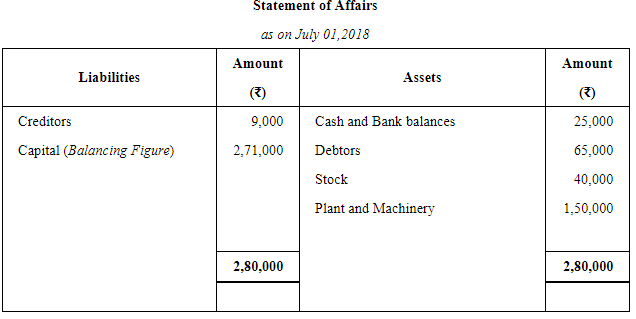

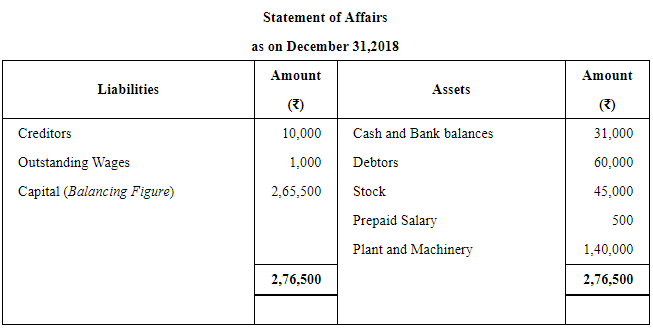

Chaman maintains his books according to Single Entry System. Following figures were available from the books for the six months ended 31st December 2018:

Adjustments:

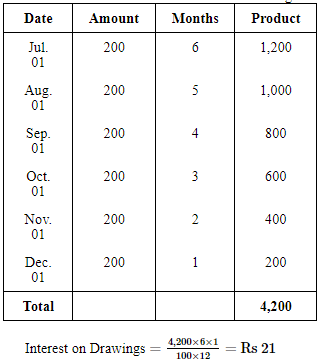

(a) He had withdrawn ₹ 200 in the beginning of every month for household purposes.

(b) Depreciation on Plant and Machinery @ 10% p.a.

(c) Further Bad Debts ₹ 5,000 and Provision for Doubtful Debts to be created @ 2%.

(d) During the period, salaries have been prepaid by ₹ 500 while wages outstanding were ₹ 1,000.

(e) Interest on drawings to be reckoned @ 6% p.a.

You are required to prepare the Statement of Profit or Loss for the half year ended 31st December, 2018, followed by Revised Statement of Affairs as on that date.

ANSWER:

Working Notes:

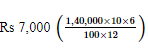

WN1: Depreciation on plant and machinery would be charged for six months only i.e.,

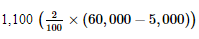

WN2: Amount of Provision for Doubtful Debts would be  WN3: Calculation of Amount of Interest on Drawings:

WN3: Calculation of Amount of Interest on Drawings:

|

64 videos|152 docs|35 tests

|

FAQs on Accounts From Incomplete Records Single Entry System (Part - 2) - Accountancy Class 11 - Commerce

| 1. What is an incomplete records single entry system? |  |

| 2. What are the key features of an incomplete records single entry system? |  |

| 3. How does an incomplete records single entry system differ from a complete records double-entry system? |  |

| 4. What are the limitations of an incomplete records single entry system? |  |

| 5. What are some common examples of businesses that may use an incomplete records single entry system? |  |