Redemption of Debentures ( Part - 4) | Accountancy Class 12 - Commerce PDF Download

Question 15:

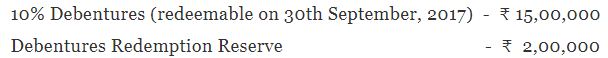

In 1st April, 2016, following were the balances of Blue Bird Ltd.:

The company met the requirements of the Companies Act, 2013 regarding Debentures Redemption Reserve and Investment and redeemed the debentures.

Pass necessary Journal entries for the above transactions in the books of the company.

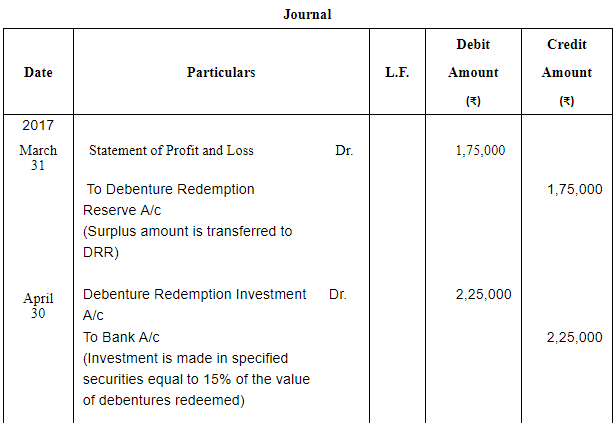

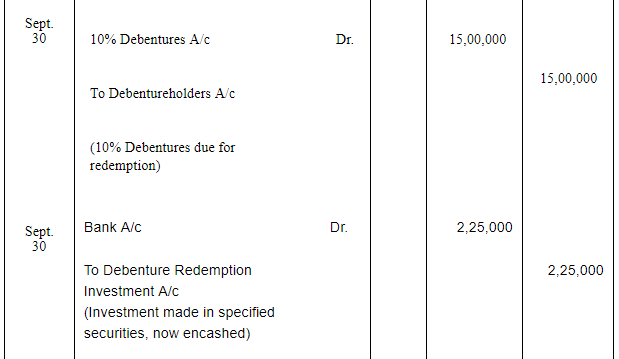

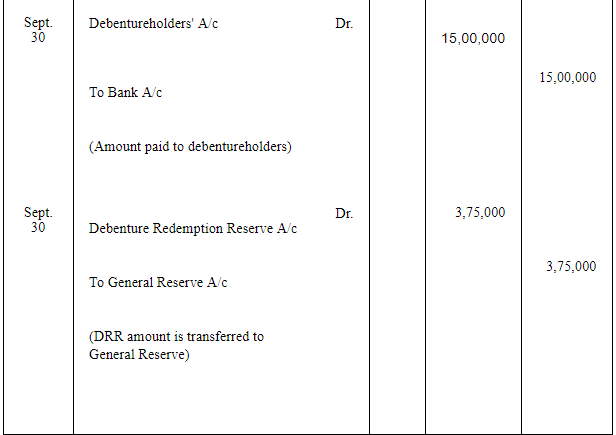

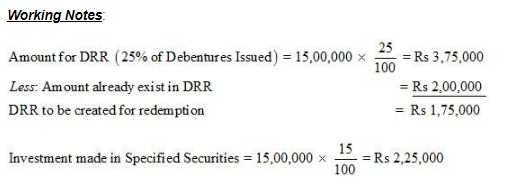

ANSWER:

*As per circular no. 04/2015 issued by Ministry of Corporate Affairs (dated 11.02.2013), every company required to create/maintain DRR shall on or before the 30th day of April of each year, deposit or invest, as the case may be, a sum which shall not be less than fifteen percent of the amount of its debentures maturing during the year ending on the 31st day of March next following year. Accodingly, entries for DRR and Investment have been passed a year before redemption year.

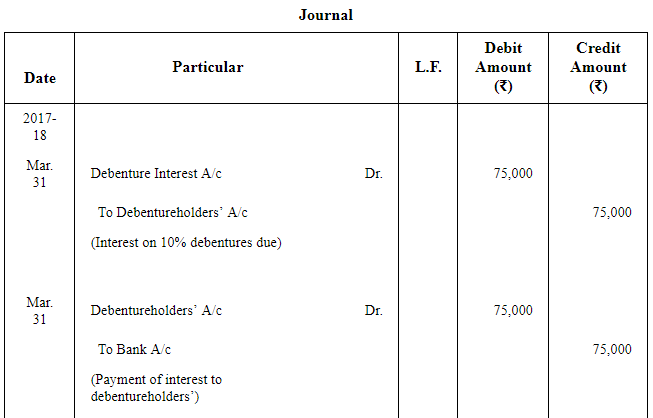

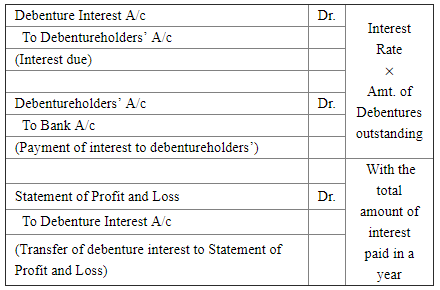

Note: Entries for interest on debentures have been ignored in the above solution as the question was silent in this regards. However, the students' may journalise the entries related to interest on debentures as given below.

Page No 10.31:

Question 16:

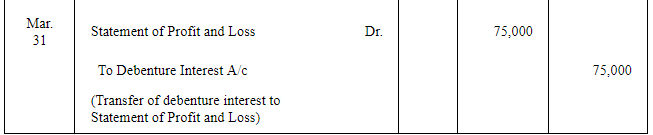

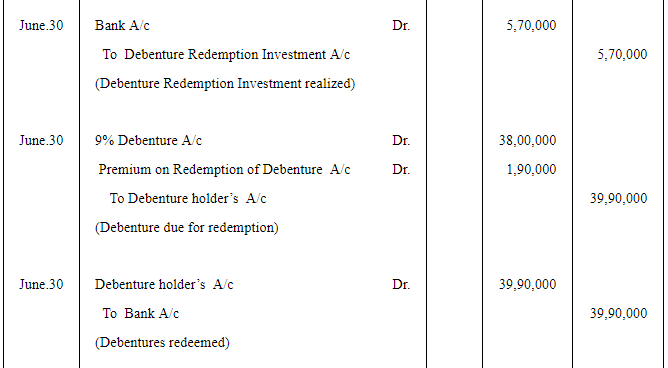

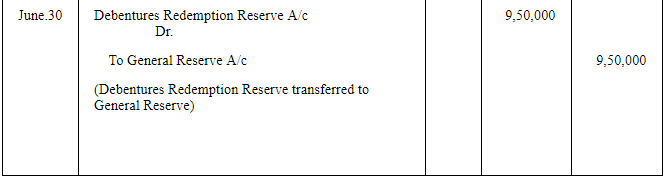

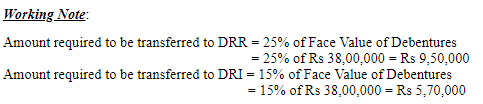

Mahima Ltd.issued ₹ 38,00,000, 9% Debentures of ₹ 100 each on 1st April, 2013. The debentures were redeemable at a premium of 5% on 30th June, 2015. The company transferred an amount of ₹ 9,50,000 to Debentures Redemption Reserve on 31st March, 2015. Investments as required by law were made in fixed deposit of a bank on 1st April, 2015.

Ignoring interest on fixed deposit ,pass necessary journal entries starting from 31st March, 2015 regarding redemption of debentures.

ANSWER:

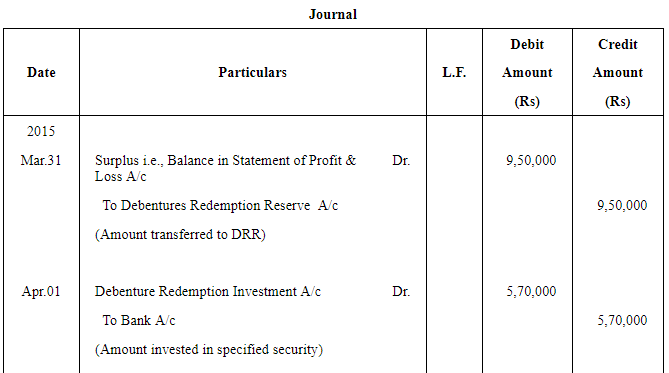

Question 17:

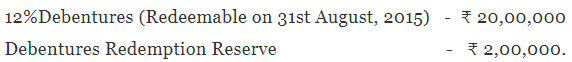

On 1st April, 2013 the following balances appeared in the books of Blue and Green Ltd.:

The company met the requirements of Companies Act, 2013 regarding Debentures Redemption Reserve and Debentures Redemption Investments and redeemed the debentures.

Ignoring interest on investments, pass necessary journal entries for the above transactions in the books of company.

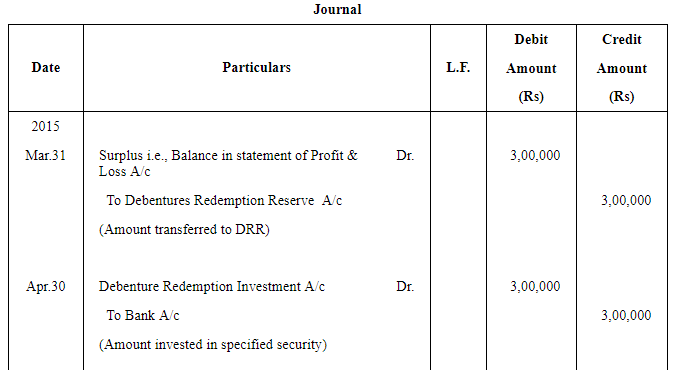

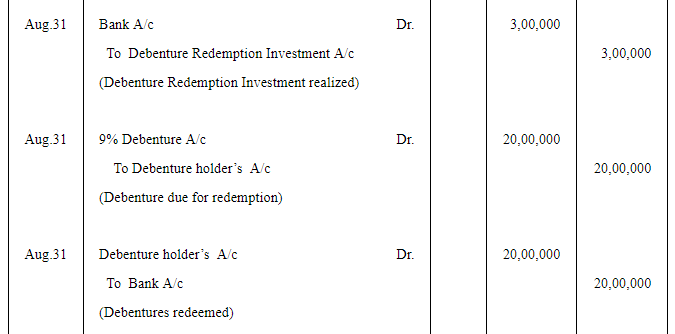

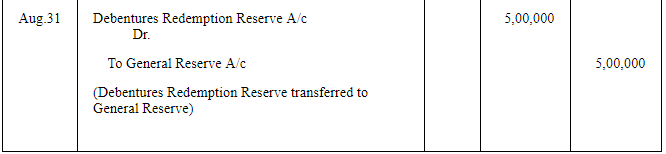

ANSWER:

Question 18:

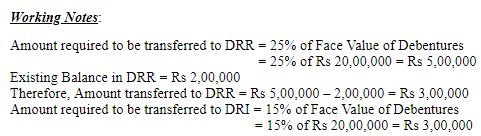

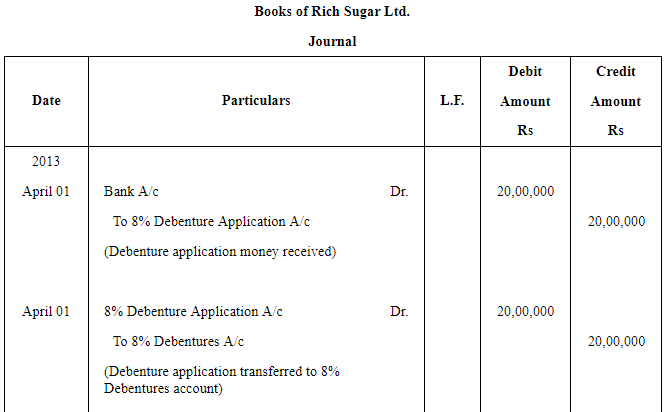

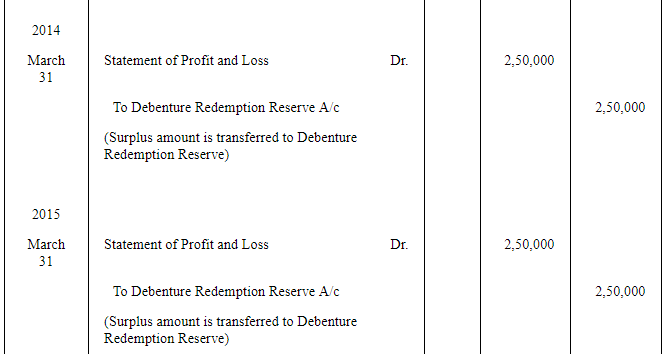

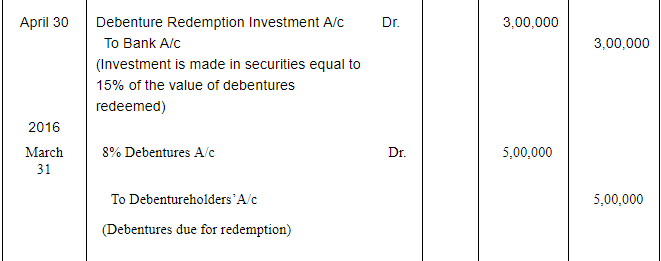

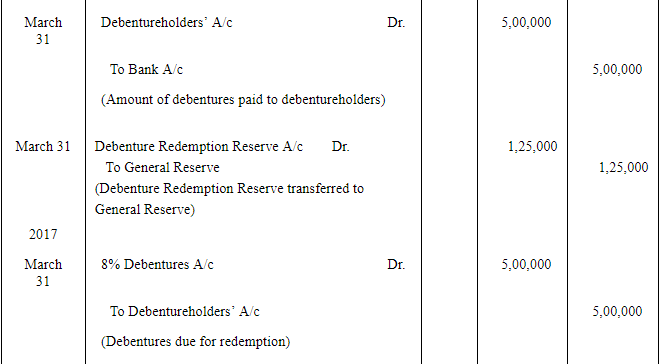

Rich sugar Ltd. issued ₹ 20 Lakh,8% Debentures divided into debentures of ₹ 100 each on 1st April, 2013, redeemable in four equal annual installments starting from 31st March,2016. The company decided to transfer to Debentures Redemption Reserve ₹ 2,50,000 each year on 31st March,2014 and 2015.

The company invested ₹ 3,00,000 in Government securities as required by the Companies Act, 2013.

Pass necessary journal entries for the above transactions.

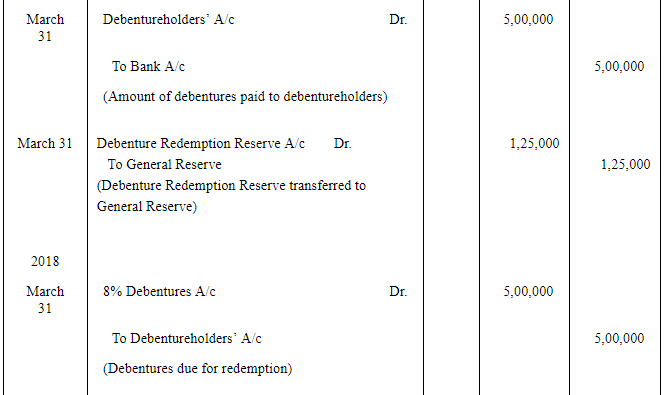

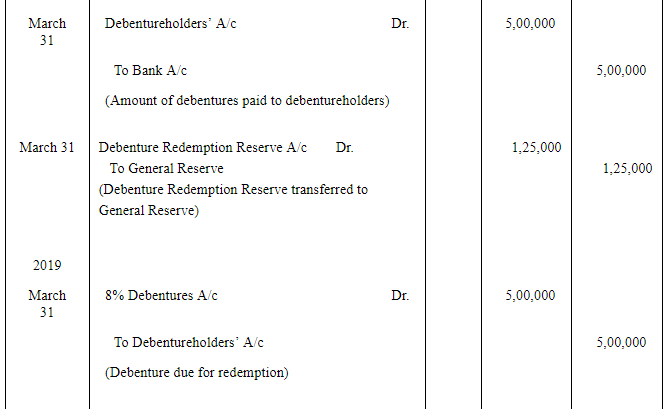

ANSWER:

*As per circular no. 04/2015 issued by Ministry of Corporate Affairs (dated 11.02.2013), every company required to create/maintain DRR shall on or before the 30th day of April of each year, deposit or invest, as the case may be, a sum which shall not be less than fifteen percent of the amount of its debentures maturing during the year ending on the 31st day of March next following year. Accodingly, entry for investment in Government securities has been passed a year before first redemption year.

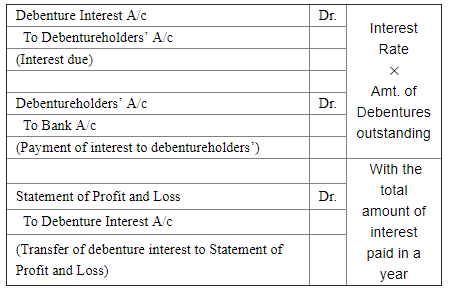

Note: Since the question is silent regarding the payment of interest, the following entries may be passed at the end of every year (i.e. on 31 March before the redemption of debentures). However, it is not essential to pass these entries unless explicitly stated in the question.

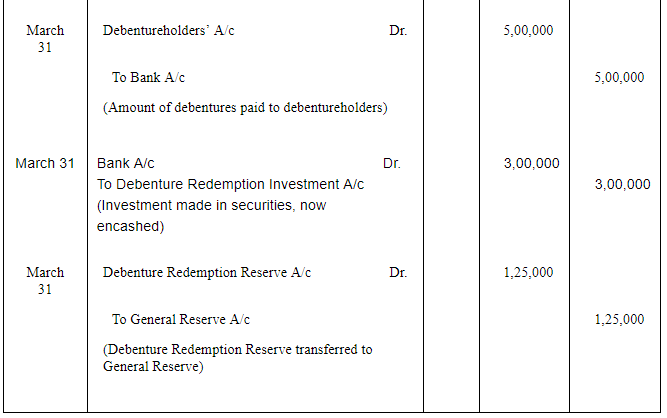

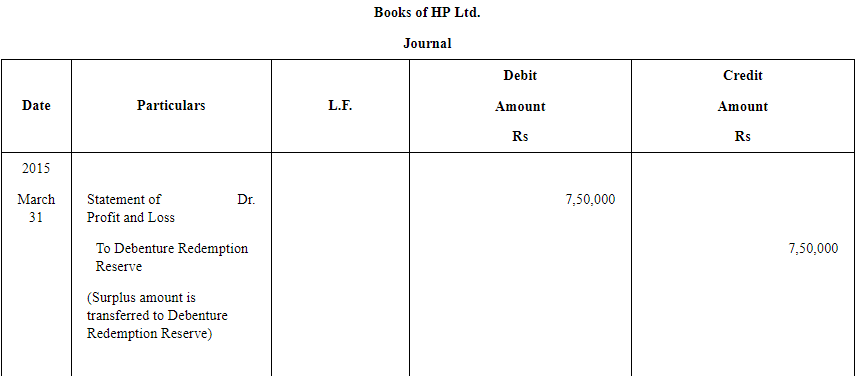

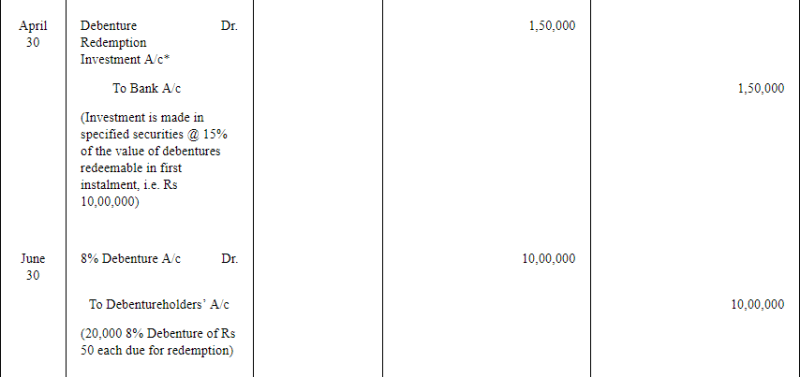

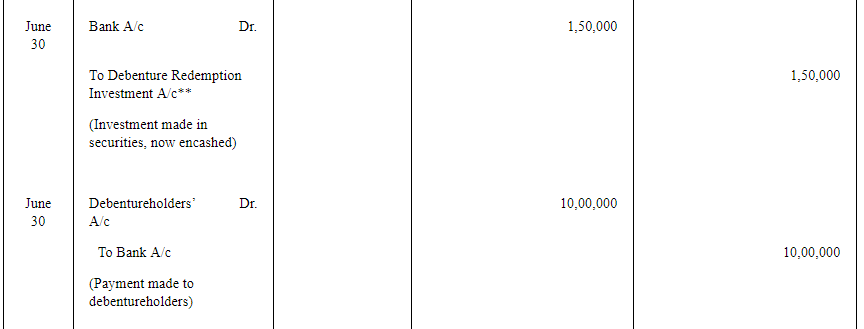

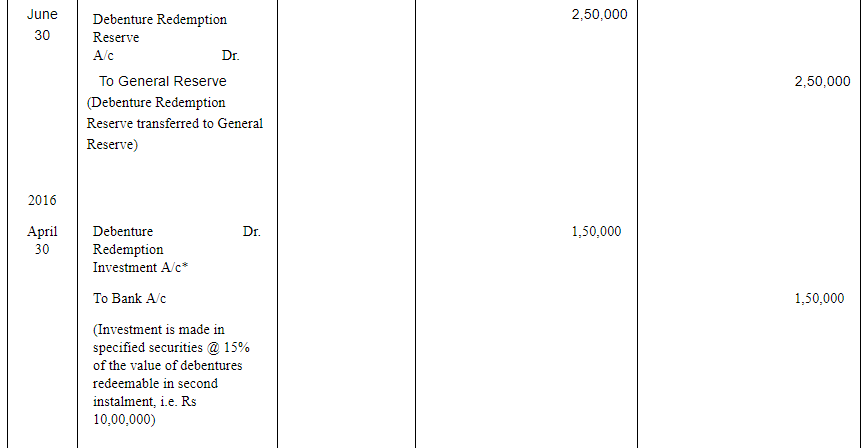

Question 19:

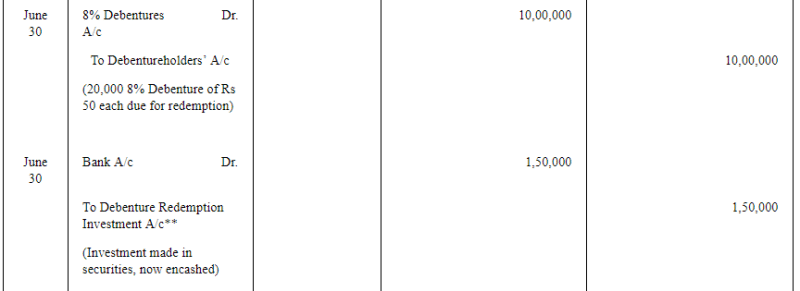

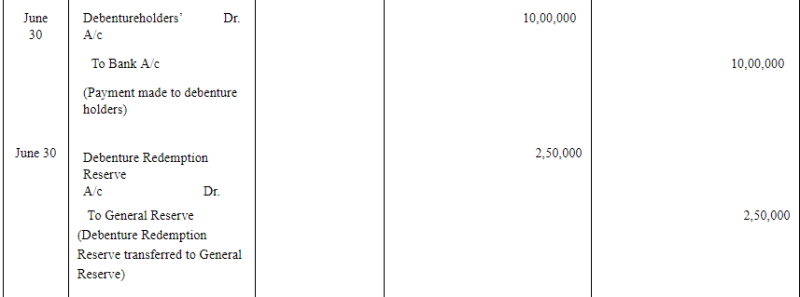

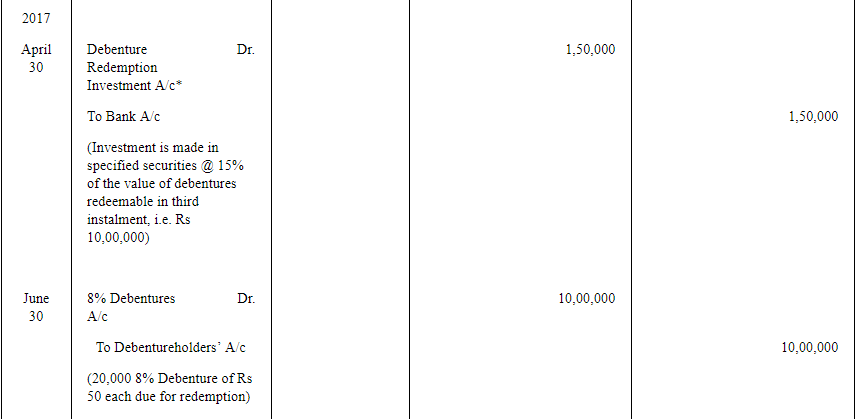

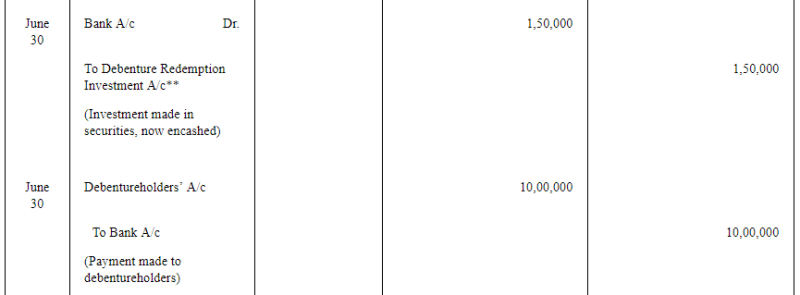

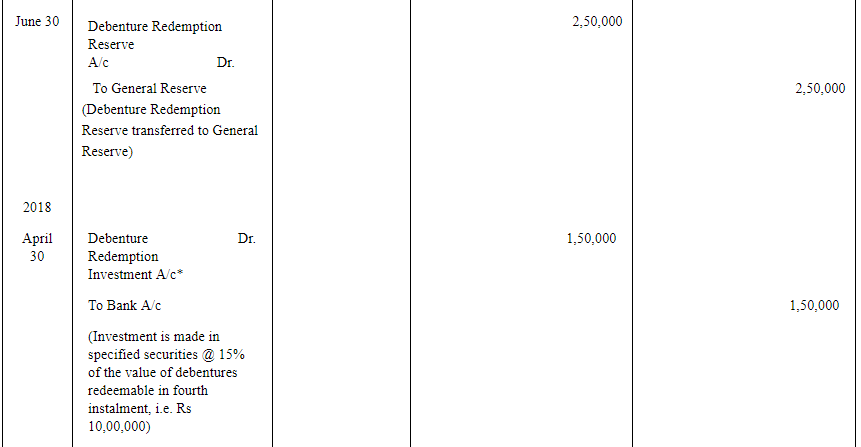

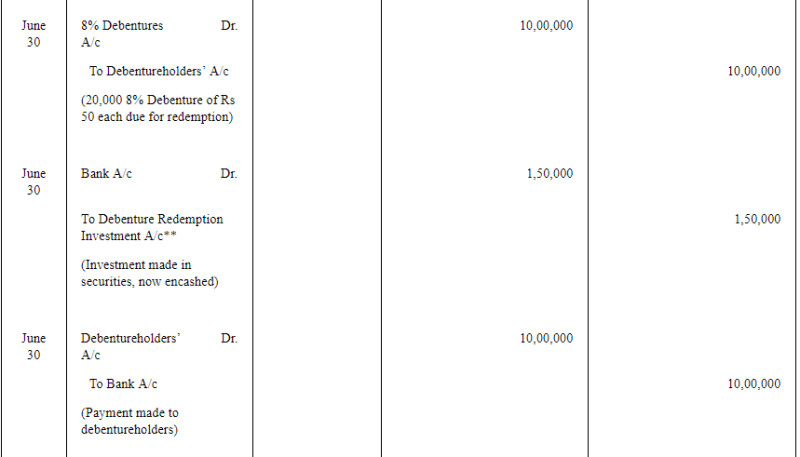

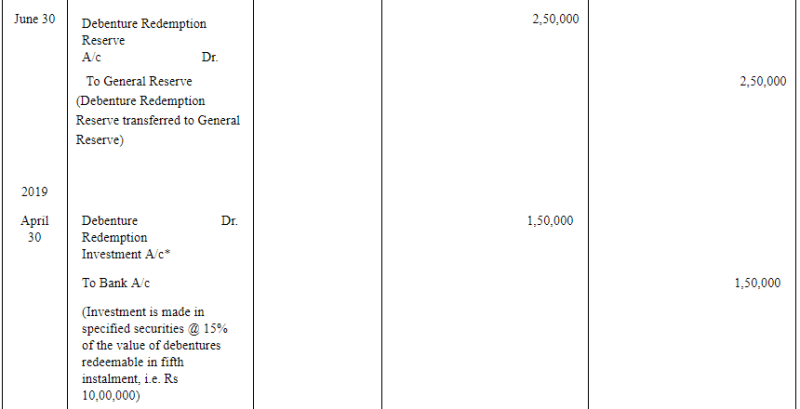

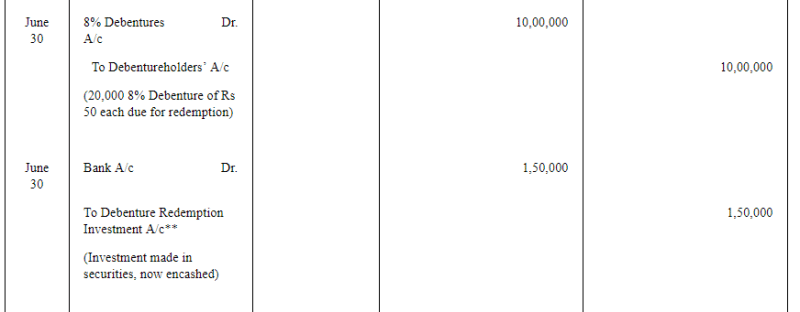

Hp Ltd. has 1,00,000;8% Debentures of ₹ 50 each due for redemption in five equal annual installments starting from 30th June, 2015. Debentures Redemption Reserve has a balnce of ₹ 5,00,000 on that date . Pass journal entries.

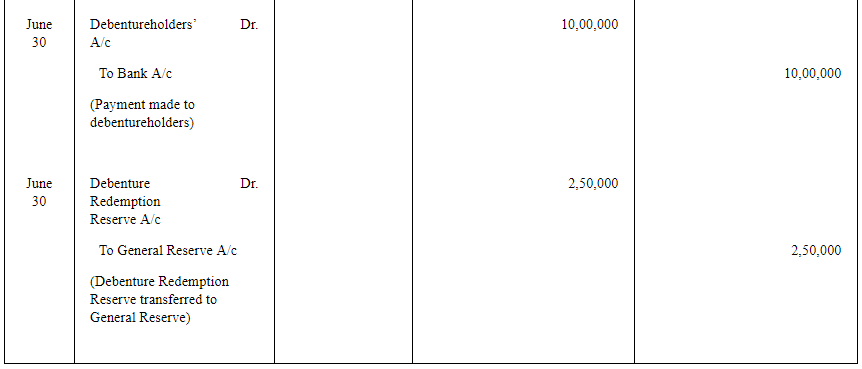

ANSWER:

*As per circular no. 04/2015 issued by Ministry of Corporate Affairs (dated 11.02.2013), every company required to create/maintain DRR shall on or before the 30th day of April of each year, deposit or invest, as the case may be, a sum which shall not be less than fifteen percent of the amount of its debentures maturing during the year ending on the 31st day of March next following year. Accodingly, entry for investment in Government securities has been passed a year before first redemption year.

**Since nothing is specified, investments will be encashed before debentures are redeemed.

Note: Since the question is silent regarding the payment of interest, the following entries may be passed at the end of every year (i.e. on 31 March before the redemption of debentures). However, it is not essential to pass these entries unless explicitly stated in the question.

|

42 videos|199 docs|43 tests

|

FAQs on Redemption of Debentures ( Part - 4) - Accountancy Class 12 - Commerce

| 1. What is the meaning of redemption of debentures? |  |

| 2. How does a company redeem its debentures? |  |

| 3. Can a company redeem its debentures before the maturity date? |  |

| 4. What are the methods of redeeming debentures? |  |

| 5. What are the accounting entries for the redemption of debentures? |  |