Accounting for Partnership Firms-Fundamentals (Part - 5) | Accountancy Class 12 - Commerce PDF Download

Page No 2.88:

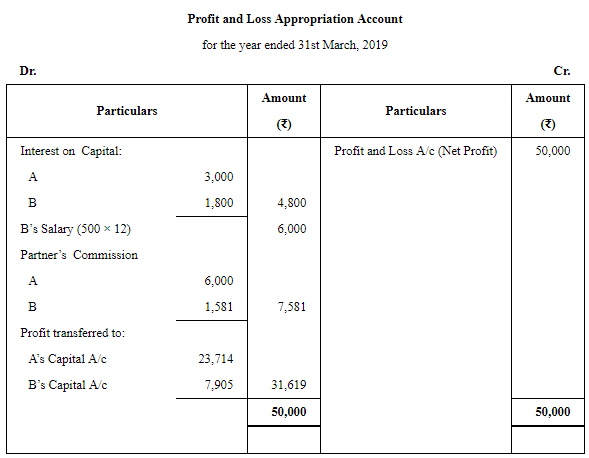

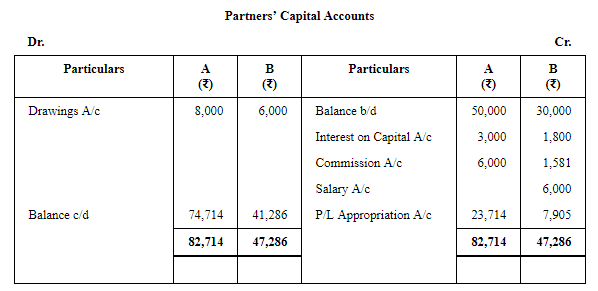

Question 46: A and B are partners sharing profits and losses in the ratio of 3 : 1. On 1st April, 2018, their capitals were: A ₹ 50,000 and B ₹ 30,000. During the year ended 31st March, 2019 they earned a net profit of ₹ 50,000. The terms of partnership are:

(a) Interest on capital is to allowed @ 6% p.a.

(b) A will get a commission @ 2% on turnover.

(c) B will get a salary of ₹ 500 per month.

(d) B will get commission of 5% on profits after deduction of all expenses including such commission.

Partners' drawings for the year were: A ₹ 8,000 and B ₹ 6,000. Turnover for the year was ₹ 3,00,000.

After considering the above facts, you are required to prepare Profit and Loss

Appropriation Account and Partners' Capital Accounts.

ANSWER:

Working Notes:

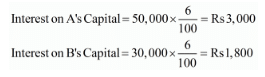

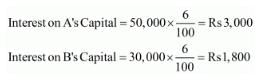

WN 1 Calculation of Interest on Capital

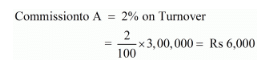

WN 2 Calculation of Commission to Partners

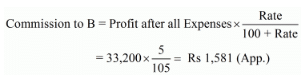

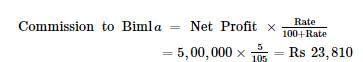

Commission to B = 5% on Profits after all Expense including such Commission

Profits after all expense = 50,000 − 4,800 − 6,000 − 6,000 = Rs 33,200

WN 3 Calculation of Profit Share of each Partner

Profit available for Distribution = 50,000 − 4,800 − 6,000 −7,581 = Rs 31,619

Profit sharing ratio = 3 : 1

Page No 2.88:

Question 47: A, B and C were partners in a firm having capitals of ₹ 50,000 ; ₹ 50,000 and ₹ 1,00,000 respectively. Their Current Account balances were A: ₹ 10,000; B: ₹ 5,000 and C: ₹ 2,000 (Dr.). According to the Partnership Deed the partners were entitled to an interest on Capital @ 10% p.a. C being the working partner was also entitled to a salary of ₹ 12,000 p.a. The profits were to be divided as:

(a) The first ₹ 20,000 in proportion to their capitals.

(b) Next ₹ 30,000 in the ratio of 5 : 3 : 2.

(c) Remaining profits to be shared equally.

The firm earned net profit of ₹ 1,72,000 before charging any of the above items.

Prepare Profit and Loss Appropriation Account and pass necessary Journal entry for the appropriation of profits.

ANSWER:

Working Notes:

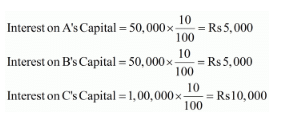

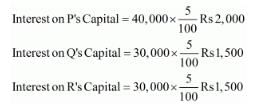

WN 1 Calculation of Interest on Capital

WN 2 Calculation of Profit Share of each Partner

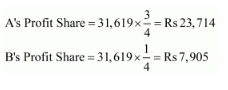

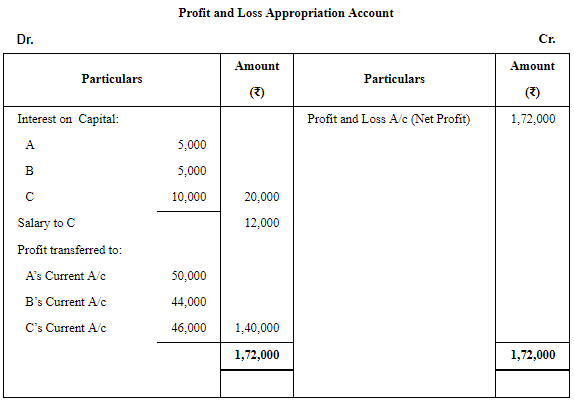

Profits available for Distribution = 1,72,000 − 20,000 − 12,000

= Rs 1,40,000

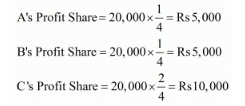

1. Distribution of first Rs 20,000 in the Capital Ratio i.e. 1:1:2

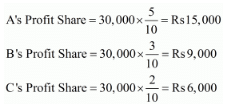

2. Distribution of Next Rs 30,000 in the ratio of 5:3:2

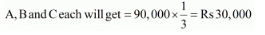

3. Remaining Profit available for distribution = Rs 1,40,000 − 20,000 − 30,000 = Rs 90,000

This profit of Rs 90,000 is to be shared equally by the partners.

Therefore,

Total Profit Share of A = 5,000 + 15,000 + 30,000 = Rs 50,000

Total Profit Share of B = 5,000 + 9,000 + 30,000 = Rs 44,000

Total Profit Share of C = 10,000 + 6,000 + 30,000 = Rs 46,000

Page No 2.88:

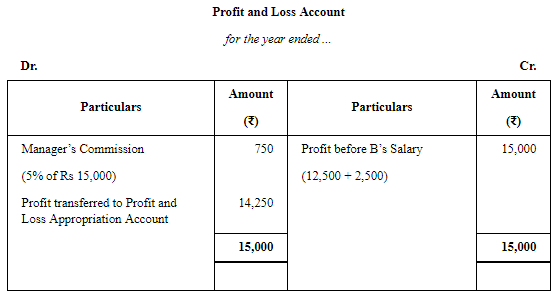

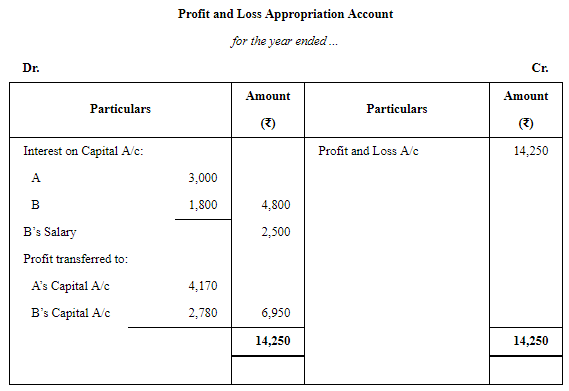

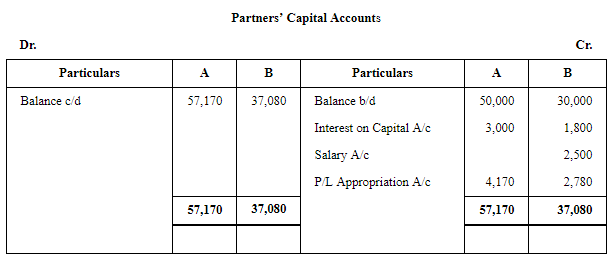

Question 48: A and B are partners sharing profits in the ratio of 3 : 2 with capitals of ₹ 50,000 and ₹ 30,000 respectively. Interest on capital is agreed @ 6% p.a. B is to be allowed an annual salary of ₹ 2,500. During the year profit prior to interest on capital but after charging B's salary amounted to ₹ 12,500. A provision of 5% of the profits is to be made in respect of Manager's Commission.

ANSWER:

Working Notes:

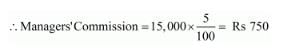

WN 1 Calculation of Managers’ Commission

1. Managers’ Commission = 5% on Net Profit (before Salary)

Profit before Salary = Profit after Salary + Salary = 12,500 + 2500 = Rs 15,000

WN 2 Calculation of Interest on Capital

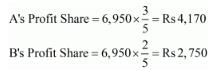

WN 3 Calculation of Profit Share of each Partner

Profit available for distribution = 12,500 − 750 − 3,000 − 1,800 = Rs 6,950

Profit sharing ratio = 3 : 2

Page No 2.88:

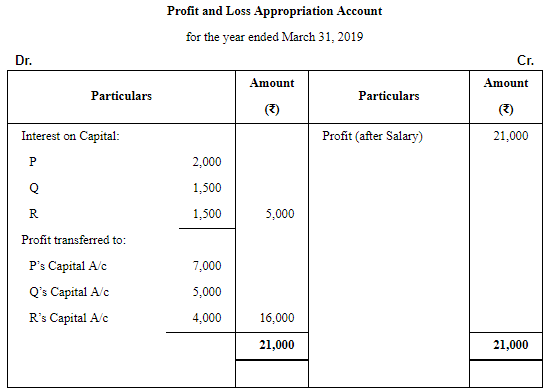

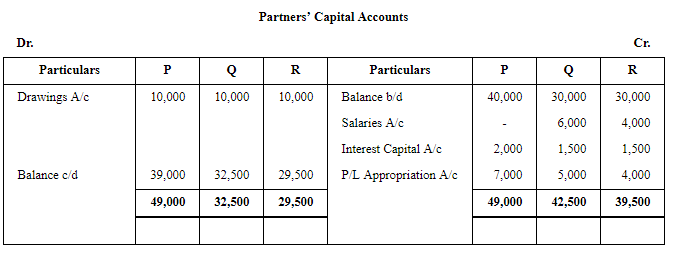

Question 49: P, Q and R are in a partnership and as at 1st April, 2018 their respective capitals were: ₹ 40,000, ₹ 30,000 and ₹ 30,000. Q is entitled to a salary of ₹ 6,000 and R ₹ 4,000 p.a. payable before division of profits. Interest is allowed on capital @ 5% p.a. and is not charged on drawings. Of the divisible profits, P is entitled to 50% of the first ₹ 10,000, Q to 30% and R to 20%, rest of the profit are shared equally. Profits for the year ended 31st March, 2019, after debiting partners' salaries but before charging interest on capital was ₹ 21,000 and the partners had drawn ₹ 10,000 each on account of salaries, interest and profit.

Prepare Profit and Loss Appropriation Account for the year ended 31st March, 2019 showing the distribution of profit and the Capital Accounts of the partners.

ANSWER:

Working Notes:

WN 1 Calculation of Interest on Capital

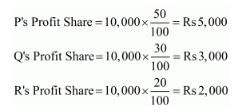

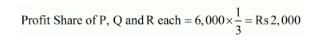

WN 2 Calculation of Profit Share of each Partner

Profit available for distribution = 21,000 − 5000 = Rs 16,000

a. Distribution of first Rs 10,000 (50%, 30% and 20%)

b. Distribution of Reaming Profit i.e. Rs 6,000 (16,000 − 10,000) equally

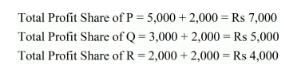

Therefore,

Page No 2.89:

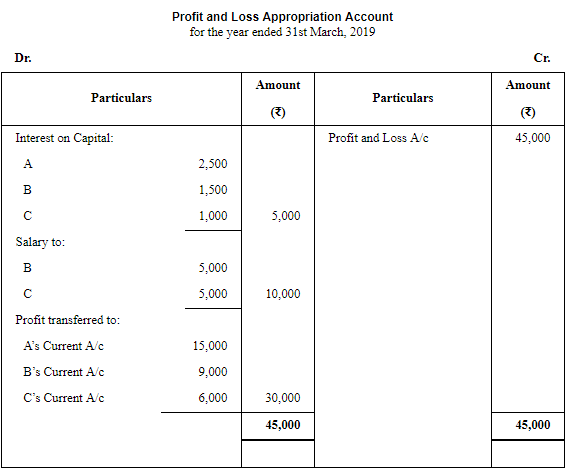

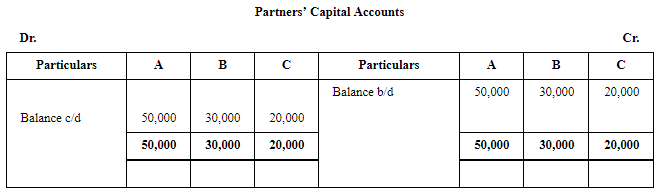

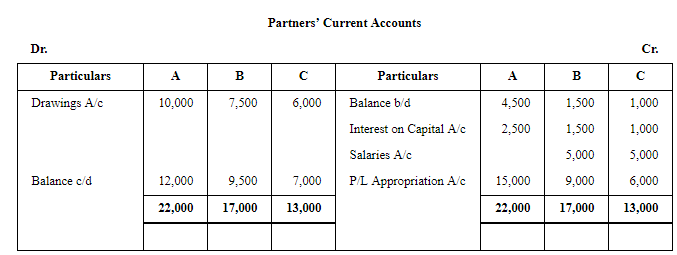

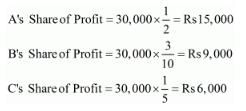

Question 50: A, B and C are partners sharing profits and losses in the ratio of A 1/2, B 3/10, C 1/5 after providing for interest @ 5% on their respective capitals, viz., A ₹ 50,000; B ₹ 30,000 and C ₹ 20,000 and allowing B and C a salary of ₹ 5,000 each per annum. During the year ended 31st March, 2019, A has drawn ₹ 10,000 and B and C in addition to their salaries have drawn ₹ 2,500 and ₹ 1,000 respectively. Profit and Loss Account for the year ended 31st March, 2019 showed a net profit of ₹ 45,000. On 1st April, 2018, the balances in the Current Accounts of the partners were A (Cr.) ₹ 4,500; B (Cr.) ₹ 1,500 and C (Cr.) ₹ 1,000. Interest is not charged on Drawings or Current Account balances. Show Partners' Capital and Current Accounts as at 31st March, 2019 after division of profits in accordance with the partnership agreement.

ANSWER:

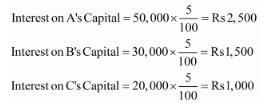

Working Notes:

WN 1 Calculation of Interest on Capital

WN 2 Calculation of Profit Share of each Partner

Profit available for Distribution = 45,000 − 15,000 = Rs 30,000

Page No 2.89:

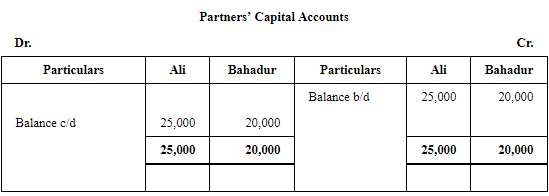

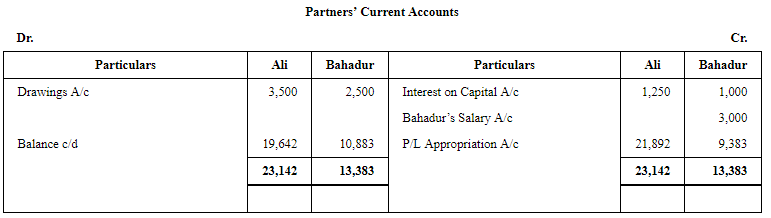

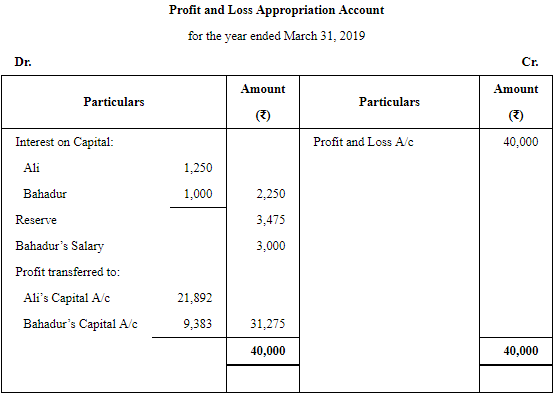

Question 51:Ali the Bahadur are partners in a firm sharing profits and losses as Ali 70% and Bahadur 30%. Their respective capitals as at 1st April, 2018 stand as Ali ₹ 25,000 and Bahadur ₹ 20,000. The partners are allowed interest on capitals @ 5% p.a. Drawings of the partners during the year ended 31st March, 2019 amounted to ₹ 3,500 and ₹ 2,500 respectively.

Profit for the year, before charging interest on capital and annual salary of Bahadur @ ₹ 3,000, amounted to ₹ 40,000, 10% of divisible profit is to be transferred to Reserve.

You are asked to show Partners' Current Account and Capital Accounts recording the above transactions.

ANSWER:

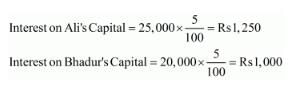

Working Notes:

WN 1

WN 2 Calculation of Interest on Capital

WN 3 Calculation of Amount to be transferred to Reserve

WN 4 Calculation of Profit Share of each Partner

Page No 2.89:

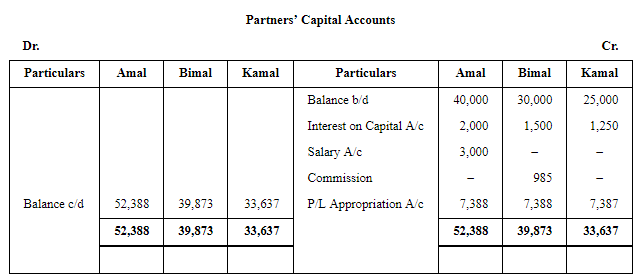

Question 52: Amal, Bimal and Kamal are three partners. On 1st April, 2018, their Capitals stood as: Amal ₹ 40,000, Bimal ₹ 30,000 and Kamal ₹ 25,000. It was decided that:

(a) they would receive interest on Capital @ 5% p.a.,

(b) Amal would get a salary of ₹ 250 per month,

(c) Bimal would receive commission @ 4% on net profit after deducting commission, interest on capital and salary, and

(d) After deducting all of these 10% of the profit should be transferred to the General Reserve.

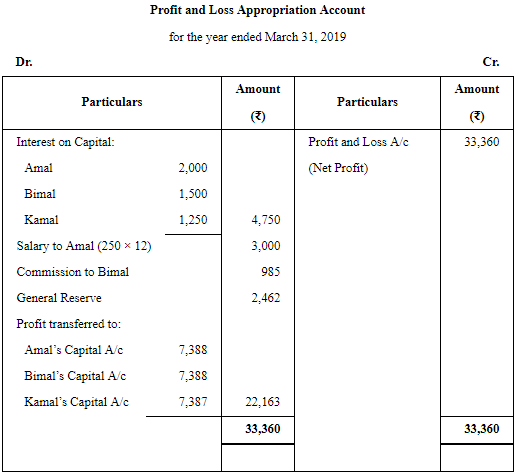

Before the above items were taken into account, net profit for the year ended 31st March, 2019 was ₹ 33,360. Prepare Profit and Loss Appropriation Account and the Capital Accounts of the Partners.

ANSWER:

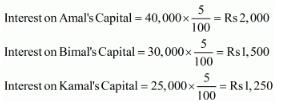

Working Notes:

WN 1 Calculation of Interest on Capital

WN 2 Calculation of Commission to Bimal

Commission to Bimal = 4% on Net Profits after Commission

Profit after expenses = 33,360 − 4,750 − 3,000 = Rs 25,610

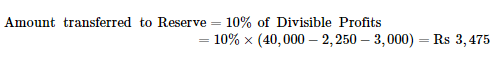

WN 3 Calculation of Amount to be transferred to General Reserve

Amount for General Reserve = 10% of Profit

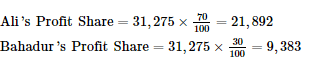

WN 4 Calculation of Profit Share of each Partner

Profit available for Distribution = 33,360 − 4,750 − 3,000− 985 − 2,462

= Rs 22,163

Page No 2.89:

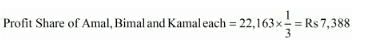

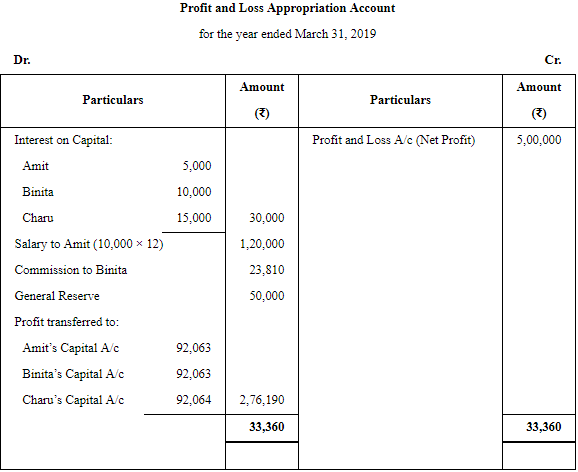

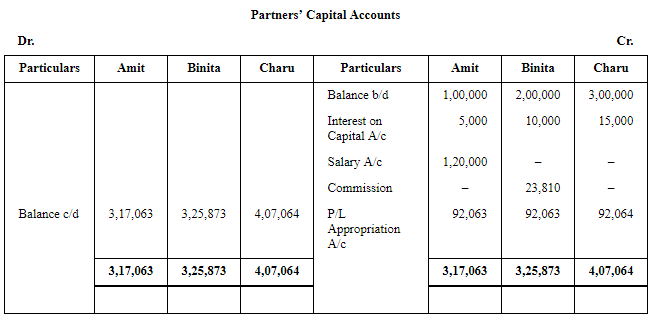

Question 53: Amit, Binita and Charu are three partners. On 1st April, 2018, their Capitals stood as: Amit ₹ 1,00,000, Binita ₹ 2,00,000 and Charu ₹ 3,00,000. It was decided that:

(a) they would receive interest on Capital @ 5% p.a.,

(b) Amit would get a salary of ₹ 10,000 per month,

(c) Binita would receive commission @ 5% of net profit after deduction of commission, and

(d) 10% of the net profit would be transferred to the General Reserve.

Before the above items were taken into account, the profit for the year ended 31st March, 2019 was ₹ 5,00,000.

Prepare Profit and Loss Appropriation Account and the Capital Accounts of the partners.

ANSWER:

Working Notes:

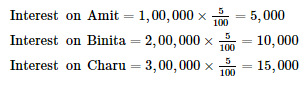

WN 1 Calculation of Interest on Capital

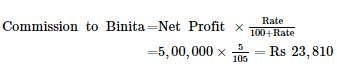

WN 2 Calculation of Commission to Binita

Commission to Binita = 5% on Net Profits after Commission

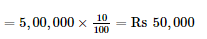

WN 3 Calculation of Amount to be transferred to General Reserve

Amount for General Reserve = 10% of Profit

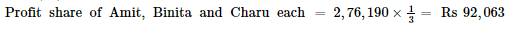

WN 4 Calculation of Profit Share of each Partner

Profit available for Distribution = 5,00,000 - 30,000 - 1,20,000 - 23,810 - 50,000

= Rs 2,76,190

Page No 2.89:

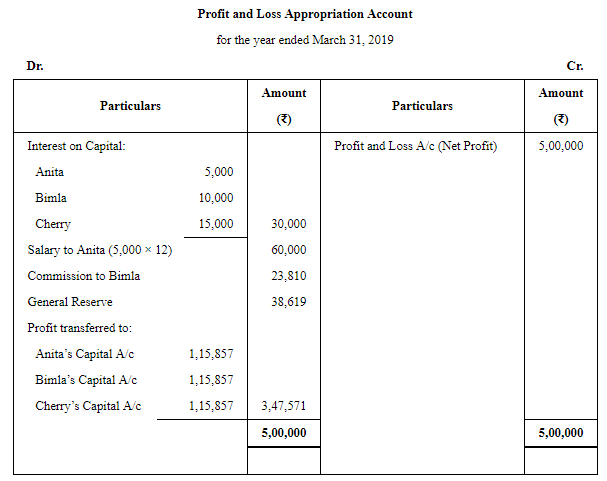

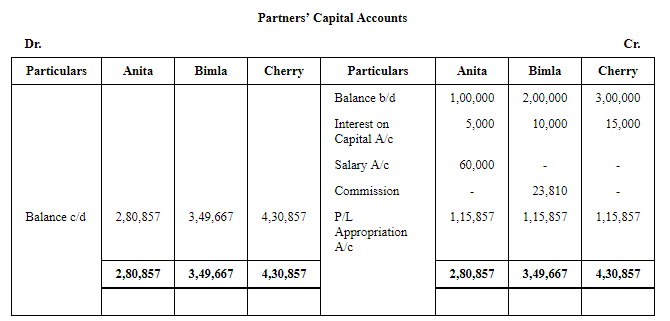

Question 54: Anita, Bimla and Cherry are three partners. On 1st April, 2018, their Capitals stood as: Anita ₹ 1,00,000, Bimla ₹ 2,00,000 and Cherry ₹ 3,00,000. It was decided that:

(a) they would receive interest on Capital @ 5% p.a.,

(b) Anita would get a salary of ₹ 5,000 per month,

(c) Bimla would receive commission @ 5% of net profit after deduction of commission, and

(d) 10% of the net divisible profit would be transferred to the General Reserve.

Before the above items were taken into account, the profit for the year ended

31st March, 2019 was ₹ 5,00,000. Prepare Profit and Loss Appropriation

Account and the Capital Accounts of the partners.

ANSWER:

Working Notes:

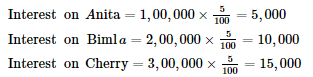

WN 1 Calculation of Interest on Capital

WN 2 Calculation of Commission to Bimla

Commission to Bimla = 5% on Net Profits after Commission

WN 3 Calculation of Amount to be transferred to General Reserve

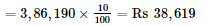

Amount for General Reserve = 10% of Divisible Profit

Divisible Profit = 5,00,000 – 30,000 – 23,810 – 60,000 = 3,86,190

WN 4 Calculation of Profit Share of each Partner

Profit available for Distribution = 5,00,000 – 30,000 – 60,000 – 23,810 – 38,619

= Rs 3,47,571

Page No 2.90:

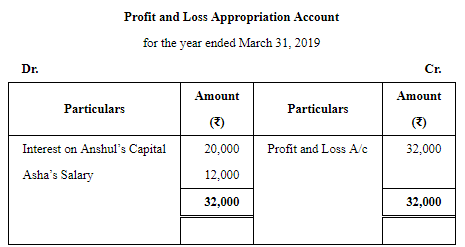

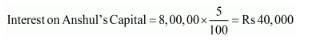

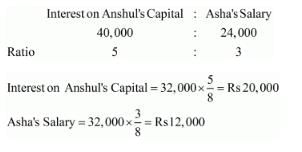

Question 55: Anshul and Asha are partners sharing profits and losses in the ratio of 3 : 2. Anshul being a non-working partner contributed ₹ 8,00,000 as her capital. Asha being a working partner did not contribute capital. The partnership Deed provides for interest on capital @ 5% and salary to every working partner @ ₹ 2,000 per month. Net profit (before providing for interest on capital and partner's salary) for the year ended 31st March, 2019 was ₹ 32,000.

ANSWER:

Working Note:

Salary to Asha = Rs 24,000

Total appropriation to be made = 40,000 + 24,000 = Rs 64,000

Profit earned during the year = 32,000

Here, profit available for distribution (i.e. Rs 32,000) is less than the sum total of Interest on Capital and Salary (i.e. Rs 64,000).

Therefore, profit will be distributed in the ratio of Interest on Capital and Salary.

Page No 2.90:

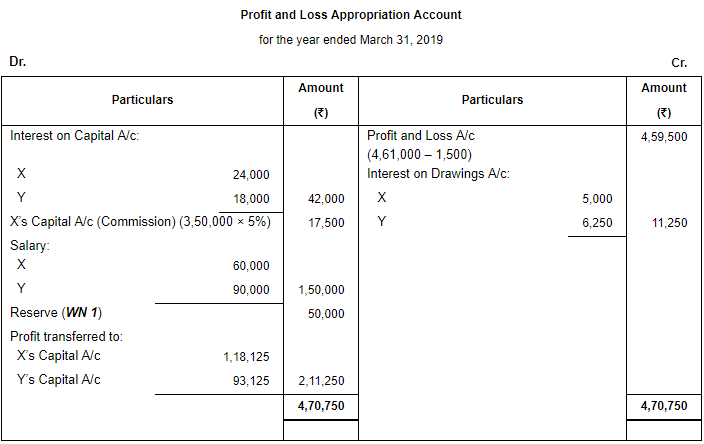

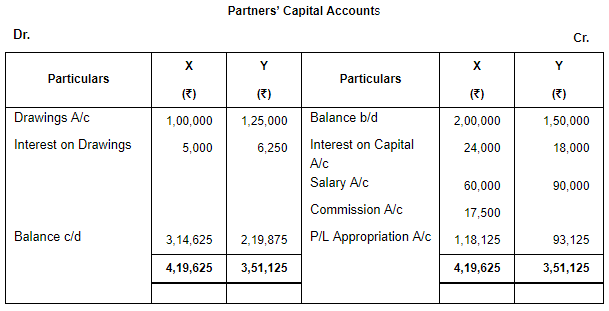

Question 56: X and Y entered into partnership on 1st April, 2017. Their capitals as on 1st April, 2018 were ₹ 2,00,000 and ₹ 1,50,000 respectively. On 1st October, 2018, X gave ₹ 50,000 as loan to the firm. As per the provisions of the partnership Deed:

(i) 20% of Profits before charging interest on Drawings but after making appropriations to be transferred to General Reserve.

(ii) Interest on capital at 12% p.a. and Interest on Drawings @ 10% p.a.

(iii) X to get monthly salary of ₹ 5,000 and Y to get salary of ₹ 22,500 per quarter.

(iv) X is entitled to a commission of 5% on sales. Sales for the year were ₹ 3,50,000.

(v) Profit to be shared in the ratio of their capitals up to ₹ 1,75,000 and balance equally.

Profit for the year ended 31st March, 2019 before allowing or charging interest was ₹ 4,61,000. The drawings of X and Y were ₹ 1,00,000 and ₹ 1,25,000 respectively.

Pass the necessary Journal entries relating to appropriation out of profit.

Prepare Profit and Loss Appropriation Account and the Partners' Capital Accounts.

ANSWER:

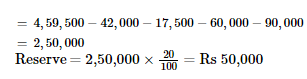

Working Notes:

WN1: Calculation of Reserve

Profit before charging Interest on Drawings but after making appropriations

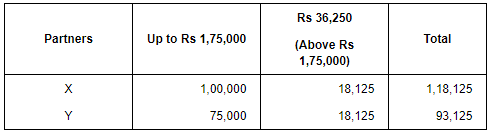

WN2: Division of Profit

Page No 2.90:

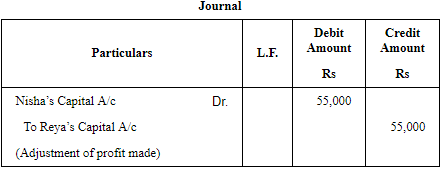

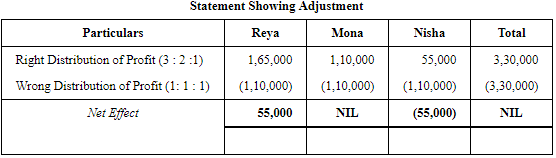

Question 57: Reya, Mona and Nisha shared profits in the ratio of 3 : 2 : 1. The profits for the last three year were ₹ 1,40,000; ₹ 84,000 and ₹ 1,06,000 respectively. These profits were by mistake shared equally for all the give necessary Journal entry for the same.

ANSWER:

Working Note:

Total Profits for Last 3 years = 1,40,000 + 84,000 + 1,06,000 = Rs 3,30,000

Page No 2.90:

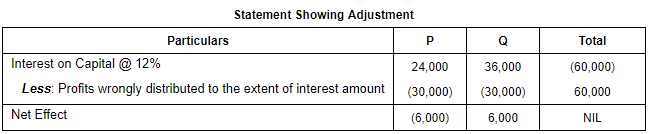

Question 58: P and Q were partners in a firm sharing profits and losses equally. Their fixed capitals were ₹ 2,00,000 and ₹ 3,00,000 respectively. The Partnership Deed provided for interest on capital @ 12% per annum. For the year ended 31st March, 2016, the profits of the firm were distributed without providing interest on capital.

Pass necessary adjustment entry to rectify the error.

ANSWER:

Working Notes:

Page No 2.91:

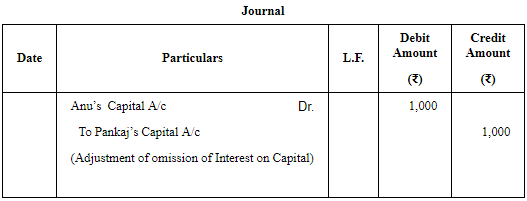

Question 59: Profit earned by a partnership firm for the year ended 31st March, 2018 were distributed equally between the partners – Pankaj and Anu – without allowing interest on capital. Interest due on capital was Pankaj – ₹ 3,000 and Anu – ₹ 1,000.

Pass necessary adjustment entry.

ANSWER:

Working Note:

Page No 2.91:

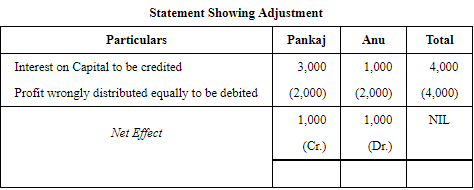

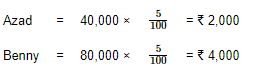

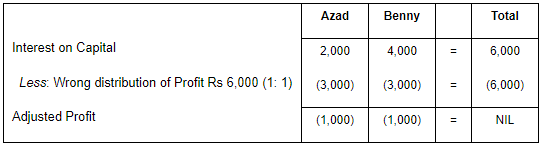

Question 60: Azad and Benny are equal partners. Their capitals are ₹ 40,000 and ₹ 80,000 respectively. After the accounts for the year had been prepared, it was noticed that interest @ 5% p.a. as provided in the Partnership Deed was not credited to their Capital Accounts before distribution of profits. It is decided to pass an adjustment entry in the beginning of the next year. Record the necessary Journal entry.

ANSWER:

Interest on Capital

Adjustment of Profit

Page No 2.91:

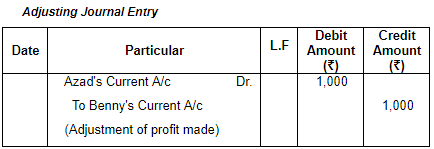

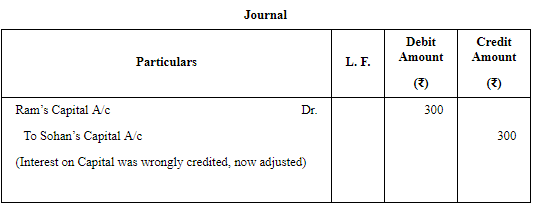

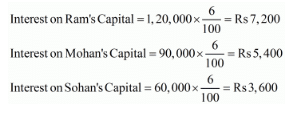

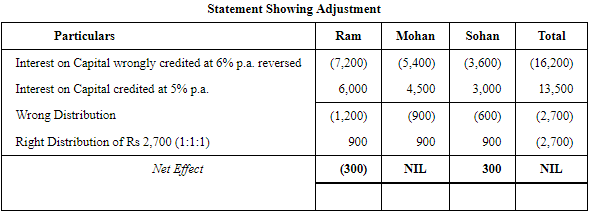

Question 61: Ram, Mohan and Sohan sharing profits and losses equally have capitals of ₹ 1,20,000, ₹ 90,000 and ₹ 60,000 respectively. For the year ended 31st March, 2019, interest was credited to them @ 6% instead of 5%.

Give adjustment Journal entry.

ANSWER:

Working Notes:

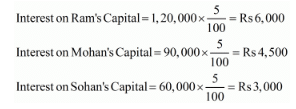

WN 1 Calculation of Interest on Capital at 6% p.a.

WN 2 Calculation of Interest on Capital at 5% p.a.

WN 3

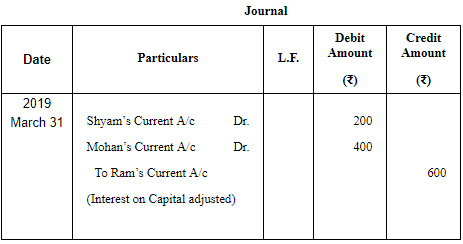

Page No 2.91:

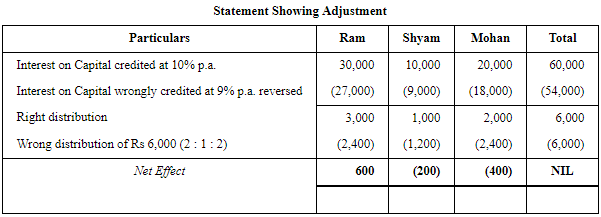

Question 62: Ram, Shyam and Mohan were partners in a firm sharing profits and losses in the ratio of 2 : 1 : 2. Their capitals were fixed at ₹ 3,00,000, ₹ 1,00,000, ₹ 2,00,000. For the year ended 31st March, 2019, interest on capital was credited to them @ 9% instead of 10% p.a. The profit for the year before charging interest was ₹ 2,50,000.

Show your working notes clearly and pass necessary adjustment entry.

ANSWER:

Working Notes:

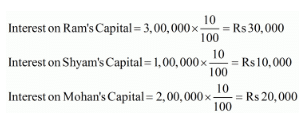

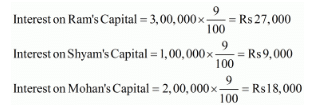

WN 1 Calculation of Interest on Capital 10% p.a.

WN 2 Calculation of Interest on Capital 9% p.a.

WN 3

Page No 2.91:

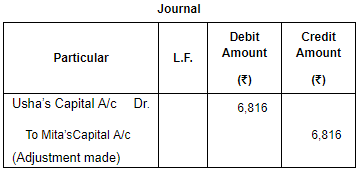

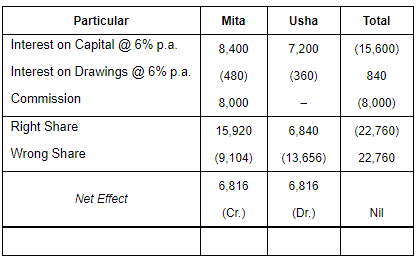

Question 63: Mita and Usha are partners in a firm sharing profits in the ratio of 2 : 3. Their Capital Accounts as on 1st April, 2015 showed balances of ₹ 1,40,000 and ₹ 1,20,000 respectively. The drawings of Mita and Usha during the year 2015-16 were ₹ 32,000 and ₹ 24,000 respectively. Both the amounts were withdrawn on 1st January 2016. It was subsequently found that the following items had been omitted while preparing the final accounts for the year ended 31st March, 2016:

(a) Interest on Capital @ 6% p.a.

(b) Interest on Drawings @ 6% p.a.

(c) Mita was entitled to a commission of ₹ 8,000 for the whole year.

Showing your working clearly, pass a rectifying entry in the books of the firm.

ANSWER:

Page No 2.91:

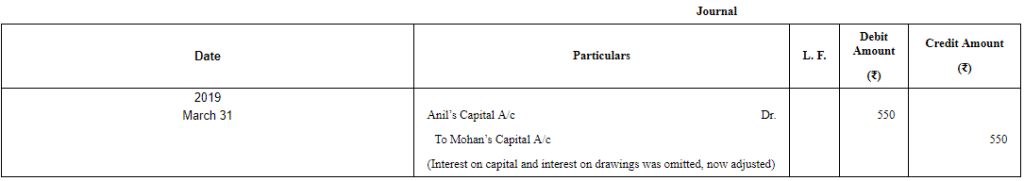

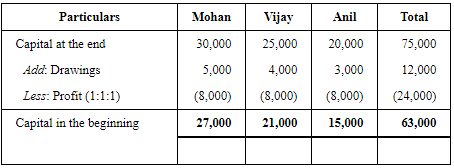

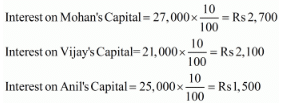

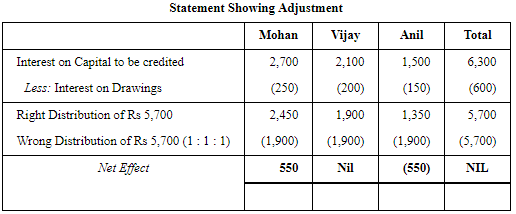

Question 64: Mohan, Vijay and Anil are partners, the balances of their Capital Accounts being ₹ 30,000, ₹ 25,000 and ₹ 20,000 respectively. In arriving at these amounts profit for the year ended 31st March, 2019, ₹ 24,000 had already been credited to partners in the proportion in which they shared profits. Their drawings were ₹ 5,000 (Mohan), ₹ 4,000 (Vijay) and ₹ 3,000 (Anil) during the year. Subsequently, the following omissions were noticed and it was decided to rectify the errors:

(a) Interest on capital @ 10% p.a.

(b) Interest on drawings: Mohan ₹ 250, Vijay ₹ 200 and Anil ₹ 150.

Make necessary corrections through a Journal entry and show your workings clearly.

ANSWER: Working Notes:

Working Notes:

WN 1 Calculation of Capital at the beginning

WN 2 Calculation of Interest on Capital

WN 3

WN 4 Calculation of Final Profit Share of Partners

Total Corrected Profit Available for Distribution = Profit - Interest on Capital + Interest on Drawings = 24,000 – 6,300 + 600 = Rs 18,300

Page No 2.91:

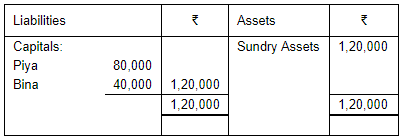

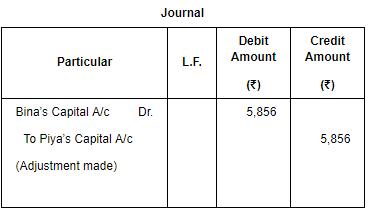

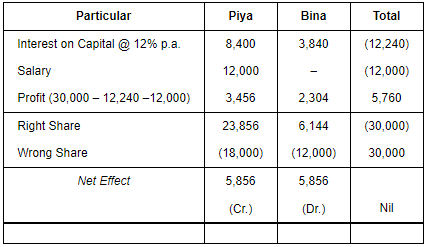

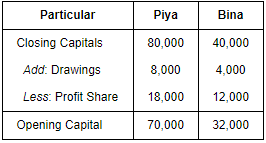

Question 65: Piya and Bina are partners in a firm sharing profits and losses in the ratio of 3 : 2. Following was the Balance Sheet of the firm as on 31st March, 2016:

The profits ₹ 30,000 for the year ended 31st March, 2016 were divided between the partners without allowing interest on capital @ 12% p.a. salary to Piya @ ₹ 1,000 per month. During the year Piya withdrew ₹ 8,000 and Bina withdrew ₹ 4,000. Showing your working notes clearly, pass the necessary rectifying entry.

ANSWER:

Working Notes:

Page No 2.92:

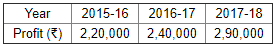

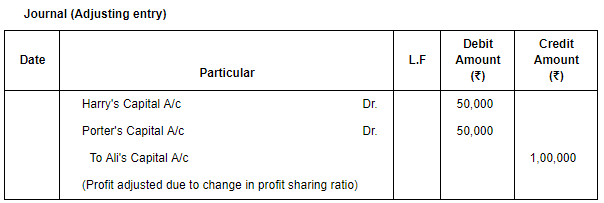

Question 66: The firm of Harry, Porter and Ali, who have been sharing profits in the ratio of 2 : 2 : 1, have existed for same years. Ali wants that he should get equal share in the profits with Harry and Porter and he further wishes that the change in the profit-sharing ratio should come into effect retrospectively were for the three years. Harry and Porter have agreement on this account. The profits for the last three years were:

Show adjustment of profits by means of a single adjustment Journal entry.

ANSWER:

Page No 2.92:

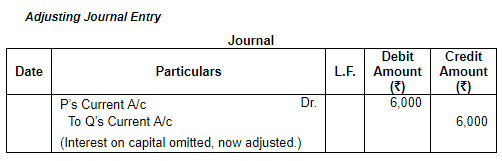

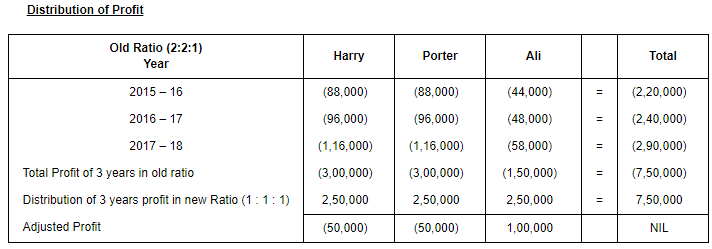

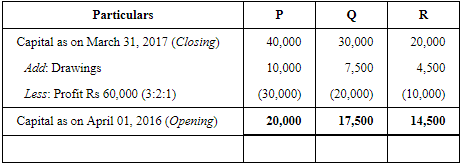

Question 67: On 31st March, 2019, after the closing of the accounts, the Capital Accounts of P, Q and R stood in the books of the firm at ₹ 40,000; ₹ 30,000 and ₹ 20,000 respectively. Subsequently, it was noticed that interest on capital @ 5% had been omitted. Profit for the year ended 31st March, 2019 was ₹ 60,000 and the partners' drawings had been P – ₹ 10,000, Q – ₹ 7,500 and R – ₹ 4,500. Profit-sharing ratio of P, Q and R is 3 : 2 : 1. Give necessary adjustment entry.

ANSWER:

Working Notes:

WN 1 Calculation of Capital at the beginning (as on April 01, 2018)

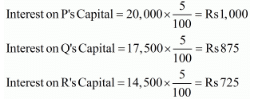

WN 2 Calculation of Interest on Capital

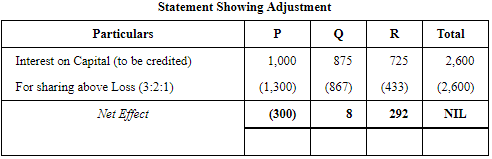

WN 3

|

42 videos|255 docs|51 tests

|

FAQs on Accounting for Partnership Firms-Fundamentals (Part - 5) - Accountancy Class 12 - Commerce

| 1. What are the main features of partnership firms? |  |

| 2. How is the profit distribution calculated in a partnership firm? |  |

| 3. What is the difference between partnership and sole proprietorship? |  |

| 4. What are the advantages of a partnership firm? |  |

| 5. What are the disadvantages of a partnership firm? |  |