Admission of a Partner (Part - 2) | Accountancy Class 12 - Commerce PDF Download

Page No 5.88:

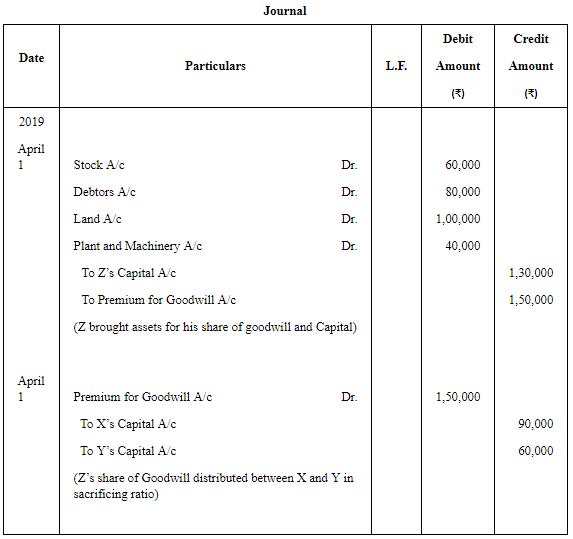

Question 31: X and Y are partners in a firm sharing profits in the ratio of 3 : 2. On 1st April, 2019, they admit Z as a partner for 1/4th share in the profits. Z contributed following assets towards his capital and for his share of goodwill:

Stock ₹ 60,000; Debtors ₹ 80,000; Land ₹ 1,00,000, Plant and Machinery ₹ 40,000.

On the date of admission of Z, the goodwill of the firm was valued at ₹ 6,00,000.

Pass necessary Journal entries in the books of the firm on Z's admission.

ANSWER:

Page No 5.89:

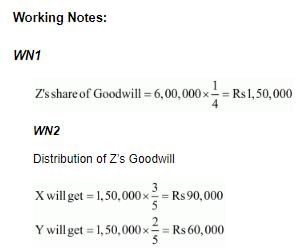

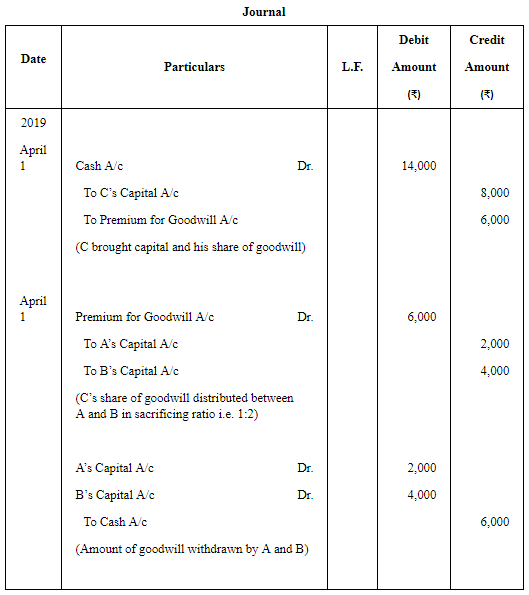

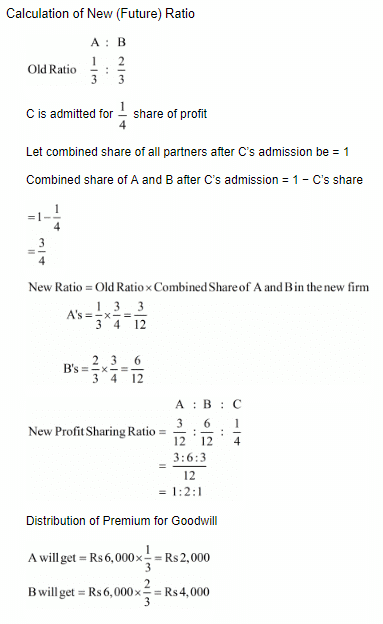

Question 32: A and B are partners in a business sharing profits and losses in the ratio of 1/3rd and 2/3rd. On 1st April, 2019, their capitals were ₹ 8,000 and ₹ 10,000 respectively. On that date, they admit C in partnership and give him 1/4th share in the future profits. C brings ₹ 8,000 as his capital and ₹ 6,000 as goodwill. The amount of goodwill is withdrawn by the old partners in cash. Draft the journal entries and show the Capital Accounts of all the Partners. Calculate proportion in which partners would share profits and losses in future.

ANSWER:

Page No 5.89:

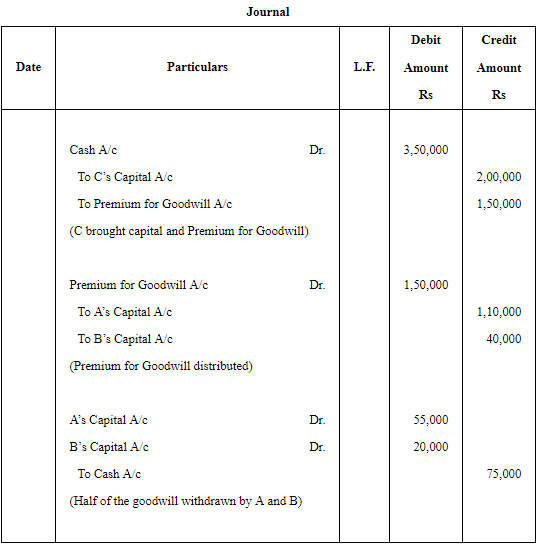

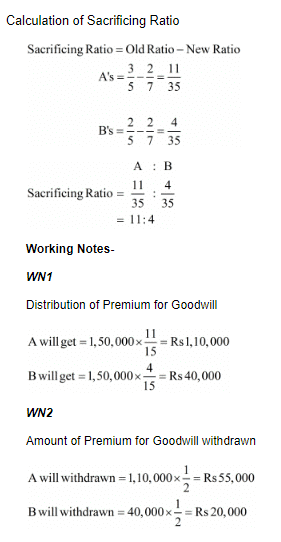

Question 33: A and B were partners in a firm sharing profits and losses in the ratio of 3 : 2. They admitted C as a new partner for 3/7th share in the profit and the new profit-sharing ratio will be 2 : 2 : 3. C brought ₹ 2,00,000 as his capital and ₹ 1,50,000 as premium for goodwill. Half of their share of premium was withdrawn by A and B from the firm. Calculate sacrificing ratio and pass necessary Journal entries for the above transactions in the books of the firm.

ANSWER:

Page No 5.89:

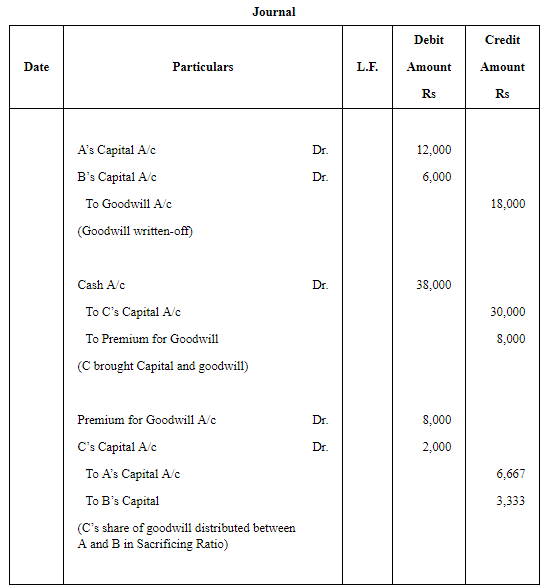

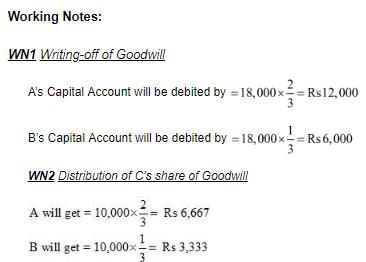

Question 34: A and B are partners sharing profits in the ratio of 2 : 1. They admit C for 1/4th share in profits. C brings in ₹ 30,000 for his capital and ₹ 8,000 out of his share of ₹ 10,000 for goodwill. Before admission, goodwill appeared in books at ₹ 18,000. Give Journal entries to give effect to the above arrangement.

ANSWER:

Page No 5.89:

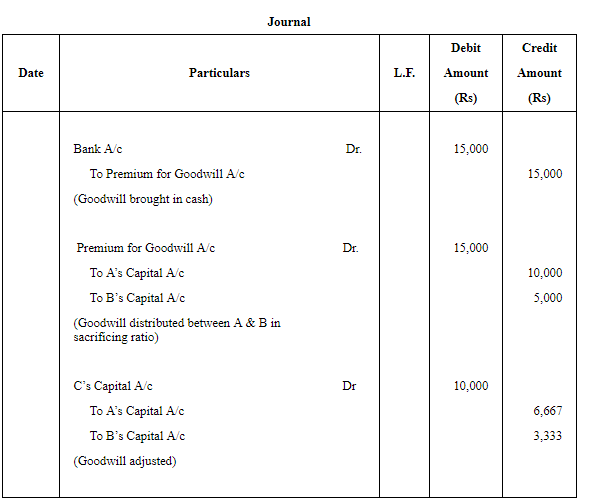

Question 35: A and B are partners sharing profits and losses in the ratio of 3 : 2. They admit C as partner in the firm for 1/4th share in profits which he takes 1/6th from A and 1/12th from B. C brings in only 60% of his share of firm's goodwill. Goodwill of the firm has been valued at ₹ 1,00,000. Pass necessary journal entries to record this arrangement.

ANSWER:

Page No 5.89:

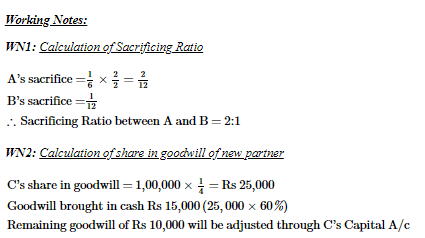

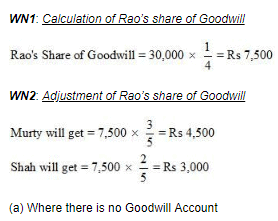

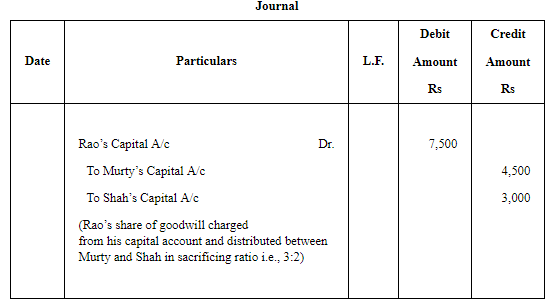

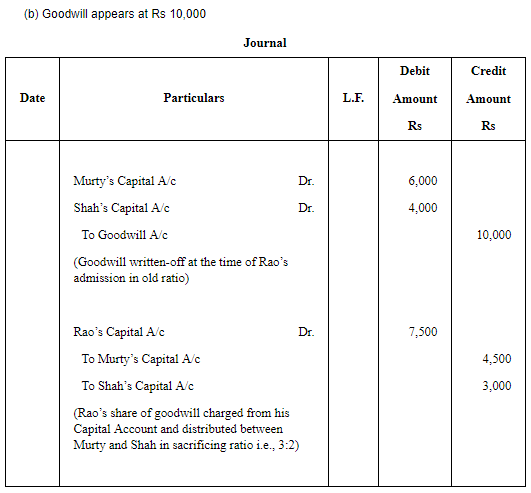

Question 36: On the admission of Rao, goodwill of Murty and Shah is valued at ₹ 30,000. Rao is to get 1/4th share of profits. Previously Murty and Shah shared profits in the ratio of 3 : 2. Rao is unable to bring amount of goodwill. Give Journal entries in the books of Murty and Shah when:

(a) there is no Goodwill Account and

(b) Goodwill appears in the books at ₹ 10,000.

ANSWER:

Page No 5.89:

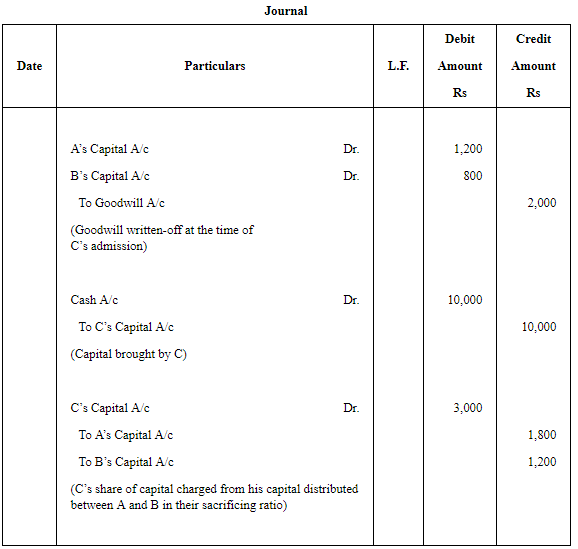

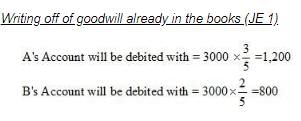

Question 37: A and B are partners sharing profits in the ratio of 3 : 2. Their books show goodwill at ₹ 2,000. C is admitted as partner for 1/4th share of profits and brings in ₹ 10,000 as his capital but is not able to bring in cash for his share of goodwill ₹ 3,000. Draft Journal entries.

ANSWER:

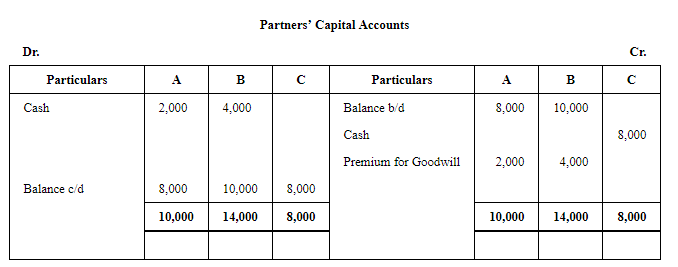

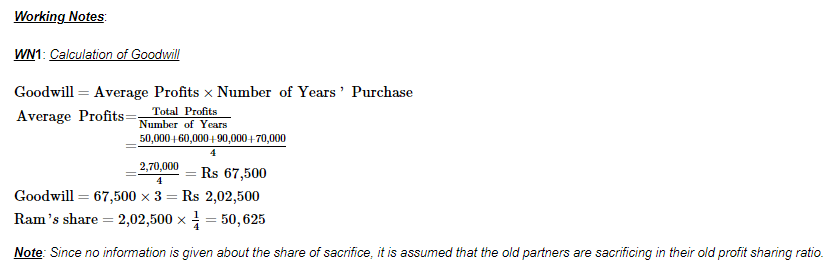

Working Notes:

Page No 5.89:

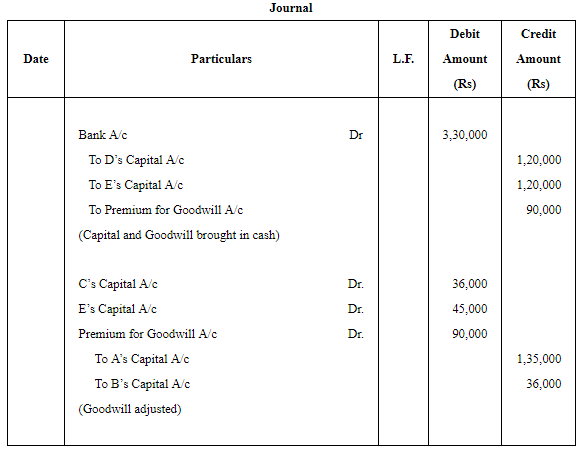

Question 38: A, B and C are in partnership sharing profits and losses in the ratio of 5 : 4 : 1 respectively. Two new partners D and E are admitted. The profits are now to be shared in the ratio of 3 : 4 : 2 : 2 : 1 respectively. D is to pay ₹ 90,000 for his share of Goodwill but E has insufficient cash to pay for Goodwill. Both the new partners introduced ₹ 1,20,000 each as their capital. You are required to pass necessary Journal entries.

ANSWER:

Page No 5.90:

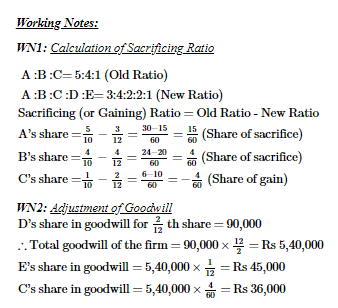

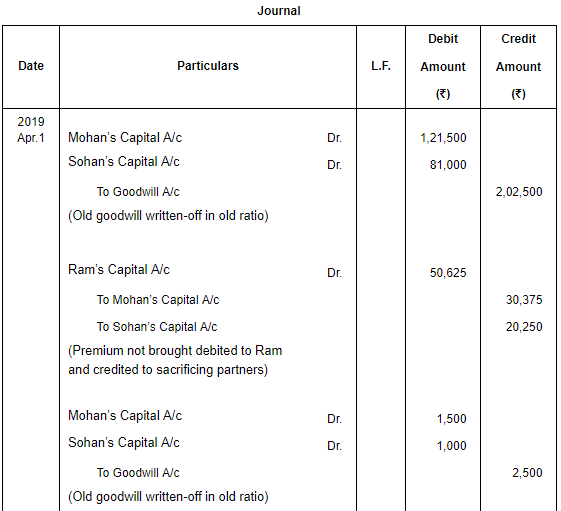

Question 39: Mohan and Sohan were partners in a firm sharing profits and losses in the ratio of 3 : 2. They admitted Ram for 1/4th share on 1st April, 2019. It was agreed that goodwill of the firm will be valued at 3 years' purchase of the average profit of last 4 years ended 31st March, were ₹ 50,000 for 2015-16, ₹ 60,000 for 2016-17, ₹ 90,000 for 2017-18 and ₹ 70,000 for 2018-19. Ram did not bring his share of goodwill premium in cash. Record the necessary Journal entries in the books of the firm on Ram's admission when

(a) Goodwill appears in the books at ₹ 2,02,500.

(b) Goodwill appears in the books at ₹ 2,500.

(c) Goodwill appears in the books at ₹ 2,05,000.

ANSWER:

Page No 5.90:

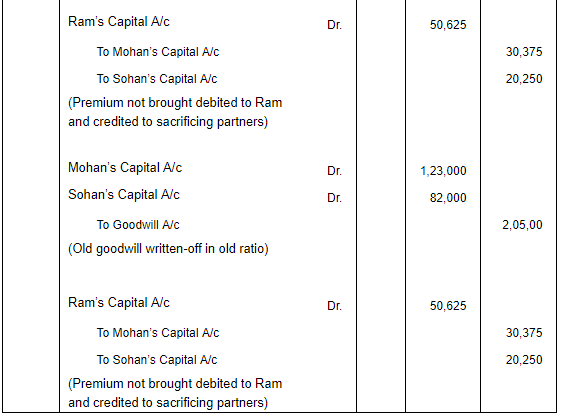

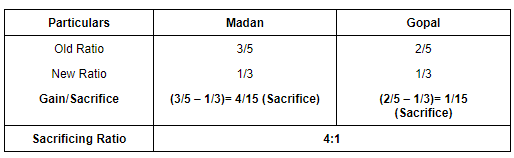

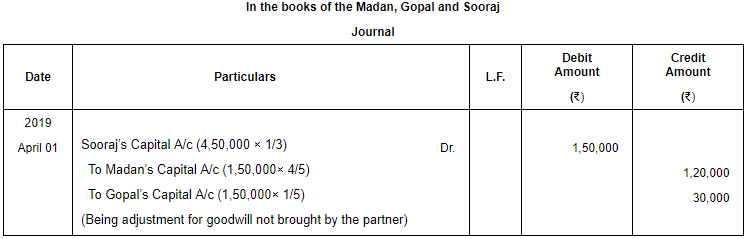

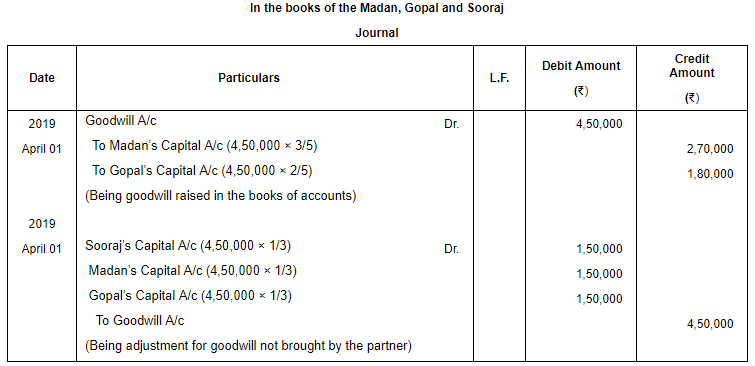

Question 40: Madan and Gopal are partners sharing profits in the ratio of 3 : 2. They admit Sooraj for 1/3rd share in profits on 1st April, 2019. They also decide to share future profits equally. Goodwill of the firm was valued at ₹ 5,50,000. Goodwill existed in the books of account at ₹ 1,00,000, which the partners decide to carry forward.

Sooraj is unable to bring his share of goodwill. Pass the necessary Journal entries on admission of Sooraj, if:

(a) Goodwill is not to be raised and written off; and

(b) Goodwill is to be raised and written off.

ANSWER:

Case a) Goodwill is not be raised and written off:

Case b) Goodwill is to be raised and written off:

Page No 5.90:

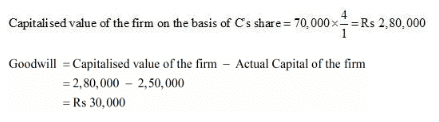

Question 41: Anil and Sunil are partners in a firm with fixed capitals of ₹ 3,20,000 and ₹ 2,40,000 respectively. They admitted Charu as a new partner for 1/4th share in the profits of the firm on 1st April, 2012. Charu brought ₹ 3,20,000 as her share of capital.

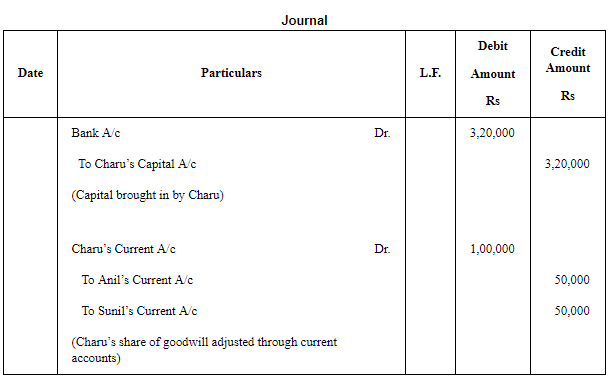

Calculate value of goodwill and record necessary Journal entries.

ANSWER:

Page No 5.91:

Question 42:A and B are partners in a firm with capital of ₹ 60,000 and ₹ 1,20,000 respectively. They decide to admit C into the partnership for 1/4th share in the future profits. C is to bring in a sum of ₹ 70,000 as his capital. Calculate amount of goodwill.

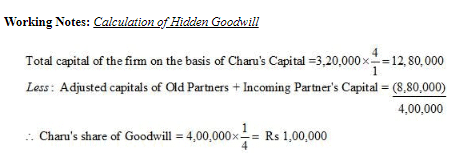

ANSWER:

Actual Capital of the firm after admission of C = A’s Capital + B’s Capital + C’s Capital

= 60,000 + 1, 20,000 + 70,000 = Rs 2, 50,000

Page No 5.91:

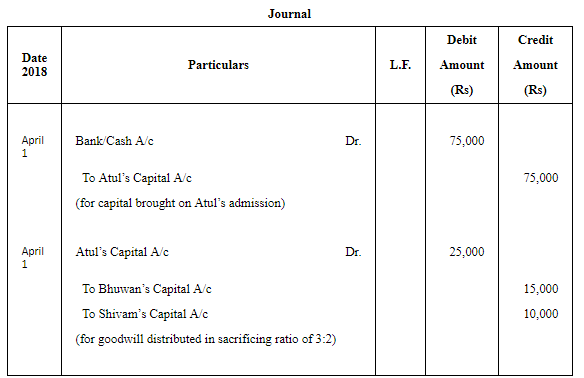

Question 43: Bhuwan and Shivam were partners in a firm sharing profits in the ratio of 3 : 2. Their capitals were ₹ 50,000 and ₹ 75,000 respectively. They admitted Atul on 1st April, 2018 as a new partner for 1/4th share in future profits. Atul brought ₹ 75,000 as his capital. Calculate the value of goodwill of the firm and record necessary Journal entries for the above transactions on Atul's admission.

ANSWER:

The journal entries are as follows:

Here, Atul is entered into partnership for 1/4th share in future profits. He contributes Rs 75,000 towards his share of capital.

Taking Atul’s capital as the base, we can calculate the firm’s capital as

Firm's Capital = New Partner's Capital × Reciprocal of his share

i.e., = 75,000 × 4 = Rs 3,00,000

However, the total capital as at that date is Rs 2,00,000 (i.e. 50,000 + 75,000 + 75,000)

So, the difference of 1,00,000 is hidden goodwill.

Atul’s share in goodwill = 1/4th of 1,00,000 = Rs 25,000

Note: In this case, as no information is provided for the share sacrificed by the old partners, so it is assumed that the old partners are sacrificing in their old profit share.

Page No 5.91:

Question 44: Vinay and Naman are partners sharing profits in the ratio of 4 : 1. Their capitals were ₹ 90,000 and ₹ 70,000 respectively. They admitted Prateek for 1/3 share in the profits. Prateek brought ₹ 1,00,000 as his capital.

Calculate the value of firm's goodwill.

ANSWER: Prateek apostrophe straight s space Capital equals ₹ 1 comma 00 comma 000

Capitalised space Value space of space the space firm equals open parentheses Prateek apostrophe straight s space Capital cross times space Reciprocal space of space his space share space of space profits close parentheses equals ₹ left parenthesis 1 comma 00 comma 000 cross times 3 right parenthesis equals ₹ 3 comma 00 comma 000

Net space Worth space of space the space firm equals Total space Capital space of space all space the space Partners space left parenthesis including space the space new space partner right parenthesis equals ₹ left parenthesis 90 comma 000 plus 70 comma 000 plus 1 comma 00 comma 000 right parenthesis equals ₹ 2 comma 60 comma 000

Hidden space Goodwill equals left parenthesis Capitalised space Value space of space the space firm space minus space Net space Worth space of space the space firm right parenthesis equals ₹ left parenthesis 3 comma 00 comma 000 space minus space 2 comma 60 comma 000 right parenthesis equals ₹ 40 comma 000

Thus, Value of firm's Goodwill is ₹40,000.

Page No 5.91:

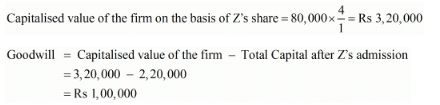

Question 45: X and Y are partners with capitals of ₹ 50,000 each. They admit Z as a partner for 1/4th share in the profits of the firm. Z brings in ₹ 80,000 as his share of capital. The Profit and Loss Account showed a credit balance of ₹ 40,000 as on date of admission of Z.

Give necessary journal entries to record the goodwill.

ANSWER:

Total Capital of the firm after Z’s admission = X’s Capital + Y’s Capital + undistributed Profit +Z’s Capital

= 50,000 + 50,000 + 40,000 + 80,000

= Rs 2,20,000

Page No 5.91:

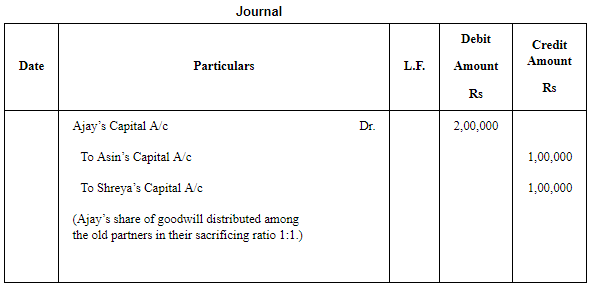

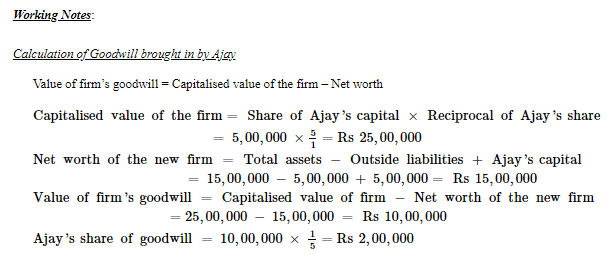

Question 46: Asin and Shreyas are partners in a firm. They admit Ajay as a new partner with 1/5th share in the profits of the firm. Ajay brings ₹ 5,00,000 as his share of capital. The value of the total assets of the firm was ₹ 15,00,000 and outside liabilities were valued at ₹ 5,00,000 on that date. Give necessary Journal entry to record goodwill at the time of Ajay's admission. Also show your workings.

ANSWER:

Page No 5.91:

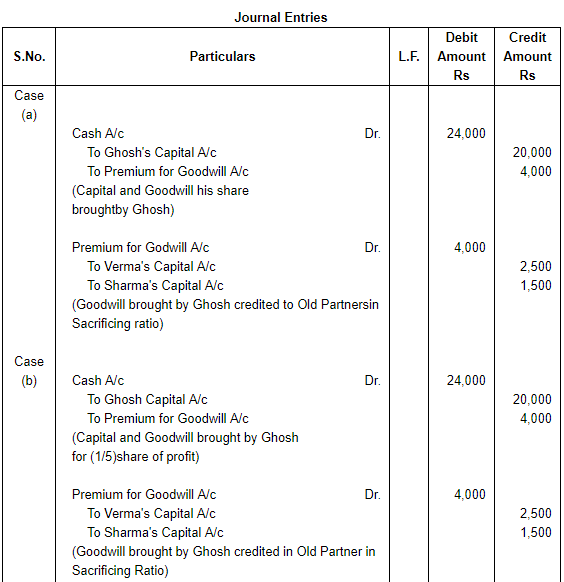

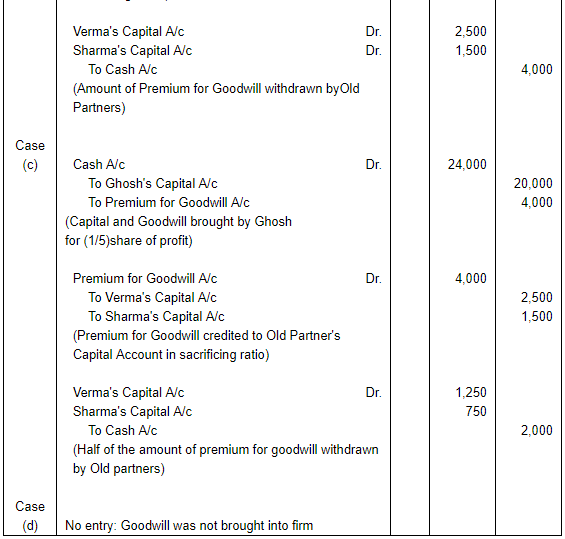

Question 47: Verma and Sharma are partners in a firm sharing profits and losses in the ratio of 5 : 3. They admitted Ghosh as a new partner for 1/5th share of profits. Ghosh is to bring in ₹ 20,000 as capital and ₹ 4,000 as his share of goodwill premium. Give the necessary Journal entries:

(a) When the amount of goodwill is retained in the business.

(b) When the amount of goodwill is fully withdrawn.

(c) When 50% of the amount of goodwill is withdrawn.

(d) When goodwill is paid privately.

ANSWER:

Page No 5.91:

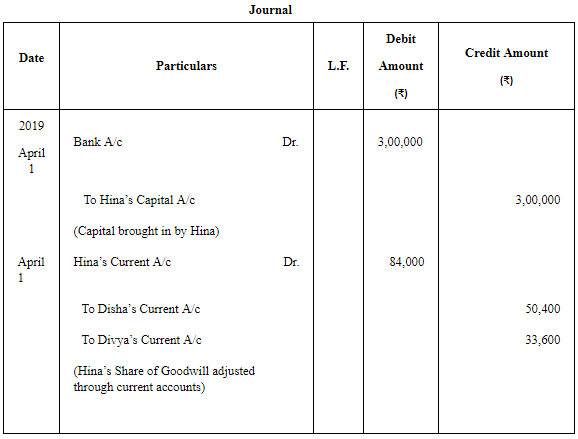

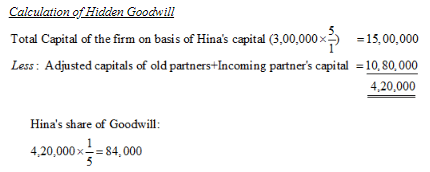

Question 48: Disha and Divya are partners in a firm sharing profits in the ratio of 3 : 2 respectively. The fixed capital of Disha is ₹ 4,80,000 and of Divya is ₹ 3,00,000. On 1st April, 2019 they admitted Hina as a new partner for 1/5th share in future profits. Hina brought ₹ 3,00,000 as her capital. Calculate value of goodwill of the firm and record necessary Journal entries on Hina's admission.

ANSWER:

Working Note:

Page No 5.91:

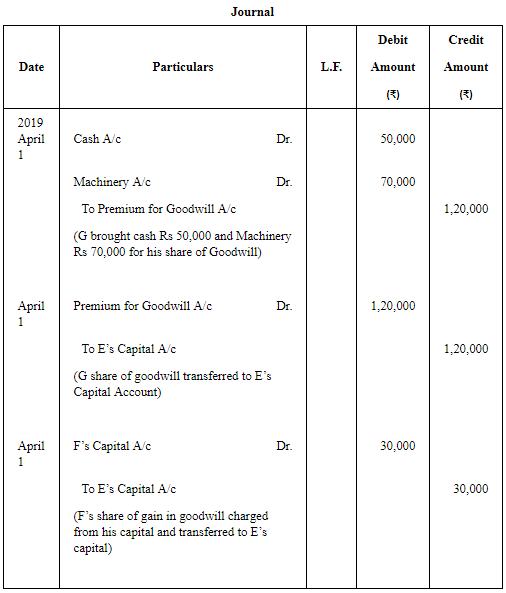

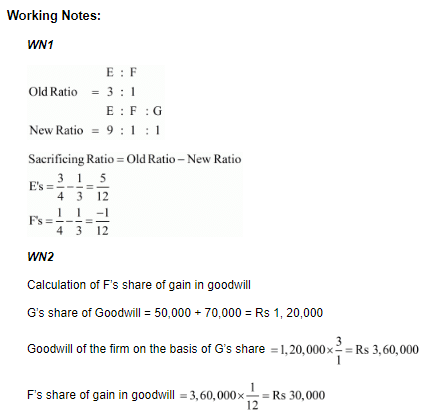

Question 49: E and F were partners in a firm sharing profits in the ratio of 3 : 1. They admitted G as a new partner on 1st April, 2019 for 1/3rd share. It was decided that E, F and G will share future profits equally. G brought ₹ 50,000 in cash and machinery valued at ₹ 70,000 as premium for goodwill.

Pass necessary Journal entries in the books of the firm.

ANSWER:

Page No 5.92:

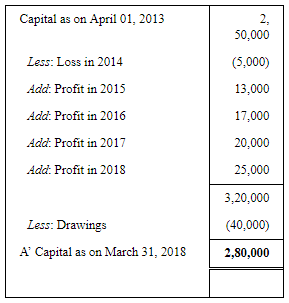

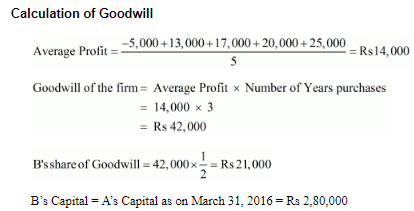

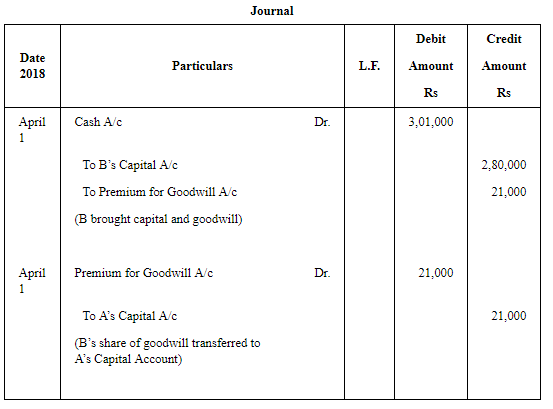

Question 50: Mr. A commenced business with a capital of ₹ 2,50,000 on 1st April, 2013. During the five years ended 31st March, 2018, the following profits and losses were made:

31st March, 2014−Loss ₹ 5,000

31st March, 2015−Profit ₹ 13,000

31st March, 2016−Profit ₹ 17,000

31st March, 2017−Profit ₹ 20,000

31st March, 2018−Profit ₹ 25,000

During this period he had drawn ₹ 40,000 for his personal use. On 1st April,

2018, he admitted B into partnership on the following terms:

B to bring for his half share in the business, capital equal to A's Capital on 31st March, 2018 and to pay for the one-half share of goodwill of the business, on the basis of three times the average profit of the last five years. Prepare the statement showing what amount B should invest to become a partner and pass entries to record the transactions relating to admission.

ANSWER:

Page No 5.92:

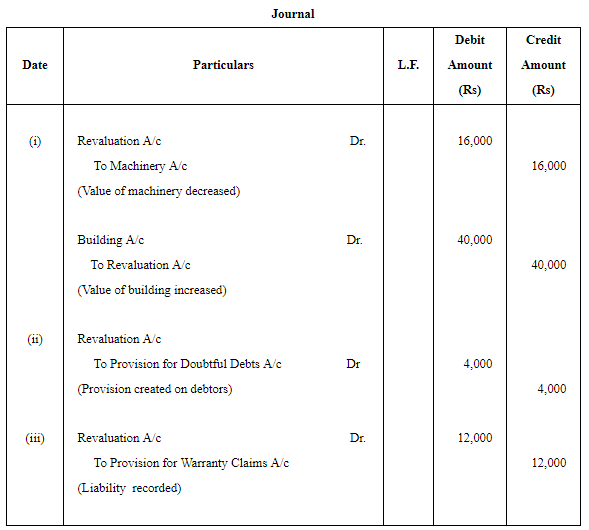

Question 51: Pass entries in the firm's journal for the following on admission of a partner:

(i) Machinery be reduced by ₹ 16,000 and Building be appreciated by ₹ 40,000.

(ii) A provision be created for Doubtful Debts @ 5% of Debtors amounting to ₹ 80,000.

(iii) Provision for warranty claims be increased by ₹ 12,000.

ANSWER:

Page No 5.92:

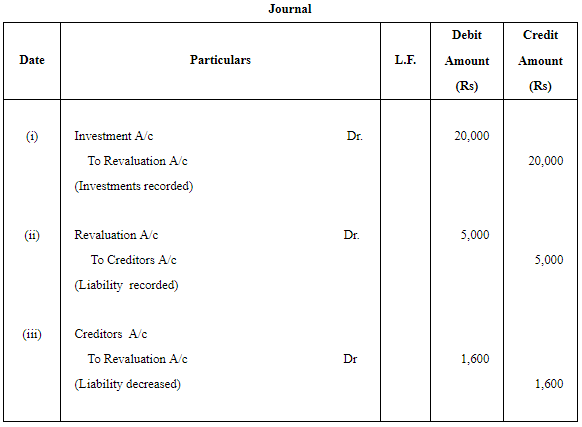

Question 52: Pass entries in firm's Journal for the following on admission of a partner:

(i) Unrecorded Investments worth ₹ 20,000.

(ii) Unrecorded liability towards suppliers for ₹ 5,000.

(iii) An item of ₹ 1,600 included in Sundry Creditors is not likely to be claimed and hence should be written back.

ANSWER:

Page No 5.92:

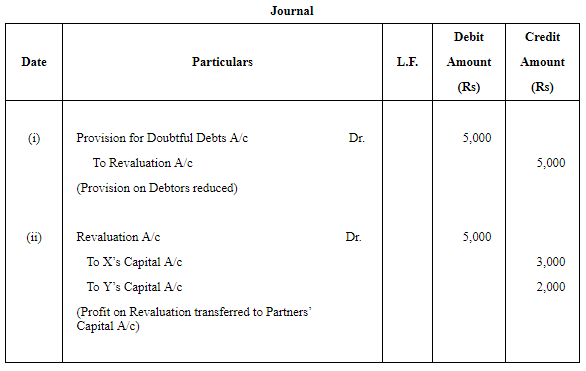

Question 53: X and Y are partners in a firm sharing profits in the ratio of 3 : 2. They admitted Z as a partner and fixed the new profit-sharing ratio as 3 : 2 : 1. At the time of admission of Z, Debtors and Provision for Doubtful Debts appeared at ₹ 50,000 and ₹ 5,000 respectively all debtors are good. Pass the necessary Journal entries.

ANSWER:

Page No 5.92:

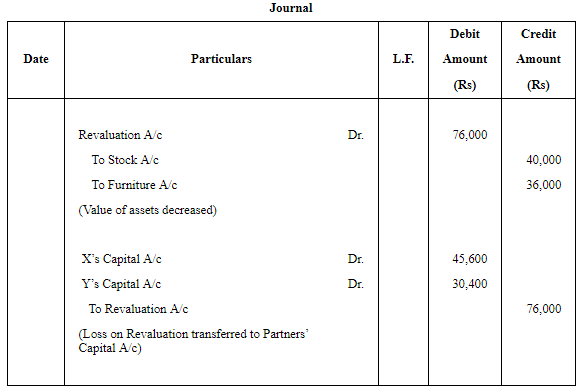

Question 54: X and Y are partners in a firm sharing profits in the ratio of 3 : 2. They admitted Z as a partner for 1/4th share. At the time of admission of Z, Stock (Book Value ₹ 1,00,000) is to be reduced by 40% and Furniture (Book Value ₹ 60,000) is to be reduced to 40%. Pass the necessary Journal entries.

ANSWER:

Page No 5.92:

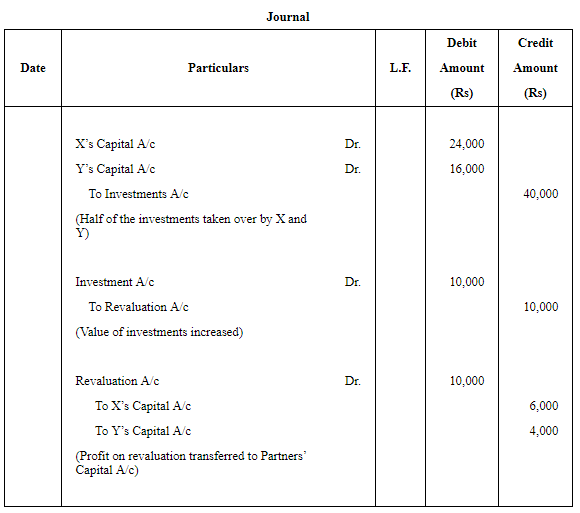

Question 55:X and Y are partners sharing profits in the ratio of 3 : 2. They admitted Z as a partner for 1/4th share of profits. At the time of admission of Z, Investments appeared at ₹ 80,000. Half of the investments to be taken by X and Y in their profit-sharing ratio at book value. Remaining investments were valued at ₹ 50,000. Pass the necessary Journal entries.

ANSWER:

Page No 5.93:

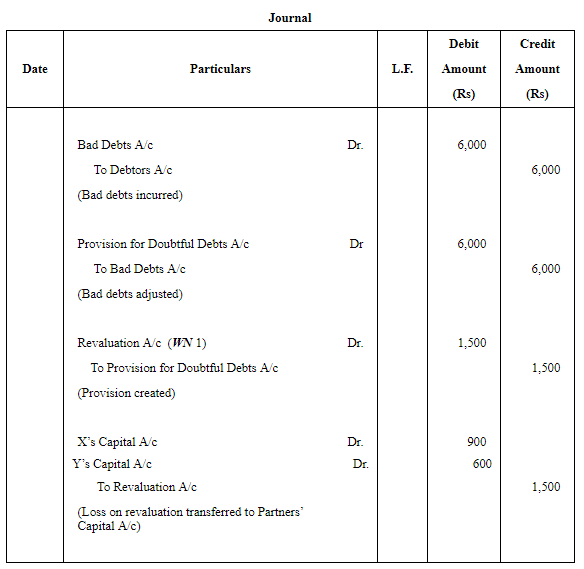

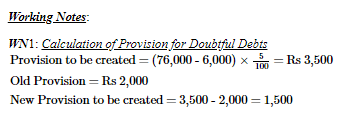

Question 56: X and Y are partners in a firm sharing profits in the ratio of 3 : 2. They admitted Z as a partner for 1/4th share of profits. At the time of admission of Z, Debtors and Provision for Doubtful Debts appeared at ₹ 76,000 and ₹ 8,000 respectively. ₹ 6,000 of the debtors proved bad. A provision of 5% is to be created on Sundry Debtors for doubtful debts. Pass the necessary Journal entries.

ANSWER:

Page No 5.93:

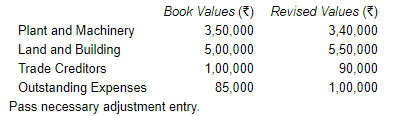

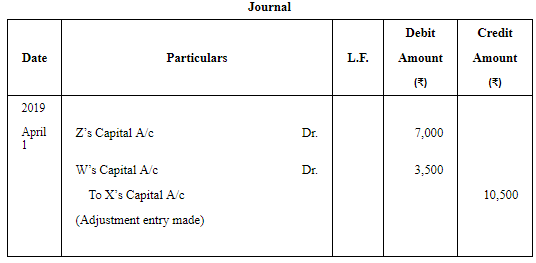

Question 57: X, Y and Z are partners sharing profits and losses in the ratio of 6 : 3 : 1. They admitted W into partnership with effect from 1st April, 2019. New profit-sharing ratio between X, Y, Z and W was agreed to be 3 : 3 : 3 : 1. They also decide to record the effect of the following revaluations without affecting the book values of the assets and liabilities by passing an adjustment entry:

ANSWER:

Page No 5.93:

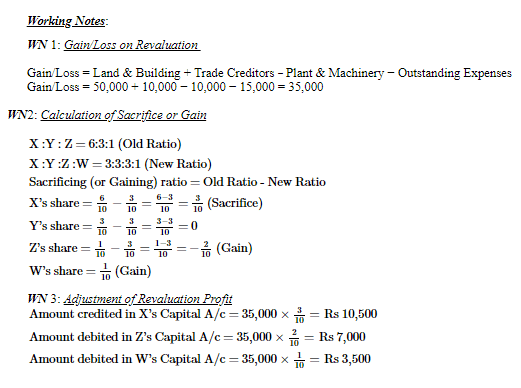

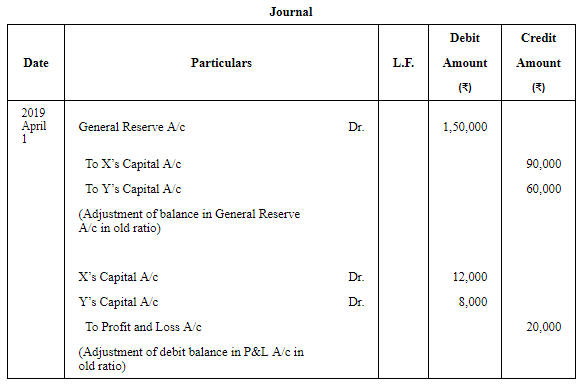

Question 58: At the time of admission of a partner C, assets and liabilities of A and B were revalued as follows:

(a) A Provision for Doubtful Debts @10% was made on Sundry Debtors (Sundry Debtors ₹ 50,000).

(b) Creditors were written back by ₹ 5,000.

(c) Building was appreciated by 20% (Book Value of Building ₹ 2,00,000).

(d) Unrecorded Investments were valued at ₹ 15,000.

(e) A Provision of ₹ 2,000 was made for an Outstanding Bill for repairs.

(f) Unrecorded Liability towards suppliers was ₹ 3,000.

Pass necessary Journal entries.

ANSWER:

Page No 5.93:

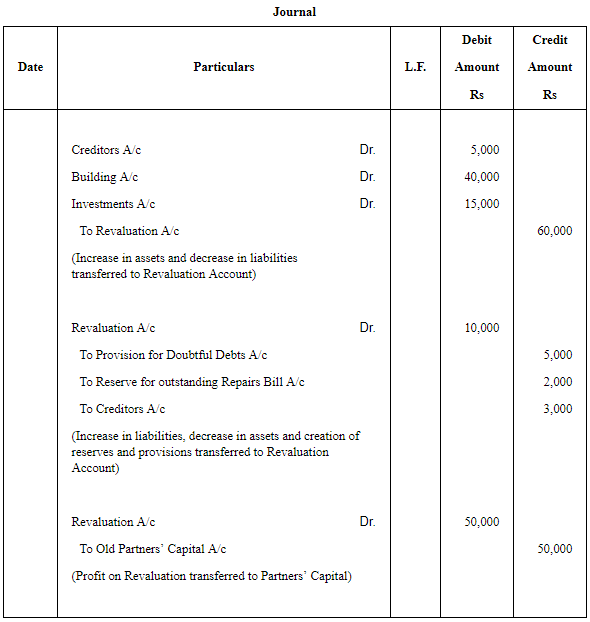

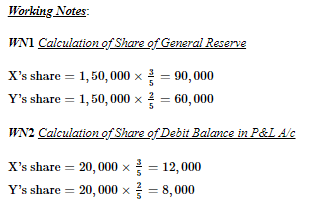

Question 59: X and Y are partners in a firm sharing profits and losses in the ratio of 3 : 2. On 1st April, 2019, they admit Z as a partner for 1/5th share in profits. On that date, there was a balance of ₹ 1,50,000 in General Reserve and a debit balance of ₹ 20,000 in the Profit and Loss Account of the firm. Pass necessary Journal entries regarding adjustment of reserve and accumulated profit/loss.

ANSWER:

Page No 5.93:

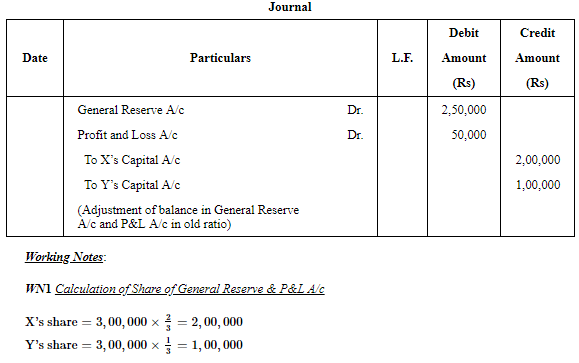

Question 60: X and Y were partners in a firm sharing profits and losses in the ratio of 2 : 1. Z was admitted for 1/3rd share in the profits. On the date of Z's admission, the Balance Sheet of X and Y showed General Reserve of ₹ 2,50,000 and a credit balance of ₹ 50,000 in Profit and Loss Account. Pass necessary Journal entries on the treatment of these items on Z's admission.

ANSWER:

|

42 videos|198 docs|43 tests

|

FAQs on Admission of a Partner (Part - 2) - Accountancy Class 12 - Commerce

| 1. What is the process of admission of a partner in a commerce firm? |  |

| 2. What factors are considered while admitting a new partner? |  |

| 3. Can a partner be admitted without the consent of existing partners? |  |

| 4. How is the profit-sharing ratio determined for a new partner? |  |

| 5. What are the accounting entries made during the admission of a partner? |  |