Financial Statements of Not- for-Profit Organizations | Accountancy Class 12 - Commerce PDF Download

MEANING

It is an organization provides service to the society. The motive of these organizations is social welfare as a service provider, not for earning profit.

Following Statements are to be prepared by these organizations that are:

1. Receipts and Payment Account.

2. Income and Expenditure Account.

3. Opening and Closing Balance Sheet.

1. Receipts and Payment Account: It is prepared for recording the transactions related to cash. It is just like a cash book. All cash receipts recorded in debit side and all cash payments are recorded in credit side.

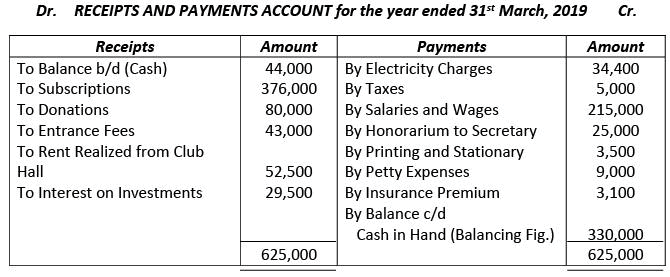

Example 1. From the following information given below, prepare Receipts and Payments Account of Friends Club, Delhi, for the year ended 31st March, 2019.

Cash Balance on 1st April, 2018 Rs. 44,000; Subscriptions Rs. 376,000; Donations Rs. 80,000; Entrance Fees Rs. 43,000; Rent Realized from Club Hall Rs. 52,500; Electricity Charges Rs. 34,400; Taxes Rs. 5,000; Salaries and Wages Rs. 215,000; Honorarium to Secretary Rs. 25,000; Interest Received on Investments Rs. 29,500; Printing and Stationary Rs. 3,500; Petty Expenses Rs. 9,000; Insurance Premium Paid Rs. 3,100.

Solution.

Friends Club, Delhi

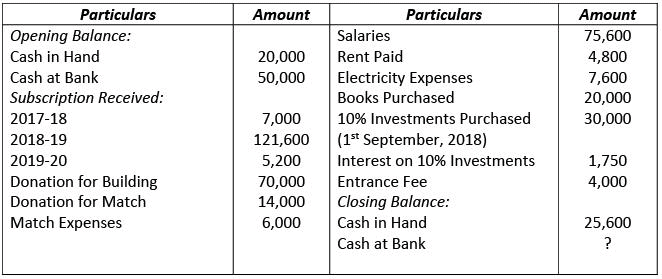

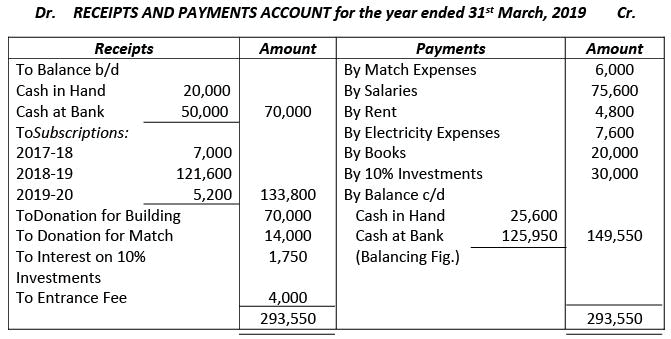

Example 2. From the information given below, prepare Receipts and Payments Account of Old men Recreation Club for the year ended 31st March, 2019. Solution.

Solution.

Oldmen Recreation Club, Delhi

2. Income and Expenditure Account: It is prepared to record the transactions that are incurred and generated in the same years. It means items are related to previous years or next year must be excluded. All expenses/losses are recorded in debit side and all incomes/profits are recorded in credit side.

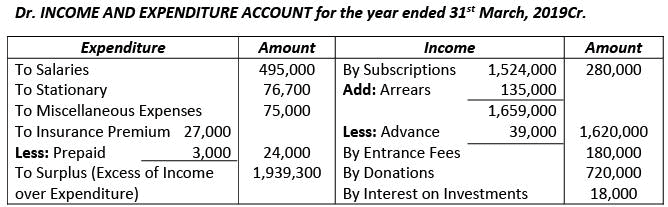

Example 3. From the following Receipts and Payments Account of Accountants Club Prepare Income and Expenditure Account for the year ended 31st March, 2019.

(i) Subscriptions in arrears for the year ended 31st March, 2019 – Rs. 135,000 and Subscriptions received in advance during the year ended 31st March, 2019 – Rs. 39,000.

(ii) Insurance Premium prepaid is Rs. 3,000.

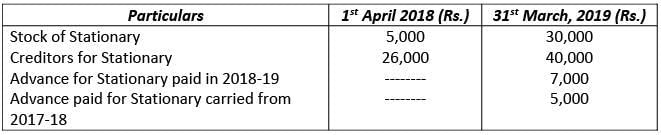

(iii) The details with respect to Stationary of Accountants Club is as follows: Solution.

Solution.

Accountants Club

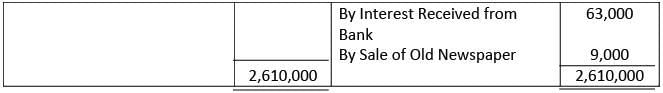

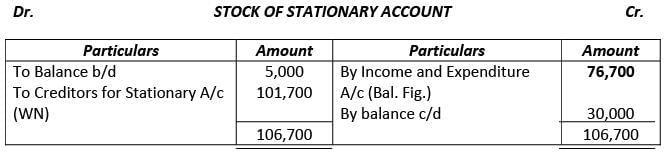

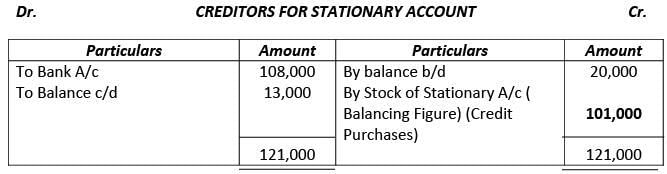

Working Note: Consumption of Stationary during the year:

Working Note: Consumption of Stationary during the year: Alternatively: Consumption of Stationary may be calculated by preparing following two accounts:

Alternatively: Consumption of Stationary may be calculated by preparing following two accounts:

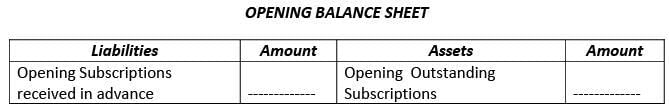

3. Opening Balance Sheet: It is prepared to find out the value of Capital Funds means opening capital.

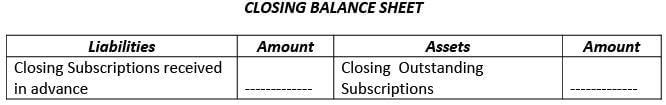

4. Closing Balance Sheet: It is prepared to record the value of different types of Assets and Liabilities with adjusted value.

Before above three statements, you have to know the treatment of following items separately:

(a) Subscriptions.

(b) Fund based accounting like Match Fund.

(c) Consumable value of items likes Sports materials, Medicine, etc.

(d) Incomes like Entrance Fees, Locker Rent, etc.

(e) Expenses like Salary Paid, Rent Paid, etc.

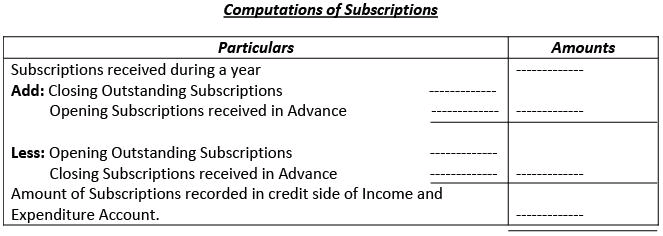

(a) Subscriptions: It is an amount paid by the members of Not-for-Profit Organizations for their membership. It is the main sources of revenue for NPO or we can say primary source of revenue.

(i) Outstanding Subscriptions: It means earned but not received. Opening Outstanding related to previous year and closing outstanding related to current year, treated as assets.

(ii) Subscriptions received in Advance: It means received but not earned. Opening received in advance related to current year and closing received in advance related to next year, treated as liabilities.

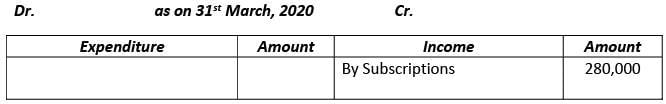

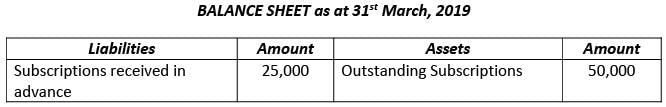

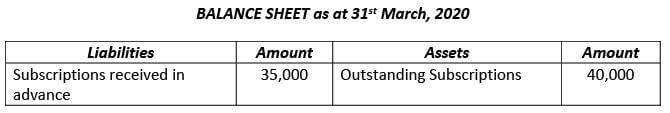

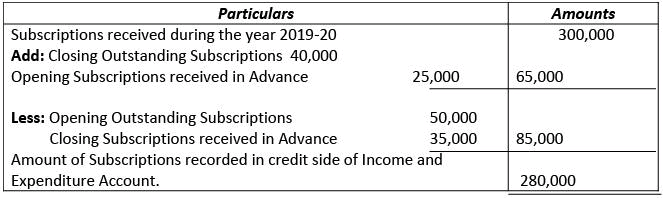

Examples 4. Calculate amount of Subscriptions which will be recorded in credit side of Income and Expenditure A/c for the year ended 31st March, 2020 from the following informations;

(a) Outstanding Subscriptions for the year 2018-19 was Rs. 50,000.

(b) Subscription received in advance for the year 2019-20 was Rs. 40,000.

(c) Subscription received during the year 2019-20 was Rs. 300,000.

(d) Outstanding Subscription for the year 2019-20 was Rs. 25,000.

(e) Subscription received in advance for the year 2020-21 was Rs.35, 000.

Solution.

INCOME AND EXPENDITURE ACCOUNT

Working Note:

Working Note:

Computations of Subscriptions

Example 5. Subscriptions received during the year ended 31st March, 2019 are:

| For the year ended 31st March, 2018 | Rs. 4,000 |

| For the year ended 31st March, 2019 | Rs. 211,000 |

| For the year ended 31st March, 2020 | Rs. 8,000 |

| Rs. 223,000 |

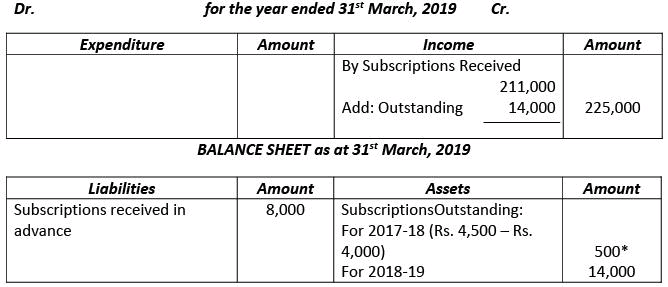

There are 450 members, each paying an annual subscription of Rs. 500. Rs 4,500 were in arrears for the year ended 31st March, 2018 in the beginning of the year ended 31st March, 2019. Calculate subscriptions to be shown in Income and Expenditure Account for the year ended 31st March, 2019 and also show treatment of subscriptions in the Income and Expenditure Account and Balance Sheet.

Solution.

Subscriptions receivable for the year ended 31st March, 2019

= Number of Members × Annual Subscription

= 450 × Rs. 500 = Rs. 225,000.

Subscriptions Outstanding = Total Subscriptions – Subscriptions received for the year ended 31st March, 2019

= Rs. 225,000 – Rs. 211,000 = Rs. 14,000.

INCOME AND EXPENDITURE ACCOUNT

*Subscriptions in arrears for the year ended 31st March, 2018 in the beginning of 2018-19 was Rs. 4,500, out of which Rs. 4,000 were received in the year ended 31st March, 2019.

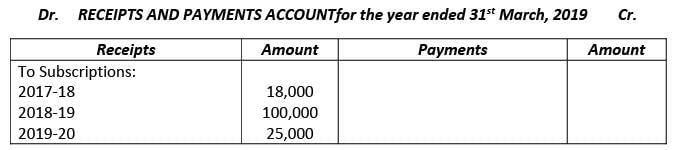

Example 6. From the following extract of the Receipts and Payments Account and the additional information, you are required to calculate Income from Subscriptions for the year ended 31st March, 2019 and show it in the Final Account of the Club.

Additional Information:

(i) Subscriptions outstanding as at 31st March, 2018: Rs. 20,000.

(ii) Subscriptions outstanding as at 31st March, 2019: Rs. 30,000.

(iii) Subscriptions received in advance as at 31st March, 2018: Rs. 20,000.

Solution.

INCOME AND EXPENDITURE ACCOUNT

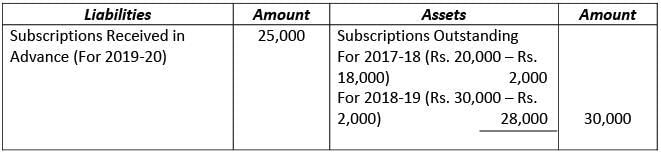

BALANCE SHEET as at 31st March, 2019

Note: Subscriptions outstanding as at 31st March, 2019 appearing on the asset side of the Balance Sheet is Rs. 30,000. It includes subscriptions outstanding for the year 2017-18 Rs. Rs. 2,000 [i.e., Rs. 20,000 – Rs. 18,000 (received during 2018-19)] and subscriptions outstanding for the year 2018-19, amounts to Rs. 28,000.

Note: Subscriptions outstanding as at 31st March, 2019 appearing on the asset side of the Balance Sheet is Rs. 30,000. It includes subscriptions outstanding for the year 2017-18 Rs. Rs. 2,000 [i.e., Rs. 20,000 – Rs. 18,000 (received during 2018-19)] and subscriptions outstanding for the year 2018-19, amounts to Rs. 28,000.

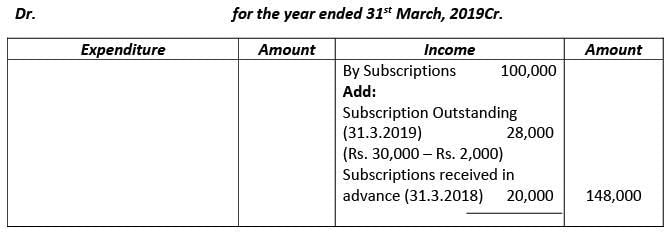

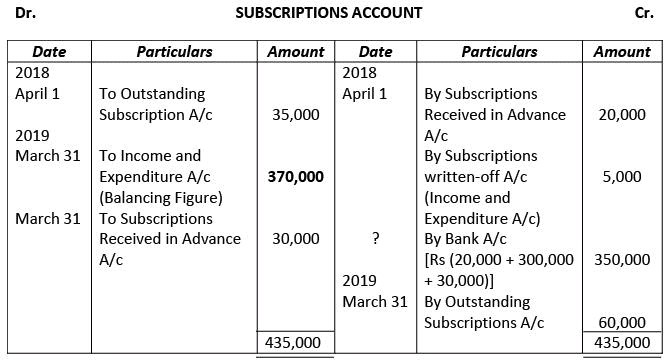

Example 7. From the following determine the amount of subscription that should be credited to Income and Expenditure Account for the year ended 31st March, 2019. Subscriptions received during the year were as follows:

For the year ended 31st March, 2018: Rs. 20,000

For the year ended 31st March, 2019: Rs. 300,000

For the year ended 31st March, 2020: Rs. 30,000

Subscription outstanding as at 31st March, 2018 was Rs. 35,000 out of which Rs. 5,000 was not recoverable. On that date, subscriptions received in advance for the year ended 31st March, 2019 were Rs. 20,000. Subscription still outstanding as at 31st March, 2019 amounted to Rs. 60,000.

Solution.

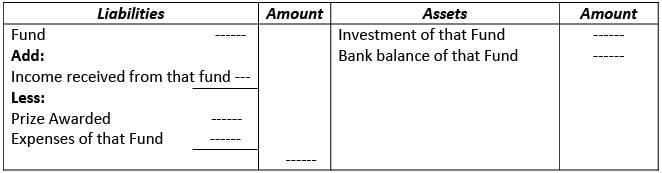

(b) Fund Based Accounting: It refers to an accounting system in which receipts and income related to that fund are credited (added) to that fund, not to Income and Expenditure A/c. Similarly, expenses related to that fund are charged to the fund (subtracted), not debited to Income and Expenditure A/c. Following are the examples of fund like Match Fund, Sports Fund, Prize Fund, Building Fund, etc.

Treatment of Fund

BALANCE SHEET as on 31st March, 20..

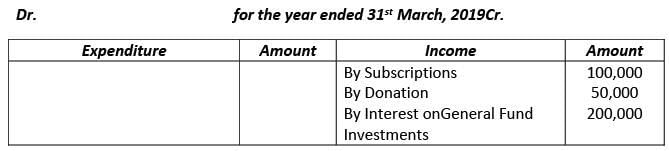

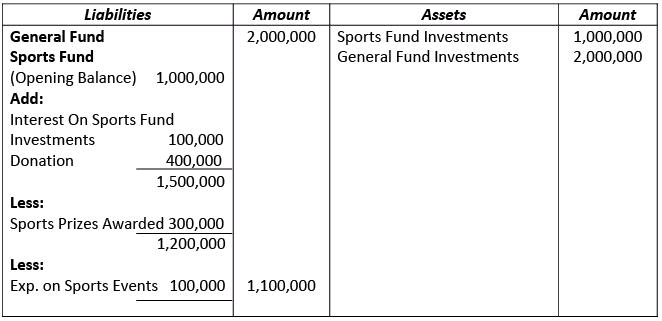

Example 8. The information given below relates to a sports club. Show them in the Income and Expenditure Account and the Balance Sheet of the club as at 31st March, 2019.

Sports Fund as at 1st April, 2018………......... Rs. 1,000,000

Sports Fund Investments………......... Rs. 1,000,000

Interest on Sports Fund Investments………......... Rs. 100,000 Donations for Sports Fund………......... Rs. 400,000 Subscription………......... Rs. 100,000

Donation………......... Rs. 50,000

Sports Prize Awarded……….........Rs. 300,000

Expenses on Sports Events………......... Rs. 100,000

General Fund………......... Rs. 2,000,000

General Fund Investments………......... Rs. 2,000,000

Interest on General Fund Investments………......... Rs. 200,000

Solution.

INCOME AND EXPENDITURE ACCOUNT

BALANCE SHEET (Only Relevant Items) as at 31st March, 2019

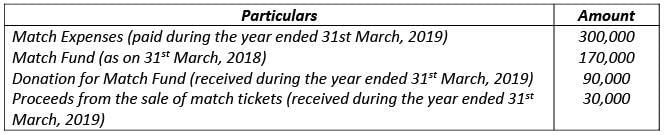

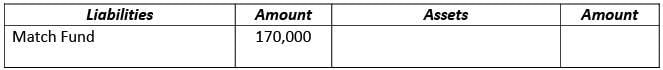

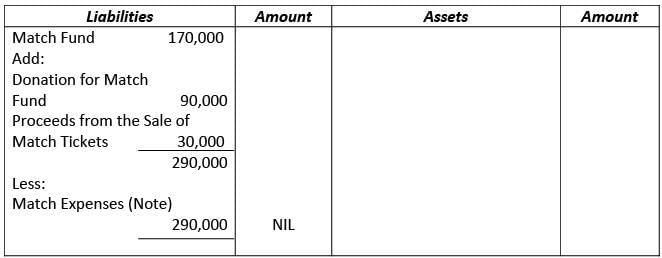

Example 9. From the following information of Indian Sports Club show the amounts of Match Expenses and Match Fund in the Financial Statement of the Club for the year ended on 31st March, 2018 and 31st March, 2019: Solution.

Solution.

BALANCE SHEET as at 31st March, 2018

BALANCE SHEET as at 31st March, 2029

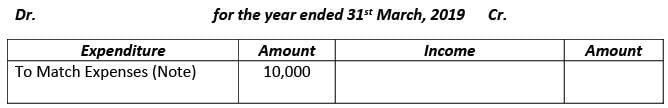

INCOME AND EXPENDITURE ACCOUNT

INCOME AND EXPENDITURE ACCOUNT

Note: Match Expenses are Rs. 300,000 out of which Rs. 290,000 is met from Match Fund up to available fund and balance expenses of Rs. 10,000 are debited to Income and Expenditure Account. Thus, balances of Match Fund in nil in the Balance Sheet

Note: Match Expenses are Rs. 300,000 out of which Rs. 290,000 is met from Match Fund up to available fund and balance expenses of Rs. 10,000 are debited to Income and Expenditure Account. Thus, balances of Match Fund in nil in the Balance Sheet

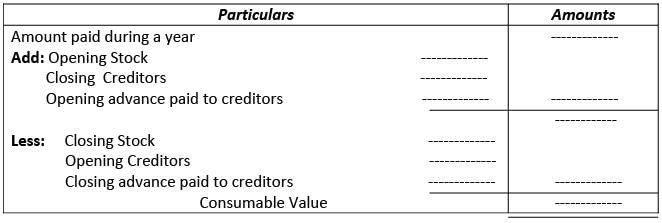

(c) Consumable Value of Items: Following items are not recorded in Income and Expenditure Account with all informations. Only consumable value of these items are recorded in debit side of Income and Expenditure Account and other informations like opening stock, closing stock, opening creditors, closing creditors, etc. are recorded in Opening and Closing Balance Sheet, These items are Medicine, Sports Materials, etc.

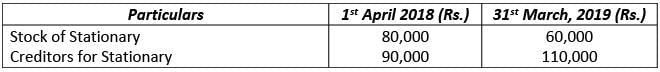

Example 10. From the following information, determine the amount to be debited to Stationary Account in Income and Expenditure Account for the year ended 31st March, 2019.

| Stock of stationary on 1st April, 2018 | Rs. 30,000 |

| Creditors for stationary on 1st April, 2018 | Rs. 20,000 |

| Amount paid for stationary during the year ended 31st March, 2019 | Rs. 108,000 |

| Stock of Stationary on 31st March, 2019 | Rs. 5,000 |

| Creditors for stationary on 31st March, 2019 | Rs. 13,000 |

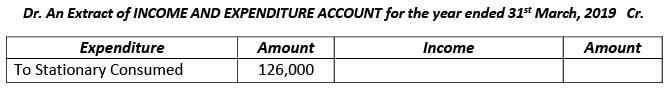

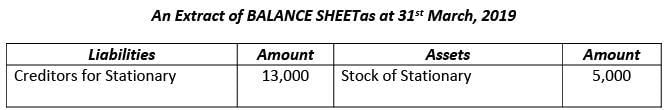

Also, show the above items in the Income and Expenditure Account for the year ended 31st March, 2019 and in the Balance Sheet as at that date.

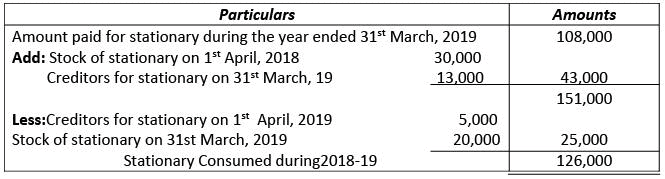

Solution.

Statement Showing Stationary Consumed during 2018-19

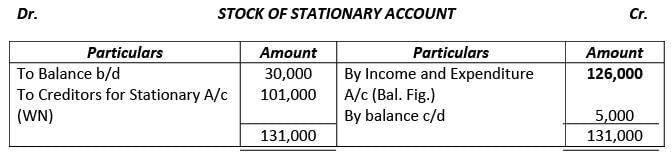

Alternative: Amount of Stationary consumed to be debited to Income and Expenditure Account can be also be computed by preparing Stock of Stationary Account as follows:

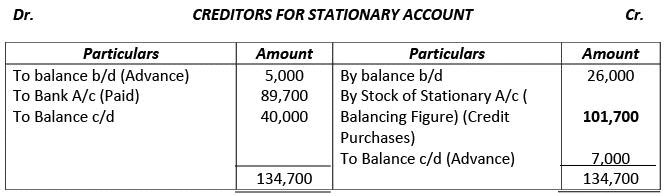

Alternative: Amount of Stationary consumed to be debited to Income and Expenditure Account can be also be computed by preparing Stock of Stationary Account as follows: Working Note: Calculation of Stationary purchased during the year:

Working Note: Calculation of Stationary purchased during the year:

Example 11. On the basis of the information given below, calculate the amount of stationary to be debited to Income and Expenditure Account of Good Health Sports Club for the year ended 31st March, 2019: Stationary purchased during the year ended 31st March, 2019 was Rs. 470,000.

Stationary purchased during the year ended 31st March, 2019 was Rs. 470,000.

Solution.

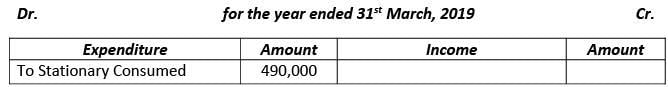

Good Health Sports Club

An Extract of INCOME AND EXPENDITURE ACCOUNT

Working Note:

Stationary Consumed (2018-19) = Opening Stock of Stationary + Purchases of Stationary – Closing Stock of Stationary

= Rs. 80,000 + Rs. 470,000 – Rs. 60,000 = Rs. 490,000.

Since stationary purchased during the year is given, creditors are already adjusted in it and, therefore, no treatment is given to creditors.

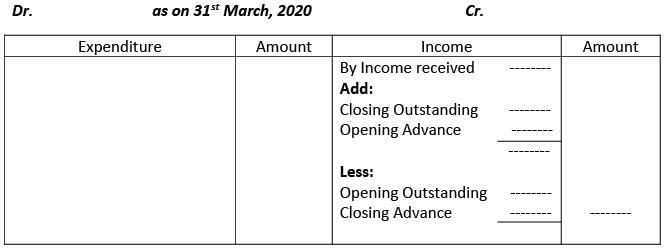

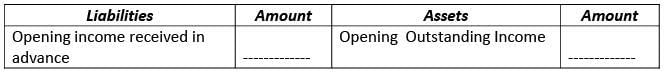

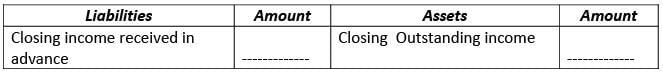

(d) Income Received: Income received by firm is recorded in credit side of Income and Expenditure Account. Only those incomes are recorded that are related to current year. If any amount related to previous year or next year are included in particular income that will be deducted. Same as, any amount related to current year is not received or received in advance in previous year are added. Examples of incomes are Entrance Fees, Rent, Locker Rent, etc.

INCOME AND EXPENDITURE ACCOUNT

Opening Balance Sheet

Closing Balance Sheet

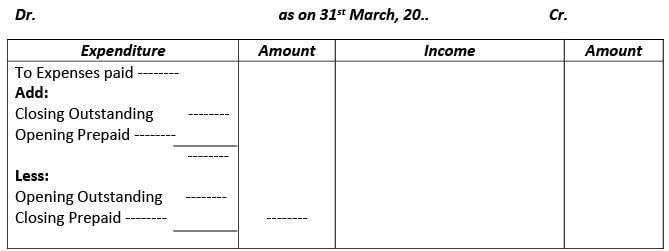

(e) Expenses Paid: An expense paid by a firm is recorded in debit side of Income and Expenditure Account. Only those expenses are recorded that are related to current year. If any amount related to previous year or next year are included in particular expenses that will be deducted. Same as, any amount related to current year is not paid or already paid in previous year are added. Examples of expenses are Salary, Rent, Wages, etc.

INCOME AND EXPENDITURE ACCOUNT

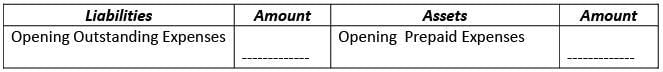

Opening Balance Sheet

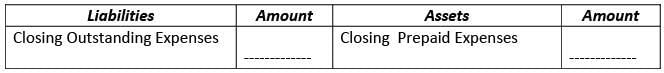

Closing Balance Sheet

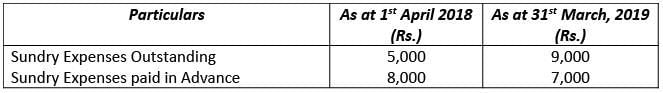

Example 12. How are the following items dealt in preparing Income and Expenditure Account for the year ended 31st March, 2019 and Balance Sheet as at that date? Sundry Expenses paid during the year ended 31st March, 2019 Rs. 40,000.

Sundry Expenses paid during the year ended 31st March, 2019 Rs. 40,000.

Solution.

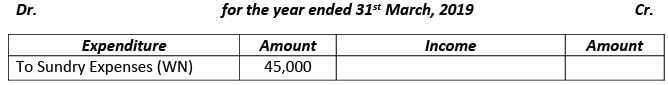

INCOME AND EXPENDITURE ACCOUNT (An Extract)

BALANCE SHEET(An Extract) as at 31st March, 2019

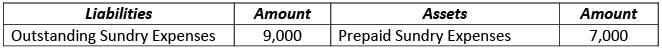

Working Note:

Working Note:

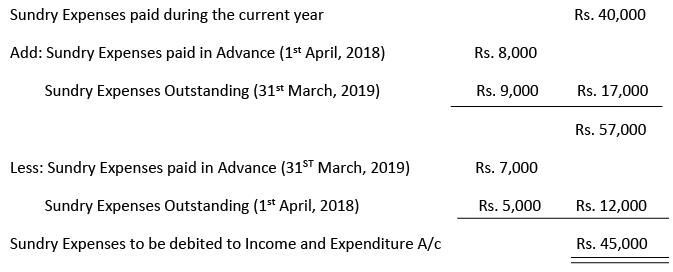

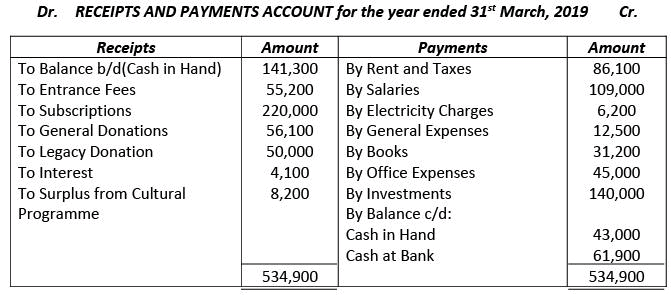

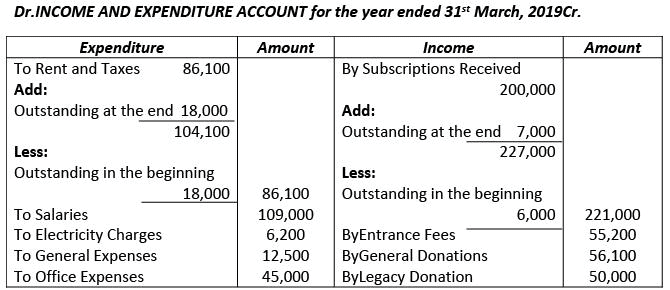

Example 13. From the following Receipts and Payments Account of Friends Club for the year ended 31st March, 2019, prepare Income and Expenditure Account for the year ended 31st March, 2019 and Balance Sheet as at that date: Additional Informations:

Additional Informations:

(i) In the beginning of the year, the club had Books of Rs. 300,000 and Furniture of Rs. 58,000.

(ii) Subscriptions in Arrears on 1st April, 2018 were Rs. 6,000 and Rs. 7,000 on 31st March, 2019.

(iii) Rs. 18,000 was due by the way of Rent in the beginning as well as at the end of the year.

(iv) Write off Rs. 5,000 from Furniture and Rs. 30,000 from Books.

Solution.

Friends Club

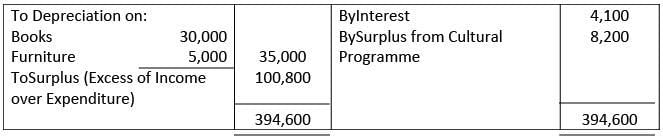

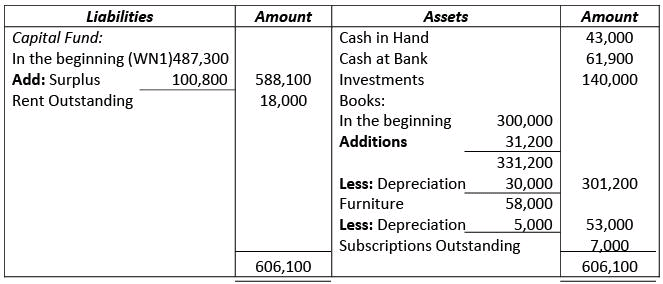

BALANCE SHEET as at 31st March, 2019

Working Notes:

Working Notes:

(i) Calculation of Opening Capital Fund:

BALANCE SHEET as at 31st March, 2018

(ii) Legacy Donation is credited to Income and Expenditure Account, it being not for specific purpose.

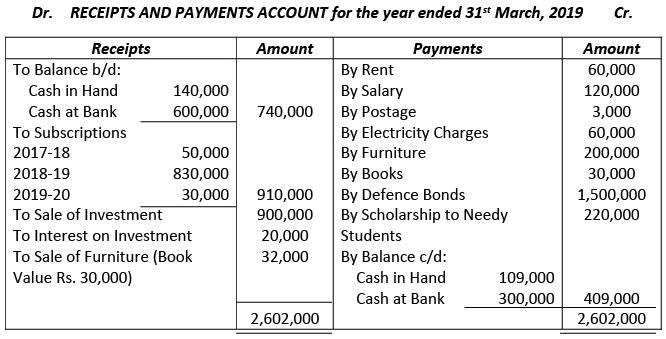

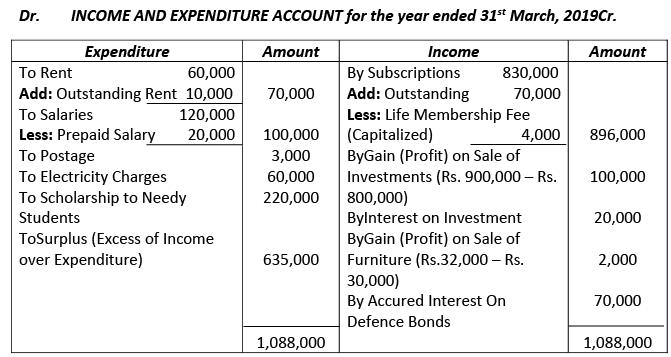

Example 14. Following is the Receipts and Payments Account of Rajdhani Charitable Trust: Prepare Income and Expenditure Account for the year ended 31st March, 2019 and Balance Sheet as on that date after the following adjustments:

Prepare Income and Expenditure Account for the year ended 31st March, 2019 and Balance Sheet as on that date after the following adjustments:

Subscription for the year ended 31st March, 2019 still due were Rs. 70,000. Interest due on Defence Bonds was Rs. 70,000. Rent Outstanding was Rs. 10,000. Book Value of Investment sold was Rs. 800,000, Rs. 300,000 of the investments were still in hand. Subscriptions received in the year ended 31st March, 2019 included Rs. 4,000 from a life member. Total Furniture on 1ST April, 2018 was worth Rs. 120,000. Salary paid for the year ended 31st March, 2020 is Rs. 20,000.

Solution.

Rajdhani Charitable Trust

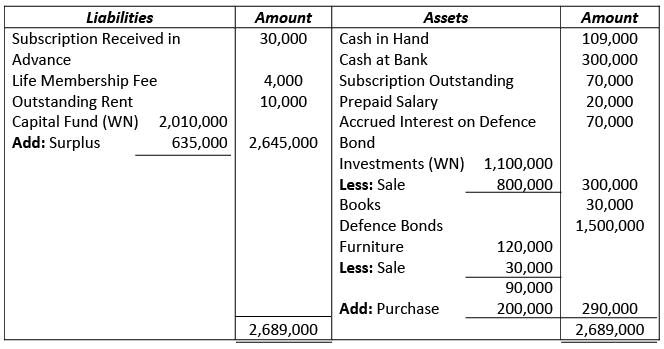

BALANCE SHEET as at 31st March, 2019

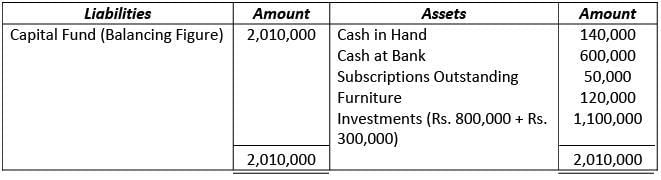

Working Notes: Calculation of Capital Fund on 1st April, 2018:

BALANCE SHEET as at 31st March, 2018

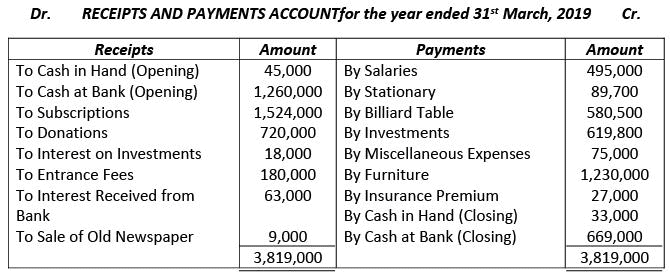

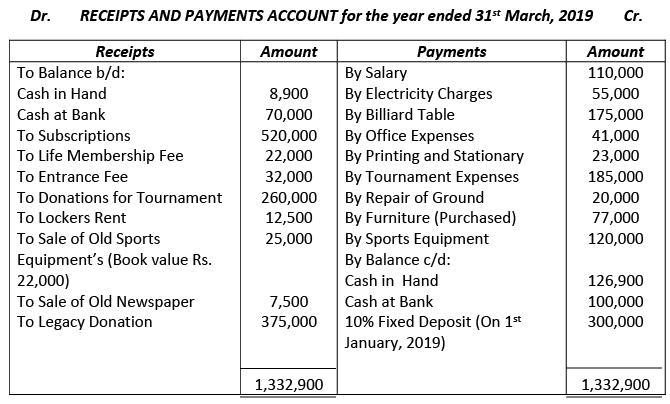

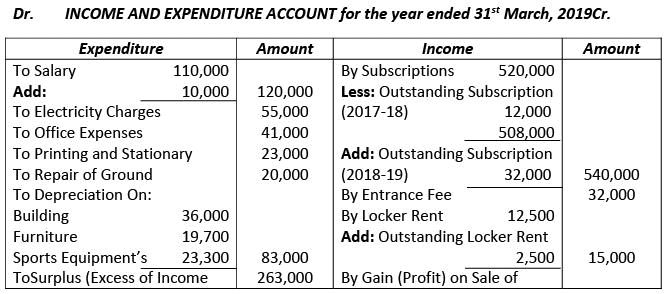

Example 15. Following is the Receipts and Payments Account of Indian Sports Club; prepare Income and Expenditure Account and Balance Sheet as on 31st March, 2019:

Other Information:

Subscription outstanding was on 31st March, 2018 Rs. 12,000 and Rs. 32,000 on 31st March, 2019. Lockers Rent outstanding on 31st March, 2019 Rs. 2,500. Salary outstanding on 31st March, 2019 Rs. 10,000.

On 1st April, 2018, club has building Rs. 360,000, furniture Rs. 120,000, Sports Equipment’s Rs. 175,000. Depreciation charged on these items @10% (including purchase).

Legacy Donation is for constructing hostel for sports persons.

Solution.

Indian Sports Club

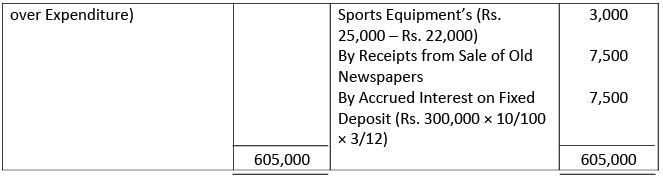

BALANCE SHEET as at 31st March, 2019

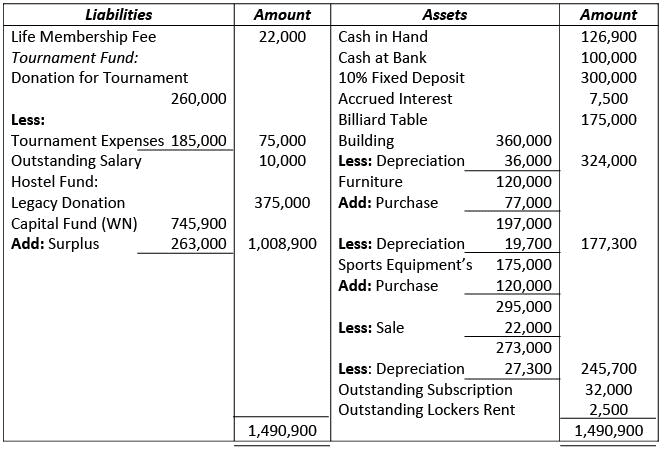

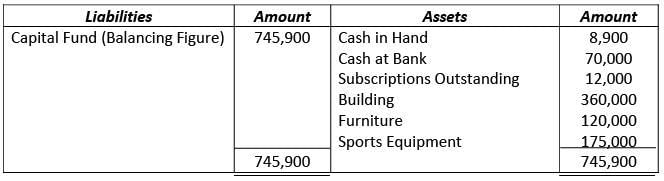

Working Notes: Calculation of Capital Fund on 1st April, 2018:

BALANCE SHEET as at 31st March, 2018

|

42 videos|267 docs|51 tests

|

FAQs on Financial Statements of Not- for-Profit Organizations - Accountancy Class 12 - Commerce

| 1. What are financial statements of not-for-profit organizations? |  |

| 2. What is the purpose of financial statements for not-for-profit organizations? |  |

| 3. What are the key differences between financial statements of for-profit and not-for-profit organizations? |  |

| 4. How can financial statements of not-for-profit organizations be used for benchmarking and performance evaluation? |  |

| 5. What are the reporting requirements for financial statements of not-for-profit organizations? |  |