The Hindu Editorial Analysis- 2nd December, 2020 | Additional Study Material for UPSC PDF Download

1. REGIONAL PRIORITIES-

GS 2- Bilateral, regional and global groupings and agreements involving India and/or affecting India’s interests

Context

Three years after joining the eight-nation Shanghai Cooperation Organisation (SCO), India hosted the SCO heads of governments (HoG) meeting for the first time on Monday.

Shanghai Cooperation Organisation (SCO)

(i) The Shanghai Cooperation Organisation (SCO), or Shanghai Pact, is a Eurasian political, economic, and security alliance, the creation of which was announced on 15 June 2001 in Shanghai, China by the leaders of China, Kazakhstan, Kyrgyzstan, Russia, Tajikistan, and Uzbekistan; the Shanghai Cooperation Organisation Charter, formally establishing the organisation, was signed in June 2002 and entered into force on 19 September 2003.

(ii) The original five nations, with the exclusion of Uzbekistan, were previously members of the Shanghai Five group, founded on 26 April 1996.

(iii) Since then, the organisation has expanded its membership to eight countries when India and Pakistan joined SCO as full members on 9 June 2017 at a summit in Astana, Kazakhstan.

(iv) The Heads of State Council (HSC) is the supreme decision-making body in the SCO, it meets once a year and adopts decisions and guidelines on all important matters of the organisation.

(v) Military exercises are also regularly conducted among members to promote cooperation and coordination against terrorism and other external threats, and to maintain regional peace and stability.

(vi) The SCO is the largest regional organisation in the world in terms of geographical coverage and population, covering three-fifths of the Eurasian continent and nearly half of the human population.

The Aim of SCO is to Establish Cooperation Between Member Nations On

(i) Security-related concerns

(ii) Resolving border issues

(iii) Military cooperation

(iv) Intelligence sharing

(v) Countering terrorism

(vi) Countering American influence in Central Asia

Members Of Shanghai Cooperation Organisation

(i) Apart from the founding members (listed above), Uzbekistan joined the group later as a permanent member.

(ii) India and Pakistan are the newest inclusion to the Organisation and it added another 1.45 billion people in the SCO making the group cover around 40 per cent of the global population.

(iii) Both these nations signed the memoranda for becoming a permanent member of the Shanghai Cooperation Organisation in 2016.

(a) The Eight Permanent Members Of The SCO Are

- China

- Kazakhstan

- Kyrgyzstan

- Russia

- Tajikistan

- Uzbekistan

- India

- Pakistan

Point Of Discussion During Hog Meeting

(i) The focus of the 66-point joint communiqué at the end of the virtual conference was in developing a “Plan of Priority Practical Measures for 2021-2022 to overcome the socio-economic, financial and food consequences of COVID-19 in the region”.

(ii) Members committed to strengthening multilateralism and the UN charter while welcoming the fact that the grouping is now being seen as an “influential and responsible participant in the modern system of international relations”.

(iii) Vice-President Venkaiah Naidu, who made strong observations on cross-border terrorism; he called it the SCO region’s “biggest challenge”, in comments aimed at Pakistan.

(iv) Pakistan’s representative too spoke of the need to combat what she called “state terrorism” in disputed areas, in a reference to Jammu and Kashmir.

(v) The SCO is a rare forum where India-Pakistan troops take part in joint exercises under the Regional Anti-Terror Structure, although it would seem the two countries have come no closer on the issue.

(vi) Neither statement on terrorism was reflected in the final joint statement, which focused on trade and economic issues.

(vii) India also marked its differences with China over the BRI by not joining other SCO members in a paragraph endorsing the BRI.

(viii) Mr. Naidu made a pitch for “transparent and trustworthy” trade practices, seen as a sidebar aimed at China.

Why India's membership to SCO matters?

(i) Shanghai Cooperation Organisation is seen as an eastern counter-balance to NATO. With India being its member, it will allow the country to push effective action in combating terrorism and on issues related to security.

(ii) With the presence of India and China, the world's most populous countries, SCO is now the organisation that has the largest population coverage.

(iii) India's entry into the group is expected to increase the group's heft in regional geopolitics and trade negotiations while giving it a pan-Asian hue at the same.

Importance Of SCO

(i) Regardless of the differences, the Modi government has consistently maintained the importance of the SCO grouping, referred to as the “Asian NATO” although it does not mandate security alliances.

(ii) The SCO is one of the few regional structures India is a part of now, given a decline in its engagement with SAARC, BBIN and the RCEP.

(iii) The SCO provides India a convenient channel for its outreach — trade and strategic ties — to Central Asian countries.

(iv) It has afforded a platform, when needed, for bilateral discussions with the two countries India has the most tense ties with: China and Pakistan.

(v) While the government has eschewed meetings with Pakistan for the last five years, it has used the SCO for talks with China, including this year amidst the LAC stand-off, when Rajnath Singh and S. Jaishankar met their counterparts on the sidelines of SCO meets.

(vi) Above all, the SCO has been seen as a grouping worth pursuing as it retains India’s geopolitical balance, a useful counterpoint to New Delhi’s otherwise much more robust relations with the western world, and hosting the SCO meeting was one more step towards developing that engagement.

(vii) The SCO serves India’s quest for geopolitical balance and regional engagement.

2. WHY BUSINESS BARONS SHOULD NOT RUN BANKS-

GS 3- Economy, Banking

In a blistering critique in Bloomberg titled ‘India’s banking rules need to close door to tycoon cronyism’, renowned analyst Andy Mukherjee wrote: “From telecommunications to transportation, India’s business landscape is already starting to resemble a Monopoly board.”

Context

Private companies will not only enrich themselves but also crush competition when allowed to run banks

RBI’s Decision

(i) The Reserve Bank of India (RBI), the last guardian of India’s financial and banking system, constituted an Internal Working Group to determine if large corporate houses can be given licence to promote banks and recommended that they be allowed to operate banks, all without inviting a larger public debate, is unconscionable.

(ii) Banking regulations for licensing have not been diluted in the last 50 years to allow business barons to promote a bank and the RBI has always opposed the idea in the past.

Reasons For The License

(i) The Indian economy needs money (credit) to grow. So, corporate houses will bring capital and expertise to banking.

(ii) Govt. owned banks are struggling to even out their non-performing assets (NPAs).

(iii) Covid-19 has led to further straining of govt. resources.

(iv) Low revenue generation has put a cap on the govt.’s ability to push growth through public sector banks.

(v) Many corporate houses worldwide provide essential banking services.

(vi) Corporate owned NBFCs have been regulated for a while.

IWG Recommendations

(i) Large corporate/industrial houses may be allowed as promoters of banks only after necessary amendments to the Banking Regulation Act, 1949 (to prevent connected lending and exposures between the banks and other financial and non-financial group entities); and

(ii) Strengthen the mechanism for large conglomerates for better supervision

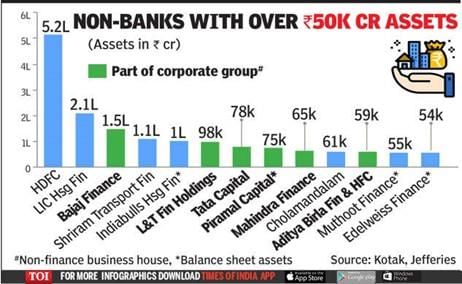

(iii) Non-banking Financial Companies (NBFCs), with an asset size of ?50,000 crore and above, including those which are owned by a corporate house, may be considered for conversion into banks subject to completion of 10 years of operations.

(iv) Also, NBFCs ought to meet certain criteria and compliance with additional conditions specified in this regard.

(v) For Payments Banks with a track record of 3 years of experience may convert to a Small Finance Banks.

What Are NBFCs?

NBFCs are Non-banking financial institutions licensed under the Indian Companies Act, 1956) that meets the following conditions:

(i) Minimum Net Owned Funds (NOF) of Rs.5 crore. (For those registered in the North Eastern Region of the country, Rs. 2 crore is required as minimum NOF)

(ii) At least 85% of its Total Net Assets are in the nature of Qualifying Assets (those which have a substantial period of time to be ready for its intended use or sale)

Reserve Bank Of India

The Reserve Bank of India was established on April 1, 1935 under the provisions of the Reserve Bank of India Act, 1934. The functions of the RBI include the following -

(i) Regulate and Supervise of the Financial System

(ii) Manage Foreign Exchange

(iii) Issue of Currency

(iv) Roll out various directives to promote development

(v) Financial Inclusion

Not A Welcome Move

(i) In a joint paper posted on November 23, former RBI Governor Raghuram Rajan and former RBI Deputy Governor Viral Acharya termed the recommendations allowing corporates into banking a “bombshell” and said this proposal is “best left on the shelf”.

(ii) Referring to business houses owning an in-house bank that may lead to self-lending, they said, “The history of such connected lending is invariably disastrous. For eample – “Yes Bank managed to conceal its weak exposures for considerable periods.”

(iii) Professor T.T. Ram Mohan wrote in this newspaper, “If the record of over-leveraging in the corporate world in recent years is anything to go by, the entry of corporate houses into banking is a road to perdition.”

(iv) Hemindra Hazari, a well-known Securities and Exchange Board of India (SEBI) research analyst, wrote in an article titled ‘RBI’s working group recommends foxes be put in charge of chicken coops’: “Even under the existing financial regime, the RBI was unable to detect at an early stage the connected lending which felled large regulated financial entities like.

(v)

- IL & FS,

- Yes Bank (Rana Kapoor and his entities held 10.6% as on end September 2018),

- Punjab and Maharashtra Co-operative Bank and DHFL (promoter holding 39%).

Issues With Corporate-Owned Banks

(i) Possibility of concentration of economic power and eventually lead to privatization.

(ii) Flow of funds/money to selective customers.

(iii) Previously, regulators have ensured that no single owner has too much stake.

(iv) RBI has always viewed that banks should promote a balance between efficiency, equity and financial stability.

(v) A govt.-owned banking system is feasible for the long run due to public dependency and trust.

(vi) Connected lending – A situation where the loan issuer is also the borrower. This may allow for flow of money into their own pursuits. Also, tracing this will be a huge challenge.

(vii) Exposure of the safety net provided to banks (through guarantee of deposits) to commercial sectors of the economy.

(viii) RBI will have to come up with a new mechanism to effectively supervise conglomerates that venture into banking.

What Is Promoter Holding?

Promoter holding is the percentage of shares held by the promoters of a company/entity. They have significant influence on the working of that entity and may even have a controlling stake by holding major executive positions.

Incongruency in RBI’s Decisions

(i) The RBI is overlooking time-tested principles and limits of disallowing mega business houses from promoting and owning banks.

(ii) It is saying this can be done by making necessary amendments to the Banking Regulation Act of 1949 to deal with connected lending and linkages between banks and non-financial group entities, and strengthening the supervisory mechanism for conglomerates.

(iii) This is in stark departure from its long-held opinion on the subject since 1969 when banks were nationalised.

(iv) History is replete with evidence of business barons who were good when they started out only to eventually morph into robber barons who not only enriched themselves owing to their enormous wealth and nexus with politicians in power, but also crushed competition.

(v) It will be naive to believe that a bank owned by a corporate house will permit lending to its competitors.

Conclusion

(i) Privatise public sector banks must be allowed for wide and diversified holding of stock by the general public.

(ii) If the government exits banking ownership, that would lead to professional management and broader distribution of wealth. The banks would come under both SEBI and stringent RBI guidelines.

(iii) Also, there will have to be a strong mechanism and monitoring to hold strict regulations on the funding by the NBFCs.

(iv) The banking sector requires reform but inclusion of corporate houses owned banks may lead to serious repercussions.

3. THE LAST STRAW IS BEING FURTHER DISABLED-

GS 3- Challenges to internal security

Context

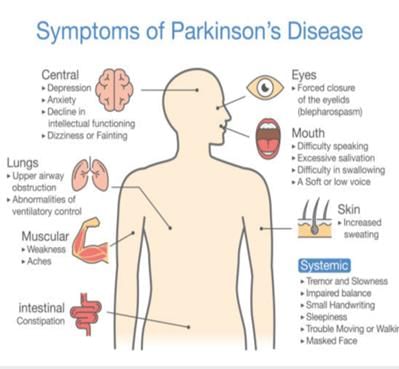

Father Swami, the 83-year-old activist who suffers from Parkinson’s disease was denied to give straw by prison staff.

Why He Is In Prison?

(i) He was arrested by the National Investigation Agency (NIA) in October for his alleged involvement in the 2018 Bhima Koregaon violence and charged under the draconian Unlawful Activities (Prevention) Act, 1967.

(ii) Lodged in Mumbai’s Taloja prison, Father Swamy reportedly made an application to be provided with a sipper and straw, as he was unable to hold a glass, a request which was inexplicably deferred for 20 days, only for the NIA to inform the court that it did not have a straw and sipper to give to the incarcerated octogenarian.

(iii) The court has now posted the matter on December 4, seeking a report from the jail authorities on allowing Father Swamy to receive a straw and sipper at his own cost.

What Is NIA?

NIA(National Investigating Agency) is India’s counter-terrorism task force. The agency is empowered to deal with terror-related crimes across states without special permission from the state. The agency came into existence with the enactment of the National Investigating Agency act 2008, which was passed after the deadly 26/11 terror attack in Mumbai.

What is Uapa Act 1967?

Unlawful Activities(Prevention)Act is an Indian law aimed at effective prevention of unlawful activities associated with India. Its main objective was to make powers available for dealing with activities directed against the integrity and sovereignty of India.

Uapa(Amendment)Act 2019

Now NIA can seize the property it considers to be proceeds of terrorism, with the written consent of the Director-General of Police of the state. However, the NIA officer can obtain the permission of the DGP of NIA thus bypassing the state DGP. Now the investigating time for police is extended to 180 days. The main provision of the amended act is that it allows considering a person a terrorist while before it only organizations can be marked as terrorist organizations.

What Is Parkinsons Disease?

It is a long term degenerative disorder of the central nervous system that mainly affects the motor system. The symptoms usually emerge slowly and as the disease worsens, non-motor symptoms become more common.

WHAT ABOUT BHIMA KOREGAON CASE?

The 2018 Bhima Koregaon violence refers to violence during an annual celebratory gathering on 1 January 2018 at Bhima Koregaon to mark the 200th anniversary of the Battle of Bhima Koregaon. The violence and stone-pelting by anti-social elements on the gathering resulted in the death of a 28-year old youth and injury to five others. The annual celebration also called Elgar Parishad convention was organised by retired justices B.G Kolte-Patil and P. B. Sawant. Justice P. B. Sawant claimed that the term "Elgar" meant loud invitation or loud declaration.

What About International Law?

(i) The UN Convention on the Rights of Persons with Disabilities (CRPD), which applies to all persons with disabilities including detainees and prisoners and to which India is a signatory, imposes a positive obligation on authorities, including prison staff, to ensure that prisoners with disabilities are on an “equal basis with others, entitled to guarantees following international human rights law” and are “treated in compliance with the objectives and principles of the convention, including by provision of reasonable accommodation”.

(ii) The obligation encompasses the provision of auxiliary aids relevant to the disability to secure the inherent dignity of the prisoner to enable them to live independently and participate in all aspects of their daily lives.

(iii) In cases where such provision is not made by prison authorities, it may amount to a breach of a state’s obligation to “prevent persons with disabilities... from being subjected to torture, cruel or inhuman degrading treatment or punishment”.

(iv) Article 10 of the International Covenant on Civil and Political Rights, or ICCPR The Nelson Mandela Rules, approved by the UN General Assembly through a resolution in 2015, on the standard minimum rules for the treatment of prisoners, also requires that the prison administration “make all reasonable accommodation and adjustments to ensure that prisoners with physical, mental or other disabilities have full and effective access to prison life on an equitable basis”

What About Indian Law?

(i) Apart from the constitutional guarantees under Articles 14 and 21 of the Constitution available to persons with disabilities, there is specific Indian legislation on the subject.

(ii) The Rights of Persons with Disabilities Act, 2016 enacted with the object of giving effect to the CRPD, also requires that persons with disabilities enjoy the right to equality, life with dignity and respect for integrity equally with others; they are not to be discriminated against on the ground of disability unless to achieve a legitimate aim.

(iii) The Rights of Persons with Disabilities Act also enjoins the state to take necessary steps to protect persons with disabilities from being subjected to torture, cruel, inhuman or degrading treatment; and take necessary steps to ensure reasonable accommodation for persons with disabilities.

(iv) While the Rights of Persons with Disabilities Act does not specifically provide for persons with disabilities who are incarcerated, given the object of the legislation to give effect to the CRPD, it would even encompass prisoners.

(v) It is important to note that the Rights of Persons with Disabilities Act explicitly recognizes Parkinson’s disease as a specified disability in its Schedule.

Conclusion

In his excellent memoir, Just Mercy: A Story of Justice and Redemption, Bryan Stevenson writes that the true measure of a society’s commitment to justice, the rule of law, fairness and equality, cannot be measured by how it treats the rich, but can be measured by how it treats the poor and deprived people.

|

21 videos|562 docs|160 tests

|

FAQs on The Hindu Editorial Analysis- 2nd December, 2020 - Additional Study Material for UPSC

| 1. What is the significance of the UPSC exam? |  |

| 2. What is the purpose of the Hindu Editorial Analysis? |  |

| 3. How can the Hindu Editorial Analysis be helpful for UPSC aspirants? |  |

| 4. What should UPSC aspirants focus on while reading the Hindu Editorial Analysis? |  |

| 5. How can UPSC aspirants make the most of the Hindu Editorial Analysis? |  |