Cash Flow Statement (Part - 3) | Accountancy Class 12 - Commerce PDF Download

Question:51

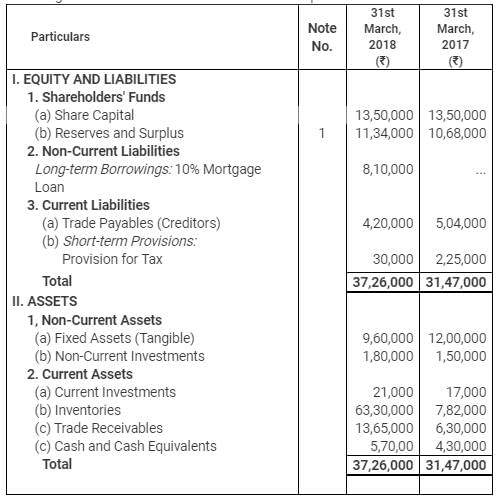

Following is the summarised Balance Sheet of Philips India Ltd. as at 31st March 2018:

Additional Information:

1. Investments costing ₹ 24,000 were sold during the year for ₹ 25,5000.

2. Provistion for Tax made during the year was ₹ 27,000.

3. During the year, a part of the Fixed Assets costing ₹ 30,000 was sold for ₹ 36,000. The profits were included in the Statement of Profit and Loss.

4. The Interim Dividend paid during the year amounted to ₹ 1,20,000.

You are required to prepare Cash Flow Statement.

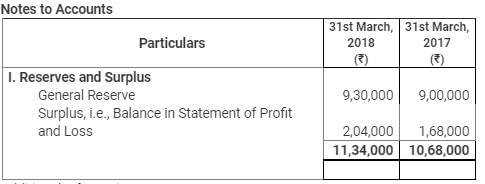

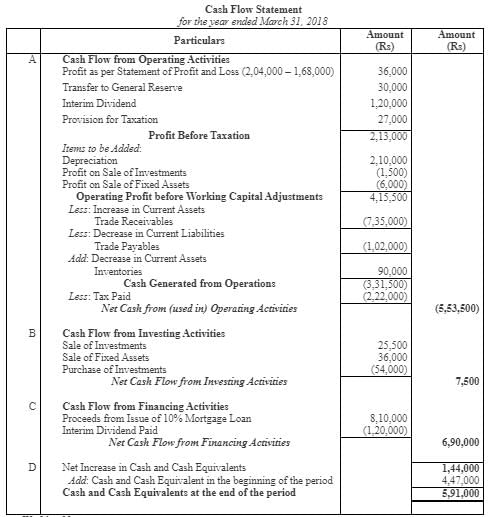

Solution:

Question:52

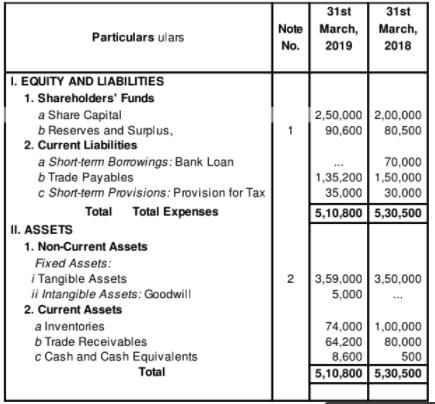

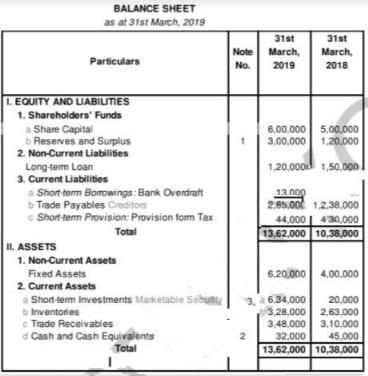

From the following Balance Sheet, prepare Cash Flow Statement:

Additional Information:

1. Proposed Dividend for the year ended 31st March, 2019 was 25,000 and for the year ended 31st March, 2018 was 14,000. 2. Interim Dividend paid during the year was 9,000.

3. Income Tax paid during the year was 28,000.

4. Machinery was purchased during the year 33,000.

5. Depreciation to be charged on machinery 14,000 and building 10,000.

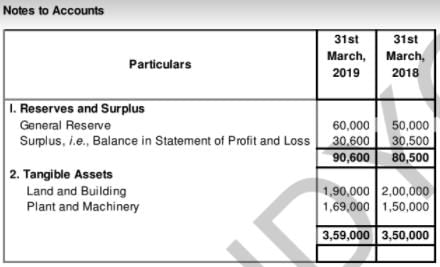

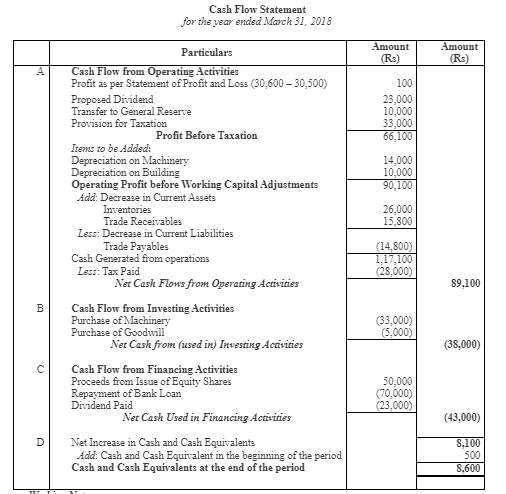

Solution:

Question:53

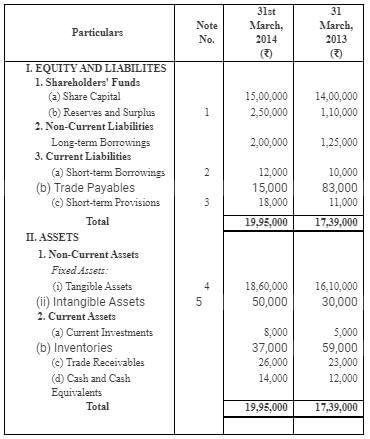

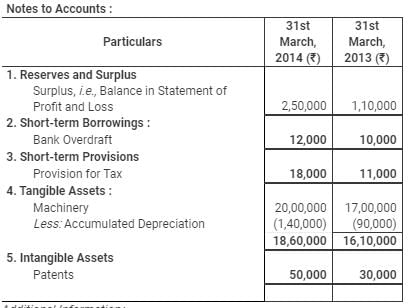

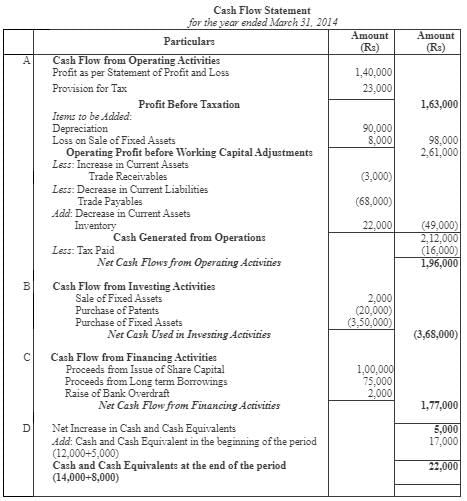

From the following Balance Sheet of Akash Ltd. as at 31st March 2014:

Additional Information :

(i) Tax paid during the year amounted to ₹ 16,000.

(ii) machine with a net book value of ₹ 10,000 (Accumulated Depreciation ₹ 40,000) was sold for ₹ 2,000.

Prepare Cash Flow Statement.

Solution:

Question:54

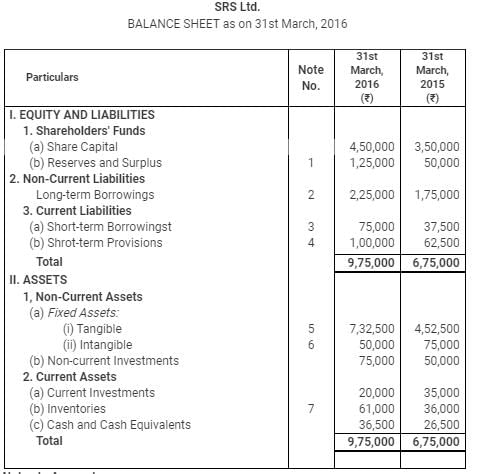

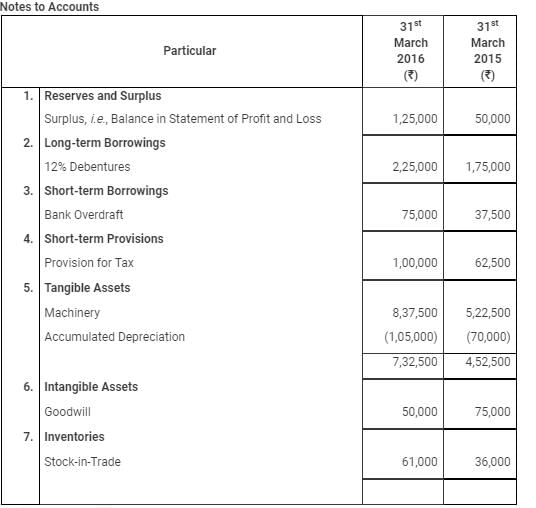

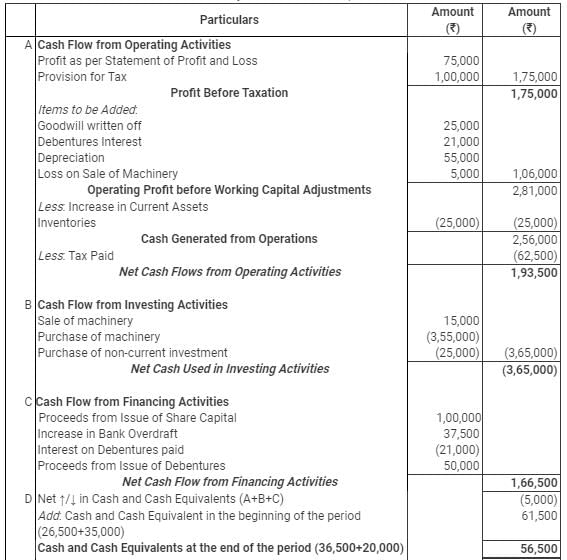

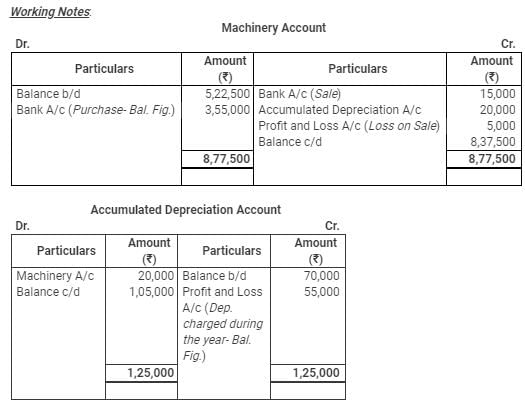

From the following Balance Sheet of SRS Ltd. and the additional information as on 31st March, 2016, prepare a Cash Flow Statement:

Additional Information:

(i) ₹50,000, 12% Debentures were issued on 31st March, 2016.

(ii) During the year, a piece of machinery costing ₹40,000, on which accumulated depreciation was ₹20,000, was sold at a loss of ₹5,000.

Solution:

Question:55

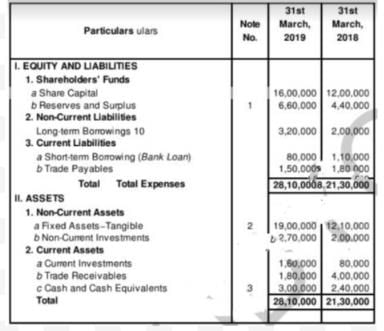

From the following Balance Sheet of Mishi Ltd. as at 31st March, 2019, prepare Cash Flow Statement:

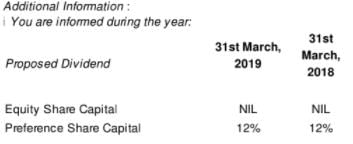

Additional Information :

Additional Information :

i. During the year, Machinery costing 1,40,000 accumulated depreciation provided thereon 1, 10, 000 was sold for 20,000.

ii. During the year, Non-current Investments costing 80,000 were sold at a profit of 16,000.

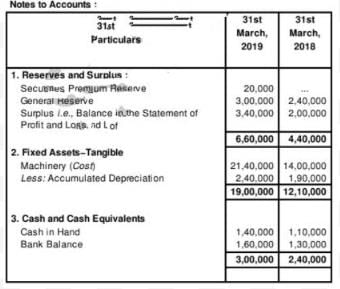

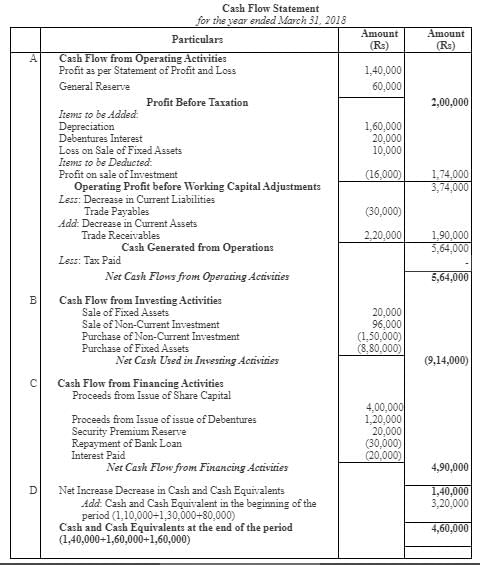

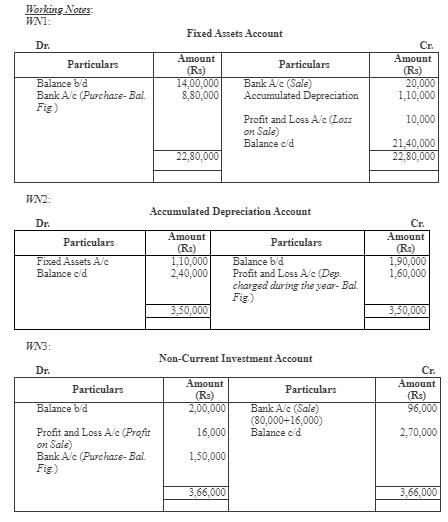

Solution:

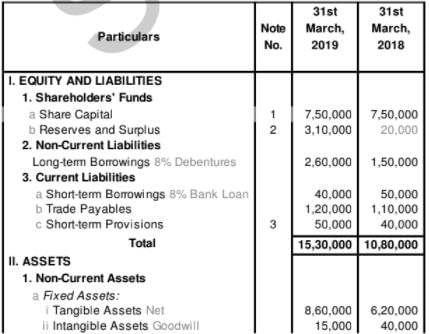

Question:56

From the following Balance Sheet and information of Sun Ltd., prepare Cash Flow Statement:

ii A machine with a book value of 90,000 was sold for 50,000;

iii Depreciation charged during the year 60,000;

iv Debentures were issued on 1st April, 2018;

v Investments were purchased on 31st March, 2019;

vi Preference shares were redeemed on 31st December,2018;

vii An interim dividend @ 15% was paid on equity shares on 31st December, 2018; viii Fresh equity shares were issued at a premium of 5% on 31st March, 2019.

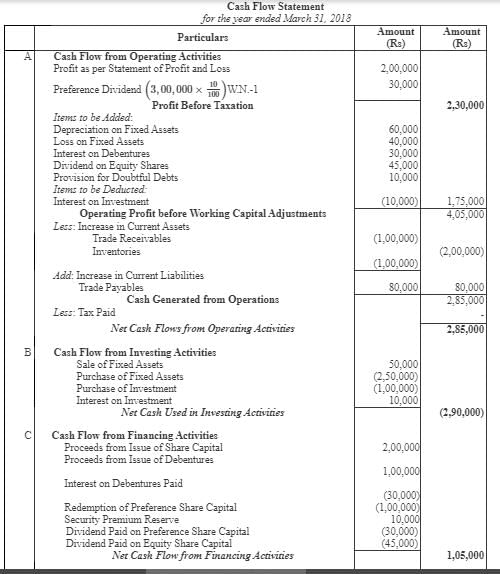

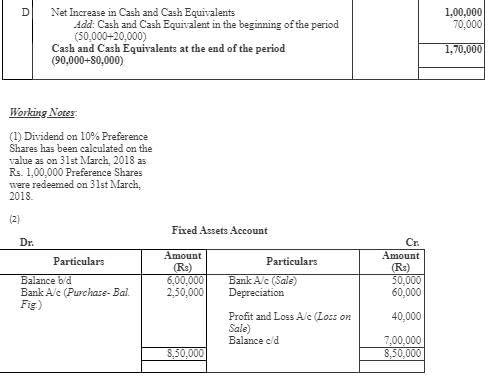

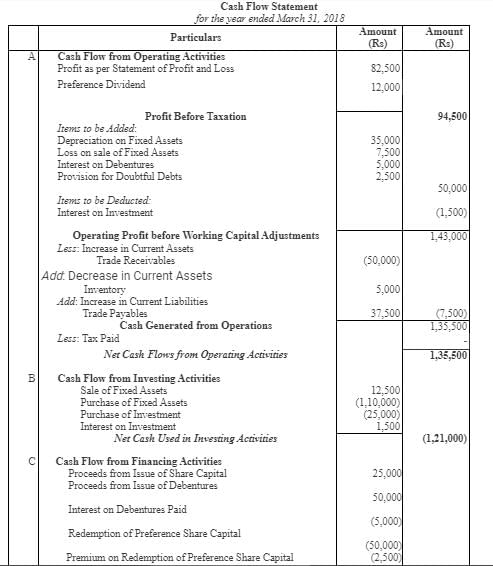

Solution:

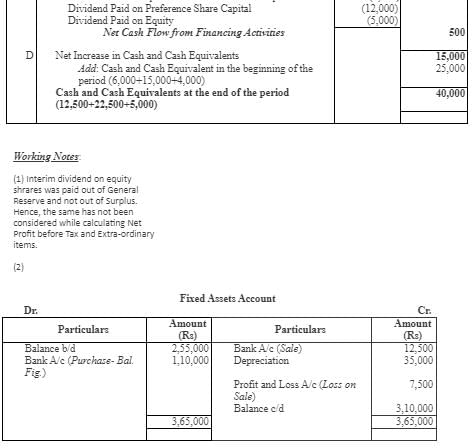

Question:57

From the following Balance Sheet and information of Volvo Ltd., prepare Cash Flow Statement:

ii A machine with a book value of 20,000 was sold for 12,500;

iii Depreciation charged during the year was 35,000;

iv Preference shares were redeemed on 31st March, 2018 at a premium of 5%; v An Interim dividend of 5,000 was paid on equity shares on 31st March, 2019 out of General Reserve;

vi Fresh equity shares were Issued on 31st March, 2019; and

vii Additional Investments were purchased on 31st March, 2019.

Solution:

Question:58

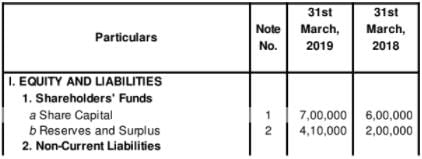

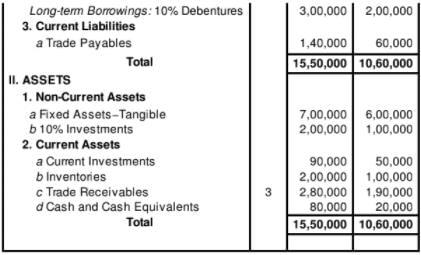

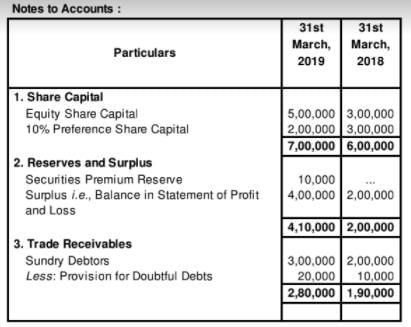

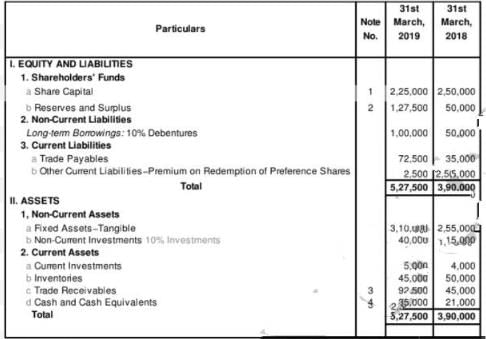

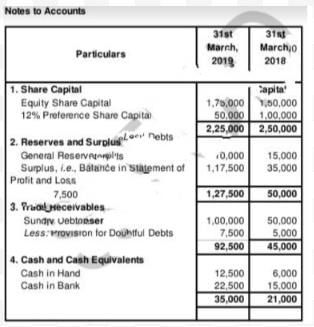

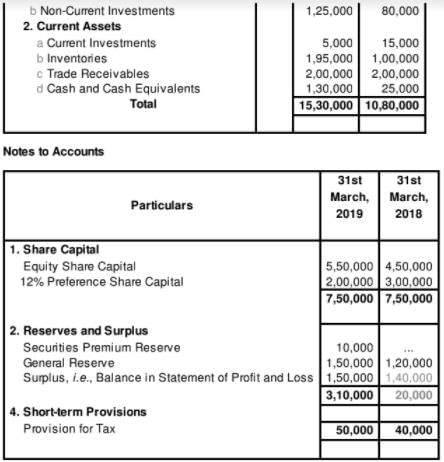

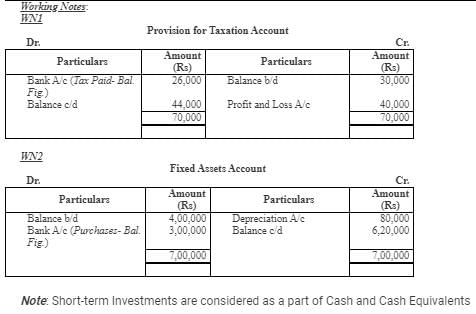

From the following Balance Sheet of Samta Ltd., as at 31st March, 2019, prepare Cash Flow Statement:

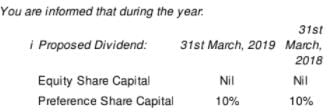

Additional Information :

i During the year a piece of machinery costing 60,000 on which depreciation charged was 20,000 was sold at 50% of its book value. Depreciation provided on tangible Assets 60,000;

ii Income tax 45,000 was provided;

iii Additional Debentures were issued at par on 1st October, 2018 and Bank Loan was repaid on the same date;

iv At the end of the year Preference Shares were redeemed at a premium of 5%.

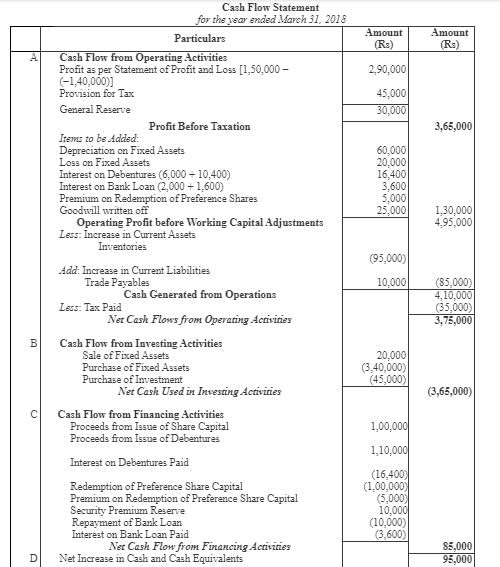

Solution:

Question:59

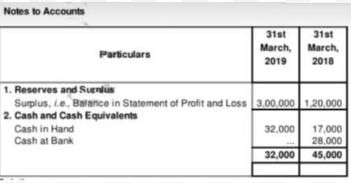

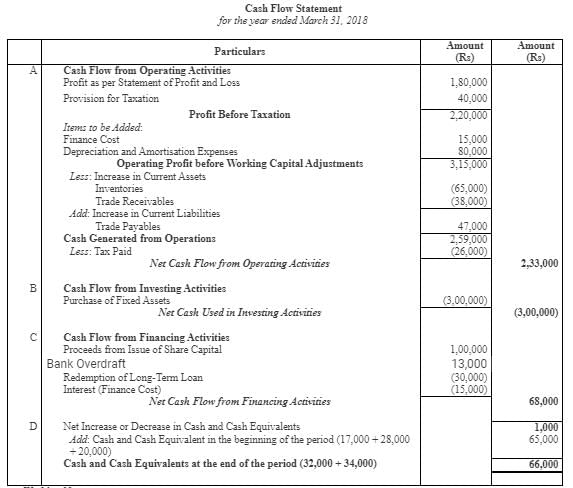

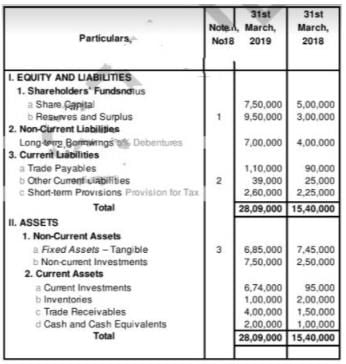

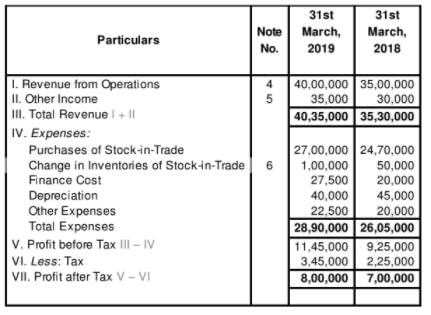

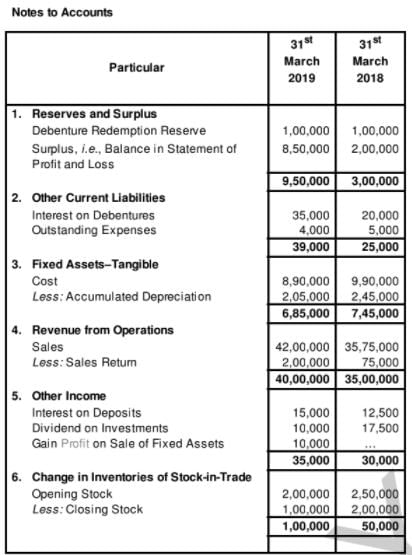

Prepare Cash Flow Statement from the following:

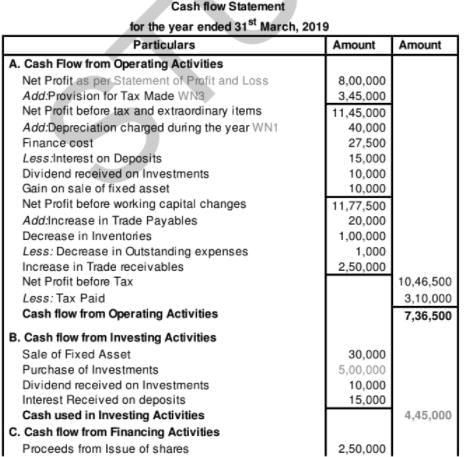

Solution:

`

`

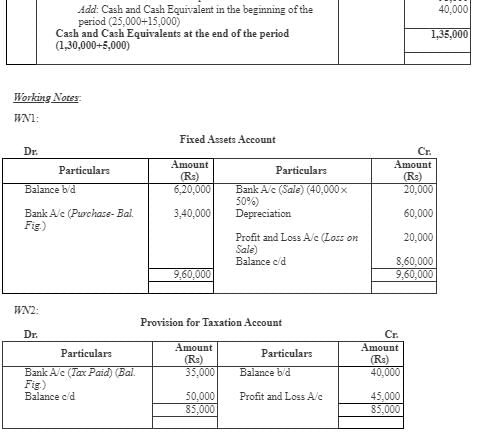

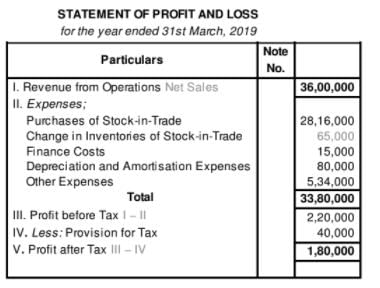

Question:60

From the following Balance Sheet as at 31st March, 2019 and Statement of Profit and Loss for the year ended 31st March, 2019 of RSB Ltd. and additional information, prepare Cash Flow Statement:

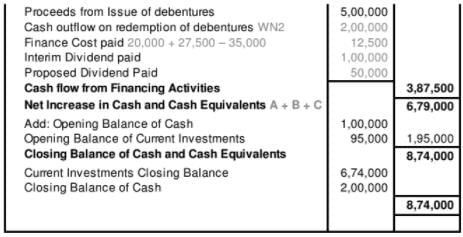

Additional Information:

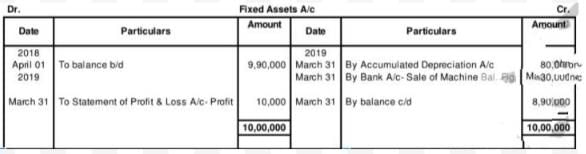

i. Additional debentures were issued on 1st October, 2018 of 5,00,000. On the same date, part of outstanding debentures were redeemed and interest was paid, whereas interest on outstanding debentures was paid on 10th April, 2019.

ii. Board of Directors proposed dividend in both the years @ 10%.

iii. Interim Dividend of 1,00,000 was paid during the year.

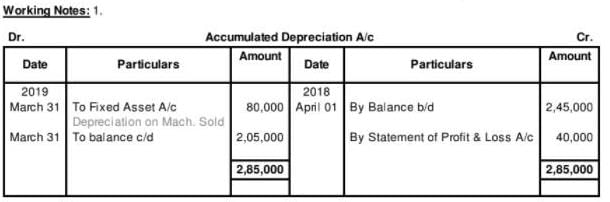

iv. A fixed asset with original cost of 1,00,000, on which depreciation till date was provided of 80,000 was sold at a profit of 10,000.

Solution:

|

42 videos|199 docs|43 tests

|

FAQs on Cash Flow Statement (Part - 3) - Accountancy Class 12 - Commerce

| 1. What is a cash flow statement and why is it important? |  |

| 2. What are the three main components of a cash flow statement? |  |

| 3. How is the cash flow statement different from the income statement? |  |

| 4. How can a positive cash flow be a sign of financial stability? |  |

| 5. How can a cash flow statement help in making investment decisions? |  |