Accountancy: CBSE Sample Question Papers (2020-21)- 3 | Sample Papers for Class 12 Commerce PDF Download

Class - XII

Accountancy

TIME: 3 Hrs.

M.M: 80

General Instructions :

Read the following instructions very carefully and strictly follow them :

(i) This question paper comprises two Parts—A and B. There are 32 questions in the question paper. All Questions are compulsory.

(ii) Heading of the option opted must be written on the Answer-Book before attempting the questions of that particular option.

(iii) Question numbers 1 to 13 and 23 to 29 are very short answer type questions carrying 1 mark each.

(iv) Question numbers 14 and 30 are short answer type-I questions carrying 3 marks each.

(v) Question numbers 15 to 18 and 31 are short answer type-II questions carrying 4 marks each.

(vi) Question numbers 19, 20 and 32 are long answer type-I questions carrying 6 marks each.

(vii) Question numbers 21 and 22 are long answer type-II questions carrying 8 marks each.

(viii) There is no overall choice. However, an internal choice has been provided in 2 questions of three marks, 2 questions of four marks and 2 questions of eight marks. You have to attempt only one of the choices in such questions.

PART - A

(Accounting for Not-For-Profit Organizations, Partnership Firms and Companies)

Q.1. Receipts and Payments Account is a summary of :

(a) Debit and credit balance of ledger account

(b) Cash receipts and payments

(c) Income and Expenses

(d) Balance of assets and liabilities

Ans. (b) Cash receipts and payments

Q.2. If creditors of the firm is Rs. 50,000. X’s capital is Rs. 20,000, Y’s capital is Rs. 30,000. Loan from bank is Rs. 50,000. What will be the total assets of the firm :

(a) Rs. 1,50,000

(b) Rs. 1,40,000

(c) Rs. 1,60,000

(d) Rs. 1,70,000

Ans. (a) Rs. 1,50,000

Q.3. Reserve Capital is not a part of :

(a) Authorized Capital

(b) Subscribed Capital

(c) Unsubscribed Capital

(d) Issued Share Capital

Ans. (c) Unsubscribed capital

Q.4. A, B and C were partners in a firm sharing profits in the ratio of 3 : 2 : 1. They admitted D as a new partner for 1/8 share in the profits, which he acquired 1/16th from B and 1/16th from C.

The New Profit Sharing Ratio of A, B, C and D is :

(a) 24 : 13 : 5 : 6

(b) 24 : 5 : 13 : 6

(c) 3 : 6 : 8 : 2

(d) 3 : 2 : 1 : 1

Ans. (a) 2 4 : 13 : 5 : 6

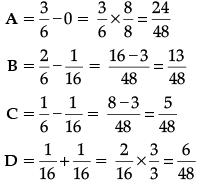

Calculation of New Profit Sharing Ratio :

New Ratio = 24 : 13 : 5 : 6

Q.5. In the absence of Partnership Deed, interest on Partner ’s loan is provided @ _______.

(a) 6% p.a.

(b) 7% p.a.

(c) 4% p.a.

(d) 10% p.a.

Ans. (a) 6% p.a.

Q.6. No entry is required when a ___________________ accepts a fixed asset in payment of his dues on dissolution of firm :

(a) Creditor

(b) Debtor

(c) Partner

(d) Government

Ans. (a) Creditor

Q.7. On the basis of the following data, how much final payment will be made to a partner on firm’s dissolution ?

Credit balance of capital account of the partner was Rs. 50,000. Share of loss on realization amounted to Rs. 10,000. Firm’s liability taken over by him was for Rs. 8,000.

(a) Rs. 32,000

(b) Rs. 48,000

(c) Rs. 40,000

(d) Rs. 52,000

Ans. (b) Rs. 48,000

Q.8. Gobind, Hari and Pratap are partners. On retirement of Gobind, the goodwill already appears in the Balance Sheet at Rs. 24,000. The goodwill will be written-off :

(a) by debiting all partners’ capital accounts in their old profit sharing ratio

(b) by debiting remaining partners’ capital accounts in their new profit sharing ratio

(c) by debiting retiring partners’ capital accounts with his share of goodwill

(d) None of the above

Ans. (a) by debiting all partners’ capital accounts in their old profit sharing ratio

Q.9. P, Q and R were partners in a firm sharing profits in the ratio of 5 : 4 : 3 respectively. Their capitals were Rs. 50,000, Rs. 40,000 and Rs. 30,000 respectively. Identify the ratio in which the Goodwill of the firm, amounting to Rs. 6,00,000, will be adjusted in the capital accounts of the remaining partners on the retirement of R :

(a) 5 : 4

(b) 4 : 5

(c) 3 : 4

(d) 4 : 3

Ans. (a) 5 : 4

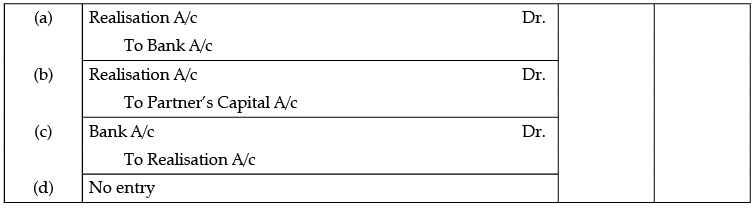

Q.10. When the assets are given away to any of the creditors towards the full payment of his dues, the journal entry for the same would be :

Ans. (d) No entry

Q.11. A, B and C are partners. C expired on 18th December, 2019 and as per agreement surviving partners A and B directed the accountant to prepare financial statements as on 18th December, 2019 and accordingly the share of profits of C (decreased partner) was calculated as Rs. 12,00,000. Which account will be debited to transfer C’s share of profits : (a) Profit and Loss Suspense Account

(b) Profit and Loss Appropriation Account

(c) Profit and loss Account

(d) None of the above

Ans. (b) Profit and loss Appropriation Account.

Q.12. Joy Ltd. issued 1,00,000 equity shares of Rs. 10 each. The amount was payable as follows :

On application — Rs. 3 per share

On allotment — Rs. 4 per share

On first and final call — balance

Applications for 95,000 shares were received and shares were allotted to all applicants. Soham to whom 500 shares were allotted failed to pay allotment money and Gautam paid his entire amount due including the amount due on first and final call on the 750 shares allotted to him along with allotment.

The amount received on allotment was :

(a) Rs. 2,25,000

(b) Rs. 3,78,000

(c) Rs. 3,80,250

(d) Rs. 2,19,000

Ans. (c) Rs. 3,80,250

Q.13. Interest on Debentures is a/an ________ against profit :

(a) Charge

(b) Appropriation

(c) Provision

(d) None of these

Ans. (a) Charge

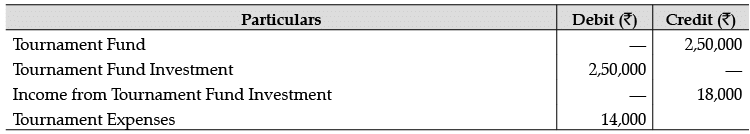

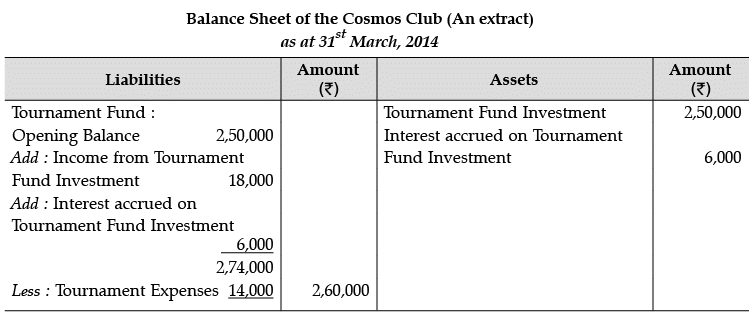

Q.14. Show the following information in the Balance Sheet of the Cosmos Club as on 31st March, 2014 :

Additional Information :

Interest accrued on Tournament Fund Investment Rs. 6,000.

Ans.

OR

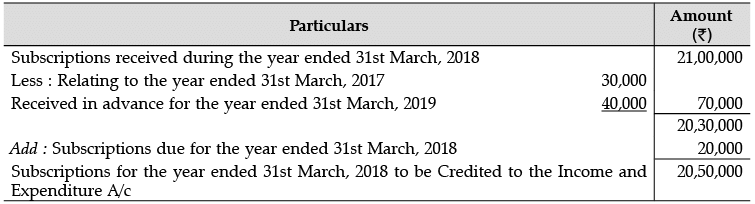

In the year ended 31st March, 2018, subscriptions received were Rs. 21,00,000. These subscriptions include 30,000 for the year ended 31st March, 2017 and Rs. 40,000 for the year ending 31st March, 2019. On 31st March, 2018, subscriptions due but not received were Rs. 50,000. The corresponding amount on 1st April, 2017 was Rs. 60,000. Determine the amount that should be credited to Income and Expenditure Account as subscriptions for the year ended 31st March, 2018.

Ans.

Statement showing subscription to be credited to Income & Expenditure Account :

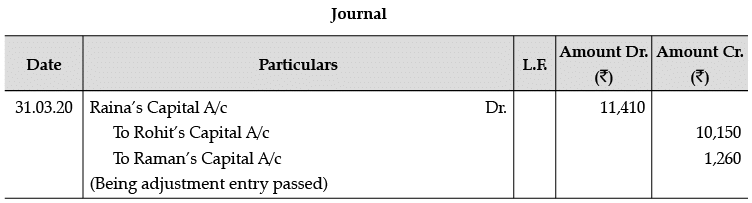

Q.15. Rohit, Raman and Raina are partners in a firm. Their capital accounts on 1st April, 2019, stood at Rs. 2,00,000, Rs. 1,20,000 and Rs. 1,60,000 respectively. Each partner withdrew Rs. 15,000 during the financial year 2019-20.

As per the provisions of their partnership deed :

(a) Interest on capital was to be allowed @ 5% per annum.

(b) Interest on drawings was to be charged @ 4% per annum.

(c) Profits and losses were to be shared in the ratio 5 : 4 : 1.

The net profit of Rs. 72,000 for the year ended 31st March, 2020, was divided equally amongst the partners without providing for the terms of the deed.

You are required to pass a single adjustment entry to rectify the error (show working clearly).

Ans.

OR

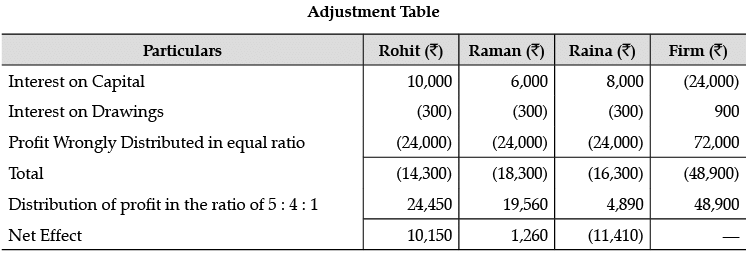

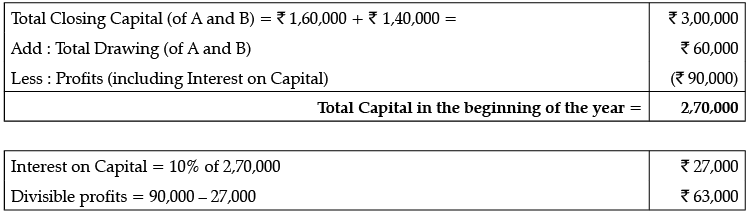

A and B are partners in the ratio of 3 : 2. The firm maintains fluctuating capital accounts and the balance of the same as on 31-03-2020 amounted to Rs. 1,60,000 and Rs. 1,40,000 for A and B respectively. Their drawings during the year were Rs. 30,000 each.

As per partnership deed interest on capital @10% p.a. on opening capitals had been provided to them. Calculate opening capitals of partners given that their profits were Rs. 90,000. Show your workings clearly.

Ans.

Working Notes :

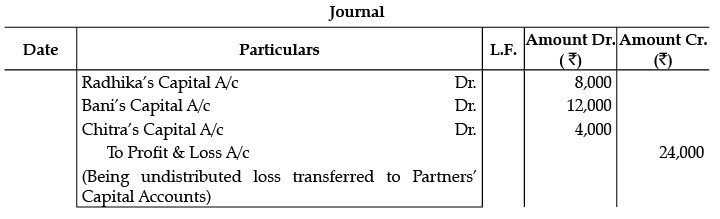

Q.16. Radhika, Bani and Chitra were partners in a firm sharing profits and losses in the ratio of 2 : 3 : 1. With effect from 1st April, 2018 they decided to share future profits and losses in the ratio of 3 : 2 : 1. On that date, their Balance Sheet showed a debit balance of Rs. 24,000 in Profit & Loss Account and a balance of Rs. 1,44,000 in General Reserve. It was also agreed that :

(a) The goodwill of the firm be valued at Rs. 1,80,000.

(b) The Land (having book value of Rs. 3,00,000) will be valued at Rs. 4,80,000.

Pass the necessary journal entries for the above changes.

Ans.

OR

OR

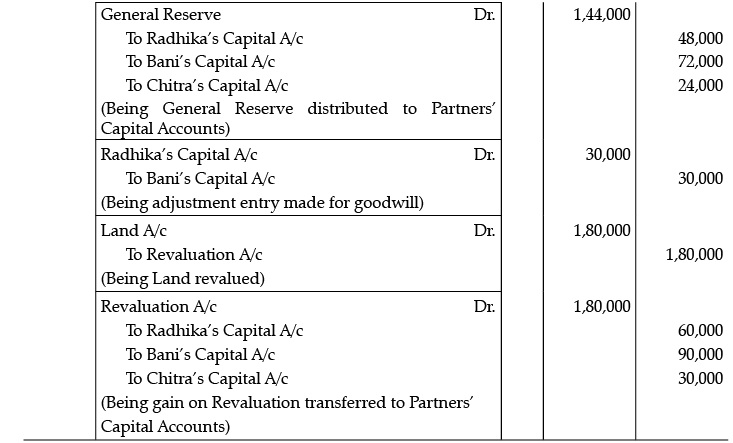

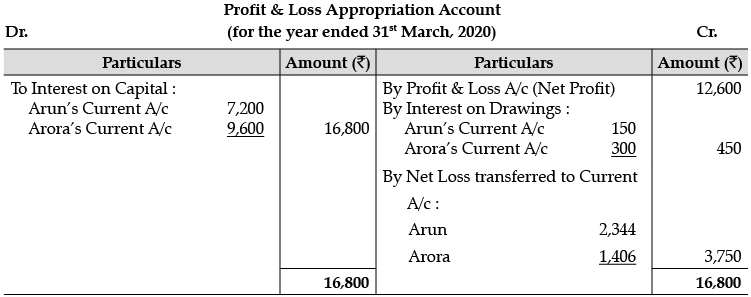

Arun and Arora were partners in a firm sharing profits in the ratio of 5 : 3. Their fixed capitals on 1·4·2019 were : Arun Rs. 60,000 and Arora Rs. 80,000. They agreed to allow interest on capital @ 12% p.a. and to charge on drawings @ 15% p.a. The profit of the firm for the year ended 31st March, 2020 before all above adjustments were Rs. 12,600. The drawings made by Arun were Rs. 2,000 and by Arora Rs. 4,000 during the year.

Prepare Profit & Loss Appropriation A/c of Arun and Arora. Show your calculations clearly. The Interest on Capital will be allowed even if the firm incurs loss.

Ans.

Working Notes :

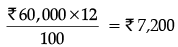

(i) Interest on Capital received by Arun =

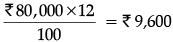

(ii) Interest on capital received by Arora =

(iii) Interest on drawings to be calculated for 6 months because date of drawing is not given :

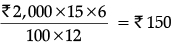

Interest on drawings given by Arun =

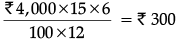

Interest on drawings given by Arora =

(iv) Loss will be distributed among partners in the ratio of 5 : 3 :

Arun’s Loss = Rs. 3,750 × 5/8 = Rs. 2,344

Arora’s Loss = Rs. 3,750 × 3/8 = Rs. 1,406

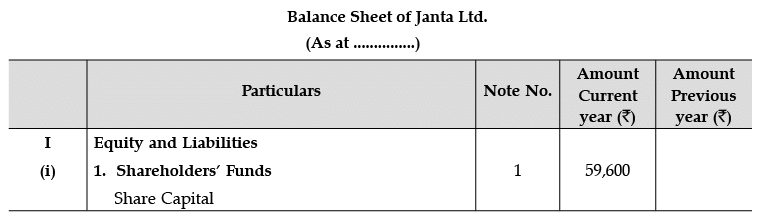

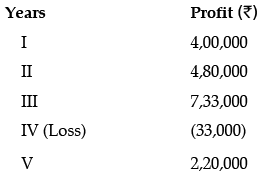

Q.17. Janta Ltd. had an authorised capital of Rs. 2,00,000 divided into equity shares of Rs. 10 each. The company offered for subscription of Rs. 10,000 shares. The issue was fully subscribed. The amount payable on application was Rs. 2 per share. Rs. 4 per share were payable each on allotment and first and final call. A share holder holding 100 shares failed to pay the allotment money. His shares were forfeited. The company did not make the final call. How the ‘Share Capital’ will be presented in the company’s balance sheet ? Also prepare Notes to Accounts for the same.

Ans.

Notes to Accounts :

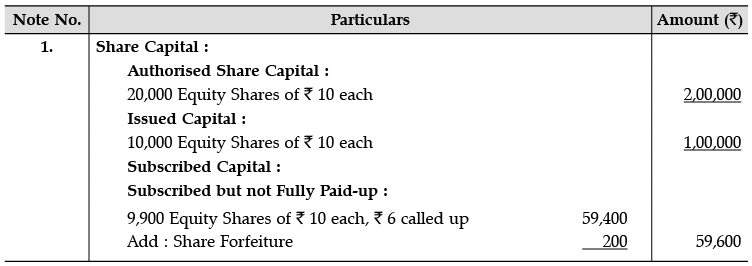

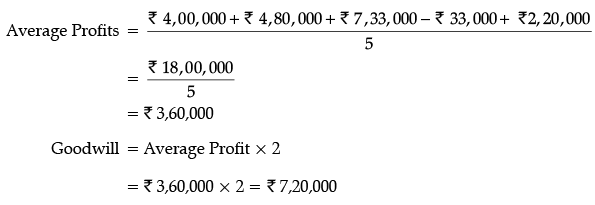

Q.18. Kumar, Gupta and Kavita were partners in a firm sharing profits and losses equally. The firm was engaged in the storage and distribution of canned juice and its godowns were located at three different places in the city. Each godown was being managed individually by Kumar, Gupta and Kavita. Because of increase in business activities at the godown managed by Gupta, he had to devote more time. Gupta demanded that his share in the profits of the firm be increased, to which Kumar and Kavita agreed. The new profit sharing ratio was agreed to be 1 : 2 : 1. For this purpose, the Goodwill of the firm was valued at two years’ purchase of the average profits of last five years. The profits of the last five years were as follows :

You are required to :

(i) Calculate the Goodwill of the firm.

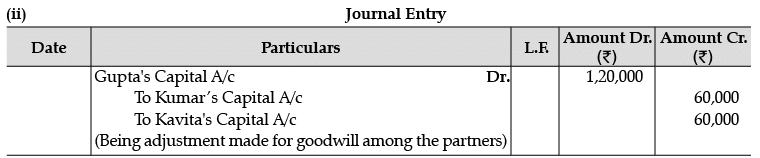

(ii) Pass necessary Journal Entry for the treatment of Goodwill on change in profit sharing ratio of Kumar, Gupta and Kavita.

Ans.

(i) Calculation of Goodwill :

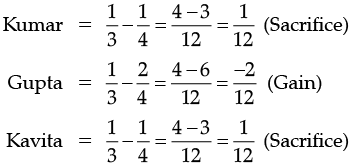

Working Notes : Calculation of Sacrificing Ratio :

Sacrificing Ratio = Old Ratio – New Ratio

Calculation of proportionate amount of goodwill adjusted among partners :

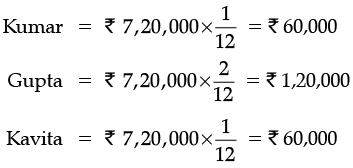

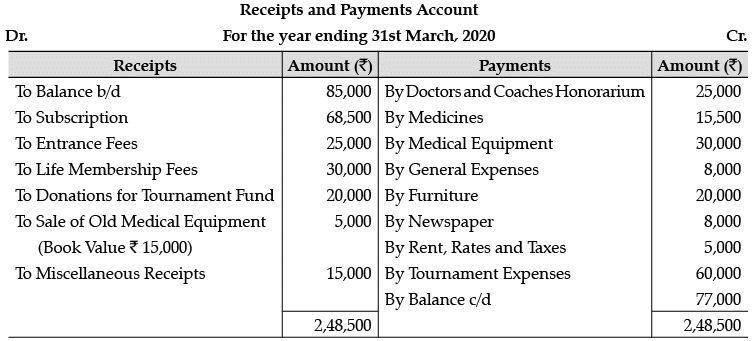

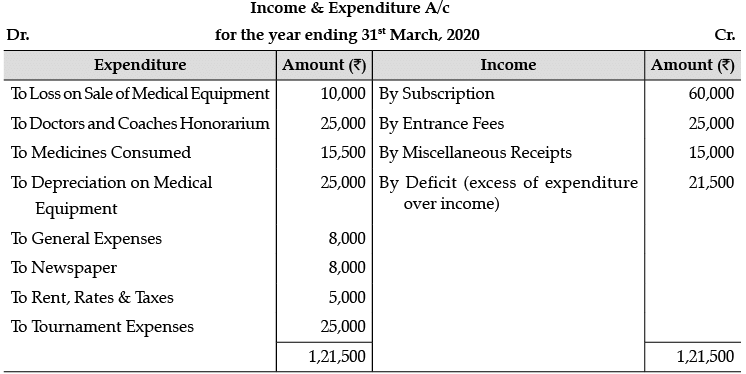

Q.19. From the following Receipts and Payments Account of Krish Fitness and Wellness Club for the year ended 31st March, 2020, prepare Income and Expenditure Account.

Additional Information : Following opening balances appeared in the books on 1st April, 2019.

(a) Tournament fund Rs. 15,000.

(b) Medical Equipment Rs. 1,50,000.

(c) Outstanding Subscription was Rs. 8,000 and Advance Subscription Rs. 5,000 (from 2019-20).

During the year 2019-20, depreciation on medical equipment was Rs. 25,000.

There were 600 members each paying an annual subscription of Rs. 100.

Ans.

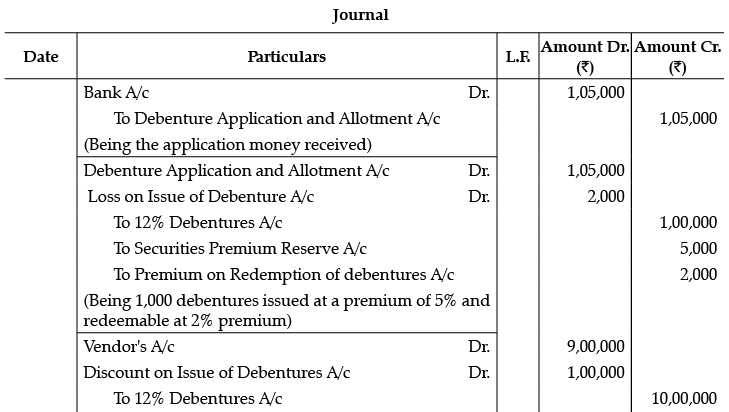

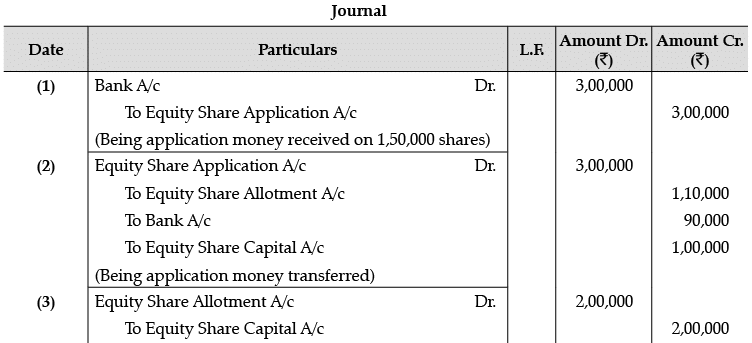

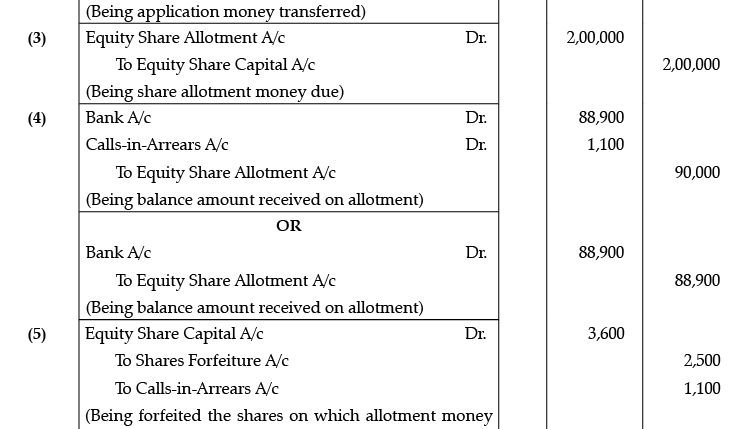

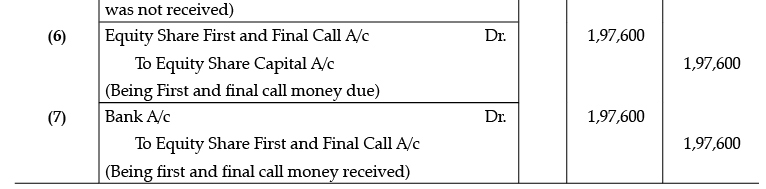

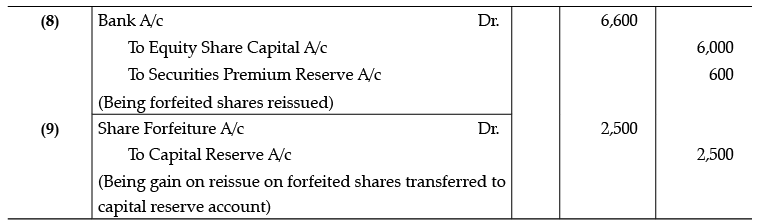

Q.20. Journalise the following transactions :

(a) Mehar Ltd. issued Rs. 1,00,000, 12% Debentures of Rs. 100 each at a premium of 5%, redeemable at a premium of 2%.

(b) 12% Debentures were issued at a discount of 10% to a vendor of machinery for payment of Rs. 9,00,000.

(c) Issue of 10,000, 11% debentures of Rs. 100 each as collateral in favour of State Bank of India. Company opted to pass necessary entry for issue of debentures.

Ans.

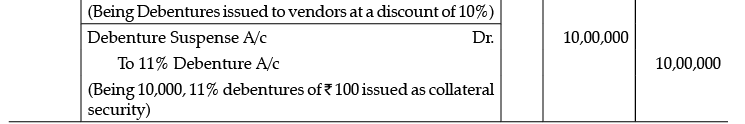

Q.21. JK Ltd. invited applications for issuing 50,000 equity shares of Rs. 10 each at per. The amount was payable as follows :

On Application : Rs. 2 per share

On Allotment : Rs. 4 per share

On First and Final Call : Balance Amount

The issue was oversubscribed three times. Applications for 30% shares were rejected and money refunded. Allotment was made to the remaining applicants as follows :

Excess money paid by the applicants who were allotted shares was adjusted towards the sums due on allotment.

Deepak, a shareholder belonging to Category I, who had applied for 1,000 shares, failed to pay the allotment money. Raju, a shareholder holding 100 shares, also failed to pay the allotment money. Raju belonged to Category II. Shares of both Deepak and Raju were forfeited immediately after allotment. Afterwards, first and final call was made and was duly received. The forfeited shares of Deepak and Raju were reissued at Rs. 11 per share fully paid up.

Pass necessary journal entries for the above transactions in the books of the company.

OR

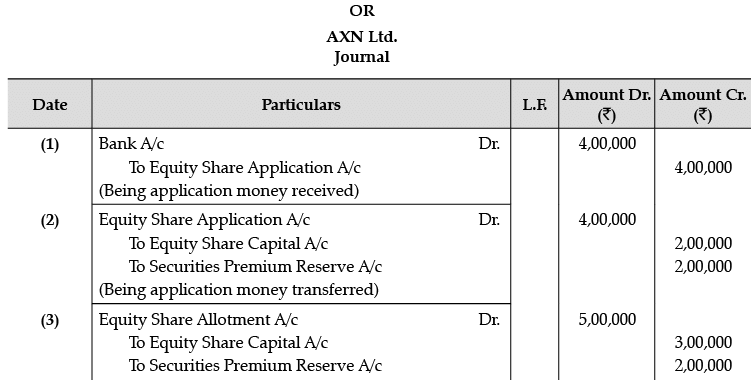

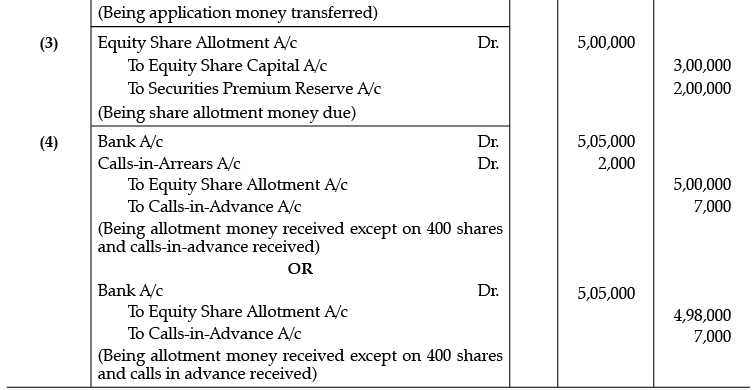

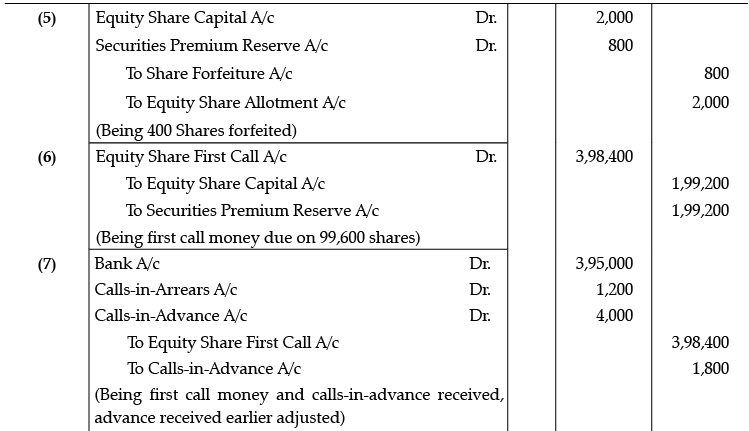

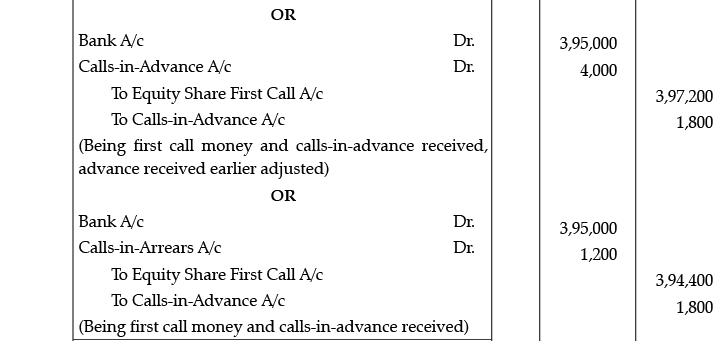

AXN Ltd. invited applications for issuing 1,00,000 equity shares of Rs. 10 each at a premium of Rs. 6 per share. The amount was payable as follows :

On Application – Rs. 4 per share (including Rs. 2 premium)

On Allotment – Rs. 5 per share (including Rs. 2 premium)

On First Call – Rs. 4 per share (including Rs. 2 premium)

On Second and Final Call – Balance Amount

The issue was fully subscribed.

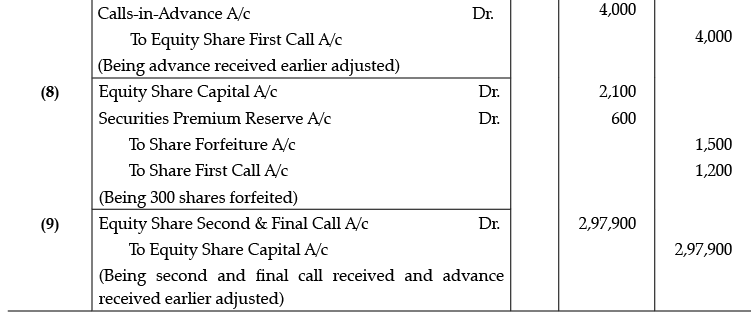

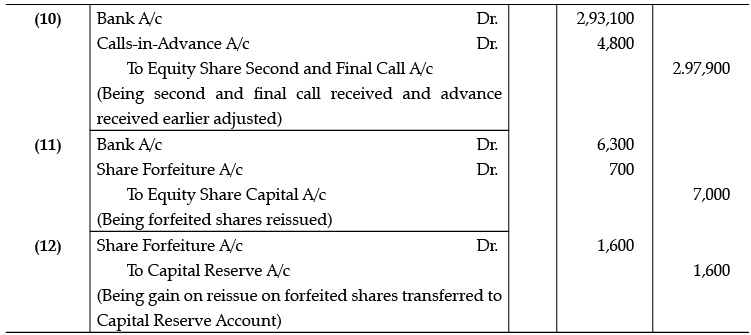

Kumar the holder of 400 shares did not pay the allotment money and Ravi the holder of 1,000 shares paid his entire share money along with allotment money. Kumar’s shares were forfeited immediately after allotment. Afterwards first call was made. Gupta a holder of 300 shares failed to pay the first call money and Gopal a holder of 600 shares paid the second call money along with first call. Gupta’s shares were forfeited immediately after the first call. Second and final call was made afterwards. The whole amount due on second call was received. All the forfeited shares were re-issued at Rs. 9 per share fully paid up.

Pass necessary Journal Entries for the above transactions in the books of the company.

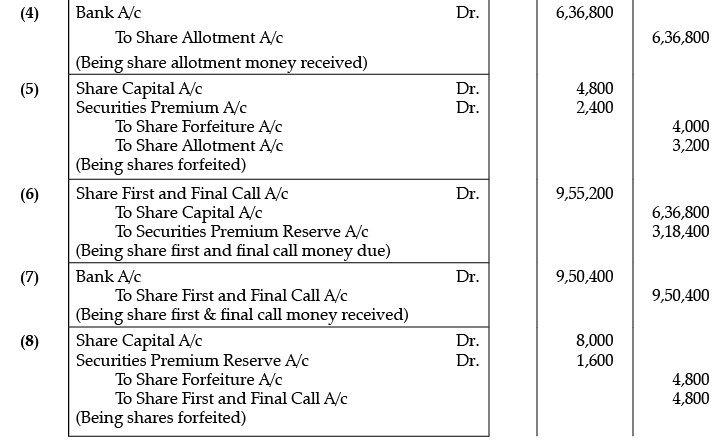

Ans.

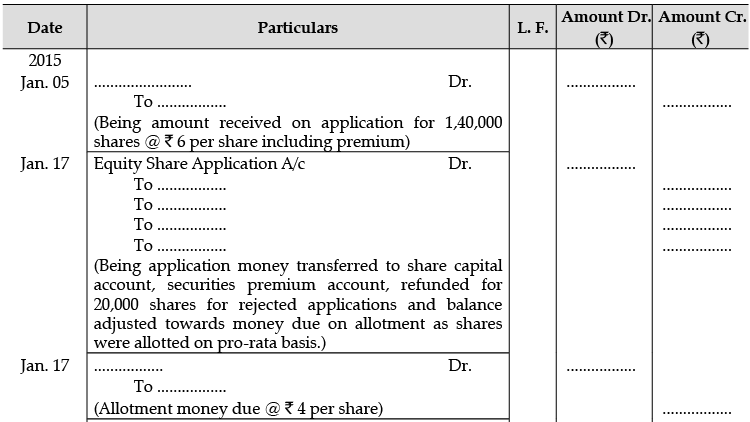

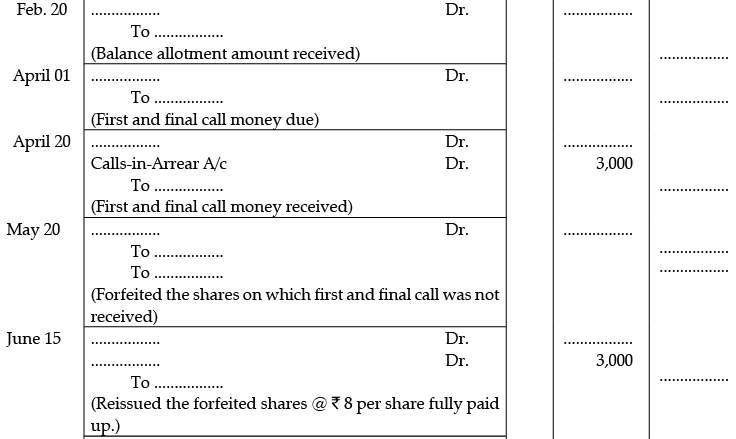

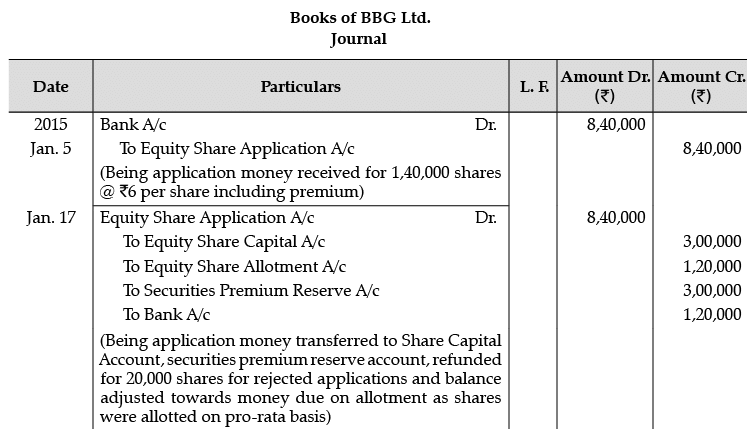

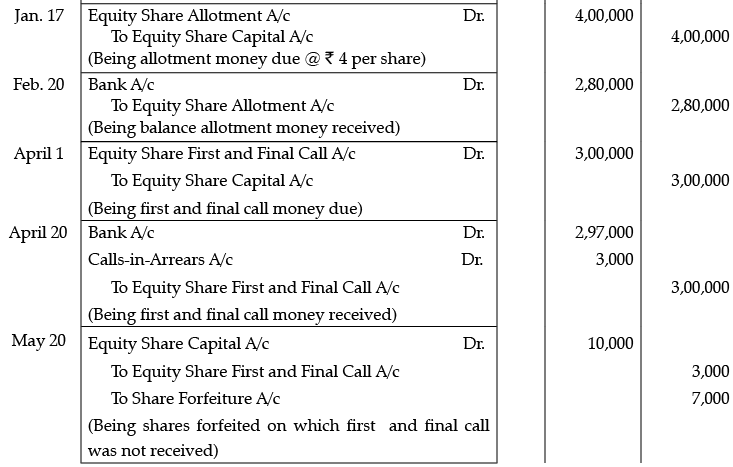

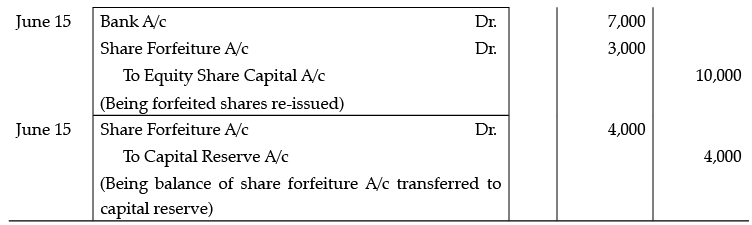

Q.22. BBG Ltd. had issued 1,00,000 equity shares of Rs. 10 each at a premium of Rs. 3 per share payable with application money. While passing the journal entries related to the issue, some blanks are left. You are required to fill these blanks :

OR

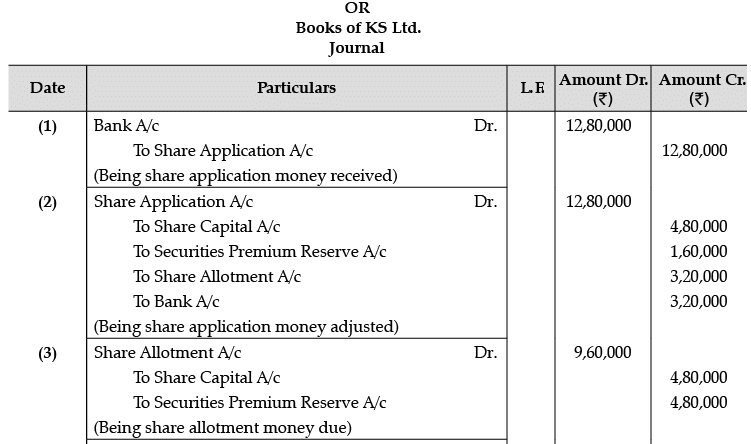

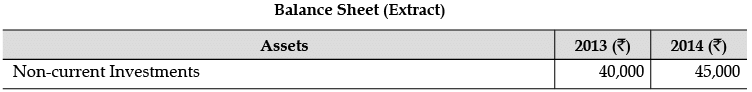

KS Ltd. invited applications for issuing 1,60,000 equity shares of Rs. 10 each at a premium of Rs. 6 per share. The amount was payable as follows :

On Application— Rs. 4 per share (including premium Rs. 1 per share)

On Allotment— Rs. 6 per share (including premium Rs. 3 per share)

One First and Final Call—Balance Applications for 3,20,000 shares were received.

Applications for 80,000 shares were rejected and application money refunded. Shares were allotted on pro-rata basis to the remaining applicants. Excess money received with applications was adjusted towards sums due on allotment. Jain holding 800 shares failed to pay the allotment money. His shares were forfeited immediately after allotment. Afterwords the final call was made. Gupta who had applied for 1,200 shares failed to pay the final call. His shares were also forfeited. Out of the forfeited shares 1,000 shares were re-issued at Rs. 8 per share fully paid-up. The re-issued shares included all the forfeited shares of Jain.

Pass necessary Journal entries for the above transactions in the books of KS Ltd.

Ans.

PART - B

(Analysis of Financial Statements)

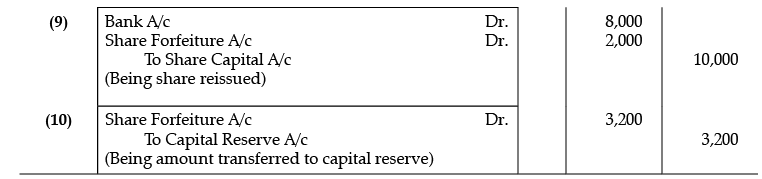

Q.23.

Additional Information:

Interest on debentures is paid on half yearly basis on 30th September and 31st March each year.

Debentures were redeemed on 30th September, 2019.

How much amount (related to above information) will be shown in Financing Activity for Cash Flow Statement prepared on 31st March, 2020?

(a) Outflow Rs. 40,000

(b) Inflow Rs. 42,600

(c) Outflow Rs. 61,600

(d) Outflow Rs. 64,000

Ans. (c) Outflow Rs. 61,600

Q.24. The operating ratio of X Ltd. is 84%. Whether conversion of Debentures into Equity Shares will :

(a) Improve

(b) Reduce

(c) No Change

(d) None of these

Ans. (c) No change

Q.25. What level of total assets to total debt ratio is considered satisfactory ?

(a) 1 : 1

(b) 2 : 1

(c) 1 : 2

(d) None of these

Ans. (a) 1 : 1

Q.26. Trade payables consists of _________ and _________ .

Ans. Sundry creditors, Bill Payable

Q.27. Proposed dividend is a liability.

Ans. Contingent

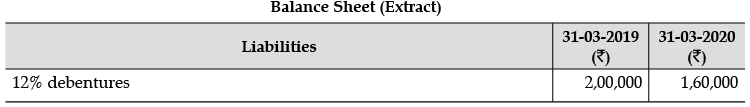

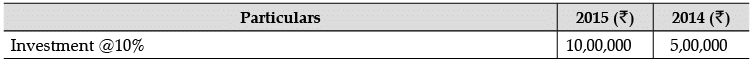

Q.28.

Additional Information :

Investment costing Rs. 10,000 were sold at a profit of 40% : How much amount (related to above information) for purchase of investment will be shown in Investing Activity of Cash Flow Statement prepared at the end of 2014 ?

(a) Rs. 14,000

(b) Rs. 15,000

(c) Rs. 10,000

(d) Rs. 25,000

Ans. (b) Rs. 15,000

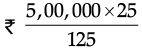

Q.29. From the following information, calculate and identify amount for purchase of investment shown in investing activities :

(a) Rs. 7,50,000

(b) Rs. 2,75,000

(c) Rs. 25,000

(d) Rs. 10,00,000

Ans. (a) Rs. 7,50,000

Q.30. (i) From the following details, calculate Opening Inventory :

Closing Inventory : Rs. 60,000; Total Revenue from Operations : Rs. 5,00,000 (including cash revenue from operations : Rs. 1,00,000); Total Purchase : Rs. 3,00,000 (including credit purchases : Rs. 60,000). Goods are sold at a profit of 25% on cost.

(ii) Current Assets of a company are 17,00,000. Its current ratio is 2.5 and liquid ratio is 0.95. Calculate Current Liabilities and Inventory of the company.

OR

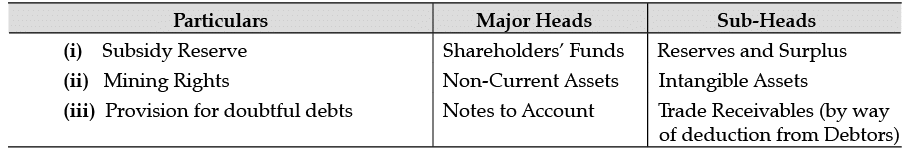

Under which heads and sub-heads will the following items to be placed in the Balance Sheet of a company as per Schedule III, Part – I of the Companies Act, 2013 :

(i) Subsidy Reserve

(ii) Mining Rights

(iii) Provision for doubtful debts

Ans. (i) Total Revenue from Operations = Rs. 5,00,000

Gross Profit =

= Rs. 1,00,000

Cost of Revenue from Operations = Net Revenue from Operations – Gross Profit

= Rs. 5,00,000 – Rs. 1,00,000

= Rs. 4,00,000

Cost of Revenue from Operations = Opening Inventory+Net Purchases – Closing Inventory

⇒ Rs. 4,00,000 = Opening Inventory + Rs. 3,00,000 – Rs. 60,000

∴ Opening Inventory = Rs. 1,60,000

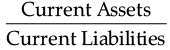

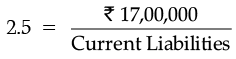

(ii) Current Ratio =

⇒

∴ Current Liabilities = Rs. 6,80,000

Liquid Ratio =

∴ Liquid Assets = Rs. 6,46,000

Inventory = Current Assets – Liquid Assets

= Rs. 17,00,000 – Rs. 6,46,000

= Rs. 10,54,000

⇒ Current Liabilities = Rs. 6,80,000

and Inventory = Rs. 10,54,000

OR

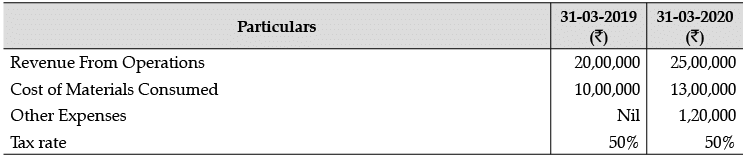

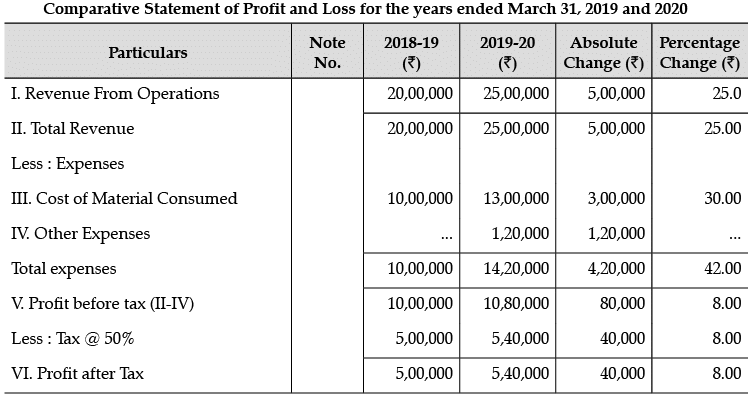

Q.31. Prepare a Comparative Statement of Profit and Loss from the following :

Ans.

OR

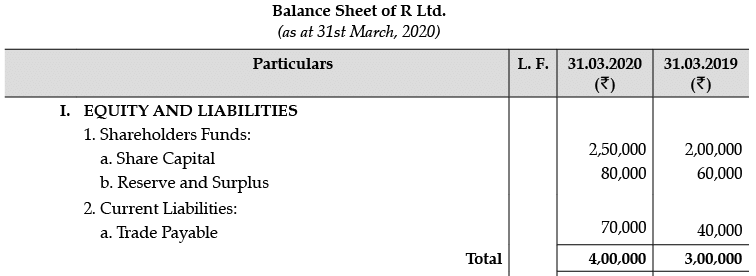

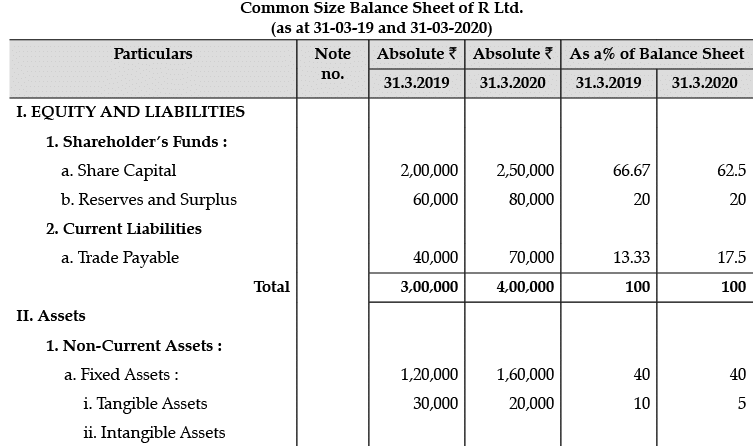

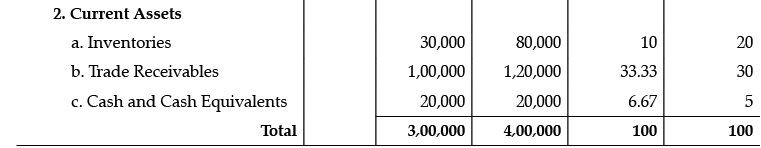

From the following Balance Sheet of R Ltd., prepare a Common Size Statement

Ans.

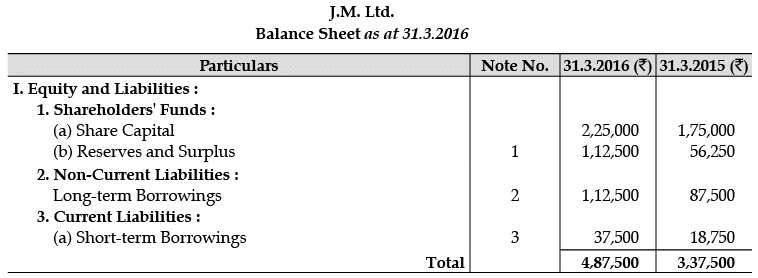

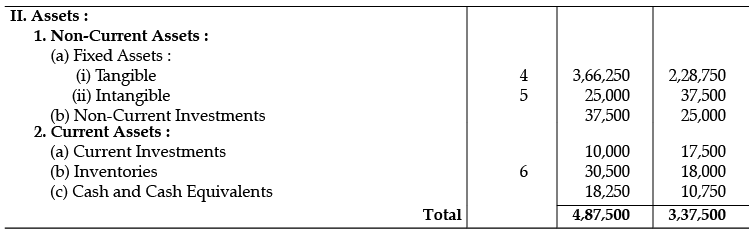

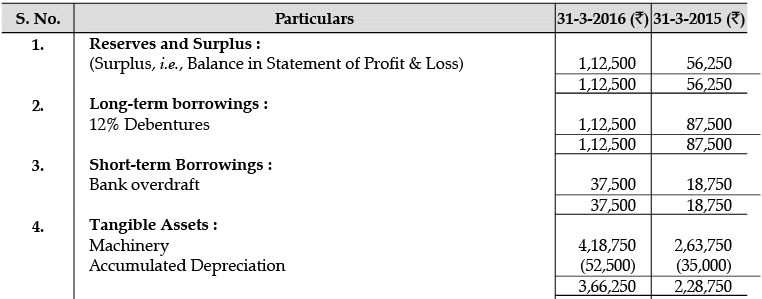

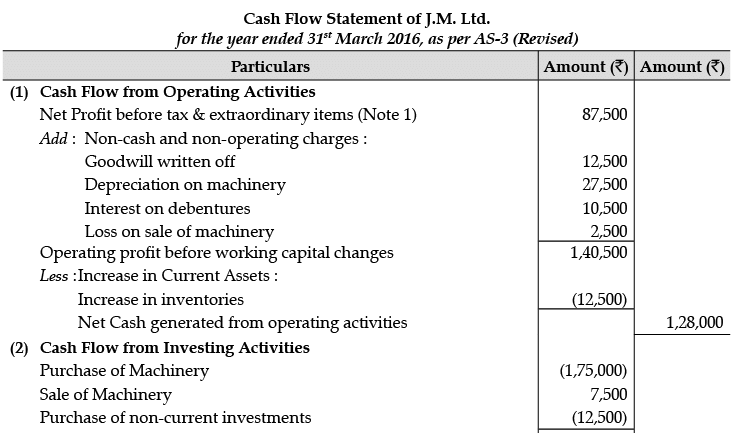

Q.32. Following is the Balance Sheet of J.M. Ltd. as at 31.3.2016 :

Notes to Accounts :

Additional Information :

(i) Rs. 25,000, 12% debentures were issued on 31.3.2016.

(ii) During the year a piece of machinery costing Rs. 20,000, on which accumulated depreciation was Rs. 10,000 was sold at a loss of Rs. 2,500.

Prepare Cash Flow Statement

Ans.

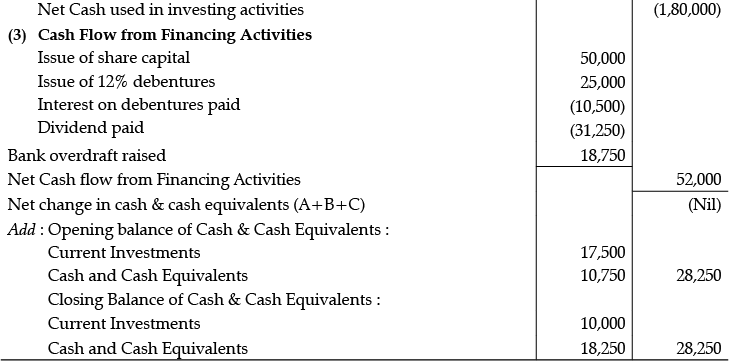

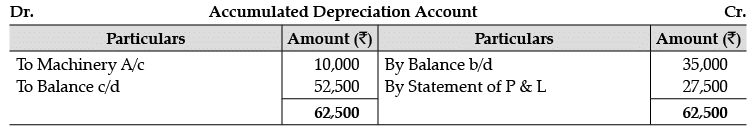

Working Notes :

|

130 docs|5 tests

|

FAQs on Accountancy: CBSE Sample Question Papers (2020-21)- 3 - Sample Papers for Class 12 Commerce

| 1. What are CBSE Sample Question Papers? |  |

| 2. How can CBSE Sample Question Papers help in exam preparation? |  |

| 3. Are CBSE Sample Question Papers available for all subjects in Class 12? |  |

| 4. How can students make the most of CBSE Sample Question Papers? |  |

| 5. Can solving CBSE Sample Question Papers guarantee good marks in the board exams? |  |