Class 10 Exam > Class 10 Notes > Social Studies (SST) Class 10 > Mindmap: Money & Credit

Mindmap: Money & Credit | Social Studies (SST) Class 10 PDF Download

The document Mindmap: Money & Credit | Social Studies (SST) Class 10 is a part of the Class 10 Course Social Studies (SST) Class 10.

All you need of Class 10 at this link: Class 10

|

63 videos|445 docs|87 tests

|

FAQs on Mindmap: Money & Credit - Social Studies (SST) Class 10

| 1. What is the importance of money and credit in the economy? |  |

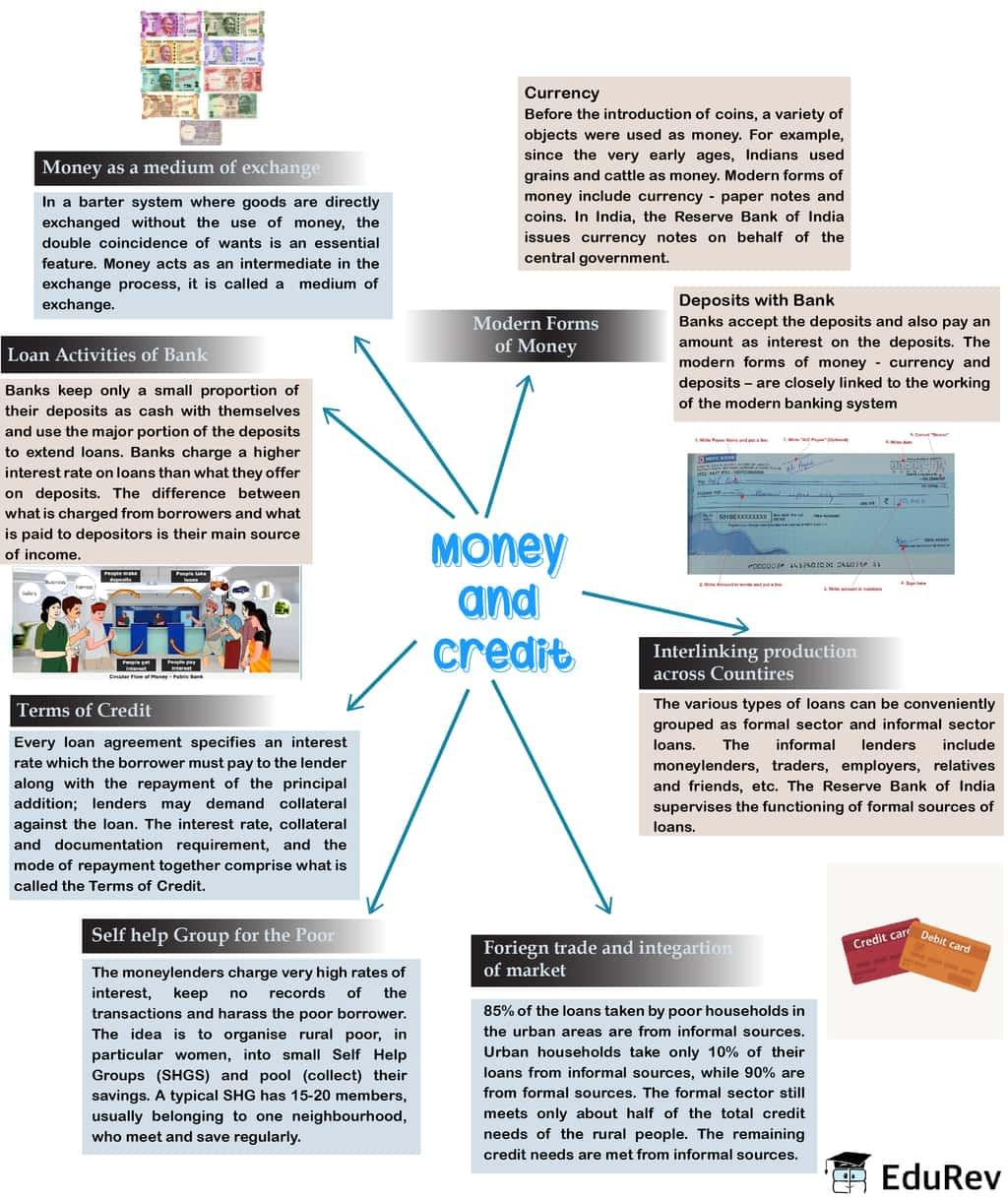

Ans. Money and credit play a vital role in the economy by facilitating the exchange of goods and services. Money serves as a medium of exchange, unit of account, and store of value, enabling transactions and economic activities. Credit, on the other hand, allows individuals and businesses to borrow funds for various purposes, such as investment, expansion, or consumption. This access to credit stimulates economic growth and can help individuals achieve their financial goals.

| 2. How does money creation occur in the banking system? |  |

Ans. Money creation in the banking system primarily occurs through the process of fractional reserve banking. When a bank receives a deposit, it keeps a fraction of it as reserves and lends out the rest. This loaned amount then becomes a deposit in another bank, which follows the same process. As this cycle continues, the total money supply expands as banks create new loans and corresponding deposits. However, this process is regulated by central banks to maintain stability and control inflation.

| 3. What are the different types of credit? |  |

Ans. There are various types of credit, including consumer credit, business credit, and government credit. Consumer credit refers to loans or credit extended to individuals for personal use, such as credit cards, mortgages, or auto loans. Business credit, on the other hand, involves loans or credit provided to companies for investment, working capital, or expansion purposes. Government credit refers to borrowing by the government to finance public expenditure, infrastructure projects, or to cover budget deficits.

| 4. How does credit affect individuals and the economy? |  |

Ans. Credit has both positive and negative impacts on individuals and the economy. On one hand, access to credit allows individuals to make significant purchases, invest in education or housing, and start businesses. It can promote economic growth by stimulating consumption and investment. However, excessive credit and debt can lead to financial instability and economic downturns. High levels of debt can burden individuals with interest payments, restrict their financial freedom, and potentially lead to bankruptcy. Moreover, if credit is not managed properly, it can contribute to economic bubbles and financial crises.

| 5. What are the factors that determine an individual's creditworthiness? |  |

Ans. Several factors are considered when determining an individual's creditworthiness. These include their credit history, which reflects their past borrowing and repayment behavior, including any defaults or late payments. The individual's income and employment stability are also crucial as they indicate their ability to repay the loan. Additionally, the individual's debt-to-income ratio, which compares their total debt to their income, is assessed. Other factors may include the length of credit history, the types of credit used, and any existing assets or collateral that can be used as security for the loan.

|

Explore Courses for Class 10 exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.

Related Searches