Finance Commission | Famous Books for UPSC Exam (Summary & Tests) PDF Download

| Table of contents |

|

| Finance Commission of India |

|

| Composition of Finance Commission of India |

|

| Functions of Finance Commission |

|

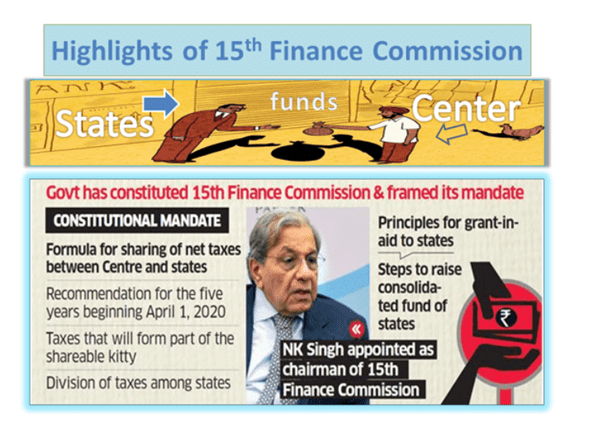

| The mandate of the 15th Commission |

|

Finance Commission of India

- Finance Commission is a constitutional body for the purpose of allocation of certain revenue resources between the Union and the State Governments.

- It was established under Article 280 of the Indian Constitution by the Indian President. It was created to define the financial relations between the Centre and the states.

- It was formed in 1951.

- Shri Ajay Narayan Jha recently joined the Fifteenth Finance Commission as its member. The 15th Finance Commission has released a report titled ‘Finance Commission in COVID Times’ on 1st February 2021.

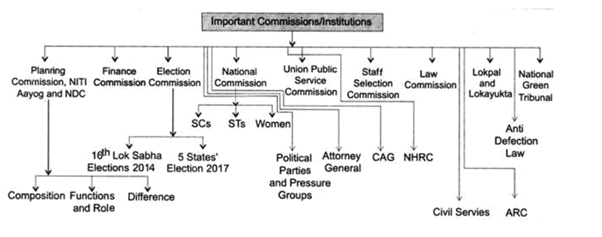

Key functions

The Commission makes recommendations to the president with regard to:

- The distribution of the proceeds of taxes between the union and the states.

- The principles which should govern the grants-in-aid to be given to the states.

- Any other matter referred to the Commission by the President in the interest of sound finance.

- The recommendations of the commission are generally accepted by the Union Government as well as by the parliament.

Articles dealing with Finance Commission of India

Article 280 of the Indian Constitution:

- President after two years of the commencement of the Indian Constitution and thereafter every 5 years, has to constitute a Finance Commission of India.

- It shall be the duty of the Commission to make recommendations to the President in relation to the:

- The distribution between the Union and the States of the net proceeds of taxes which are to be, or maybe, divided between them and the allocation between the States of the respective shares of such proceeds;

- The principles which should govern the grants in aid of the revenues of the States out of the Consolidated Fund of India;

- Any other matter referred to the Commission by the President in the interests of sound finance.

- The Commission shall determine their procedure and shall have such powers in the performance of their functions as Parliament may by law confer on them Note: President can also constitute Finance Commission before the expiry of five years as he considers necessary

Article 281 of the Indian Constitution

- It is related to the recommendations of the Finance Commission.

- The President has to lay the recommendation made by Finance Commission and its explanatory memorandum before each house of Parliament.

Members and Appointment

The Finance Commission is appointed by the President under Article 280 of the Constitution. As per the provisions contained in the Finance Commission [Miscellaneous Provisions] Act, 1951 and The Finance Commission (Salaries & Allowances) Rules, 1951, the Chairman of the Commission is elected from among persons who have had experience in public affairs, and the four other members are selected from among persons who:

- are, or have been, or are qualified to be appointed as Judges of a High Court; or

- have special knowledge of the finances and accounts of Government; or

- have had wide experience in financial matters and in administration; or

- have special knowledge of economics

Composition of Finance Commission of India

Finance Commission Chairman and Members

- Chairman: Heads the Commission and presides over the activities. He should have had public affairs experience.

- Four Members.

- The Parliament determines legally the qualifications of the members of the Commission and their selection methods.

Qualifications of Finance Commission Chairman and Members

- The 4 members should be or have been qualified as High Court judges, or be knowledgeable in finance or experienced in financial matters and are in administration, or possess knowledge in economics.

- All the appointments are made by the President of the country.

- Grounds of disqualification of members:

- found to be of unsound mind, involved in a vile act, if there is a conflict of interest.

- The tenure of the office of the Member of the Finance Commission is specified by the President of India and in some cases, the members are also re-appointed.

- The members shall give part-time or service to the Commission as scheduled by the President.

- The salary of the members is as per the provisions laid down by the Constitution.

Functions of Finance Commission

The Finance Commission makes recommendations to the president of India on the following issues:

- The net tax proceeds distribution to be divided between the Centre and the states, and the allocation of the same between states.

- The principles governing the grants-in-aid to the states by the Centre out of the consolidated fund of India.

- The steps required to extend the consolidated fund of a state to boost the resources of the panchayats and the municipalities of the state on the basis of the recommendations made by the state Finance Commission.

- Any other matter referred to it by the president in the interests of sound finance.

- The Commission decides the basis for sharing the divisible taxes by the centre and the states and the principles that govern the grants-in-aid to the states every five years.

- Any matter in the interest of sound finance may be referred to the Commission by the President.

- The Commission’s recommendations along with an explanatory memorandum with regard to the actions done by the government on them are laid before the Houses of the Parliament.

- The FC evaluates the rise in the Consolidated Fund of a state in order to affix the resources of the state Panchayats and Municipalities. The FC has sufficient powers to exercise its functions within its activity domain.

- As per the Code of Civil Procedure 1908, the FC has all the powers of a Civil Court. It can call witnesses, ask for the production of a public document or record from any office or court.

Advisory Role of Finance Commission

- The recommendations made by the Finance Commission are of an advisory nature only and therefore, not binding upon the government.

- It is up to the Government to implement its recommendations on granting money to the states.

- To put it in other words, ‘It is nowhere laid down in the Constitution that the recommendations of the commission shall be binding upon the Government of India or that it would amount to a legal right favouring the recipient states to receive the money recommended to be provided to them by the Commission.

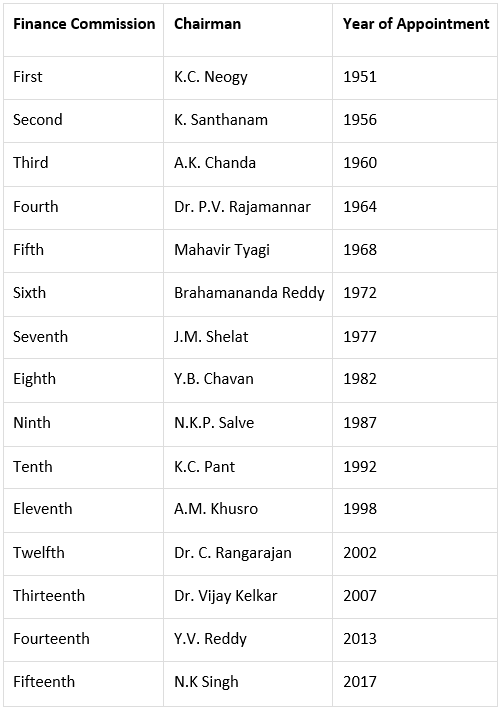

List of Finance Commissions of India

Finance Commissions list year-wise are given in the table below:

The mandate of the 15th Commission

Apart from setting rules regarding revenue distribution and granting aids to the states, the 15th finance commission has the following mandate/ terms of reference:

- Assess the impact of GST on revenues.

- Suggest a Fiscal consolidation roadmap for the Centre and the states.

- Propose performance-based incentives for States in areas including expansion and deepening of tax net under GST, moving towards replacement rate of population growth, increase in capital expenditure, eliminating losses of the power sector, promoting digital transactions and improving ease of doing business.

|

1179 videos|2219 docs|849 tests

|