Incomes which do not form part of Total Income: Notes | Taxation for CA Intermediate PDF Download

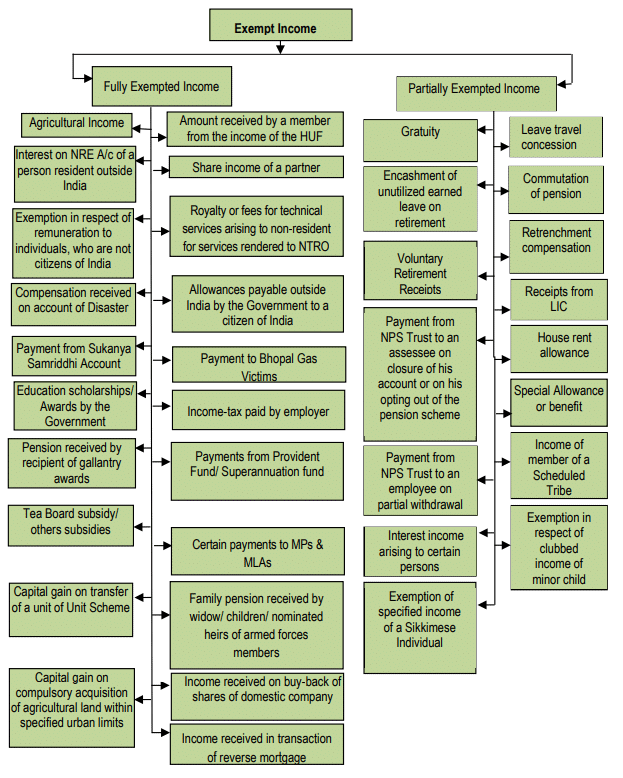

Chapter Overview

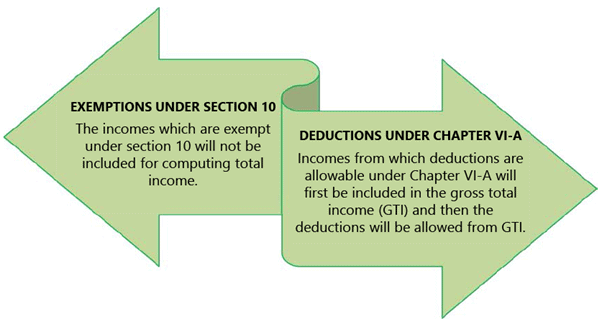

Exemption under section 10 vis-a-vis Deduction under Chapter VI-A

The various items of income referred to in the different clauses of section 10 are excluded from the total income of an assessee. These incomes are known as exempted incomes. Consequently, such income shall not enter into the computation of taxable income.

Moreover, there are certain other incomes which are included in Gross total income but are wholly or partly allowed as deductions under Chapter VI-A in computation of total income. Students should note this very important difference between exemption under section 10 and the deduction under Chapter VI-A.

Exemptions which are discussed under the relevant chapters

In this chapter, we are going to study the provisions of section 10 which enumerate the various categories of income that are exempt from tax.

Students may note that, in this chapter, only some of the exemptions as listed out in the chapter overview are discussed. The remaining exemptions are being discussed in the respective chapters as shown hereunder:

List of Exemptions Being Discussed in Respective Chapters

➤ Salaries [Chapter 4 Unit 1]

- Leave travel concession

- Allowance payable outside India by the Government to a citizen of India

- Gratuity

- Commutation of pension

- Leave Encashment

- Retrenchment Compensation

- Voluntary Retirement Receipts

- Income-tax paid by employer on non-monetary perquisite

- Payment from Provident Fund

- Payment from Superannuation Fund

- House Rent Allowance

- Special Allowance or benefit to meet expenses relating to duties or personal expenses

➤ Capital Gains [Chapter 4 Unit 4]

- Capital gain on transfer of a unit of Unit Scheme

- Income received on buy-back of shares of domestic company

- Capital gain on compulsory acquisition of agricultural land within specified urban limits

- Income received in transaction of reverse mortgage

➤ Income from Other Sources [Chapter 4 Unit 5]

- Interest income arising to certain persons

- Family pension received by widow/children/nominated heirs of armed forces members

➤ Income of Other Persons Included in Assessee's Total Income [Chapter 5]

- Exemption in respect of minor's income included in the hands of parent

➤ Deductions from Gross Total Income [Chapter 7]

- Receipts from LIC

- Payment from NPS Trust to an assessee on closure of his account or on his opting out of the pension scheme

- Payment from NPS Trust to an employee on partial withdrawal

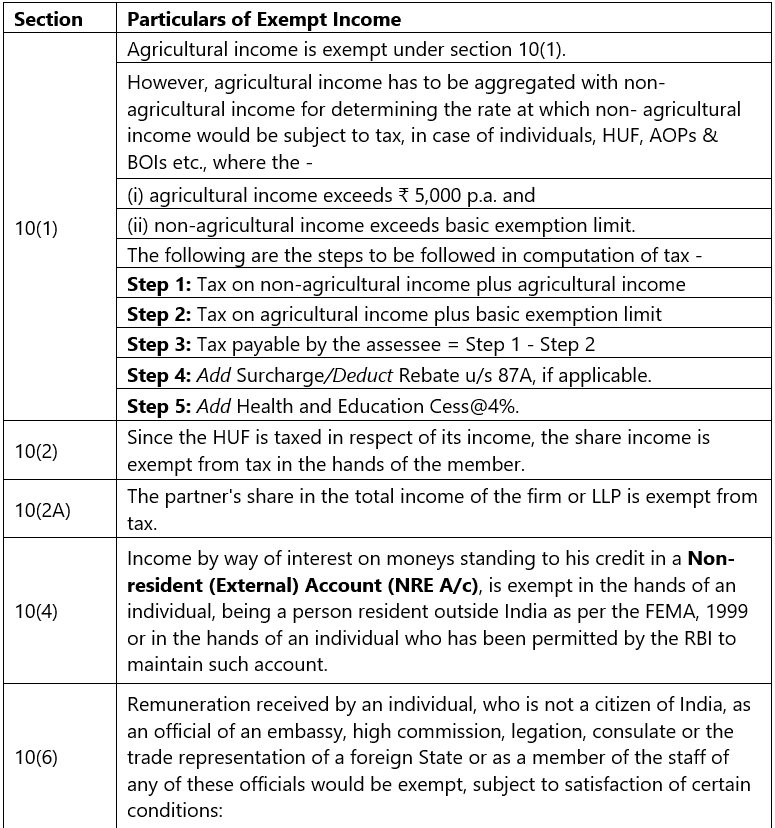

Incomes Not Included in Total Income [Section 10]

Let us now have a look at the various incomes that are exempt from tax and the conditions to be satisfied in order to be eligible for exemption.

Agricultural income [Section 10(1)]

Section 10(1) provides that agricultural income is not to be included in the total income of the assessee. The reason for total exemption of agricultural income from the scope of central income-tax is that under the Constitution, the Central Government has no power to levy a tax on agricultural income.

Definition of agricultural income [Section 2(1A)]

This definition is very wide and covers the income of not only the cultivators but also the land holders who might have rented out the lands. Agricultural income may be received in cash or in kind.

Agricultural income may arise in any one of the following three ways:-

- It may be rent or revenue derived from land situated in India and used for agricultural purposes.

- It may be income derived from such land by

(i) Agriculture or

(ii) The performance of a process ordinarily employed by a cultivator or receiver of rent in kind to render the produce fit to be taken to the market or

(iii) The sale, by a cultivator or receiver of rent in kind, of such agricultural produce raised or received by him, in respect of which no process has been performed other than a process of the nature mentioned in point (b) above. - Lastly, agricultural income may be derived from any farm building required for agricultural operations.

Now let us take a critical look at the following aspects:

1. Rent or revenue derived from land situated in India and used for agricultural purposes: The following three conditions have to be satisfied for income to be treated as agricultural income:

- Rent or revenue should be derived from land;

- land has to be situated in India (If agricultural land is situated in a foreign country, the entire income would be taxable); and

- land should be used for agricultural purposes.

The amount received in money or in kind, by one person from another for right to use land is termed as Rent. The rent can either be received by the owner of the land or by the original tenant from the sub-tenant. It implies that ownership of land is not necessary. Thus, the rent received by the original tenant from sub-tenant would also be agricultural income subject to the other conditions mentioned above.

The scope of the term “Revenue” is much broader than rent. It includes income other than rent. For example, fees received for renewal for grant of land on lease would be revenue derived from land.

2. Income derived from such land by

- Agriculture The term “Agriculture” has not been defined in the Act. However, cultivation of a field involving human skill and labour on the land can be broadly termed as agriculture.

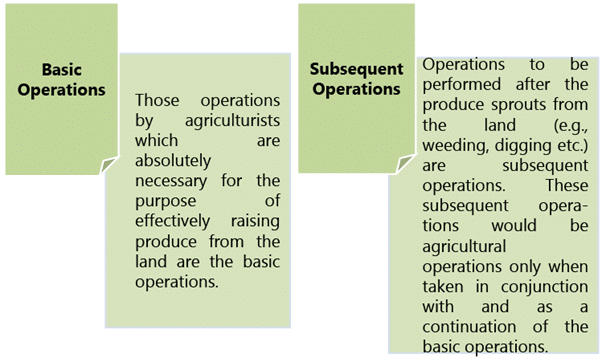

“Agriculture” means tilling of the land, sowing of the seeds and similar operations. It involves basic operations and subsequent operations.

Note: The term ‘agriculture’ cannot be extended to all activities which have some distant relation to land like dairy farming, breeding and rearing of live stock, butter and cheese making and poultry farming. This aspect is discussed in detail later on in this chapter.

Whether income from nursery constitutes agricultural income?

Yes, as per Explanation 3 to section 2(1A), income derived from saplings or seedlings grown in a nursery would be deemed to be agricultural income, whether or not the basic operations were carried out on land.

- Process ordinarily employed to render the produce fit to be taken to the market: Sometimes, to make the agricultural produce a saleable commodity, it becomes necessary to perform some kind of process on the produce. The income from the process employed to render the produce fit to be taken to the market would be agricultural income. However, it must be a process ordinarily employed by the cultivator or receiver of rent in kind and the process must be applied to make the produce fit to be taken to the market.

- The ordinary process employed to render the produce fit to be taken to market includes thrashing, winnowing, cleaning, drying, crushing etc. For example, the process ordinarily employed by the cultivator to obtain the rice from paddy is to first remove the hay from the basic grain, and thereafter to remove the chaff from the grain. The grain has to be properly filtered to remove stones etc. and finally the rice has to be packed in gunny bags for sale in the market.

- After such process, the rice can be taken to the market for sale. This process of making the rice ready for the market may involve manual operations or mechanical operations. All these operations constitute the process ordinarily employed to make the product fit for the market. The produce must retain its original character in spite of the processing unless there is no market for selling it in that condition.

However, if marketing process is performed on a produce which can be sold in its raw form, income derived therefrom is partly agricultural income and partly business income. - Sale of such agricultural produce in the market: Any income from the sale of any produce to the cultivator or receiver of rent-in kind is agricultural income provided it is from the land situated in India and used for agricultural purposes. However, if the produce is subjected to any process other than process ordinarily employed to make the produce fit for market, the income arising on sale of such produce would be partly agricultural income and partly non-agricultural income.

- Similarly, if other agricultural produce like tea, cotton, tobacco, sugarcane etc. are subjected to manufacturing process and the manufactured product is sold, the profit on such sale will consist of agricultural income as well as business income. That portion of the profit representing agricultural income will be exempted.

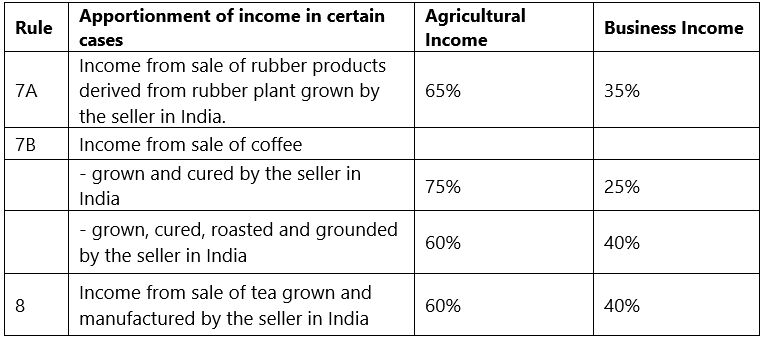

Apportionment of Income between business income and agricultural income: Rules 7, 7A, 7B & 8 of Income-tax Rules, 1962 provide the basis of apportionment of income between agricultural income and business income.

(i) Rule 7 - Income from growing and manufacturing of any product -

- Where income is partially agricultural income and partially income chargeable to income-tax as business income, the market value of any agricultural produce which has been raised by the assessee or received by him as rent in kind and which has been utilised as raw material in such business or the sale receipts of which are included in the accounts of the business shall be deducted. No further deduction shall be made in respect of any expenditure incurred by the assessee as a cultivator or receiver of rent in kind.

Determination of market value - There are two possibilities here:

- The agricultural produce is capable of being sold in the market either in its raw stage or after application of any ordinary process to make it fit to be taken to the market. In such a case, the value calculated at the average price at which it has been so sold during the relevant previous year will be the market value.

- It is possible that the agricultural produce is not capable of being ordinarily sold in the market in its raw form or after application of any ordinary process. In such case the market value will be the total of the following:

(i) The expenses of cultivation;

(ii) The land revenue or rent paid for the area in which it was grown; and

(iii) Such amount as the Assessing Officer finds having regard to the circumstances in each case to represent at reasonable profit.

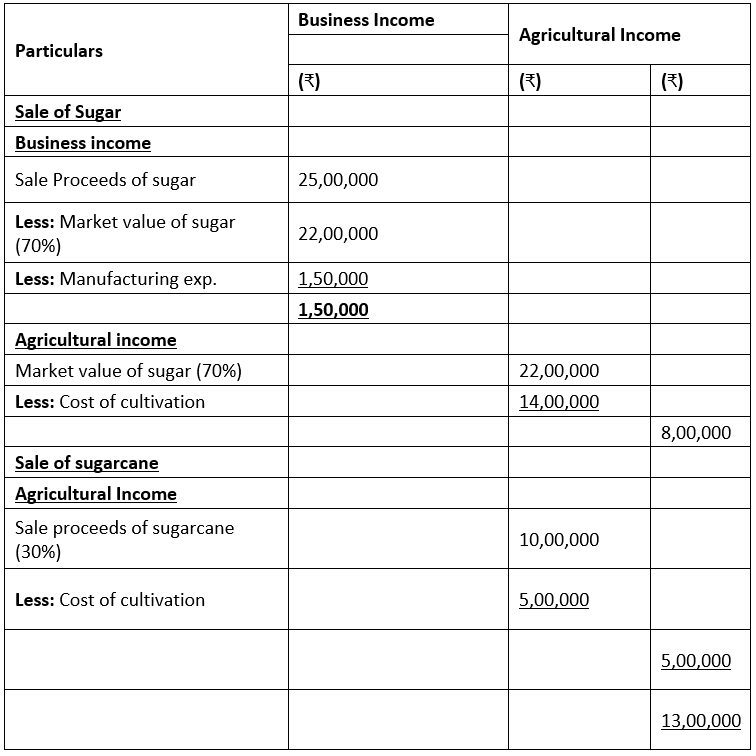

Illustration 1: Mr. B grows sugarcane and uses the same for the purpose of manufacturing sugar in his factory. 30% of sugarcane produce is sold for ₹ 10 lacs, and the cost of cultivation of such sugarcane is ₹ 5 lacs. The cost of cultivation of the balance sugarcane (70%) is ₹ 14 lacs and the market value of the same is ₹ 22 lacs. After incurring ₹ 1.5 lacs in the manufacturing process on the balance sugarcane, the sugar was sold for ₹ 25 lacs. Compute B’s business income and agricultural income.

Solution: Computation of Business Income and Agriculture Income of Mr. B

(ii) Rule 7A – Income from growing and manufacturing of rubber -

- This rule is applicable when income derived from the sale of centrifuged latex or cenex or latex based crepes or brown crepes or technically specified block rubbers manufactured or processed from field latex or coagulum obtained from rubber plants grown by the seller in India. In such cases 35% profits on sale is taxable as business income under the head “profits and gains from business or profession”, and the balance 65% is agricultural income and is exempt.

Illustration 2: Mr. C manufactures latex from the rubber plants grown by him in India. These are then sold in the market for ₹ 30 lacs. The cost of growing rubber plants is ₹ 10 lacs and that of manufacturing latex is ₹ 8 lacs. Compute his total income.

Solution: The total income of Mr. C comprises of agricultural income and business income.

Total profits from the sale of latex= ₹ 30 lacs – ₹ 10 lacs – ₹ 8 lacs = ₹ 12 lacs.

Agricultural income = 65% of ₹ 12 lacs = ₹ 7.8 lacs

Business income = 35% of ₹ 12 lacs = ₹ 4.2 lacs

(iii) Rule 7B – Income from growing and manufacturing of coffee

- In case of income derived from the sale of coffee grown and cured by the seller in India, 25% profits on sale is taxable as business income under the head “Profits and gains from business or profession”, and the balance 75% is agricultural income and is exempt.

- In case of income derived from the sale of coffee grown, cured, roasted and grounded by the seller in India, with or without mixing chicory or other flavoring ingredients, 40% profits on sale is taxable as business income under the head “Profits and gains from business or profession”, and the balance 60% is agricultural income and is exempt.

(iv) Rule 8 - Income from growing and manufacturing of tea

- This rule applies only in cases where the assessee himself grows tea leaves and manufactures tea in India. In such cases 40% profits on sale is taxable as business income under the head “Profits and gains from business or profession”, and the balance 60% is agricultural income and is exempt.

3. Income from farm building

- Income from the farm building which is owned and occupied by the receiver of the rent or revenue of any such land or occupied by the cultivator or the receiver of rent in kind, of any land with respect to which, or the produce of which, any process discussed above is carried on, would be agricultural income.

- However, the income arising from the use of such farm building for any purpose (including letting for residential purpose or for the purpose of business or profession) other than agriculture referred in (1) & (2) of para 2.1 in page 3.5 would not be agricultural income.

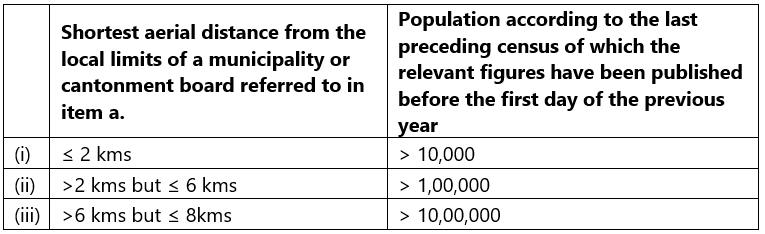

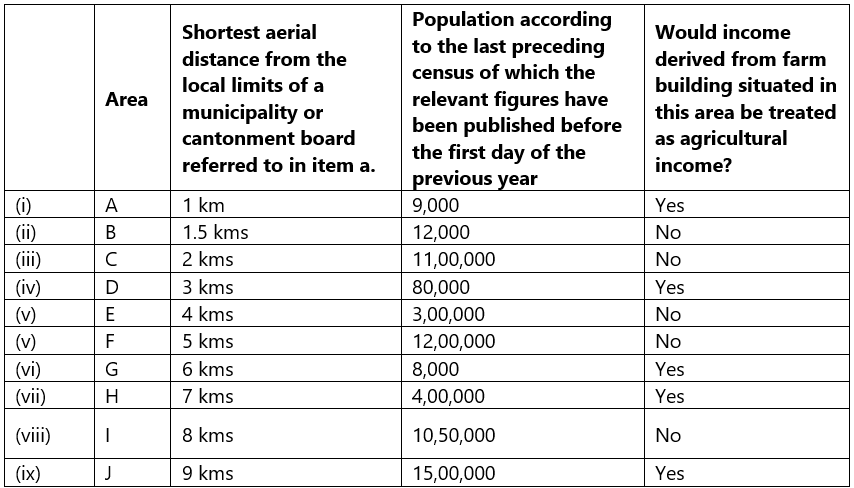

- Further, the income from such farm building would be agricultural income only if the following conditions are satisfied:

(i) The building should be on or in the immediate vicinity of the land; and

(ii) The receiver of the rent or revenue or the cultivator or the receiver of rent in kind should, by reason of his connection with such land require it as a dwelling house or as a store house.

In addition to the above conditions any one of the following two conditions should also be satisfied:

- The land should either be assessed to land revenue in India or be subject to a local rate assessed and collected by the officers of the Government as such or;

- Where the land is not so assessed to land revenue in India or is not subject to local rate:-

(i) It should not be situated in any area as comprised within the jurisdiction of a municipality or a cantonment board and which has a population not less than 10,000 or

(ii) It should not be situated in any area within such distance, measured aerially, in relation to the range of population as shown hereunder –

Example1:

Would income arising from transfer of agricultural land situated in urban area be agricultural income?

No, as per Explanation 1 to section 2(1A), the capital gains arising from the transfer of urban agricultural land would not be treated as agricultural income under section 10 but will be taxable under section 45.

Example 2: Suppose A sells agricultural land situated in New Delhi for ₹ 10 lakhs and makes a surplus of ₹ 8 lakhs over its cost of acquisition. This surplus will not constitute agricultural income exempt under section 10(1) and will be taxable under section 45.

Indirect connection with land

We have seen above that agricultural income is exempt, whether it is received by the tiller or the landlord. However, non-agricultural income does not become agricultural merely on account of its indirect connection with the land. The following examples will illustrate the above point.

Example 3: A rural society has as its principal business the selling on behalf of its member societies, butter made by these societies from cream sold to them by farmers. The making of butter was a factory process separated from the farm. The butter resulting from the factory operations separated from the farm was not an agricultural product and the society was, therefore, not entitled to exemption under section 10(1) in respect of such income.

Example 4: X was the managing agent of a company. He was entitled for a commission at the rate of 10% p.a. on the annual net profits of the company. A part of the company’s income was agricultural income. X claimed that since his remuneration was calculated with reference to income of the company, part of which was agricultural income, such part of the commission as was proportionate to the agricultural income was exempt from income tax.

Since, X received remuneration under a contract for personal service calculated on the amount of profits earned by the company; such remuneration does not constitute agricultural income.

Example 5: Y owned 100 acres of agricultural land, a part of which was used as pasture for cows. The lands were purely maintained for manuring and other purposes connected with agriculture and only the surplus milk after satisfying the assessee’s needs was sold. The question arose whether income from such sale of milk was agricultural income.

The regularity with which the sales of milk were effected and quantity of milk sold showed that the assessee carried on regular business of producing milk and selling it as a commercial proposition. Hence, it was not agricultural income.

Example 6: In regard to forest trees of spontaneous growth which grow on the soil unaided by any human skill and labour there is no cultivation of the soil at all. Even though operations in the nature of forestry operations performed by the assessee may have the effect of nursing and fostering the growth of such forest trees, it cannot constitute agricultural operations.

Income from the sale of such forest trees of spontaneous growth does not, therefore, constitute agricultural income.

Examples of Agricultural income and Non-agricultural income

For better understanding of the concept, certain examples of agricultural income and non-agricultural income are given below:

Example 7: Agricultural income

- Income derived from the sale of seeds.

- Income from growing of flowers and creepers.

- Rent received from land used for grazing of cattle required for agricultural activities.

- Income from growing of bamboo.

Example 8: Non-agricultural income

- Income from breeding of livestock.

- Income from poultry farming.

- Income from fisheries.

- Income from dairy farming.

Partial integration of agricultural income with non-agricultural income

As in the above discussion we have seen that agricultural income is exempt subject to conditions mentioned in definition clause of section 2(1A). However, a method has been laid down to levy tax on agricultural income in an indirect way. This concept is known as partial integration of agricultural income with nonagricultural income. It is applicable to individuals, HUF, AOPs, BOIs and artificial juridical persons. Two conditions which need to be satisfied for partial integration are:

- The net agricultural income should exceed ₹ 5,000 p.a., and

- Non-agricultural income should exceed the maximum amount not chargeable to tax. (i.e., ₹ 5,00,000 for resident very senior citizens, ₹ 3,00,000 for resident senior citizens, ₹ 2,50,000 for all others).

It may be noted that aggregation provisions do not apply to company, LLP, firm, co-operative society and local authority. The object of aggregating the net agricultural income with non-agricultural income is to tax the non-agricultural income at higher rates.

Tax calculation in such cases is as follows:

- Step 1: Add non-agricultural income with net agricultural income. Compute tax on the aggregate amount.

- Step 2: Add net agricultural income and the maximum exemption limit available to the assessee (i.e., ₹ 2,50,000/ ₹ 3,00,000/ ₹ 5,00,000). Compute tax on the aggregate amount.

- Step 3: Deduct the amount of income tax calculated in step 2 from the income tax calculated in step 1 i.e., Step 1 – Step 2.

- Step 4: The sum so arrived at shall be increased by surcharge, if applicable. It would be reduced by the rebate, if any, available u/s 87A.

- Step 5: Thereafter, it would be increased by health and education cess @4%.

The above concept can be clearly understood with the help of the following illustration:

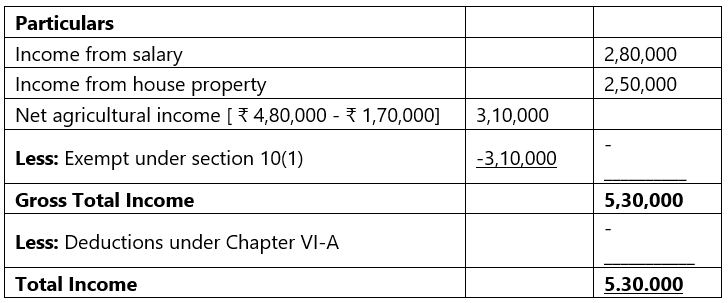

Illustration 3: Mr. X, a resident, has provided the following particulars of his income for the P.Y. 2020-21.

(i) Income from salary (computed) - ₹ 2,80,000

(ii) Income from house property (computed) - ₹ 2,50,000

(iii) Agricultural income from a land in Jaipur - ₹ 4,80,000

(iv) Expenses incurred for earning agricultural income - ₹ 1,70,000

Compute his tax liability assuming his age is -

(a) 45 years

(b) 70 years

Assuming Mr. X does not opt for the provisions of section 115BAC.

Solution: Computation of total income of Mr. X for the A.Y. 2021-22

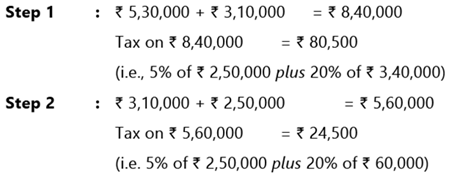

(a) Computation of tax liability (age 45 years)

For the purpose of partial integration of taxes, Mr. X has satisfied both the conditions i.e.

1. Net agricultural income exceeds ₹ 5,000 p.a., and

2. Non-agricultural income exceeds the basic exemption limit of ₹ 2,50,000.

His tax liability is computed in the following manner:

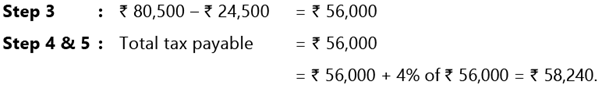

(b) Computation of tax liability (age 70 years)

For the purpose of partial integration of taxes, Mr. X has satisfied both the conditions i.e.

1. Net agricultural income exceeds ₹ 5,000 p.a., and

2. Non-agricultural income exceeds the basic exemption limit of ₹ 3,00,000.

His tax liability is computed in the following manner:

Amounts received by a member from the income of the HUF [Section 10(2)]

(i) As explained in Chapter 1, a HUF is a ‘person’ and hence, a unit of assessment under the Act. Income earned by the HUF is assessable in its own hands.

(ii) In order to prevent double taxation of one and the same income, once in the hands of the HUF which earns it and again in the hands of a member when it is paid out to him, section 10(2) provides that members of a HUF do not have to pay tax in respect of any amounts received by them from the family.

(iii) The exemption applies only in respect of a payment made by the HUF to its member

Illustration 4: Mr. A, a member of a HUF, received ₹ 10,000 as his share from the income of the HUF. Is such income includible in his chargeable income? Examine with reference to the provisions of the Income-tax Act, 1961.

Solution: No. Such income is not includible in Mr. A’s chargeable income since section 10(2) exempts any sum received by an individual as a member of a HUF where such sum has been paid out of the income of the family.

Share income of a partner [Section 10(2A)]

This clause exempts from tax a partner’s share in the total income of the firm. In other words, the partner’s share in the total income of the firm determined in accordance with the profit-sharing ratio will be exempt from tax.

Taxability of partner’s share, where the income of the firm is exempt under Chapter III/ deductible under Chapter VI-A [Circular No. 8/2014 dated 31.03.2014]

Section 10(2A) provides that a partner’s share in the total income of a firm which is separately assessed as such shall not be included in computing the total income of the partner. In effect, a partner’s share of profits in such firm is exempt from tax in his hands.

Sub-section (2A) was inserted in section 10 by the Finance Act, 1992 with effect from 1.4.1993 consequent to change in the scheme of taxation of partnership firms. Since A.Y.1993-94, a firm is assessed as such and is liable to pay tax on its total income. A partner is, therefore, not liable to tax once again on his share in the said total income.

An issue has arisen as to the amount which would be exempt in the hands of the partners of a partnership firm, in cases where the firm has claimed exemption/deduction under Chapter III or Chapter VI-A.

The CBDT has clarified that the income of a firm is to be taxed in the hands of the firm only and the same can under no circumstances be taxed in the hands of its partners. Therefore, the entire profit credited to the partners’ accounts in the firm would be exempt from tax in the hands of such partners, even if the income chargeable to tax becomes Nil in the hands of the firm on account of any exemption or deduction available under the provisions of the Act.

Interest on moneys standing to the credit of individual in his NRE A/c [Section 10(4)(ii)]

As per section 10(4)(ii), in the case of an individual, any income by way of interest on moneys standing to his credit in a Non-resident (External) Account (NRE A/c) in any bank in India in accordance Foreign Exchange Management Act, 1999 (FEMA, 1999), and the rules made thereunder, would be exempt, provided such individual;

- is a person resident outside India, as defined in FEMA, 1999, or

- is a person who has been permitted by the Reserve Bank of India to maintain such account.

In this context, it may be noted that the joint holders of the NRE Account do not constitute an AOP by merely having these accounts in joint names. The benefit of exemption under section 10(4)(ii) will be available to such joint account holders, subject to fulfillment of other conditions contained in that section by each of the individual joint account holders.

Remuneration received by individuals, who are not citizens of India [Section 10(6)]

Individual assessees who are not citizens of India are entitled to certain exemptions:

- Remuneration received by officials of Embassies etc. of Foreign States [Section 10(6)(ii)] The remuneration received by a person for services as an official of an embassy, high commission, legation, commission, consulate or the trade representation of a foreign State or as a member of the staff of any of these officials is exempt.

- Conditions:

(a) The remuneration received by our corresponding Government officials or members of the staff resident in such foreign countries should be exempt.

(b) The above-mentioned members of the staff should be the subjects of the respective countries represented and should not be engaged in any other business or profession or employment in India. - Remuneration received for services rendered in India as an employee of foreign enterprise [Section 10(6)(vi)]

Remuneration received by a foreign national as an employee of a foreign enterprise for service rendered by him during his stay in India is also exempt from tax. - Conditions:

(a) The foreign enterprise is not engaged in any business or trade;

(b) The employee’s stay in India does not exceed 90 days during the previous year;

(c) The remuneration is not liable to be deducted from the employer’s income chargeable to tax under the Act. - Salary received by a non-citizen non-resident for services rendered in connection with employment on foreign ship [Section 10(6)(viii)] Salary income received by or due to a non-citizen of India who is also nonresident for services rendered in connection with his employment on a foreign ship is exempt where his total stay in India does not exceed 90 days during the previous year.

- Remuneration received by Foreign Government employees during their stay in India for specified training [Section 10(6)(xi)]

Any remuneration received by employees of foreign Government from their respective Government during their stay in India, is exempt from tax, if such remuneration is received in connection with their training in any establishment or office of or in any undertaking owned by –

(a) The Government; or

(b) Any company wholly owned by the Central or any State Government(s) or jointly by the Central and one or more State Governments; or

(c) Any company which is subsidiary of a company referred to in (b) above; or

(d) Any statutory corporation; or

(e) Any society registered under the Societies Registration Act, 1860 or any other similar law, which is wholly financed by the Central Government or any State Government(s) or jointly by the Central and one or more State Governments.

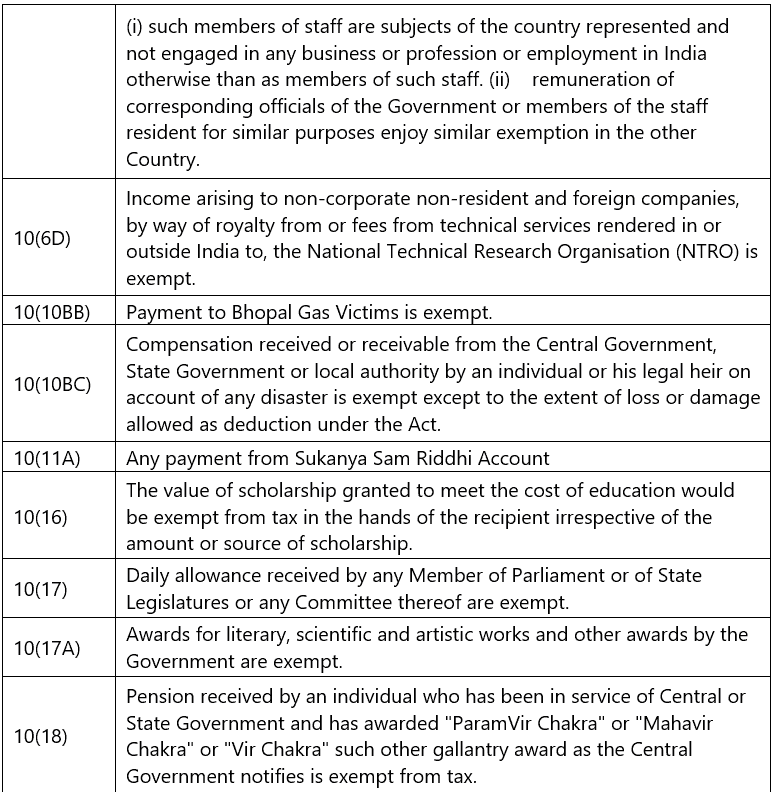

Royalty income or fees for technical services received from National Technical Research Organisation (NTRO) [Section 10(6D)]

Income arising to non-corporate non-residents and foreign companies, by way of royalty from, or fees from technical services rendered in or outside India to, the National Technical Research Organisation (NTRO) is exempt.

Payments to Bhopal Gas Victims [Section 10(10BB)]

Any payment made to a person under Bhopal Gas Leak Disaster (Processing of Claims) Act, 1985 and any scheme framed thereunder will be fully exempt. However, payments made to any assessee in connection with Bhopal Gas Leak Disaster to the extent he has been allowed a deduction under the Act on account of any loss or damage caused to him by such disaster will not be exempted.

Compensation received on account of disaster [Section 10(10BC)]

- This clause exempts any amount received or receivable as compensation by an individual or his legal heir on account of any disaster.

- Such compensation should be granted by the Central Government or a State Government or a local authority.

- However, exemption would not be available in respect of compensation for alleviating any damage or loss, which has already been allowed as deduction under the Act.

- "Disaster" means a catastrophe, mishap, calamity or grave occurrence in any area, arising from natural or manmade causes, or by accident or negligence. It should have the effect of causing -

(i) Substantial loss of life or human suffering; or

(ii) Damage to, and destruction of, property; or

(iii) Damage to, or degradation of, environment.

It should be of such a nature or magnitude as to be beyond the coping capacity of the community of the affected area.

Illustration 5: Compensation on account of disaster received from a local authority by an individual or his/her legal heir is taxable. Examine the correctness of the statement with reference to the provisions of the Income-tax Act, 1961.

Solution: The statement is not correct. As per section 10(10BC), any amount received or receivable as compensation by an individual or his/her legal heir on account of any disaster from the Central Government, State Government or a local authority is exempt from tax. However, the exemption is not available to the extent such individual or legal heir has already been allowed a deduction under this Act on account of such loss or damage caused by such disaster.

Payment from Sukanya Samriddhi Account [Section 10(11A)]

Section 10(11A) provides that any payment from an account opened in accordance with the Sukanya Samriddhi Account Rules, 2014, made under the Government Savings Bank Act, 1873, shall not be included in the total income of the assessee.

Accordingly, the interest accruing on deposits in, and withdrawals from any account under the said scheme would be exempt.

Educational scholarships [Section 10(16)]

The value of scholarship granted to meet the cost of education would be exempt from tax in the hands of the recipient irrespective of the amount or source of scholarship.

Payments to MPs & MLAs [Section 10(17)]

The following incomes of Members of Parliament or State Legislatures will be exempt:

- Daily Allowance: Daily allowance received by any Member of Parliament or of any State Legislatures or any Committee thereof.

- Constituency Allowance of MPs: In the case of a Member of Parliament, any allowance received under Members of Parliament (Constituency Allowance) Rules, 1986; and

- Constituency allowance of MLAs: Any constituency allowance received by any person by reason of his membership of any State Legislature under any Act or rules made by that State Legislature.

Awards for literary, scientific and artistic works and other awards by the Government [Section 10(17A)]

Any award instituted in the public interest by the Central/State Government or by any other body approved by the Central Government and a reward by Central/State Government for such purposes as may be approved by the Central Government in public interest, will enjoy exemption under this clause.

Pension received by recipient of gallantry awards [Section 10(18)]

- Any income by way of pension received by an individual is exempt from income-tax if –

(a) such individual was an employee of Central or State Government and

(b) has been awarded “Param Vir Chakra” or “Maha Vir Chakra” or “Vir Chakra” or such other gallantry award notified by the Central Government in this behalf. - In case of the death of such individual, any income by way of family pension received by any member of the family of such individual shall also be exempt under this clause.

- Family, in relation to an individual, means –

(a) The spouse and children of the individual; and

(b) The parents, brothers and sisters of the individuals or any of them, wholly or mainly dependent on the individual.

Exemption of disability pension granted to disabled personnel of armed forces who have been invalided on account of disability attributable to or aggravated by such service [Circular No. 13/2019, dated 24.6.2019]

The entire disability pension, i.e. “disability element” and “service element” of pension granted to members of naval, military or air forces who have been invalided out of naval, military or air force service on account of bodily disability attributable to or aggravated by such service would be exempt from tax.

The CBDT has, vide this circular, clarified that exemption in respect of disability pension would be available to all armed forces personnel (irrespective of rank) who have been invalided out of such service on account of bodily disability attributable to or aggravated by such service. However, such tax exemption will be available only to armed forces personnel who have been invalided out of service on account of bodily disability attributable to or aggravated by such service and not to personnel who have been retired on superannuation or otherwise.

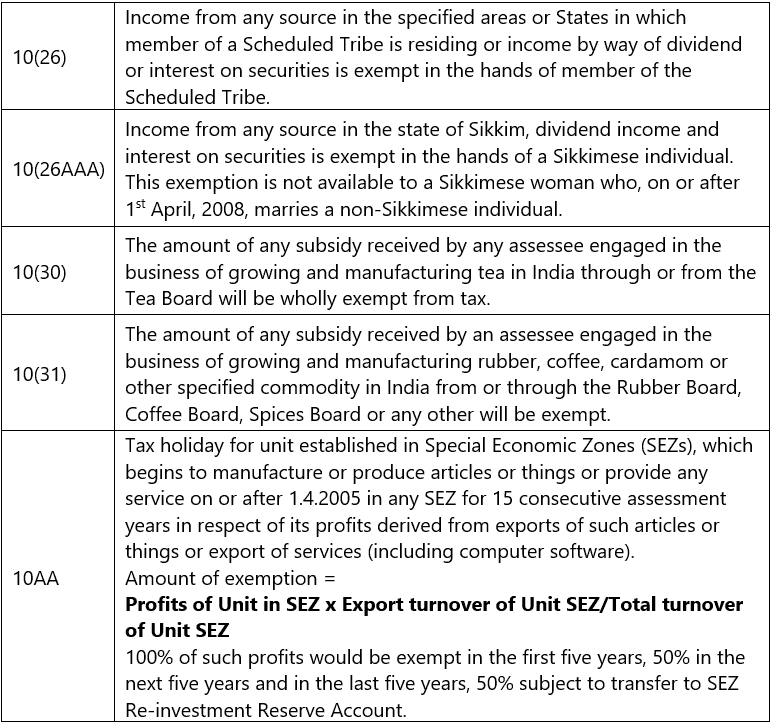

Income of member of a Scheduled Tribe [Section 10(26)]

A member of a Scheduled Tribe residing in -

- Any area specified in the Constitution i.e., The North Cachar Hills District, The Karbi Anglong District, The Bodoland Territorial Areas District, Khasi Hills District, Jaintia Hills District or The Garo Hills District or

- In the States of Manipur, Tripura, Arunachal Pradesh, Mizoram and Nagaland, or

- In Ladakh is exempt from tax on his income arising or accruing –

(a) from any source in the areas or States aforesaid.

(b) by way of dividend or interest on securities.

Specified income of a Sikkimese Individual [Section 10(26AAA)]

- The following income, which accrues or arises to a Sikkimese individual, would be exempt from income-tax –

(a) Income from any source in the State of Sikkim; or

(b) Income by way of dividend or interest on securities. - However, this exemption will not be available to a Sikkimese woman who, on or after 1st April, 2008, marries a non-Sikkimese individual.

Illustration 6: “Exemption is available to a Sikkimese individual, only in respect of income from any source in the State of Sikkim”. Examine the correctness of the statement with reference to the provisions of the Income-tax Act, 1961.

Solution: The statement is not correct. Exemption under section 10(26AAA) is available to a Sikkimese individual not only in respect of the said income, but also in respect of income by way of dividend or interest on securities.

Tea board subsidy [Section 10(30)]

The amount of any subsidy received by any assessee engaged in the business of growing and manufacturing tea in India through or from the Tea Board will be wholly exempt from tax.

- Conditions:

(a) The subsidy should have been received under any scheme for replantation or replacement of the bushes or for rejuvenation or consolidation of areas used for cultivation of tea, as notified by the Central Government.

(b) The assessee should furnish a certificate from the Tea Board, as to the amount of subsidy received by him during the previous year, to the Assessing Officer along with his return of the relevant assessment year or within the time extended by the Assessing Officer for this purpose.

Other subsidies [Section 10(31)]

Amount of any subsidy received by an assessee engaged in the business of growing and manufacturing rubber, coffee, cardamom or other specified commodity in India, as notified by the Central Government, will be wholly exempt from tax.

- Conditions:

(a) The subsidies should have been received from or through the Rubber Board, Coffee Board, Spices Board or any other Board in respect of any other commodity under any scheme for replantation or replacement of rubber, coffee, cardamom or other plants or for rejuvenation or consolidation of areas used for cultivation of all such commodities.

(b) The assessee should furnish a certificate from the Board, as to the amount of subsidy received by him during the previous year, to the Assessing Officer along with his return of the relevant assessment year or within the time extended by the Assessing Officer for this purpose.

Students should carefully note that all the items under section 10 listed above are either wholly or partially exempt from taxation and the exempt portion is not even includible in the total income of the person concerned.

Tax Holiday for Units Established In Special Economic Zones [Section 10AA]

A deduction of profits and gains which are derived by an assessee being an entrepreneur from the export of articles or things or providing any service, shall be allowed from the total income of the assessee.

1. Assessees who are eligible for exemption:

Exemption is available to all categories of assessees who derive any profits or gains from an undertaking, being a unit, engaged in the manufacturing or production of articles or things or provision of any service. Such assessee should be an entrepreneur referred to in section 2(j) of the SEZ Act, 2005 i.e., a person who has been granted a letter of approval by the Development Commissioner under section 15(9) of the said Act.

2. Essential conditions to claim exemption:

The exemption shall apply to an undertaking which fulfils the following conditions:

- It has begun to manufacture or produce articles or things or provide any service in any SEZ during the previous year relevant to A.Y.2006-07 or any subsequent assessment year but not later than A.Y.2020-21.

However, in case where letter of approval, required to be issued in accordance with the provisions of the SEZ Act, 2005, has been issued on or before 31st March, 2020 and the manufacture or production of articles or things or providing services has not begun on or before 31st March, 2020 then, the date for manufacture or production of articles or things or providing services has been extended to 31st March, 2021 or such other date after 31st March, 2021, as notified by the Central Government.

Example 9: If the SEZ unit has received the necessary approval by 31.3.2020 and begins manufacture or production of articles or things or providing services on or before 31st March, 2021, then it would be deemed to have begun manufacture or production of articles or things or providing services during the A.Y. 2020-21 and would be eligible for exemption under section 10AA. [The Taxation and Other Laws (Relaxation of Certain Provisions) Act, 2020] - The assessee should furnish in the prescribed form, before the date specified in section 44AB i.e., one month prior to the due date for furnishing return of income u/s 139(1), the report of a chartered accountant certifying that the deduction has been correctly claimed.

Example 10: An individual, subject to tax audit u/s 44AB, claiming deduction u/s 10AA is required to furnish return of income on or before 31.10.2021 and the report of a chartered accountant before 30.9.2021, certifying the deduction claimed u/s 10AA.

3. Period for which deduction is available:

The unit of an entrepreneur, which begins to manufacture or produce any article or thing or provide any service in a SEZ on or after 1.4.2005, shall be allowed a deduction of:

- 100% of the profits and gains derived from the export, of such articles or things or from services for a period of 5 consecutive assessment years beginning with the assessment year relevant to the previous year in which the Unit begins to manufacture or produce such articles or things or provide services, and

- 50% of such profits and gains for further 5 assessment years.

- So much of the amount not exceeding 50% of the profit as is debited to the profit and loss account of the previous year in respect of which the deduction is to be allowed and credited to a reserve account (to be called the "Special Economic Zone Re-investment Reserve Account") to be created and utilised in the manner laid down under section 10AA(2) for next 5 consecutive years.

- However, Explanation below section 10AA(1) has been inserted to clarify that amount of deduction under section 10AA shall be allowed from the total income of the assessee computed in accordance with the provisions of the Act before giving effect to the provisions of this section and the deduction under section 10AA shall not exceed such total income of the assessee.

- Example 11: An undertaking is set up in a SEZ and begins manufacturing on 15.10.2006. The deduction under section 10AA shall be allowed as under:

(a) 100% of profits of such undertaking from exports from A.Y.2007-08 to A.Y.2011-12.

(b) 50% of profits of such undertaking from exports from A.Y.2012-13 to A.Y. 2016-17.

(c) 50% of profits of such undertaking from exports from A.Y.2017-18 to A.Y.2021-22 provided certain conditions are satisfied.

4. Conditions to be satisfied for claiming deduction for further 5 years (after 10 years) [Section 10AA(2)]:

Sub-section (2) provides that the deduction under (3)(iii) above shall be allowed only if the following conditions are fulfilled, namely

(i) The amount credited to the Special Economic Zone Re-investment Reserve Account is utilised-

- For the purposes of acquiring machinery or plant which is first put to use before the expiry of a period of three years following the previous year in which the reserve was created; and

- Until the acquisition of the machinery or plant as aforesaid, for the purposes of the business of the undertaking. However, it should not be utilized for

(a) Distribution by way of dividends or profits; or

(b) For remittance outside India as profits; or

(c) For the creation of any asset outside India;

(ii) The particulars, as may be specified by the CBDT in this behalf, have been furnished by the assessee in respect of machinery or plant. Such particulars include details of the new plant/machinery, name and address of the supplier of the new plant/machinery, date of acquisition and date on which new plant/machinery was first put to use. Such particulars have to be furnished along with the return of income for the assessment year relevant to the previous year in which such plant or machinery was first put to use.

5. Consequences of mis-utilisation/ non-utilisation of reserve [Section 10AA(3)]

Where any amount credited to the Special Economic Zone Re-investment Reserve Account -

- Has been utilised for any purpose other than those referred to in subsection (2), the amount so utilized shall be deemed to be the profits in the year in which the amount was so utilised and charged to tax accordingly; or

- Has not been utilised before the expiry of the said period of 3 years, the amount not so utilised, shall be deemed to be the profits in the year immediately following the said period of three years and be charged to tax accordingly.

6. Computation of profits and gains from exports of such undertakings

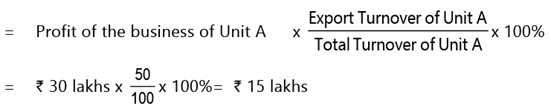

The profits derived from export of articles or things or services (including computer software) shall be the amount which bears to the profits of the business of the undertaking, being the unit, the same proportion as the export turnover in respect of such articles or things or services bears to the total turnover of the business carried on by the undertaking i.e.

Profits of Unit in SEZ x Export turnover of Unit SEZ/Total turnover of Unit SEZ

Clarification on issues relating to export of computer software

Section 10AA provides deduction to assessees who derive any profits and gains from export of articles or things or services (including computer software) from the year in which the Unit begins to manufacture or produce such articles or things or provide services, as the case may be, subject to fulfillment of the prescribed conditions. The profits and gains derived from the on site development of computer software (including services for development of software) outside India shall be deemed to be the profits and gains derived from the export of computer software outside India.

Meaning of Export turnover: It means the consideration received in India or brought into India by the assessee in respect of export by the undertaking being the unit of articles or things or services.

However, it does not include

- Freight

- Telecommunication charges

- Insurance

Attributable to the delivery of the articles or things outside India or expenses incurred in foreign exchange in rendering of services (including computer software) outside India.

Clarification on issues relating to deduction of freight, telecommunication charges and other expenses from total turnover

"Export turnover", inter alia, does not include freight, telecommunication charges or insurance attributable to the delivery of the articles or things outside India or expenses, if any, incurred in foreign exchange in rendering of services (including computer software) outside India.

CBDT has, vide circular No. 4/2018, dated 14/08/2018, clarified that freight, telecommunication charges and insurance expenses are to be excluded both from "export turnover" and "total turnover', while working out deduction admissible under section 10AA to the extent they are attributable to the delivery of articles or things outside India.

Similarly, expenses incurred in foreign exchange for rendering services outside India are to be excluded from both "export turnover" and "total turnover" while computing deduction admissible under section 10AA.

7. Conversion of EPZ / FTZ into SEZ

- The provisions of erstwhile section 10A shall not apply to any undertaking, being a Unit referred to under section 2(zc) of the SEZ Act, 2005, which has begun or begins to manufacture or produce articles or things or computer software during the previous year relevant to the assessment year commencing on or after the 1.4.2006 in any SEZ. In such cases, the undertaking, being the Unit shall be entitled to deduction under section only for the unexpired period of ten consecutive assessment years and thereafter it shall be eligible for deduction from income as provided in point (3)(iii) above.

- "Unit" as per section 2(zc) of the SEZ Act, 2005 means unit set up by an entrepreneur in a Special Economic Zone and includes an existing Unit, an Offshore Banking Unit and a Unit in an International Financial Services Centre, whether established before or after the commencement of this Act.

- However, where a Unit initially located in any FTZ or EPZ is subsequently located in a SEZ by reason of conversion of such FTZ or EPZ into a SEZ, the period of 10 consecutive assessment years referred to above shall be reckoned from the assessment year relevant to the previous year in which the Unit began to manufacture, or produce or process such articles or things or services in such FTZ or EPZ.

- Further, where a unit initially located in any FTZ or EPZ is subsequently located in a SEZ by reason of conversion of such FTZ or EPZ into a SEZ and has already completed the period of 10 consecutive assessment years, it shall not be eligible for further deduction from income w.e.f. A.Y.2006-07.

8. Restriction on other tax benefits

- The business loss under section 72(1) or loss under the head “Capital Gains” under section 74(1), in so far as such loss relates to the business of the undertaking, being the Unit shall be allowed to be carried forward or set off.

- In order to claim deduction under this section, the assessee should furnish report from a Chartered Accountant in the prescribed form along with the return of income certifying that the deduction is correct.

- During the period of deduction, depreciation is deemed to have been allowed on the assets. Written Down Value shall accordingly be reduced.

- No deduction under section 80-IA and 80-IB 1 shall be allowed in relation to the profits and gains of the undertaking.

- Where any goods or services held for the purposes of eligible business are transferred to any other business carried on by the assessee, or where any goods held for any other business are transferred to the eligible business and, in either case, if the consideration for such transfer as recorded in the accounts of the eligible business does not correspond to the market value thereof, then the profits eligible for deduction shall be computed by adopting market value of such goods or services on the date of transfer. In case of exceptional difficulty in this regard, the profits shall be computed by the Assessing Officer on a reasonable basis as he may deem fit. Similarly, where due to the close connection between the assessee and the other person or for any other reason, it appears to the Assessing Officer that the profits of eligible business is increased to more than the ordinary profits, the Assessing Officer shall compute the amount of profits of such eligible business on a reasonable basis for allowing the deduction.

- Where a deduction under this section is claimed and allowed in relation to any specified business eligible for investment-linked deduction under section 35AD, no deduction shall be allowed under section 35AD in relation to such specified business for the same or any other assessment year.

9. Deduction allowable in case of amalgamation and demerger

In the event of any undertaking, being the Unit which is entitled to deduction under this section, being transferred, before the expiry of the period specified in this section, to another undertaking, being the Unit in a scheme of amalgamation or demerger, -

- No deduction shall be admissible under this section to the amalgamating or the demerged Unit for the previous year in which the amalgamation or the demerger takes place; and

- The provisions of this section would apply to the amalgamated or resulting Unit, as they would have applied to the amalgamating or the demerged Unit had the amalgamation or demerger had not taken place.

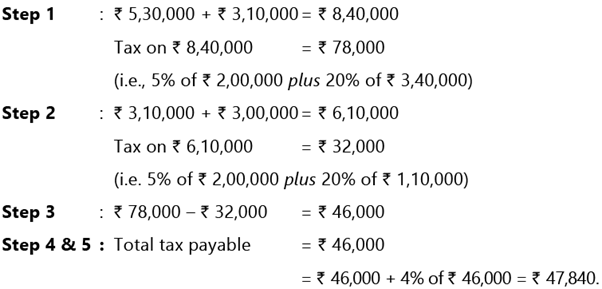

Illustration 7: Y Ltd. furnishes you the following information for the year ended 31.3.2021:

Compute deduction under section 10AA for the A.Y. 2021-22, assuming that Y Ltd. commenced operations in SEZ and DTA in the year 2016-17.

Solution: 100% of the profit derived from export of articles or things or services is eligible for deduction under section 10AA, assuming that F.Y. 2020-21 falls within the first five year period commencing from the year of manufacture or production of articles or things or provision of services by the Unit in SEZ. As per section 10AA(7), the profit derived from export of articles or things or services shall be the amount which bears to the profits of the business of the undertaking, being the Unit, the same proportion as the export turnover in respect of articles or things or services bears to the total turnover of the business carried on by the undertaking.

Deduction under section 10AA

= Profit of the business of Unit A × Export Turnover of Unit A/Total Turnover of Unit A

Note – No deduction under section 10AA is allowable in respect of profits of business of Unit B located in DTA.

Restrictions on Allowability of Expenditure [Section 14a]

As per section 14A, expenditure incurred in relation to any exempt income is not allowed as a deduction while computing income under any of the five heads of income [Sub-section (1)].

The Assessing Officer is empowered to determine the amount of expenditure incurred in relation to such income which does not form part of total income in accordance with such method as may be prescribed [Sub-section (2)].

The method for determining expenditure in relation to exempt income is to be prescribed by the CBDT for the purpose of disallowance of such expenditure under section 14A. Such method should be adopted by the Assessing Officer in the following cases –

- If he is not satisfied with the correctness of the claim of the assessee, having regard to the accounts of the assessee. [Sub-section (2)]; or

- Where an assessee claims that no expenditure has been incurred by him in relation to income which does not form part of total income [Sub-section (3)].

Rule 8D lays down the method for determining the amount of expenditure in relation to income not includible in total income.

If the Assessing Officer, having regard to the accounts of the assessee of a previous year, is not satisfied with –

- The correctness of the claim of expenditure by the assessee; or

- The claim made by the assessee that no expenditure has been incurred

In relation to exempt income for such previous year, he shall determine the amount of expenditure in relation to such income in the manner provided hereunder –

The expenditure in relation to income not forming part of total income shall be the aggregate of the following:

- The amount of expenditure directly relating to income which does not form part of total income;

- An amount equal to 1% of the annual average of the monthly averages of the opening and closing balances of the value of investment, income from which does not form part of total income.

However, the amount referred to in clause (i) and clause (ii) shall not exceed the total expenditure claimed by the assessee.

Clarification regarding disallowance of expenses under section 14A in cases where corresponding exempt income has not been earned during the financial year [Circular No. 5/2014, dated 11.2.2014]

Section 14A provides that no deduction shall be allowed in respect of expenditure incurred relating to income which does not form part of total income. A controversy has arisen as to whether disallowance can be made by invoking section 14A even in those cases where no income has been earned by an assessee, which has been claimed as exempt during the financial year.

The CBDT has, through this Circular, clarified that the legislative intent is to allow only that expenditure which is relatable to earning of income. Therefore, it follows that the expenses which are relatable to earning of exempt income have to be considered for disallowance, irrespective of the fact whether such income has been earned during the financial year or not.

The above position is clarified by the usage of the term “includible” in the heading to section 14A [Expenditure incurred in relation to income not includible in total income] and Rule 8D [Method for determining amount of expenditure in relation to income not includible in total income], which indicates that it is not necessary that exempt income should necessarily be included in a particular year’s income, for triggering disallowance. Also, the terminology used in section 14A is “income under the Act” and not “income of the year”, which again indicates that it is not material that the assessee should have earned such income during the financial year under consideration.

In effect, section 14A read along with Rule 8D provides for disallowance of expenditure even where the taxpayer has not earned any exempt income in a particular year.

Let's Revise

|

38 videos|118 docs|12 tests

|

FAQs on Incomes which do not form part of Total Income: Notes - Taxation for CA Intermediate

| 1. What is the purpose of Section 10 in relation to incomes not included in total income? |  |

| 2. What is the significance of Section 10AA in relation to tax holidays for units established in special economic zones? |  |

| 3. What are the restrictions on the allowability of expenditure under Section 14A? |  |

| 4. Can you provide examples of incomes that do not form part of total income under Section 10? |  |

| 5. What are the benefits of providing tax holidays for units established in special economic zones? |  |