Resource Mobilization: Notes | Entrepreneurship Class 12 - Commerce PDF Download

| Table of contents |

|

| What is Resource Mobilization? |

|

| What are Venture Capital Funds? |

|

| Stock Market: Raising Funds |

|

| Regulatory Framework |

|

| Institutions |

|

| Frequently Asked Questions |

|

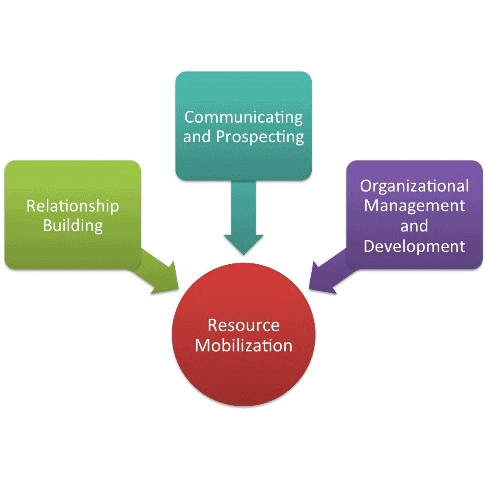

What is Resource Mobilization?

Resource mobilization is one of the most important aspects of any entrepreneurship venture. Any start up business needs a huge amount of financial, human and physical resources to get going.

- An entrepreneur should ensure that there is a proper estimate of the resources required for the business and there should be viable sources of resource mobilization available at his or her disposal.

- In this chapter, we will discuss various options available for resource mobilization and the advantages and disadvantages available with each of them.

What is Angel Investor?

An angel investor is the one who provides financial backing for small startups or entrepreneurs.

- They may be an entrepreneur's family, friends, or any other interested individual investor.

- They can provide one-time investment or ongoing support to carry the company with a view to earning some reasonable return on their investment.

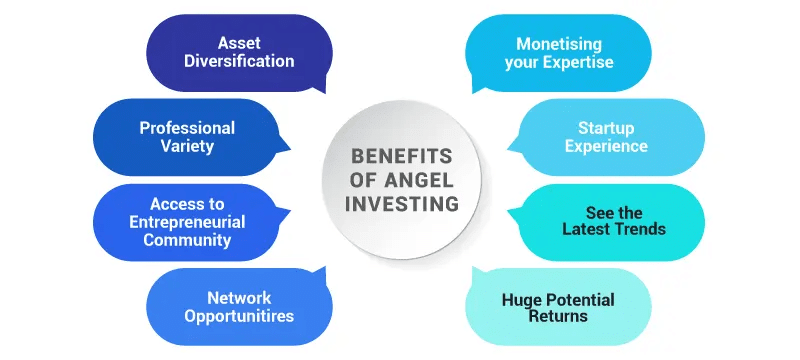

The following are the advantages of angel investors:

- Angel investors give more favorable terms than other lenders

- They are quick decision-makers

- They have a personal rapport with entrepreneurs and help the business grow

- They do not look at huge profits but success in the venture which makes them an ideal partner for the entrepreneur.

The following are the disadvantages of angel investors:

- Angel investor is not suitable for huge investments. They are suited for the small investment need of the entrepreneur

- They are less structured as compared to large investment companies and give limited support to the growth of the venture

- They are not big enough to provide constant support to the business both financially and personally.

Hence, an Angel investor is a good option for a small venture and where an entrepreneur wishes to work with a known and approachable person.

What are Venture Capital Funds?

Entrepreneurs have one another source of funding called venture capital. Venture capital companies make larger investments than angel investors making them suitable for entrepreneur's having big plans with fair bit of complexity.

- They are likely to have a more formal relationship with the businesses they invest in and to build exit procedures into agreements.

- Venture capital is also known as seed capital or private capital.

For which entrepreneur venture capital is suitable?

- It is mostly used to help businesses that have a high potential for growth.

- It is used primarily for entrepreneurs who may not have sufficient operating history to qualify for traditional loans through a bank

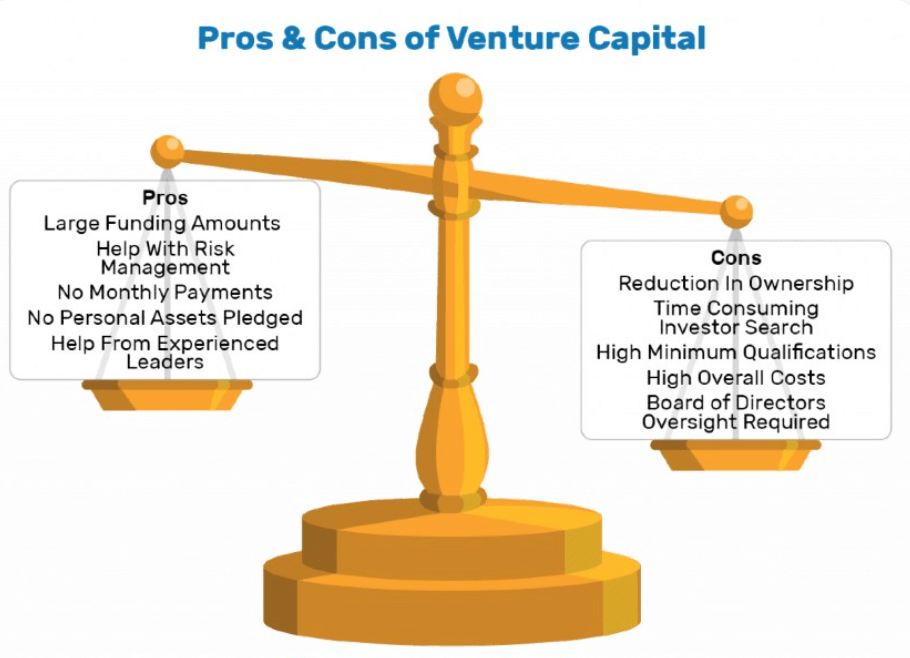

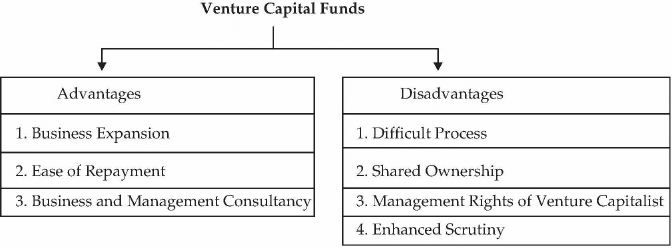

Advantages of Venture Capital

- Business Expansion: An entrepreneur can expand his business through venture capital funds which is not possible with a bank loan as there are various conditions attached to the loan given by the bank.

- Ease of Repayment: Repayment of VC investors isn't necessarily an obligation like it would be for a bank loan. On the other hand, investors are shouldering the investment risk because they believe in the company's future success.

- Business and Management Consultancy: Venture capitalists provide valuable expertise, advice, and industry connections apart from funding the business venture. They have separate specialists for each line of business and use their networking to help the entrepreneur in mobilizing resources.

Disadvantages of Venture Capital

- Difficult Process: Securing a VC deal can be a difficult process due to accounting and legal costs a firm must shoulder.

- Shared Ownership: The start-up company must also give up some ownership stake to the VC Company investing in it. This results in a partial loss of autonomy that finds venture capitalists involved in decision-making processes.

- Management Rights of Venture Capitalists: VC deals also come with stipulations and restrictions in the composition of the start-up's management team, employee salary, and other factors.

- Enhanced Scrutiny: The VC firm literally invested in the company's success, all business operations will be under constant scrutiny. The loss of control varies depending on the terms of the VC deal.

Stock Market: Raising Funds

An entrepreneur can raise funds through the stock market also.

- However, this source of funding is not available at the start-up stage but at a stage when the entrepreneur's business is in expansion mode and it is already running successfully in the market.

- Raising funds from the stock market is highly regulated and entrepreneurs should ensure that he or she is complying with the conditions stipulated under various legislations.

- The stock market also known as capital market is one of the most important segments of the Indian financial system. It is the market available to the companies for meeting their requirements of the long-term funds.

- It refers to all the facilities and the institutional arrangements for borrowing and lending funds. In other words, it is concerned with the raising of money capital for purposes of making long-term investments.

There are two main categories of capital markets.

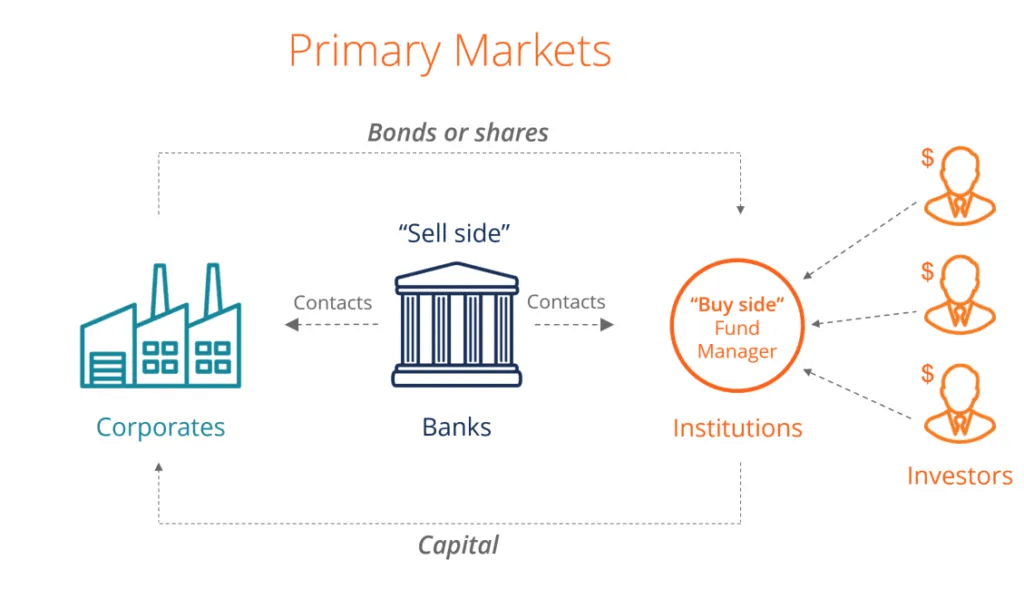

Primary Market or New Issue Market

- It deals with 'new securities', that is, securities that were not previously available and are offered to the investing public for the first time.

- It is the market for raising fresh capital in the form of shares and debentures.

- It provides the issuing company with additional funds for starting a new enterprise or for either expansion or diversification of an existing one, and thus its contribution to company financing is direct.

- The new offerings by the companies are made either as an Initial Public Offering (IPO) or rights issue.

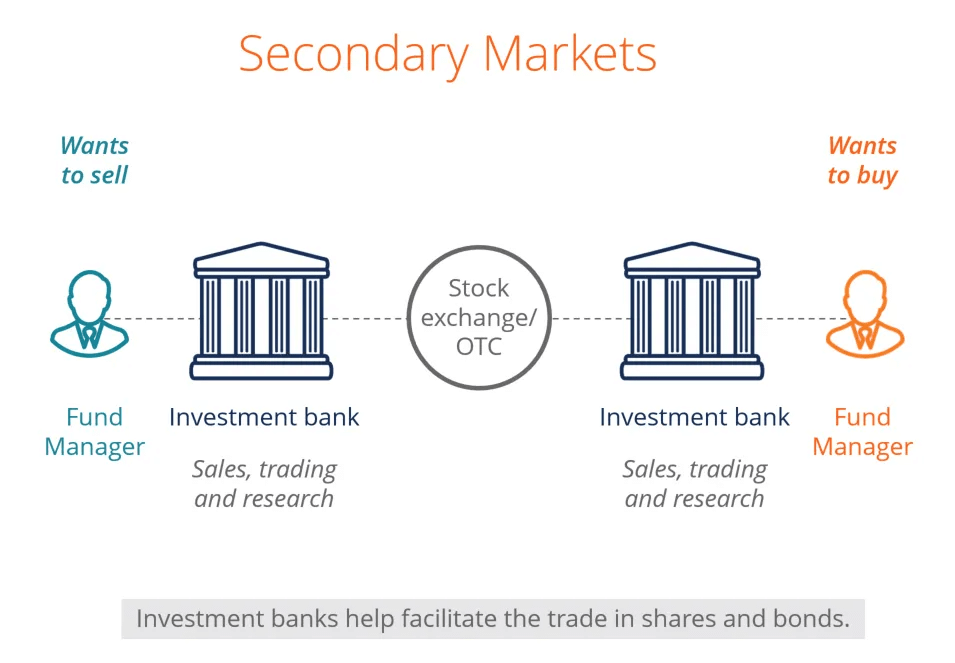

Secondary Market/ Stock Market or Old Issues Market:

- A secondary market is a market for buying and selling securities of the existing companies. Under this, securities are traded after being initially offered to the public in the primary market and/or listed on the stock exchange.

- The stock exchanges are the exclusive centers for trading securities. It is a sensitive barometer and reflects the trends in the economy through fluctuations in the prices of various securities.

- It has been defined as, "a body of individuals, whether incorporated or not, constituted for the purpose of assisting, regulating and controlling the business of buying, selling and dealing in securities".

- Listing on stock exchanges enables the shareholders to monitor the movement of the share prices in an effective manner.

- This assists them to take prudent decisions on whether to retain their holdings or sell off or even accumulate further. However, to list the securities on a stock exchange, the issuing company has to go through set norms and procedures.

Regulatory Framework

Capital market is regulated by the Capital Market Division of Department of Economic Affairs, Ministry of Finance.

It is responsible for formulating the policies related to the orderly growth and development of the securities markets (Le., share, debt and derivatives) as well as protecting the interest of the investors. In particular, it is responsible for

- Institutional reforms in the securities markets

- Building regulatory and market institutions • Strengthening investor protection mechanism

- Providing efficient legislative framework for securities markets, such as Securities and Exchange Board of India Act, 1992 (SEBI Act 1992); Securities Contracts (Regulation) Act, 1956; and the Depositories Act, 1996.

Institutions

- Long-term and medium-term loans can be secured by entrepreneurs from financial institutions like the Industrial Finance Corporation of India, Industrial Credit and Investment Corporation of India (ICICI), State level Industrial Development Corporations, etc.

- These financial institutions grant loans for a maximum period of 25 years against approved schemes or projects.

- Loans agreed to be sanctioned must be covered by securities by way of mortgage of the company's property or assignment of stocks, shares, gold, etc.

Specialized Financial Institutions

The Indian financial institutions are governed under the regulations of both the state and central governments.

- Specialized Financial Institutions in India make an important segment amongst all the financial institutions in India.

- The governments on the other hand use them in structuring the planning and development of the country.

- With the help of these financial institutions, the government takes up projects and tasks in order to enhance the overall economic scenario of the country.

- The specialized financial institutions in India are not only committed to offer financial services to its clients but are also devoted to attain certain missions in the steps of economic development of the country.

- There are specialized financial institutions in all levels. Both in the Central and State level there are a wide variety of financial institutions offering various financial services.

- Some of the major financial institutions of India such as the Industrial Finance Corporation of India, Industrial Development Bank of India, ICICI and Export Import Bank of India are the specialized financial institutions in India that work both in the state level and central level.

- There are other financial institutions also that offer specialized financial services to its clients. These financial institutions are generally devoted to serve some specific domains such as: small and medium scale industries, sick industries, housing, agriculture, railways, shipping, power, roads, and others.

- Small and medium scale business and agriculture are the two domains for which these specialized financial institutions have come up with various financial products and services.

- Specialized financial institutes like Export Credit Guarantee Corporation of India Ltd and Export-Import Bank of India (EXIM) also offer special financial services to help the exporters with their business. Apart from offering financial products, these institutions also provide guarantee products to the export companies.

Frequently Asked Questions

Q.1. How will you differentiate between the financial market with other markets?

Financial market is a market in which people and entities can trade financial securities (stocks and bonds), commodities (including precious metals or agricultural goods), and others like crude oil, etc. at prices that reflect supply and demand. Market refers to the aggregate of possible buyers and sellers of a certain good or service and the transactions between them.

Q.2. ‘Production’, ‘Marketing’, and Financing’ – deemed as the most important factors for any business’s survival rates. Among these name the most critical element and why?

Production, marketing, and financing, deemed to be the most important factors for any business survival. ‘ Financing’ is considered to be the first because no entrepreneur can start and run a business without money. Among these the most critical element for success in business is ‘Finance’. Before doing anything, an entrepreneur should clearly answer the following three questions:

- How much money is required?

- Where will the money come from?

- When does the money need to be available?

Q.3. State the nature of money market. Who are the major participants in the money market?

The money market refers to transactions involving lending and borrowing money for short periods like a day a week a month or 3 to 6 months. It meets the short-term requirements.

The major participants in the market are:

- Reserve Bank of India

- Commercial Banks, Cooperative Banks

- Non-Banking Finance Companies

- State Government

- Large Corporate Houses and Mutual Funds

- LIC, GIC, UTI, etc.

Q.4. Explain how capital markets are the most important source of raising finance for an entrepreneur.

Capital markets are the most important source of raising finance for entrepreneurs. This market:

- Mobilizes the financial resources on a nationwide scale.

- Secures the much-required foreign capital and know-how to promote economic growth at a faster rate.

- Ensures the most effective allocation of the mobilized financial resources by directing the same either to such projects which are capable of the highest yield or to the underdeveloped priority areas where there is an urgent need to promote balanced and diversified industrialization. The needs of entrepreneurs who actually use the savings for productive purposes are varied. The capital market satisfies the tastes of savers and the needs of investors through its financial instruments and institutions.

|

23 videos|101 docs|12 tests

|

FAQs on Resource Mobilization: Notes - Entrepreneurship Class 12 - Commerce

| 1. What is resource mobilization? |  |

| 2. What are venture capital funds? |  |

| 3. How does the stock market help in raising funds? |  |

| 4. What is the regulatory framework for resource mobilization? |  |

| 5. What role do institutions play in resource mobilization? |  |