Long Answer Type Question- Business Arithmetic | Entrepreneurship Class 12 - Commerce PDF Download

Unit of Sale, Unit Cost and Break-Even Analysis

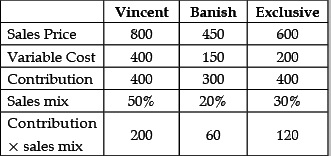

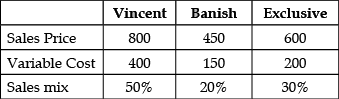

Question 1: CleAir pvt. ltd. started a business of making three varieties of portable air purifiers for vehicles - Vincent, Banish, and Exclusive. From the following information calculate breakeven point in units for the company and suggest which variety is most revenue generating. Fixed costs are ₹ 15,20,000.

Weighted Contribution = 200+60+120= ₹ 380

BEP = Fixed cost/WACM

= 15,20,000/380 = 4,000 units

In Units:

Vincent = 50% of 4,000 = 2,000 units

Banish = 20% of 4,000 = 800 units

Exclusive = 30% of 4,000 = 1,200 units

In Rupees:

Vincent = 2,000 units × 800 = ₹16,00,000

Banish = 800 units × 450 = ₹3,60,000

Exclusive = 1,200 units × 600 = ₹7,20,000

The company is earning more revenue in the sale of Vincent.

Weighted Contribution = 200+60+120 = ₹380

BEP = Fixed cost/WACM = 15,20,000/380 = 4,000 units

In Units:Vincent = 50% of 4,000 = 2,000 unit

Banish = 20% of 4,000 = 800 unit

Exclusive = 30% of 4,000 = 1,200 units.

In Rupees:

Vincent = 2,000 units × 800 = ₹16,00,000

Banish = 800 units × 450 = ₹ 3,60,000

Exclusive = 1,200 units × 600 = ₹ 7,20,000The company is earning more revenue in the sale of Vincent.

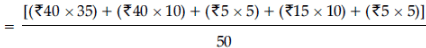

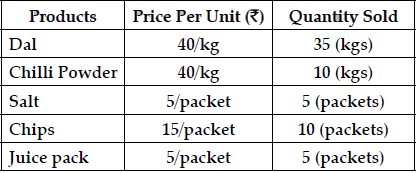

Question 2: A grocery store sold in a day different quantity of different products at the prices indicated against them:

The shopkeeper also found, based on the number of bills issued by him, that there were 50 customers.

If customer is the unit sale, what is the “Unit Price” in the above case? If the cost of each grocery item is 75% of its selling price, calculate the ‘unit cost’ and the ‘gross margin’ per unit of sale.

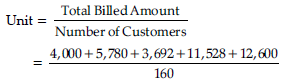

Unit Price = Total Billed Amount/Number of customers

= ₹ 40

∴ Unit price per customer is ₹40.

Unit cost = ₹40 × 75/100 = ₹30

∴ Unit cost is ₹30

Gross margin = Unit price – Unit cost

= ₹40 – ₹30 = ₹10

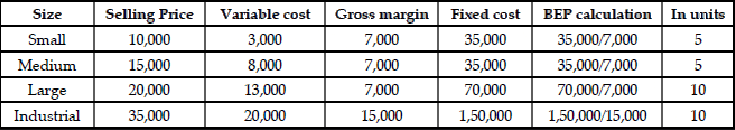

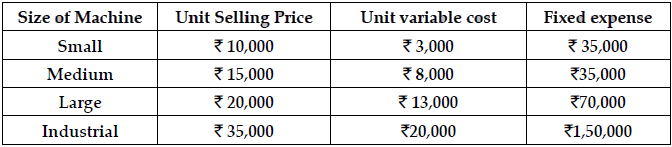

Question 3: ‘Good wash’ are manufacturers of different sizes of fully automatic washing machines marked as ‘small’, ‘medium’, ‘large’ and ‘industrial’.

From the information given below, calculate the ‘Break-Even Quality’ of the washing machines manufactured per month.

Information:

Formula for break even point = Fixed expenses / Gross margin

Gross margin = Selling price per unit – Variable cost per unit

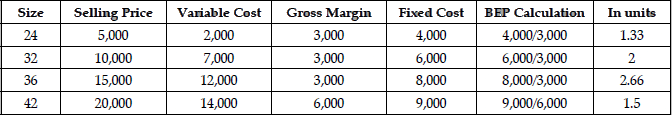

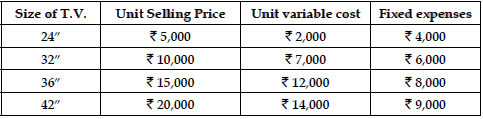

Question 4: ‘Nomy India Ltd.’ are the producers of different sizes of televisions. From the information given below, calculate the ‘Break-Even Quantity’ of the T.V. SETs manufactured per month.

Information :

Formula for break-even point = Fixed expenses / Gross margin

Gross margin = Selling price per unit – Variable cost per unit

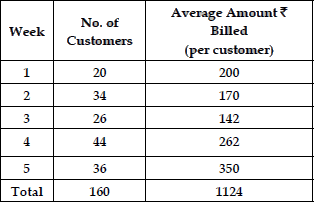

Question 5: A Courier-Service company ‘Speed-Express’ had a varying number of customers during five weeks. The information regarding the number of customers and the average weekly billing is presented in the following table. What is the ‘unit of sale’ and ‘unit price’ in this case? If the cost of goods sold or variable cost is 60% of the sale price, calculate the ‘Unit-Cost’ and the ‘Gross-Margin’ per unit of Sale.

The unit of sale is No. of customers and the unit price is Average billing per customer.

= ₹233.75

Unit cost = ₹ 235 × 60/100 = ₹140.25

Gross margin = Unit price – Unit cost

= ₹ 235 – ₹141 = ₹ 93.50

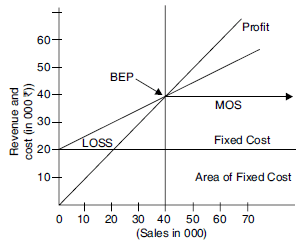

Question 6: Illustrate with the help of an example the concept of Break-Even-Point.

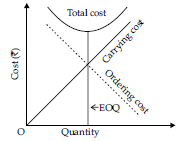

The Break Even Point is the sales volume at which there is neither profit nor loss, cost being equal to revenue. Break Even Point is a neutral point. Sales below this point shows loss and sales above this point shows profit.

Question 7: Explain the concepts of Cost, Revenue and Break-Even-Point. Also explain how Break-Even point is calculated.

Cost: The ‘term’ cost refers to the amount of expenditure incurred on, or attributable to a given thing. Cost determination is an important function of the entrepreneur.

The major element of cost are:

(i) Cost of materials.

(ii) Cost of labour.

(iii) Cost of overheads and other expenses.

Revenue: Revenue refers to the money receipt of a firm from the sale of its output.

Total revenue, marginal revenue and arrange revenue are of its types.

Break Even Point: The business is at break even when its value is equal to its total cost. The breakeven point (B.E.P.) is the sales volume at which there is neither profit nor loss. Cost being equal to revenue breakeven point is a neutral point. Sales below this point show loss and sales excess of this point show profit. It is the relationship among cost of production, volume of production, profit & the sales value.

At B.E.P., the revenue equals the cost. The formula for computing B.E.P. is simple.

Total revenue (R) = Price (P) × number of units sold (Q)

Total cost (C) = Fixed costs (F) + (Q × variable cost per unit.)

By definition, BEP R = C or P × Q = F + (Q × V)

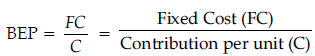

BEP of output = Fixed Cost (FC)/Contribution per unit

Contribution = Selling price – Variable cost

BEP on sales = Fixed costs × (Selling price per unit/Contribution per unit)

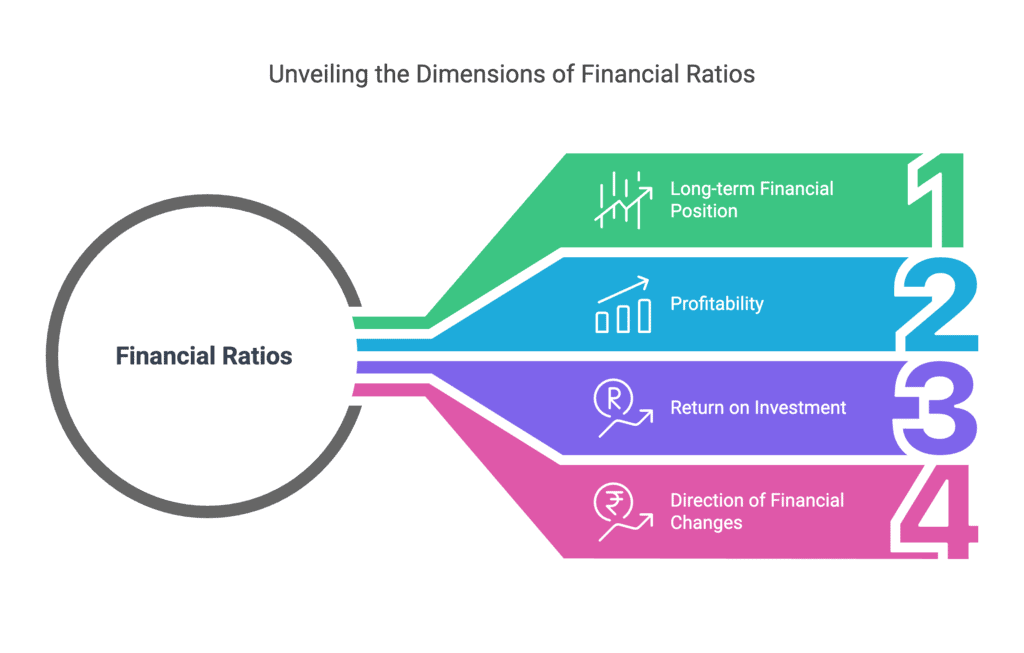

Question 8: What are Financial Ratios? What do they indicate?

Financial ratios are devices for measuring financial conditions of financial changes. It is the relationship between two accounting figures expressed mathematically, which shows meaningful relations with each other.

They indicate as under:

(i) The long term financial position of a business.(ii) The profitability of the business activity.

(iii) Return on the investment done by the firm.

(iv) The direction of the financial changes required.

Question 9: What is Net Profit Ratio? What does it indicate?

The main objective of a business is to earn maximum profit by using minimum resources. It establishes the relationship between net profit before taxes and net sales turnover. It is usually expressed as a percentage. It is calculated as follows:

Net Profit Ratio = Net Profit before taxes/Sales turnover

It is an indicator of the profitability of the business activity. Higher the ratio the better it is. It measures the rate of return on sales. It enables to measure the overall efficiency of business. While comparing with the last year’s ratio, if it increases, it is treated as an improvement in overall efficiency of the business.

Question 10: What is a Break Even Point? Why should an entrepreneur know about BEP?

A business is at break-even point when its value is equal to its total cost. The Break Even Point (BEP) is the sales volume at which there is neither profit nor loss, cost being equal to revenue. Break Even Point is a neutral point. Sales below this point show loss and sales above this point show profit. It is the relationship among the cost of production, volume of production, profit and the sales value.

The entrepreneur should know B.E.P. as it helps in:

(i) Forecast: He can forecast about profit fairly and accurately.

(ii) Cost estimation: He can ascertain costs, sales & profits at different levels of activity.

(iii) Price Policy: For taking decision regarding price.

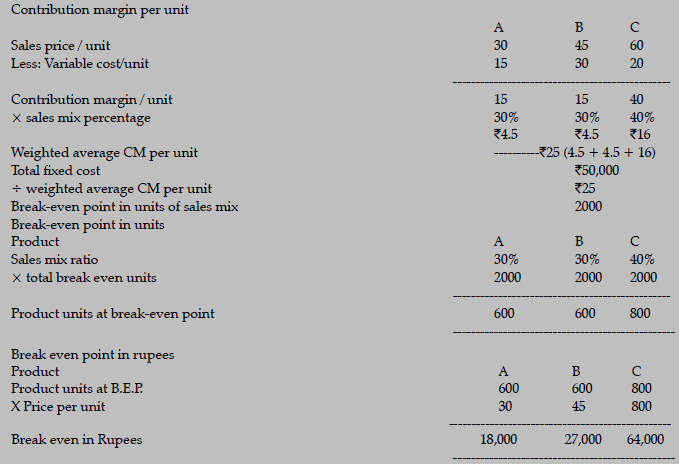

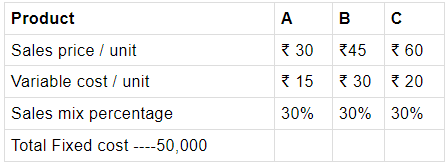

Question 11: What is meant by the break-even point? State any two assumptions for calculating the break-even point for the sales mix. Calculate the break-even point in units and in rupees for the following:

Break even point is the level of sales that equals all the expenses required for generating that revenue.

Assumptions:

(i) The proportion of sales mix must be determined.

(ii) The sales mix must not change within the relevant time period.

(iii) All cost can be categorised as variable or fixed.

(iv) Sales price per unit, variable cost per unit and total fixed cost are constant.

(v) All units produced are sold.

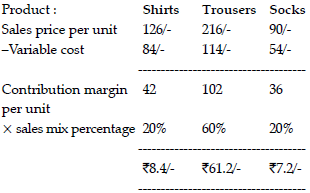

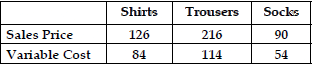

Question.12: ‘Hi-Fi Company is the manufacturer of school uniforms. Their main items were Shirts, Pants and Socks. Fixed cost of production was ₹1,53,600. Sales price and variable cost per unit were as follows:

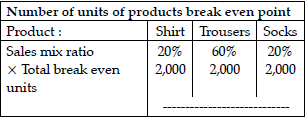

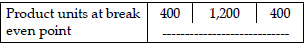

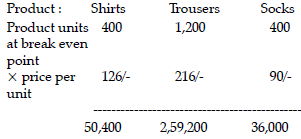

Sales mix percentage of the three products was 20%, 60% and 20% respectively. Find out the Break- Even-Point in units and rupees.

Sum weighted Average CM per unit ₹ 76.8/-

Break even points in units of sales mix = Total fixed cost ÷ weighted CM per

Total fixed cost = ₹1,53,600

÷ weighted Average CM per unit ₹ 76.8

Break even point in unit of sales mix = ₹ 2,000

Break-even points in rupees

Sum : Break even point in Rupees : = ₹ 3,45,600

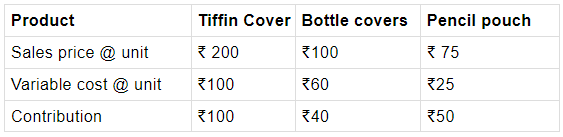

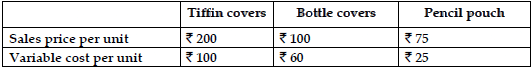

Question.13: The School Gear Ltd. manufactures three product – Tiffin covers; Bottle covers; Pencil pouch. The variable expenses and sales prices of all these products are given below:

The total fixed expenses of the company are ₹ 55,000 per month. For the coming month, it expects the sale of three products in the following proportions:

Tiffin covers : 20%

Bottle covers : 50%

Pencil pouch : 30%

Compute the break-even point of company in units and rupees for the coming month.

Contribution Margin per unit for each product :

Thus contribution margin per unit is calculated.

Now to calculate weighted average contribution margin (CM) per unit = Tiffin Cover CM × sales mix percentage + Bottle Cover CM × Sales mix percentage + Pencil pouch CM × Sales mix percentage= 100 × 20% + 40 × 50% + 50 × 30% = 20 + 20 + 15 = ₹ 55

Thus weighted average CM per unit is ₹ 55.

Break-even point in Units of sales mix = Total fixed cost / Weighted average CM per unit

= ₹ 55,000/55 = 1,000 units

Product break-even in units

(a) Tiffin cover – 1,000×20 = 200 units

(b) Bottle cover – 1,000×50 = 500 units

(c) Pencil pouch – 1,000×30 = 300 units

Product break-even in rupees

Product units at break-even point × price per unit

(a) Tiffin Cover = 200 units × ₹ 200 = ₹ 40,000

(b) Bottle Cover = 500 units × ₹ 100 = ₹ 50,000

(c) Pencil pouch = 300 units × ₹ 75 = ₹ 22,500

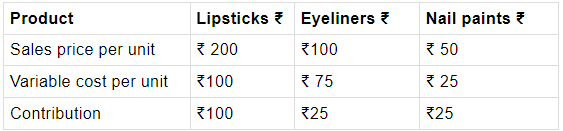

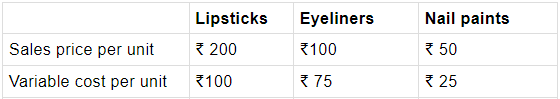

Question.14: The United Company manufactures three products Lipsticks, Eyeliners, Nail paints. The variable expenses and sales price of all these products are given below:

The total fixed expenses of the company are ₹ 50,000 per month. For the coming month, it expects the sale of three products in the following ratio:

Product X : 20%

Product Y : 50 %

Product Z : 70 %

Compute the break-even point of the company in units and rupees for the coming months.

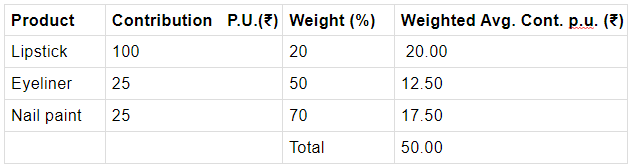

Contribution per unit for each product :

Calculation of weighted average contribution p.u. :

Break-even point of sales mix (in units) = Total fixed cost/Weighted Average Cont. p.u.

= ₹ 5,000/₹ 50

= 1,000 units

Products break-even points in units :

Lipsticks = 1,000 units × 20% = 200 units

Eyeliner = 1,000 units × 50% = 500 units

Nail paints = 1,000 units × 70% = 700 units

Break-even point in rupees :

Lipsticks = 200 units × ₹ 200 = ₹ 40,000

Eyeliners = 500 units × ₹ 100 = ₹ 50,000

Nail Paints = 700 units × ₹ 50 = ₹ 35,000

Question.15: Find out break-even point from the following information :

(i) Fixed Cost = ₹ 40,000/-

Variable Cost = ₹ 2 per unit

Sales Price = ₹ 4 per unit

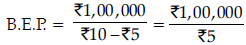

(ii) Fixed Cost = ₹ 1,00,000/-

Variable Cost per unit = ₹ 5

Sales Price per unit = ₹ 10

(a) Determine BEP.

(b) What is the BEP if Sales Price is reduced by 10%?

(i) (a) B.E.P. (in units) = Fixed Cost (FC)/Contribution per unit

= ₹ 40,000 / ₹ 4 – ₹ 2

= 20,000 units

B.E.P. (in ₹) = 20,000 × ₹ 4= ₹ 80,000/-

(b)

C = S – V

= 20,000 units

B.E.P. (in ₹) = 20,000 × ₹ 10

= ₹ 2,00,000

(ii) (a) New selling price = ₹ 4 – (10% of ₹ 4) = ₹ 3.60

B.E.P. (Units) = 40 000/₹2 - ( 10% of ₹ 4)

= 25,000 units

B.E.P. (in rupees) = 25,000 × ₹ 3.60

= ₹ 90,000

(b) B.E.P. at reduced Selling Price by 10% Selling Price is ₹ 10/- reduction by 10% means Selling Price is now ₹ 9/- Contribution = S – V = 9 – 5 = ₹4/-

B.E.P. (in units) = FC/Contribution

= ₹ 1,00,000/4

= 25,000 units

B.E.P. (in ₹) = 25,000 × ₹ 9 = ₹ 2,25,000

Question.16: How will you calculate B.E.P.?

At the B.E.P. the revenue equals the cost. The formula for computing B.E.P. is simple.

Total Revenue (R) = Price (P) × Number of units sold (Q)

Total Cost (C) = Fixed cost (F) + Q × Variable cost per unit (V)

By definition, BEP

R = C or P × Q = F + Q × V

BEP of output = FC/Contribution per unit

Contribution = Selling price – Variable cost

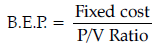

BEP on sales = Fixed cost × Selling price per unit/Contribution per unitBEP = Fixed cost/P/V Ratio

P/V Ratio = Contribution/Selling price per unit

BEP = Contribution/Contribution ratio

Contribution Ratio = (Selling price - Marginal cost)/Selling price

Marginal Cost = Total variable cost

Or = Total cost – Fixed cost

= Direct material + Direct labour + Direct expenses + Variable Overhead

Or B.E.P. = (Fixed cost × Sales)/(Sales - Variable cost)

Question.17: A factory is engaged in manufacturing plastic buckets. The following information is available to you:

Sales = ₹ 1,00,000

Direct labour cost (1,000 units) = ₹ 10,000

Direct material cost (1,000 units) = ₹ 25,000

Direct expenses (1,000 units) = ₹ 5,000

Fixed cost = ₹ 30,000

Find out : (i) Variable cost per unit, (ii) Total cost, (iii) BEP.

(i) Variable cost = Direct labour cost + Direct material cost + Direct expenses

= ₹ 10,000 + ₹ 25,000 + ₹ 5,000

= ₹ 40,000

Variable cost per unit = ₹ 40,000/1000 = ₹ 40 per unit

(ii) Total cost = Fixed cost + Variable cost

= ₹ 30,000 + ₹ 40,000

= ₹ 70,000

(iii) B.E.P. = Fixed Cost/P/V Ratio

P/V Ratio = (Sales - Variable Cost)/Sales

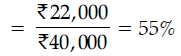

= (₹ 1,00,000 - ₹ 40,000)/₹1,00,000 = 60%

B.E.P. = (30,000)/60%

= ₹ 50,000

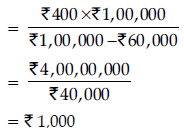

Question.18: A company produces calculators and sells 1,000 units of the same at ₹ 100 each. The variable cost of production is ₹ 60 per unit and fixed cost is ₹ 400 per annum. Calculate the BEP.

Sale at Break Even Point = Fixed cost × Sales/Sales - Variable Cost

The sales of ₹ 1,000 are such that the business neither earns profit nor incurs a loss but is just able to pay its own way.

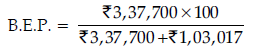

Question.19: Calculate B.E.P. from the following information:

X Co. Ltd. earns profits during the year ₹ 1,03,017 Depreciation changed on :

- Building = ₹ 6,000

- Fixtures = ₹ 5,000

- Office equipment = ₹ 13,120

- Total Depreciation = ₹ 24,120

- Rent = ₹ 1,20,000

- Interest on Investment = ₹ 73,950

- Fixed 40% of salary = ₹ 6,800

- Fixed 40% of overheads = ₹ 60,000

- Insurance = ₹ 52,830

B.E.P. = (Fixed cost x 100)/Fixed cost Profit

Fixed Cost = Depreciation + Rent + Interest on Investment + 40% of wages+ Insurance + 40% of overheads

= ₹ 24,120 + ₹ 1,20,000 + ₹ 73,950 + ₹ 52,830 + ₹ 60,000

= ₹3,37,700

= 76.62%

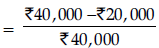

Question 20: Sales = ₹ 40,000

Variable cost = ₹ 20,000

Fixed cost = ₹ 12,000

(i) Find out P/V ratio, breakeven point, margin of safety.

(ii) Calculate B.E.P. with the effect of :

(a) 10% decrease in fixed cost

(b) 10% increase in fixed cost

(c) 10% decrease in valuable cost

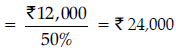

(i) Profit volume ratio = Contribution/Sales

= (Sales-Variable cost)/Sales

= 50%

MOS = Actual Sales – B.E.P. sales

= ₹ 40,000 – 24,000

= ₹ 16,000

(ii) (a) 10% decrease in fixed cost

Then, sales = ₹ 40,000

Variable cost = ₹ 20,000

Fixed cost = ₹ 12,000 – (10% of ₹ 12,000)

= ₹ 12,000 – 1,200

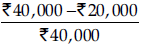

= ₹ 10,800

P/V Ratio =

= 50%

B.E.P. =

(b) 10% increase in fixed cost

Fixed cost = ₹ 13,200

Sales = ₹ 40,000

Variable cost = ₹ 20,000

P/V ratio = (S - V)/S = 50%

B.E.P. = ₹13 200/50%

= ₹ 26,400

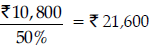

(c) 10% decrease in variable cost

Sales = ₹ 40,000

Variable cost = ₹ 20,000 – 2,000

= ₹ 18,000

Fixed cost = ₹ 12,000

P/V Ratio =(S-V)/S

B.E.P. = ₹12,000/55% = ₹21,818

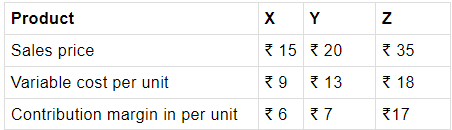

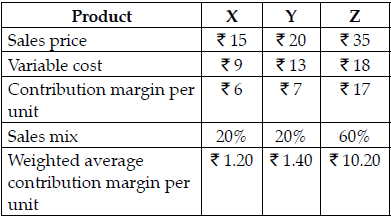

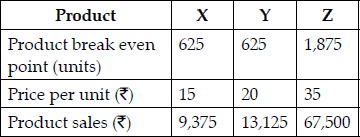

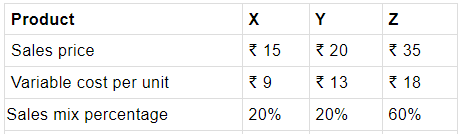

Question.21: Calculate breakeven point for multiple products from the following information :

Total fixed cost = ₹ 40,000

Calculation of contribution margin per unit

Weighted average contribution margin per unit for sales mix = Sum of (product contribution × % sales mix)

Calculation of weighted average contribution margin per unit

Sum of weighted average = ₹ 1.20 + ₹ 1.40 + ₹ 10.20 = ₹ 12.80

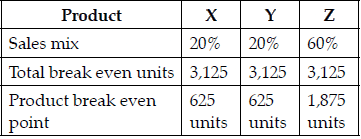

Break even point units of sales mix = Total fixed cost/Weighted average per unit

= 3,125 units

Product unit break even point = Total break even point × Sales mix

Calculation of Product Break Even Point

Calculation of Break Even Point in Rupees

Break even sales = ₹ 9,375 + ₹ 13,125 + ₹ 67,500 = ₹ 90,000

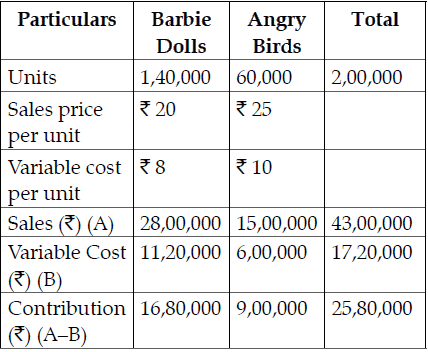

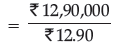

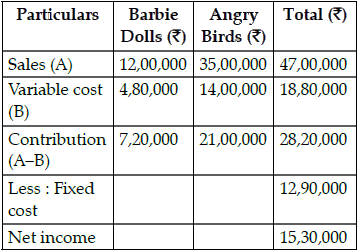

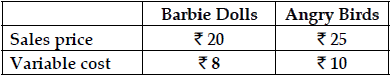

Question.22: A toy making company produces Barbie Dolls and Angry Bird toys.

Fixed cost = ₹12,90,000 per year

Sales price and variable costs per unit are as follows:

(i) If current sale of Barbie Doll is 1,40,000 per year and Angry Birds is 6,000 per year, how many Barbie Dolls and Angry Birds should be sold to Break-Even ?

Sales mix = 14:6

(ii) Suppose company currently sells 1,40,000 Barbie Dolls and 60,000 Angry Birds per year (sales mix = 6:14), how many Barbie Dolls and Angry Birds Company must produce to attain break-even point.

(iii) Explain why Break Even points for (i) and (ii) are same or different.

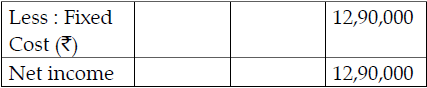

Weighted average contribution = Total contribution/Total units

= ₹25,80,000/2,00,000 units

= ₹12.90

Break-even point (units) = Fixed cost/Weighted average contribution

= 1,00,000 unitsAllocating total units to each product based on expected proportion = 14:6

Break-even point for Barbie Dolls = 1,00,000 × (14/20) = 70,000 units

Break-even point for Angry Birds = 1,00,000 × (6/20) = 30,000 units

Weighted average contribution

= Total contribution / Total units

= ₹ 28,20,000 / 2,00,000 units

= ₹ 14.10

Break-even point = Fixed cost / Weighted average contribution

= ₹ 12,90,000 / ₹ 14.10

= 91,489 units

Break-even point for Barbie Dolls

= 91,489 units × (6/20)

= 27,446 unitsBreak-even point for Angry Birds = 91,489 units × (14/20)

= 64,042 units(iii) The total number of toys for break even point in

(a) is different from break even point in

(b). This is because weighted contribution per unit has increased.

Computation of Working Capital

Question.1: How do we calculate the total cost of production?

Total cost of production is calculated annually. In these various assets, like current assets and fixed assets, are those assets which are purchased to be used in the operations of the business, not for sale.

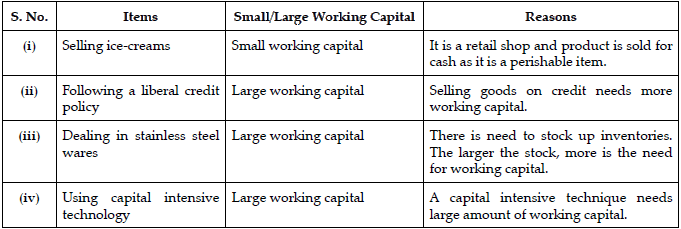

Question.2: State, giving reasons, whether the following require small or large working capital :

(i) Selling ice-creams.

(ii) Following a liberal credit policy.

(iii) Dealing in stainless steel wares.

(iv) Using capital intensive technology.

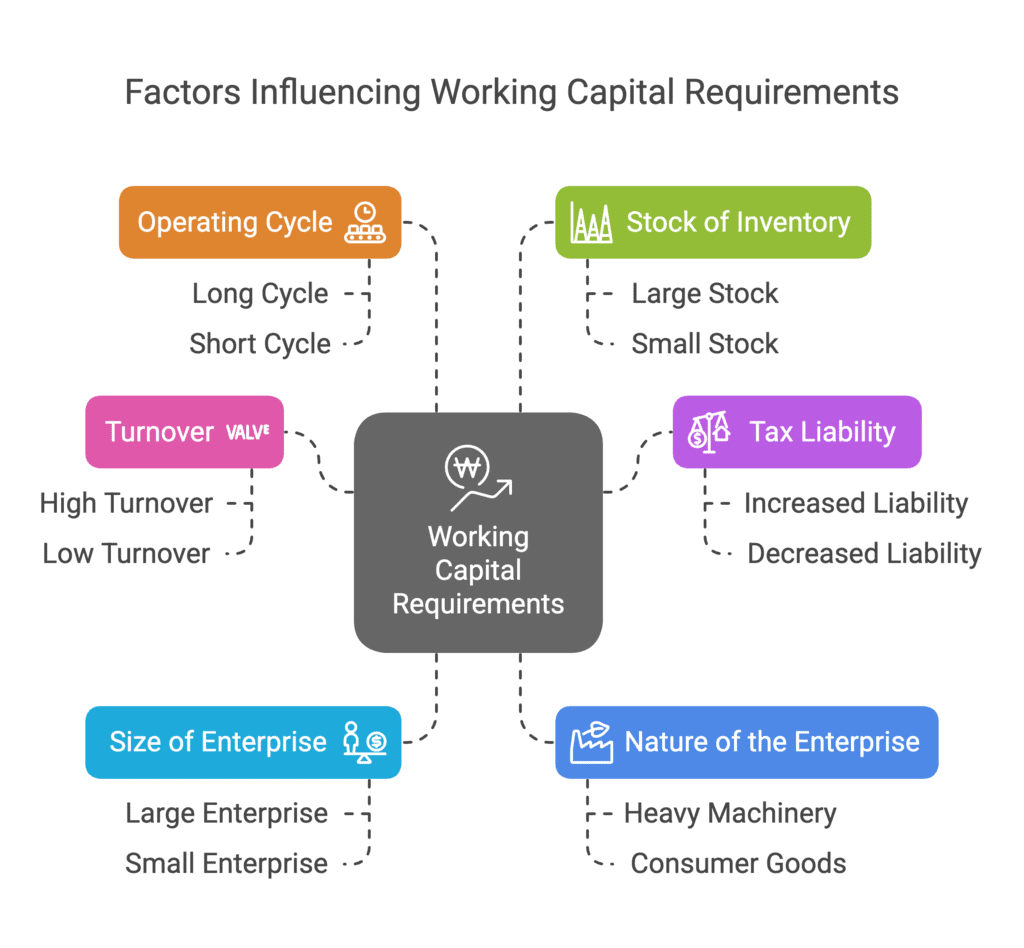

Question.3: Explain the factors determining the working capital requirements.

Following factors determine the working capital requirements :

(i) Turnover : Higher is the sales turnover, lower is the requirement of working capital. On the other hand, lower is the sale turnover, higher is the requirement of working capital.(ii) Tax Liability : Increase in tax liability increases the requirement of working capital

and decrease in tax liability of the enterprise decreases the need of working capital.

(iii) Size of Enterprise : Larger the size of enterprise, larger is the requirement of working capital.

(iv) Nature of the Enterprise : Requirement of working capital is dependent on the type of enterprise. Enterprise producing heavy machines needs more working capital, as their

operating cycle is longer.

(v) Operating Cycle : Longer is the length of operating cycle longer is the requirement of working capital. This is due to the fact that more money is needed for making stocks,purchasing raw materials, etc.

(vi) Stock of Inventory : If the enterprises prefer to make a larger stock of finished, semi-finished goods and raw materials, then more working capital is required.

Inventory Control, Economic Order Quantity (EOQ), Return on Investment (ROI) and Return on Equity (ROE)

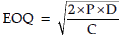

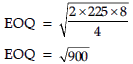

Question.1: Ms. Rosy is a readymade garments manufacturer. Her Annual Usage rate is 225 Pcs. The cost of placing each order is ₹8 and the carrying cost is ₹4 per unit. Calculate the Economic Order Quantity (EOQ). How does calculating EOQ facilitate budgeting?

(i)

EOQ = 30 Units

(ii) EOQ denotes the ideal quantity of raw material and goods to be ordered. This leads to optimum utilization of the financial resources.

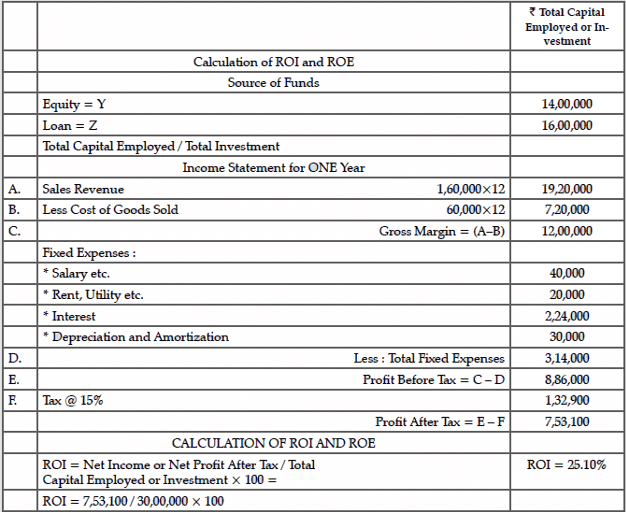

Question.2: Aditi started a beauty parlour business. She spend ₹30,00,000 to open the parlour of which she invested ₹14,00,000 of her own money and borrowed a loan for ₹16,00,000. Interest rate per annum is 14%. Sales revenue per month is 1,60,000. Cost of goods sold is 60,000 per month Fixed expenses for that month is 60,000 (salary 40,000, rent and utility 20,000), depreciation 30,000 and tax @ 15%.

Question.3: State any four advantages of ‘Inventory Control’.

Four advantages of inventory control :

(i) To know whether materials are readily available for production use.

(ii) To examine quantity discounts for large orders.

(iii) To ensure prompt delivery of materials to consumers.

(iv) To stabilise the fluctuation of demands.

Question.4: What is Order Processing Costs? What are the major components of this cost? List any three of them.

The cost associated with the placement of an order for the acquisition of inventories is called order processing cost. It is determined on the basis of expenses incurred in the purchase department.

Some of the components of cost are :

(i) Finding the sources of supply.

(ii) Obtaining quotations.

(iii) Transportation cost.

(iv) Expenses and follow up an order.

(v) Forgone discounts.

(vi) Loss of sales and customer goodwill.

(vii) Higher prices paid for emergency purchases.

Question.5: Why is return on investment deemed as a yardstick for the performance of an enterprise?

Return on investment is a relationship between profit before interest and tax and capital employed. It is deemed as a yardstick for the performance of an enterprise because it measures the overall profitability and efficiency of the enterprise in relationship to investment made by an entrepreneur in business. Higher the ratio, higher the overall profitability of the business. The ratio is compared with earlier year’s ratio and important conclusions are drawn from such comparisons. As a yardstick it also shows how efficiently the resources are used in the business.

Question.6: State the significance of ROI.

(i) ROI indicates how well management has used its assets.

(ii) ROI can be compared with the previous year’s ROI to see the progress.

(iii) ROI can be compared with the ROI of other firms in the same industry to find out firm’s position.

(iv) It provides an indication of productivity of the capital.

(v) High ROI attracts more investors to invest in the firm.

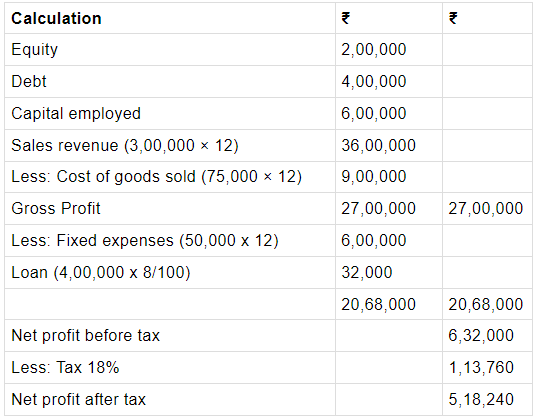

Question.7: Yashshree has opened a small shop selling shell jewellery and handicrafts, in Bengaluru in the name ‘ShilpOshell’ by spending ₹6,00,000. She invested ₹2,00,000 of her own money and took a loan of ₹4,00,000 from State Bank of India @ 8% per annum. Her monthly sales revenue is ₹3,00,000 and monthly cost of goods sold is ₹75,000. She pays monthly salary of ₹25,000 to her employees. Advertisement cost per month is ₹15,000. Electricity and miscellaneous charges per month is ₹10,000. The Goods and Service tax rate is 18%.

You are required to calculate for Yashshree:

(a) Return on investment.

(b) Return on Equity.

Formula for calculating Return on Investment = (Net profit after tax (PAT)/Capital Employed) x 100

ROI = Net Profit after tax/Capital employed × 100

= 5,18,240/6,00,000 × 100

= 86.37%

Return On Equity = Earnings after tax / Equity × 100

= 5,18,240/2,00,000 × 100 = 259.12%

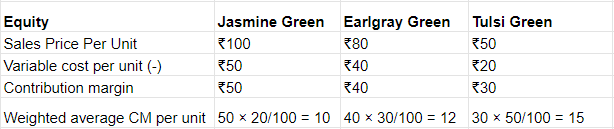

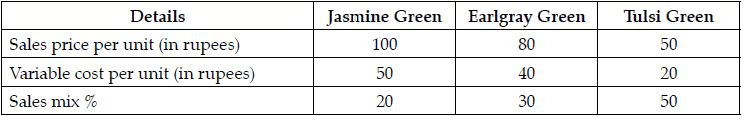

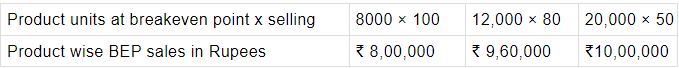

Question.8: KPCL Ltd. Manufactures variants of Green tea, namely Tulsi Green, Earlgray Green, Jasmine green. They sell tea in a packaging of 25 T-bags in a corrugated box.

From the following information, calculate:

(a) Weighted average contribution.

(b) Overall break-even point in units.

(c) Product-wise break-even points in units.

(d) Breakeven point in rupees.

Total fixed cost = ₹14,80,000

(a) What is the ‘Unit of Sale’ and ‘Unit Price’ in this case ?

(b) If the cost of goods sold or variable cost is 60% of the sales price, calculate the ‘unit cost’ and the ‘gross profit’.

Total Weighted average CM per unit = 10+12+15=37

Overall breakeven point = Fixed cost/Contribution = 14,80,000/37 = 40,000 units

Product-wise breakeven point :

Breakeven point of JG = 40,000 × 20% = 8000 unit

Breakeven point of EG = 40,000 × 30% = 12,000 units

Breakeven point of TG = 40,000 × 50% = 20,000 units

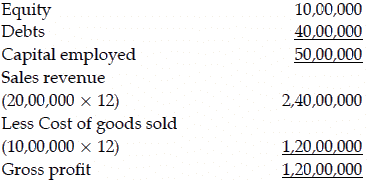

Question.9: Parvesh has started a restaurant in a small town by the name of ‘Spices of India’ by spending ₹50,00,000. He invested ₹10,00,000 of his own and took a loan of ₹40,00,000 from State Bank of India @ 6% per annum. His monthly sales revenue is ₹20,00,000 and monthly cost of goods sold is ₹10,00,000. He pays a monthly salary of ₹2,00,000 to his employees. The GST rate is 18%.

Calculate (a) Return on Investment, and (b) Return on Equity.

ROI = Net profit after tax/ capital employed *100 = 76,75,200/50,00,000 × 100 = 153.50%

ROE = Net Income / Owner’s fund (equity) *100 = 76,75,200/ 10,00,000 × 100 = 767.52%

Note: In case an examinee calculated ratios taking into consideration GST, full credit may be given.

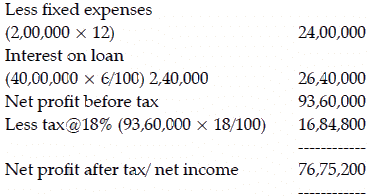

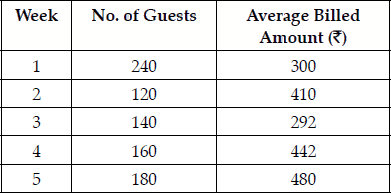

Question.9: A hotel had varying number of guests during five weeks. The information regarding the number of guests and the average weekly billing is presented in the following table :

(a) What is the ‘Unit of Sale’ and ‘Unit Price’ in this case ?

(b) If the cost of goods sold or variable cost is 60% of the sales price, calculate the ‘unit cost’ and the ‘gross profit’.

(a) Unit of sale = Number of customers = 840

Unit price = (Total billed amount/Number of customer)

= 3,19,200/840 = ₹ 380

(b) Unit cost = 60% of Unit price

= 380 ×(60/100) = ₹ 228

Gross Margin = Unit Price – Unit Cost

= 380 – 228 = ₹152

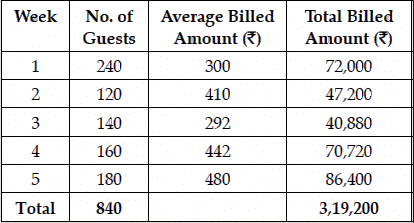

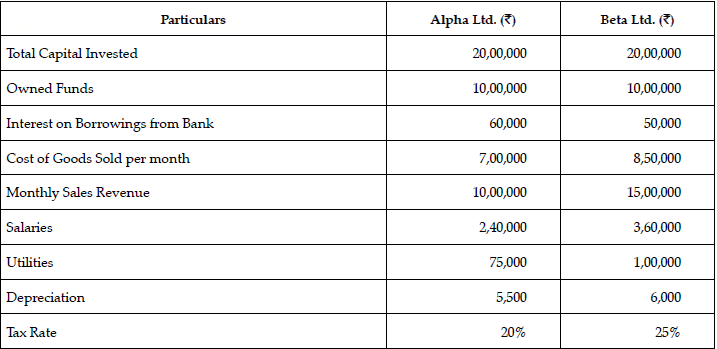

Question.10: Raman is a potential investor who wishes to be a part of Equity Linked Saving Scheme (ELSS). He has given the particulars of two companies to seek your advice for investment. Compare the Return on Equity of the two companies and suggest to Raman where he should invest.

Raman should invest in Beta Company as its ROE is better than that of Alpha Company.

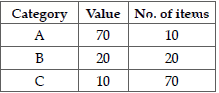

Question.11: What is ABC Analysis? What does it indicate?

A firm maintains several types of inventories. The firm adopts a selective approach which is called ABC analysis. In this, the firm classifies all items according to values so that the most valuable items may be paid highly. More attention is given regarding their safety and care as compared to other items. It has been observed that out of the long list

of inventory, ‘A’ category list is small in number say 5 to 10 per cent of the total number of items but they are quite valuable of total value. The value being 70- 75 per cent of the total value of stocks.

‘B’ category is in between A and C categories having 15 to 20 per cent of the number of items and 15 to 20% of the total value. ‘C’ category items comprise of 70-75% in number but carrying little value ranging from 5-10 percent. We can see following categorization :

The above three categories vary from product to product and organization to organization. Great care and control is to be exercised on items of ‘A’ list, as any loss or breakage or wastage of any item of this list may prove to be very costly. Proper care is to be taken on ‘B’ list items and comparatively less control is needed for ‘C’ list items.

ABC analysis indicates the following :

(i) About the items to be stocked in more quantities.

(ii) The working capital needed for sustaining an enterprise.

(iii) The relative importance of the various items needed by an enterprise.

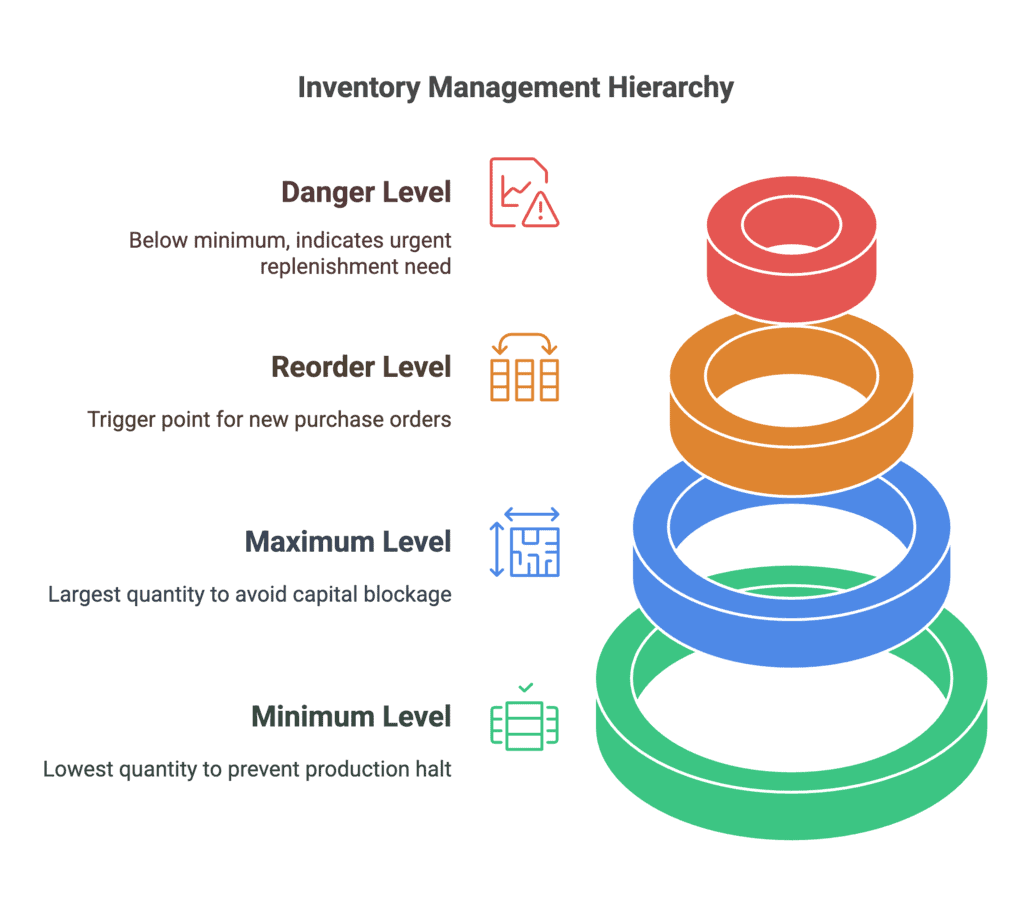

Question.12: Classify and explain the different inventory levels to order economic quantity of inventory.

(i) Minimum Inventory Level : It represents the lowest quantity of a particular material, below which stock should not be allowed to fall. This level must be maintained at every time so that production does not get interrupted due to shortage of raw materials.

Minimum level of inventory can be determined by the following factors:

(a) Average rate of consumption of materials.

(b) Lead Time : Normal time taken between ordering and receiving of inventory.

(c) Safety Margin : Some extra time is added to lead time as safety margin.

(d) Availability of Substitutes : Are there any substitutes for materials required ?

(ii) Maximum Inventory Level : It represents the largest quantity of a particular materialwhich should be kept in store at one time. The fixation of maximum level is essential to avoid unnecessary blocking up of capital in inventory. It is fixed keeping in mind the following factors:

(a) Rate of consumption of material

(b) Storage of space available

(c) Lead time

(d) Nature of material

(e) Cost of inventory

(f) Working capital required

(g) Market trends such as fashion trends

(h) Government restriction

(i) Economic order quantity (EOQ)

(j) Risk involved.

Maximum level = Reordering level + Reordering quantity.(iii) Recording level : It is the level of inventory at which purchase requisition should be issued and purchase order should be made. The ordering level is fixed somewhere between the maximum and minimum level. When this level is reached, stock keeper will issue the purchase requisition. Reorder level = (Maximum consumption during the period) × (Maximum period required for delivery)

(iv) Danger level : This is generally fixed below the minimum level because general stock should not reach below minimum level and if it reaches, it indicates alarming situation. If it reaches the danger level at any point of time, urgent actions for replenishment of stock must be taken to prevent stock out.

Question.13: Re–order quantity = 3600 units

Maximum consumption = 900 units per week

Minimum consumption = 300 units per week

Normal consumption = 600 units per week

Re-order point = 3 to 5 weeks

Calculate :

(i) Re-order level

(ii) Minimum level

(iii) Maximum level

(i) Re-order level = Maximum consumption × Maximum delivery period.

= 900 × 5 = 4,500 units(ii) Minimum level = Re-order level – (Normal usage per week × Average delivery time)

= 4,500 – (600×4) = 2,100 units

(iii) Maximum level = (Re-order level + Reorder quantity) – (Minimum consumption × Minimum reorder period)

= (4,500 + 3,600) – (300 × 3) = 7,200 units

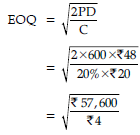

Question.14: Explain Economic Order Quantity. Also give an example.

Economic Order Quantity (E.O.Q.) represents the quantity of an item which is most economical to order when fresh supplies are required. At such level of re-order, the total ordering cost and inventory carrying cost would be minimum. E.O.Q. is the quantity at which the ordering cost is equal to the inventory cost. At this level, total cost of inventory

would be minimum and most favourable to the buyer. The quantity of a material which is ordered at a time is known as ordering quantity.

Economic order quantity is determined at that level where the total ordering cost and carrying cost is minimum.

E.O.Q. is calculated by the following formula :

E.O.Q. =

Where : D = Annual demand

P = Ordering cost per unit

C = Carrying cost per unit

Example : Annual usage = 600 units

Cost of placing order = ₹ 48

Price of material per unit = ₹ 20

Cost of storage = 20% of inventory value.

Calculate EOQ and number of orders to be placed.

Solution :

= 120 units.

No. of orders to be placed = Annual usage/E.O.Q.

= 600 units/120units = 5

Question.15: From the following information calculate ROI :

Equity share capital ₹ 5,00,000

Preference share capital ₹ 2,00,000

10% Debentures ₹ 5,00,000

Current liabilities ₹ 1,00,000

Net profit after interest but before tax ₹ 1,00,000

ROI = Earning before interest, tax and depreciation / Total investment

Net profit before interest and tax = Net profit + Interest on debentures

= ₹ 1,00,000 + ₹ 50,000

= ₹ 1,50,000

Total investment / Capital employed = Equity share capital + Preference share capital + 10% debentures

= ₹ 5,00,000 + ₹ 2,00,000 + ₹ 5,00,000

= ₹ 12,00,000

ROI = (1,50,000 / ₹ 12,00,000) × 100 = 12.5%

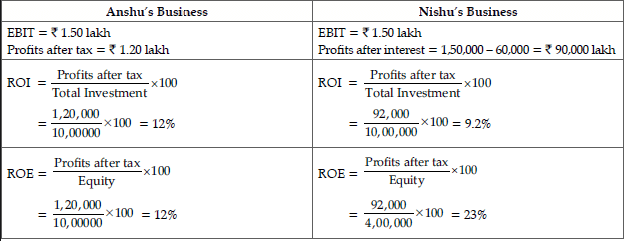

Question.16: Anshu and Nishu started identical business and performing identically in terms of sales, variable costs, fixed costs etc. The only difference is Anshu did not borrow any money and Nishu borrowed ₹6 lacs at the interest rate of 10% per annum. Total capital investment in both businesses is ₹10 lakh. Their EBIT is ₹1.50 lakh. Tax rate @ 20%.

(i) Calculate ROE and ROI for each business.

(ii) Comment on the results.

(iii) Which of these is a good indicator of own money?

(i)

(ii) Nishu’s ROE is greater than Anshu’s ROE due to presence of loan capital in capital structure and ROI is lesser.

(iii) For a true measure of how “own money” is being used ROE is a good indicator. ROI on the other hand, gives an indication of how “total money” is being used.

|

23 videos|101 docs|12 tests

|

FAQs on Long Answer Type Question- Business Arithmetic - Entrepreneurship Class 12 - Commerce

| 1. What is business arithmetic in commerce? |  |

| 2. How is business arithmetic relevant to commerce? |  |

| 3. What are the key skills required for business arithmetic in commerce? |  |

| 4. Can business arithmetic be used for small-scale businesses as well? |  |

| 5. How can one improve their proficiency in business arithmetic? |  |