Poverty, Planning, Finance & Economic - Solved Questions (2011- 2015) | UPSC Topic Wise Previous Year Questions PDF Download

Question 1: With reference to the Fourteenth Finance Commission, which of the following statements is/ are correct? [2015-I]

1. It has increased the share of States in the central divisible pool from 32 percent to 42 percent.

2. It has made recommendations concerning sector specific grants.

Select the correct answer using the code given below.

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

View Answer

View Answer

Correct Answer is Option (a)

Union Government accepted the 14th Finance Commission's recommendation to devolve an unprecedented 42 per cent of the divisible pool to states during 20015-16 to 2019-20, against 32 per cent suggested by the previous commission.

Question 2: Convertibility of rupee implies [2015-I]

(a) being able to convert rupee notes into gold

(b) allowing the value of rupee to be fixed by market forces

(c) freely permitting the conversion of rupee to other currencies and vice versa

(d) developing an international market for currencies in India

View Answer

View Answer

Correct Answer is Option (c)

Convertibility of rupee implies freely permitting the conversion of rupee to other currencies and vice versa. Currency Convertibility is the ease with which a country's currency can be converted into gold or another currency

Question 3: The Government of India has established NITI Aayog to replace the [2015-I]

(a) Human Rights Commission

(b) Finance Commission

(c) Law Commission

(d) Planning Commission

View Answer

View Answer

Correct Answer is Option (d)

The Government of India has established NITI Aayog to replace the Planning Commission. The Union Government of India announced formation of NITI Aayog on 1 January 2015 and the first meeting of NITI Aayog was held on 8 February 2015.

Question 4: With reference to 'Indian Ocean Rim Association for Regional Cooperation (IOR-ARC)', consider the following statements: [2015-I]

1. It was established very recently in response to incidents of piracy and accidents of oil spills.

2. It is an alliance meant for maritime security only.

Which of the statements given above is / are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

View Answer

View Answer

Correct Answer is Option (d)

IOR-ARC is a regional cooperation initiative of the Indian Ocean Rim countries which was established in Mauritius in March 1997 with the aim of promoting economic and technical cooperation. IOR-ARC is the only pan-Indian ocean grouping. It brings together countries from three continents having different sizes, economic strengths, and a wide diversity of languages, cultures. It aims to create a platform for trade, socio-economic and cultural cooperation in the Indian Ocean rim area, which constitutes a population of about two billion people. Presently it has 19 members- Australia, Bangladesh, India, Indonesia, Iran, Kenya, Malaysia, Madagascar, Mauritius, Mozambique, Oman, Seychelles, Singapore, South Africa, Sri Lanka, Tanzania, Thailand, UAE and Yemen. Six priority areas were identified to take forward the cooperation under IOR-ARC:

- Maritime Safety and Security;

- Trade and Investment Facilitation;

- Fisheries Management;

- Disaster Risk Reduction;

- Academic and S&T Cooperation; and

- Tourism Promotion and Cultural Exchanges.

Question 5: statements is correct? [2015-I]

(a) Controlling the inflation in India is the responsibility of the Government of India only

(b) The Reserve Bank of India has no role in controlling the inflation

(c) Decreased money circulation helps in controlling the inflation

(d) Increased money circulation helps in controlling the inflation

View Answer

View Answer

Correct Answer is Option (c)

When inflation becomes very high, the RBI decreases supply of money (to check inflation) by adopting tight monetary policy. Decreasing the money circulation decreases the demand of goods and services, which helps in controlling the inflation. It is mainly effective in case of demand pull inflation.

Question 6: There has been a persistent deficit budget year after year. Which of the following actions can be taken by the government to reduce the deficit? [2015-I]

1. Reducing revenue expenditure

2. Introducing new welfare schemes

3. Rationalizing subsidies

4. Expanding industries

Select the correct answer using the code given below.

(a) 1 and 3 only

(b) 2 and 3 only

(c) 1 only

(d) 1, 2, 3 and 4

View Answer

View Answer

Correct Answer is Option (a)

To reduce the budget deficit, the government has to increase income and reduce Expenditure. Introducing new welfare schemes and Expanding industries will increase the government expenditure.

Question 7: The Fair and Remunerative Price (FRP) of sugarcane is approved by the [2015-I]

(a) Cabinet Committee on Economic Affairs

(b) Commission for Agricultural Costs and Prices

(c) Directorate of Marketing and Inspection, Ministry of Agriculture

(d) Agricultural Produce Market Committee

View Answer

View Answer

Correct Answer is Option (a)

The Fair and Remunerative Price (FRP) of sugarcane is approved by Cabinet Committee on Economic Affairs.

Question 8: 'Pradhan Mantri Jan-Dhan Yojana' has been launched for [2015-I]

(a) providing housing loan to poor people at cheaper interest rates

(b) promoting women's Self-Help Groups in backward areas

(c) promoting financial inclusion in the country

(d) providing financial help to the marginalized communities

View Answer

View Answer

Correct Answer is Option (c)

Pradhan Mantri Jan-Dhan Yojana (PMJDY) is National Mission for Financial Inclusion to ensure access to financial services, namely, Banking/ Savings & Deposit Accounts, Remittance, Credit, Insurance, Pension in an affordable manner.

Question 9: If the interest rate is decreased in an economy, it will [2014 - I]

(a) decrease the consumption expenditure in the economy

(b) increase the tax collection of the Government

(c) increase the investment expenditure in the economy

(d) increase the total savings in the economy

View Answer

View Answer

Correct Answer is Option (c)

When interest rates decreases then investment expenditure by businesses on capital goods like factories and equipment will increase in an economy.

Question 10: With reference to Union Budget, which of the following is/are covered under Non-Plan Expenditure? [2014 - I]

1. Defence expenditure

2. Interest payments

3. Salaries and pensions

4. Subsidies

Select the correct answer using the code given below.

(a) 1 only

(b) 2 and 3 only

(c) 1, 2, 3 and 4

(d) None

View Answer

View Answer

Correct Answer is Option (c)

Non-plan expenditure covers interest payments, subsidies (mainly on food and fertilisers), wage and salary payments to government employees, grants to States and Union Territories governments, pensions, police, economic services in various sectors, defence, loans to public enterprises, loans to States, Union Territories and foreign governments.

Question 11: The sales tax you pay while purchasing a toothpaste is a

[2014 - I]

(a) tax imposed by the Central Government

(b) tax imposed by the Central Government but collected by the State Government

(c) tax imposed by the State Government but collected by the Central Government

(d) tax imposed and collected by the State Government

View Answer

View Answer

Correct Answer is Option (d)

Taxes on tooth paste come under GST which is administered by State government. Sales tax is paid to sales tax authority in the state from where the goods are moved.

Question 12: What does venture capital mean? [2014 - I]

(a) A short-term capital provided to industries

(b) A long-term start-up capital provided to new entrepreneurs

(c) Funds provided to industries at times of incurring losses

(d) Funds provided for replacement and renovation of industries

View Answer

View Answer

Correct Answer is Option (b)

Venture capital (VC) is a long term financial capital provided to early-stage, high-potential, growth startup companies or new companies.

Question 13: Who among the following constitute the National Development Council? [2013 - I]

1. The Prime Minister

2. The Chairman, Finance Commission

3. Ministers of the Union Cabinet

4. Chief Ministers of the States

Select the correct answer using the codes given below.

(a) 1, 2 and 3 only

(b) 1, 3 and 4 only

(c) 2 and 4 only

(d) 1, 2, 3 and 4

View Answer

View Answer

Correct Answer is Option (b)

The National Development Council includes the Prime Minister, Union ministers, Chief ministers of all states, administrative heads of the Union Territories and members of the planning commission.

Question 14: To obtain full benefits of demographic dividend, what should India do? [2013 - I]

(a) Promoting skill development

(b) Introducing more social security schemes

(c) Reducing infant mortality rate

(d) Privatization of higher education

View Answer

View Answer

Correct Answer is Option (a)

To reap the benefits of demographic dividend, skills have to be developed because a relatively larger portion of population fall under the category of productive labour force when there is a demographic dividend.

Question 15: A rise in general level of prices may be caused by [2013 - I]

1. an increase in the money supply

2. a decrease in the aggregate level of output

3. an increase in the effective demand

Select the correct answer using the codes given below.

(a) 1 only

(b) 1 and 2 only

(c) 2 and 3 only

(d) 1, 2 and 3

View Answer

View Answer

Correct Answer is Option (d)

General Price rise may be caused by an increase in the money supply as the real value of the money reduces. The higher aggregate price level will reduce the purchasing power subsequently reducing the consumer spending. Effective demand also increases when there is less purchasing power due to inflation.

Question 16: Which one of the following is likely to be the most inflationary in its effect? [2013 - I]

(a) Repayment of public debt

(b) Borrowing from the public to finance a budget deficit

(c) Borrowing from banks to finance a budget deficit

(d) Creating new money to finance a budget deficit

View Answer

View Answer

Correct Answer is Option (d)

Extremely high rates of inflation are generally associated with high rates of money growth. It is often the result of financing large deficits by printing money

Question 17: Supply of money remaining the same when there is an increase in demand for money, there will be [2013 - I]

(a) a fall in the level of prices

(b) an increase in the rate of interest

(c) a decrease in the rate of interest

(d) an increase in the level of income and employment

View Answer

View Answer

Correct Answer is Option (c)

Supply of money remaining the same when there is an increase in demand for money, there will be an increase in the rate of interest and vice-versa.

Question 18: Economic growth in country X will necessarily have to occur if [2013 - I]

(a) there is technical progress in the world economy

(b) there is population growth in X

(c) there is capital formation of X

(d) the volume of trade grows in the world economy

View Answer

View Answer

Correct Answer is Option (c)

A country’s economic growth is reflected through capital formation, which in turn encourages private enterprises in enhancing the growth of a country’s economy.

Question 19: How do District Rural Development Agencies (DRDAs) help in the reduction of rural poverty in India? [2012 - I]

1. DRDAs act as Panchayati Raj Institutions in certain specified backward regions of the country.

2. DRDAs undertake area-specific scientific study of the causes of poverty and malnutrition and prepare detailed remedial measures.

3. DRDAs secure inter-sectoral and inter-departmental coordination and cooperation for effective implementation of anti-poverty programmes.

4. DRDAs watch over and ensure effective utilization of the funds intended for anti-poverty programmes.

Which of the statements given above is/are correct?

(a) 1, 2 and 3 only

(b) 3 and 4 only

(c) 4 only

(d) 1, 2, 3 and 4

View Answer

View Answer

Correct Answer is Option (b)

DRDA has traditionally been the principal organ at the district level to oversee the implementation of anti-poverty programmes of the Ministry of Rural Development. It does not acts as Panchayati Raj Institutions.

Question 20: The Multi-dimensional Poverty Index developed by Oxford Poverty and Human Development Initiative with UNDP support covers which of the following? [2012 - I]

1. Deprivation of education, health, assets and services at household level

2. Purchasing power parity at national level

3. Extent of budget deficit and GDP growth rate at national level

Select the correct answer using the codes given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

View Answer

View Answer

Correct Answer is Option (a)

Deprivation of education, health, assets and services at household level

Question 21: Which of the following is /are among the noticeable features of the recommendations of the Thirteenth Finance Commission? [2012 - I]

1. A design for the Goods and Services Tax, and a compensation package linked to adherence to the proposed design

2. A design for the creation of lakhs of jobs in the next ten years in consonance with India’s demographic dividend

3. Devolution of a specified share of central taxes to local bodies as grants

Select the correct answer using the codes given below:

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

View Answer

View Answer

Correct Answer is Option (a)

The 13th finance commission has an elaborate design for the GST. Statement 1 is correct. Statement 2 is incorrect. Report basically discusses the improved implementation of the existing schemes. The third statement is correct. The report in its para 10.44 mentions: “Taking into account the demand of local bodies that they be allowed to benefit from the buoyancy of central taxes and the constitutional design of supplementing the resources of Panchayats and municipalities through grants-in-aid, we recommend that local bodies be transferred a percentage of the divisible pool of taxes cover and above the share of the states, as stipulated by us, after converting this share to grant-in-aid under Article 275.”

Question 22: Consider the following specific stages of demographic transition associated with economic development: [2012 - I]

1. Low birthrate with low death rate

2. High birthrate with high death rate

3. High birthrate with low death rate

Select the correct order of the above stages using the codes given below:

(a) 1, 2, 3

(b) 2, 1, 3

(c) 2, 3, 1

(d) 3, 2, 1

View Answer

View Answer

Correct Answer is Option (c)

Demographic Transition is the transition from high birth and death rates to lower birth and death rates as a country or region develops from a pre-industrial to an industrialized economic System.

Question 23: Under which of the following circumstances may ‘capital gains’ arise? [2012 - I]

1. When there is an increase in the sales of a product

2. When there is a natural increase in the value of the property owned

3. When you purchase a painting and there is a growth in its value due to increase in its popularity

Select the correct answer using the codes given below:

(a) 1 only

(b) 2 and 3 only

(c) 2 only

(d) 1, 2 and 3

View Answer

View Answer

Correct Answer is Option (b)

Capital gain is an increase in the value of a capital asset (investment or real estate) that gives it a higher worth than the purchase price. The gain is the difference between a higher selling price and a lower purchase price. The increase in the sales of a product does not mean increase the selling price of the product.

Question 24: Which of the following measures would result in an increase in the money supply in the economy? [2012 - I]

1. Purchase of government securities from the public by the Central Bank

2. Deposit of currency in commercial banks by the public

3. Borrowing by the government from the Central Bank

4. Sale of government securities to the public by the Central Bank

Select the correct answer using the codes given below:

(a) 1 only

(b) 2 and 4 only

(c) 1 and 3

(d) 2, 3 and 4

View Answer

View Answer

Correct Answer is Option (c)

1. Purchase of government securities from the public by the Central Bank

3. Borrowing by the government from the Central Bank

Question 25: Which of the following would include Foreign Direct Investment in India? [2012 - I]

1. Subsidiaries of foreign companies in India

2. Majority foreign equity holding in Indian companies

3. Companies exclusively financed by foreign companies

4. Portfolio investment

Select the correct answer using the codes given below:

(a) 1, 2, 3 and 4

(b) 2 and 4 only

(c) 1 and 3 only

(d) 1, 2 and 3 only

View Answer

View Answer

Correct Answer is Option (d)

A Foreign direct investment (FDI) involves establishing a direct business interest in a foreign country, such as buying or establishing a manufacturing business, while foreign Portfolio Investment (FPI) refers to investing in financial assets such as stocks or bords in a foreign country. Hence, FDI does not involve portfolio Investment.

Question 26: India has experienced persistent and high food inflation in the recent past. What could be the reasons?

1. Due to a gradual switchover to the cultivation of commercial crops, the area under the cultivation of food grains has steadily decreased in the last five years by about 30%.

2. As a consequence of increasing incomes, the consumption patterns of the people have undergone a significant change.

3. The food supply chain has structural constraints. [2011 - I]

Which of the statements given above are correct ?

(a) 1 and 2 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

View Answer

View Answer

Correct Answer is Option (b)

Notwithstanding some moderation, food price inflation has remained persistently elevated for over a year now, reflecting in part the structural demand-supply mismatches in several commodities. The trend of food inflation was pointing at not only structural demand-supply mismatches in commodities comprises the essential consumption basket but also at changing consumption patterns.

Question 27: In terms of economy, the visit by foreign nationals to witness the XIX commonwealth games in India amounted to [2011 - I]

(a) Export

(b) Import

(c) Production

(d) Consumption

View Answer

View Answer

Correct Answer is Option (a)

Income from “tourism” is an invisible export and brings foreign exchange in the country.

Question 28: Which one of the following statements appropriately describes the “fiscal stimulus” ? [2011 - I]

(a) It is a massive investment by the government in manufacturing sector to ensure the supply of goods to meet the demand surge caused by rapid economic growth.

(b) It is an intense affirmative action of the government to boost economic activity in the country.

(c) It is government’s intensive action on financial institutions to ensure disbursement of loans to agriculture and allied sectors to promote greater food production and contain food inflation.

(d) It is an extreme affirmative action by the government to pursue its policy of financial inclusion.

View Answer

View Answer

Correct Answer is Option (b)

Governments use fiscal policy to influence the level of aggregate demand in the economy. It is an effort to achieve economic objectives of price stability, full employment, and economic growth.

Question 29: Consider the following actions which the government can take: [2011 - I]

1. Devaluing the domestic currency.

2. Reduction in the export subsidy.

3. Adopting suitable policies which attract greater FDI and more funds from FIIs.

Which of the above action/actions can help in reducing the current account deficit ?

(a) 1 and 2

(b) 2 and 3

(c) 3 only

(d) 1 and 3

View Answer

View Answer

Correct Answer is Option (d)

Current Account deficit is excess of Exports over imports. After devaluation of domestic currency, domestic goods would become cheaper which will create additional demand for countries products in the world markets. Rising capital Inflow through FDI and FII may appreciate the domestic currency and can worsen a country’s current account by increasing more imports and reducing exports, FDI and FII represents non-debt liabilities.

Question 30: Both Foreign Direct Investment (FDI) and Foreign Institutional Investor (FII) are related to investment in a country. Which one of the following statements best represents an important difference between the two ? [2011 - I]

(a) FII helps bring better management skills and technology, while FDI only brings in capital.

(b) FII helps in increasing capital availability in general, while FDI only targets specific sectors.

(c) FDI flows only into the secondary market while FII targets primary market

(d) FII is considered to be more stable than FDI.

View Answer

View Answer

Correct Answer is Option (b)

Foreign Direct Investment only targets a specific enterprise. It aims to increase the enterprises capacity or productivity or change its management control. The FII investment flows only into the secondary market. It helps in increasing capital availability in general rather than enhancing the capital of a specific enterprise. The Foreign Direct Investment is considered to be more stable than Foreign Institutional Investor. FDI not only brings in capital but also helps in good governance practises and better management skills and even technology transfer.

Question 31: With reference to “Aam Admi Bima Yojana’’, consider the following statements ?

1. The member insured under the scheme must be the head of the family or an earning member of the family in a rural landless house-hold.

2. The member insured must be in the age group of 30 to 65 years.

3. There is a provision for free scholarship for up to two children of the insured who are studying between classes 9 and 12. [2011 - I]

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

View Answer

View Answer

Correct Answer is Option (c)

The statements 1st and 3rd are correct, but 2nd statement is wrong because, the member should be aged between 18 and 59 years not 30 and 65 years.

Question 32: Microfinance is the provision of financial services to people of low-income groups. This includes both the consumers and the self-employed. The service/services rendered under microfinance is/are: [2011 - I]

1. Credit facilities

2. Savings facilities

3. Insurance facilities

4. Fund Transfer facilities

Select the correct answer using the codes given below the lists ?

(a) 1 only

(b) 1 and 4 only

(c) 2 and 3 only

(d) 1, 2, 3 and 4

View Answer

View Answer

Correct Answer is Option (d)

Microfinance is a movement whose object is "a world in which as many poor and near-poor households as possible have permanent access to an appropriate range of high quality financial services, including not just credit but also savings, insurance, and fund transfers."

Question 33: Among the following who are eligible to benefit from the “Mahatma Gandhi National Rural Employment Guarantee Act”? [2011 - I]

(a) Adult members of only the scheduled caste and scheduled tribe households

(b) Adult members of below poverty line (BPL) households

(c) Adult members of households of all backward communities

(d) Adult members of any household

View Answer

View Answer

Correct Answer is Option (d)

All adult members of the household who registered can apply for work. To register, they have to: Be local residents

Question 34: With reference to the Finance Commission of India, which of the following statements is correct ? [2011 - I]

(a) It encourages the inflow of foreign capital for infrastructure development

(b) It facilitates the proper distribution of finances among the Public Sector Undertakings

(c) It ensures transparency in financial administration

(d) None of the statements (a), (b) and (c) given above is correct in his context

View Answer

View Answer

Correct Answer is Option (d)

The Commission shall make recommendations as to the following matters, namely:

- The distribution between the Union and the States of the net proceeds of taxes which are to be, or may be, divided between them under Chapter I Part XII of the Constitution and the allocation between the States of the respective shares of such proceeds;

- The principles which should govern the grants-in-aid of the revenues of the States out of the Consolidated Fund of India and the sums to be paid to the States which are in need of assistance by way of grants-in-aid of their revenues under article 275 of the Constitution for purposes other than those specified in the provisions to clause (1) of that article; and

- The measures needed to augment the Consolidated Fund of a State to supplement the resources of the Panchayats and Municipalities in the State on the basis of the recommendations made by the Finance Commission of the State.

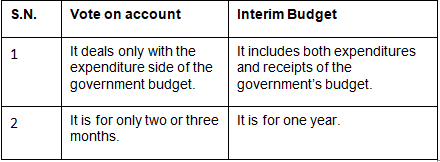

Question 35: What is the difference between “vote-on-account” and interim budget” ? [2011 - I]

1. The provision of a “vote-on-account’’ is used by a regular Government, while an “interim budget’’ is a provision used by a caretaker Government

2. A “vote-on-account’’ only deals with the expenditure in Government budget, while an “interim budget’’ includes both expenditure and receipts

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

View Answer

View Answer

Correct Answer is Option (b)

Statement 1 is not correct as caretaker Government is the government which is ready to Go, it does not present the Interim Budget. The Interim Budget is presented by the

Incoming Government or new Government which has different fiscal and revenue plans from the outgoing Government.

Question 36: Why is the offering of “teaser loans’’ by commercial banks a cause of economic concern ? [2011 - I]

1. The teaser loans are considered to be an aspect of sub-prime lending and banks may be exposed to the risk of defaulters in future.

2. In India, the teaser loans are mostly given to inexperienced entrepreneurs to set up manufacturing or export units.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

View Answer

View Answer

Correct Answer is Option (a)

The statement 1 is correct because it includes the definition of teaser loans but the statement (2) is not correct, because in India teaser loan is provided to the home buyers not setting up manufacturing or export units.

Question 37: Which of the following can aid in furthering the Government’s objective of inclusive growth ? [2011 - I]

1. Promoting Self-Help Groups.

2. Promoting Micro Small and Medium Enterprises.

3. Implementing the Right to Education Act.

Select the correct answer using the codes given below:

(a) 1 only

(b) 1 and 2 only

(c) 2 and 3 only

(d) 1,2 and 3 only

View Answer

View Answer

Correct Answer is Option (d)

The concept of the inclusive growth is based on both economic and social empowerment of ordinary and under privileged individuals. Thus all the statement are correct.

Question 38: Why is the Government of India disinvesting its equity in the Central Public Sector Enterprises (CPSEs) ? [2011 - I]

1. The Government intends to use the revenue earned from the disinvestment mainly to pay back the external debt.

2. The Government no longer intends to retain the management control of the CPSEs

Which the correct statements given above is/are correct ?

(a) 1 only

(b) 2 only

(c) Both 1 and 2

(d) Neither 1 nor 2

View Answer

View Answer

Correct Answer is Option (d)

When we say “Mainly” the money is to be used to pay the external debt, it is not correct to say so. Government though “may intend” to retain the management control, but there are fiscal constraints, that induce the government to go for disinvestment. Both statements are NOT correct.

Question 39: Economic growth is usually coupled with [2011 - I]

(a) Deflation

(b) Inflation

(c) Stagflation

(d) Hyperinflation

View Answer

View Answer

Correct Answer is Option (b)

Inflation and economic growth are parallel lines and can never meet. Inflation reduces the value of money and makes it difficult for the common people. Inflation and economic growth are incompatible because the former affects all sectors as indicated by CPI or Consumer Price Index.

Question 40: The lowering of Bank Rate by the Reserve Bank of India leads to [2011 - I]

(a) more liquidity in the market

(b) less liquidity in the market

(c) no change in the liquidity in the market

(d) mobilization of more deposits by commercial banks

View Answer

View Answer

Correct Answer is Option (a)

Bank rate refers to the official interest rate at which RBI will provide loans to the banking system which includes commercial/cooperative banks, development banks etc. when RBI lowers the bank rate, the cost of borrowing for banks decreases and the credit volume gets increased leading to increase in money and more liquidity in the market.

|

72 docs|31 tests

|

FAQs on Poverty, Planning, Finance & Economic - Solved Questions (2011- 2015) - UPSC Topic Wise Previous Year Questions

| 1. What are the main causes of poverty in India? |  |

| 2. How does economic planning impact poverty alleviation? |  |

| 3. What are the key financial instruments used in poverty alleviation programs? |  |

| 4. How does economic growth influence poverty rates? |  |

| 5. What role do government policies play in addressing poverty? |  |