Class 12 Accountancy: CBSE Sample Question Papers- Term I (2021-22)- 3 | Sample Papers for Class 12 Commerce PDF Download

| Table of contents |

|

| Class-XIITime: 90 MinutesMax. Marks: 40 |

|

| Part I: Section A |

|

| Part I: Section B |

|

| Part I: Section C |

|

| Part II: Section A |

|

| Part II: Section B |

|

Class-XII

Time: 90 Minutes

Max. Marks: 40

General instructions:

Read the following instructions very carefully and strictly follow them:

- This question paper comprises two PARTS – I and II. There are 55 questions in the question paper.

- There is an internal choice provided in each section.

I. Part I, contains three Sections -A, B and C. Section A has questions from 1 to 18 and Section B has questions from 19 to 36, you have to attempt any 15 questions each in both the sections.

II. Part I, Section C has questions from 37 to 41. You have to attempt any four questions.

III. Part II, contains two Sections – A and B. Section A has questions from 42 to 48, you have to attempt any five questions and Section B has questions from 49 to 55, you have to attempt any six questions. - All questions carry equal marks. There is no negative marking.

- Specific instructions related to each Part and sub-divisions (Section) is mentioned clearly before the questions. Candidates should read them thoroughly and attempt accordingly.

Part I: Section A

(a) ₹ 1,00,000

(b) ₹ 2,00,000

(c) ₹ 10,000

(d) ₹ 20,000

Correct Answer is Option (b)

Capitalized value of actual profits = ₹ 2,20,000 × 100/10 = ₹ 22,00,000

Goodwill = Capital value of actual profits – Actual capital invested

= ₹ 22,00,000 – ₹` 20,00,000

= ₹ 2,00,000

Q.2: When forfeited shares are re-issued, the amount of discount allowed on these shares cannot exceed:

(a) 10% of called-up capital per share

(b) 6% of paid-up capital per share

(c) The amount received per share on forfeited shares

(d) The unpaid amount per share on forfeited shares

Correct Answer is Option (c)

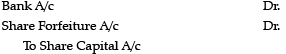

Q.3: Identify the journal entry for the issued, of forfeited shares at par.

(a)

(b)

(c)

(d) None of the above

Correct Answer is Option (a)

Q.4: 12,000 shares of ₹ 100 each forfeited due to non-payment of ₹ 40 per share. First & final call of ₹ 30 per share not yet made. These shares were reissued at ₹ 80 per share of ₹ 70 per share. Which of the following forfeited amount will be transferred to Capital Reserve?

(a) ₹ 4,80,000

(b) ₹ 3,60,000

(c) ₹ 1,20,000

(d) None of these

Correct Answer is Option (b)

Reissue of shares at a premium of (₹ 80 – ₹ 70) ₹ 10 per share. Therefore, all forfeited amount i.e., 12,000× ₹ 30 = ₹ 3,60,000 will be transferred to Capital Reserve.

Q.5: 12,000 shares of ₹ 100 each forfeited due to non-payment of allotment money of ₹ 40 per share and first & final call of ₹ 30 per share. Out of the forfeited shares, 9,000 shares were reissued at ₹ 80 per share fully paid. Which of the following amount of share forfeiture account will be transferred to Capital Reserve Account?

(a) ₹ 90,000

(b) ₹ 1,80,000

(c) ₹ 3,60,000

(d) ₹ 2,70,000

Correct Answer is Option (a)

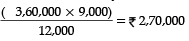

Forfeited amount on 12,000 shares (12,000 × ₹ 30) is ₹ 3,60,000 and only 9,000 shares reissued. Therefore, on 9,000 shares forfeited money

=

Less : Adjusted loss on reissue of shares (9,000 × ₹ 20) = (1,80,000)

Amount to be transferred to Capital Reserve = ₹ 2,70,000 – ₹ 1,80,000 = ₹ 90,000

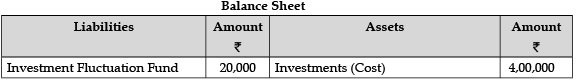

Q.6: A, B and C are partners sharing profits in the ratio of 3:2:1. They agreed to admit D into the partnership for 1/4th share. An extract of their balance sheet on 1st April, 2021 is as follows:

If the market value of Investments is ₹ 4,20,000 then the Investment Fluctuation Fund will be shown in the Balance Sheet of reconstituted firm at _____.

(a) ₹ 40,000

(b) ₹ 20,000

(c) Zero

(d) None of these

Correct Answer is Option (c)

Whole amount of fund will be distributed among old partners in their old profit sharing ratio.

Q.7: ________ means an assurance that incoming partner or an existing partner will not get his share of profit less than the amount guaranteed to him.

(a) Guarantee

(b) Past adjustment

(c) Insurance

(d) None of these

Correct Answer is Option (a)

Guarantee means an assured amount is payable to a partner and the deficiency, if any, is borne by remaining partners or partner as decided between them. If nothing is mentioned about the amount of deficiency to be paid, than it is payable by remaining partners in existing profit sharing ratio.

Q.8: The increase in the value of assets and decrease in the value of liabilities is recorded in the ________ side of revaluation.

(a) Debit

(b) Credit

(c) Either (A) or (B)

(d) None of these

Correct Answer is Option (b)

Q.9: Rohan and Karan are doing business in partnership without any agreement between them. Rohan demands a salary of ₹ 10,000 and Karan demands a commission of ₹ 15,000. Who is correct?

(a) Rohan

(b) Karan

(c) Both (A) and (B)

(d) None of these

Correct Answer is Option (d)

No salary or commission is payable to partners in the absence of partnership deed. Thus, both Karan and Rohan are not justified.

Q.10: Sun and Star were partners in a firm sharing profit in the ratio of 2 : 1. Moon is admitted as a new partner in the firm. New profit sharing ratio was 3 : 3 : 2. Moon brought the following assets towards his share of Goodwill and Capital:

Machinery : ₹ 2,00,000

Furniture : ₹ 1,20,000

Stock : ₹ 80,000

Cash : ₹ 50,000

If his capital is considered as ₹ 3,80,000, the Goodwill of the firm will be:

(a) ₹ 70,000

(b) ₹ 2,80,000

(c) ₹ 4,50,000

(d) ₹ 1,40,000

Correct Answer is Option (b)

New partner's share of goodwill = Assets – Capital

= ₹ 4,50,000 – ₹ 3,80,000

= ₹ 70,000

Goodwill of the firm = ₹ 70,000 × 8/2

= ₹ 2,80,0 00

Q.11: The fixed capital a partner may can change if :

(a) Fresh capital is introduced

(b) Capital is withdrawn permanently

(c) Both (A) and (B)

(d) None of these

Correct Answer is Option (b)

The fixed capital changes only when fresh capital is introduced or existing capital is withdrawn permanently.

Q.12: A and B are partners in a firm sharing profits in the ratio of 3 : 2. They decided to share future profits equally. Calculate A’s gain or sacrifice.

(a) 2/10 (sacrifice)

(b) 5/10 (gain)

(c) 1/10 (Gain)

(d) 1/10 (sacrifice)

Correct Answer is Option (d)

A = 3/5 − 1/2

=1/10(Sacrifice)

Q.13: In case of change in profit-sharing ratio, the gaining partner must compensate the sacrificing partners by paying the proportional amount of :

(a) Capital

(b) Cash

(c) Goodwill

(d) None of these

Correct Answer is Option (c)

Q.14: Pick the odd one out :

(a) Issue of shares to vendors

(b) Issue of shares to general public

(c) Issue of shares to underwriters

(d) Issue of shares to promoters

Correct Answer is Option (b)

Issue of shares to general public is the only one which is not done to settle previous debt but to raise share capital.

Q.15: Karan Ltd. forfeited 10,000 equity shares of 100 each for non-payment of first and final call of 20 per share. The maximum amount of discount at which these share can be re-issued will be :

(a) ₹ 8,00,000

(b) ₹ 12,00,000

(c) ₹ 20,00,000

(d) ₹ 20,000

Correct Answer is Option (a)

Amount forfeited by company = 10,000 x 8 = 80,000

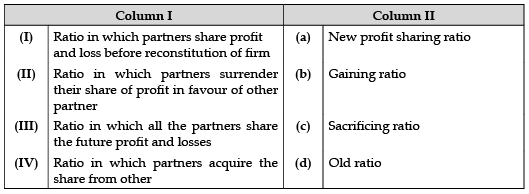

Q.16: Match the following items :

(a) I-(d), II-(c), (III)-(a), (IV)-(b)

(b) I-(a), (II)-(c), (III)-(b), (IV)-(d)

(c) I-(a), (II)-(b), (III)-(c), (IV-(d)

(d) I-(d), (II)-(c), (III)-(b), (IV)-(a)

Correct Answer is Option (a)

Q.17: X and Y share profits in the ratio of 3:2. Z was admitted as a partner who gets 1/5 share. New profitsharing ratio, if Z acquires 3/20 from X and 1/20 from Y would be:

(a) 9 : 7 : 4

(b) 8 : 8 : 4

(c) 6 : 10 : 4

(d) 10 : 6 : 4

Correct Answer is Option (a)

X = 3/5 − 3/20 = 9/20

Y = 2/5−1/20 = 7/20

Z = 1/5 × 4/4 = 4/20

New ratio = 9 : 7 : 4

Q.18: If the interest on capital is omitted, what will be the journal entry during the situation?

(a) Profit & Loss Adjustment A/c Dr.

To Partners’ Capital/Current A/cs (Being adjustment made for interest on capital previously omitted, now carried out)

(b) Profit & Loss A/c Dr.

To Partners’ Capital/Current A/cs (Being adjustment made for interest on capital previously omitted, now carried out)

(c) Partners’ Capital/Current A/cs Dr.

To Profit and Loss Appropriation A/c (Being adjustment made for interest on capital previously omitted, now carried out)

(d) Profit and Loss Appropriations A/c Dr.

To Profit and Loss A/c (Being adjustment made for interest on capital previously omitted, now carried out)

Correct Answer is Option (a)

Part I: Section B

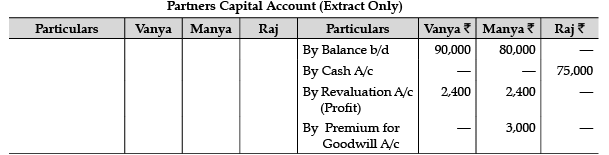

Q.19: Vanya and Manya are partners. They admit Raj as a new partner. Following information is provided by the firm on the admission of new partner:

Vanya made no gain/no sacrifice and Manya’s Sacrifice = 1/6

New profit sharing ratio of the partners:

(a) 1:1:1

(b) 2:1:1

(c) 2:2:1

(d) 3:2:1

Correct Answer is Option (d)

Q.20: Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R):

Assertion (A): On admission of a new partner, assets and liabilities are revalued.

Reason (R): Assets and liabilities are revalued so as to show the proper financial position of the firm and the capital held by the partners at the time of admission.

In the context of the above two statements, which of the following is correct?

(a) Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true,but Reason (R) is not the correct explanation of Assertion (A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Correct Answer is Option (a)

Q.21: Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R):

Assertion (A): At the time of admission of a partner, if there is any General Reserve, Reserve Fund or the balance of Profit & Loss Account appearing in the balance sheet, it should be transferred to old partners’ capital/current accounts in their old profit sharing ratio.

Reason (R): The General Reserve, Reserve Fund or the Balance of Profit and Loss Account are the result of the past profits when the new partner was not admitted.

In the context of the above two statements, which of the following is correct?

(a) Both Assertion (A) and Reason (R) are true,and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true,but Reason (R) is not the correct explanation of Assertion (A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Correct Answer is Option (a)

All accumulated profits and reserves need to adjusted as they are the result of the past profits of the firm.

Q.22: Which of the following statements is not true?

(a) All partners share profit and losses equally in the absence of a partnership deed

(b) A minor can be admitted as a partner, only into the benefits of the partnership

(c) A sleeping partner is allowed to sleep during a meeting of the partners.

(d) A nominal partner is a partner who has no actual interest in the trade or its profits.

Correct Answer is Option (c)

Q.23: X and Y shared profits and losses in the ratio of 3:2. With effect from 1st April 2019, they agreed to share profit equally. The goodwill of the firm was valued at ₹ 60,000. The adjustment entry will be:

(a) Debit Y and credit X with ₹ 6,000

(b) Debit X and credit Y with ₹ 6,000

(c) Debit X and credit Y with ₹ 600

(d) Debit Y and credit X with ₹ 600

Correct Answer is Option (a)

Sacrifice or gain of the partners :

X's sacrifice = 3/5 - 1/2 = 1/10

Gain of Y = 2/5 - 1/2 = -1/10

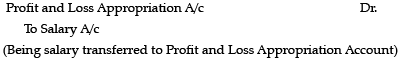

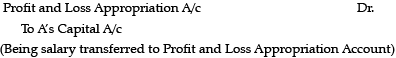

Q.24: Identify the correct journal entry for transferring salaries paid to the active partner A to the Profit and Loss Appropriation A/c.

(a)

(b)

(c)

(d)

Correct Answer is Option (a)

When the salary is transferred to Profit and Loss Appropriation Account, Salary Account is credited and Profit and Loss Appropriation Account is debited.

Q.25: A and B are partners sharing profits and losses equally. They admitted C as a partner with an equal share giving him a guarantee of minimum ₹ 50,000 profit p.a. The profit for the year after C’s admission was ₹ 1,20,000. What will be the net amount that will be credited to A’s Capital A/c?

(a) ₹ 50,000

(b) ₹ 40,000

(c) ₹ 35,000

(d) ₹ 80,000

Correct Answer is Option (c)

Share of A in profit= ₹ 40,000 less Deficiency paid to C= ₹ 5,000. So net amount received by A = ₹ 35,000.

Q.26: Analyse the transaction and identify the effect on the Revaluation Account.

Two month's salaries @ ₹ 6,000 per month was outstanding.

(a) Revaluation account is debited by ₹ 12,000

(b) Revaluation account is credited by ₹ 12,000

(c) Revaluation account is debited by ₹ 6,000

(d) Revaluation account is credited by ₹ 6,000

Correct Answer is Option (a)

Q.27: XYZ Ltd. purchased a running business of AXN Ltd. and paid ₹ 30,000 by a bank draft and balance by issuing equity shares of ₹ 10 each at a premium of 60%. Company has acquired Total Assets of ₹ 2,80,000; Creditors ₹ 20,000 and a balancing figure was credited as Capital Reserve ₹ 10,000.

Number of shares to be issued :

(a) 13,750

(b) 22,000

(c) 25,000

(d) 15,625

Correct Answer is Option (a)

Explanation = ₹ 2,80,000

– ₹ 30,000 – ₹ 30,000

= ₹ 2,20,000

No. of shares = 2,20,000/16

= 13,750 shares

Q.28: A shareholder failed to pay share allotment money on 12,000 shares @ ₹ 30 per share. Which one of the following account will be taken into account?

(a) Debited to Share Capital A/c

(b) Debited to Calls-in-Arrears A/c

(c) Credited to Calls-in-Arrears A/c

(d) Credited to Share Capital A/c

Correct Answer is Option (b)

Q.29: If a partner withdraws an equal amount in the beginning of each month for a period of 10 months, what will be the average period for calculation of Interest on Drawings?

(a) 6.5 months

(b) 7.5 months

(c) 6 months

(d) 5.5 months

Correct Answer is Option (d)

Time left after first drawing=10 months

Time left after last drawing=1 month;(10+1)/2 =5.5

Q.30: Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R):

Assertion (A): Tara Ltd. gave shares worth ` 1,50,000 to the vendor from whom they bought a machinery.

Reason (R): The company can issue shares as against the payment to the vendors.

In the context of the above two statements, which of the following is correct?

(a) Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Correct Answer is Option (a)

Instead of paying the amount, the company can issue shares to the vendors from the authorised share capital, at par, premium or discount.

Q.31: Black Ltd. had issued 5,000 equity shares of ₹ 10 each at par. The application money was ₹ 3 per share and the public applied for 7,500 shares. Pro-rata allotment was made. Sohan applied for 450 shares. The amount carried forward towards the sum due on allotment on his share will be:

(a) ₹ 1,350

(b) ₹ 900

(c) ₹ 450

(d) ₹ 4,500

Correct Answer is Option (c)

Amount adjusted will be:

Applied shares=450

Allotted shares=300

Excess paid to be adjusted on allotment

= (450 – 300) × ₹ 3 = ₹ 450

Q.32: X and Y are partners sharing profits and losses in the ratio of 3:2 with capitals ₹ 5,00,000 each.

According to partnership deed, interest on capital is allowed @ 10% p.a. The profit for the year is ₹ 50,000. What amount will be credited to X and Y in such condition?

(a) ₹ 50,000 to A and B each

(b) ₹ 25,000 to A and B each

(c) ₹ 30,000 to A and ₹ 20,000 to B

(d) None of these

Correct Answer is Option (b)

Interest payable to A and B= ₹ 50,000 each. So the profit will be divided in an equal ratio between A and B. When appropriations are more than profits then the available profit is distributed between the partners in the

Q.33: XYZ Ltd. forfeited 200 equity shares of ₹ 10 each on which the company has called ₹ 9 per share, for the non-payment of allotment money ₹ 4 per share. On forfeiture, the amount debited to Share Capital A/c will be:

(a) ₹ 1,000

(b) ₹ 800

(c) ₹ 200

(d) ₹ 1,800

Correct Answer is Option (d)

Called up value = No. of shares issued × Called up value of share

= 200 × ₹ 9 = ₹ 1,800

Q.34: Surya Ltd. has issued 20,000 equity shares of ₹ 20 each and total nominal face value has been called. It has received full amount except the final call ₹ 6 per share on 1,000 equity shares. These equity shares will be known as:

(a) Subscribed and fully paid

(b) Subscribed but not fully paid

(c) Authorized Capital

(d) None of these

Correct Answer is Option (b)

Because the shareholders have not paid the final call money shares have been subscribed but not fully paid.

Q.35: X and Y are partners sharing profits and losses in the ratio of 3 : 2. They admit Z into partnership with 1/5th share in profits which he acquires equally from X and Y. Z brings in ₹ 40,000 as goodwill in cash. Goodwill amount will be credited to :

(a) X ₹ 20,000; Y ₹ 20,000

(b) X ₹ 25,000; Y ₹ 15,000

(c) X ₹ 24,000; Y ₹ 16,000

(d) X ₹ 4,000; Y ₹ 4,000

Correct Answer is Option (b)

Sacrificing ratio = X= 3/5 - 1/10 = 5/10

Y = 2/5 -1/10 = 3/10

Goodwill will be credited in their sacrificing ratio.

Q.36: A company has called ₹ 8 out of the nominal face value of share ₹ 10. It has received ` 7 per share. What amount will be credited to Share Capital A/c?

(a) ₹ 10

(b) ₹ 7

(c) ₹ 8

(d) ₹ 3

Correct Answer is Option (c)

The company has called the money so the money has been due by the company. And on the time of due, share capital is credited with the amount of calls mde. So, ` 8 will be the answer.

Part I: Section C

Question no.’s 37 and 38 are based on the hypothetical situation given below:

Zocon Ltd. issued a prospectus inviting applications for 5,00,000 equity shares of ₹10 each issued at a premium of 10% payable as: ₹ 3 on Application ₹ 5 on Allotment (including premium) and ₹ 3 on call.

Applications were received for 6,60,000 shares. Allotment was made as follows: (A) Applicants of 4,00,000 shares were allotted in full. (B) Applicants of 2,00,000 shares were allotted 50% on pro-rata basis. (C) Applicants of 60,000 shares were issued letters of regret.

A shareholder to whom 500 shares were allotted under category (a) paid full amount on shares allotted to him along with allotment money.

Q.37: What is the total amount collected on application?

(a) ₹15,00,000

(b) ₹19,80,000

(c) ₹3,00,000

(d) ₹4,00,000

Correct Answer is Option (b)

6,60,000 × ₹3 = ₹19,80,000

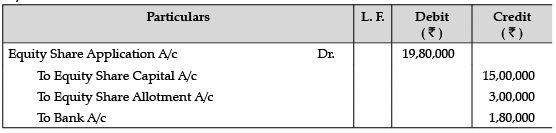

Q.38: What is the total amount transferred to Share Capital Account received from applications?

(a) ₹15,00,000

(b) ₹19,80,000

(c) ₹3,00,000

(d) ₹4,00,000

Correct Answer is Option (a)

Question no.’s 39, 40 and 41 are based on the hypothetical situation given below:

Anu and Bhagwan were partners in a firm sharing profits in the ratio of 3 : 1. Goodwill appeared in the book at ₹4,40,000. Raja was admitted to the partnership. The new profit-sharing ratio among Anu, Bhagwan and Raja was 2 : 2 : 1. Raja brought ₹1,00,000 for his capital and necessary cash for his goodwill premium. The Goodwill of the firm was valued at ₹2,50,000.

Q.39: What will be the sacrificing/ gaining ratio for each?

(a) Anu: 7/10 (sacrificing Ratio); Bhagwan: 3/10 (gaining ratio)

(b) Anu: 3/10 (gaining ratio); Bhagwan: 7/10 (sacrificing Ratio)

(c) Anu: 3/4 (gaining ratio); Bhagwan: 1/4 (sacrificing Ratio)

(d) Anu: 2/5 (sacrificing Ratio); Bhagwan: 2/5 (gaining ratio)

Correct Answer is Option (a)

Anu's Ratio = 3/4 - 2/5 = 15-8 / 20 = 7/20(Sacrificing Ratio)

Bhagwan's Ratio = 1/4 - 2/5 = 5 - 8 /20 = -3/20(Gaining Ratio)

Q.40: What is the share of Raja in Goodwill?

(a) ₹ 50,000

(b) ₹ 37,500

(c) ₹ 1,00,000

(d) ₹ 75,000

Correct Answer is Option (a)

Share of Raja in Goodwill =

= ₹ 50,000

Q.41: What is the share of Bhagwan in Goodwill?

(a) ₹ 50,000

(b) ₹ 37,500

(c) ₹ 1,00,000

(d) ₹ 75,000

Correct Answer is Option (b)

Share of Bhagwan in Goodwill =

= ₹ 37,500

Part II: Section A

Q.42: Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R):

Assertion (A): The focus of calculation of working capital revolves around managing the operating cycle of the business.

Reason (R): It is because the concept of operating cycle is required to ascertain the liquidity of assets and urgency of payments to liabilities.

In the context of the above two statements, which of the following is correct?

(a) Both (A) and (R) are true, but (R) is not the explanation of (A).

(b) Both(A) and (R) are true and (R) is a correct explanation of (A).

(c) Both (A) and (R) are false.

(d) (A) is false, but (R) is true.

Correct Answer is Option (a)

Once done effectively, ratio analysis provides a lot of information which helps the analyst:

(i) To know the areas of the business which need more attention;

(ii) To know about the potential areas which can be improved with the effort in the desired direction;

(iii)To provide a deeper analysis of the profitability, liquidity, solvency and efficiency levels in the business;

(iv) To provide information for making cross-sectional analysis by comparing the performance with the best industry standards; and

(v) To provide information derived from financial statements useful for making projections and estimates for the future.

Q.43: Which of the following are included in traditional classification of ratios?

(i) Liquidity Ratios.

(ii) Statement of Profit and Loss Ratios.

(iii) Balance Sheet Ratios.

(iv) Profitability Ratios.

(v) Composite Ratios.

(vi) Solvency Ratios.

(a) (ii), (iii) and (v)

(b) (i), (iv) and (vi)

(c) (i), (ii) and (vi)

(d) All (i), (ii), (iii), (iv), (v), (vi)

Correct Answer is Option (a)

Ratio analysis helps to understand whether the business firm has taken the right kind of operating, investing and financing decisions. It indicates how far they have helped in improving the performance.

Q.44: The following groups of ratios primarily measure risk:

(a) solvency, activity, and profitability

(b) liquidity, efficiency, and solvency

(c) liquidity, activity, and profitability

(d) liquidity, solvency, and profitability

Correct Answer is Option (d)

Working capital turnover ratio is an activity ratio.

Q.45: Which of the following is/are correct?

(i) A ratio is an arithmetical relationship of one number to another number.

(ii) Liquid ratio is also known as acid test ratio.

(iii) Ideally accepted current ratio is 1: 1.

(iv) Debt equity ratio is the relationship between outsider ’s funds and shareholders’ funds

(a) All (i), (ii), (iii) and (iv) are correct.

(b) Only (i), (ii) and (iv) are correct.

(c) Only (ii), (iii) and (iv) are correct.

(d) Only (ii) and (iv) are correct.

Correct Answer is Option (d)

Financial Statements are the basic sources of information to the shareholders and other external parties for understanding the profitability and financial position of any business concern. They provide information about the results of the business concern during a specified period of time in terms of assets and liabilities, which provide the basis for taking decisions.

Q.46: Which of the following a

the tools of Vertical Analysis?

(i) Ratio Analysis.

(ii) Comparative Statements.

(iii) Common Size Statements.

(a) Only (iii)

(b) Both (i) and (iii)

(c) Both (i) and (ii)

(d) Only (i)

Correct Answer is Option (d)

Financial analysis can be undertaken by management of the firm, or by parties outside the firm, viz., owners, trade creditors, lenders, investors, labour unions, analysts and others. The nature of analysis will differ depending on the purpose of the analyst.

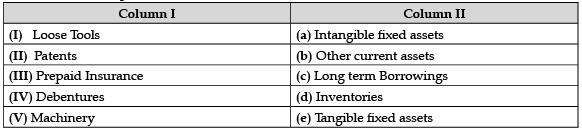

Q.47: Match the items given in Column I with the headings/sub-headings (Balance Sheet) as defined in Schedule III of Companies Act 2013.

Choose the correct option:

a. (I)-(a), (II)-(b), (III)-(d), (IV)-(c), (V)-(e)

b. (I)-(d), (II)-(a), (III)-(b), (IV)-(c), (V)-(e)

c. (I)-(d), (II)-(a), (III)-(b), (IV)-(e), (V)-(c)

d. (I)-(e), (II)-(d), (III)-(a), (IV)-(b), (V)-(b)

Correct Answer is Option (a)

Q.48: Which ratio indicates the proportion of assets financed out of shareholders’ funds?

(a) Debt equity ratio.

(b) Fixed assets turnover ratio.

(c) Proprietary ratio.

(d) Total assets to debt ratio.

Correct Answer is Option (b)

Liquidity ratios are calculated to measure the short-term solvency of the business, i.e. the firm’s ability to meet its current obligations. These are analyzed by looking at the amounts of current assets and current liabilities in the balance sheet. The two ratios included in this category are current ratio and liquidity ratio.

Part II: Section B

Q.49: From the following information, find out ‘Interest Coverage Ratio’:

Profit after interest and tax ₹ 6,00,00

10% Debentures ₹ 8,00,000

Income Tax ₹ 4,00,000

(a) 13.5 times

(b) 12 times

(c) 10 times

(d) 8.5 times

Correct Answer is Option (b)

Interest Coverage Ratio = Profit before Interest and Tax / Interest ×100

Profit after Interest and Tax = ₹ 6,00,000

Profit before Interest and Tax = ₹ 6,00,000 + ₹ 80,000 + ₹ 4,00,000 = ₹ 10,80,000

Interest Coverage Ratio = ₹ 10,80,000 / ₹ 80,000 = = 13.5 times

Q.50: Which of the following statements is/are false?

(i) Ratios may not be comparable.

(ii) There is no single standard ratio.

(iii) Ratios may be affected by window dressing.

(iv) Ratio analysis is a technique of qualitative analysis.

Choose from the following options:

(a) Only (i)

(b) Only (i) and (ii)

(c) Only (iii) and (iv)

(d) Only (iv)

Correct Answer is Option (d)

Accounting provides information about quantitative (or monetary) aspects of business. Hence, the ratios also reflect only the monetary aspects, ignoring completely the nonmonetary (qualitative) factor.

Q.51: The fixed assets of a company were ₹ 35,00,000. Its current assets were ₹ 4,30,000 and current liabilities were ₹ 3,30,000. During the year ended 31-3-2019 the company earned net profit before tax ₹ 18,00,000. The tax rate was 30%. Find out return on investment.

(a) 50%

(b) 40%

(c) 75%

(d) 65%

Correct Answer is Option (a)

Return on Investment = Profit before Interest and Tax / Capital Employed ×100

Capital Employed = Total Assets + Current Assets – Current Liabilities

= ₹ 35,00,000 + ₹ 4,30,000 – ₹ 3,30,000

= ₹ 36,00,000

Return on Investment = ₹18,00,000 / ₹36,00,000 x 100 = 50%

Q.52: Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R).

Assertion (A): Certain accounting conventions are followed while preparing financial statements.

Reason (R): The convention of valuing inventory at cost or market price, whichever is lower, is followed.

In the context of the above statements, which one of the following is correct?

(a) Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Correct Answer is Option (b)

Certain accounting conventions are followed while preparing financial statements as the use of accounting conventions makes financial statements comparable, simple and realistic.

Q.53: Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R).

Assertion (A): Liquidity ratios are essentially short-term in nature.

Reason (R): Liquidity ratios are the ratios that measure the ability of a company to meet its short term debt obligations.

In the context of the above statements, which one of the following is correct?

(a) Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Correct Answer is Option (a)

Q.54: From the following information, obtained from the books of Kamal Ltd., find out Gross Profit Ratio:

Revenue from Operations 2,50,000

Purchases 1,05,000

Carriage Inward 4,000

Salaries 30,000

Decrease in Inventory 15,000

Returns Outward 5,000

Wages 18,000

(a) 35.8%

(b) 39.8%

(c) 45.2%

(d) 25.5%

Correct Answer is Option (a)

Gross Profit Ratio = Gross Profit / Revenue from Operations ×100

Gross Profit = Revenue from Operations – Net Purchases – Carriage Inward – Decrease in Inventory – Wages

= ₹ 2,50,000 – ₹ 1,00,000 – ₹ 4,000 – ₹ 15,000 – ₹ 18,000

= ₹ 1,13,000

Gross Profit Ratio = ₹ 1,13,000 / ₹ 2,50,000 = 45.2%

Q.55: The Operating Ratio of a company is 60%. The 'Purchase of goods costing ` 20,000 will _________ the operating ratio.

(a) Increase

(b) Decrease

(c) Not change

(d) None of the above

Correct Answer is Option (c)

Since cost of goods sold includes purchases as well as closing stock so a purchase of ₹ 20,000 worth of goods will increase the value of both closing stock as well as purchases and hence will lead to change in the value of COGS. Thus, the operating ratio will remain unchanged.

|

130 docs|5 tests

|

FAQs on Class 12 Accountancy: CBSE Sample Question Papers- Term I (2021-22)- 3 - Sample Papers for Class 12 Commerce

| 1. What is the duration of Class 12 Accountancy exam? |  |

| 2. How many marks is the Class 12 Accountancy exam out of? |  |

| 3. Which sections are included in Part I of the Class 12 Accountancy exam? |  |

| 4. What are the two sections in Part II of the Class 12 Accountancy exam? |  |

| 5. Are there any sample question papers available for the Class 12 Accountancy exam? |  |