Class 12 Accountancy: CBSE Sample Question Papers- Term I (2021-22)- 4 | Sample Papers for Class 12 Commerce PDF Download

| Table of contents |

|

| Class-XIITime: 90 MinutesMax. Marks: 40 |

|

| Part I: Section A |

|

| Part I: Section B |

|

| Part I: Section C |

|

| Part II: Section A |

|

| Part II: Section B |

|

Class-XII

Time: 90 Minutes

Max. Marks: 40

General instructions:

Read the following instructions very carefully and strictly follow them:

- This question paper comprises two PARTS – I and II. There are 55 questions in the question paper.

- There is an internal choice provided in each section.

I. Part I, contains three Sections -A, B and C. Section A has questions from 1 to 18 and Section B has questions from 19 to 36, you have to attempt any 15 questions each in both the sections.

II. Part I, Section C has questions from 37 to 41. You have to attempt any four questions.

III. Part II, contains two Sections – A and B. Section A has questions from 42 to 48, you have to attempt any five questions and Section B has questions from 49 to 55, you have to attempt any six questions. - All questions carry equal marks. There is no negative marking.

- Specific instructions related to each Part and sub-divisions (Section) is mentioned clearly before the questions. Candidates should read them thoroughly and attempt accordingly.

Part I: Section A

Choose the correct statement from the following :

(b) Rohit’s Capital Account is to be credited by ₹ 30,000 and debited by ₹ 1,500.

(c) Divij’s Capital Account is to be credited with ₹ 20,000 and debited with ₹ 1,500.

(d) Kanav ’s Capital Account is to be credited with ₹ 10,000 and debited with ₹ 1,500.

Correct Answer is Option (c)

Divij's capital account credited with

= ₹ 60,000 × 2/6 = ₹ 20,000

Divij's capital account debited with

= ₹ 45,000 × 1/30 = ₹ 1,500

Q.2: Vinod Ltd. has received a lump sum amount of ₹ 3,30,000 on application and allotted 20,000 equity shares of ₹ 10 each at a premium of 10%.

How much amount is to be refunded to the applicants?

(a) ₹ 5,00,000

(b) ₹ 1,30,000

(c) ₹ 1,00,000

(d) ₹ 1,10,000

Correct Answer is Option (d)

Amount refunded = ₹ 10,000 × ₹ 11 = ₹ 1,10,000

Q.3: Rahul Ltd. invited applications for 20,000 equity shares of ₹ 10 each at a premium of 20%. Applications were received 2.5 times out of which 40% applications were rejected. Full allotment was made to 8,000 applicants and pro-rata allotment was made to the remaining applicants. One shareholder Yuvraj holding 300 shares was allotted shares on pro-rata basis. Yuvraj had applied for______ shares.

(a) 300

(b) 500

(c) 550

(d) 450

Correct Answer is Option (c)

300 × 22,000/12,000 = 550 shares

Q.4: X Ltd. offered 50,000 equity shares of ₹ 10 each, of these 48,000 shares were subscribed. The amount was payable as ₹ 3 on application, ₹ 4 on allotment along with premium of ₹ 2 and balance on first & final call. Yashika, one of the shareholders did not pay allotment money on 2,000 shares and her shares were forfeited immediately after the allotment.

Navya another shareholder holding 1,500 shares did not pay the first & final call. How much amount was received on first & final call by Vinod Ltd.?

(a) ₹ 1,33,500

(b) ₹ 1,39,500

(c) ₹ 1,45,500

(d) ₹ 2,22,500

Correct Answer is Option (d)

Total amount of calls in arrears on first and final call

= ₹ 2,0 00 × ₹ 5 + ₹ 1,500 × ₹ 5

= ₹ 10,0 00 + ₹ 7,500 = ₹ 17,500

Amount received on first and final call

= ₹ 48,0 00 × ₹ 5 – ₹ 17,500

= ₹ 2,40 ,000 – ₹ 17,500 = ₹ 2,22,500

Q.5: What will be the correct sequence of the following capitals in the balance sheet of the company?

(i) Issued Capital

(ii) Nominal Capital

(iii) Subscribed but not Fully Paid up

(iv) Subscribed and Fully Paid up

Choose the correct option:

(a) (i) (iv) (iii) (ii)

(b) (ii) (i) (iii) (iv)

(c) (ii) (i) (iv) (iii)

(d) (ii) (iii) (iv) (i)

Correct Answer is Option (c)

Q.6: Y and Z are partners sharing profits in the ratio of 3:2:1. They admit M as a new partner. Following information is available on the admission of M:

Creditors - 84,000

Machinery - 66,000

Stock - 30,000

Machinery was overvalued by 10% and creditors were found only ₹ 81,000. Stock was also overvalued. Loss on revaluation debited to Z’s Capital Account ₹ 1,500.

Stock was overvalued by__________.

(a) 10%

(b) 15%

(c) 20%

(d) 25%

Correct Answer is Option (d)

Total loss on revaluation = ₹ 1,500 × 6 = ₹ 9,000

Overvaluation of stock = 9,000 + 3,000 – 6,000 = ₹ 6,000

Overvaluation = ₹ 6,000 ×100/ ₹ 24,000 = 25%

Q.7: Which of the following is true regarding the Interest on Drawings of a partner, when the firm maintains Fluctuating Capital Accounts?

(a) Profit and Loss Appropriation A/c Cr. and Partners' Current A/c Dr.

(b) Profit and Loss Appropriation A/c Cr. and Partners' Capital A/c Cr.

(c) Profit and Loss Appropriation A/c Cr. and Partners' Current A/c Cr.

(d) Profit and Loss Appropriation A/c Cr. and Partners' Capital A/c Dr.

Correct Answer is Option (d)

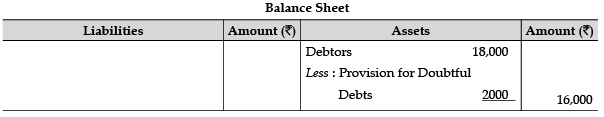

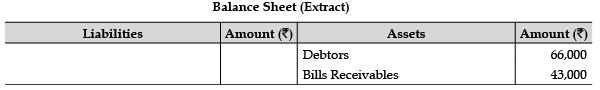

Q.8: Hari and Prashant are partners. At the time of reconstitution of partnership firm, following situation was found:

Debtors ₹ 1,500 will be written off as bad debts and a provision of 5% will be created for bad and doubtful debts.

What amount of Debtors will be shown in the new Balance Sheet of the firm?

(a) ₹ 16,600

(b) ₹ 15,675

(c) ₹ 16,700

(d) ₹ 13,775

Correct Answer is Option (b)

₹ 18,000 – ₹ 1,500 = ₹ 16,500

New provision = ₹ 16,500 × 5/100= ₹ 825

Debtors to be shown in the balance sheet of the reconstituted firm

= ₹16,500 – ₹ 825 = ₹15,675

Q.9: A, B, C and D are partners sharing profits as: A 40%; B 30% ; C 10% and D 20%. As per the new partnership agreement, C is to get a minimum amount of ₹ 57,500 p.a. Deficiency on this account will be borne by A and B personally in the ratio of 3:2. The net loss for the year ending 31st March, 2021 was ₹ 25,000.

The amount of deficiency to be borne by B:

(a) ₹ 36,000

(b) ₹ 23,000

(c) ₹ 24,000

(d) ₹ 25,000

Correct Answer is Option (b)

Total deficiency given to C = ₹57,500 + ₹ 2,500 = ₹ 60,000B’s share in deficiency = ₹ 60,000 × 2/5 = ₹ 24,000

Q.10: At the time of reconstitution of a partnership firm, a partners' ready to meet an unrecorded liability will lead to:

(a) Revaluation gain

(b) Revaluation loss

(c) No gain or loss on revaluation

(d) Decrease in the balance of capital account of that partner

Correct Answer is Option (c)

Q.11: Guru, Naresh and Gaurav are partners. Their fixed closing capitals on 31st March, 2021 were ₹ 2,00,000 each. Additional capital of ₹ 50,000 was introduced on 1st October, 2020 by Guru. As per the partnership deed Interest on Capital is provided @6% p.a. The profit made by the firm at the end of the year 31st March, 2021 was ₹ 63,000.

Partnership deed was silent on sharing profit among the partners.

Profit of Guru will be____________.

(a) ₹ 20,000

(b) ₹ 16,000

(c) ₹ 8,500

(d) ₹ 8,500

Correct Answer is Option (c)

₹ 63,000 – ₹ 12,000 – ₹ 12,000 – ₹ 13,500 = ₹ 25,500

Guru’s share = ₹ 25,500 × 1/3 = ₹ 8,500

Q.12: Average profits of a firm during the last few years are ₹ 1,20,000 and the normal rate of return in the similar business is 10%. If the goodwill of the firm is ₹ 1,12,500 at 3 years' purchase of super profit, the capital employed of the firm was ____________.

(a) ₹ 8,25,000

(b) ₹ 12,00,000

(c) ₹ 3,75,000

(d) ₹ 5,55,000

Correct Answer is Option (a)

Super profit = ₹ 1, 12, 500 / 3 = ₹ 37,500

Normal profit = ₹ 1,20,000 – ₹ 37,500 = ₹ 82,500

Capital employed = ₹ 82,500 × 100 / 10 = ₹ 8,25,000

Q.13: At the time of change in profit sharing ratio, it is important to determine the _________ and ___________ of partners.

(a) Sacrificing ratio, gaining ratio

(b) Profit, loss

(c) Goodwill, profit

(d) Capital, profit

Correct Answer is Option (a)

This may result in the gain to a few partners and loss to others. The partners who are in profit due to this change should compensate the sacrificing partner.

Q.14: Which of the following is mentioned in Companies Act, 2013 ?

(a) Application money should not be less than 25% of the issued price.

(b) Minimum subscription should be atleast 90% of the shares at the time of IPO.

(c) Securities Premium Reserve can be used to write off the underwriters’ commission.

(d) All of the above

Correct Answer is Option (d)

Q.15: Securities Premium Reserve ₹ 5,00,000

Preliminary Expenses ₹ 1,00,000

Share Issue Expenses ₹ 80,000

Old Machinery to be written off ₹ 1,20,000

Bad Debts ₹ 40,000

If Securities Premium Reserve is utilized as per Section 52 (2) of the Companies Act, 2013, balance of Securities Premium Reserve will be____________.

(a) ₹ 5,00,000

(b) ₹ 4,00,000

(c) ₹ 1,60,000

(d) ₹ 3,20,000

Correct Answer is Option (d)

₹ 5,00,000 – ₹ 1,00,000 – ₹ 80,000 = ₹ 3,20,000

Q.16: A, B and C were are partners in a firm sharing profits in the ratio of 3:4:1. They decided to share profits equally w.e.f from 1.4.2019. On that date, the Profit And Loss Account showed the credit balance of ₹ 96,000. Instead of closing the Profit and Loss Account, it was decided to record an adjustment entry reflecting the change in profit sharing ratio. In the journal entry, the following will be reflected :

(A) Dr. A by ₹ 4,000; Dr. B by ₹ 16,000; Cr. C by ₹ 20,000

(B) Cr. A by ₹ 4,000; Cr. B by ₹ 16,000; Dr. C by ₹ 20,000

(C) Cr. A by ₹ 16,000; Cr. B by ₹ 4,000; Dr. C by ₹ 20,000

(D) Dr. A by ₹ 16,000; Dr. B by ₹ 4,000; Cr. C by ₹ 20,000

Correct Answer is Option (b)

Sacrificing ratio = A = 3/8 - 1/3 = 1/24

B = 4/8 - 1/3 = 4/24

C = 1/8 - 1/3 = -5/24

Q.17: X, Y and Z are partners sharing profits in the ratio of 3:2:1. They admit V as a new partner and the following situation is found at the time of admission of V:

A debtor whose due of ₹ 10,000 were written off last year as bad debts, paid 25% amount in full settlement of his debt. A bill receivable of ₹ 15,000 discounted with bank was dishonoured, which is to be recorded in the books of account.

Debtors to be shown in new Balance Sheet will be:

(a) ₹ 81,000

(b) ₹ 73,500

(c) ₹ 66,000

(d) ₹ 68,500

Correct Answer is Option (a)

So, A's account will be credited with = ₹ 96,000/24 = ₹ 4,000

B's capital account will be credited with

= ₹ 96,000 × 4/24 = ₹ 16,000

C's capital account will be debited with

= ₹ 96,000 × 5/24 = ₹ 20,000

Q.18: Albert, Peter and William are partners sharing profits in the ratio of 2:2:1. It is provided that William’s share of profit would not be less than ₹ 35,000. Deficiency if any will be borne by Albert 35% and remaining by Peter. Profit for the year ended 31 March, 2021 was ₹ 15,000.

Deficiency borne by Peter:

(a) ₹ 20,800

(b) ₹ 32,000

(c) ₹ 11,200

(d) No deficiency is to borne by any partner due to less profit.

Correct Answer is Option (a)

Deficiency = ₹ 35,000 – ₹ 3,000 = ₹32,000

Peter’s share in deficiency = ₹ 32,000 × 65/100 = ₹ 20,800

Part I: Section B

Q.19: Angle and Circle ware partners in a firm. Their Balance Sheet showed Furniture at ₹2,00,000; Stock at ₹1,40,000; Debtors at ₹1,62,000 and Creditors at ₹60,000. Square was admitted and new profit sharing ratio was agreed at 2:3:5. Stock was revalued at ₹1,00,000, Creditors of ₹15,000 are not likely to be claimed, Debtors for ₹2,000 have become irrecoverable and Provision for doubtful debts to be provided @ 10%.

Angle’s share in loss on revaluation amounted to ₹30,000. Revalued value of Furniture will be:

(a) ₹2,17,000

(b) ₹1,03,000

(c) ₹3,03,000

(d) ₹1,83,000

Correct Answer is Option (d)

Angle’s share in loss on revaluation = ₹30,000

Total loss on revaluation = ₹30,000 × 2 = ₹ 60,000

Total profit on revaluation except furniture

= (₹15,000 not to be paid to creditors) = ₹15,000

Total loss on revaluation except furniture

= (₹40,000 stock decreased) + (₹2,000 bad debts)+ (₹16,000 PBD)

= ₹ 58,000

Net loss on revaluation except furniture = ₹58,000 – ₹15,000 = ₹43,000

Actual loss as per the Revaluation Account = ₹60,000

Loss on revaluation of furniture = ₹60,000 – ₹43,000 = ₹17,000

Hence, value of furniture was declined on revaluation.

Revalued value of furniture = ₹2,00,000 – ₹17,000

= ₹ 1,83,000

Q.20: Asha and Nisha are partner’s sharing profits in the ratio of 2:1. Kashish was admitted for 1/4 share of which 1/8 was gifted by Asha. The remaining was contributed by Nisha.

Goodwill of the firm is valued at ₹ 40,000. How much amount for goodwill will be credited to Nisha’s Capital Account?

(a) ₹ 2,500.

(b) ₹ 5,000.

(c) ₹ 20,000.

(c) ₹ 40,000.

Correct Answer is Option (b)

Kashish was admitted for 1/4th share of which 1/8 was sacrificed by Asha and remaining by Nisha

Sacrifice made by Nisha = 1/4 : 1/8

= 2-1 / 8

= 1/8

Sacrificing ratio of Asha and Nisha = 1/8:1/8

= 1 : 1

Total goodwill of the firm = ₹ 40,000

Goodwill to be brought in by new partner= ₹40 000 x 1/4 = ₹10,000

Share of Nisha in goodwill= ₹ 10 000 x 1/ = ₹ 5,000

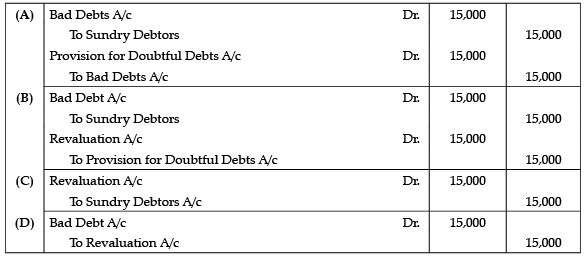

Q.21: At the time of admission of new partner Vasu, old partners Paresh and Prabhav had debtors of ₹6,20,000 and a provision for doubtful debts of ₹20,000 in their books. As per terms of admission, assets were revalued, and it was found that debtors worth ₹15,000 had turned bad and hence should be written off. Which journal entry reflects the correct accounting treatment of the above situation.

Correct Answer is Option (a)

First, bad debts will be charged to debtors and then will be written off by the amount of old PBD given.

Q.22: Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R).

Assertion (A): Transfer to reserves is shown in P & L Appropriation A/c.

Reason (R): Reserves are charge against the profits.

In the context of the above statements, which one of the following is correct?

(a) (A) is correct, but (R) is wrong.

(b) Both (A) and (R) are correct.

(c) (A) is wrong, but (R) is correct.

(d) Both (A) and (R) are wrong.

Correct Answer is Option (a)

Reserves are appropriation of profits hence shown in the Profit and Loss Appropriation Account. Hence statement (A) is correct but (R) is wrong.

Q.23: Anubhav, Shagun and Pulkit are partners in a firm sharing profits and losses in the ratio of 2:2:1. On 1st April, 2021, they decided to change their profit-sharing ratio to 5:3:2. On that date, debit balance of Profit & Loss A/c ₹30,000 appeared in the balance sheet and partners decided to pass an adjusting entry for it.

Which of the undermentioned options reflect correct treatment for the above situation:

(a) Shagun's capital account will be debited by ₹3,000 and Anubhav ’s capital account credited by ₹3,000

(b) Pulkit's capital account will be credited by ₹3,000 and Shagun's capital account will be credited by ₹3,000

(c) Shagun's capital account will be debited by ₹30,000 and Anubhav ’s capital account credited by ₹30,000

(d) Shagun's capital account will be debited by ₹3,000 and Anubhav ’s and Pulkit’s capital account credited by ₹2,000 and ₹1,000 respectively.

Correct Answer is Option (a)

Debit balance of Profit and Loss Account = ₹ 30,000

Sacrifice/ gain made by Anubhav on change in profit sharing ratio = 2/5 - 5/10

= -1/10(gain)

Sacrifice/ gain made by Shagun on change in profit sharing ratio = 2/5 - 3/10

= 1/10(sacrifice)

Sacrifice/ gain made by Pulkit on change in profit sharing ratio = 1/5 - 2/10 = Nil

Hence, Share of Anubhav in debit balance of profit and loss = 30,000 x 1/10 = ₹ 3000

So, Shagun’s capital account will be debited by ₹3,000 and Anubhav’s capital account credited by ₹3,000

Q.24: A, B and C are partners, their partnership deed provides for interest on drawings at 8% per annum. B withdrew a fixed amount in the middle of every month and his interest on drawings amounted to ₹4,800 at the end of the year. What was the amount of his monthly drawings?

(a) ₹10,000.

(b) ₹5,000.

(c) ₹1,20,000.

(d) ₹48,000.

Correct Answer is Option (a)

Rate of interest on drawings = 8%

Average period =11. 5 months + 0.5 month / 2 = 6 months

Interest on drawings = Total amount withdrawn × rate × average period / 100×12

₹ 4,800 = Total amount withdrawn x 8 x 6 / 100 x 12

Total amount withdrawn =

= ₹ 100 × 100 × 12

= ₹ 10,000 × 12

= ₹ 1,20,000 (for the whole year)

Monthly drawings= ₹1,20,000 / 12 = ₹ 10,000 per month

Q.25: Abhay and Baldwin are partners sharing profit in the ratio 3:1. On 31st March, 2021, firm’s net profit is ₹1,25,000. The partnership deed provided interest on capital to Abhay and Baldwin ₹15,000 and ₹10,000 respectively and interest on drawings for the year amounted to ₹6,000 from Abhay and ₹4,000 from Baldwin. Abhay is also entitled to commission @10% on net divisible profits. Calculate profit to be transferred to Partners Capital A/c’s.

(a) ₹1,00,000

(b) ₹1,10,000

(c) ₹1,07,000

(d) ₹90,000

Correct Answer is Option (a)

Net profit of the firm = ₹ 1,25,000

Total interest on drawings = ₹6,000+ ₹4,000 = ₹10,000

Total interest on capital = ₹15,000 + ₹10,000 = ₹25,000

Net profit after interest on drawings and capital= ₹1,25,000 + ₹10,000 – ₹25,000

= ₹1,35,000 – ₹25,000

= ₹1,10,000

Commission to Abhay = 10% of ₹1,10,000 (as in question, it is given that commission to be paid on net divisible profit hence it is given after charging such commission)

= ₹ 110 000 x 10 /110

= ₹ 10,000

Net profit to be distributed between Abhay and Baldwin = 1,10,000 – 10,000

= ₹ 1,00,000

Q.26: Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R):

Assertion (A): Revaluation A/c is prepared at the time of admission of a partner.

Reason (R): It is required to adjust the values of assets and liabilities at the time of admission of a partner, so that the true financial position of the firm is reflected.

In the context of the above two statements, which of the following is correct?

(a) Both (A) and (R) are correct and (R) is the correct reason of (A).

(b) Both (A) and (R) are correct but (R) is not the correct reason of (A).

(c) Only (R) is correct.

(d) Both (A) and (R) are wrong.

Correct Answer is Option (a)

Revaluation Account is prepared in order to record the correct market value of the assets of the firm in the balance sheet in order to show the true financial position of the firm.

Q.27: Apaar Ltd. forfeited 4,000 shares of ₹20 each, fully called up, on which only application money of ₹6 has been paid. Out of these 2,000 shares were reissued and ₹8,000 has been transferred to capital reserve. Calculate the rate at which these shares were reissued.

(a) ₹20 Per share

(b) ₹18 Per share

(c) ₹22 Per share

(d) ₹8 Per share

Correct Answer is Option (a)

Credit balance of share forfeiture = Amount paid on forfeited shares

= ₹4,000 × 6

= ₹ 24,000

2,000 shares were reissued.

Proportionate amount of profit on forfeiture of 2,000 shares = ₹24,000 × 2,000 /4000

= ₹12,000

Amount actually transferred to capital reserve = ₹ 8,000

Hence,

₹ (12,000 – 8,000) = ₹4,000 is discount on reissue of the forfeited shares

Discount on 2,000 shares = ₹ 4,000

Discount per share = ₹ 4,000 / ₹2000

= ₹ 2 per share

So, rate at which shares were reissued = Face value of share – Discount on issue of shares

= ₹ 20 – ₹ 2

= ₹ 18 per share

Q.28: Which of the following statement is/are true?

(i) Authorized Capital < Issued Capital

(ii) Authorized Capital ≥ Issued Capital

(iii) Subscribed Capital ≤ Issued Capital

(iv) Subscribed Capital > Issued Capital

(a) (i) only

(b) (i) and (iv) both

(c) (ii) and (iii) both

(d) (ii) only

Correct Answer is Option (c)

Issued capital can be equal or will always be less than the authorized capital. Subscribed capital can be equal or will always be less than the issued capital.

Hence option (C) is correct.

Q.29: Mickey, Tom and Jerry were partners in the ratio of 5:3:2. On 31st March, 2021, their books reflected a net profit of ₹2,10,000. As per the terms of the partnership deed they were entitled for interest on capital which amounted to ₹80,000, ₹60,000 and ₹40,000 respectively. Besides this a salary of ₹60,000 each was payable to Mickey and Tom.

Calculate the ratio in which the profits would be appropriated.

(a) 1:1:1

(b) 5:3:2

(c) 7:6:2

(d) 4:3:2

Correct Answer is Option (c)

mount of appropriation to be paid to Mickey = ₹80,000 + ₹60,000 = ₹ 1,40,000

Amount of appropriation to be paid to Tom = ₹60,000 + ₹60,000 = ₹ 1,20,000

Amount of appropriation to be paid to Jerry = ₹ 40,000

Total appropriation amount = ₹1,40,000 + ₹1,20,000 + ₹40,000

= ₹ 3,00,000

But net profit available is ₹ 2,10,000

Hence, profit will be distributed among partners in the ratio of their appropriation amount :

= 1,40,000 : 1,20,000 : 40,000 = 7 : 6 : 2

Q.30: Mohit had been allotted 600 shares by Govinda Ltd. on pro rata basis which had issued two shares for every three applied. He had paid application money of ₹3 per share and could not pay allotment money of ₹5 per share. First and final call of ₹2 per share was not yet made by the company. His shares were forfeited. The following entry will be passed:

Here X, Y and Z are:

(a) ₹ 6,000; ₹2,700; ₹3,000 respectively.

(b) ₹ 9,000; ₹2,700; ₹4,500 respectively.

(c) ₹ 4,800; ₹2,700; ₹2,100 respectively.

(d) ₹ 7,200; ₹2,700; ₹4,500 respectively.

Correct Answer is Option (c)

Mohit was allotted 600 shares

Company allotted two shares for every three applied shares.Hence, number of shares applied by Mohit = 600 x 3/2 = 900 shares

Excess amount received from him on application = 300 x ₹3 = ₹ 900

Called up amount per share = ₹3 + ₹ 5 = ₹ 8 per share

Number of shares he was allotted = 600

So, Share Capital Account will be debited with (600 X ₹8) = ₹4,800

Amount actually received by him = 900 X ₹3 = ₹ 2,700

So, Share Forfeiture Account will be credited with ₹ 2,700

Amount not received = ₹4,800 - ₹2,700 = ₹ 2,100

It will be credited with the Equity Share Allotment Account.

Q.31: Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R):

Assertion (A): In case of shares issued on pro–rata basis, excess money received at the time of application can be utilised till allotment only.

Reason (R): Company has to pay interest on calls in advance @12% p.a. for amount adjusted towards calls (if any).

In the context of the above two statements, which of the following is correct?

(a) Both (A) and (R) are true, but (R) is not the explanation of (A).

(b) Both(A) and (R) are true and (R) is a correct explanation of (A).

(c) Both (A) and (R) are false.

(d) (A) is false, but (R) is true.

Correct Answer is Option (d)

Assertion is wrong as amount received in excess on share application can be utilized for the calls after allotment also, if shares are issued as pro rata basis. Reason is correct, as company can pay interest on calls in advance @12% p.a. for the amount adjusted towards calls as the excess money received on application for allotment and calls is considered as calls in advance.

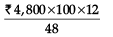

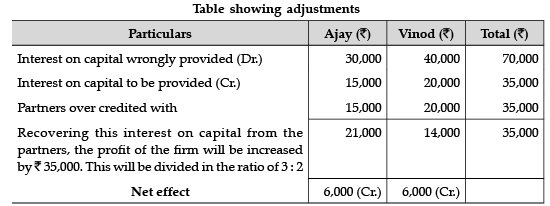

Q.32: Ajay and Vinod are partners in the ratio of 3:2. Their fixed capital were ₹3,00,000 and ₹4,00,000 respectively. After the close of accounts for the year it was observed that the Interest on Capital which was agreed to be provided at 5% p.a. was erroneously provided at 10%p.a. By what amount will Ajay’s account be affected if partners decide to pass an adjustment entry for the same?

(a) Ajay ’s Current A/c will be Debited by ₹15,000.

(b) Ajay ’s Current A/c will be Credited by ₹6,000.

(c) Ajay ’s Current A/c will be Credited by ₹35,000.

(d) Ajay ’s Current A/c will be Debited by ₹20,000.

Correct Answer is Option (b)

Hence, Ajay’s current account will be credited with ₹ 6,000

Q.33: Vishnu Ltd. forfeited 20 shares of ₹10 each, ₹8 called up, on which John had paid application and allotment money of ₹5 per share. Of these, 15 shares were reissued to Parker as fully paid up for ₹6 per share. What is the balance in the Share Forfeiture Account after the relevant amount has been transferred to Capital Reserve Account?

(a) ₹0

(b) ₹5

(c) ₹25

(d) ₹100

Correct Answer is Option (c)

Credit balance of share forfeiture at the time of forfeiture of 20 shares

= 20 × ₹5 = 100

Proportionate credit balance for 15 shares that were reissued

=₹ 100 × 15/20

= ₹ 75

Balance of share forfeiture after the relevant amount has been transferred to capital reserve

= ₹100 – ₹75

= ₹ 25

Q.34: Newfound Ltd. took over business of Old land Ltd. and paid for it by issue of 30,000 equity shares of ₹100 each at par along with 6% preference shares of ₹1,00,00,000 at a premium of 5% and a cheque of ₹8,00,000. What was the total agreed purchase consideration payable to Old Land Ltd.

(a) ₹1,05,00,000.

(b) ₹1,43,00,000.

(c) ₹1,40,00,000.

(d) ₹1,35,00,000.

Correct Answer is Option (b)

Purchase consideration = Total value of equity shares + Total value of preference shares + Amount of cheque

= 30,000× ₹ 100 + ₹ 1,00,00,000 + ₹ 5,00,000 + ₹ 8,00,000

= ₹ 30,00,000 + ₹ 1,00,00,000 + ₹ 5,00,000 + ₹ 8,00,000

= ₹1,43,00,000

Q.35: A and B are partners in the ratio of 3:2. C is admitted as a partner and he takes 1/4th of his share from A. B gives 3/16 from his share to C. What is the share of C?

(a) 1/4

(b) 1/16

(c) 1/6

(d) 3/16

Correct Answer is Option (a)

Let total share of C = x

He takes 1/4th of his share from A

1/4th of x = x/4

Remaining share to be taken from B = x - x/4

= 4x -x / 4

= 3x / 4

3x / 4 = 3/16

3x x 16 = 4 x 3

48x = 12

x = 12/48

x = 1/4

Total share of C in the new firm = 1/4

Q.36: Krishan Ltd. has issued capital of 20,00,000 equity shares of ₹10 each. Till date `8 per share have been called up and the entire amount received except calls of ₹4 per share on 800 shares and ₹3 per share from another holder who held 500 shares. What will be amount appearing as ‘Subscribed but not fully paid capital’ in the balance sheet of the company?

(a) ₹ 2,00,00,000

(b) ₹ 1,95,99,000

(c) ₹ 1,59,95,300

(d) ₹ 1,99,95,300

Correct Answer is Option (a)

Issued capital = 80% of ₹ 50,00,000

= ₹ 50,00,00,000 × 80/100

= ₹ 40,00,00,000

Number of equity shares issued for subscription = 40,00,00,000 / 125

= 32,00,000 shares

Total application money was received on 32,00,000 + 2,00,000 shares

= 34,00,000 × ₹125

= ₹ 42,50,00,000

Part I: Section C

Question no.’s 37 and 38 are based on the hypothetical situation given below :

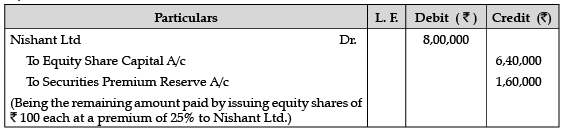

Govind Ltd. purchased furniture of ₹ 10,00,000 from Nishant Ltd. and paid 20% of the amount by accepting a bill of exchange in favour of Nishant Ltd. The remaining amount was paid by issuing equity shares of ₹100 each at a premium of 25% to Nishant Ltd.

Q.37: Amount to be credited to Share Capital A/c will be:

(a) ₹ 1,25,000

(b) ₹ 6,40,000

(c) ₹ 10,00,000

(d) ₹ 8,00,000

Correct Answer is Option (b)

No. of Equity Shares issued = Purchase consideration / Issue price of equity share

= ₹ 8,00,000 / ₹125

= 6,400 shares

Amount to be credited to share capital = 6,400 ×100 = ₹ 6,40,000

Q.38: What will be the amount to be credited to Securities Premium Account?

(a) ₹ 1,64,000

(b) ₹ 6,40,000

(c) ₹ 1,60,000

(d) ₹ 8,00,000

Correct Answer is Option (c)

Question no.’s 39, 40 and 41 are based on the hypothetical situation given below:

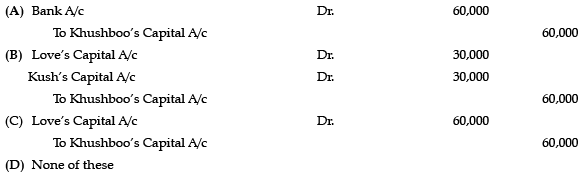

Love and Kush were partners in a firm sharing profits in the ratio of 3 : 2. Their capitals were ₹ 80,000 and ₹ 50,000 respectively. They admitted Khushboo in the firm on 1st January, 2019 as a new partner for 1/5th share in the future profits. Khushboo brought ₹ 60,000 as her capital. The value of Goodwill of the firm is based on capital brought in by Khushboo.

Q.39: The value of Goodwill of the firm on Khushboo’s admission will be:

(a) ₹ 1,00,000

(b) ₹ 1,10,000

(c) ₹ 3,00,000

(d) ₹ 1,90,000

Correct Answer is Option (b)

Total Capital of the firm based of Khushboo's capital and share of Profit= ₹ 3,00,000

Less : Capital balance of all partners including new partner (80,000 + 50,000 + 60,000) = ₹ 1,90,000

Goodwill of the firm = ₹ 1,10,000

Q.40: What will be the journal entry for the capital brought in by the new partner?

Correct Answer is Option (a)

Khushboo’s Capital A/c will be credited as it is giver. Bank A/c will be debited as as per accounting rule, debit what comes in and credit what goes out.

Q.41: Look at the journal entry for the treatment of goodwill of the new partner. What is X and Y in the following journal entry?

(a) ₹ 13,200 and ₹ 8,800

(b) ₹ 8,800 and ₹ 13,200

(c) ₹ 10,000 and ₹ 12,00

(d) ₹ 22,000 and ₹ 10,000

Correct Answer is Option (a)

Khushboo's Share of Goodwill = ₹ 1, 10, 000 × 1/5 = ₹ 22,000

It is to be credited to sacrificing partners in their sacrificing ratio (3 : 2).

Part II: Section A

Q.42: Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R):

Assertion (A): Ratio analysis is indispensable part of interpretation of results revealed by the financial statements.

Reason (R): Ratio analysis provides users with crucial financial information and points out the areas which require investigation.

In the context of the above two statements, which of the following is correct?

(A) Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A).

(B) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

(C) Assertion (A) is true, but Reason (R) is false.

(D) Assertion (A) is false, but Reason (R) is true.

Correct Answer is Option (a)

Once done effectively, ratio analysis provides a lot of information which helps the analyst:

(i) To know the areas of the business which need more attention;

(ii) To know about the potential areas which can be improved with the effort in the desired direction;

(iii)To provide a deeper analysis of the profitability, liquidity, solvency and efficiency levels in the business;

(iv) To provide information for making cross-sectional analysis by comparing the performance with the best industry standards; and

(v) To provide information derived from financial statements useful for making projections and estimates for the future.

Q.43: Which of the following are the advantages of ratio analysis?

(i) Helps to understand efficacy of decisions

(ii) Ignores price-level changes

(iii) Variations in accounting practices

(iv) Ignore qualitative or non-monetary aspects

(a) Only (i)

(b) Only (i) and (ii)

(c) Only (ii)

(d) All (i), (ii), (iii), and (iv)

Correct Answer is Option (a)

Ratio analysis helps to understand whether the business firm has taken the right kind of operating, investing and financing decisions. It indicates how far they have helped in improving the performance.

Q.44: Which of the following is not a solvency ratio?

(a) Debt-Equity Ratio

(b) Debt to Capital Employed Ratio

(c) Proprietary Ratio

(d) Working Capital Turnover Ratio

Correct Answer is Option (d)

Working capital turnover ratio is an activity ratio.

Q.45: Which one of the following is correct?

(i) Financial Statements provide information about economic resources and obligations of a business.

(ii) Financial Statements provide information about the earning capacity of the business.

(iii) Financial Statements provide information about cash flows.

(iv) Financial Statements judge effectiveness of management.

(a) Only (i)

(b) Only (i) and (ii)

(c) Only (ii)

(d) All (i), (ii), (iii), and (iv)

Correct Answer is Option (d)

Financial Statements are the basic sources of information to the shareholders and other external parties for understanding the profitability and financial position of any business concern. They provide information about the results of the business concern during a specified period of time in terms of assets and liabilities, which provide the basis for taking decisions.

Q.46: Financial analysis is useful and significant to different user. Who among the following are those users?

(i) Finance manager

(ii) Top management

(iii) Trade payables

(iv) Lenders

(a) Only (i)

(b) Only (i) and (ii)

(c) Only (i), (ii), and (iii)

(d) All (i), (ii), (iii), and (iv)

Correct Answer is Option (d)

Financial analysis can be undertaken by management of the firm, or by parties outside the firm, viz., owners, trade creditors, lenders, investors, labour unions, analysts and others. The nature of analysis will differ depending on the purpose of the analyst.

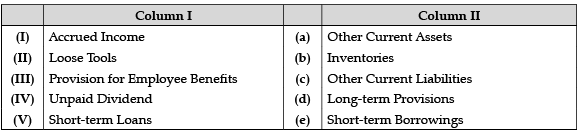

Q.47: Match the items given in Column I with the headings/subheadings (Balance sheet) as defined in Schedule III of Companies Act, 2013.

Choose the correct option:

(a) (I)-(a), (II)-(b), (III)-(d), (IV)-(c), (V)-(e)

(b) (I)-(d), (II)-(a), (III)-(b), (IV)-(c), (V)-(e)

(c) (I)-(d), (II)-(a), (III)-(b), (IV)-(e), (V)-(c)

(d) (I)-(e), (II)-(d), (III)-(a), (IV)-(b), (V)-(b)

Correct Answer is Option (a)

Q.48: The two basic measures of liquidity are:

(a) Inventory Turnover and Current ratio

(b) Current ratio and Liquid ratio

(c) Gross profit margin and Operating ratio

(d) Current ratio and Average collection period

Correct Answer is Option (b)

Liquidity ratios are calculated to measure the short-term solvency of the business, i.e. the firm’s ability to meet its current obligations. These are analyzed by looking at the amounts of current assets and current liabilities in the balance sheet. The two ratios included in this category are current ratio and liquidity ratio.

Part II: Section B

Q.49: Calculate Total Assets to Debt ratio from the following information : (in ₹)

(a) 1.56 : 1

(b) 2.56 : 1

(c) 3.56 : 1

(d) None of these

Correct Answer is Option (a)

Total assets to debt ratio = Total assets / Debt

Total assets = Fixed assets + Investments + Current assets

= ₹ 8,00,000 + ₹ 1,00,000 + ₹ 3,00,000 = ₹ 12,00,000

Debt = Total Debts – (Loan + Creditors + Bills Payable)

= ₹ 9,00,000 – (₹1,35,000)

= ₹ 7,65,000

Total Assets to Debt Ratio = ₹ 12,00,000 / ₹ 7,65,000 = 1.56 : 1

Q.50: Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R):

Assertion (A): Total long term debt includes debentures, long term loans from banks and financial institutions.

Reason (R): Shareholders funds includes equity share capital, preference share capital, reserves and surplus.

In the context of the above two statements, which of the following is correct?

(a) Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Correct Answer is Option (b)

Q.51: Gain on sale of fixed assets by a financial company is shown in the Statement of Profit and Loss as :

(a) Revenue from Operations

(b) Other Income

(c) Both (A) and (B)

(d) None of the above

Correct Answer is Option (b)

Q.52: Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R):

Assertion: Capital employed means the long-term funds employed in the business and includes shareholders’ funds, debentures and long-term loans

Reason: Capital employed may be taken as the total of non-current assets and working capital

In the context of the above two statements, which of the following is correct?

(a) Both Assertion (A) and Reason (R) are true, and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true, but Reason (R) is not the correct explanation of Assertion (A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Correct Answer is Option (b)

Capital Employed can be calculated from two approaches: Liabilities Side and Assets Side.

Statement A is following Liabilities side approach whereas statement (R) is following Asset side approach.

Q.53: Calculate Gross Profit Ratio from the following information: Sales or Revenue from Operations = ₹ 8,00,000 Cost of Goods Sold or Cost of Revenue from Operations = ₹ 7,20,000

(a) 10 %

(b) 20%

(c) 30%

(d) 40%

Correct Answer is Option (a)

Gross Profit = Sales – Cost of Goods Sold

Gross Profit = ₹ 8,00,000 – ₹ 7,20,000 = ₹ 80,000

Gross Profit Ratio = Gross Profit × 100/Net Sales

= ₹ 80,000 × 100/ 8,00,000

= 10%

Q.54: Calculate Stock turnover ratio:-Sales : ₹ 2,50,000 Gross profit ratio : 40% Average stock : ₹ 30,000

(a) 4 times

(b) 2 times

(c) 3 times

(d) 5 times

Correct Answer is Option (d)

Stock turnover ratio = COGS/Average stock

COGS = Sales – (Sales × Gross Profit Ratio)

= ₹ 2,50,000 – (₹ 2,50,000 × 40%)

= ₹ 1,50,000

Stock turnover ratio = ₹1,50,000/ ₹30,000 = 5 times

Q.55: Which of the following is not an activity ratio ?

(a) Inventory turnover ratio

(b) Interest coverage ratio

(c) Working capital turnover ratio

(d) Trade receivables turnover ratio

Correct Answer is Option (b)

Interest coverage ratio is a solvency ratio.

|

130 docs|5 tests

|

FAQs on Class 12 Accountancy: CBSE Sample Question Papers- Term I (2021-22)- 4 - Sample Papers for Class 12 Commerce

| 1. What is the duration of CBSE Class 12 Accountancy exam? |  |

| 2. How many marks is the CBSE Class 12 Accountancy exam out of? |  |

| 3. What are the different sections in Part I of the CBSE Class 12 Accountancy exam? |  |

| 4. What are the different sections in Part II of the CBSE Class 12 Accountancy exam? |  |

| 5. Are there any sample question papers available for the CBSE Class 12 Accountancy exam? |  |