Class 12 Accountancy: CBSE Sample Question Papers- Term II (2021-22)- 1 | Sample Papers for Class 12 Commerce PDF Download

Class-XII

Time: 120 Minutes

Max. Marks: 40

General instructions:

Read the following instructions very carefully and strictly follow them:

- This question paper comprises two Parts – A and B. There are 12 questions in the question paper. All questions are compulsory.

- Part-A is compulsory for all candidates.

- Part-B has two options i.e. (i) Analysis of Financial Statements and (ii) Computerized Accounting. Students must attempt only one of the given options.

- Question nos. 1 to 3 and 10 are short answer type–I questions carrying 2 marks each.

- Question nos. 4 to 6 and 11 are short answer type–II questions carrying 3 marks each.

- Question nos. 7 to 9 and 12 are long answer type questions carrying 5 marks each.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

Part- A

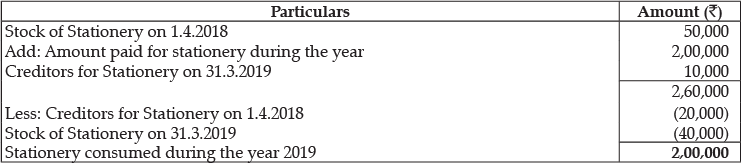

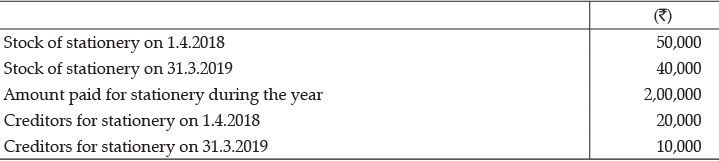

Calculation of amount of Stationery to be shown in Income and Expenditure Account:Amount of Stationery to be shown in Income and Expenditure Account = ₹2,00,000.

The share of profit of the deceased partner can be determined by either of the following two methods:(i) On the basis of Time: In this method, proportionate estimated profit of the firm will be determined for the period for which the deceased partner remained in the firm on the basis of profit of previous years and then, share of deceased partner in that profit will be calculated. In this, part of current year’s profit will be computed on the basis of profit of the previous year or on the basis of average profits of previous years.

(ii) On the basis of Sales/Turnover: In this method, ratio of profit to sales of past year (or average of past few years) is calculated, which is applied to the amount of sales from the beginning of the current year upto the date of death to determine profit of that period and share of deceased partner is calculated.

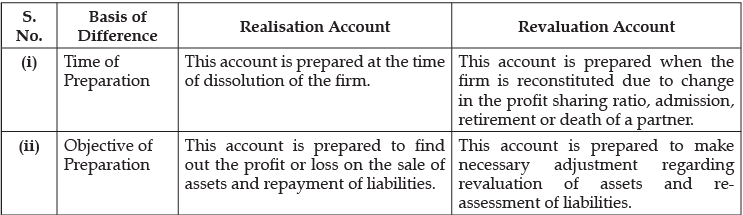

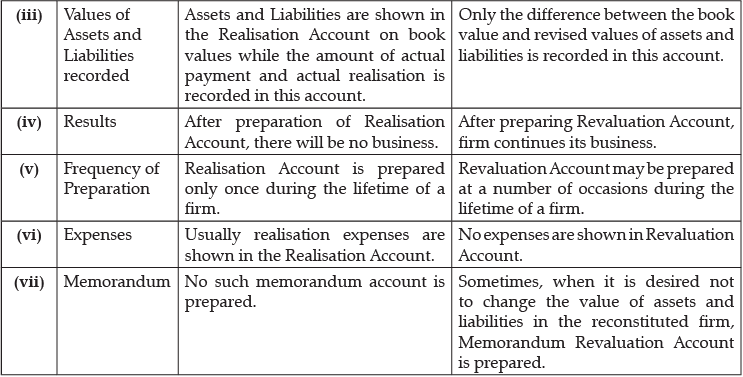

The difference between realisation account and revaluation account are:

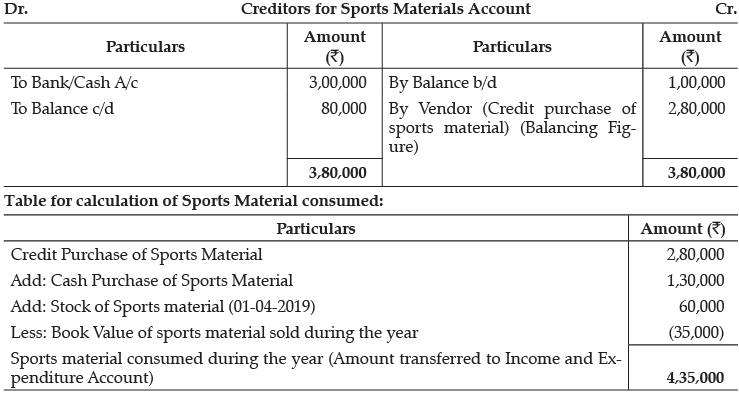

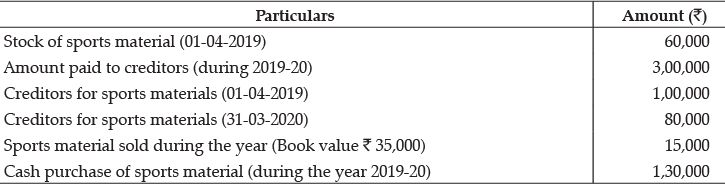

There was a zero stock at the end of the financial year 2019-20.

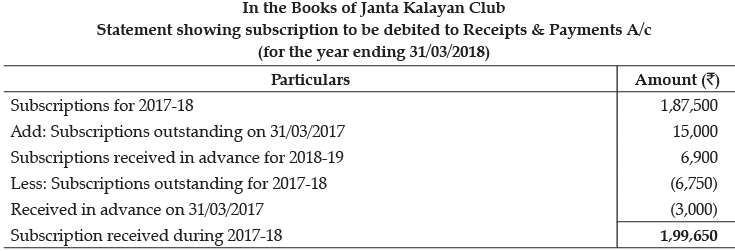

Janta Kalayan Club has 1,250 members each paying an annual subscription of ₹150. During the year ended 31st March, 2018, the club did not receive subscription from 45 members and received subscriptions in advance from 46 members for the year ending 31st March, 2019. On 31st March, 2017, the outstanding subscriptions were ₹ 15,000 and subscriptions received in advance were ₹ 3,000. Calculate the amount of subscription that will be debited to the Receipts and Payments Account for the year ended 31st March, 2018.

OR

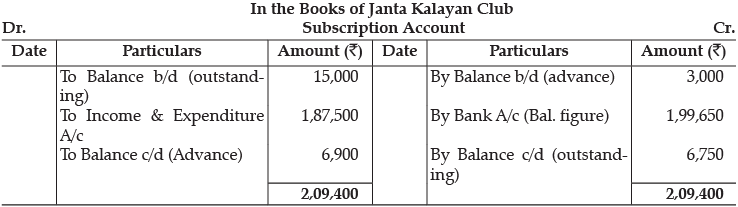

ORAlternatively, students may show the solution in the form of Subscription A/c

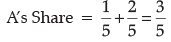

Q.5. (i) A, B and C were partners sharing profits and losses in the ratio of 1 : 2 : 2. On 1st Sep., 2018, C served a notice of his retirement and surrendered his whole share in the favour of A. Calculate new profit sharing ratio of A and B.

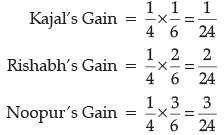

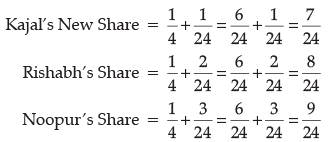

(ii) Kajal, Rohit, Rishabh and Noopur were partners and were sharing profits equally. Rohit retired and his share was taken over by remaining partners in the ratio of 1 : 2 : 3 respectively. Calculate new profit sharing ratio.

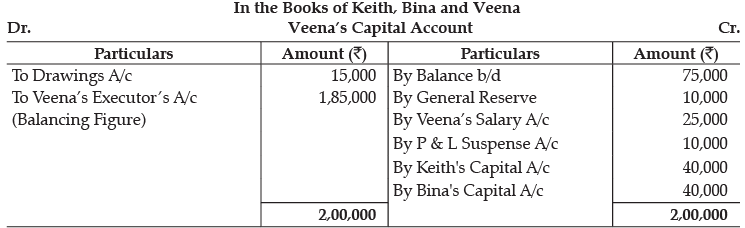

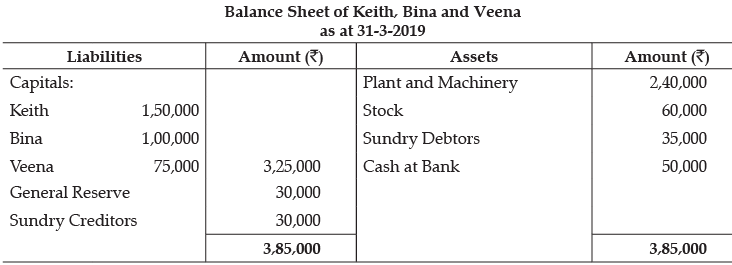

Keith, Bina and Veena were partners in a firm sharing profits and losses equally. Their balance sheet as on 31-3-2019 was as follows:

(i) Balance in capital account.

(ii) Salary till the date of death @ ₹ 25,000 per annum.

(iii) Share of goodwill calculated on the basis of twice the average profits of past three years.

(iv) Share of profit from the closure of the last accounting year till the date of death on the basis of average of three completed years before death.

(v) Profits for 2016-17, 2017-18 and 2018-19 were ₹ 1,20,000, ₹ 90,000 and ₹ 1,50,000 respectively.

Veena withdrew ₹15,000 on 1st June, 2019 for paying her daughter’s school fees.

Prepare Veena’s capital account to be rendered to her executors.

(i) New Share = Old Profit Share + Gaining Share

B’s Share = 2/5

New Share of A and B = 3 : 2

(ii)

New Profit Sharing Ratio = 7 : 8 : 9OR

Note: If an examinee has raised the goodwill, full credit be given.

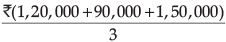

Working Note:

Average Profit =

= ₹ 1,20,000

Veena’s Share in Profit = ₹ 1,20,000 × (1/3) x (3/12)

= ₹ 10,000

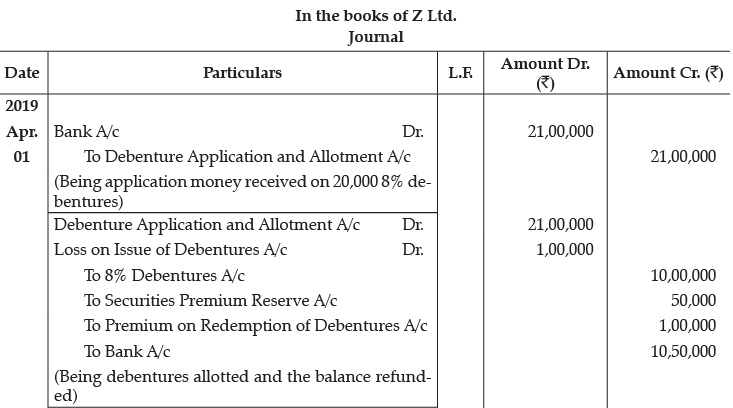

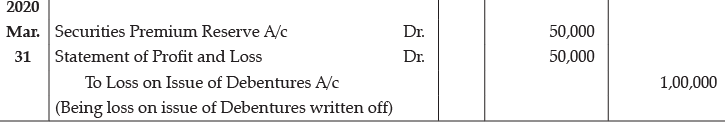

Q.6. On April 1, 2019, Z Ltd. issued, 10,000, 8% Debentures of ₹ 100 each at premium of 5%, to be redeemable at a premium of 10%, after 5 years. The entire amount was payable on application. The issue was oversubscribed to the extent of 10,000 debentures and the allotment was made proportionately to all the applicants. The securities premium amount has not been utilized for any other purpose during the year. Give journal entries for the issue of debentures and writing off loss on issue of debentures.

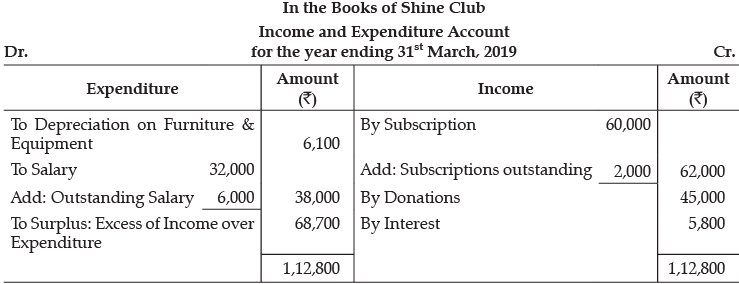

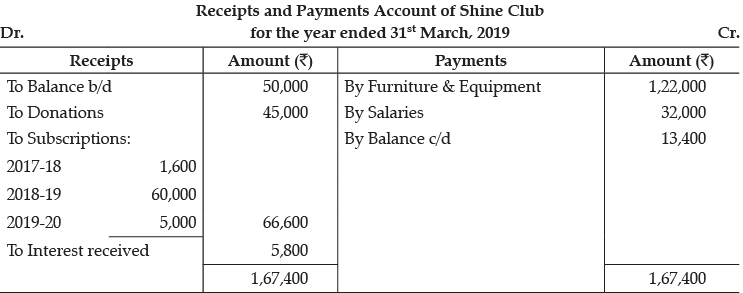

Q.7. From the given Receipts and Payments Account and additional information of Shine Club for the year ended 31st March, 2019, prepare Income and Expenditure Account for the year ended 31st March, 2019:

Additional Information:

(i) Furniture and equipment were purchased on 1-10-2018. Depreciation @ 10% p.a. was to be provided on furniture and equipment.

(ii) Subscription in arrears for the year 2018-19 were ₹ 2,000.

(iii) Outstanding salary ₹ 6,000.

Working Note:

Depreciation on furniture and equipment: 10% of ₹ 1,22,000 × 1/2 = ₹ 6,100.

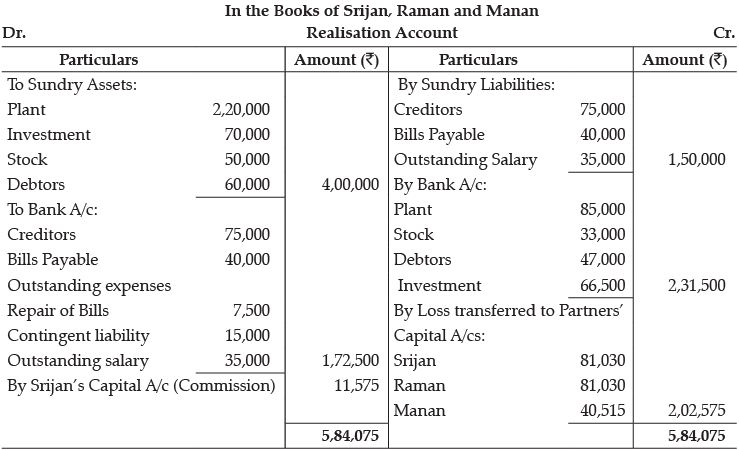

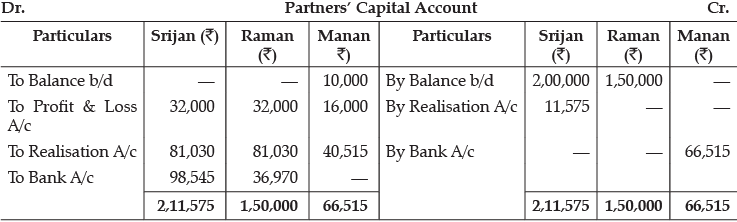

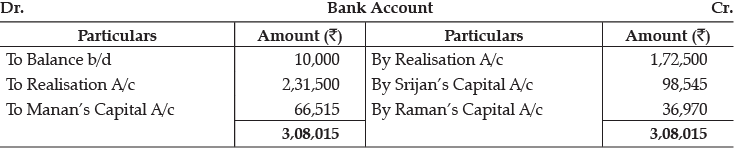

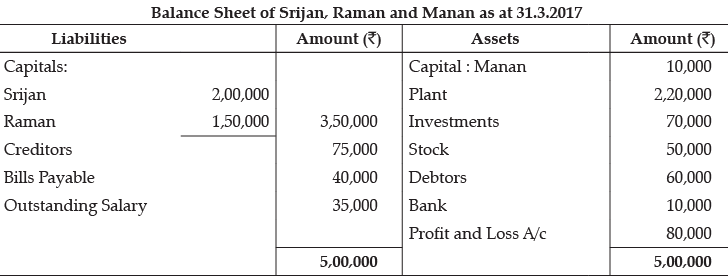

Q.8. Srijan, Raman and Manan were partners in a firm sharing profits and losses in the ratio of 2:2:1. On 31st March, 2017, their Balance Sheet was as follows:

On the above date, they decided to dissolve the firm.

(i) Srijan was appointed to realise the assets and discharge the liabilities. Srijan was to receive 5% commission on sale of assets (except cash) and was to bear all expenses of realisation.

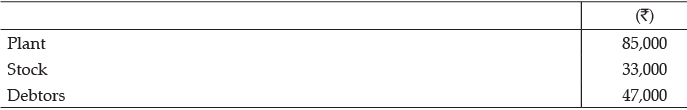

(ii) Assets were realised as follows:

(iii) Investments were realised at 95% of the book value.

(iv) The firm had to pay ₹ 7,500 for an outstanding repair bill not provided for earlier.

(v) A contingent liability in respect of bills receivable, discounted with the bank had also materialised and had to be discharged for ₹ 15,000.

(vi) Expenses of realisation amounting to ₹ 3,000 were paid by Srijan.

Prepare Realisation Account, Partners’ Capital Account and Bank Account.

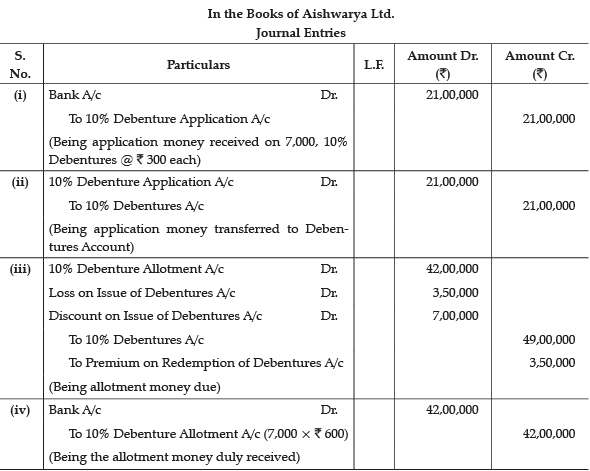

Q.9. ‘Aishwarya Ltd.’ issued 7,000, 10% Debentures of ₹ 1,000 each at a discount of 10%, redeemable at a premium of 5% after 4 years. According to the terms of issue ₹ 300 were payable on application and balance on allotment of debentures. Pass the necessary journal entries for the above transactions.

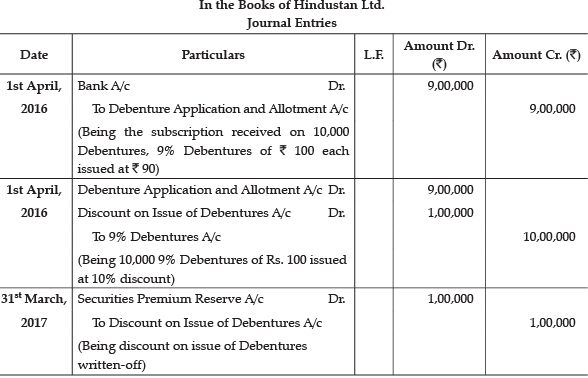

On April, 2016, Hindustan Ltd. issued 10,000, 9% Debentures of ₹ 100 each at a discount of 10%, redeemable after 5 years. The issued price is payable along with application. The debentures were subscribed. It has a balance of ₹ 1,75,000 in Securities Premium Reserve. It decided to write-off discount in the year ended on 31st March, 2017 from Securities Premium Reserve.

Pass the Journal Entries for Issue of Debentures and writing-off the discount.

OR

Part- B

Q.10. Will the following result in cash inflow or cash outflow or no cash flow:

(i) Depreciation of plant and machinery

(ii) Increase in Debtors

(i) It will result in no cash flow as the money doesn’t actually flow from the company when depreciation is charged against profit.

(ii) It will result in cash inflow as the debtors will pay the amount in the future.

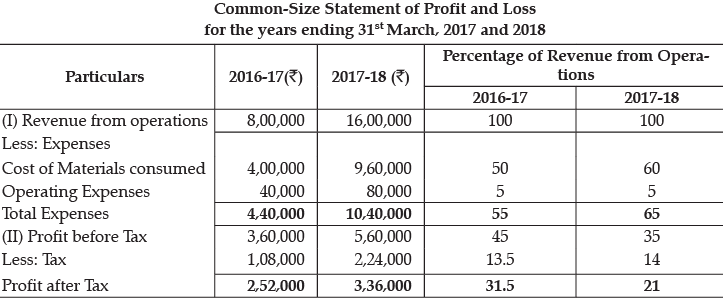

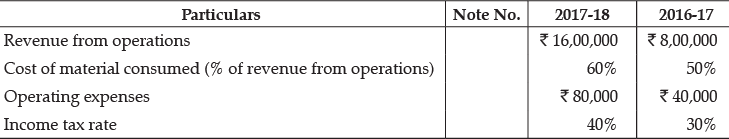

Q.11. Prepare common-size statement of profit and loss from the following information:

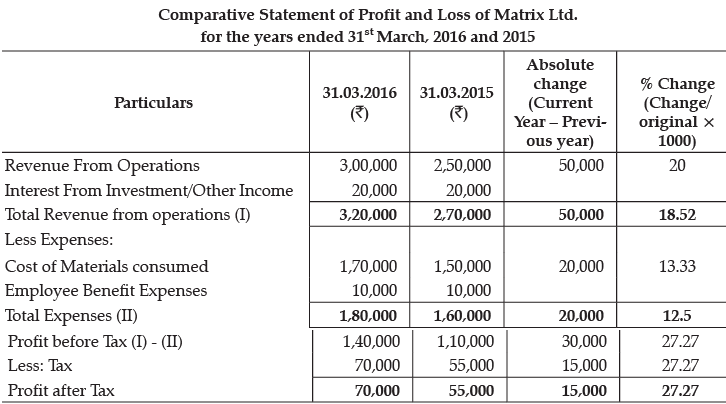

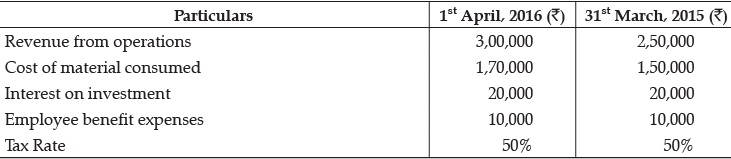

From the following information, prepare a comparative statement of profit and loss of matrix Ltd.:

OR

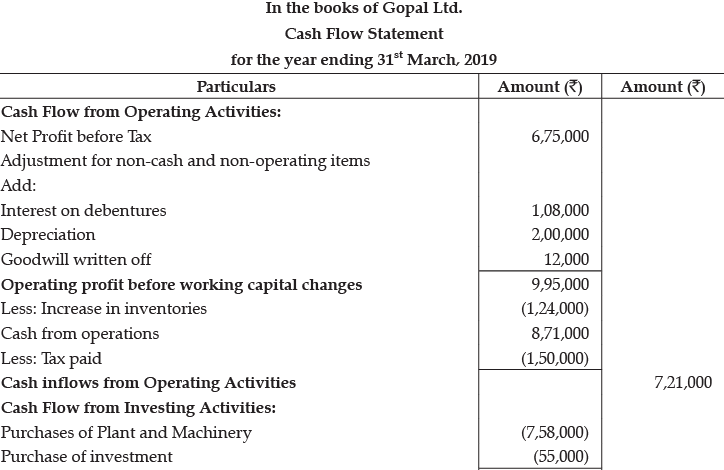

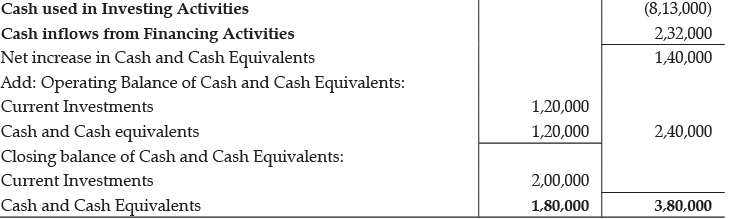

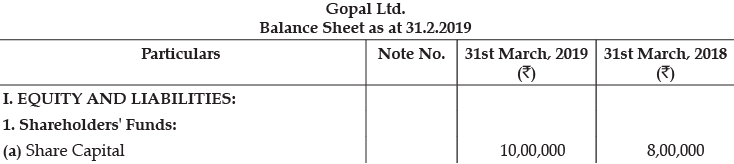

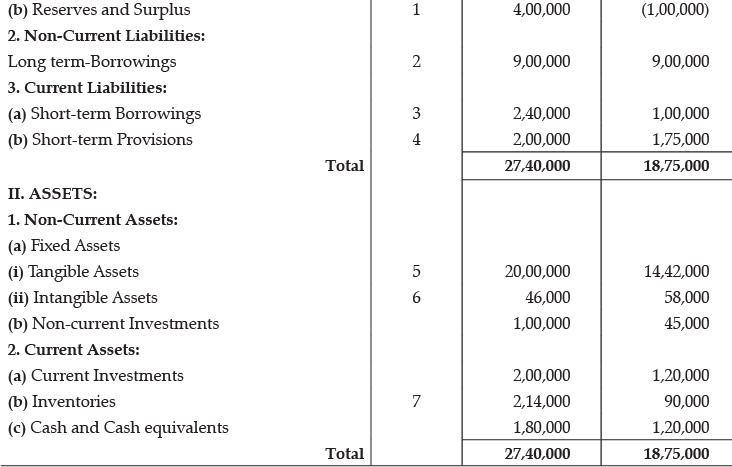

Q.12. From the following Balance Sheet of Gopal Ltd. and the additional information as at 31st March, 2019, prepare a Cash Flow Statement when cash flow from financing activities is ₹ 2,32,000.

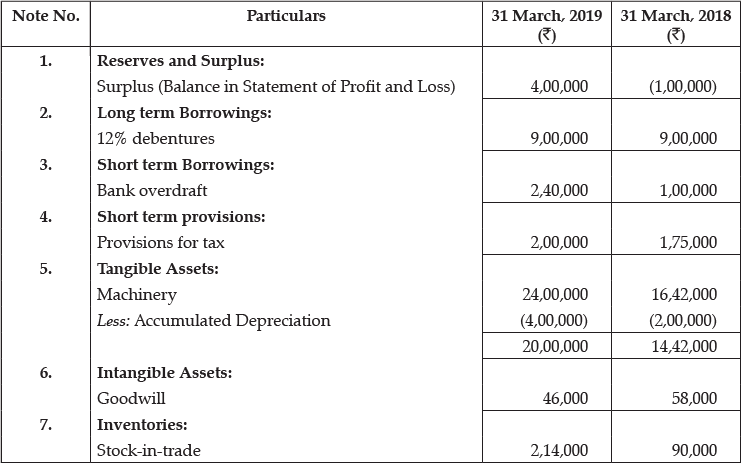

Notes to Accounts:

Additional Information:

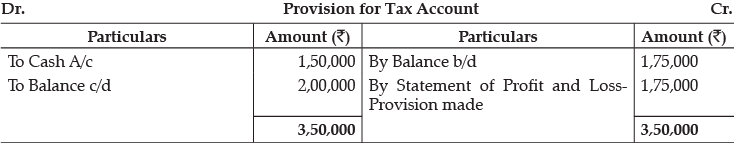

Tax ₹ 1,50,000 was paid during the year.

Working Notes:

Calculation of Net Profit before Tax: ₹

|

130 docs|5 tests

|

FAQs on Class 12 Accountancy: CBSE Sample Question Papers- Term II (2021-22)- 1 - Sample Papers for Class 12 Commerce

| 1. What is the duration of Class XII Accountancy exam? |  |

| 2. How many marks are allotted for the Class XII Accountancy exam? |  |

| 3. What are the two parts of the Class XII Accountancy exam? |  |

| 4. What is the maximum time limit for Part A of the Class XII Accountancy exam? |  |

| 5. How many frequently asked questions (FAQs) are required to be provided for Class XII Accountancy exam? |  |