Class 12 Accountancy: CBSE Sample Question Papers- Term II (2021-22)- 2 | Sample Papers for Class 12 Commerce PDF Download

| Table of contents |

|

| Class-XIITime: 120 MinutesMax. Marks: 40 |

|

| Part- A |

|

| Part- B |

|

| Option-I (Analysis of Financial Statements) |

|

Class-XII

Time: 120 Minutes

Max. Marks: 40

General instructions:

Read the following instructions very carefully and strictly follow them:

- This question paper comprises two Parts – A and B. There are 12 questions in the question paper. All questions are compulsory.

- Part-A is compulsory for all candidates.

- Part-B has two options i.e. (i) Analysis of Financial Statements and (ii) Computerized Accounting. Students must attempt only one of the given options.

- Question nos. 1 to 3 and 10 are short answer type–I questions carrying 2 marks each.

- Question nos. 4 to 6 and 11 are short answer type–II questions carrying 3 marks each.

- Question nos. 7 to 9 and 12 are long answer type questions carrying 5 marks each.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

Part- A

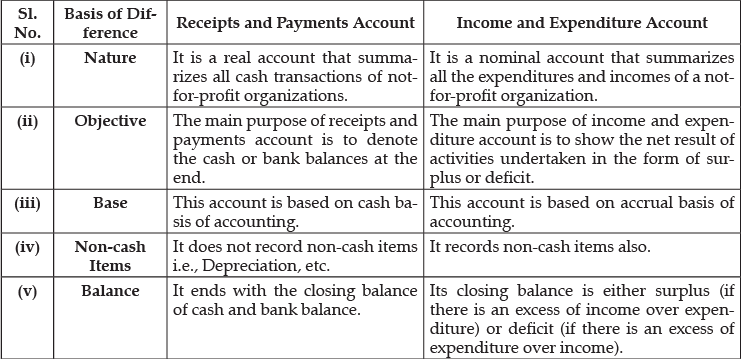

The distinction between Receipts and Payments Account and Income and Expenditure Account are:

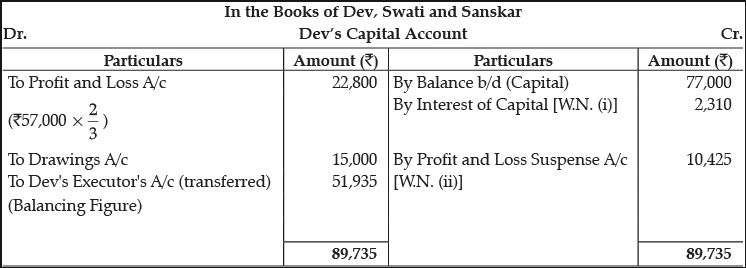

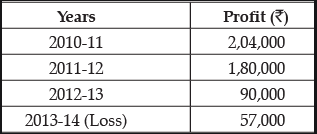

On 30th June, 2014, Dev died. According to partnership agreement, Dev was entitled to interest on capital at 12% per annum. His share of profit till the date of his death was to be calculated on the basis of the average profits of last four years. The profits of the last four years were:

On 1.4.2014, Dev withdrew ₹ 15,000 to pay for his medical bills.

Prepare Dev ’s account to be presented to his executors.

Working Notes:

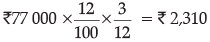

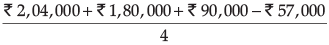

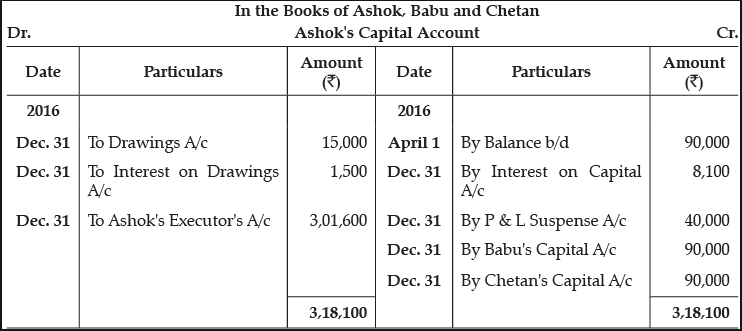

(i) Calculation of Interest on Capital =(ii) Calculation of profit upto the date of death

Average profit =

= ₹ 1,04,250

Dev ’s share of profit =

= ₹ 10,425

Q.3. What do you mean by dissolution of the partnership firm?

Dissolution of the partnership firm means that the firm means closing down its business and comes to an end. On dissolution of partnership firm, assets of the firm are sold out, liabilities are paid off and out of the remaining amount, the accounts of partners are settled.

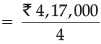

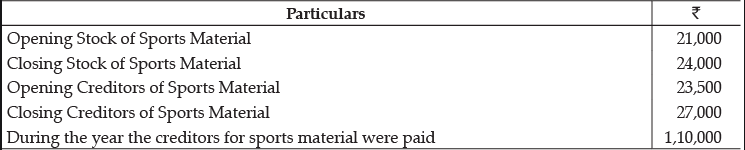

Q.4. From the following information, calculate the amount of ‘Sports Material’ to be debited to Income and Expenditure Account of Young Football Club for the year ended 31st March, 2018:

OR

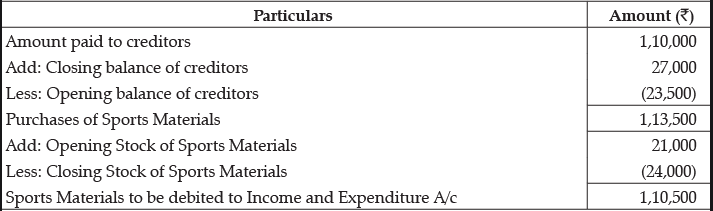

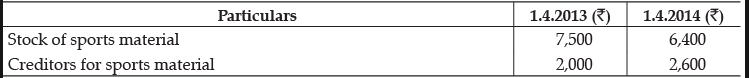

Calculate the amount of sports material to be debited to the Income and Expenditure Account of a Sports Club for the year ended 31.3.2014 on the basis of the following information:

Amount paid for sports material during the year was ₹ 19,000.

Calculation of Sports Materials to be debited to Income and Expenditure A/c:

In the Books of Young Football Club

OR

Amount of sports materials to be debited to Income and Expenditure Account = ₹ 20,700.

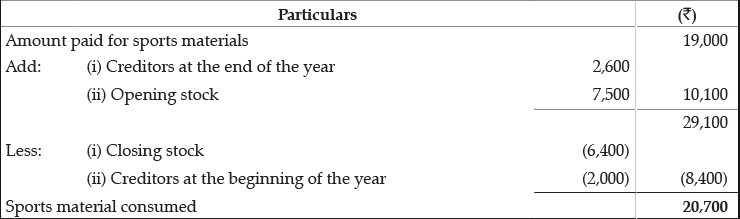

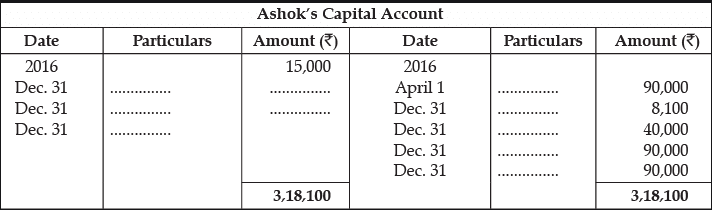

Q.5. Ashok, Babu and Chetan were partners in a firm sharing profits in the ratio of 4 : 3 : 3. The firm closes its books on 31st March every year. On 31st December, 2016, Ashok died. The partnership deed provided that on the death of a partner his executors will be entitled for the following:

(i) On 1.4.2016, there was a balance of ₹ 90,000 in Ashok’s Capital Account.

(ii) Interest on capital @ 12% per annum.

(iii) His share in the profits of the firm in the year of his death will be calculated on the basis of rate of net profit on sales of the previous year, which was 25%. The sales of the firm till 31st December, 2016 were ₹ 4,00,000.

(iv) His share in the goodwill of the firm. The goodwill of the firm on Ashok’s death was valued at ₹ 4,50,000.

The partnership deed also provided for the following deductions from the amount payable to the executor of the deceased partner:

(i) His drawings in the year of his death. Ashok’s drawings till 31.12.2016 were ₹ 15,000.

(ii) Interest on drawings @ 12% per annum which was calculated as ₹ 1,500.

The accountant of the firm prepared Ashok’s Capital Account to be presented to the executor of Ashok but in a hurry he left it incomplete. Ashok’s Capital Account as prepared by the firm’s accountant is given below :

You are required to complete Ashok’s Capital Account.

OR

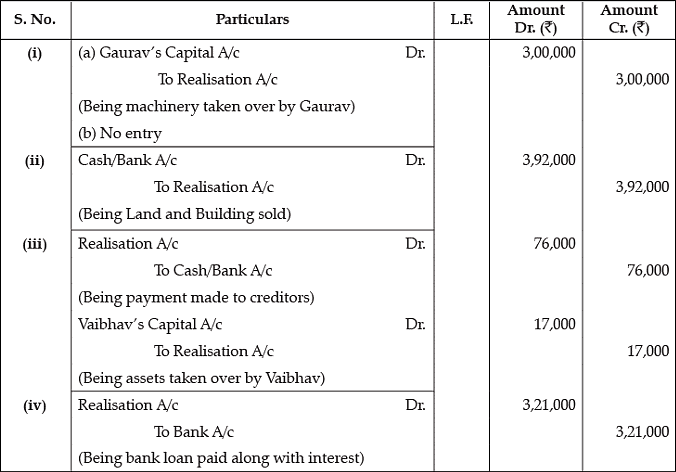

Gaurav, Saurabh and Vaibhav were partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. They decided to dissolve the firm on 31st March, 2018. After transferring sundry assets (other than cash in hand and cash at bank) and third party liabilities to Realisation Account, the assets were realised and liabilities were paid off as follows:

(i) A machinery with a book value of ₹ 6,00,000 was taken over by Gaurav at 50% and stock worth ₹ 5,000 was taken over by creditor of ₹ 9,000 in full settlement of his claim.

(ii) Land and building (book value ₹ 3,00,000) was sold for ₹ 4,00,000 through a broker who charged 2% commission.

(iii) The remaining creditors were paid ₹ 76,000 in full settlement of their claim and the remaining assets were taken over by Vaibhav for ₹ 17,000.

(iv) Bank loan of ₹ 3,00,000 was paid along with interest of ₹ 21,000.

Pass the necessary journal entries for the above transactions in the books of the firm.

OR

In the Books of Gaurav, Saurabh and Vaibhav Journal Entries

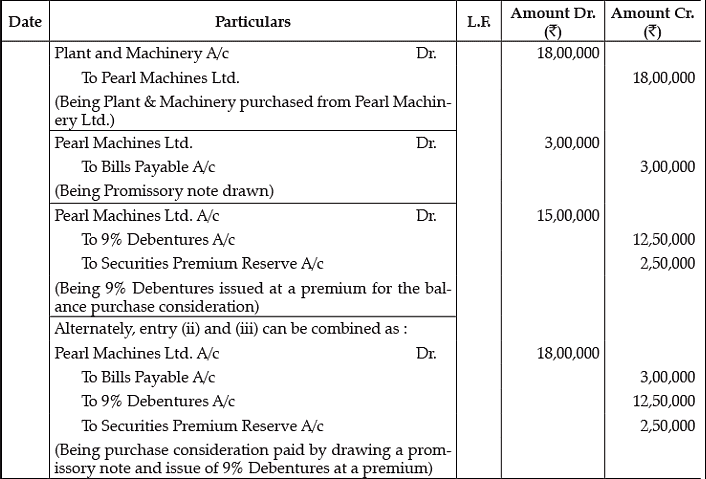

Q.6. Hero Ltd. purchased plant and machinery for ₹ 18,00,000 from Pearl Machines Ltd. paid ₹ 3,00,000 by drawing a promissory note and the balance by issue of 9% debentures of ₹ 100 each at a premium of 20%.

Pass the necessary journal entries in the books of Hero Ltd. for the above transactions.

In the books of Hero Ltd. Journal

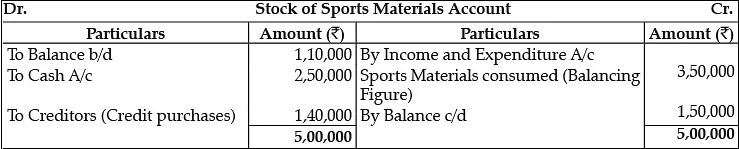

Q.7. From the following information, calculate the amount of sports material that will be debited to the Income and Expenditure Account of Bright Sports Club for the year ended 31.3.2019:

Additional Information:

Cash purchase of sports material during the year was ₹ 2,50,000. ₹ 1,50,000 were paid to the creditors of sports material.

In the Books of Bright Sports Club

Alternatives: Credit Purchases = Payment made to creditors + Closing creditors – Opening creditors – Closing advance + Opening advance

= ₹ 1,50,000 + ₹ 60,000 – ₹ 25,000 – ₹ 70,000 + ₹ 25,000 = ₹ 1,40,000

Sports Materials Consumed = Opening Stock of Sports Materials + Purchases – Closing Stock of Sports Materials

= ₹ 1,10,000 + (₹ 2,50,000 + ₹ 1,40,000) – ₹ 1,50,000 = ₹ 3,50,000

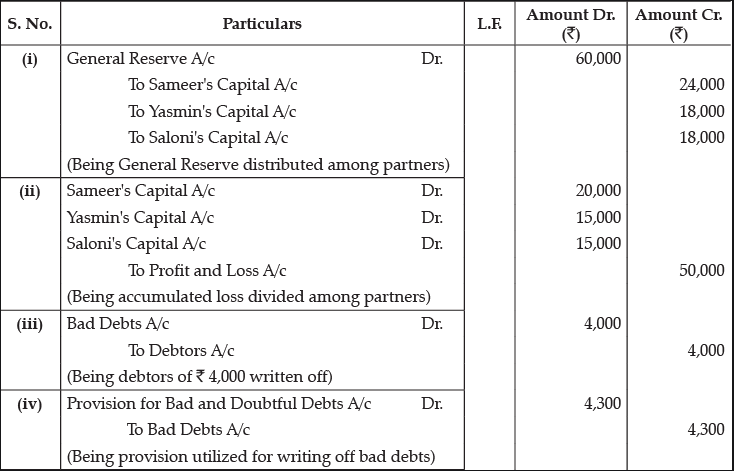

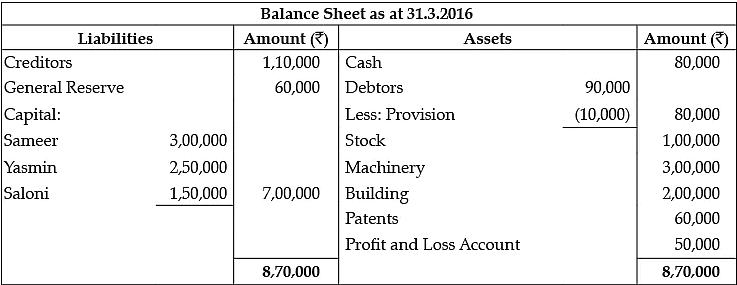

Q.8. Sameer, Yasmin and Saloni were partners in a firm sharing profits and losses in the ratio of 4 : 3 : 3. On 31.3.2016, their Balance Sheet was as follows:

On the above date, Sameer retired and it was agreed that:

(i) Debtors of ₹ 4,000 will be written off as bad debts and a provision of 5% on debtors for bad and doubtful debts will be maintained.

(ii) An unrecorded creditor of ₹ 20,000 will be recorded.

(iii) Patents will be completely written off and 5% depreciation will be charged on stock, machinery and building.

(iv) Yasmin and Saloni will share future profits in the ratio of 3 : 2.

(v) The Goodwill of the firm on Sameer ’s retirement was valued at ₹ 5,40,000.

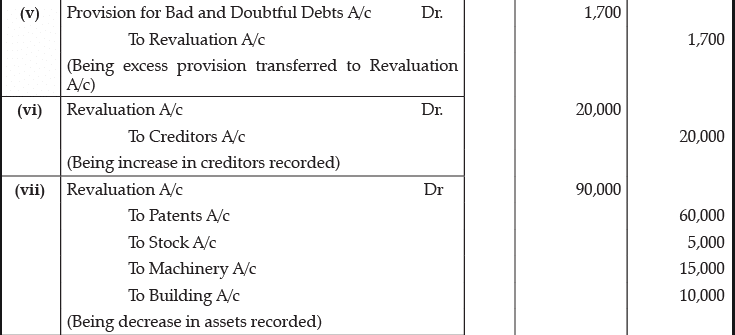

Pass necessary journal entries for the above transactions in the books of the firm on Sameer’s retirement.

In the Books of the firm Sameer, Yasmin and Saloni Journal

Working Note: Amount payable to Sameer = (₹ 24,000 – ₹ 20,000 – ₹ 43,320+ ₹ 2,16,000 + ₹ 3,00,000) = ₹ 4,76,680.

Q.9. On 1st May, 2016, VKR Ltd. issued 10,000, 9% Debentures of ₹ 100 each at a discount of 10%, redeemable at par after five years. All the debentures were subscribed. It has a balance of ₹ 60,000 in Securities Premium Reserve which the company decided to use for writing-off the losses and also decided to write-off the remaining discount on issue of debentures. Pass the necessary Journal Entries and also prepare Discount on Issue of Debentures Account.

OR

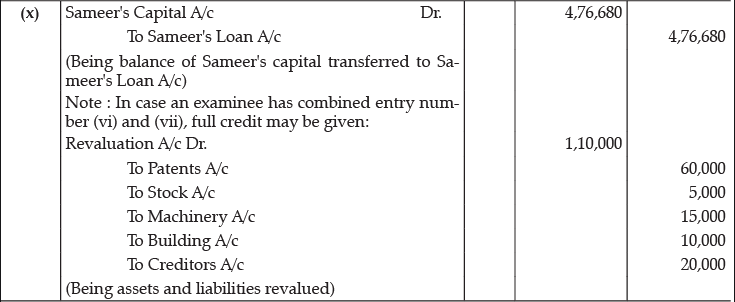

How would you differentiate between Debenture holders and shareholders?

In the books of VKR Ltd. Journal

OR

The important differences between a debenture holder and a shareholder of a company are as follows:

Part- B

Option-I (Analysis of Financial Statements)

(i) Decrease in outstanding employees benefits by ₹3000 .

(ii) Increase in Current Investment by ₹ 6,000.

(i) Outflow

(ii) No Flow

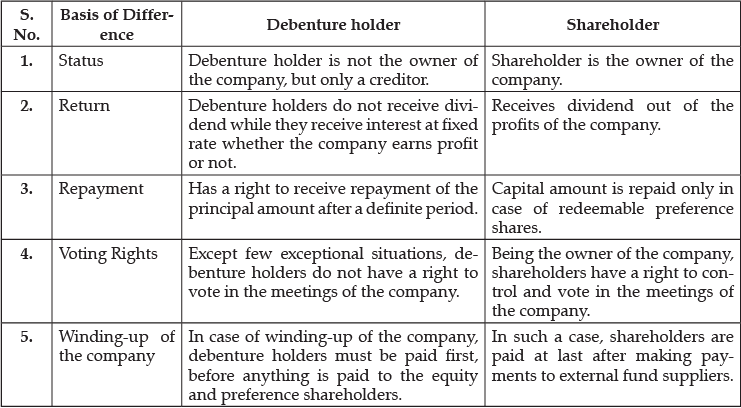

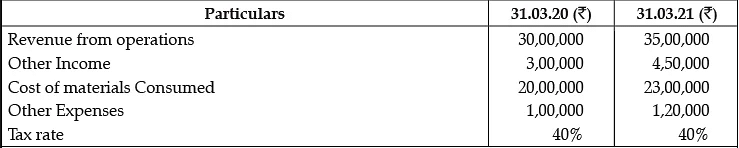

Q.11. From the following details provided by Kumud Ltd., prepare Comparative Statement of Profit & Loss for the year ended 31st March 2021:

OR

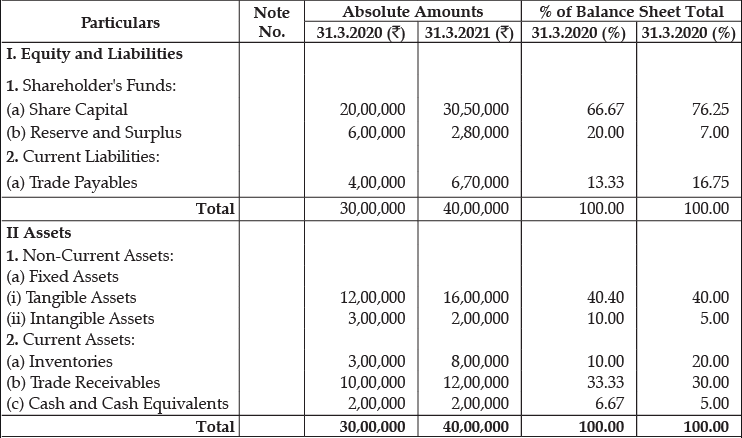

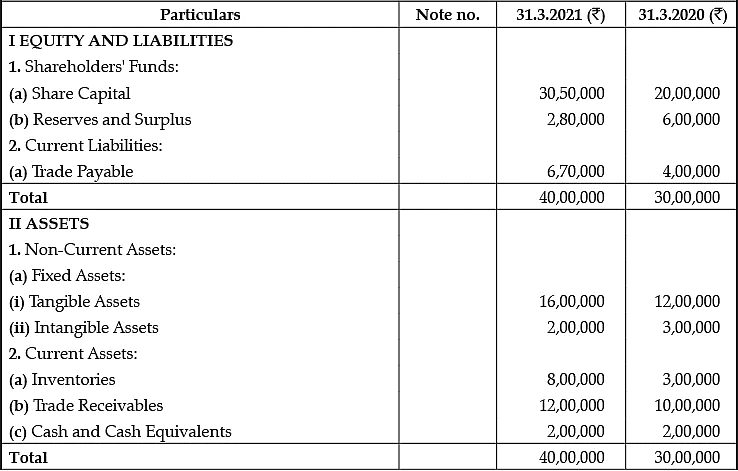

From the following Balance Sheets of Vinayak Ltd. as at 31st March, 2021. Prepare a Common-size Balance Sheet.

Vinayak Ltd. Balance Sheet as on 31st March, 2021

COMPARATIVE STATEMENT PROFIT AND LOSS OF KUMUD LTD.

FOR THE YEAR ENDED 31st March, 2021

OR

COMMON SIZE BALANCE SHEET OF VINAYAK LTD. as at 31st March, 2020 and 2021

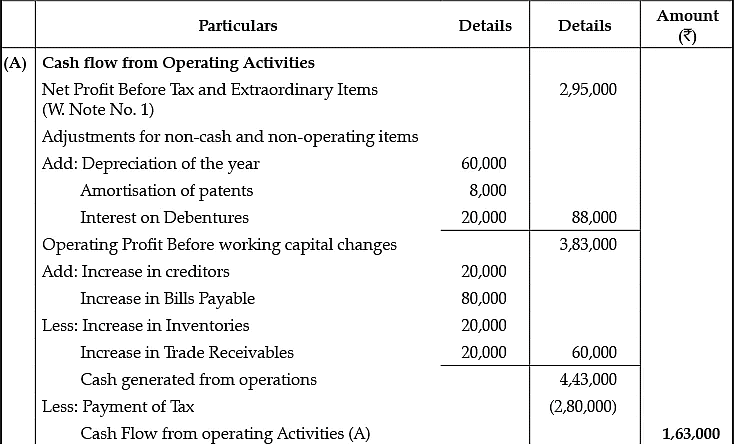

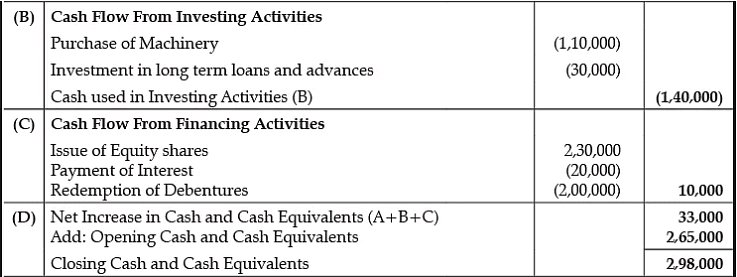

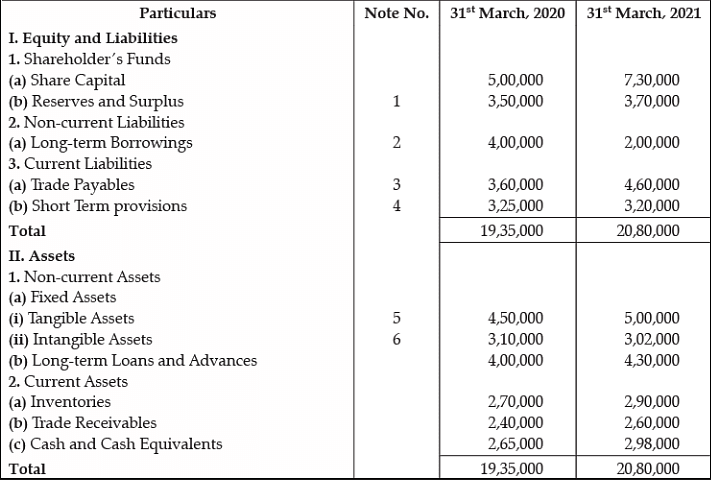

Q.12. On the basis of information given by Aradhana Ltd., prepare Cash Flow Statement for the year ending 31st March, 2021:

Aradhana Ltd. Balance Sheet as on 31st March, 2021

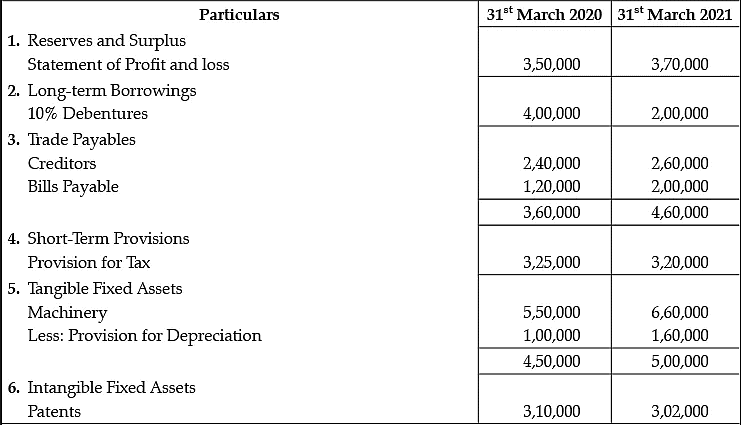

Notes to Accounts

Additional Information:

1. Debentures were redeemed on 1st April, 2020.

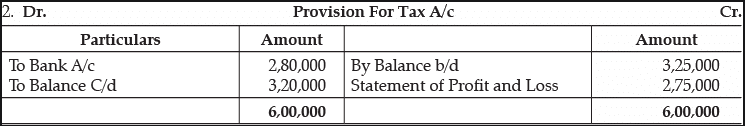

2. Tax paid during the year ₹ 2,80,000.

Cash Flow statement of Aradhana Ltd. for the year ended 31.3.21

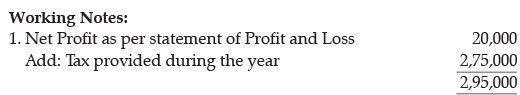

Working Notes:

Option-II (Computerized Accounting)

Q.10. What do you understand by terms ‘primary key ’ and ‘secondary key ’ in a database?

A primary key is a field that identifies each record in a database table admitting that the primary key must contain its UNIQUE values.

A secondary key shows the secondary value that is unique for each record. It can be used to identify the record and it is usually indexed. It is also termed as Alternate key.

Q.11. State any three features of computerized accounting system.

Features of Computerized Accounting System are: Simple and Integrated: It helps all businesses by automating and integrating all the business activities, such activities are sales, finance, purchase, inventory, and manufacturing, etc. It also facilitates the arrangement of accurate and up-to-date business information in a readily usable form.

Accuracy & Speed: Computerized accounting has customized templates for users, which allow fast and accurate data entry. Thus, after recording the transactions, it generates the information and reports automatically.

Scalability: It is flexible to record the transactions with the changing volume of business.

OR

State any three advantages of computerized accounting system.

Advantages of Computerized Accounting

- Better Quality Work: The accounts prepared with the use of a computerized accounting system are usually uniform, neat, accurate, and more legible than a manual job.

- Lower Operating Costs: The Computer is a reliable and time-saving device. The volume of the job handled with the help of computerized systems results in the economy and lower operating costs. The overall operating cost of this system is low in comparison to the traditional system.

- Improves Efficiency: This system is more efficient in comparison to the traditional system. The computer makes sure speed and accuracy in preparing the records and accounts and thus, increases the efficiency of employees.

Q.12. Identify and explain the steps required to create a new database in Access.

Steps to create a database in Access are:

(i) Open the Microsoft Access window. Choose blank access database and click OK button.

(ii) Click on the displayed new file database dialogue box. This will help the user to enter the file name and set a location for the database. Click on 'Create' button.

(iii) If the task pane does not open, please choose the file from the menu bar and click open to open the task pane and create a new database.

|

130 docs|5 tests

|