Class 12 Business Studies: CBSE Sample Question Papers- Term II (2021-22)- 1 | Sample Papers for Class 12 Commerce PDF Download

Class-XII

Time:120

Max. Marks: 40

General instructions:

- This is a Subjective Question Paper containing 12 questions.

- This paper contains 4 questions of 2 marks each, 4 questions of 3 marks each and 4 questions of 5 marks each.

- 2 marks questions are Short Answer Type Questions and are to be answered in 30-50 words.

- 3 marks questions are Short Answer Type Questions and are to be answered in 50-80 words.

- 5 marks questions are Long Answer Type Questions and are to be answered in 80-120 words.

- This question paper contains Case/Source Based Questions.

Short Answer Type Questions – I

Employment Exchange: Employment exchanges run by the Government are regarded as a good source of recruitment for unskilled and skilled operative jobs. In some cases, compulsory notification of vacancies to employment exchange is required by law. Thus, employment exchanges help to match personnel demand and supply by serving as link between job-seekers and employers. Unfortunately, the records of employment exchange are often not up to date and many of the candidates referred by them may not be found suitable.

Q.2. Rajni Auto Manufacturers has been into business for the last 30 years and have decided to give a special privilege to their existing shareholders to subscribe to the new issue of shares where they will be given shares according to the proportion of shares held by them. The company always gives special treatment to its loyal stakeholders and also ensures that they remain associated with the organization for longer durations. Last year, the company was successfully dealing through the capital market where both the buying and selling of securities were taking place. The owner of the company is a man of ethical business. He often contributes to business magazines by writing articles and editorials. He recently wrote an article about the watchdog of stock market. The article gained a lot of popularity and now is part of the curriculum of MBA students.

(i) Explain the method of floatation which was used by Rajni Auto Manufacturers?

(ii) Which type of capital market was this company dealing in?

(i) The method of floatation which was used by Rajni Auto Manufacturers is Rights Issue. Rights Issue is a privilege given to existing shareholders to subscribe to a new issue of shares according to the terms and conditions of the company. The shareholders are offered the ‘right’ to buy new shares in proportion to the number of shares they already possess.

(ii) The type of capital market this company was dealing in is the secondary market. The secondary market is also known as the stock market or stock exchange. It is a market for the purchase and sale of existing securities. It helps existing investors to disinvest and fresh investors to enter the market. It also provides liquidity and marketability to existing securities.

Q.3. Explain ‘Apprenticeship Programmes’ as a method of training.

Apprenticeship Programmes: Apprenticeship programmes put the trainee under the guidance of a master worker. These are designed to acquire a higher level of skill. People seeking to enter skilled jobs, to become, for example, plumbers, electricians or iron-workers, are often required to undergo apprenticeship training. These apprentices are trainees who spend a prescribed amount of time working with an experienced guide, or trainer. A uniform period of training is offered to trainees, in which both fast and slow learn here, are placed together. Slow learners may require additional training.

Q.4. An important project at AMB Consultants is running behind schedule by a month. This has upset their clients and might affect the reputation of the company in the long run. No managerial action like assigning more workers, equipment or giving overtime has been able to solve the problem. What managerial action may now be taken by the company to avoid such a situation from arising in future?

Correct Answer: Managerial action may now be taken by the company to avoid such a situation from arising in future is to judge accuracy in standards. A good control system enables management to verify whether the standards set are accurate and objective. An efficient control system keeps a careful check on the changes taking place in the organization and in the environment and helps to review and revise the standards in light of such changes.

Short Answer Type Questions – II

Q.5. Mr. Pawan Kumar, the CEO of an E-Commerce start up, which was facing the problem of huge employee turnover, decided to hold a meeting with the managers to discuss the issue. While addressing the managers in the meeting, he advised them to take certain measures which focus on psychological, social and emotional factors, in order to motivate employees. Explain any two such measures discussed by him, when he suggested that job should be made interesting so that the job itself becomes a source of motivation, employees should be congratulated for good performance, also, stability regarding future income and work should be provided to employees, in order to develop a positive attitude among the subordinates.

Non-monetary incentives:

(i) Job enrichment: It is concerned with designing jobs that include greater variety of work content, require higher level of knowledge and skill, etc,.

(ii) Employee recognition programmes: Recognition means acknowledgment with a show of appreciation.

(iii) Job security: Employees want their job to be secure. They want certain stability about income and work so that they do not feel worried about these aspects and work with greater zeal.Detailed Answer:

(i) Job Enrichment: Job enrichment is concerned with designing jobs that include greater variety of work content, require higher level of knowledge and skill; give workers more autonomy and responsibility; and provide the opportunity for personal growth and a meaningful work experience. If jobs are enriched and made interesting, the job itself becomes a source of motivation to the individual.

(ii) Employee Recognition programmes: Most people have a need for evaluation of their work and due recognition. They feel that what they do should be recognized by others concerned. Recognition means acknowledgment with a show of appreciation. When such appreciation is given to the work performed by employees, they feel motivated to perform/work at higher level.

(iii) Job security: Employees want their job to be secure. They want certain stability of future income and work so that they do not feel worried about these aspects and work with greater zeal. However, there is one negative aspect of job security. When people feel that they are not likely to lose their jobs, they may become complacent.

Q.6. State any three points of importance of Directing.

OR

Define leadership as an element of Directing? Enumerate any two styles of Leadership.

Importance of Directing:

(i) Directing helps to initiate action by people in the organization towards attainment of desired objectives.

(ii) Directing integrates employees’ efforts in the organization in such a way that every individual effort contributes to the organizational performance.

(iii) Directing guides employees to fully realize their potential and capabilities by motivating and providing effective leadership.

(iv) Directing facilitates introduction of needed changes in the organization.

(v) Effective directing helps to bring stability and balance in the organization since it fosters cooperation and commitment among the people and helps to achieve balance among various groups, activities and the departments.

OR

Leadership indicates the ability of an individual to maintain good interpersonal relations with followers and motivate them to contribute for achieving organizational objectives. (or any other correct definition)

Styles of leadership:

(i) Autocratic or Authoritarian leader gives orders and expects his subordinates to obey those orders.

(ii) Democratic or Participative leaders will develop action plans and make decisions in consultation with their subordinates.

(iii) Laissez faire or Free-rein leader does not believe in the use of power unless it is absolutely essential.

Detailed Answer:

The points which emphasise the importance of directing are presented as follows:

(i) Directing helps to initiate action by people in the organization towards attainment of desired objectives.

For example, if a supervisor guides his subordinates and clarifies their doubts in performing a task, it will help the worker to achieve work targets given to him.

(ii) Directing integrates employees efforts in the organization in such a way that every individual effort contributes to the organizational performance. Thus, it ensures that the individuals work for organizational goals. For example, a manager with good leadership abilities will be in a position to convince the employees working under him that individual efforts and team effort will lead to achievement of organizational goals.

(iii) Directing guides employees to fully realize their potential and capabilities by motivating and providing effective leadership. A good leader can always identify the potential of his employees and motivate them to extract work up to their full potential.

(iv) Directing facilitates introduction of needed changes in the organization. Generally, people have a tendency to resist changes in the organization. Effective directing through motivation, communication and leadership helps to reduce such resistance and develop required cooperation in introducing changes in the organization. For example, if a manager wants to introduce new system of accounting, there may be initial resistance from accounting staff. But, if manager explains the purpose, provides training and motivates with additional rewards, the employees may accept change and cooperate with manager.

(v) Effective directing helps to bring stability and balance in the organization since it fosters cooperation and commitment among the people and helps to achieve balance among various groups, activities and the departments.

OR

Leadership may be defined as a process by which manager guides and influences the work of subordinates in desired direction.

Styles of leadership:

(i) Autocratic or Authoritarian leader: An autocratic leader gives orders and expects his subordinates to obey those orders. If a manager is following this style, then communication is only one-way with the subordinate only acting according to the command given by the manager. This leader is dogmatic i.e., does not change or wish to be contradicted. His following is based on the assumption that reward or punishment both can be given depending upon the result.

(ii) Democratic or Participative leader: A democratic leader will develop action plans and makes decisions in consultation with his subordinates. He will encourage them to participate in decision making. This kind of leadership style is more common nowadays, since leaders also recognise that people perform best if they have set their own objectives. They also need to respect the other’s opinion and support subordinates to perform their duties and accomplish organizational objectives. They exercise more control by using forces within the group.

(iii) Laissez-faire or Free-rein leader: Such a leader does not believe in the use of power unless it is absolutely essential. The followers are given a high degree of independence to formulate their own objectives and ways to achieve them. The group members work on their own tasks resolving issues themselves. The manager is there only to support them and supply them the required information to complete the task assigned. At the same time, the subordinate assumes responsibility for the work to be performed.

Q.7. List any three factors affecting the Working Capital requirement of a company.

Factors affecting working capital requirement of the company:

(i) Nature of Business influences working capital requirements in a trading organization which usually needs a smaller amount of working capital compared to a manufacturing organization, while service industries which usually do not have to maintain inventory require less working capital.

(ii) Scale of operations influences working capital requirements in large organizations which require a large amount of working capital as compared to the organizations which operate on a lower scale.

(iii) Business cycle affects the requirement of working capital by a firm, as in case of a boom a larger amount of working capital is required as compared to the period of depression.

(iv) Seasonal Factors affect the working capital requirement, as in peak season large amounts of working capital is required and lower amount is required in the lean season.

(v) Production cycle affects the working capital requirement, as it is higher in firms with longer processing cycles and lower in firms with shorter processing cycles.

(vi) Credit allowed in a firm with liberal credit policy results in a higher amount of debtors, increasing the requirement of working capital.

(vii) Credit availed by a firm, to the extent to which the firm avails the credit on purchase’s the working capital requirement is reduced.

(viii) Operating efficiency may reduce the level of raw materials, finished goods and debtors resulting in lower requirement of working capital.

(ix) Availability of raw material influences the working capital requirement as larger the lead time larger the quantity of material to be stored and larger shall be the amount of working capital required.

(x) If the growth potential of a concern is perceived to be higher, it will require a larger amount of working capital.

(xi) Higher level of competitiveness may necessitate larger stocks and increases working capital requirement.

(xii) The working capital requirement of a business becomes higher with higher rate of inflation.

Detailed Answer:

Factors affecting working capital requirement of the company are as follows:

(i) Nature of Business: The basic nature of a business influences the amount of working capital required. A trading organization usually needs a smaller amount of working capital compared to a manufacturing organization. This is because there is usually no processing. Therefore, there is no distinction between raw materials and finished goods. Sales can be effected immediately upon the receipt of materials, sometimes even before that. In a manufacturing business, however, raw material needs to be converted into finished goods before any sales become possible. Other factors remaining the same, a trading business requires less working capital. Similarly, service industries which usually do not have to maintain inventory require less working capital.

(ii) Scale of Operations: For organizations which operate on a higher scale of operation, the quantum of inventory and debtors required is generally high. Such organizations, therefore, require large amount of working capital as compared to the organizations which operate on a lower scale.

(iii) Business Cycle: Different phases of business cycles affect the requirement of working capital by a firm. In case of a boom, the sales as well as production are likely to be larger and, therefore, larger amount of working capital is required. As against this, the requirement for working capital will be lower during the period of depression as the sales as well as production will be small.

(iv) Seasonal Factors: Most business have some seasonality in their operations. In peak season, because of higher level of activity, larger amount of working capital is required. As against this, the level of activity as well as the requirement for working capital will be lower during the lean season.

(v) Production Cycle: Production cycle is the time span between the receipt of raw material and their conversion into finished goods. Some businesses have a longer production cycle while some have a shorter one. Duration and the length of production cycle, affects the amount of funds required for raw materials and expenses. Consequently, working capital requirement is higher in firms with longer processing cycle and lower in firms with shorter processing cycle.

(vi) Credit Allowed: Different firms allow different credit terms to their customers. These depend upon the level of competition that a firm faces as well as the creditworthiness of their clientele. A liberal credit policy results in higher amount of debtors, increasing the requirement of working capital.

(vii) Credit Availed: Just as a firm allows credit to its customers it also may get credit from its suppliers. To the extent it avails the credit on purchases, the working capital requirement is reduced.

(viii) Operating Efficiency: Firms manage their operations with varied degrees of efficiency. For example, a firm managing its raw materials efficiently may be able to manage with a smaller balance. This is reflected in a higher inventory turnover ratio. Similarly, a better debtors turnover ratio may be achieved reducing the amount tied up in receivables. Better sales effort may reduce the average time for which finished goods inventory is held. Such efficiencies may reduce the level of raw materials, finished goods and debtors resulting in lower requirement of working capital.

(ix) Availability of Raw Material: If the raw materials and other required materials are available freely and continuously, lower stock levels may suffice. If, however, raw materials do not have a record of uninterrupted availability, higher stock levels may be required. In addition, the time lag between the placement of order and the actual receipt of the materials (also called lead time) is also relevant. Larger the lead time, larger the quantity of material to be stored and larger shall be the amount of working capital required.

(x) Growth Prospects: If the growth potential of a concern is perceived to be higher, it will require larger amount of working capital so that it is able to meet higher production and sales target whenever required.

(xi) Level of Competition: Higher level of competitiveness may necessitate larger stocks of finished goods to meet urgent orders from customers. This increases the working capital requirement. Competition may also force the firm to extend liberal credit terms discussed earlier.

(xii) Inflation: With rising prices, larger amounts are required even to maintain a constant volume of production and sales. The working capital requirement of a business thus become higher with higher rate of inflation.

Q.8. Priya is a regional manager of XYZ. Ltd. She is a hardworking employee and is trying to reduce wastage of resources in her company. She has set standards for performance of different activities and is ensuring that targets are met according to these standards with minimal wastage of resources. She has set up CCTV cameras which helps her to keep a close check on the activities of the subordinates and know how the employees are performing. She also rewards the employees with a bonus when these standards are met. She is trying her best to ensure a good performance of her team this year through the application of an important function of management. Explain any two benefits of the function of management highlighted above.

Importance of controlling:

(i) Accomplishing organizational goals: The controlling function measures progress towards the organizational goals and brings to light the deviations, if any, and indicates corrective action.

(ii) Ensuring Order and discipline: Controlling creates an atmosphere of order and discipline in the organization. It helps to minimise dishonest behavior by keeping a close check on their activities.

(iii) Making efficient use of resources: Each activity is performed in accordance with predetermined standards and norms. This ensures that resources are used in the most effective and efficient manner.

(iv) Improving employee motivation: A good control system ensures that employees know well in advance what they are expected to do and what are the standards of performance on the basis of which they will be appraised. It, thus, motivates them and helps them to give better performance.

Detailed Answer:

Importance of controlling are as follows:

(i) Accomplishing organizational goals: The controlling function measures progress towards the organizational goals and brings to light the deviations, if any, and indicates corrective action. It, thus, guides the organization and keeps it on the right track so that organisational goals might be achieved.

(ii) Judging accuracy of standards: A good control system enables management to verify whether the standards set are accurate and objective. An efficient control system keeps a careful check on the changes taking place in the organization and in the environment and helps to review and revise the standards in light of such changes.

(iii) Making efficient use of resources: By exercising control, a manager seeks to reduce wastage and spoilage of resources. Each activity is performed in accordance with predetermined standards and norms. This ensures that resources are used in the most effective and efficient manner.

(iv) Improving employee motivation: A good control system ensures that employees know well in advance what they are expected to do and what are the standards of performance on the basis of which they will be appraised. It, thus, motivates them and helps them to give better performance.

(v) Ensuring order and discipline: Controlling creates an atmosphere of order and discipline in the organization. It helps to minimise dishonest behavior on the part of the employees by keeping a close check on their activities.

(vi) Facilitating coordination in action: Controlling provides direction to all activities and efforts for achieving organizational goals. Each department and employee is governed by predetermined standards which are well coordinated with one another. This ensures that overall organizational objectives are accomplished.

Long Answer Type Questions

Q.9. Under the Consumer Protection Act, 2019, how are the consumer grievances redressed by the threetier machinery?

OR

What is meant by ‘Consumer Protection’? Explain the following rights of the consumers:

(i) Right to be Informed

(ii) Right to be Protected

The three-tier machinery to redress consumer grievances under Consumer Protection Act, 2019 is as follows:

(i) District Commission: When the value of goods or services along with the compensation being claimed is not more than Rs. 1 crore, then a complaint can be made to the appropriate District Commission. Moreover, any appeal against the orders passed by the District Commission can be filed before the State Commission, if the customer is unsatisfied.

(ii) State Commission: When the value of goods or services along with the compensation being claimed is more than Rs. 1 crore but less than Rs. 10 crores, then a complaint can be filed with the suitable State Commission. Moreover, any appeal against the orders of the State Commission can be filed before the National Commission if the customer is unsatisfied.

(iii) National Commission: When the value of goods and services along with the compensation being claimed is more than Rs. 10 crore, then a complaint can be filed with the National Commission. Moreover, an order passed by the National Commission in a matter of its original jurisdiction is appealable before the apex court in India i.e., The Supreme Court.

OR

Meaning of Consumer Protection: Consumer protection means the act of providing adequate protection to consumers against the unscrupulous, exploitative and unfair trade practices of manufacturers and service providers.

(i) Right to be Informed: The consumer has a right to have complete information about the product he intends to buy including its ingredients, date of manufacture, price, quantity, directions for use, etc. It is because of this reason that the legal framework in India requires the manufacturer’s to provide such information on the package and label of the product.

(ii) Right to be Protected: The consumer has a right to be protected against goods and services which are hazardous to life and health. For instance, electrical appliances which are manufactured with substandard products or do not conform to the safety norms might cause serious injury. Thus, consumers are educated that they should use electrical appliances which are ISI marked as this would be an assurance of such products meeting quality specifications.

Q.10. What is meant by ‘Capital Market’? Explain the two segments of Capital Market.

Capital Market: Capital market includes all those organizations, institutions and instruments that provide long-term and medium-term funds through shares, bonds, debentures, etc. It consists of development banks, commercial banks and stock exchanges.

Two segments of capital market:

(i) Primary Market: The primary market is also known as the new issues market. It deals with new securities being issued for the first time. The essential function of a primary market is to facilitate the transfer of investible funds from savers to entrepreneurs seeking to establish new enterprises or to expand existing ones through the issue of securities for the first time. The investors in this market are banks, financial institutions, insurance companies, mutual funds and individuals. A company can raise capital through the primary market in the form of equity shares, preference shares, debentures, loans and deposits. Funds raised may be for setting up new projects, expansion, diversification, modernisation of existing projects, mergers and takeovers etc.(ii) Secondary Market: The secondary market is also known as the stock market or stock exchange. It is a market for the purchase and sale of existing securities. It helps existing investors to disinvest and fresh investors to enter the market. It also provides liquidity and marketability to existing securities. It also contributes to economic growth by channelizing funds towards the most productive investments through the process of disinvestment and reinvestment. Securities are traded, cleared and settled within the regulatory framework prescribed by SEBI.

Q.11. Ashish, the Marketing Head; Raman, the Assistant Manager and Jyoti, the Human Resource Manager of ‘Senor Enterprises Ltd.’ decided to leave the company. The Chief Executive Officer of the company called Jyoti, the Human Resource Manager, and requested her to fill up the vacancies before leaving the organization. Informing that her subordinate Miss Alka Pandit was very competent and trustworthy, Jyoti suggested that if she could be moved up in the hierarchy, she would do the needful. The Chief Executive Officer agreed for the same. Miss Alka Pandit contacted ‘Keith Recruiters’, who advertised for the post of marketing head for ‘Senor Enterprises Ltd’. They were able to recruit a suitable candidate for the company. Raman’s vacancy was filled up by screening the database of unsolicited applications lying in the office.

(i) Name the internal/external sources of recruitment used by ‘Senor Enterprises Ltd.’ to fill up the above stated vacancies.

(ii) Also state any one merit of each of the above identified sources of recruitment.

(i) Sources of recruitment used to fill up the vacancies are:

(a) Promotion

(b) Placement Agencies and Management Consultants

(c) Casual Callers

(ii) Merit of each of the above identified sources of recruitment are:

Promotion:

(a) It helps to motivate and improve loyalty and satisfaction level of employees.

(b) It has a great psychological impact over the employees because a promotion at a higher level may lead to a chain of promotions at lower levels in the organization.

(c) It is a more reliable way of recruitment since the candidates are known to the organization.

(d) It is a cheaper source of recruitment.

Placement Agencies and Management Consultants:

(a) They recommend only suitable candidates to their clients.

(b) It helps in enticing the needed top executives from other companies by making the right offers.

Casual Callers:

(a) It reduces the cost of recruiting workforce in comparison to other sources.

(b) It saves time.

Q.12. The Capital of India has been declared as the most polluted city in the world. Bengaluru, Mumbai, Patna, Ahmedabad, Lucknow, Kanpur and Ludhiana are also the highly polluted Indian cities. This has resulted into a dramatic increase in the sale of home air purifiers. The prices of these devices range from ₹ 2,000 to ₹ 25,000 depending upon the type of pollutant these purifiers remove. Looking at the increasing demand of these air purifiers, ‘Pure Air Technology India Ltd.’ has developed a low cost home air purifier in its R&D Lab. The company has estimated that a commercial production of 1,00,000 units per year may cost the company ₹ 500 per unit. For this, capital of ₹ 100 crore will be required. The company decided to have both equity and debt in its capital structure. Explain any five factors that the company should consider while deciding its capital structure.

OR

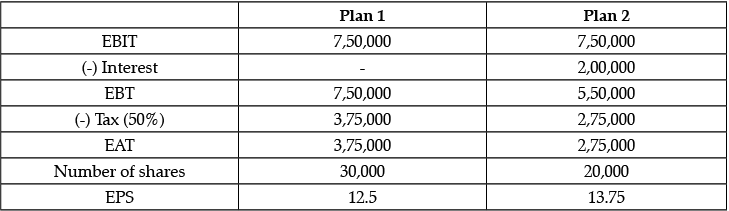

Alto Ltd. has a share capital of ₹ 20,00,000 divided into shares of ₹ 100 each. For expansion purpose, the company requires additional funds of ₹ 10,00,000. The management is considering the following alternatives for raising funds:

Alternative 1: Issue of 10,000 Equity shares of ₹ 100 each

Alternative 2: Issue of 20% Debentures of ₹10,00,000

The company ’s present Earnings Before Interest and Tax (EBIT) is ₹ 5,00,000 p.a. Assuming that the rate of Return on Investment remains the same after expansion, which alternative should be used by the company in order to maximize the returns to the equity shareholders. The Tax rate is 50%. Show the working.

Following are the factors affecting the choice of capital structure of a company:

(i) Cash Flow Position: Size of projected cash flows must be considered before borrowing. Cash flows must not only cover fixed cash payment obligations but there must be sufficient buffer also. It must be kept in mind that a company has cash payment obligations for normal business operations; for investment in fixed assets; and for meeting the debt service commitments i.e., payment of interest and repayment of principal.

(ii) Interest Coverage Ratio (ICR): The interest coverage ratio refers to the number of times a company covers the interest obligation before applying taxes and interest is deducted. The higher the ratio, lower shall be the risk of company failing to meet its interest payment obligations. However, this ratio is not an adequate measure. A firm may have a high EBIT but low cash balance. Apart from interest, repayment obligations are also relevant.

(iii) Debt Service Coverage Ratio (DSCR): Debt Service Coverage Ratio takes care of the deficiencies referred to in the Interest Coverage Ratio (ICR). The cash profits generated by the operations are compared with the total cash required for the service of the debt and the preference share capital. A higher DSCR indicates better ability to meet cash commitments and consequently, the company’s potential to increase debt component in its capital structure.

(iv) Return on Investment (ROI): If the ROI of the company is higher, it can choose to use trading on equity to increase its EPS, i.e., its ability to use debt is greater.

(v) Cost of debt: A firm’s ability to borrow at a lower rate increases its capacity to employ higher debt. Thus, more debt can be used if debt can be raised at a lower rate.

(vi) Tax Rate: Since interest is a deductible expense, cost of debt is affected by the tax rate. A higher tax rate makes debt relatively cheaper and increases its attraction vis-a-vis equity.

(vii) Cost of Equity: Stock owners expect a rate of return from the equity which is commensurate with the risk they are assuming. When a company increases debt, the financial risk faced by the equity holders, increases. Consequently, their desired rate of return may increase. It is for this reason that a company cannot use debt beyond a point. If debt is used beyond that point, cost of equity may go up sharply and share price may decrease in spite of increased EPS. Consequently, for maximization of shareholders’ wealth, debt can be used only up to a level.

(viii) Floatation Costs: Process of raising resources also involves some cost. Public issue of shares and debentures requires considerable expenditure. Getting a loan from a financial institution may not cost so much. These considerations may also affect the choice between debt and equity and hence the capital structure.

(ix) Risk Consideration: Use of debt increases the financial risk of a business. Financial risk refers to a position when a company is unable to meet its fixed financial charges namely interest payment, preference dividend and repayment obligations. Apart from the financial risk, every business has some operating risk (also called business risk). Business risk depends upon fixed operating costs. Higher fixed operating costs result in higher business risk and vice-versa. The total risk depends upon both the business risk and the financial risk. If a firm’s business risk is lower, its capacity to use debt is higher and vice-versa.

(x) Flexibility: If a firm uses its debt potential to the full, it loses flexibility to issue further debt. To maintain flexibility, it must maintain some borrowing power to take care of unforeseen circumstances.

(xi) Control: Debt normally does not cause a dilution of control. A public issue of equity may reduce the managements’ holding in the company and make it vulnerable to takeover. This factor also influences the choice between debt and equity especially in companies in which the current holding of management is on a lower side.

(xii) Regulatory Framework: Every company operates within a regulatory framework provided by the law e.g.; public issue of shares and debentures have to be made under SEBI guidelines. Raising funds from banks and other financial institutions require fulfillment of other norms. The relative ease with which these norms can be met or the procedures completed may also have a bearing upon the choice of the source of finance.

(xiii) Stock Market Conditions: If the stock markets are bullish, equity shares are more easily sold even at a higher price. Use of equity is often preferred by companies in such a situation. However, during a bearish phase, a company, may find raising of equity capital more difficult and it may opt for debt. Thus, stock market conditions often affect the choice between the two.

(xiv) Capital Structure of other Companies: A useful guideline in the capital structure planning is the debt equity ratios of other companies in the same industry. There are usually some industry norms which may help. Care however must be taken that the company does not follow the industry norms blindly. For example, if the business risk of a firm is higher, it cannot afford the same financial risk. It should go in for low debt. Thus, the management must know what the industry norms are, whether they are following them or deviating from them and adequate justification must be there in both cases.

OR

Rate of Return on Investment is

EBIT after expansion = 25% × 30,00,000 = 7,50,000

Calculation of EPS:

The company should use Plan 2 in order to increase the return to the equity shareholders.

|

130 docs|5 tests

|

FAQs on Class 12 Business Studies: CBSE Sample Question Papers- Term II (2021-22)- 1 - Sample Papers for Class 12 Commerce

| 1. What is the weightage of the CBSE Class 12 Business Studies exam in the final score? |  |

| 2. How long is the duration of the CBSE Class 12 Business Studies exam? |  |

| 3. Are there any sample question papers available for the CBSE Class 12 Business Studies Term II exam? |  |

| 4. What is the difficulty level of the CBSE Class 12 Business Studies exam? |  |

| 5. How can I prepare effectively for the CBSE Class 12 Business Studies exam? |  |