Class 12 Economics: CBSE Sample Question Papers- Term II (2021-22)- 2 | Sample Papers for Class 12 Commerce PDF Download

Class-XII

Time: 120

Max. Marks: 40

General instructions:

- This is a Subjective Question Paper containing 13 questions.

- This paper contains 5 questions of 2 marks each, 5 questions of 3 marks each and 3 questions of 5 marks each.

- 2 marks questions are Short Answer Type Questions and are to be answered in 30-50 words.

- 3 marks questions are Short Answer Type Questions and are to be answered in 50-80 words.

- 5 marks questions are Long Answer Type Questions and are to be answered in 80-120 words.

- This question paper contains Case/Source Based Questions.

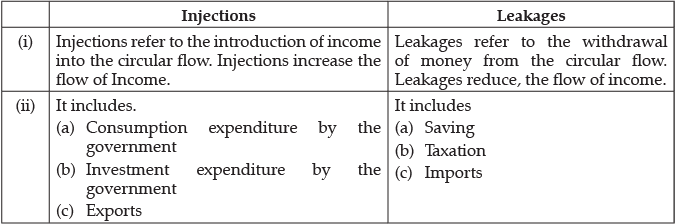

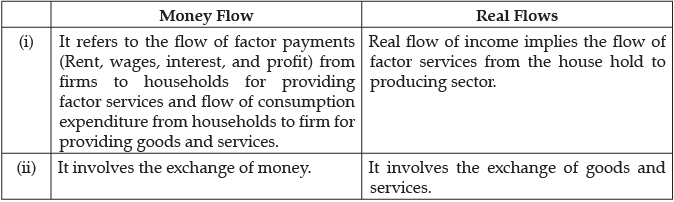

Q.1. Explain the difference between injections and leakages in context of circular flow of income.

OR

Distinguish between money flow and real flows.

The difference between Injections and Leakages are:

OR

The difference between Money Flow and Real Flow are:

Q.2. In a hypothetical economy, Let Consumption Function is 10 + 0.25 Y and Investment expenditure is 100 crores, Find the equilibrium level of income.

OR

Let the economy having situation of full employment with saving function – 250 + 0.25 Y. Find out the Investment expenditure, If the National income is ₹ 5,000 crores?

Given,

Consumption Function = 10 + 0.05 Y

It means,

Autonomous Consumption = 10

Marginal Propensity to consume = 0.25

Investment = 100

Thus, finding the value of the equilibrium level of income.

We know that

Y = C + I

Y = 10 + 0.25 Y + I

Y = 10 + 0.25 Y + 100

Y – 0.25 Y = 10 + 100

0.75 Y = 110

Y = 110/0.75

= 146.6 Crores

OR

Given

National Income = 5000

Y = 5000

Saving Function = – 250 + 0.25 Y

S = – 250 + 0.25Y

We know that in a state of equilibrium in economy only occurs the situation of full employment. We also know that at the equilibrium level of economy.

S = I

Thus, I = – 250 + 0.25 Y

Putting the value of Y in above

I = – 250 + 0.25 × 5000

= – 250 + 1250

= 1000

Investment expenditure = ₹ 1000 crores.

Q.3. “Repo Rate is a surefire medicine to bridge the inflationary gap”.

Justify the above statement by summarizing the inflationary gap.

Inflationary Gap: It refers to the amount by which the actual aggregate demand exceeds the level of aggregate demand required to establish the full employment. To correct the situation of Inflationary Gap, Repo Rate is increased. As a follow-up action, Commercial Banks raise the market rate of interest (the rate at which the Commercial Banks lends money to the consumers and the investors). This reduces demand for credit. Consequently, consumption expenditure and investment expenditure get reduced. Implying a reduction in Aggregate Demand, as required to correct Inflationary Gap.

Q.4. State and discuss any two problems of India’s health sector.

OR

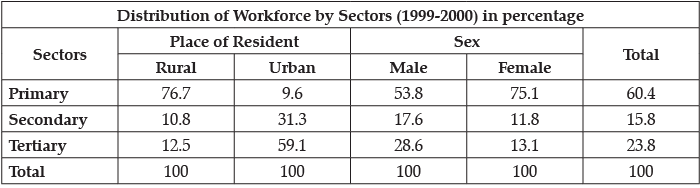

Study the following data given in the table, do a comparative analysis of the distribution of workforce in different sectors.

We can point out two important problems of India’s health sector as follows.

(i) Inadequate and inefficient health infrastructural facilities : The existing health system suffers from inequitable and inefficient infrastructure & manpower. There are huge gaps in primary healthcare system in the remote area where health care needs are the greatest.

(ii) Quality and accountability in healthcare : The acute lack of quality and accountability is the second biggest problem in the health sector. In recent years, there has been increasing public concern over the quality of health care both because of increasing awareness of the people.

OR

According to the above information, more than 60 percent workforce earns its livelihood from the primary sector. It means agriculture, mining and quarrying activities are still the major source of employment in the Indian economy. The share of secondary sector in the total employment is nearly 16 percent whereas the share of tertiary sector is about 24 percent. In rural sector more than 75 percent workforce depends on agriculture and about 11 percent workers get their job in the secondary sector and tertiary sector provides employment to 12.5 percent rural workers.

Q.5. “The infrastructure Induce Investment”. Justify the given statement with a valid argument.

Availability of infrastructure motivates investors to invest. A developed network of highways would definitely induce investment across all sectors of the economy. Because, it facilitates efficient movement of goods and services across different regions of the country. In fact, infrastructure is the backbone of business investment.

Q.6. Giving valid reasons explain which of the following will not be included or not in estimation of National Income of India?

(a) Value of machine purchased by a factory

(b) Governmental Expenditure on Defence

(c) Expenditure incurred by a household on feeding of beggers

OR

Calculate the value of Gross National Product at market price and factor cost from the given data.

(i) Amount of the Tea produced = 2,000

(ii) Market Price of tea per kg = 100

(iii) Amount of coffee produced = 1,500

(iv) Market Price of coffee per kg = 300

(v) Value of other agricultural Product = 6,00,00

(vi) Value of Industrial product = 8,00,000

(vii) Value of intermediate input = 3,00,000

(viii) Net indirect taxes = 1,00,000

(i) Value of machine purchased by a factory is included in the national income because it is used by the factory for its own use and not for resale in the market.

(ii) Governmental expenditure on defence is included in the estimation of national income of a country it is a part of government final consumption expenditure.

(iii) Expenditure incurred by a household on feeding of beggers is a transfer payment. Beggars do not contribute anything by virtue of production of goods and services. Therefore, it will not be included in the national income.

OR

GNPMP = (Price × Quantity of Tea) + (Price × Quantity of Coffee) + Value of other agricultural Product + Value of Industrial product – Value of intermediate input

= (100 × 2000) + (300 × 1500) + 6,00,000 + 8,00,000 – 3,00,000

= 2,00,000 + 4,50,000 + 11,00,000

= ₹ 17,50,000

GNPFC = GNPMP – Net indirect tax

= 17,50,000 – 1,00,000

= ₹ 16,50,000

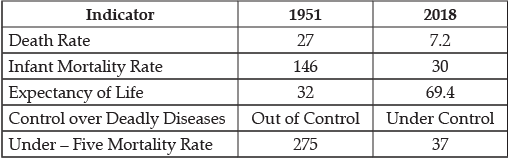

Q.7. Study the following information and comment on the main characteristics of health of the people of India.

Read the following hypothetical case study and answer the questions 8 and 9 that follows on the basis of the same:

China and India are the two emerging economies of the world. As of 2019, China and India are 2nd and 5th largest country of the world, respectively in nominal basis. On PPP basis, China is at 1st and India is at 3rd place. Both countries together share 19.46% and 27.18% of total global wealth in nominal and PPP terms, respectively. Among Asian countries, China and India together contribute more than half of Asia’s GDP.

In 1987, GDP (Nominal) of both countries was almost equal. But in 2019, China’s GDP is 4.78 times greater than India. On PPP basis, GDP of China is 2.38x of India. China crossed $1 trillion mark in 1998 while India crossed 9 year later in 2007 at exchange rate basis.

Both countries have been neck-to-neck in GDP per capita terms. As per both methods, India was richer than China in 1990. Now in 2019, China is almost 4.61 times richer than India in nominal method and 2.30 times richer in PPP method. Per capita rank of China and India is 72th and 145th, respectively in nominal Per capita rank of China and India is 75th and 126th, respectively in PPP.

China attains maximum GDP growth rate of 19.30% in year 1970 and minimum -27.27% in 1961. India reached an all-time high of 9.63% in 1988 and a record low of -5.24% in 1979. During period 1961 to 2018, China grew by more than 10% in 22 years while India never. GDP growth rate was negative in five and four years for China and India, respectively.

According to CIA Factbook sector wise GDP composition of India in 2017 are as follows: Agriculture (15.4%), Industry (23%) and Services (61.5%). Sector wise GDP composition of China in 2017 are: Agriculture (8.3%), Industry (39.5%) and Services (52.2%).

- Comparing China and India by Economy – The Statistic Times – 28th August, 2019

After the independence, since 1951, There has been considerable progress in health facilities. Death rate has come down from as high as 27 per thousand in 1951 to 7.2 thousand in 2018. Infant mortality rate has significantly reduced from 146 per thousand in 1951 to 30 per thousand in 2018. Expectancy of life has risen from 32 year in 1951 to 69.4 years in 2018. Deadly diseases like malaria & TB have been brought under control. Under-five mortality rates has declined significantly from 248 per thousand in 1960 to 37 per thousand in 2018.

Q.8. Outline and discuss any two economic advantages of China Pakistan Economic Corridor (CPEC) accruing to the economy of Pakistan.

Economic advantages of China Pakistan Economic Corridor (CPEC) to the economy of Pakistan are:

(i) China provided financial and technical expertise to help Pakistan build its road infrastructure, supporting employment and income in the economy.

(ii) CPCE has led to a massive increase in power generation capacity of Pakistan. It has brought an end to upply-side constraints in the nation, which had made blackouts a regular phenomenon across the country.

Detailed Answers: Therefore more Power generation will lead to rapid industrialization and higher productivity of resources giving a boost to economic growth.

Q.9. Analyse the implication of bilateral ‘debt-trap’ situation of Pakistan vis-à-vis the Chinese Economy.

China has become famous for its ‘Debt Trap Diplomacy ’ in recent times. Under this China provides financial and technical expertise/assistance to help various nations to bring them under its direct or indirect influence.

The first and the foremost implication of the diplomacy is that Beijing has now become Islamabad’s largest creditor. According to documents released by Pakistan’s finance ministry, its total public external debt stood at $44.35 billion in June 2013, just 9.3 percent of which was owed to China. By April 2021, this external debt had ballooned to $90.12 billion, with Pakistan owing 27.4 percent —$24.7 billion — of its total external debt to China, according to the IMF.

Q.10. Explain how ‘Non-Monetary Exchanges’ impact the use of Gross Domestic Product as an index of economic welfare.

Non-monetary exchange transactions are not included in the estimation of Gross Domestic Product on account of practical difficulties like non-availability of reliable data. Although these activities enhance public welfare which may lead to underestimation of GDP.

For example: kitchen gardening, services of homemaker etc.

Detailed Answer:

Non monetary exchange transactions mean those goods and services which are produced but not exchanged for money value. For example .in rural economies, barter system of exchange still prevails to some extent. Payments for farm labour or interest to money lenders are often made in kind rather than in cash. All such transactions are not included in GDP on account of practical difficulties like non-availability of reliable data. Although these activities enhance public welfare which may lead to underestimation of GDP. and economic welfare. Therefore GDP remains an inappropriate index of welfare.

Q.11. ‘Monetary measures offer a valid solution to the problem of Inflationary gap in an economy ’. State and discuss any two monetary measures to justify the given statement.

Two measures which may be used to solve the problem of inflation are:

(a) An increase in Cash Reserve Ratio (CRR) may reduce the credit creation capacity of the commercial banks in the economy. This may lead to a fall in the borrowings from banks causing a fall in Aggregate Demand in the economy, and helps to correct the inflationary gap in the economy.

(b) Sale of Government Securities in the open market by the Central Bank will adversely affect the ability of the Commercial Banks to create credit in the economy. As a result Aggregate Demand in the economy may fall and correct the inflationary gap in the economy.

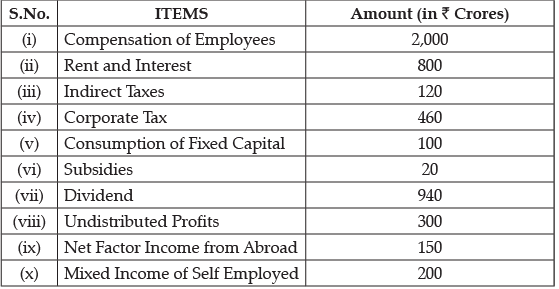

Q.12. (a) From the following data calculate the value of Domestic Income:

(b) Distinguish between ‘Value of Output’ and ‘Value Added’.

OR

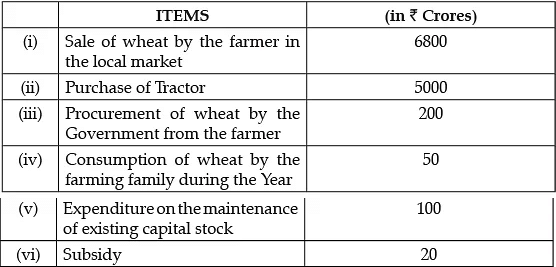

(a) Given the following data, find Net Value Added at Factor Cost by Sambhav (a farmer) producing Wheat:

(b) State any two components of ‘Net Factor Income from Abroad’.

(a) Domestic Income (NDP@fc) = (i) + (ii) + (iv) + (vii) + (viii) + (x)

= ₹ 2000 + ₹ 800 + ₹ 460 + ₹ 940 + ₹ 300 + ₹ 200 = ₹ 4,700 crore

(b) Value of output is the estimated money value of all the goods and services, inclusive of change in stock and production for self-consumption. Whereas, Value added is the excess of value of output over the value of intermediate consumption.

OR

(a) Net Value Added at Factor Cost (NVA @ FC) = (i) + (iii) + (iv) + (vi) – (v)

= ₹ 6800 + ₹ 200 + ₹ 50 + ₹ 20 – ₹ 100 = ₹ 6,970 crore

(b) Component of net factor income from abroad are:

(i) Net compensation of employees

(ii) Net income from property and entrepreneurship

(iii) Net retained earnings of resident companies abroad

Q.13. (a) ‘Pesticides are chemical compounds designed to kill pests. Many pesticides can also pose health risks to people even if exposed to nominal quantities.‘

In the light of the above statement, suggest any two traditional methods for replacement of the chemical pesticides.

(b) ‘In recent times the Indian Economy has experienced the problem of Casualisation of the workforce. This problem has only been aggravated by the outbreak of COVID-19.’

Do you agree with the given statement? Discuss any two disadvantages of casualisation of the workforce in the light of the above statement.

(a) The traditional practices can help in controlling contamination without the use of chemical fertilizers, as follows:

(i) Neem trees and its by products are a natural pest-controller, which has been used since ages in India. Recently, the government promoted the sale Neem coated urea as a measure of natural pest control.

(ii) Large variety of birds should be allowed to dwell around the agricultural areas, they can clear large varieties of pests including insects.

(b) The given statement is quite appropriate with reference to the ‘casualisation of labour ’ in India.

(i) For casual workers, the rights of the labour are not properly protected by labour laws. Particularly, during pandemic times, as demand for goods and services fell the casual workers were left jobless, without any compensation or support.

(ii) During the COVID-19 lockdown millions of casual workers lost their jobs, raising the question of their survival. Also, additional health expenditure added to their troubles. Had such workers been working under the formal sector, it would have given them some respite in their difficult times.

|

130 docs|5 tests

|