Automobile, Fertiliser & Paper Industry | Geography Optional for UPSC (Notes) PDF Download

Automobile Industry in India

- The term "automobile" comes from two words: "auto," meaning self, and "mobile," meaning movable. It refers to vehicles that can move by themselves without the need for human or animal force. Automobiles are used for the transportation of goods and passengers through various means, such as roads, tracks, water, or airways.

- Before India gained its independence, the automobile industry did not truly exist in the country. Only assembly work was done using imported parts. General Motors (India) Ltd. began assembling trucks and cars in their Mumbai factory in 1928. Ford Motor Co. (India) Ltd. started assembling cars and trucks in Chennai in 1930 and Mumbai in 1931.

- The real growth of the automobile industry in India began with the establishment of Premier Automobiles Ltd. in Kurla (Mumbai) in 1947 and Hindustan Motors Ltd. in Uttarpara (Kolkata) in 1948. Since then, the industry has made significant progress over the past three decades and is now one of the most dynamic sectors of the Indian economy.

- The Indian automobile industry has continued to expand since the liberalization policies of 1991. Today, there are 15 manufacturers of passenger cars and multi-utility vehicles, nine commercial vehicle manufacturers, 14 two/three-wheeler manufacturers, and 14 tractor manufacturers, as well as five engine manufacturers. The industry has attracted investments of over Rs. 50,000 crore.

- In 2003-04, the turnover of the Indian automobile sector exceeded Rs. 1,00,000 crore. The industry also offers significant employment opportunities, currently providing 4.5 lakh direct jobs and about one crore indirect jobs. The contribution of the automobile industry to India's GDP has increased from 2.77 percent in 1992-93 to 4.7 percent in 2002-03.

Production and Distribution

- The commercial vehicle industry is divided into two main segments: passenger and goods vehicles. The passenger segment is predominantly managed by state-owned transport undertakings (STUs), while goods vehicles are generally produced by private sector companies. The production of commercial vehicles began in the 1950s, and the industry experienced significant growth during the post-liberalization era due to government incentives.

- Commercial vehicle production, which includes buses, trucks, tempos, and 3- and 4-wheelers, increased from a mere 8.6 thousand units in 1950-51 to 145.5 thousand in 1990-91 and 327.3 thousand in 1996-97. However, production trends have fluctuated since then, and in 2003-04, India produced 275.1 thousand commercial vehicles.

- Currently, there are seven major companies involved in the manufacturing of buses and trucks. Tata Engineering and Locomotive Co. Ltd. (TELCO) is the top producer of medium and heavy commercial vehicles, accounting for over 70% of such vehicles produced in India. Light commercial vehicles are manufactured at four plants located in Hyderabad, Pithampur (M.P.), Arson near Rupnagar (Punjab), and Surajpur in U.P.

- Other notable manufacturers include Premier Automobiles and Mahindra & Mahindra in Mumbai, Ashok Leyland Ltd. and Standard Motor Products of India Ltd. in Chennai, Hindustan Motors Ltd. in Kolkata, and Bajaj Tempo Ltd. in Pune. Additionally, Shaktiman trucks are produced under the Ministry of Defence, and Nissan Jeeps are manufactured in Jabalpur in collaboration with Nissan of Japan.

Passenger Cars

- A number of companies are engaged in manufacturing passenger cars. Of these, Maruti Udyog Ltd. (MUL) is at the top. It is located at Gurgaon in Haryana. It started production in 1983 with the collaboration of Suzuki Motor Corporation of Japan. Currently, this company produces about four-fifths of the total cars produced in India.

- It produces a variety of models of which Maruti 80, Zen, Wagon R, Esteem, and Gypsy are very popular.

- Hindustan Motors (Kolkata and Chennai), Premier Automobiles (Mumbai), Standard Motor Products (Chennai), and Sunrise Industries (Bangalore) are other important producers.

- Several new companies have entered the car manufacturing industry of India after liberalization in 1991. These include Hyundai Motors India at Irrungattukottai in Kanchiura district (Tamil Nadu), Daewoo of Korea in 1995 at Surajpur (Uttar Pradesh), Telco at Pimpri (near Pune). Honda of Japan has set up a plant in Uttar Pradesh to manufacture ‘City’. General Motors has launched Opel Astra. It has a tie-up with Hindustan Motors.

- Ford in collaboration with Mahindra has introduced Ford.

- Hindustan Motors in collaboration with Mitsubishi of Japan has launched ‘Lancer’.

- Mercedes Benz of Germany in collaboration with Telco is manufacturing E220 and 250D for the upper strata of society.

- Premier Automobiles in collaboration with Fiat-India Auto Limited is manufacturing the Fiat Uno model.

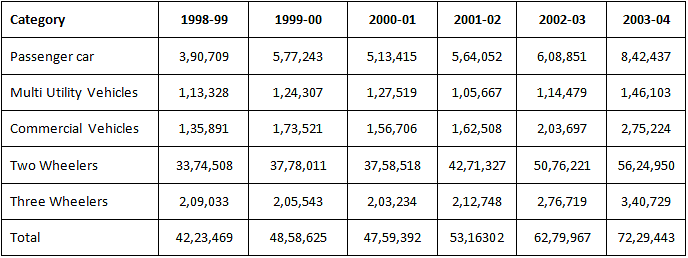

- Table 27.19 shows that the car manufacturing industry made rapid progress particularly after Maruti Udyog Limited (MUL) started production in the mid-1980s. The production of passenger cars increased from 390.7 thousand in 1998-99 to 842.4 thousand in 2003-04.

Production of Vehicles in India

- The production of cars (including jeeps and land rovers) recorded more than a hundred percent increase in a short span of six years from 220.8 thousand in 1999-91 to 483.0 thousand in 1996-97. After a brief slack period of 1997-98 and 1998-99, the production again picked up in 1999-2000 and stood at 1,008.1 thousand in 2003-04.

- Several factors have made it a buoyant industry in the recent past and the industry has a bright future. Reduction in excise duty on passenger cars from 32 to 24 percent in 2004 has led to reduced car prices and created the potential for an increase in demand.

- This has helped in the growth of the industry to a great extent. The government’s Auto Policy also has the stated aim of making India an ‘Asian hub’ for the manufacture of small cars. The small car segment, which refers to the A and В segments, accounts for over 65 percent of the market. Giving a further push to this segment, therefore, adds impetus to a movement that is already underway. For India to become a large manufacturer of small cars, quality and price are the two basic deciding factors.

- The potential for growth is good considering that passenger car penetration in India is a mere 20 cars per 1,000 population whereas it is much higher in other developing countries. The market is projected to grow at a rate of around 7 percent annually.

- Over the years car sales in the A and В segments category as a whole have registered a steady growth because these cars are available in a wide range of models and at affordable prices. The mid-size category normally pertains to С segment cars. This segment accounts for 15-16 percent.

- In addition to varied models and affordable prices, various finance options have also grown with the automobile industry.

- There were times when a car loan meant tedious trips to the bank, reams of paperwork, and long waiting periods for requisite approvals from the sanctioning authority. Today the scenario is quite different, with customers having fast access to very flexible financing options that suit their different needs. Attractive automobile financing schemes have definitely boosted sales of passenger cars. Today, almost 70 percent of new cars are financed through auto loans.

Jeeps

- Almost the entire production of jeeps comes from Mahindra, Mumbai. It has a capacity to produce about 13,000 jeeps per annum.

Two Wheelers

- Two-wheeler industries mainly comprise motorcycles, scooters, mopeds, and scooterettes. The Indian two-wheeler industry made a humble beginning in the early 1950s when Automobile Products of India (API) started manufacturing scooters in the country. Until 1958, API and Enfield were the sole producers. In 1960, Bajaj Auto set up a plant in collaboration with Pioggio of Italy.

- Two-wheeler industries have also made rapid strides. It came a long way from an insignificant production of 0.9 thousand units in 1960-61 to 5,624.9 thousand units in 2003-04. The two-wheeler market was opened to foreign competition in the mid-1980s. Practically, all the global giants have been present in India for quite some time.

- The first to come was Suzuki Motor Corporation with TVS in 1984. Honda followed within a year, in a joint venture with Hero Group. Then Kawasaki and Yamaha entered into a license agreement with Bajaj Auto and Escorts respectively.

- Piaggio has joined up with LML which is planning to expand its capacity to six lakh vehicles per annum. Bajaj Auto is expanding its capacity to two million vehicles per annum. Hero Honda is expanding its Dharuhera plant capacity to over 2, 52,000 vehicles a year and has set up a plant at Gurgaon with an investment of Rs.160 crore.

- TVS Suzuki plans to invest Rs. 200 crores to expand its production capacity to one million vehicles per annum. Yamaha-Escorts, a joint venture has also announced plans to introduce a new range of products and expansion facilities in its Surajpur plant. Mumbai, Pune, New Delhi, and Kanpur are the main centers of scooter manufacturing. Public sector units are located at Hyderabad, Bangalore, Satara, Lucknow, and Alwar. Motorcycle-producing units are located in New Delhi, Chennai, Mysore, and Gurgaon.

- The dynamics of the two-wheeler industry in India makes fascinating reading. From a semi-luxury product for the urban middle class in the 1980s and earlier, the two-wheeler has now become not only the favorite form of personal transport but also the most coveted personal possession among various consumer classes except perhaps the most affluent.

- Leading this emergent boom has been the stylish fuel-efficient and sturdy four-stroke motorcycle that seems to be equally at home on highways and rural byways. In addition, economically active and ambitious consumer class, the relative youth of the population, the substantially lower cost of two-wheelers (as compared to cars) as well as its inherent attractiveness, especially to the young male population have played a crucial role.

- Today with annual sales of over 5 million units, the Indian two-wheeler market is the second-largest market in the world after that of China (annual sales of 12.5 million units).

- Technically, the two-wheeler industry is divided into five major classifications: mopeds, motorcycles, scooters, step thrust, and ungeared scooters. Of all the two-wheelers, motorcycles have registered the maximum growth.

- In fact, motorcycles are the fastest-growing segment, with scooter and moped volumes seeing a steady decline. The sale of motorcycles registered a more than fourfold increase in a short span of six years. It increased from 802 thousand units in 1996-97 to 3,757 thousand units in 2002-03.

- In contrast, the sale of scooters declined from 1,137 thousand units in 1964-97 to only 338 thousand units in 2002- 03 Similarly the sale of mopeds was reduced to about half from 655 thousand units in 1996-97 to 362 thousand units in 2002-03 (see Fig. 27.9).

- While sales of all other product categories declined motorcycles grow at a robust 31 percent in 2002-03 and represented 74 percent of all two-wheeler rates as against just 27 percent in 1996-97 (see Figure 27.10). While scooter sales have predominantly been in urban areas, motorcycle sales are split 50: 50 among urban and semi-urban/rural areas.

- Like the passenger car industry, the two-wheeler industry has also gained a lot from the availability of easy finance. Financing was a rare phenomenon till the early 1990s but increased fourfold between 1996-97 and 2003-04. Though only 35-45 percent of two-wheeler sales are financed now, this proportion has moved up from 15 percent in 1999-2000.

- Two-wheelers are the most effective safety valve which relieves pressure on urban personal transportation. More than 65 percent of the two-wheeler population is concentrated in urban and semi-urban areas. With public transport being scarce in most cities of India, the two-wheelers offer a convenient alternative.

- The demography of the Indian population is skewed in favor of the younger generation, which prefers two-wheelers. Therefore, the scope of further growth of the industry is great. The younger generation in the age group of 15-34 years comprised 35.1 percent of the population as per 2001 census figures, and this is expected to increase in the near future.

- The office-going middle class (typically in the age group of 25 and 59 years) which prefers motorcycles on account of fuel economy, formed 23.5 percent of the population in 2001, and this is expected to increase further in the near future. Consequently, this segment in expected to progress rapidly in the next ten years.

- Although India is the second-largest two-wheeler market in the world after China, the penetration levels are low at 38 per thousand people, compared to Indonesia (75), Thailand (150), and Malaysia (220). Thus there is ample scope for this industry to grow fast.

Fertilizer Industry

- The Indian fertilizer industry has made good progress in the case of Nitrogen-based fertilizers. India is the 2nd largest consumer of Urea fertilizers after China. India also ranks 2nd in the production of nitrogenous fertilizers and 3rd in phosphatic fertilizers. Potash requirement is met through imports since we have limited reserves of potash. Productions are largely state-controlled. Popular PSUs are The Fertilizer Corporation of India Ltd, National fertilizers Limited, Hindustan Fertilizer Corporation Ltd., etc.

- Fertilizer provided the cradle in which the HYV seeds and assured irrigation flourished in the form of the green revolution, mitigating the ever-multiplying problem of food security in India.

- Its importance can be gauged from the fact that the regions with high use of fertilizers are now known as ‘granaries of India.’ The fertilizers industry is the second most important industry in India after iron and steel.

- Decreasing fertility of the land and increasing population have raised the importance of this industry manifold. The fertilizer industry provides vital forward-backward linkages with other industries. Forward linkages are with agriculture and backward linkages are with petrochemical industries. The by-products of the petrochemical industry are used as raw materials in the fertilizers industry.

- General productivity of the fertilizers industry is low. India is still not self-reliant in fertilizer production (about 50% of fertilizers are imported).

- Further, there is a high Spatio-temporal variation in consumption. Fertilizer can most effectively be used with ample water. So rainfed areas (deprived of irrigation) constitute 70 % of agricultural land and still, they use only 20% of national Fertilizers consumption. On other hand Rabi crops are dominantly produced in Irrigated areas, so they consume about 66% of fertilizers while their share of total agriculture output is 33%

- India meets 85 percent its urea requirement through indigenous production but depends heavily on imports for its phosphate and potash (P & K) fertilizer requirements.

Growth and development

- It is one of the fastest-growing basic industries, which has taken rapid strides in recent years. Although the first superphosphate factory in the country was set up at Banipet (T.N) as early as 1906, India’s fertilizer industry is essentially post-independence development.

- The setting up of the Sindri plant in Bihar by Fertilizer Corporation of India Ltd. (FCI) in 1951 was a turning point and since then this industry has progressed steadily. The progress was, however, slow till 1966.

- Thereafter due to a series of factors, chief among which were HYV programmes, a faster expansion of irrigated area and introduction of urea as a straight fertilizer and the demand, led to the production of fertilizers grew sharply.

- Three decades of planning and development of the fertilizer industry has brought India to the frontline of a fertilizer-producing country.

- As far as Potassic (K) fertilizers is concerned, there is no indigenous capacity. The requirements are met entirely through imports. India meets its 80 % requirement of Urea (N), while it is heavily dependent on Imports for its potassium (K) and phosphorus (P) fertilizer requirements.

- The fertilizer industry of India is developed both under the Public and Private sectors.

- During 1951-52, the production capacity of nitrogen fertilizer in India was a mere 85,000 tonnes, which finally shot up to 11.07 million tonnes in 1999-2000. In this period, the increase of Phosphate fertilizer production capacity was also remarkable and praiseworthy. It was only 63,000 tonnes in 1951-52, in sharp contrast with 3.65 million tonnes of production in 1999-2000.

- In the case of capacity utilization, the fertilizer sector has improved considerably. In nitrogen fertilizer, it was only 18.82% in 1951-52 when the actual production was only 16,000 tonnes but, remarkably, capacity utilization rate increased to 82% in 2004-05 when production achieved an all-time high of 12.03 million tonnes.

Reasons and trends of growth of fertilizer industry in India

Location factors

- Raw Materials: Most of the industries are raw material oriented i.e. located where raw material is available.

- Naphtha is the most important and preferred feedstock accounting for over 70% of the installed capacity of nitrogen production. Naphtha is a by product of petroleum industry i.e. why many fertilizer industries near oil refineries. Most of the Napatha required by the industry is imported.

- Coal is another important constituent of the location factors. It is used both as fuel and raw material. Ammonia is required for nitrogenous fertilizer. The coal based fertilizer units are located at Ramagundem and Korba. The only lignite based unit in the country is located at Neyveli.

- Coke oven gas (COG), a by-product of iron & steel plants is also used as raw materials. This is the reason for many fertilizers plants located near Iron & Steel plants e.g. in Bhilai, Durgapur, Jamshedpur and Rourkela etc.

- Other important raw material includes Rock Phosphate used the manufacture of phosphoric fertilizers. About 90% of the requirement of phosphates is imported. The small phosphate deposits of commercial importance are confined to Singhbhum (Jharkhand), Vishakhapatnam (A.P.), and in some parts of Rajasthan.

- Sulphur is also an important raw material. There are no known large reserves of elemental sulphur in the country. However, some of the reserves of Sulphur is available in Tamil Nadu. Hydro-grade gypsum is used in large quantities for the manufacture of ammonium sulphate.

- Energy: It is another important determining factor, since the fertilizer industry is highly energy-intensive so many plants are located in areas where cheap energy is available i.e. Nangal Plant.

- Transportation: Since many raw materials needed by this industry have to be transported to the plant location and finished goods are to be transported to the consumption center and both of them are bulky so efficient transportation make the backbone of this industry. Ports offer an attractive location for the fertilizers industry that is why there are many port-based fertilizers plants. Gas pipelines e.g. HBJ has correspondence with fertilizer plants. Many fertilizer industries are located where there is a very high density of rail networks.

- Market: Apart from raw material, the market is also an important factor to be accounted in the location of these industries i.e. in Punjab and Uttar Pradesh the location of this industry is guided by market pull.

- Technology: Involvement of various chemical processes makes up gradation of technology imperative. Besides, fuel efficiency is very important owning to energy intensive nature of this industry.

- Government policy: It is the major factor deciding the localization of fertilizer industry besides the raw material vicinity. Location of Sindri fertilizer plant was a part of government policy. Further, Administered Price Mechanism earlier determined the prospects of this industry in India. International agreements in the form of increase or subsides regulate the consumption and in turn the growth of this industry. Fertilizer consumption has gone down in past few years because of abolishment of subsides.

- Capital: fertilizer industry involves huge capital viz-a-viz new materials, heavy machinery, transportation and new techniques. This factor has facilitated the location of industry in Gujarat-Maharashtra region.

Distribution

- Fertilizer industry in India is concentrated in certain major regions of the country. This industry is mainly spread over 5 regions.

- Gujarat region

- Chhottanagpur region

- Tamil Nadu region

- North West region

- Uttar Pradesh region

- Gujarat Region

- It includes Gujarat and Maharashtra and is the largest producer of fertilizer in the country.

- Petrochemical industries and oil refineries of this region produce Naphtha which is a basic raw material for nitrogenous fertilizer. Important centers are Vadodara, Kalol, Ahmedabad, Kandla and Trombay

- Chotanagpur plateau region and other Iron and Steel locations

- Here the fertilizer industries have cropped up due to proximity to Iron and Steel industries.

- The fertilizer industry of this region use byproducts of Iron and Steel industry as raw material that is Steel slug, coke, and lignite.

- Important centers are Jamshedpur, Rourkela, Durgapur, Burnpur, Sindri, Bhilai, etc

- Bhilai, Vizag, Mettur are other centers having fertilizer industry due to the presence of the Iron and Steel industry.

- Tamil Nadu Region

- It is the availability of Sulphur in the Tamil Nadu region that has propelled the growth of the industry in this region. Dispersal of fertilizer industry to South was important for its localization in this area.

- Important centers are Coimbatore, Neyveli, Alwaye (Kerala), Kochi (Kerala), Tuticorin, Ennore.

- North West region

- This location has the advantage of huge market as it is the agriculturally most advanced region and market driven demand fuelled the growth of fertilizer industry in this region.

- Important centres are Bhatinda, Nangal (Punjab), Panipat (Haryana) and Delhi.

- Uttar Pradesh region

- This region became the hub of the fertilizer industry due to the availability of the mineral Phosphate

- Phosphatic fertilizer plants are located here i.e. Jagdishpur, Gorakhpur, Aonla, Shahjahanpur, Babrala etc.

- HBJ Pipeline

- This pipeline has been constructed by the Gas Authority of India Limited (GAIL) to transport gas and Neptha through the pipeline. It is 1,750 km long and connects Hazira in Maharashtra to Bijapur in M.P. and Jagdishpur in U.P.

- It carries 18 million cubic meters of gas every day to three powerhouses at Kawas (Gujarat), Anta (Rajasthan), and Auraiya (U.P.) and to six fertilizer plants at Bijapur, Sawai Madhopur,. Jagdishpur, Shahjahanpur, Aonla, and Babrala.

- Coal based Plants

- These plants are located in the close proximity of coal producing regions. Some of the plants are located in Korba, Talcher, Ramagundam and Neyveli.

Problems of fertilizer Industry

General Problems

- Raw Material Availability and Pricing: The Indian fertilizers industry faces some serious challenges in the form of availability and fluctuating prices of raw materials required to produce fertilizers. The primary cause of fertilizer price fluctuations is related to the supply and demand factors. India also faces a handicap due to lack of natural resources required to produce fertilizers. In case of urea, there is not enough natural gas available in the country. At times, increase in price of oil in international market has adverse impact on fertilizer industry.

- Government Policies: In order to make available the fertilizers to the farmers at low cost and to prevent the increase in cost of production of food crops the Govt. provided subsidies but now Governments are increasingly governed by international institution i.e. under WTO agreement there must be reduction in subsidies. This goes against the growth of this industry.

- Lesser expansion of Irrigation facilities and consequent low fertilizer consumption leads to low demand and therefore, restricts the growth of industry.

- Obsolete Technology: Most of the fertilizer industry operates under PSUs which are using decade old technology and thus making huge losses and also the competitive edge.

- Less expansion of irrigation facilities is also the reason for low demand hampering the growth of industry.

Prospects of the fertilizer industry

- Population: The increasing population and increasing demand for food security provides brighter prospects for fertilizer industry of higher growth.

- Food consumption: The pattern of food consumption and demand for varieties of food grains with improved attributes increases the role of fertilizers for their production.

- Fertilizer awareness: With increase in education, literacy and reach of digital means of communication, the awareness among farmers to use fertilizers has increased which in turn has increased its demand in the areas where use of fertilizer has not been common practice.

- Neem Coated urea

(i) Neem has proven nitrification inhibition properties. It slows down the process of nitrogen release from urea (by about 10 to 15 percent) and reduces the consumption of the fertilizer.

(ii) Government, on 24th March, 2015 made mandatory for all the indigenous producers of urea to produce 75%of their total production of subsidized urea as Neem Coated Urea.

(iii) Subsequently, on 25th May 2015, Department of Fertilizers made it mandatory for all the domestic producers of urea to produce 100% as Neem Coated Urea with an extra MRP of 5% (of Rs. 5360/- per MT) to be charged by the fertilizer manufacturing entities from farmers. Entire quantity of indigenously produced urea and imported urea is being neem coated w.e.f 1st September, 2015 and 1st December, 2015 respectively.

Some other topics related to the fertilizer sector

- Nutrient Based Subsidy Scheme:

- Nutrient Based Subsidy (NBS) Programme for Fertilizers was initiated in the year 2010. The NBS deals with 22 grades of decontrolled fertilizers namely DAP, MAP, TSP, DAP Lite, MOP, SSP, Ammonium Sulphate and 15 grades of complex fertilizers.

- These fertilizers are provided to the farmers at the subsidized rates based on the nutrients (N, P, K & S) contained in these fertilizers.

- In a recent development, the Cabinet Committee on Economic Affairs has approved the proposal of the Department of Fertilizers for the continuation of the Nutrient Based Subsidy (NBS) till 2019-20.

- Joint Ventures Agreements in the Fertilizer Sector

- The Government of India is encouraging fertilizers companies to establish joint ventures abroad in Countries which are rich in fertilizer resources for production facilities with buy back arrangements and to enter into long term agreement for supply of fertilizers and fertilizer inputs to India.

- Fertilizers companies need Natural Gas, Ammonia, Phosphoric Acid, Rock Phosphates, and Sulphuric Acid as raw materials for production of fertilizers.

Paper Industry

- The pulp and paper industry comprises companies that use wood as raw material and produce pulp, paper, paperboard, and other cellulose-based products.

- The pulp and paper industry is one of the largest industries in the world. It is dominated by North American, Northern European, and East Asian countries. Latin America and Australasia also have significant pulp and paper industries.

- Over the next few years, it is expected that both India and China will become the key countries in the industry’s growth. World production of paper and paperboard is around 390 million tonnes and is expected to reach 490 million tonnes by 2020. In 2009, the total global consumption of paper was 371 million tonnes.

- The Paper industry is a vital and core industry for any country and the per capita paper consumption can be taken as a measure of growth and progress in areas related to industrial culture and education activities. Per capita consumption is tending to be stagnant in India at approximately 2 kg as against more than 200 kg in highly developed countries.

Growth and development

- Though the art of papermaking was introduced in India by Muslim rulers during the 10th century, it was flourishing as a cottage industry only.

- The first modern paper mill of course was established in 1832 at Serampore (West Bengal) which could not survive and the industry made a beginning again in 1870 at Ballygaunj ( Royal Bengal paper mills) near Calcutta.

- Many mills thereafter were started at Serampur (W.B), Lucknow (U.P), Titagarh (W.B), Deccan paper mills (Pune), Bengal paper mills (Raniganj), and Indian paper pulp (Shyam Nagar). But progress was sluggish till independence.

- During the period of planned development since independence, the paper industry has made rapid progress.

- In 1950-51 there were 17 units which produced 0.16 million tonnes of paper and 0.9 million tonnes of paper was imported.

- At present, there are more than 30 small and medium paper mills with a capacity of 18.38 lakh tonnes. At present, there are 43 large integrated pulp & paper mills. Besides these, more than 300 small & medium paper mills with a capacity of around 20 lakh tones are also working.

- The small sector accounts for 50% of the installed capacity and of production of paper in the country. In the early 1970s when the country was faced with paper famine, the government came to appreciate the role of the small paper units cause of the short gestation period, the use of cheap second-hand machinery readily available in foreign countries, the use of non-conventional raw materials such as rice and wheat straw, bagasse, jute stalks paper. The small units could be set up in any part of the country.

- The government gave necessary fillip and encouragement to the paper sector and liberal incentives were provided to paper units. The small paper units went into production and adverted the paper crisis.

- Production of paper falls short of our demand and hence large quantities of paper board, better quality paper (insulation paper, parchment paper, tissue paper, etc) have to be imported from Sweden, Canada, Japan, France, Belgium, U.S.A. Paper pulp and west paper are also imported for use as raw materials.

- Some quantities of printing and writing paper, craft and paper board, packing and wrapping paper is also exported to countries of the Middle East, East Africa, and South East Asia.

Paper industry: Growth Pattern

Since paper can be manufactured using a variety of raw materials, the growth pattern of the industry is sporadic, which is mainly due to:

- Large integrated paper mills.

- Small paper mills based on non-conventional raw materials like bagasse, or in combination with pulp.

- Small units based on waste paper.

- Units as part of large integrated sugar complexes.

- Large integrated newsprint manufacturing units.

- Handmade paper units under KVIC.

Location factors

The main factors that determine the location of the paper industry are:

- Nearness to the source of raw material: The location of the paper industry is dependent on the availability of bamboo, softwood. E.g. South Gujarat, Odisha, Madhya Pradesh

- Supply of abundant coal: Energy requirement and total transport cost of coal offset the disadvantage of the dearth of raw materials. Paper manufacturing started in Bengal due to the availability of coal.

- Nearness to the market: Some of the paper mills are located near the market where cheap labour is also available. For example, in Kolkata where raw material is brought from the North Eastern States. Here cheap labour, coal, water is readily available.

- Water Supply: The paper/pulp mills require clean water free from chemicals/pollutants. This is one of the reason why they are set up near forest locations away from polluted rivers.

Manufacturing

- Paper is manufactured in 2 stages in India:

- First Stage: Pulp is extracted from cellulose raw material: In 1st stage gross raw materials is required due to which pulp manufacturing units are located in the midst of cellulose producing areas.

- Second Stage: Pulp is pressed to from paper: In 2nd stage pulp is the raw material and therefore, paper units can be located near urban markets.

- Pulp is drawn from variety of sources like wood, bamboo, sabai/salai grass, bagasse, and crop straw. Hence paper industry is widely distributed across different regions in India.

Raw materials for manufacturing paper

- Bamboo

- Generally speaking 2.3 to 2.4 tonnes of bamboo is required for producing one tonne of paper. The paper industry uses bamboo to the extent of 60-70 percent of the total requirements of cellulosic raw materials. Bamboo has the advantage of possessing long fiber, dense stands, and quick regeneration.

- It reaches maturity in 2-3 years and provides a continuous flow of renewable sources of raw material.

- However, there is a danger of this source of important raw material being depleted if the rate of exploitation exceeds the rate of regeneration. The total supply of bamboo at the current rate is estimated at 20-30 lakh tonnes per annum.

- Assam, Orissa, Andhra Pradesh, Madhya Pradesh, Tamil Nadu, Karnataka, and Maharashtra are important producers of bamboo.

- Sabai grass

- This is another important raw material for manufacturing paper. It was the sole raw material before the introduction of bamboo as a significant raw material, but its use has decreased considerably since then. It now constitutes 7 to 9 percent of the total cellulosic raw material in the country.

- Although Sabai grass has long fiber and requires low chemical consumption, it grows in tufts intermixed with other vegetation and it is often difficult to separate impurities from it.

- Moreover, its supplies are much less than those of bamboo. The annual supply of Sabai grass along with other allied grasses is about one million tonnes. It mainly grows in the sub-Himalayan tracts of the Shiwaliks and the Tarai area.

- Bagasse

- It is a fibrous residue of the sugarcane stalk, mainly from the sugar mills, obtained after sucrose is extracted by crushing the sugarcane.

- On an average 50-60 lakh tonne of bagasse is produced in the country, half of which is used for manufacturing paper.

- Salia wood: It is widely used in the manufacture of newsprint paper.

- Others

- Paper is also manufactured by using materials other than those mentioned above. These include waste paper, rags, straw from rice and wheat, jute sticks, and soft wood obtained from eucalyptus, pine-wood, wattle, and mulberry trees.

Paper industry: Some other facts

- For producing one tonne of paper nearly 2.5 ton of bamboo and about 4 ton of coal are required. Both these materials are heavy as well as weight loosing. The location of industry should be advantageous to both.

- In the beginning when sabai and other grasses were largely used for making paper, it had to be carried to long distance to Bengal units from UP, Punjab, Bihar and Nepal. As coal mines were in Bengal, the mills were located here despite of its unfavourable position.

- In regard to source of raw materials, the Hoogly revering regime was preferred for location of earlier mills for two significant reasons viz.

- The availability of coal in large quantity

- The proximity of large market for the finished product.

- But now with the introduction of bamboo for making paper, Bengal does posses a favourable position for paper industry, from now not only large supplies of bamboo are available in the neighbourhood of the Hoogly riverine tract, but also coal mines and large consuming market exists.

- Some of the south Indian mill in Karnataka and Kerala also use bamboo which grows abundantly there.

- Most of the mills of UP and Haryana depends of sabai grass and murj grass. In UP the paper mills at Lucknow and Saharanpur (using sabai grass) command excellent transport relation in regard to raw materials and markets though in.

Location of Industry

- It is a raw material intensive industry. According to Weber concept, the ratio of raw material and finished product for the paper industry is 4:1 as it is a weight losing industry.

- The material index for it is greater than 1. Hence, in the initial phase, it is advantageous for the industry to be located near the raw material sources.

- Presently more and more plants are using bamboo as raw material. In comparison to sabai grass bamboo possesses certain advantages. Sabai grass is found intermixed with other vegetation and is often difficult to separate impurities from it.

- Further its supplies are so limited and it requires 60 years for regeneration of the forest whereas bamboo is exhausted because of its quick and dense growth and it generates in a year or two.

- Though the quality of paper produced from bamboo lacks in strength, yet bamboo has an advantage over the sabai grass in that, paper can be made entirely from bamboo without any admixture of wood pulp, the paper made from bamboo cannot be used for painting and for writing.

- Recent discovery of method for manufacturing paper from hard wood has made a revolution. Now mills have therefore been set up in M.P to utilize the hard wood.

- The newsprint mill in M.P at Nepanagar uses sabai wood for making paper pulp and also uses imported pulp from Canada and Scandavian countries. Hardwood (as in M.P), West Bengal, West Coast of India and temperate wood in the Himalaya region, J & K also provide potentialities for paper facture.

- Thus as the raw materials and chemicals are available in most of the areas around the country, all the paper mills are dispersed in locations.

Distribution

- Among the paper-producing states of India, West Bengal, Orissa Madhya Pradesh, Andhra Pradesh, Maharashtra and Karnataka constitute nearly 65% of the total production capacity. Other important producers are Tamil Nadu, Kerala, Assam, Haryana, Bihar and Gujarat. According to the estimates available, Assam possesses greatest potential to develop paper industry because of the presence of large forests as raw material.

- State-wise distribution of paper mills are:

- West Bengal: Since early eighteenth century, West Bengal contributed substantially to the national paper output. Major Mills in the state are situated along Hooghly River. The important mills of the state are Calcutta, Tribeni, Titagarh, Alambazar, Kakinara, Bansberia, Baranagar and Ranigunj. Some of these mills use waste paper and agro-residues as raw material; others use sabai grass and eucalyptus tree as raw material.

- Orissa: As a producer of paper, Orissa is gradually improving her position. Right now, three mills are producing paper at Brajarajnagar, Rayagada and Chowdwar. This state possesses wonderful assemblage of vast forest resources and cheap hydel power.

- Madhya Pradesh: A good number of new paper mills were set up within Madhya Pradesh in recent years. Major Mills are located at Nepanagar, Vidisha, Rewa, Ratlam, Shahdol etc. Nepa Nagar is the only newsprint manufacturing unit in the country.

- Andhra Pradesh: Abundance of bamboo and incentives declared by the state government attracted number of paper manufacturing units in Andhra Pradesh. All the mills are new, with sophisticated machines. Major Mills are situated at Rajamundry, Kagaznagar, Bodhan and Bhadrachalam.

- Maharashtra: At least 15 mills are located within the state. Mills are located at Kalyan, Khopli, Ballarpur, Pune, Nagpur, Bhiwandi, Bombay and Kamptee etc. Most of these mills are old and worn out.

- Karnataka: Leading paper manufacturing units in the state are Bhadravati, Belagola, Dandeli, Ramanagram, Bangalore, Krishnaraj Sagar.

- Tamil Nadu: Tamil Nadu has 24 small sized mills accounting for 5.74 per cent of the total installed capacity of the country. These mills use locally grown bamboo. Cheranmahadevi, Pallipalayam, Udmalpet, Chennai, Salem, Amravathinagar, Pahanasam, Madurai, etc. are the major producers.

- Uttar Pradesh: This state has the largest number of 68 mills, but the size of the mills being small, the installed capacity does not exceed 9 per cent. Saharanpur and Lalkuan have mills of large size. The other centres are at Meerut, Modinagar, Ghaziabad, Lucknow, Gorakhpur, Pipraich, Muzaffamagar, Allahabad (Naini), Varanasi, Kalpi, Budaun and Mainpuri.

Problems of the industry

- Shortage of raw material

- Sabai grass and Bamboo supply is often interrupted by various reasons. No industry has created its own plantation through which it could own raw material demand.

- With the dwindling forest wealth in India, there is a serious shortage of raw materials to meet the needs of paper industry. Use of unconventional raw materials (like eucalyptus, wheat bran, rice straw) also demands new process developments, installation of new processing & control equipment.

- High cost of production

- The international price of capital equipments needed for paper industry is very high. In the last decade, the cost of power and coal has increased by 400 units, royalties on bamboo and hardwood has been increased by 70% and faces heavy transport cost due to bulkiness of the raw material.

- Problems of Royalties and lease

- Many governments started raising their royalties from forest land leased to paper mills to meet their current expenditure. Some state governments have raised the royalty rates to 5-6 times in a short period of 5 to 6 years. Such policies towards royalties and the terms of lease are extremely unsatisfactory. The policy should be stable and based on long term basis.

- Over capacity and under utilization

- Active encouragement by government has resulted in over capacity in the industry.

- Between 1974 and 1984, 180 mills are set UP in the country thus creating excess capacity. Even when capacity utilization is high 72% in recent years, 7 large units & 13 small paper units have been idle for year.

- Sickness in small paper units

- High cost of investment & low rate of realization is one of the major reasons for sickness of small units. Further, heavy burden towards investment, financial institutions and markets have aggravate the problem.

- Non–availability of coal and raw materials, rise in electricity & water charges are the other major hurdles in the growth of this industry. Owing to these reasons, they could not compete with large paper units.

- Disposal of Effluents

- Disposal of effluents is a great problem. Suitable processing technique is not available for small units. So they were forced to close.

- Lack of research

- There is a need to develop new processes for the utilization of raw materials, developing the different grades of suitable pulp, designing and engineering of suitable equipment.

- In order to meet the demand, the industry need to look for unconventional raw material but this need new advanced technology which a developed country like India cannot afford.

- Eco–conservation: The growing consciousness for preservation of forests and maintenance of ecological balance and biodiversity has further reduced the availability of raw material. Moreover the environmentalists are up in arms against this industry due to effluents thrown by the paper mills into open drains, rivers and rivulets there by polluting the environment.

- Increasing demand: At the present low rate of consumption i.e. about 17% of world population constituted by India consumes only 2.5% of the world paper and paper board. India is facing wide gap between supply and demand of paper. Now with spread of education and literacy demand for paper is bound to increase and is expected to double in next 10 years.

- Average size of paper mills is abnormally own at less than 10000 tones as against 50,000 tonnes in south East Asia & 85,000 tonnes in Asia-pacific.

- Only 15% of total output of paper & paper board is based on recycled material against the world average of 30-85%. Thus there is a vast scope for using recycled material in paper industry, currently India has over 16% of world’s population but consumes a meagre 1% of worlds paper & paper board. With the spread of education & literacy the demand of the paper is bound to increase.

Future prospects and suggestions

- To overcome the problem of raw materials, various methods have been adopted such as:

(i) Shift in raw materials from bamboo to eucalyptus, wattle, mulberry wood

(ii) To recycle the fiber and making paper production environment friendly. - Move overthrust on social & farm forestry has started to ease the raw material availability.

- As bamboo cultivation has become uneconomical, reliance has been placed on unconventional raw materials. Paper mills have to undertake plantation forestry in their surrounding areas.

- Indian paper industry is placed in and better position compared to industry leaders in the west in two ways:

(i) Growth cycle of tropical plantations takes 6-7 years whereas conifers (in the west) take nearly 50 years to grow.

(ii) Low wage structure in India. - The Indian paper industry has trained manpower at all levels & hence it can produce good quality paper with appropriate technology at relatively low manpower cost.

- But for the improvement of the paper industry, technology modernization is a must. However, it requires a huge capital investment on part of private players which is not always easy to avail.

- Bagasse: Judicious use of bagasse should be encouraged as the large quantity of bagasse is used as fuel in the sugar industry and is not made available to the paper industry. Sugar mills need to be encouraged to use coal-fired boilers instead of those based on bagasse. India being the largest producer of sugarcane holds huge potential in this regard.

Advantages of the Indian paper industry

- As compared to the western countries growth cycle of Indian tropical forests is 6 to 7 years whereas the growth of conifers of the west requires 50 years.

- Labour is cheap in India as compared to the Western world. Besides that Indian manpower of this industry is well trained and produces good quality paper with relatively low manpower cost.

Conclusion

In conclusion, the Indian fertilizer industry faces challenges such as raw material availability, fluctuating prices, government policies, and outdated technology. However, the industry also has promising prospects due to the increasing population, changing food consumption patterns, and growing awareness among farmers about the benefits of fertilizers. The introduction of neem-coated urea has also led to reduced consumption and increased efficiency, improving the overall potential for the industry's growth.Frequently Asked Questions (FAQs) of Automobile, Fertiliser & Paper Industry

What are the primary challenges faced by the Indian fertilizer industry?

The Indian fertilizer industry faces challenges such as availability and fluctuating prices of raw materials, lack of natural resources required to produce fertilizers, obsolete technology, and government policies that affect subsidies and growth.

How do government policies affect the growth of the Indian fertilizer industry?

Government policies, such as subsidies, were initially introduced to make fertilizers available to farmers at a low cost and prevent an increase in the cost of food crop production. However, under the WTO agreement, there must be a reduction in subsidies, which goes against the growth of the industry.

What factors contribute to the prospects of the fertilizer industry?

Factors such as increasing population, rising demand for food security, changing patterns of food consumption, and increased awareness among farmers about the use of fertilizers contribute to the prospects of higher growth in the fertilizer industry.

What is Neem Coated Urea and how does it benefit the fertilizer industry?

Neem Coated Urea is a type of urea coated with neem, which has proven nitrification inhibition properties. It slows down the process of nitrogen release from urea and reduces the consumption of the fertilizer. The government has made it mandatory for all domestic producers of urea to produce 100% as Neem Coated Urea, which has increased its demand and benefits the industry.

How has the expansion of irrigation facilities affected the growth of the fertilizer industry?

Lesser expansion of irrigation facilities has led to low fertilizer consumption and demand, restricting the growth of the industry. However, increased awareness among farmers and improved irrigation facilities can contribute to higher growth in the fertilizer industry.

|

191 videos|373 docs|118 tests

|

|

191 videos|373 docs|118 tests

|

|

Explore Courses for UPSC exam

|

|