Class 12 Accountancy: CBSE Sample Question Papers- Term II (2021-22)- 3 | Sample Papers for Class 12 Commerce PDF Download

Class-XII

Time: 120 Minutes

Max. Marks: 40

General instructions:

Read the following instructions very carefully and strictly follow them:

- This question paper comprises two Parts – A and B. There are 12 questions in the question paper. All questions are compulsory.

- Part-A is compulsory for all candidates.

- Part-B has two options i.e. (i) Analysis of Financial Statements and (ii) Computerized Accounting. Students must attempt only one of the given options.

- Question nos. 1 to 3 and 10 are short answer type–I questions carrying 2 marks each.

- Question nos. 4 to 6 and 11 are short answer type–II questions carrying 3 marks each.

- Question nos. 7 to 9 and 12 are long answer type questions carrying 5 marks each.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

Part- A

Receipt and Payment Account is the summarised cash book which records all the cash transactions, both revenue and capital, to ascertain the cash and bank balances at the end of an accounting period.

The features of Receipt and Payment Account are:

(i) It is a real account just like Cash Account.

(ii) It starts with the balances of cash and bank just like the Cash Book.

(iii) The cash receipts are shown on the debit side irrespective of the fact whether revenue or capital in nature.

(iv) The cash payments are recorded on the credit side, irrespective of the fact whether capital or revenue in nature.

(v) The non-cash items are not recorded.

(vi) Its objective is to show the closing balance of the cash in hand and at bank.

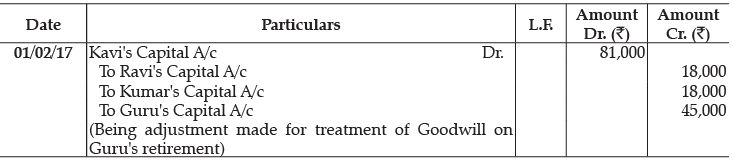

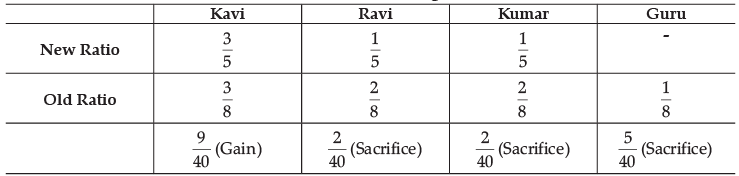

Q.2. Kavi, Ravi, Kumar and Guru were partners in a firm sharing profits in the ratio of 3 : 2 : 2 : 1. On 1.2.2017, Guru retired and the new profit sharing ratio decided between Kavi, Ravi and Kumar was 3 : 1 : 1. On Guru’s retirement, the goodwill of the firm was valued at ₹ 3,60,000. Showing your working notes clearly, pass necessary journal entry in the books of the firm for the treatment of goodwill on Guru’s retirement.

In the Books of Kavi, Ravi, Kumar and Guru Journal

Working Note:

Calculation of Gaining Ratio

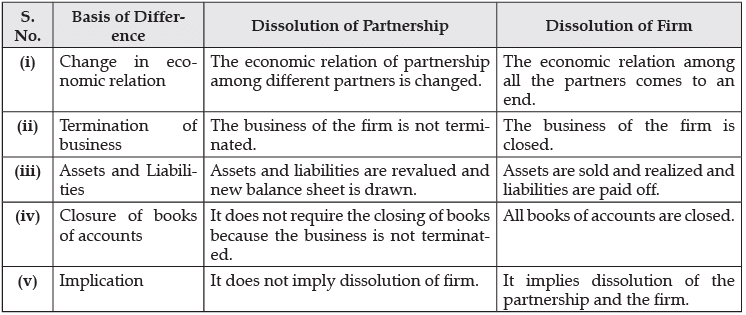

Q.3. How is dissolution of partnership different from dissolution of the Partnership firm?

The difference between dissolution of partnership and dissolution of the partnership firm are:

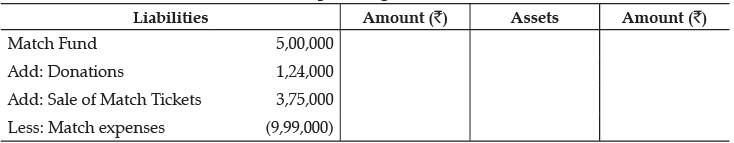

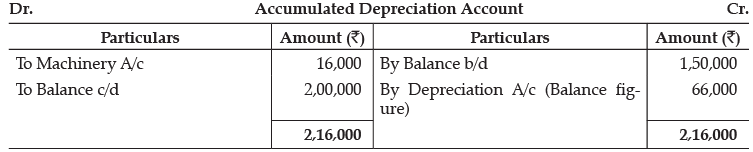

Q.4. Present the following information for the year ended 31st March, 2018 in the financial statements of a not-for-profit organization:

OR

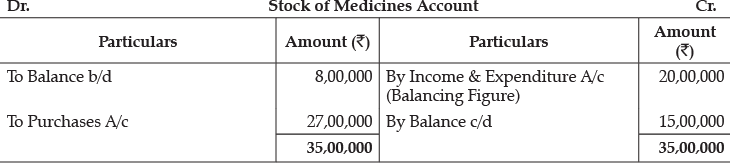

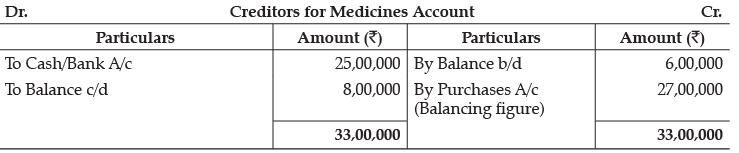

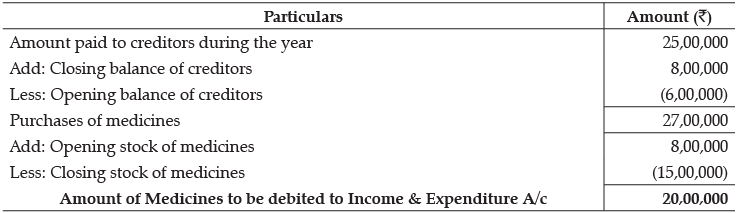

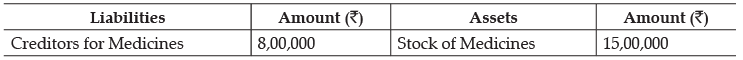

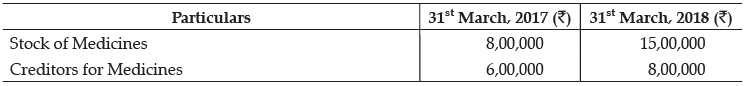

From the following information, calculate the amount of medicines to be debited to ‘Income and Expenditure Account’ of a Charitable Hospital for the year ended 31st March, 2018. Also, present the relevant information in the Balance Sheet of the hospital as at 31st March, 2018:

Additional Information:

Cash paid to the creditors for medicines during the year was ₹ 25,00,000.

Dr.

Income and Expenditure Account of a not-for-profit organisation for the year ended March 31, 2018 (An Extract)

Balance Sheet of a not-for-profit organisation as at March 31, 2018

OR

In the Books of a Charitable Hospital

Alternative Solution for (i):

Calculation of Amount of medicines to be debited to ‘Income & Expenditure A/c’

(For the year ended 31.03.2018)

(ii) Balance Sheet of Charitable Hospital as at 31.03.2018 (an extract)

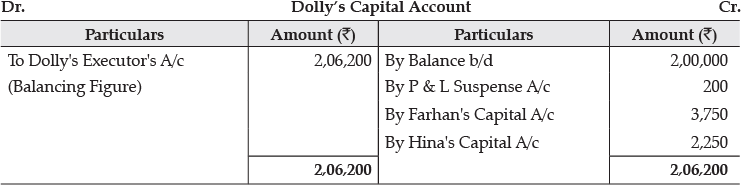

Q.5. Farhan, Hina and Dolly are partners in a firm sharing profits in the ratio of 5 : 3 : 2. On 1st April, 2016, the capitals of the partners were : ₹ 5,00,000; ₹ 3,00,000 and ₹ 2,00,000 respectively. The firm closes its books on 31st March every year. Dolly died on 5th April, 2016.

On that date:

(i) Goodwill of the firm was valued at ₹30,000; and

(ii) Dolly ’s share of profit till the date of her death was calculated as ₹ 200.

Prepare Dolly ’s Capital Account to be rendered to her executors.

OR

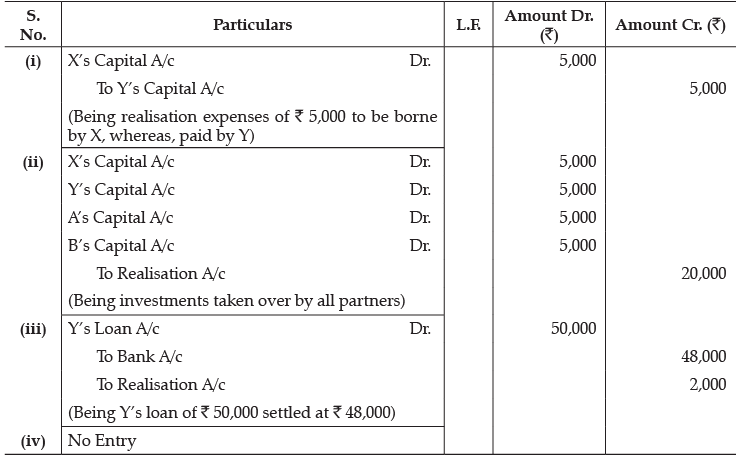

Pass the necessary journal entries in the following cases on the dissolution of a partnership firm of partners X, Y, A and B:

(i) Realization expenses of ₹ 5,000 were to borne by X, a partner. However, it was paid by Y.

(ii) Investments costing ₹ 25,000 (comprising 1,000 shares), had been written off from the books completely. These shares are valued at ₹ 20 each and were divided amongst the partners.

(iii) Y’s loan of ₹ 50,000 was settled at ₹ 48,000.

(iv) Machinery (book value ₹ 6,00,000) was given to a creditor at a discount of 20%.

Working Notes:

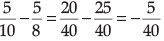

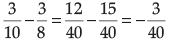

(i) Calculation of the gaining Ratio:

Farhan =

Hina =

Farhan: Hina = 5: 3

(ii) Share of Goodwill for Dolly = 2/10 x ₹ 30,000 = ₹ 6,000

₹ 6,000 will be distributed between Farhan and Hina in their Gaining Ratio.

Farhan’s Capital A/c = 5/8 x ₹ 6,000 = ₹ 3,750

Hina’s Capital A/c = 3/8 x ₹ 6,000 = ₹2,250OR

In the Books of X, Y, A and B

Journal

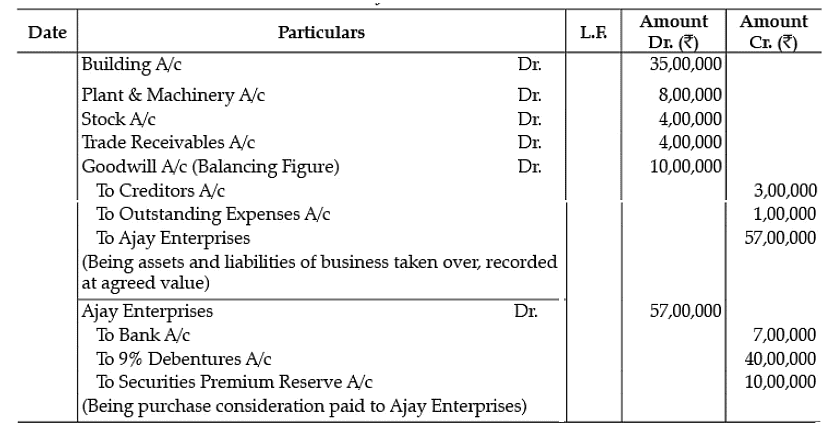

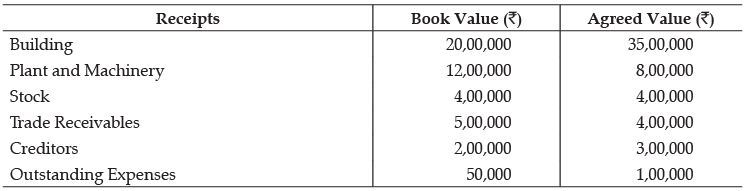

Q.6. Neeraj Ltd. took over business of Ajay Enterprises on 1-04-2020. The details of the agreement regarding the assets and liabilities to be taken over are:

It was decided to pay for purchase consideration as ₹ 7, 00,000 through cheque and balance by issue of 2,00,000, 9% Debentures of ₹20 each at a premium of 25%. Journalize.

In the books of of Neeraj Ltd.

Journal

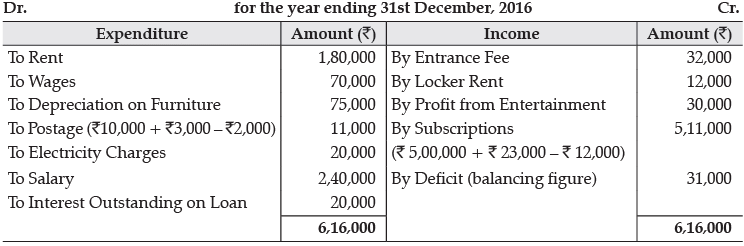

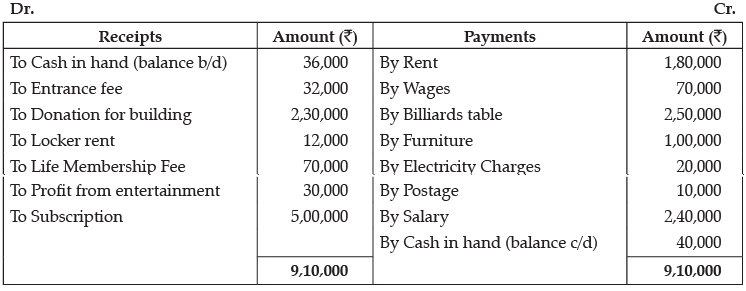

Q.7. Receipts and Payments Account of Ganesh Sports Club is given below, for the year ended 31st December, 2016:

Receipts and Payments Account

For the year ending on 31st December, 2016

Prepare Income and Expenditure Account and Balance Sheet with the help of the following information:

(i) Subscription outstanding on 31st December, 2015 is ₹ 12,000 and ₹ 23,000 on 31st December 2016.

(ii) Opening stock of postage stamps is ₹ 3,000 and closing stock is ₹ 2,000.

(iii) On 1st January, 2016 the club owned furniture ` 2,00,000. Furniture valued ₹ 2,25,000 on 31st December 2016.

(iv) The club took a loan of ` 2,00,000 @ 10% p.a. in 2015.

Correct Answer:

In the Books of Ganesh Sports Club

Income and Expenditure Account

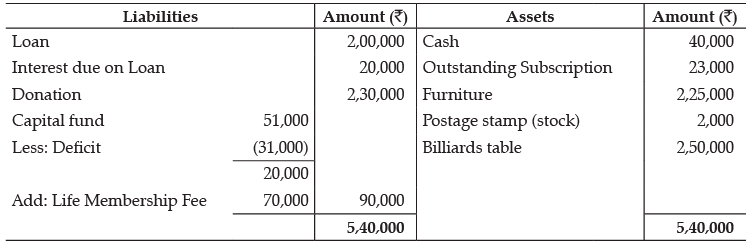

Balance Sheet

as at 31st December, 2016

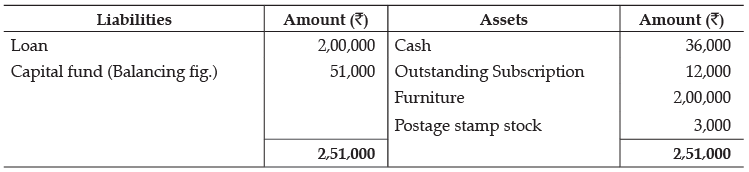

Working Note:Balance Sheet

as at 31st December, 2015

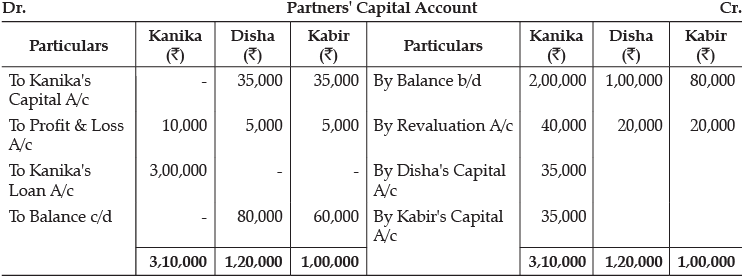

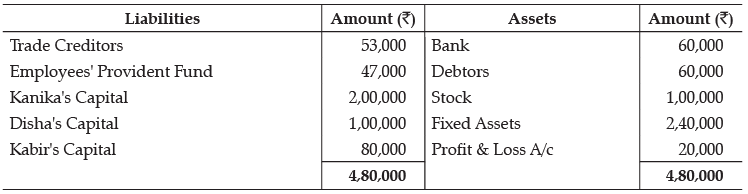

Q.8. Kanika, Disha and Kabir were partners sharing profits in the ratio of 2 : 1 : 1. On 31-3-2016, their Balance Sheet was as under:

Kanika retired on 1-4-2016. For this purpose, the following adjustments were agreed upon :

(i) Goodwill of the firm was valued at 2 years’ purchase of average profits of three completed years preceding the date of retirement. The profits for the year;2013-14 were ₹ 1,00,000 and for 2014-15 were ₹ 1,30,000.

(ii) Fixed assets were to be increased to ₹3,00,000.

(iii) Stock was to be valued at 120%.

(iv) The amount payable to Kanika was transferred to her loan account.

Prepare Revaluation Account, Capital Accounts of the partners and the Balance Sheet of the reconstituted firm.

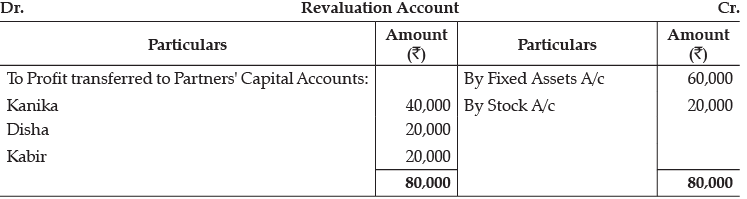

In the Books of Kanika, Disha and Kabir

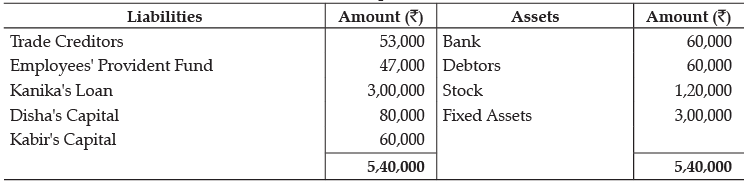

Balance Sheet of the Reconstituted Firm

as on 1st April, 2016

Working Notes:

Balance of P & L A/c is given on assets side of the Balance Sheet. So, it will be debited to the Partners’ Capital A/cs.

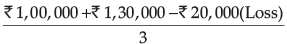

Average Profit =

=

= ₹ 70, 000

Goodwill = ₹ 70,000 × 2 = ₹ 1,40,000

Share of Kanika in Goodwill = 2/4 x ₹1,40,000 = ₹ 70,000

So, ₹ 70,000 will be debited to Disha’s and Kabir’s Capital A/c in their gaining ratio.

So, Kanika’s Capital A/c will be credited with ₹ 70,000.

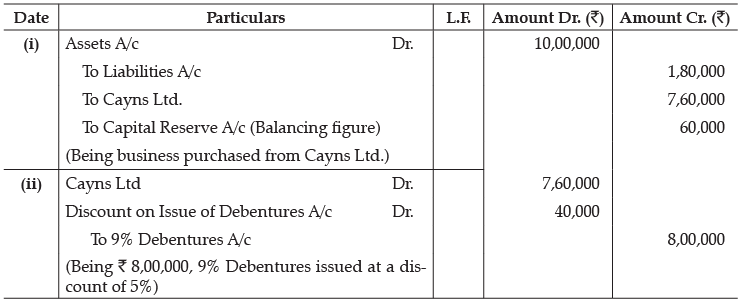

Q.9. Venus Ltd. is a real estate company. To discharge its corporate social responsibility, it decided to construct a night shelter for the homeless. The company took over assets of ₹ 10,00,000 and liabilities of ₹1,80,000 of Cayns Ltd. for ₹ 7,60,000. Venus Ltd., issued 9% Debentures of ₹ 100 each at a discount of 5% in full satisfaction of the purchase consideration in favour of Cayns Ltd.

Pass the necessary journal entries in the books of Venus Ltd. for the above transactions.

OR

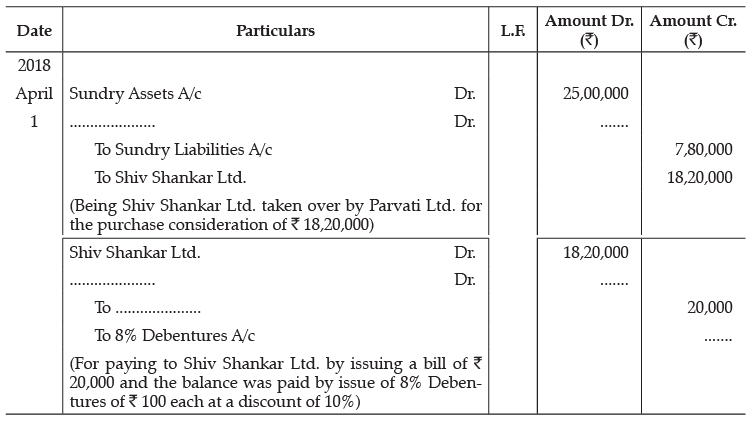

Complete the following Journal Entries of the books of Nirmal Ltd.:

In the Books of Venus Ltd.

Journal Entries

Note: Number of Debentures to be issued = ₹ 7,60,000/ ₹ 95 = 8,000 debentures.

Part- B

Q.10. In which part of the cash flow statement will the following transactions appear:

(i) Increase in Current Investments

(ii) Redemption of Debentures

(i) It will form the part of Cash and Cash equivalents

(ii) It will be shown in the cash flow from financing activities.

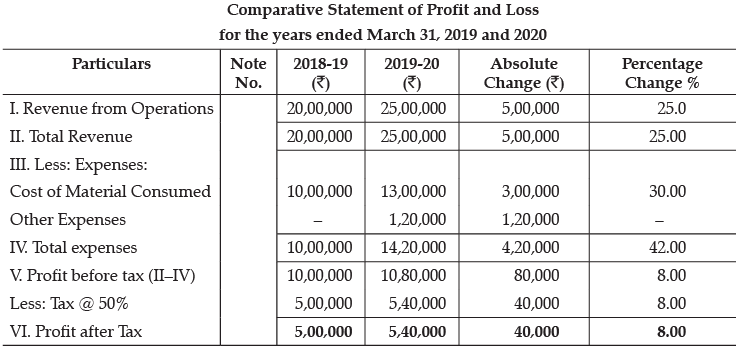

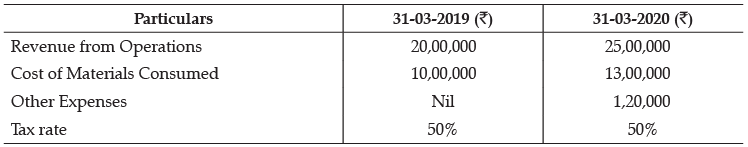

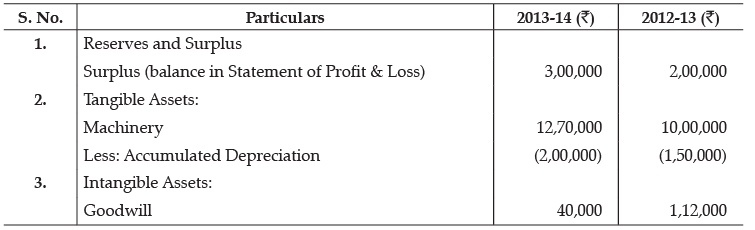

Q.11. Prepare a Comparative Statement of Profit and Loss from the following:

OR

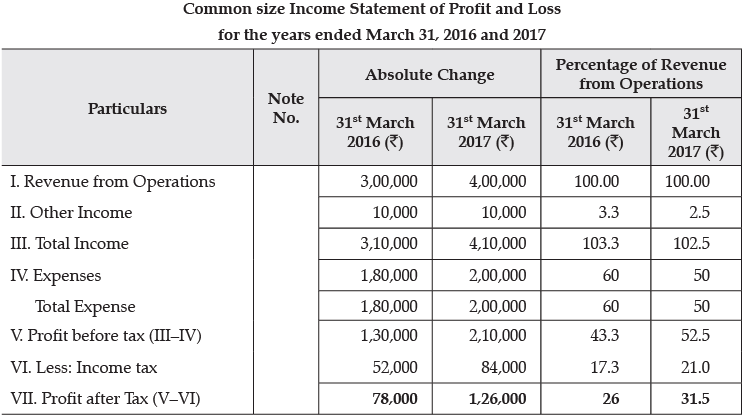

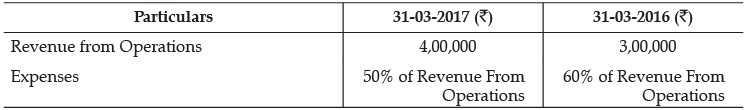

Prepare a Common Size Income Statement from the following:

Interest on Investments ` 10,000 and taxes payable @ 40% for both the years.

OR

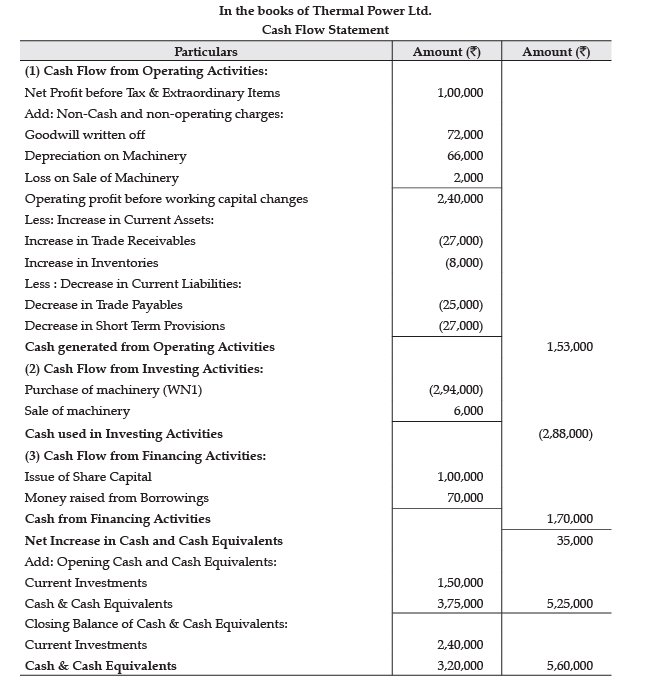

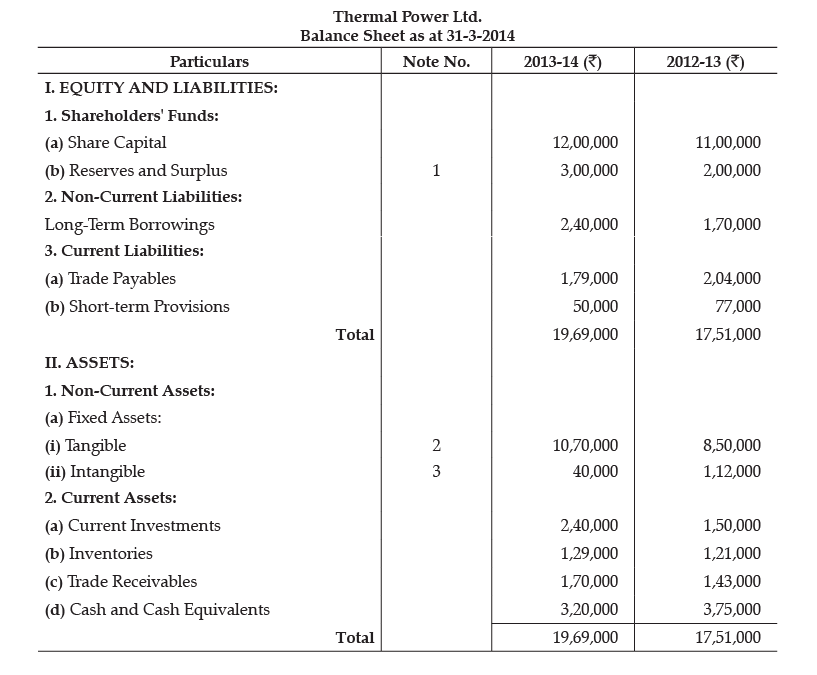

Q.12. Following is the Balance Sheet of Thermal Power Ltd. as at 31-3-2014:

Notes to Accounts:

Additional Information:

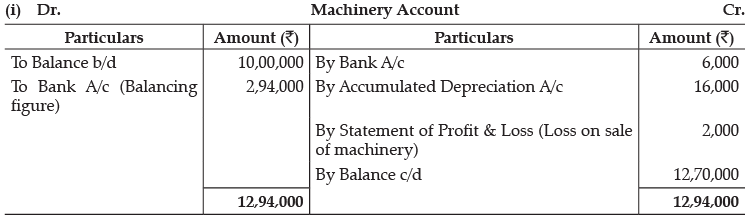

During the year, a piece of machinery, costing ₹ 24,000 on which accumulated depreciation was ₹ 16,000 was sold for ₹ 6,000.

Prepare Cash Flow Statement.

Working Notes:

|

130 docs|5 tests

|