Class 11 Accountancy: CBSE Sample Question Papers- Term II (2021-22)- 2 | Sample Papers for Class 11 Commerce PDF Download

| Table of contents |

|

| Class Xl Accountancy |

|

| Time: 2 Hours |

|

| Max. Marks: 40 |

|

| Part-A (Accounting Process) |

|

| Part-B (Financial Accounting and Computer in Accounts) |

|

Class Xl Accountancy

Time: 2 Hours

Max. Marks: 40

General Instructions :

- The Question Paper consists of two Parts – A and B. There are total 12 questions. All questions are compulsory.

- Part – A consists of Accounting Process.

- Part – B consists of Financial Accounting and Computers in Accounts.

- Question Nos. 1 to 2 and 5 to 6 are short answer type questions – I carrying 2 Marks each.

- Question Nos. 3 and 7 to 9 are short answer type questions – II carrying 3 Marks each.

- Questions Nos. 4 and 10 to 12 are long answer type questions carrying 5 marks each.

- There is no overall choice. However, an internal choice has been provided in 3 questions of three marks and 1 question of five marks.

Part-A (Accounting Process)

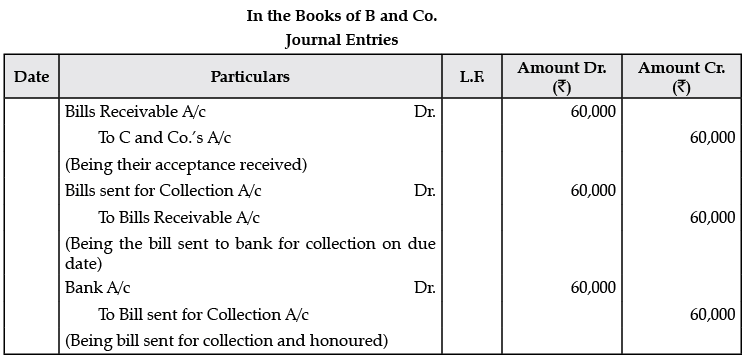

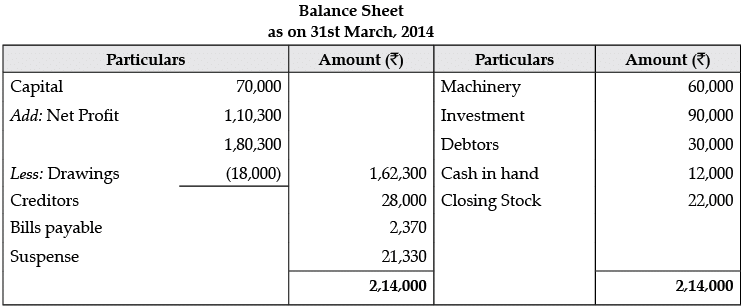

Q.1. With the help of the information given, complete the Journal entries in the books of B and Co.

A two-month Bill for Rs. 60,000 is drawn by B and Co. and accepted by C and Co., payable at the Bank of India. B and Co. gave the bill to their banker for collection. On due date, bill is honoured. Show the entries that will be passed in the books of B and Co.

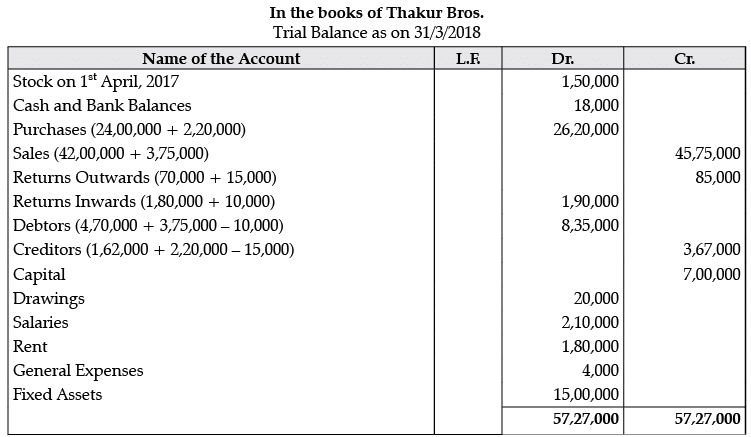

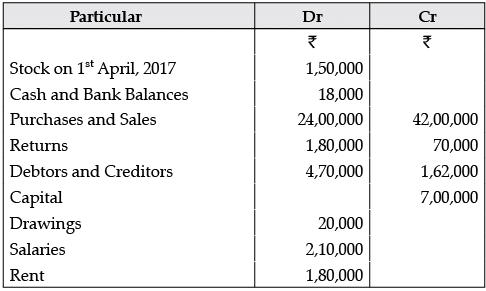

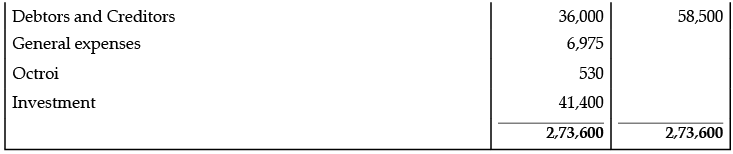

Q.2. The following is the Trial Balance of Thakur Bros. as at 28th February 2018:

The following transactions were recorded during the month of March 2018 :

(a) Credit purchase of goods Rs. 2,20,000

(b) Credit sales of goods Rs. 3,75,000

(c) Purchase Return Rs. 15,000

(d) Sales Return Rs. 10,000 You are required to prepare the Trial Balance as on 31st March 2018.

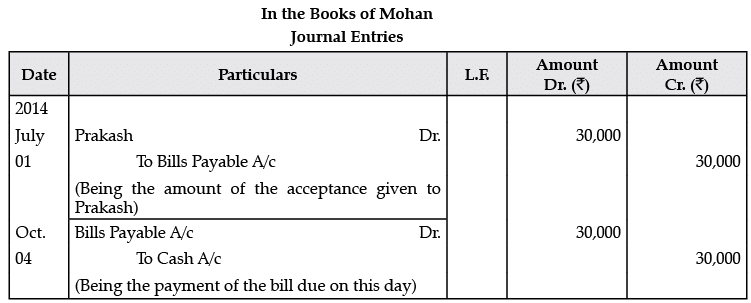

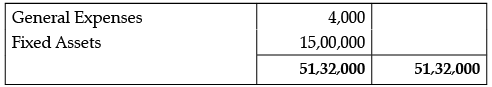

Q.3. Prakash received from Mohan an acceptance for Rs. 30,000 on 1st July, 2014 at 3 months. Prakash got this acceptance discounted at 12% per annum at his bank. On the due date, Mohan paid the required amount. Give Journal entries in the books of Prakash and Mohan.

Working Note:

Discount for whole year = Rs. 3,600

Discount for 3 months = Rs. 900

Cash received = Rs. 30,000 – Rs. 900 = Rs. 29,100

Amount of Discount = 30,000 –

Note: On payment of the bill, no entry will be made.

OR

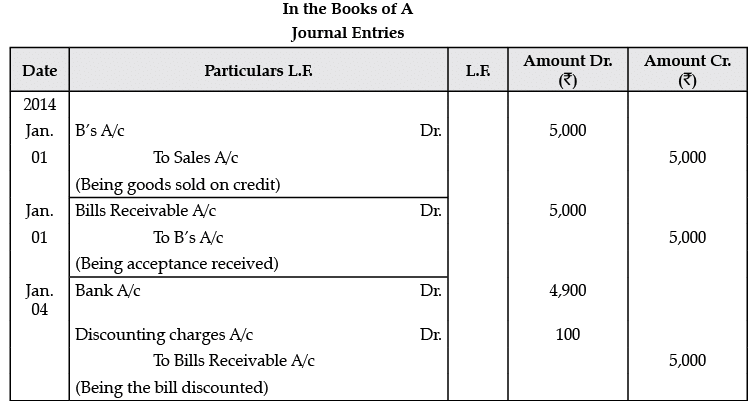

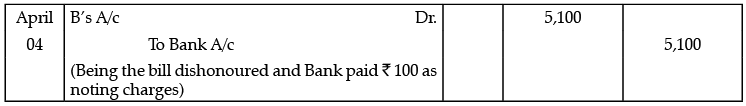

On 1st January, 2014, A sold goods to B for Rs. 5,000 and on the same day drew upon him a bill at three months for the amount. B accepted the bill and returned it to A. On 4th January, 2014, A discounted the bill with his bank at Rs. 4,900. On the due date, the bill was dishonoured and bank paid Rs. 100 as noting charges. Record these transactions in the Journals of A and B.

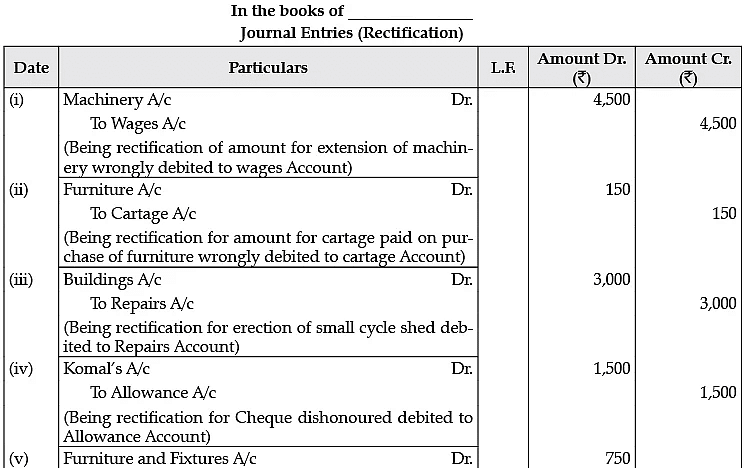

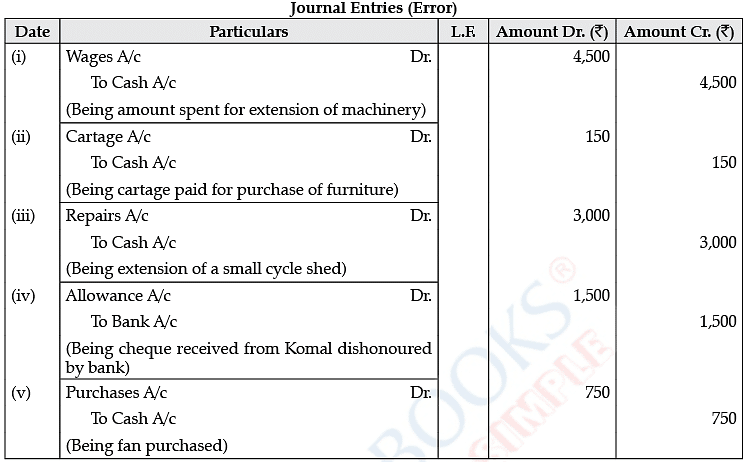

Q.4. Rectify the following errors through Journal entries and also show the wrong entries passed:

(i) An amount of Rs. 4,500 spent for the extension of machinery has been debited to Wages Account.

(ii) Rs. 150 paid as cartage for the newly purchased furniture, posted to Cartage Account.

(iii) A builder ’s bill for Rs. 3,000 for erection of a small cycle shed was debited to Repairs Account.

(iv) A cheque of Rs. 1,500 received from Komal was dishonoured and had been posted to the debit side of ‘Allowance A/c’.

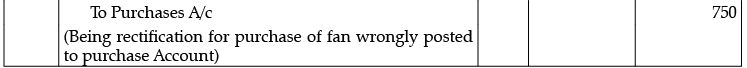

(v) Rs. 750 paid for the newly purchased ‘Fan’ posted to Purchase Account.

Part-B (Financial Accounting and Computer in Accounts)

Q.5. S. Sharma closes their financial books on 31 December, 2013. Stock taking takes about two weeks. In 2014, the value of closing stock thus arrived at was Rs. 25,000. During the two weeks in which stock taking took place, purchases made were Rs. 1,000 and sales totalled Rs. 4,000. The firm makes a Gross Profit of 30% on sales. Ascertain the value of closing stock of 31st Dec., 2013.

Cost of goods sold during stock taking period = 70% of Rs. 4,000 = Rs. 2,800 Closing stock = Value as on 16th Jan. 2007 + Cost of goods sold during 1-16 Jan. – Cost of goods purchased during 1-16 Jan.

= Rs. 25,000 + Rs. 2,800 – Rs. 1,000 = Rs. 26,800

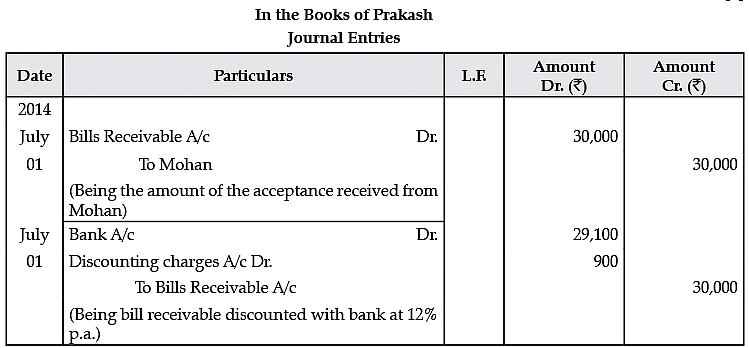

Q.6. Calculate cost of goods sold from the following :

Cost of Goods Sold = Opening stock + Purchases + Direct expenses – Closing stock = Rs. 40,000 + Rs. 50,000 + Rs. 10,000 – Rs. 15,000

= Rs. 85,000

Q.7. Briefly discuss the functional components of a computer system.

A computer is a combination of hardware and software resources which integrate together and provide various functionalities to the user. Hardware is the physical component of a computer like the processor, memory devices, monitor, keyboard etc. while software is the set of programs or instructions that are required by the hardware resources to function properly. There are a few basic components that aids the working-cycle of a computer i.e. the Input- Process- Output Cycle and these are called as the functional components of a computer. It needs certain input, processes that input and produces the desired output. The input unit takes the input, the central processing unit does the processing of data and the output unit produces the output. The memory unit holds the data and instructions during the processing.

OR

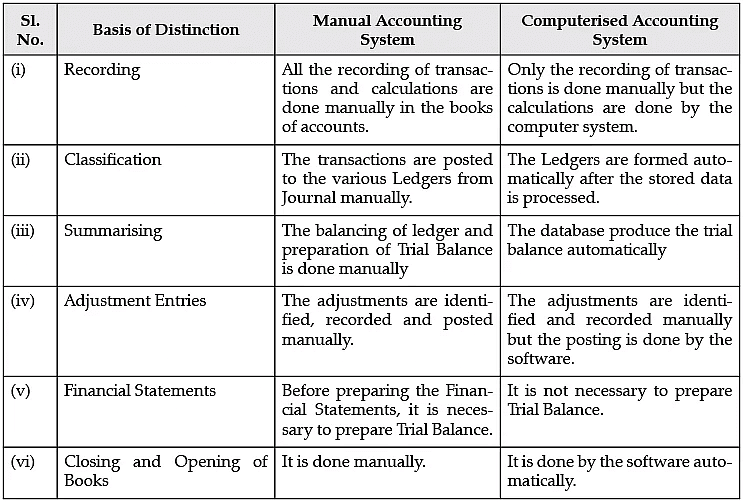

Differentiate between Manual and Computerised Accounting System.

The difference between manual and computerised accounting system are:

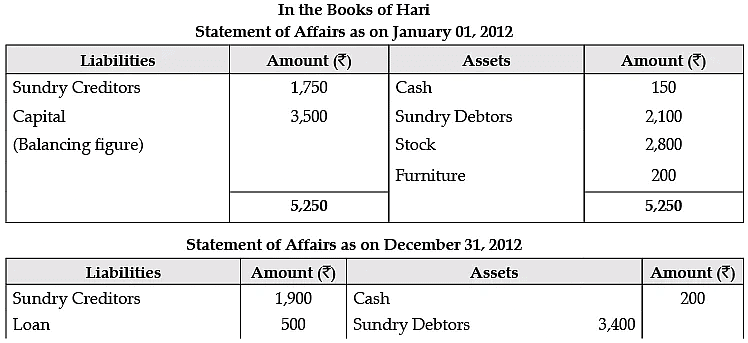

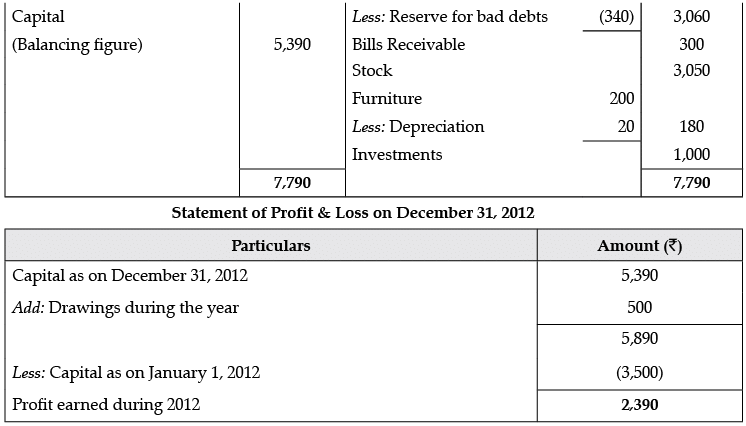

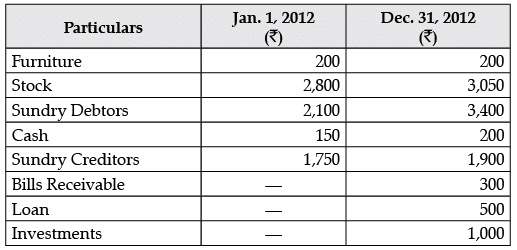

Q.8. Hari maintains his books of account on single entry system. His books provide the following information:

His drawings during the year were Rs. 500.

Depreciate furniture by 10% and provide a reserve for bad debts at 10% on sundry debtors. Calculate profit or loss earned by the firm.

OR

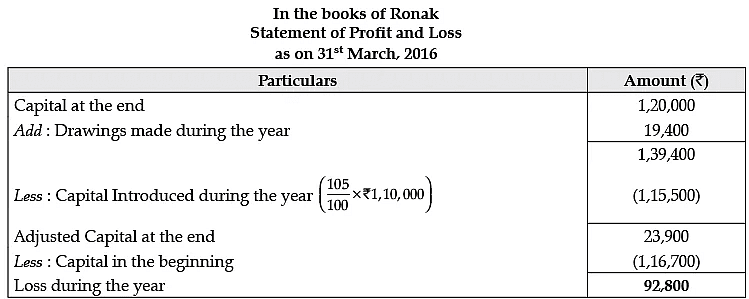

Ronak, who keeps his books on Single Entry System, has his capital on 31st March, 2016, Rs. 1,20,000 and on 1st April, 2015 was Rs. 1,16,700. He further informs that during the year, he withdrew for his personal expenses Rs. 19,400. He also sold his personal investment of Rs. 1,10,000 at 5% premium and brought that money into the business. Prepare a statement of Profit or Loss.

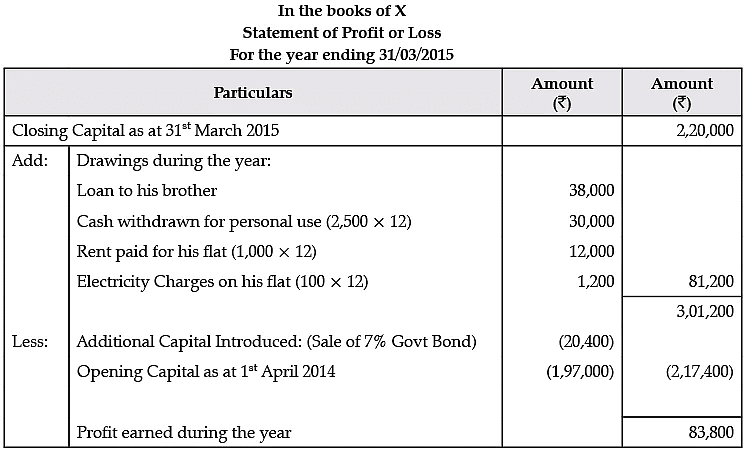

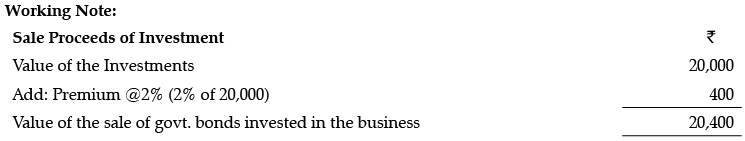

Q.9. The Capital of X on 31st March, 2015 is Rs. 2,20,000 and his capital on 31st March, 2014 was Rs. 1,97,000. During the year, he gave a loan of Rs. 38,000 to his brother on private account and withdraw Rs. 2,500 p.m. for personal purpose. He also used a flat for his personal purpose, the rent of which at the rate of Rs. 1,000 p.m. and electricity charges at an average rate of Rs. 100 p.m. were paid from business account. During the year, he sold his 7% Government Bonds of Rs. 20,000 at 2% premium and bought that money into his business. Besides this, there is no other information. You are required to prepare a Statement of Profit.

OR

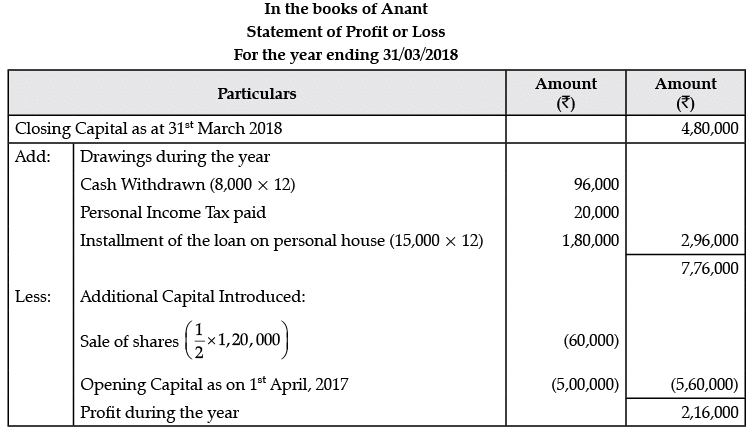

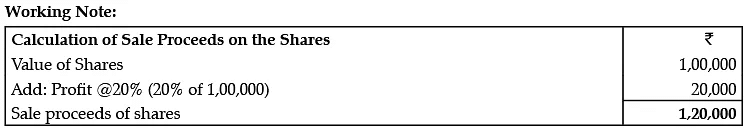

The Capital of Anant on 1st April, 2017 was Rs. 5,00,000 and on 31st March, 2018 was Rs. 4,80,000. He informed that he will withdraw from the business Rs. 8,000 per month for private use. He paid Rs. 20,000 for his personal income-tax and the instalment of the loan of his personal house at the rate of Rs. 15,000 per month from the business. He also sold his shares of Tata Finance costing Rs. 1,00,000 at a profit of 20% and invested half of this amount in the business. Calculate the profit or loss of the business.

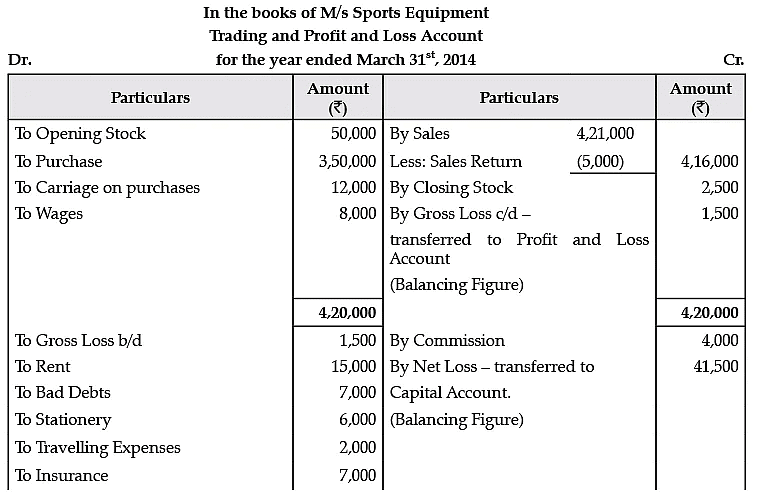

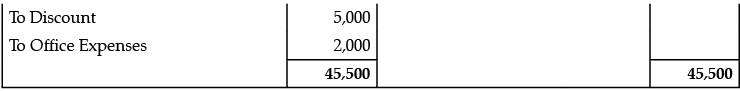

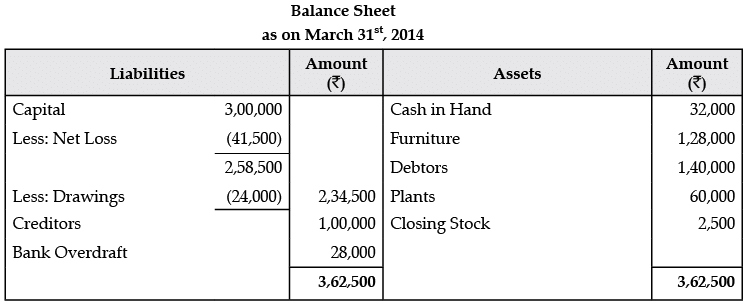

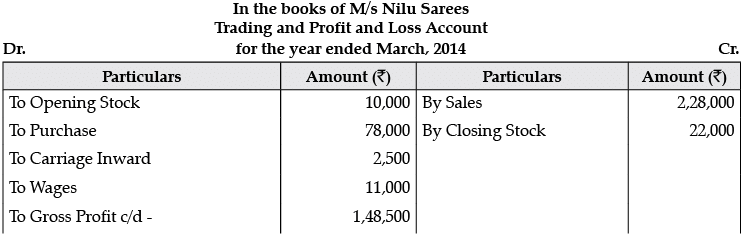

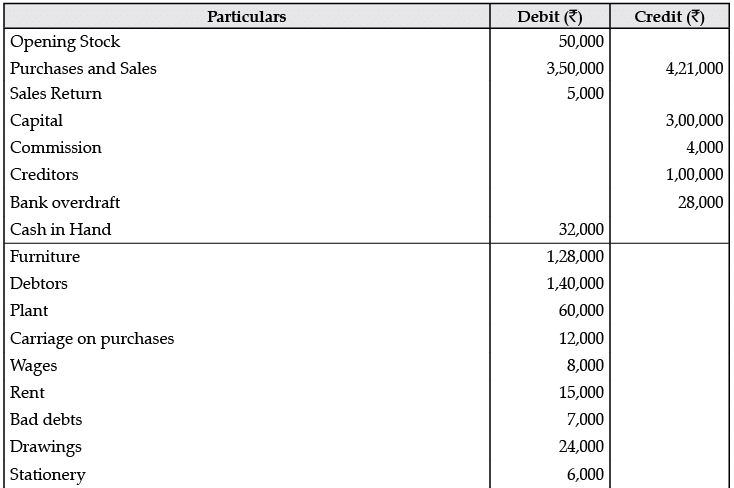

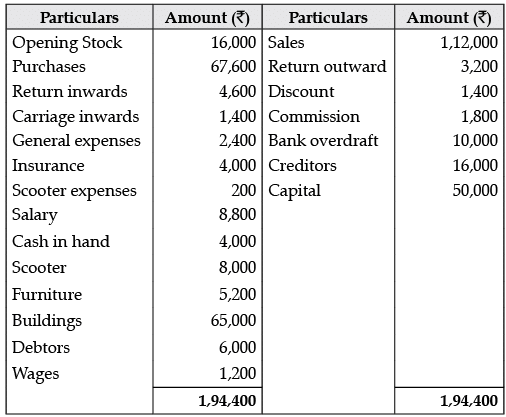

Q.10. Prepare trading and Profit and Loss account of M/s Sports Equipment for the year ended March 31, 2014 and Balance sheet as on that date :

Closing stock as on March 31st, 2014 Rs. 2,500.

OR

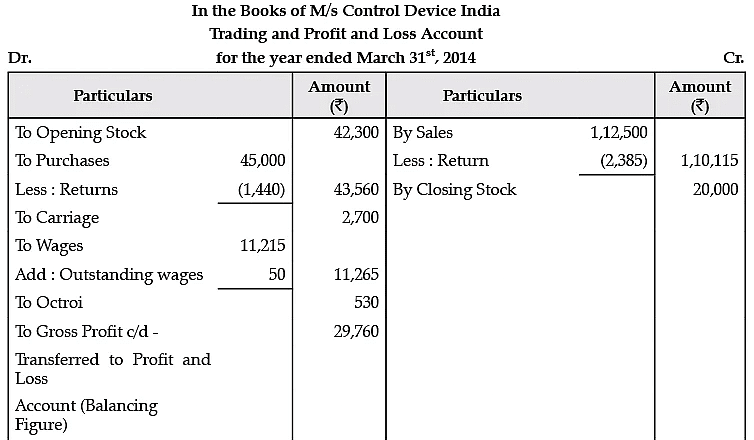

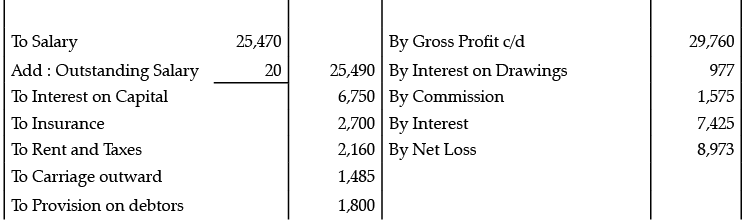

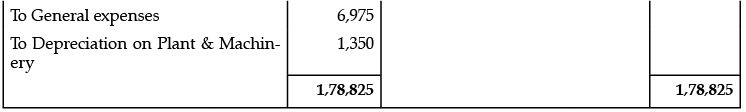

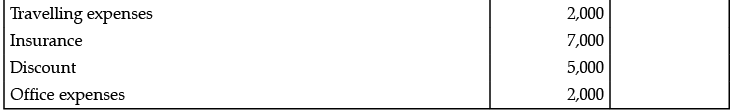

Prepare the trading and profit and loss account and balance sheet of M/s Control Device India on March 31,2014 from the following balances as on that date:

Adjustments:

(i) Closing stock was valued 20,000.

(ii) Interest or capital @ 10%.

(iii) Interest on drawings @ 5%.

(iv) Wages outstanding Rs. 50.

(v) Outstanding salary Rs. 20.

(vi) Provide depreciation @ 5% on plant and machinery.

(vii) Make a 5% provision on debtors.

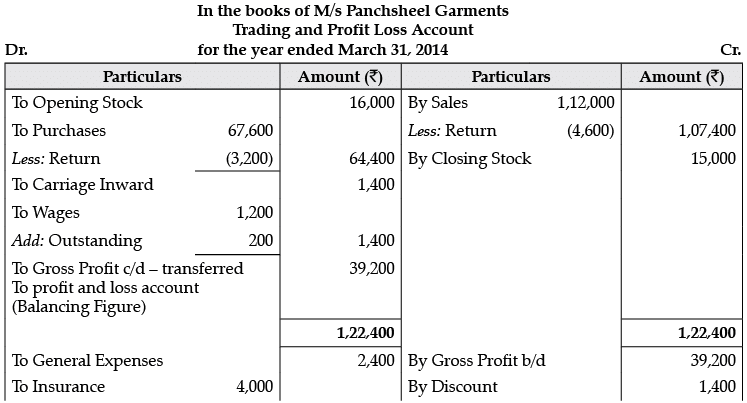

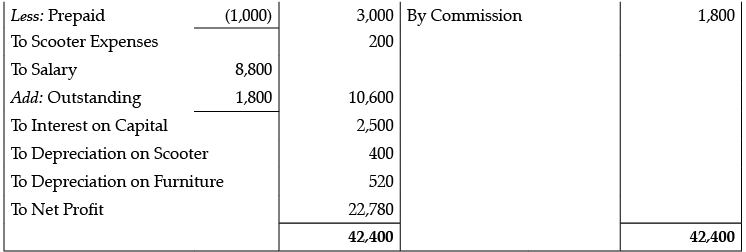

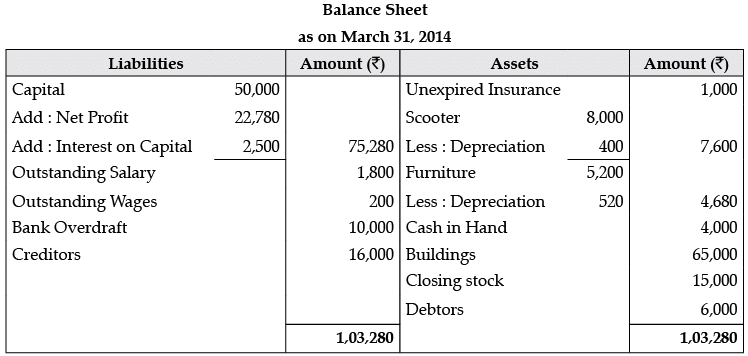

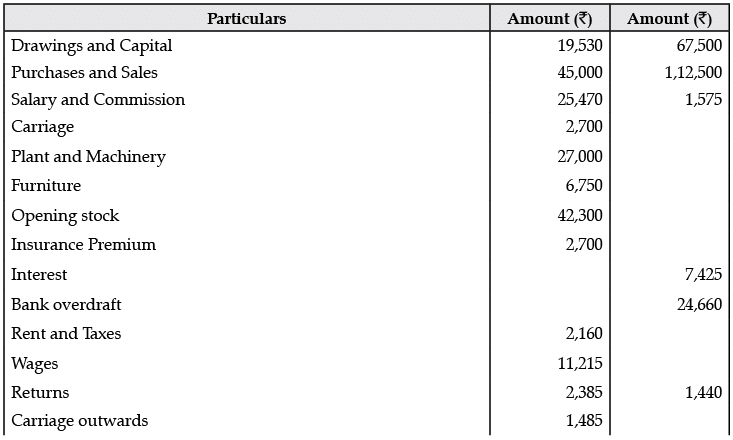

Q.11. The following balance was extracted from the books of M/s Panchsheel Garments on March 31st, 2014.

Prepare the trading and profit and loss account for the year ended March 31st, 2014 and a balance sheet as on that date taking into account the following information:

(i) Unexpired insurance Rs. 1,000.

(ii) Salary due but not paid 1,800.

(iii) Wages outstanding 200.

(iv) Interest on capital @ 5%.

(v) Scooter is depreciated @ 5%.

(vi) Furniture is depreciated @ 10%.

(vii) Closing stock was valued at Rs. 15,000.

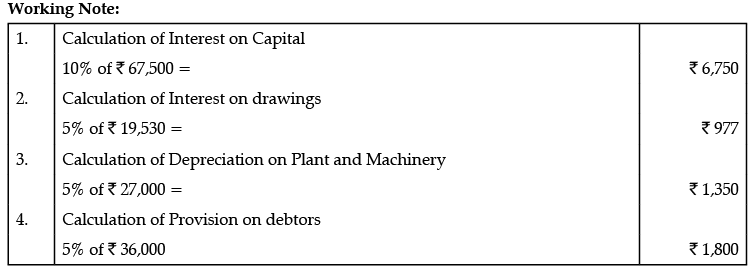

Working Note:

1. Calculation of Interest on capital: 5% of Rs. 50,000 = Rs. 2,500

2. Calculation of Depreciation on Scooter: 5% of Rs. 8,000 = Rs. 4003. Calculation of Depreciation on Furniture: 10% of Rs. 5,200 = Rs. 520

OR

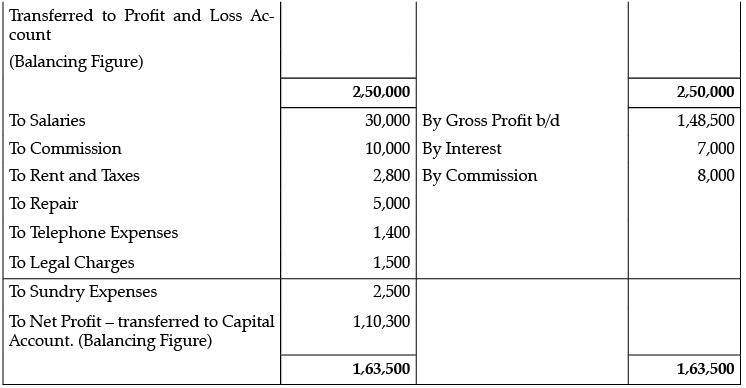

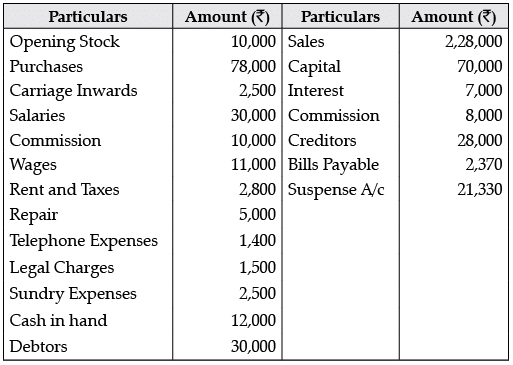

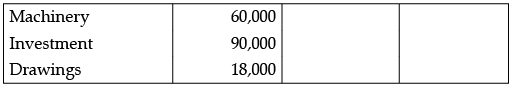

From the following balances of M/s Nilu Sarees as on March 31, 2014. Prepare Trading and Profit and Loss account and balance sheet as on date.

Stock as on March 31st, 2011 Rs. 22,000.

Note: The balance of suspense account has been given in the credit side of the trial balance, hence is to be transferred to the liabilities side of the balance sheet.

Q.12. Jagdish the new accounting manager wants to install the Accounting software for accounting to help his company in making the accounts faster. His C.E.O wants him to give a presentation in the board meeting. State the advantages of using Accounting Information System, that Jagdish can use in his presentation.

The advantages of using computerized accounting software are:

(i) Automation: Since all the calculations are handled by the software, computerized accounting eliminates many of the mundane and time-consuming processes associated with manual accounting. For example, once issued, invoices are processed automatically making accounting less time-consuming.

(ii) Accuracy: This accounting system is designed to be accurate to the minutest detail. Once the data is entered into the system, all the calculations, including additions and subtractions, are done automatically by software.

(iii) Data Access: Using accounting software, it becomes much easier for different individuals to access accounting data outside of the office, securely. This is particularly true if an online accounting solution is being used.

(iv) Reliability: Because the calculations are so accurate, the financial statements prepared by computers are highly reliable.

(v) Scalable: When a company grows, the amount of accounting necessary not only increases but becomes more complex. With computerized accounting, everything is kept straight forward because shifting through data using software is easier than shifting through a bunch of papers.

(vi) Speed: Using accounting software, the entire process of preparing accounts becomes faster. Further more, statements and reports can be generated instantly at the click of a button. Managers do not have to wait for hours, even days, to lay their hands on an important report.

(vii) Security: The latest data can be saved and stored in off-site locations, so it is safe from natural and man-made disasters like earthquakes, fires, floods and terrorist attacks. In case of a disaster, the system can be quickly restored on other computers. This level of precaution is taken by Clever Accounting.

(viii) Cost-effective: Since using computerized accounting is more efficient than paper-based accounting, work will be done faster and time will be saved. When one considers, Clever Accounting, one of the latest online accounting solutions, which starts at a low monthly subscription, then computerized accounting really becomes a no-brainer.

(ix) Visuals: Viewing your accounts using a computer allows you to take advantage of the option to view your data in different formats. You can view data in tables and using different types of charts.