Cred Success Story - How it Made Credit Card Payments Effective and Reward-Based? | Successful Entrepreneur Stories & Startup Journey - Entrepreneurship PDF Download

Cred - About

Cred is a Bangalore-based startup. It allows credit card users to pay their credit card bills through this platform and extends rewards for each transaction. The fintech platform also lets the users make their house rent payments, and also avail all the benefits of the short-term credit lines that the app now offers. The company takes utmost care in protecting the data and the information of the users. Hence, the app is completely safe and secure. Kunal Shah founded the company in 2018 and often describes CRED as a TrustTech company and not a FinTech. This is because his initial motivation to start CRED came from solving trust issues in the Indian society, which according to him, is the key to economic prosperity.

Cred - Startup Story

The goal was very simple. It was to create a platform where life could be made better and systematic. The founder wanted to offer more privileges and benefits for the people having good credit scores. And therefore, creating a flywheel effect for more people was important to improve the scores. Everybody, starting from the startups to the government, has focused on the masses. The founder of the company wanted to focus specifically on the people, the responsible citizens who pay taxes timely. He felt that nobody had solved their problems earlier.

'If you look at history, nobody has been rewarded for paying back on time. We want to fix that.'

Therefore, Cred was founded primarily to solve the problems of the taxpayers and reward them with attractive rewards in return.

Cred - Founder and Team

Kunal Shah is the founder and the CEO of Cred. He is an Indian entrepreneur, who is credited for launching new ventures for a second time. Kunal was a Philosophy graduate from Wilson College and later went on to pursue MBA from the Narsee Monjee Institute of Management Studies, but he dropped the course midway to chase his dreams as an entrepreneur. Kunal started his entrepreneurial journey with PaisaBack, a website for cashback, coupons, and other offers for the users along with Sandeep Tandon. However, he eventually shut down its operations in order to found FreeCharge, which the duo founded in 2010. FreeCharge was acquired by Snapdeal in April 2015 but the company still continued as an independent entity led by Shah. He left the firm the next year and eventually founded Cred in 2018, which has successfully turned unicorn on April 6, 2021. FreeCharge, on the other hand, was acquired by Axis Bank in July 2017. Kunal Shah was born in Mumbai in 1983. His hobbies include playing chess and poker. He loves munching on chips and guacamole. He loves the ideology of Socrates and the plays of G.B Shaw.

Cred - Tagline, Slogan and Logo

The tagline of the company is 'Suraksha Aur Bharosa Dono'.

Cred - Business Model

The business model of the company consists of four parts :

- The Cred app - The Cred app is a neat-looking, beautifully designed app, which the users can visit if they want to go through the offers that are available after they pay their credit card bills. They can easily sign up on the app and view all the offers that they can avail.

- Businesses that provide offers on the app - The users of Cred can also find a wide range of offers from numerous businesses. For this, CRED brings businesses onboard and collaborates with them. Along with benefitting CRED and its customers, who can avail of the exclusive offers provided by the businesses, it is also a win-win situation for the businesses. This is because they are also hugely benefited from the visibility they get.

- Users who pay their credit card bills - CRED also serves as a smooth and rewarding platform for the users who use it to pay their credit card bills. In comparison to banking or other apps, the end-users can choose CRED as an app to pay their credit card bills and get numerous offers and benefits. On the other hand, the users who like the app also share CRED with their family and friends.

- Cred Mint - Cred disclosed its new feature, Cred Mint on August 20, 2021, which is designed as a peer-to-peer lending platform help that will help Cred users lend their idle money to creditworthy members. It is a rather transparent process that only allows the trustworthy Cred members boasting of a minimal credit score of 750 or higher to be the borrowers. Furthermore, the lenders can also withdraw their money whenever they want with the interest that they have accumulated for the period.

Cred - Revenue Model

There are 2 prominent ways via which Cred earns its revenue:

- Listing products and offers - Cred, as we know, lists an array of products and offers that benefit its users from a range of businesses. These businesses, in turn, pay Cred a fee for their visibility. Every time a user avails of the offers, Cred generates an income through it.

- Using the financial data of the users - Cred accumulates the financial data from the users who use the platform for paying their bills and more. Along with providing Cred with the opportunity to introduce more offers to their users using these data, Cred also has other banks and financial institutions who pay them a fee for accessing these data. These companies, banks, and financial institutions would eventually approach the potential customers with their own set of products aligned to their tastes.

CRED has revealed that it does not charge any fees for the credit card payment options that it offers via its app. The company instead earns its revenues from the ancillary services it provides with the help of its technology and distribution platform.

Cred - Funding and Investors

- Cred has raised a total amount of $922.2 million in funding over the 9 funding rounds that the brand has witnessed. GIC infused $200 mn in the fresh venture round of the fintech unicorn on April 7, 2022. Dreamplug Technologies, which does business as CRED, is estimated to be valued at around $6.5 bn with this latest funding round that the company has seen.

- The last Series E funding round that the company saw was co-led by its existing investors, Tiger Global and Falcon Edge on October 19, 2021, and was worth around $251 million. DST Global, Insight Partners, Coatue, Sofina, RTP, and Dragoneer were some other investors that took part in the Series E round of fundraising. In the meanwhile, Cred also added two new investors - the London-based Marshall Wace and Steadfast Venture Capital to its captable.

Here's a look at the CRED funding rounds:

Cred is funded by 29 investors in total, as of August 23, 2021, with the recent investors being Dragoneer Investment Group and Tiger Global Management.

Cred - Acquisitions

Cred has acquired 2 companies to date, Hipbar, and Happay. Hipbar was acquired on October 21, 2021. The company is further looking to acquire Noida-based dining and restaurant tech solutions platform, Dineout, and the alternate investment platform, Wint Wealth, as per the reports dated November 19, 2021. The Dineout acquisition is reported to be between $25-50 mn while that of Wint Wealth is expected to be somewhere around $50 mn. Cred was looking to acquire Happay, as per the reports dated December 1, 2021. The deal had been sealed and was expected to be a mix of cash and stock, thereby valuing Happay at over $150 mn. Happay is the second acquisition for the company after Hipbar, which it acquired in October 2021.

Cred - Growth and Revenue

Cred has shown steady growth throughout the years. Being a startup that was founded in 2018, it successfully joined the unicorn club on April 6, 2021, closing its Series D round where the company had mopped up $215 million. CRED controls "22% of all credit card payments in India on a monthly basis,” said Kunal Shah in his statement released in April 2021.

Kunal Shah further took to his Linkedin profile on July 10, 2021, and shared highlights of the milestones reached by CRED in the month of June:

CRED Mint

Cred introduced Cred Mint on August 20, 2021, which will serve as a peer-to-peer lending feature that can be used by the customers of CRED. Cred Mint has been launched by Cred in collaboration with RBI-approved P2P Non-Banking Financial Company (NBFC), Liquiloans. With this feature, the Cred members can now lend money to the trustworthy members of Cred based on the predefined interest rates. Cred Mint can be used to lend another creditworthy user to help them earn around 9% per credit. However, it is also declared that Cred Mind will only be available for users with decent credit scores. Cred might soon be foraying into the wallet payments space with the upcoming acquisition of HipBar, a liquor delivery startup based in Chennai. Founder Kunal Shah and his brother have already joined HipBar board in order to make the acquisition feasible and thereby receive the PPI license. It completed its acquisition of Hipbar on October 21, 2021.

CRED Cash

CRED launched CRED Cash, a flexible credit line, in 2020. CRED Cash considers its members pre-approved for an active credit line of up to Rs 5 lakhs, without any documents, phone calls, forms or physical visits.

Rent Pay

CRED launched Rent Pay in 2020, which enables users to pay their monthly rent via credit cards.

CRED Store

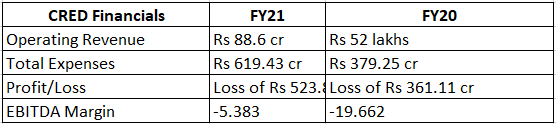

CRED launched CRED Store, an eCommerce platform, which is deemed as a haven for customers with over 500 premium brands across a wide range of categories to shop from. CRED, which was famous as a credit card bill manager, is now up with some more offerings including mobile, DTH, and FASTtag recharge options. As per the latest reports dated April 1, 2022, the Kunal Shah-led company has launched its utility bill payments segment, with the help of which the users can now pay their utility bills including the electricity, water bills, and municipal tax via the CRED app. Looking at the growth of revenues, CRED has managed to foster a whopping 170X growth in its operational revenue from Rs 52 lakhs during FY20 to make it Rs 88.6 cr during FY21. Here's a good look at the company's financial data for FY21 and compare the same with that of the previous fiscal:

CRED Finances Breakdown

CRED Revenue Breakdown

CRED helps in house rental transactions, which the users can avail of with the use of their credit cards, and collects convenience fees for the service in return. The sale of advertising space from which it collects commissions from the product sellers on the platform is another vertical of CRED revenue. Furthermore, it also operates CRED Mint now, which serves as a peer-to-peer (P2P) lending vertical that helps it earn interests on loans and other processing fees. In this fiscal, the company has also generated a non-operating income from its financial assets worth Rs 7 crore.

CRED Expenses Breakdown

The company's expenses grew considerably during FY21. The total expenses of CRED were Rs 379.3 cr and became Rs 619.4 cr, the growth of which is estimated at 63.3%. The CRED advertisements, which are prominent on television and online media, have stood out as the largest vertical of the company's expenditure accounting for 52.3% of its expense in FY21. The marketing and promotion costs only grew by 85.5% this year. Employee benefits come second in line when it comes to CRED expenses, which increased by 85% YoY. Here are the complete highlights of CRED revenues this year"

Cred - Partnerships

Cred partners with luxury and premier brands to extend the best experience to the users at the end of the bill payment cycles.

Some other partnerships of CRED are as follows:

- Cred launched Cred Mint, in partnership with the P2P non-bank LiquiLoans, which helps the users invest their savings in a capital pool.

- Cred launched Cred Pay by partnering with Razorpay. This tool helps the users to make payments using their CRED coins and experience a seamless checkout.

Cred - Competitors

The top competitors of CRED are Paytm, PhonePe, Google Pay, Amazon Pay, Freecharge and MobiKwik.

- Paytm is the top competitor of Cred. It is a fintech app and payments platform that is headquartered in Noida, Uttar Pradesh, India, and was founded in 2010.

- PhonePe is another notable competitor of Cred. It is also a digital payment and financial services platform headquartered in Bangalore, India, which was founded in 2015. This app has the largest market share of 46.04%, as of July 2021.

- Being a UPI platform that is a mass volume player, Google Pay is another competitor of CRED. This digital payments platform is developed by the Search engine giant Google itself.

- Amazon Pay is also a rival of CRED, which is now all set to provide diverse payment options. The online payments processing app is launched by Amazon and founded in 2007.

- MobiKwik is yet another fintech company, which supports digital payment options and is a rival of Cred at the same time. It is headquartered in Gurugram, Haryana, India, and was founded in 2009.

- Freecharge is also a company that CRED competes with, after the launch of its mobile bills and utility bill payments services. Originally founded by Kunal Shah and Sandeep Tandon, Freecharge now stands acquired by Axis Bank.

|

14 videos|17 docs

|

|

14 videos|17 docs

|

|

Explore Courses for Entrepreneurship exam

|

|