Bank Exams Exam > Bank Exams Notes > IBPS PO Prelims & Mains Preparation > Bank Cards & Their Features

Bank Cards & Their Features | IBPS PO Prelims & Mains Preparation - Bank Exams PDF Download

Types of cards

Cards can be classified based on their usage, issuance, and payment by the cardholders. There are three types of cards-- Debit cards

- Credit Cards

- Prepaid Card

Debit Cards

- A debit card can be used to withdraw cash up to the customer’s bank account’s limit. Therefore, debit cards are linked to bank accounts and issued by banks.

- To, use debit cards customers should have enough balance. Debit cards are used for withdrawing cash from an ATM, purchase of goods and services at Point of Sale (POS)/ E-commerce (online purchase) both domestically and internationally. Also used for domestic fund transfer from one person to another.

Credit Cards

- In the case of credit cards, a customer can withdraw money beyond the amount of money present his bank account. However, there is a credit limit for the cardholder up to which the extra money can be withdrawn.

- Also, the withdraw money will have to be paid back as dues along with interest charges as applied by the issuer of card within a time limit.

- It issued by banks / other entities approved by RBI.

- These cards are used to purchase goods and service at E-commerce (online purchase)/ Point of Sale (POS) through recurring transaction/ Interactive Voice Response (IVR) or Mail Order Telephone Order (MOTO). In addition, it can be used domestically and internationally (provided it is enabled for international use).

- These cards are can be used to withdraw money from ATM and for transferring money to bank accounts, credit cards, debit cards, prepaid cards within the country.

Prepaid Cards

- The usage of Prepaid cards depends on who has issued the card. It issued by banks/non-bank entities.

- For issuing a prepaid card, one has to pay the amount in advance for using the money whenever required. Therefore, this type of card is never linked to any bank account.

- The prepaid cards issued by banks can be used to withdraw money from ATM, purchase of goods and services at E-commerce (online purchase)/ Point of Sale (POS) and for domestic fund transfer from one person to another. This one known as open system prepaid cards. However, when it issued by authorized non-bank entities for the same usage it is known as semi-closed system prepaid cards. It can be used only domestically.

- One can store maximum Rs. 50,000/- at any point of time.

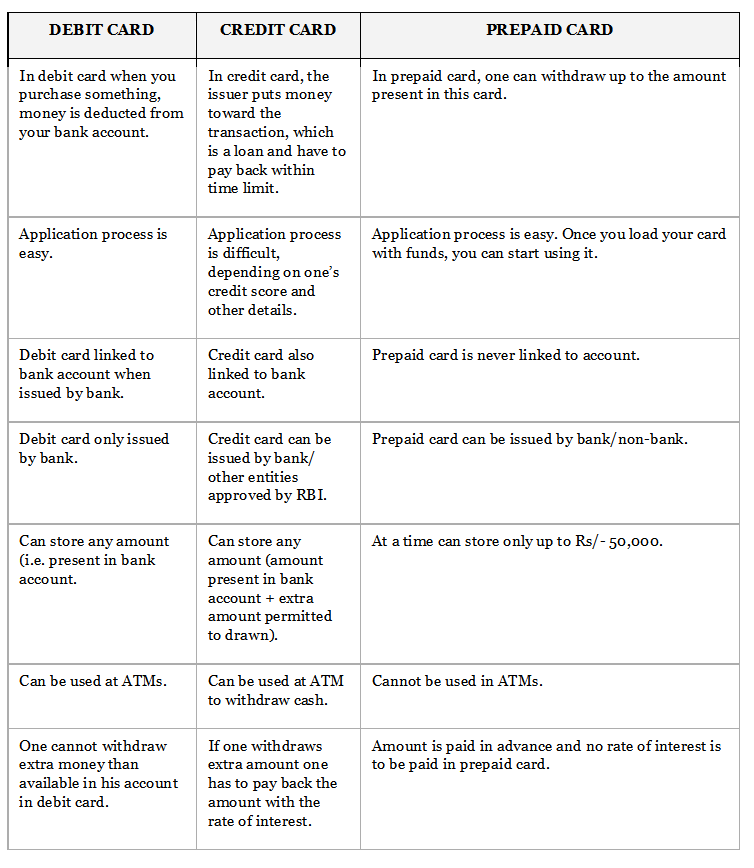

The Difference between Debit, Credit and Prepaid card.

The document Bank Cards & Their Features | IBPS PO Prelims & Mains Preparation - Bank Exams is a part of the Bank Exams Course IBPS PO Prelims & Mains Preparation.

All you need of Bank Exams at this link: Bank Exams

|

647 videos|1019 docs|305 tests

|

Related Searches