Bank Exams Exam > Bank Exams Notes > IBPS PO Prelims & Mains Preparation > Meaning of Bill of Exchange

Meaning of Bill of Exchange | IBPS PO Prelims & Mains Preparation - Bank Exams PDF Download

Definition

"An unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time a sum certain in money to or to the order of a specified person, or to the bearer".Meaning

- A bill of exchange is a non- interest bearing written order which is used primarily in foreign trade which binds one party to pay a fixed amount of money to another party at a decided future date.

- A bill of exchange is a signed by the creditor and accepted by a debtor.

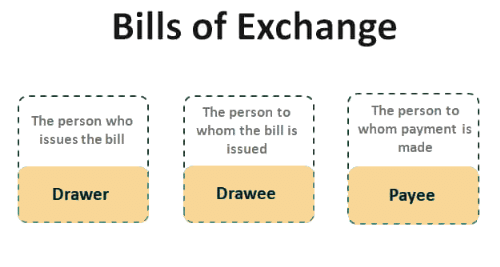

Parties involved in a bill of exchange

- Drawer: The person who makes a bill of exchange is called the drawer. He is either a creditor or a seller and orders the borrower to pay the borrowed money.

- Drawee: A drawee is the one to whom the bill of exchange is made. He is either a buyer or a debtor.

- Payee: One who has to receive the amount of the bill of exchange is called the payee. In a bill of exchange, either a drawer or a maker may receive money himself or order a drawee to pay an amount to somebody.

- Acceptor: A person who accepts a bill of exchange to pay is called an acceptor, it may be a debtor or a drawee or a banker.

- Holder: One who actually possesses the bill is called holder. He may be a drawer or a creditor, or a bearer or a payee.

- Endorser: One who transfers the right of possession of the bill to other party is called endorser. He may be a drawer or a holder.

- Endorsee: A person to whom the right of ownership is transferred is called an endorsee.

Essential components of a bill of exchange.

- A bill of exchange must be in writing form.

- It must contain an order to pay a fixed amount only.

- Order must be unconditional.

- A bill of exchange must be signed by the drawer.

- The parties involved in the transaction must be certain i.e. A drawer, drawee and a payee

- A bill of exchange must be properly stamped.

- A bill of exchange can either be payable on demand or at a future date.

Classification of the bill of exchange

Classification by place- Inland Bill: A bill which is used within a national boundary is known as inland bills. In this type, the drawer and drawee are in the same country and if a payee is from another country, the bill will remain an inland bill.

- Foreign Bill: In the foreign bill, a drawer and a drawee both are from a different country and it is known as a foreign bill.

Classification by time

- A demand or a sight Bill: In demand or a sight bill, a bill is payable on demand or at a sight. it means this bill does not contain a specific time for the payment.

- Time or Usance Bill: This type of bill is issued for a specified period of time and it is payable only after that date. In this type of bill, a grace period of 3 days is allowed after the date fixed for the payment and once the grace period over it becomes null.

Classification by documents

- Documentary Bill: This type of bills carries documents with them same as railway receipts, insurance receipts etc. It is further classified into two types.

(i) Documentary bill against payment: These types of bills are only paid when the required documents are issued and submitted to the competent authority.

(ii) Documentary bill against acceptance: Documentary bills are only which are accepted when the documents are realized by the drawer. - Clean or non-documentary bills: A clean or non- a documentary is a bill which is either drawn or accepted without being attached to the documents.

Classification by payment

- Bearer Bill: A bill which is payable to any person who bears or carries them.

- Order Bill: In this type of bill, payment is assigned to the person whose name is written as the payee.

Classification by other kinds

- Trade Bill: A trade bill an ordinary and most common type of bill used in business transactions. A bill is drawn by the seller against the buyer of goods.

- Accommodation Bill: An accommodation bill is drawn to borrow a specific amount of money. Its main intention is to accommodate the drawer.

- Bank Bill: A bank bill is drawn on the bank by a bank.

The document Meaning of Bill of Exchange | IBPS PO Prelims & Mains Preparation - Bank Exams is a part of the Bank Exams Course IBPS PO Prelims & Mains Preparation.

All you need of Bank Exams at this link: Bank Exams

|

647 videos|1019 docs|305 tests

|

Related Searches