Bank for International Settlement & BASEL | IBPS PO Prelims & Mains Preparation - Bank Exams PDF Download

Introduction

- The Bank for International Settlement was established on 17th May 1930. It is one of the oldest Financial organisation in the world. It has two representative offices in Hong Kong & Mexico City. Its main purpose is to cooperation with central banks. Its Headquarter is located real-estate Basel, Switzerland. Recently it has 60 member’s central banks.

- BASEL is a place in Switzerland where all the governors of Central Banks and finance ministers of developing countries conducted a meeting to minimize the risk factors involved in Banking Investment. In the meeting, a committee was formed known as “BASEL” committee on Banking supervision (BCBS).

- A guideline provided by this committee is known as “BASEL” Norms. Until now three meetings were conducted by this committee termed as BCBS. These are –

- BASEL –I

- BASEL – II

- BASEL – III

BASEL – I

The first meeting held in 1988 in that meeting BASEL committee on Banking supervision (BCBS) divided banks capital in three tier, namely- Tier -1

- Tier -2

- Tier -3

Tier -1: which can be easily liquidated like Gold, Shares & bonds. It is also termed as Core capital.

Tier-2: Which cannot be easily liquidated like fixed assets i.e. lands , buildings , etc. It can be termed as subordinate capital.

Tier-3: Which can never be liquidated like CRAR, SLR

BASEL committee on Banking supervision (BCBS) identified two major risks these are as follows:

- Credit Risk.

- Market Risk

BCBS sets Banks should maintain a minimum capital adequacy requirement of 8% of risk assets. But Reserve Bank of India in India fixed it at 9%.

Tits Bits-

- CRAR – Capital to risk waited assets ratio

- CAR- Capital adequate ratio

- RWA- Risk Weighted Assets

Basic Formula

CAR

Now , Total Capital = Tier 1 Capital + Tier 2 Capital

BASEL –II

The second meeting held in 2008. It has mainly 3 pillar concept. These are :3 Pillars

- Minimum Capital Requirement (Addressing Risk)

- Supervisory Review

- Market discipline

In that meeting, BCBS made the BASEL-I rules compulsory. They also introduced 3 pillar concept to support the risk management.

Minimum Capital Requirement (Addressing Risk)

The capital ratio is the certain % of a bank's capital to its risk-weighted assets. Weights are defined by risk-sensitivity ratios whose calculation is dictated under the relevant Accord. Basel II requires that the total capital ratio must be no lower than 8%.Supervisory Review – We can divide it into two parts.

- ICAAP – Internal Capital adequacy & assessment process(By the Bank Itself)

- SREP – Supervisory review 7 evaluation process (By the Central Bank)

Market discipline – It means Discipline in all the facts in social media for promotion and advertisement. This also helps in maintaining transparency & public confidence.

BASEL – III

The third meeting was held in 2010 in that meeting BCBS introduce extra precautionary measures. They ordered the bank to reserve 2.55 of Common Equity Tier-1 in capital conservation buffer. Banks can also use Tier-2 Capital on lease to real-state (Promoter) agent with a maturity period of 10 years. In India BASEL-III was implemented in 2013.We can say BASEL-III is the global Regulatory standard on bank capital adequacy, stess testing & market liquidity risk.

Effects of BASEL-III on Indian Banking standard

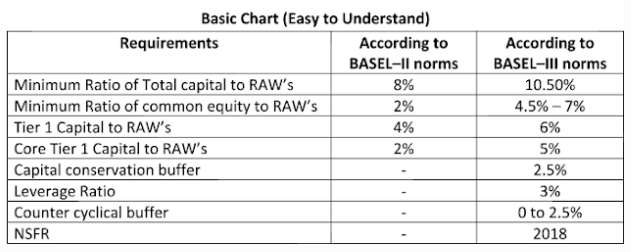

BASEL-III which is to be the implemented by the bank in India as per the guideline issued by RBI from time to time will be a challenging task for Bank’s as well as Government of India. It is estimated that Indian Banks will require Rs. 6,00,000 Cr. In external capital in few years on so i.e. by 2020. It affects in the equity of these banks especially for Public sector banks. See below chart how it will affect Indian Banks.

|

647 videos|1019 docs|305 tests

|