Economic Development: September 2022 Current Affairs | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC PDF Download

Scheme Special Assistance to States for Capital Investment

Why in News?

Recently, the Government has launched a Scheme Special Assistance to States for Capital Investment for 2022-23.

What is the Scheme Special Assistance to States for Capital Investment?

- About

- Under this Scheme, financial assistance is provided to the States Governments in the form of 50-year interest free loan for capital investment projects.

- For the 2022-23 Financial Year (FY) a total financial assistance of Rs 1 lakh crore would be given to states.

- The loan under the scheme would be over and above the normal borrowing ceiling allowed to states for FY 2022-23 and should be spent in the same year.

- Eligible Parts of the Scheme

- New or ongoing projects or for settling pending bills in ongoing capital projects.

- States may submit projects of higher value than the funds allocated, indicating their preference/priority.

- Different Parts of the Scheme

- For capital works (PM Gati Shakti Master Plan will receive priority), PM Gati Shakti related expenditure, PM Gram Sadak Yojana, Incentives for digitisation, Optical Fibre Cable, Urban reforms, Disinvestment and monetisation.

- Exclusion: Projects with capital outlay of less than 5 crore (2 crore for North East) and repair and maintenance projects irrespective of capital outlay are not eligible

What is Capital Expenditure?

- Meaning

- Capital expenditure is the money spent by the government on the development of machinery, equipment, building, health facilities, education, etc.

- It also includes the expenditure incurred on acquiring fixed assets like land and investment by the government that gives profits or dividends in future.

- Along with the creation of assets, repayment of loan is also capital expenditure, as it reduces liability.

- Capital spending is associated with investment or development spending, where expenditure has benefits extending years into the future.

- Significance

- Capital expenditure is long-term in nature and allows the economy to generate revenue for many years by adding or improving production facilities and boosting operational efficiency.

- It also increases labour participation, takes stock of the economy and raises its capacity to produce more in future.

- Different from Revenue Expenditure

- Unlike capital expenditure, which creates assets for the future, revenue expenditure is one that neither creates assets nor reduces any liability of the government.

- Salaries of employees, interest payment on past debt, subsidies, pension, etc, fall under the category of revenue expenditure. It is recurring in nature.

India Becomes the World’s 5th Largest Economy

Why in News?

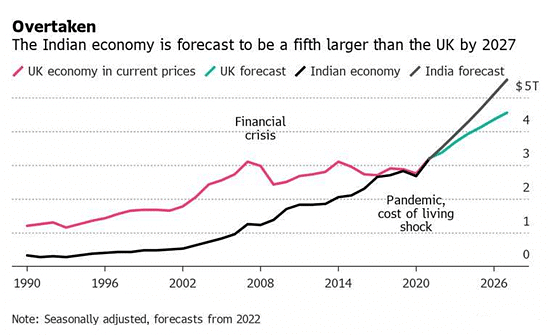

Recently, India became the world’s fifth largest economy by overtaking the United Kingdom. Now, the United States, China, Japan, and Germany are the only nations with economies larger than India's.

- The real Gross Domestic product (GDP) growth of 6-6.5% in a world full of uncertainties is the new normal and India is set to be the third largest economy by 2029.

What are the Key Highlights of this Achievement?

- New Milestone: Moving past one of the biggest economies in the world, especially one that ruled over the Indian sub-continent for two centuries, is a major milestone.

- Size of Economy: The size of the Indian economy in ‘nominal’ cash terms in the quarter through March, 2022 was USD 854.7 billion while for UK was USD 816 billion.

- Comparison with United Kingdom

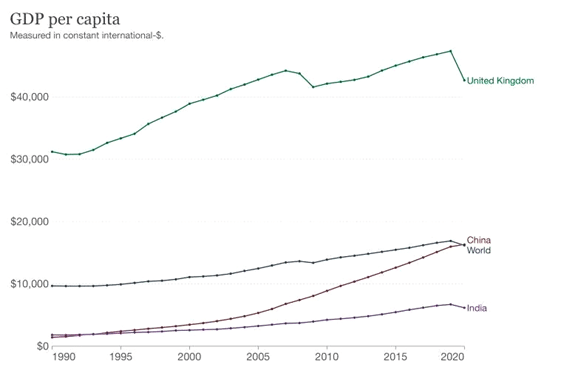

- Population Size: As of 2022, India has a population of 1.41 billion while the UK’s population is 68.5 million.

- GDP Per capita: GDP per capita provides a more realistic comparison of income levels because it divides a country’s GDP by the population of that country.

- The per capita income in India remains very low, India is ranked 122 out of 190 countries in terms of per capita income in 2021.

- Poverty

- The low per capita incomes often point to high levels of poverty.

- At the start of the 19th century, the UK’s share in extreme poverty was considerably higher than India’s.

- However, the relative positions have reversed even though India has made giant strides in curbing poverty.

- Health

- The Universal Health Coverage (UHC) Index is measured on a scale from 0 (worst) to 100 (best) based on the average coverage of essential services including reproductive, maternal, newborn and child health, infectious diseases, non-communicable diseases and service capacity and access.

- While faster economic growth and the government’s policy focus on healthcare schemes since 2005 have made a distinct improvement for India, there is still a long way to go.

- Human development Index

- The end goal of higher GDP and faster economic growth is to have better human development parameters.

- According to HDI (2019), the UK score is 0.932 and India’s score is 0.645 which is comparatively far behind the UK.

- Despite its secular improvement, India might still take a decade to be where the UK was in 1980.

- Present outlook

- The dramatic shift has been driven by India's rapid economic growth over the past 25 years as well as downslides in the value of the pound over the last 12 months.

- The right policy perspective and realignment in global geopolitics could further, also lead to an upward revision in its estimates for India.

What are the Issues Related to Indian Economy?

- Slowing Exports and Rising Imports

- The slowing growth of the manufacturing sector at 4.8% is an area of worry.

- Also, imports being higher than exports is a matter of concern.

- Unpredictable Weather

- There is an uneven monsoon that is likely to weigh upon agriculture growth and rural demand.

- Rising Inflation

- There has been continuous rise in inflation about 6% for seven straight months.

- The Indian economy faces headwinds from higher energy and commodity prices that are likely to weigh on consumer demand and companies' investment plans.

Fall in India’s Foreign Exchange Reserve

Why in News?

According to the Reserve Bank of India (RBI), India’s forex reserves have fallen by USD 110 billion in the last 13 months.

What are Forex Reserves?

- About: Forex reserves are assets held on reserve by a central bank in foreign currencies, which can include bonds, treasury bills and other government securities.

- Most foreign exchange reserves are held in US dollars.

- Components

- Foreign Currency Assets

- Gold reserves

- Special Drawing Rights

- Reserve position with the International Monetary Fund (IMF).

- Significance of Forex Reserves

- Supporting and maintaining confidence in the policies for monetary and exchange rate management.

- Provides the capacity to intervene in support of the national or union currency.

- Limits external vulnerability by maintaining foreign currency liquidity to absorb shocks during times of crisis or when access to borrowing is curtailed.

What are Special Drawings Rights?

- The SDR is an international reserve asset, created by the IMF in 1969 to supplement its member countries’ official reserves.

- The SDR is neither a currency nor a claim on the IMF. Rather, it is a potential claim on the freely usable currencies of IMF members. SDRs can be exchanged for these currencies.

- The value of the SDR is calculated from a weighted basket of major currencies, including the US dollar, the euro, the Japanese yen, the Chinese yuan, and the British pound.

- The interest rate on SDRs or (SDRi) is the interest paid to members on their SDR holdings.

What are the Reasons for the Decline in India’s Forex Reserves?

- Current Scenario

- India’s forex reserves have fallen by USD 110 billion since September 2021 where it stood at a record high of USD 642.45 billion.

- It needs to be noted that Indian rupee is a freely floating currency, and its exchange rate is market determined. The RBI does not have any fixed exchange rate.

- Despite this drastic decline, India has been faring much better than several reserve currencies, EMEs (emerging market economies) and its Asian peers.

- Causes of Declining Forex Reserves

- Defending Rupee: The central bank has been selling dollars from the forex reserves to support the rupee amid pressures caused majorly by global developments.

- The intervention is needed to curb the free fall of the rupee and reduce volatility in the market.

- Aggressive Policy of the US Fed

- Capital Outflows: Capital outflows by foreign portfolio investors (FPIs) as the US Federal Reserve started the monetary policy tightening and interest rate hikes.

- FPIs have begun to withdraw from the Indian markets. These FPIs were sellers in financial and IT services and buyers in telecom and capital goods.

- Valuation Loss: The valuation loss, reflecting the appreciation of the US dollar against major currencies and the decline in gold prices also played a part in the decrease in foreign exchange reserves.

- About 67% of the decline in reserves during the current financial year was due to valuation changes arising from an appreciating US dollar and higher US bond yields.

What are the Factors Affecting Exchange Rates?

- Inflation Rates: Changes in market inflation cause changes in currency exchange rates. For e.g., a country with a lower inflation rate than another will see an appreciation in the value of its currency.

- Balance of Payments: It consists of a total number of transactions including exports, imports, debt, etc.

- A deficit in the current account due to spending more of its Forex on importing products than it is earning through the sale of exports causes depreciation, and it further fluctuates the exchange rate of its domestic currency.

- Government Debt: Government debt is a debt owned by the central government. A country with large government debt is less likely to acquire foreign capital, leading to inflation.

- In this case, foreign investors will sell their bonds in the open market if the market predicts government debt within a certain country. As a result, a decrease in the value of its exchange rate will follow.

Windfall Tax

Context

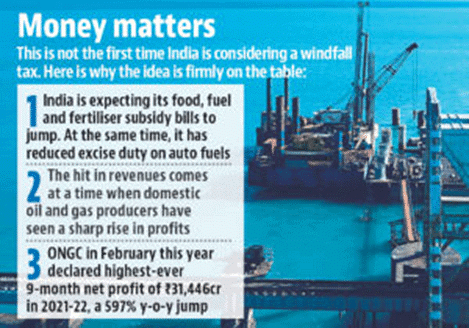

Finance Minister has defended the windfall tax imposed by the Centre on domestic crude oil producers, saying that it was not an ad hoc move but was done after full consultation with the industry.

What is a Windfall Tax?

- Windfall taxes are designed to tax the profits a company derives from an external, sometimes unprecedented event — for instance, the energy price-rise as a result of the Russia-Ukraine conflict.

- These are profits that cannot be attributed to something the firm actively did, like an investment strategy or an expansion of business.

- The US Congressional Research Service (CRS) defines a windfall as an “unearned, unanticipated gain in income through no additional effort or expense”.

- One area where such taxes have routinely been discussed is oil markets, where price fluctuation leads to volatile or erratic profits for the industry.

When did India introduce this?

- In July this year, India announced a windfall tax on domestic crude oil producers who it believed were reaping the benefits of the high oil prices.

- It also imposed an additional excise levy on diesel, petrol and air turbine fuel (ATF) exports.

- Also, India’s case was different from other countries, as it was still importing discounted Russian oil.

How is it levied?

- Governments typically levy this as a one-off tax retrospectively over and above the normal rates of tax.

- The Central government has introduced a windfall profit tax of ₹23,250 per tonne on domestic crude oil production, which was subsequently revised fortnightly four times so far.

- The latest revision was on August 31, when it was hiked to ₹13,300 per tonne from ₹13,000.

Why govt. introduced windfall tax?

- There have been varying rationales for governments worldwide to introduce windfall taxes like:

- Redistribution of unexpected gains when high prices benefit producers at the expense of consumers,

- Funding social welfare schemes, and

- Supplementary revenue stream for the government

Why are countries levying windfall taxes now?

- Prices of oil, gas, and coal have seen sharp increases since last year and in the first two quarters of the current year, although they have reduced recently.

- Pandemic recovery and supply issues resulting from the Russia-Ukraine conflict shored up energy demands, which in turn have driven up global prices.

- The rising prices meant huge and record profits for energy companies while resulting in hefty gas and electricity bills for households in major and smaller economies.

- Since the gains stemmed partly from external change, multiple analysts have called them windfall profits.

Issues with imposing such taxes

- Companies are confident in investing in a sector if there is certainty and stability in a tax regime.

- Since windfall taxes are imposed retrospectively and are often influenced by unexpected events, they can brew uncertainty in the market about future taxes.

- IMF says that taxes in response to price surges may suffer from design problems—given their expedient and political nature.

- It added that introducing a temporary windfall profit tax reduces future investment because prospective investors will internalise the likelihood of potential taxes when making investment decisions.

- There is another argument about what exactly constitutes true windfall profits; how can it be determined and what level of profit is normal or excessive.

- Another issue is who should be taxed — only the big companies responsible for the bulk of high-priced sales or smaller companies as well— raising the question of whether producers with revenues or profits below a certain threshold should be exempt.

To read more information on Taxation:

Renewable Energy and Jobs

Why in News?

Recently, the International Renewable Energy Agency (IRENA) and the International Labour Organization (ILO) released a report titled “Renewable Energy and Jobs-Annual Review 2022”, which says that around 700,000 new jobs were created in the Renewable Energy Sector in just one year.

- The report identified domestic market size, along with labor, as a major factor influencing job growth in the sector.

What are the Findings?

- Overview

- The Renewable Energy sector employed 12.7 million people across the world in 2021, up from 12 million in 2020.

- Close to two-thirds of all such jobs are in Asia, with China alone accounting for 42 % of the global total. It is followed by the European Union and Brazil with 10 % each and the United States and India with 7 % each.

- Developed economies received the largest share of investment in the renewable energy field. These countries are on their way to achieving a 60 % growth in the clean energy sector by 2022.

- Regional Trends

- Southeast Asian countries are becoming major Solar Photovoltaic (PV) manufacturing hubs and biofuel producers, while China is the pre-eminent manufacturer and installer of solar PV panels and is creating a growing number of jobs in offshore wind.

- India added more than 10 Gigawatts of solar PV, generating many installation jobs, but remains heavily dependent on imported panels.

- Europe accounts for about 40 % of the world’s wind manufacturing output and is the most important exporter of wind power equipment; it is trying to reconstitute its solar PV manufacturing industry.

- In Africa there are growing job opportunities in decentralized renewables, while in the Americas, Mexico is the leading supplier of wind turbine blades.

- Brazil remains the leading employer in biofuels but is also adding many jobs in wind and solar PV installations.

- The US is beginning to build a domestic industrial base for the budding offshore wind sector.

- Solar Energy

- Solar energy remained the fastest-growing sector.

- In 2021 it provided 4.3 million jobs — more than a third of the total renewable energy workforce.

- In 2021, a record 132.8 gigawatts of solar PV capacity were installed globally, up from 125.6 GW in 2020.

- China accounted for 53 GW (40 %) of this addition. It was followed by the US, India and Brazil, all of which set new annual records.

- Decentralized Renewable Energy

- The number of people directly employed in Decentralised Renewable Energy (DRE) in 2021 was more than 80,000 in India (mostly in solar PV), 50,000 each in Kenya and Nigeria, almost 30,000 in Uganda.

- DRE is a system that uses renewable energy to generate, store and distribute power in a localised way.

- The share of women in the DRE workforce is still low, particularly for skilled jobs, the researchers observed.

- Overall, the share of women in DRE was 41 % in Kenya, 37 % in Ethiopia and Nigeria, 28 % in Uganda and 21 % in India.

What are the Recommendations?

- An energy transition that can be considered just needs not only to create decent jobs but also to offer social protection for affected workers, communities and regions during the transition.

- A successful and just energy transition requires strong public policy interventions and capable institutions for policy implementation.

- Pursuing industrial policies that encourage the expansion of decent renewables jobs at home.

- Not only the ultimate outcome of the energy transition but also the process of a decades-long transformation of all economies must be just.

- The expansion of renewable energy needs to be supported with holistic policy packages, including training for workers to ensure jobs are decent, high quality, well paid and diverse in pursuit of a just transition.

National Technical Textiles Mission (NTTM)

Why in News?

The Ministry of Textiles recently cleared 23 strategic research projects worth around Rs 60 crores in Specialty fibres, Sustainable Textiles, Geotextiles, Mobiltech and Sports textiles under the National Technical Textiles Mission.

What are Technical Textiles?

- Technical textiles are functional fabrics that have applications across various industries including automobiles, civil engineering and construction, agriculture, healthcare, industrial safety, personal protection etc.

- Technical Textile products derive their demand from the development and industrialization in a country.

- Based on usage, there are 12 technical textile segments: Agrotech, Meditech, Buildtech, Mobiltech, Clothtech, Oekotech, Geotech, Packtech, Hometech, Protech, Indutech and Sportech.

- For example, ‘mobiltech’ refers to products in vehicles such as seat belts and airbags, airplane seats; geotech, which is incidentally the fastest growing sub-segment, used to hold back soil, etc.

What do we know about the National Technical Textiles Mission (NTTM)?

- About

- It was approved in 2020 by the Cabinet Committee on Economic Affairs (CCEA) with total outlay of Rs.1480 Crore.

- The implementation period is four years, from FY 2020-21 to FY 2023-24.

- Aim

- The aim of the mission is to position India as a global leader in Technical Textiles by taking the domestic market size from USD 40 billion to USD 50 billion by 2024.

- It also supports the ‘Make in India’ Initiative promoting domestic manufacturing of related machinery and equipment.

- Components

- First component: It will focus on research, development and innovation with an outlay of Rs. 1,000 crores.

- The research will be at both fiber level and application-based in geo, agro, medical, sports and mobile textiles and the development of biodegradable technical textiles.

- Research activities will also focus on the development of indigenous machinery and process equipment.

- Second component: It will be for the promotion and development of the market for technical textiles.

- The penetration level of technical textiles is low in India varying between 5-10% against the level of 30-70% in developed countries.

- The Mission will aim at an average growth rate of 15-20% per annum by 2024.

- Third component: It will focus on export promotion so that technical textile exports from the country reach from Rs 14,000 crores to Rs 20,000 crores by 2021-2022 and ensure 10% average growth every year till the Mission ends.

- An export promotion council for technical textiles will be set up.

- Fourth component: It will focus on education, training and skill development.

- The Mission will promote technical education at higher engineering and technology levels related to technical textiles and its application areas.

- Scenario of Textile sector

- The growth of technical textiles in India has gained momentum in the past five years, currently growing at an 8% per annum rate.

- It aims to hasten this growth to the 15-20% range during the next five years.

- Indian Technical Textiles segment is estimated at USD 16 Billion which is approximately 6% of the 250 billion USD global technical textiles market.

- The biggest players are the USA, western Europe, China and Japan (20-40% share).

- Implementation & Governance

- The mission will be implemented via a three-tier institutional mechanism which will consist of the following:

- Mission Steering Group: The group will be authorized to approve all financial norms with respect to schemes, components and programme of the mission.

- The group will also be entrusted with the responsibility of approving all scientific and technological research projects under the mission.

- Empowered Programme Committee: The committee will be required to approve all projects (except research projects) within the financial limits of various programs as approved by the Mission Steering Group.

- The committee will also be entrusted with the responsibility of monitoring the implementation of various components of the mission.

- Committee on Technical Textiles on Research, Development & Innovation: This committee will be responsible for the identification and recommendation of research projects to the Mission Steering Group for approval.

- These projects will be related to strategic sectors such as space, security, defence, para-military, and atomic energy.

What are the Other Initiatives Related to Technical Textile?

- Production Linked Incentive (PLI) Scheme for Textiles Sector: It aims to promote the production of high-value Man-Made Fiber (MMF) fabrics, garments and technical textiles.

- Harmonized System of Nomenclature (HSN) Codes for Technical Textile: In 2019, the Government of India dedicated 207 HSN codes to technical textiles to help in monitoring the data of import and export, in providing financial support and other incentives to manufacturers.

- 100% FDI under Automatic Route: The Government of India allows 100% Foreign Direct Investment (FDI) under the automatic route. International technical textile manufacturers such as Ahlstrom, Johnson & Johnson etc have already initiated operations in India.

- Technotex India: It is a flagship event organized by the Ministry of Textiles, in collaboration with Federation of Indian Chambers of Commerce & Industry (FICCI) and comprises exhibitions, conferences and seminars with the participation of stakeholders from across the global technical textile value chain.

- Amended Technology Upgradation Fund Scheme: To improve exports and indirectly promote investments in textile machinery.

|

38 videos|5264 docs|1112 tests

|

FAQs on Economic Development: September 2022 Current Affairs - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly - UPSC

| 1. What is the Scheme Special Assistance to States for Capital Investment? |  |

| 2. How does India becoming the world's 5th largest economy impact its economic development? |  |

| 3. What does the fall in India's Foreign Exchange Reserve indicate? |  |

| 4. What is a windfall tax and how can it impact economic development? |  |

| 5. How does renewable energy contribute to job creation and economic development? |  |