Important Questions & Answers: Introduction to Accounting Standards | Advanced Accounting for CA Intermediate PDF Download

AS-1 Disclosure of Accounting Policies

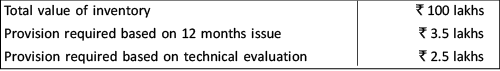

Q1: (i) ABC Ltd. was making provision for non-moving inventories based on no issues for the last 12 months u p to 31.3.2019.

The company wants to provide during the year ending 31.3.2020 based on technical evaluation:

Does this amount to change in Accounting Policy? Can the company change the method of provision?

Ans: The decision of making provision for non-moving inventories on the basis of technical evaluation doe s not amount to change in accounting policy. Accounting policy of a company may require that provision for non-moving inventories should be made. The method of estimating the amount of provision may be changed in case a more prudent estimate can be made. In the given case, considering the total value of inventory, the change in the amount of required provision of non-moving inventory from ₹ 3.5 lakhs to ₹ 2.5 lakhs is also not material. The disclosure can be made for such change in the following lines by way of notes to the accounts in the annual accounts of ABC Ltd. for the year 2019-20:

“The company has provided for non-moving inventories on the basis of technical evaluation unlike preceding years. Had the same method been followed as in the previous year, the profit for the year and the corresponding effect on the year end net assets would have been lower by ₹ 1 lakh.”

(ii) State whether the following statements are ‘True’ or ‘False’. Also give reason for your answer.

(a) Certain fundamental accounting assumptions underline the preparation and presentation of financial statements. They are usually specifically stated because their acceptance and use are not assumed.

(b) If fundamental accounting assumptions are not followed in presentation and preparation of financial statements, a specific disclosure is not required.

(c) All significant accounting policies adopted in the preparation and presentation of financial statements should form part of the financial statements.

(d) Any change in an accounting policy, which has a material effect should be disclosed. Where the amount by which any item in the financial statements is affected by such change is not ascertainable, wholly or in part, the fact need not to be indicated.

Ans: (a) False: As per AS 1 “Disclosure of Accounting Policies”, certain fundamental accounting assumptions underlie the preparation and presentation of financial statements. They are usually not specifically stated because their acceptance and use are assumed. Disclosure is necessary if they are not followed.

(b) False: As per AS 1, if the fundamental accounting assumptions, viz. Going Concern, Consistency and Accrual are followed in financial statements, specific disclosure is not required. If a fundamental accounting assumption is not followed, the fact should be disclosed.

(c) True: To ensure proper understanding of financial statements, it is necessary that all significant accounting policies adopted in the preparation and presentation of financial statements should be disclosed. The disclosure of the significant accounting policies as such should form part of the financial statements and they should be disclosed in one place.

(d) False: Any change in the accounting policies which has a material effect in the current period or which is reasonably expected to have a material effect in later periods should be disclose.

Q2: "Accounting Standards standardize diverse accounting policies with a view to eliminate the noncomparability of financial statements and improve the reliability of financial statements. "Discuss and explain the benefits of Accounting Standards.

Ans: Accounting Standards standardize diverse accounting policies with a view to eliminate the noncomparability of financial statements and improve the reliability of financial statements. Accounting Standards provide a set of standard accounting policies, valuation norms and disclosure requirements.

Accounting standards aim at improving the quality of financial reporting by promoting comparability, consistency and transparency, in the interests of users of financial statements.

The following are the benefits of Accounting Standards:

(i) Standardization of alternative accounting treatments: Accounting Standards reduce to a reasonable extent confusing variations in the accounting treatment followed for the purpose of preparation of financial statements.

(ii) Requirements for additional disclosures: There are certain areas where important is not statutorily required to be disclosed. Standards may call for disclosure beyond that required by law.

(iii) Comparability of financial statements: The application of accounting standards would facilitate comparison of financial statements of different companies situated in India and facilitate comparison, to a limited extent, of financial statements of companies situated in different parts of the world.

However, it should be noted in this respect that differences in the institutions, traditions and legal systems from one country to another give rise to differences in Accounting Standards adopted in different countries.

Q3: What are the issues, with which Accounting Standards deal?

Ans: Accounting Standards deal with the issues of:

(i) Recognition of events and transactions in the financial statements,

(ii) Measurement of these transactions and events,

(iii) Presentation of these transactions and events in the financial statements in a manner that is meaningful and understandable to the reader, and

(iv) Disclosure requirements.

Q4: What are the three fundamental accounting assumptions recognized by Accounting Standard (AS) 1? Briefly describe each one of them.

Ans: Accounting Standard (AS) 1 recognizes three fundamental accounting assumptions.

These are as follows:

(i) Going Concern: The financial statements are normally prepared on the assumption that an enterprise will continue its operations in the foreseeable future and neither there is intention, nor there is need to materially curtail the scale of operations.

(ii) Consistency: The principle of consistency refers to the practice of using same accounting policies for similar transactions in all accounting periods unless the change is required

(a) by a statute,

(b) by an accounting standard or

(c) for more appropriate presentation of financial statements.

(iii) Accrual basis of accounting: Under this basis of accounting, transactions are recognised as soon as they occur, whether or not cash or cash equivalent is actually received or paid.

Q5: The draft results of Surya Ltd. for the year ended 31st March, 2020, prepared on the hitherto followed accounting policies and presented for perusal of the board of directors showed a deficit of ₹10 crores. The board in consultation with the managing director, decided to value year-end inventory at works cost (₹ 50 crores) instead of the hitherto method of valuation of inventory at prime cost (₹ 30 crores). As chief accountant of the company, you are asked by the managing director to draft the notes on accounts for inclusion in the annual report for 2019-2020.

Ans: As per AS 1, any change in the accounting policies which has a material effect in the current period or which is reasonably expected to have a material effect in later periods should be disclosed. In the case of a change in accounting policies which has a material effect in the current period, the amount by which any item in the financial statements is affected by such change should also be disclosed to the extent ascertainable. Where such amount is not ascertainable, wholly or in part, the fact should be indicated. Accordingly, the notes on accounts should properly disclose the change and its effect.

Notes on Accounts:

“During the year inventory has been valued at factory cost, against the practice of valuing it at prime cost as was the practice till last year. This has been done to take cognizance of the more capital intensive method of production on account of heavy capital expenditure during the year. As a result of this change, the year -end inventory has been valued at ₹ 50 crores and the profit for the year is increased by ₹ 20 crores.”

Q6: In the books of Rani Ltd., closing inventory as on 31.03.2020 amounts to ₹ 1,75,000 (valued on the basis of FIFO method). The Company decides to change from FIFO method to weighted average method for ascertaining the costs of inventory from the year 2019-20. On the basis of weighted average method, closing inventory as on 31.03.2020 amounts to ₹ 1,59,000.

Realizable value of the inventory as on 31.03.2020 amounts to ₹ 2,07 ,000. Discuss disclosure requirements of change in accounting policy as per AS 1.

Ans: As per AS 1 “Disclosure of Accounting Policies”, any change in an accounting policy which has a material effect should be disclosed in the financial statements. The amount by which any item in the financial statements is affected by such change should also be disclosed to the extent ascertainable. Where such amount is not ascertainable, wholly or in part, the fact should be indicated. Thus Rani Ltd. should disclose the change in valuation method of inventory and its effect on financial statements. The company may disclose the change in accounting policy in the following manner:

“The company values its inventory at lower of cost and net realizable value. Since net realizable value of all items of inventory in the current year was greater than respective costs, the company valued its inventory at cost. In the present year i.e. 2019-20, the company has changed to weighted average method, which better reflects the consumption pattern of inventory, for ascertaining inventory costs from the earlier practice of using FIFO for the purpose. The change in policy has reduced current profit and value of inventory by ₹ 16,000 (1,75,000 – 1,59,000).”

Q7: “Accounting Standards standardize diverse accounting policies with a view to eliminate the noncomparability of financial statements and improve the reliability of financial statements.” Discuss and explain the benefits of Accounting Standards.

Ans: Accounting Standards standardize diverse accounting policies with a view to eliminate the noncomparability of financial statements and improve the reliability of financial statements. Accounting Standards provide a set of standard accounting policies, valuation norms and disclosure requirements.

Accounting standards aim at improving the quality of financial reporting by promoting comparability, consistency and transparency, in the interests of users of financial statements.

The following are the benefits of Accounting Standards:

(i) Standardization of alternative accounting treatments: Accounting Standards reduce to a reasonable extent confusing variations in the accounting treatment followed for the purpose of preparation of financial statements.

(ii) Requirements for additional disclosures: There are certain areas where important is not statutorily required to be disclosed. Standards may call for disclosure beyond that required by law.

(iii) Comparability of financial statements: The application of accounting standards would facilitate comparison of financial statements of different companies situated in India and facilitate comparison, to a limited extent, of financial statements of companies situated in different parts of the world. However, it should be noted in this respect that differences in the institutions, traditions and legal systems from one country to another give rise to differences in Accounting Standards adopted in different countries.

Q8: List the Criteria for classification of non-corporate entities as level I Entities for the purpose of application of Accounting Standards as per the Institute of Chartered Accountants of India.

Ans: Criteria for classification of non-corporate entities as level 1 entities for purpose of application of Accounting Standards decided by the Institute of Chartered Accountants of India is given below.

Non-corporate entities which fall in any one or more of the following categories, at the end of the relevant accounting period, are classified as Level I entities:

(i) Entities whose equity or debt securities are listed or are in the process of listing on any stock exchange, whether in India or outside India.

(ii) Banks (including co-operative banks ), financial institutions or entities carrying on insurance business.

(iii) All commercial, industrial and business reporting entities, whose turnover (excluding other income) exceeds rupees fifty crore in the immediately preceding accounting year.

(iv) All commercial, industrial and business reporting entities having borrowings (including public deposits) in excess of rupees ten crore at any time during the immediately preceding accounting year.

(v) Holding and subsidiary entities of any one of the above.

Q9: (i) ABC Ltd. was previously making provision for non-moving stocks based on stocks not issued for the las t 12 months up to 31.03.2020. Now, the company wants to make provisions based on technical evaluation during the year ending 31.03.2021.

Total value of stock ₹ 133.75 lakhs

Provision required based on technical evaluation ₹ 4.00 lakhs

Provision required based on 12 months not issued ₹ 5.00 lakhs.

Ans: The decision of making provision for non-moving inventories on the basis of technical evaluation doe s not amount to change in accounting policy. Accounting policy of a company may require that provision for non-moving inventories should be made. The method of estimating the amount of provision may be changed in case a more prudent estimate can be made.

In the given case, considering the total value of inventory, the change in the amount of required provision of non-moving inventory from ₹ 5 lakhs to ₹ 4 lakhs is also not material.

The disclosure can be made for such change in the following lines by way of notes to the accounts in the annual accounts of ABC Ltd. for the year 2020 -21:

“The company has provided for non-moving inventories on the basis of technical evaluation unlike preceding years. Had the same method been followed as in the previous year, the profit for the year and the corresponding effect on the year end net assets would have been lower by ₹ 1 lakh.”.

(ii) In the Books of Kay Ltd., Closing stock as on 31st March, 2021 amounts to ₹ 1,24,000 (on the basis of FIFO method)

The company decides to change from FIFO method to weighted average method for ascertaining the cost of inventory from the year 2020-2021. On the basis of weighted average method, closing stock as on 31st March, 2021 amounts to ₹ 1,15,000. Realisable value of the inventory as on 31st March, 2021 amounts to ₹ 1,54,000.

Discuss Disclosure Requirements of change in accounting policy in above cases as per AS 1.

Ans: As per AS 1 “Disclosure of Accounting Policies”, any change in an accounting policy which has a material effect should be disclosed in the financial statements. The amount by which any item in the financial statements is affected by such change should also be disclosed to the extent ascertainable. Where such amount is not ascertainable, wholly or in part, the fact should be indicated. Thus company should disclose the change in valuation method of inventory and its effect on financial statements.

The company may disclose the change in accounting policy in the following manner:

“The company values its inventory at lower of cost and net realizable value. Since net realizable value of all items of inventory in the current year was greater than respective costs, the company valued its inventory at cost. In the present year i.e. 2020-21, the company has changed to weighted average method, which better reflects the consumption pattern of inventory, for ascertaining inventory costs from the earlier practice of using FIFO for the purpose. The change in policy has reduced current profit and value of inventory by ₹ 9,000.”

Q10: Answer any four of the following:

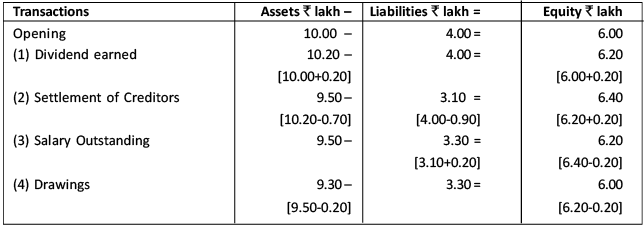

Mrs. A is showing the consolidated aggregate opening balance of equity, liabilities and assets of ₹ 6 lakh, 4 lakh and 10 lakh respectively. During the current year Mrs. A has the following transactions:

1. Received 20% dividend on 10,000 equity shares of ₹ 10 each held as investment.

2. The amount of ₹ 70,000 is paid to creditors for settlement of ₹ 90,000.

3. Salary is pending by ₹ 20,000.

4. Mrs. A’s drawing ₹ 20,000 for her personal use.

You are required to prepare the statement of the effect of aforesaid each transaction on closing balance sheet in the form of Assets – Liabilities = Equity after each transaction.

Ans: Effect of each transaction on Balance sheet of Mrs. A is shown below:

Q11: HIL Ltd. was making provision for non-moving stocks based on no issues having occurred for the last 12 months upto 31.03.2019. The company now wants to change it and make provision based on technical evaluation during the year ending 31.03.2020. Total value of stock on 31.03.20 is ₹ 120 lakhs. Provision required based on technical evaluation amounts ₹ 3.00 lakhs. However, provision required based on 12 months (no issues) is ₹ 4.00 lakhs. You are required to discuss the following points in the light of Accounting Standard (AS)-1:

(i) Does this amount to change in accounting policy?

(ii) Can the company change the method of accounting?

(iii) Explain how it will be disclosed in the annual accounts of HIL Ltd. for the year 2019-20.

Ans: The decision of making provision for non-moving inventories on the basis of technical evaluation doe s not amount to change in accounting policy. Accounting policy of a company may require that provision for non-moving inventories should be made but the basis for making provision will not constitute accounting policy. The method of estimating the amount of provision may be changed in case a more prudent estimate can be made.

In the given case, considering the total value of inventory, the change in the amount of required provision of non-moving inventory from ₹ 4 lakhs to ₹ 3 lakhs is also not material.

The disclosure can be made for such change in the following lines by way of notes to the accounts in the annual accounts of HIL Ltd. for the year 2019-20 in the following manner:

“The company has provided for non-moving inventories on the basis of technical evaluation unlike preceding years. Had the same method been followed as in the previous year, the profit for the year and the value of net assets at the end of the year would have been lower by ₹1 lakh.”

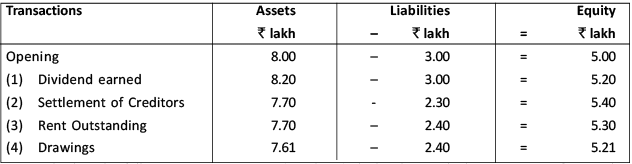

Q12: Opening Balance Sheet of Mr. A is showing the aggregate value of assets, liabilities and equity ₹ 8 lakh, ₹ 3 lakh and ₹ 5 lakh respectively. During accounting period, Mr. A has the following transactions:

(1) Earned 10% dividend on 2,000 equity shares held of ₹ 100 each

(2) Paid ₹ 50,000 to creditors for settlement of ₹ 70,000

(3) Rent of the premises is outstanding ₹ 10,000

(4) Mr. A withdrew ₹ 9,000 for his personal use.

You are required to show the effect of above transactions on Balance Sheet in the form of Assets Liabilities = Equity after each transaction.

Ans: Effects of each transaction on Balance sheet of Mr. A is shown below:

Q13: State whether the following statements are ‘ True’ or ‘False’ in line with the provisions of AS-1 Also give reason for your answer.

(i) Certain fundamental accounting assumptions underline the preparation and presentation of financial statements. They are usually specifically stated because their acceptance and use are not assumed.

Ans: False: As per AS 1 “Disclosure of Accounting Policies”, certain fundamental accounting assumptions underlie the preparation and presentation of financial statements. They are usually not specifically stated because their acceptance and use are assumed. Disclosure is necessary if they are not followed.

(ii) If fundamental accounting assumptions are not followed in presentation and preparation of financial statements, a specific disclosure is not required.

Ans: False: As per AS 1, if the fundamental accounting assumptions, viz. Going Concern, Consistency and Accrual are followed in financial statements, specific disclosure is not required. If a fundamental accounting assumption is not followed, the fact should be disclosed.

(iii) All significant accounting policies adopted in the preparation and presentation of financial statements should form part of the financial statements.

Ans: True: To ensure proper understanding of financial statements, it is necessary that all significant accounting policies adopted in the preparation and presentation of financial statements should be disclosed. The disclosure of the significant accounting policies as such should form part of the financial statements and they should be disclosed at one place.

(iv) Any change in an accounting policy, which has a material effect should be disclosed. Where the amount by which any item in the financial statements is affected by such change is not ascertainable, wholly or in part, the fact need not to be indicated.

Ans: False: Any change in the accounting policies which has a material effect in the current period or which is reasonably expected to have a material effect in later periods should be disclosed. Where such amount is not ascertainable, wholly or in part, the fact should be indicated.

(v) There is no single list of accounting policies which are applicable to all circumstances.

Ans: True: As per AS 1, there is no single list of accounting policies which are applicable to all circumstances.

The differing circumstances in which enterprises operate in a situation of diverse and complex economic activity make alternative accounting principles and methods of applying those principles acceptable.

AS-2 Valuation of Inventories

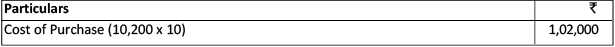

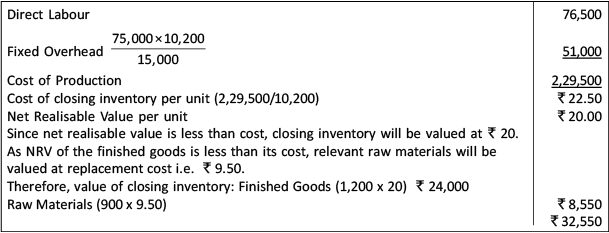

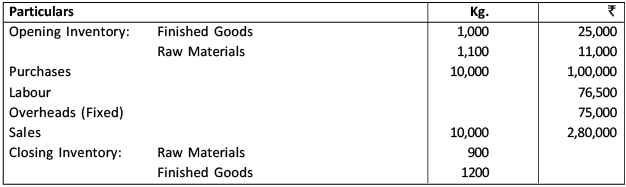

Q1: The expected production for the year was 15,000 kg of the finished product. Due to fall in market demand the sales price for the finished goods was ₹ 20 per kg and the replacement cost for the raw material was ₹ 9.50 per kg on the closing day. You are required to calculate the closing inventory as on that date.

The expected production for the year was 15,000 kg of the finished product. Due to fall in market demand the sales price for the finished goods was ₹ 20 per kg and the replacement cost for the raw material was ₹ 9.50 per kg on the closing day. You are required to calculate the closing inventory as on that date.

Ans: Calculation of cost for closing inventory:

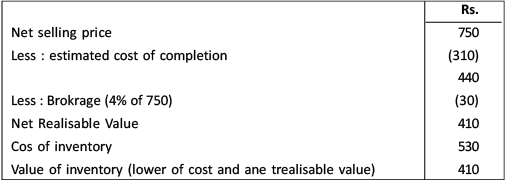

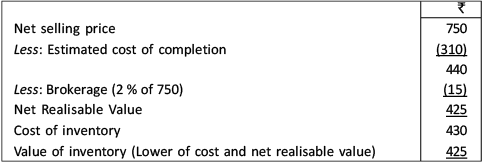

Q2: On 31st March 2017, a business firm finds that cost of a partly finished unit on that date is Rs.530 . The unit can be finished in 2017-18 by an additional expenditure of Rs.310. The finished unit can be sold for Rs.750 subject to payment of 4% brokerage on selling price. The firm seeks your advice regarding the amount at which the unfinished unit should be valued as at 31st March, 2017 for preparation of final accounts. Assume that the partly finished unit cannot be sold in semi finished form and its NRV is zero without processing it further.

Ans: Valuation of unfinished unit:

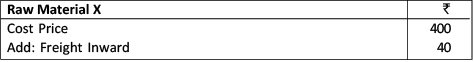

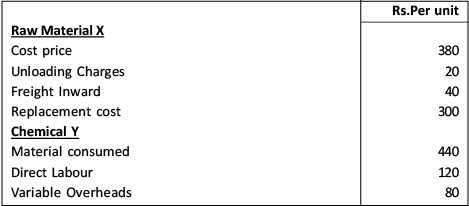

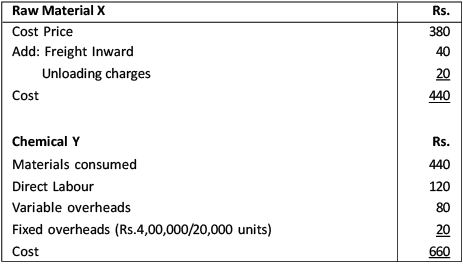

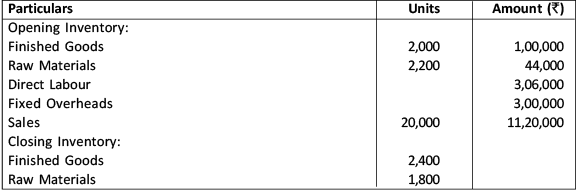

Q3: A Limited is engaged in manufacturing of Chemical Y for which Raw Material X is required. The company provides you following information for the year ended 31st March, 2017. Additional Information:

Additional Information:

(i) Total fixed overhead for the year was Rs. 4,00,000 on normal capacity of 20,000 units.

(ii) Closing balance of Raw Material X was 1,000 units and Chemical Y was Rs. 2,400 units.

You are required to calculate the total value of closing stock of Raw Material X and Chemical Y according to AS 2, when

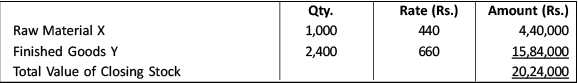

(i) Net realizable value of Chemical Y is Rs.800 per unit

(ii) Net realizable value of Chemical Y is Rs.600 per unit.

Ans: (i) When Net Realizable Value of the Chemical Y is Rs.800 per unit

NRV is greater than the cost of Finished Goods Y i.e. Rs.660 (Refer W.N.) Hence, Raw Material and Finished Goods are to be valued at cost.

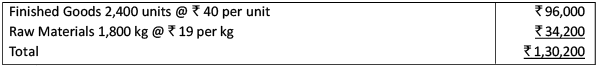

Value of Closing Stock:

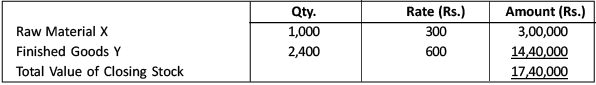

(ii) When Net Realizable Value of the Chemical Y is Rs. 600 per unit

NRV is less than the cost of Finished Goods Y i.e. Rs. 660. Hence, Raw Material is to be valued at replacement cost and Finished Goods are to be valued at NRV since NRV is less than the cost.

Value of Closing Stock:

Working Note: Statement showing cost calculation of Raw material X and Chemical Y

Q4: Hello Ltd. purchased goods at the cost of ₹ 20 lakhs in October. Till the end of the financial year, 75% of the stocks were sold. The Company wants to disclose closing stock at ₹ 5 lakhs. The expected sale value is ₹ 5.5 lakhs and a commission at 10% on sale is payable to the agent. You are required to ascertain the value of closing stock?

Ans: As per para 5 of AS 2 “Valuation of Inventories”, the inventories are to be valued at lower of cost or net realizable value.

In this case, the cost of inventory is ₹ 5 lakhs. The net realizable value is ₹ 4.95 lakhs (₹ 5.5 lakhs less cost to make the sale @ 10% of ₹ 5.5 lakhs). So, the closing stock should be valued at ₹ 4.95 lakhs.

Q5: A private limited company manufacturing fancy terry towels had valued its closing inventory of inventories of finished goods at the realizable value, inclusive of profit and the export cash incentives.

Firm contracts had been received and goods were packed for export, but the ownership in these goods had not been transferred to the foreign buyers.

You are required to advise the company on the valuation of the inventories in line with the provisions of AS 2.

Ans: Accounting Standard 2 "Valuation of Inventories" states that inventories should be valued at lower of historical cost and net realizable value. The standard states, "at certain stages in specific industries, such as when agricultural crops have been harvested or mineral ores have been extracted, performance may be substantially complete prior to the execution of the transaction generating revenue. In such cases, when sale is assured under forward contract or a government guarantee or when market exists and there is a negligible risk of failure to sell, the goods are often valued at net realizable value at certain stages of production."

Terry Towels do not fall in the category of agricultural crops or mineral ores. Accordingly, taking into account the facts stated, the closing inventory of finished goods (Fancy terry towel) should have been valued at lower of cost and net realizable value and not at net realizable value. Further, export incentives are recorded only in the year the export sale takes place. Therefore, the policy adopted by the company for valuing its closing inventory of inventories of finished goods is not correct.

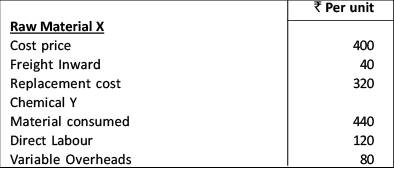

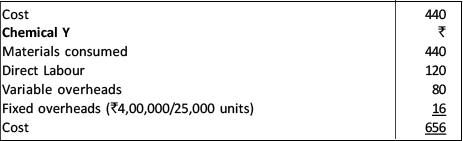

Q6: A Limited is engaged in manufacturing of Chemical Y for which Raw Material X is required. The company provides you following information for the year ended 31st March, 2020. Additional Information:

Additional Information:

(i) Total fixed overhead for the year was ₹ 4,00,000 on normal capacity of 25,000 units.

(ii) Closing balance of Raw Material X was 1,000 units and Chemical Y was 2,400 units.

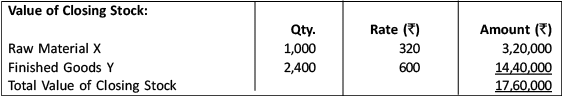

You are required to calculate the total value of closing stock of Raw Material X and Chemical Y according to AS 2, when Net realizable value of Chemical Y is ₹ 600 per unit.

Ans: Net Realizable Value of the Chemical Y (Finished Goods) is ₹ 600 per unit which is less than its cost ₹ 656 per unit. Hence, Raw Material is to be valued at replacement cost and Finished Goods are to be valued at NRV since NRV is less than the cost.

Working Note: Statement showing cost calculation of Raw material X and Chemical Y:

Q7: On 31st March 2020, a business firm finds that cost of a partly finished unit on that date is ₹ 430. The unit can be finished in 2020-21 by an additional expenditure of ₹ 310. The finished unit can be sold for ₹ 750 subject to payment of 2% brokerage on selling price. The firm seeks your advice regarding the amount at which the unfinished unit should be valued as at 31st March, 2020 for preparation of final accounts. Assume that the partly finished unit cannot be sold in semi-finished form and its NRV is zero without processing it further.

Ans: Valuation of unfinished unit

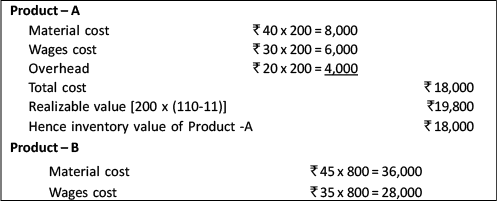

Q8: The inventory of Rich Ltd. as on 31st March, 2020 comprises of Product – A: 200 units and Product – B: 800 units.

Details of cost for these products are:

Product – A: Material cost, wages cost and overhead cost of each unit are ₹ 40, ₹ 30 and ₹ 20 respectively, Each unit is sold at ₹ 110, selling expenses amounts to 10% of selling costs.

Product – B: Material cost and wages cost of each unit are ₹ 45 and ₹ 35 respectively and normal selling rate is ₹ 150 each, however due to defect in the manufacturing process 800 units of Product-B were expected to be sold at ₹ 70.

You are requested to value closing inventory according to AS 2 after considering the above.

Ans: According to AS 2 ‘Valuation of Inventories’, inventories should be valued at the lower of cost and net realizable value.

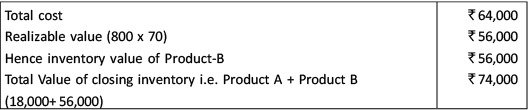

Q9: Joy Ltd. purchased 20,000 kilograms of Raw Material @ ₹ 20 per kilogram during the year 2020-21. They have furnished you with the following further information for the year ended 31st March, 2021: The plant has a capacity to produce 30,000 units of finished product per annum. However, the actual production of finished products during the year 2020-21 was 20,400 units. Due to a fall in the market demand, the price of the finished goods in which the raw material has been utilized is expected to be sold @ ₹ 40 per unit. The replacement cost of the raw material was ₹ 19 per kilogram.

The plant has a capacity to produce 30,000 units of finished product per annum. However, the actual production of finished products during the year 2020-21 was 20,400 units. Due to a fall in the market demand, the price of the finished goods in which the raw material has been utilized is expected to be sold @ ₹ 40 per unit. The replacement cost of the raw material was ₹ 19 per kilogram.

You are required to ascertain the value of closing inventory as at 31st March, 2021 as per AS 2.

Ans: Statement Showing the Computation of Value of Closing Inventory

Value of Closing Finished Goods:

Since net realizable value is less than cost, closing inventory of Finished Goods will be valued at ₹ 40 per unit

Value of Closing Raw Materials:

As NRV of finished goods is less than its cost, the relevant raw material will be valued at its replacement cost, which is the best available measure of its NRV i.e. @ ₹ 19 per kg.

Therefore, value of closing inventory would be as under:Working Note: Calculation of raw material consumed during the year

Q10: Mr. Jatin gives the following information relating to the items forming part of the inventory as on 31.03.2019. His enterprise produces product P using Raw Material X.

(i) 900 units of Raw Material X (purchases @ ₹ 100 per unit). Replacement cost of Raw Material X as on 3103.2019 is ₹ 80 per unit

(ii) 400 units of partly finished goods in the process of producing P. Cost incurred till date is ₹ 245 per unit. These units can be finished next year by incurring additional cost of ₹ 50 per unit.

(iii) 800 units of Finished goods P and total cost incurred is ₹ 295 per unit.

Expected selling price of product P is ₹ 280 per unit, subject to a payment of 5% brokerage on selling price.

Determine how each item of inventory will be valued as on 31.03.2019.

Also calculate the value of total Inventory as on 31.03.2019.

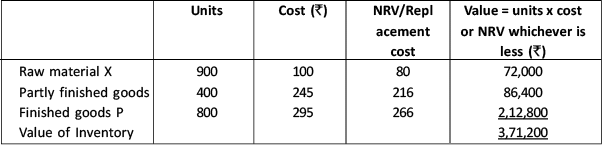

Ans: As per AS 2 (Revised) “Valuation of Inventories”, materials and other supplies held for use in the production of inventories are not written down below cost if the finished products in which they will be incorporated are expected to be sold at cost or above cost. However, when there has been a decline in the price of materials and it is estimated that the cost of the finished products will exceed net realizable value, the materials are written down to net realizable value. In such circumstances, the replacement cost of the materials may be the best available measure of their net realizable value. In the given case, selling price of product P is ₹ 266 and total cost per unit for production is ₹ 295.

Hence the valuation will be done as under:

(i) 900 units of raw material X will be written down to replacement cost as market value of finished product is less than its cost, hence valued at ₹ 80 per unit.

(ii) 400 units of partly finished goods will be valued at 216 per unit i.e., lower of cost (₹ 245) or Net realizable value ₹ 216 (Estimated selling price ₹ 266 per unit less additional cost of ₹ 50).

(iii) 800 units of finished product P will be valued at NRV of ₹ 266 per unit since it is lower than cost ₹ 295.

Valuation of Total Inventory as on 31.03.2019:

Q11: “In determining the cost of inventories, it is appropriate to exclude certain costs and recognize them as expenses in the period in which they are incurred”. Provide examples of such costs as per AS 2 ₹ Valuation of Inventories’.

Ans: As per AS 2 “Valuation of Inventories , certain costs are excluded from the cost of the inventories and are recognised as expenses in the period in which incurred.

Examples of such costs are:(a) abnormal amount of wasted materials, labour, or other production costs;

(b) storage costs, unless those costs are necessary in the production process prior to a further production stage;

(c) administrative overheads that do not contribute to bringing the inventories to their present location and condition; and

(d) selling and distribution costs.

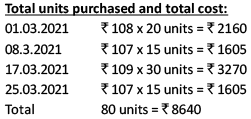

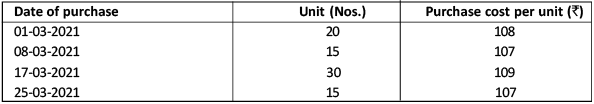

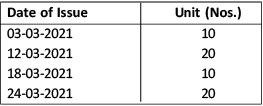

Q12: On the basis of information given below, find the value of inventory (by periodic inventory method) as per AS 2, to be considered while preparing the Balance Sheet as on 31st March, 2021 on weighted Average Basis.

Details of Purchases: Details of issue of Inventory:

Details of issue of Inventory: Net realizable value of inventory as on 31st March, 2021 is ₹ 107.75 per unit.

Net realizable value of inventory as on 31st March, 2021 is ₹ 107.75 per unit.

You are required to compute the value of Inventory as per AS 2?

Ans: Net Realizable Value of Inventory as on 31st March, 2021

= ₹ 107.75 x 20 units = ₹ 2,155

Value of inventory as per Weighted Average basis

Weighted Average Cost = ₹ 8640/80 units = ₹ 108

Total cost = ₹ 108 x 20 units = ₹ 2,160

Value of inventory to be considered while preparing Balance Sheet as on 31st March, 2021 is, Cost or Net Realisable value whichever is lower i.e. ₹ 2,155.

Q13: Rohan Pvt. Ltd., a wholesaler in agriculture products, has valued the inventory on Net Realizable Value on the ground that AS 2 does not apply to inventory of agriculture products.

Ans: AS 2 does not apply to producers of agricultural products but applies to traders in agricultural pro ducts. Hence AS 2 will apply to Rohan Pvt. Ltd. and it will have to value inventory at lower of cost or market value.

Q14: In a production process, normal waste is 5% of input. 5,000 MT of input were put in process resulting in wastage of 300 MT. Cost per MT of input is ₹ 1,000. The entire quantity of waste and finished output is in stock at the year end. State with reference to Accounting Standard, how will you value the inventories in this case? What will be treatment for normal and abnormal waste?

Ans: As per AS 2 (Revised), abnormal amounts of wasted materials, labour and other production costs are excluded from cost of inventories and such costs are recognized as expenses in the period in which they are incurred.

In this case, normal waste is 250 MT and abnormal waste is 50 MT. The cost of 250 MT will be included in determining the cost of inventories (finished goods) at the year end. The cost of abnormal waste (50 MT x 1,052.6315 = ₹ 52,632) will be charged to the profit and loss statement.

Cost per MT (Normal Quantity of 4,750 MT) = 50,00,000 / 4,750 = ₹ 1,052.6315

Total value of inventory = 4,700 MT x ₹ 1,052.6315 = ₹ 49,47,368.

AS-3 Cash Flow Statement

Q1: Classify the following activities as (1) Operating Activities, (2) Investing Activities, (3) Financing Activities (4) Cash Equivalents.

a. Proceeds from long-term borrowings.

b. Proceeds from Trade receivables.

c. Trading Commission received.

d. Redemption of Preference Shares.

e . Proceeds from sale of investment

f. Interim Dividend paid on equity shares.

g. Interest received on debentures held as investment.

h. Dividend received on shares held as investments.

i . Rent received on property held as investment.

j . Dividend paid on Preference shares.

k. Marketable Securities

Ans: Operating Activities: b, c.

Investing Activities: e, g, h, i.

Financing Activities: a, d, f, j.

Cash Equivalent: k.

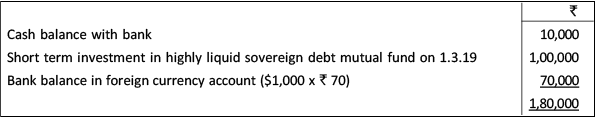

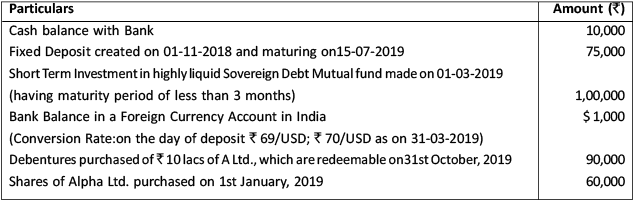

Q2: What do you mean by the term “cash and cash equivalent” as per AS 3? From the following information of XYZ Limited, calculate cash and cash equivalent as on 31-03-2019.

Ans: As per AS 3, Cash and cash equivalents consists of: (i) Cash in hand and deposits repayable on demand with any bank or other financial institutions and (ii) Cash equivalents, which are short term, highly liquid investments that are readily convertible into known amounts of cash and are subject to insignificant risk or change in value. A short-term investment is one, which is due for maturity within three months from the date of acquisition. Investments in shares are not normally taken as cash equivalent, because of uncertainties associated with them as to realizable value.

Computation of Cash and Cash Equivalents as on 31st March, 2019.

Note: Fixed deposit, Shares and Debentures will not be considered as cash and cash equivalents.

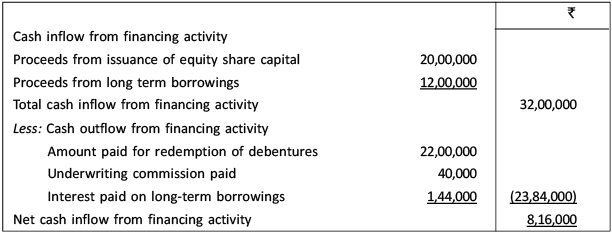

Q3: From the following information, prepare the Cash Flow from Financing activities as per AS 3 ‘Cash Flow Statements’ as the accountant of XYZ Limited is not able to decide and seeks your advice:

(i) Received ₹ 4,00,000 as redemption of short-term deposit

(ii) Proceeds of ₹ 20,00,000 from issuance of equity share capital

(iii) Received interest of ₹ 70,000 on Govt. bonds.

(iv) An amount of ₹ 13,00,000 incurred for purchase of goodwill

(v) Proceeds of ₹ 5,00,000 from sale of patent.

(vi) Proceeds of ₹ 12,00,000 from long term borrowing.

(vii) Amount paid for redemption of debentures of ₹ 22,00,000

(viii) Underwriting commission of ₹ 40,000 paid on issue of equity share capital

(ix) Interest of ₹ 1,44,000 paid on long-term borrowing.

Ans: Statement showing Cash Flow from Financing Activities

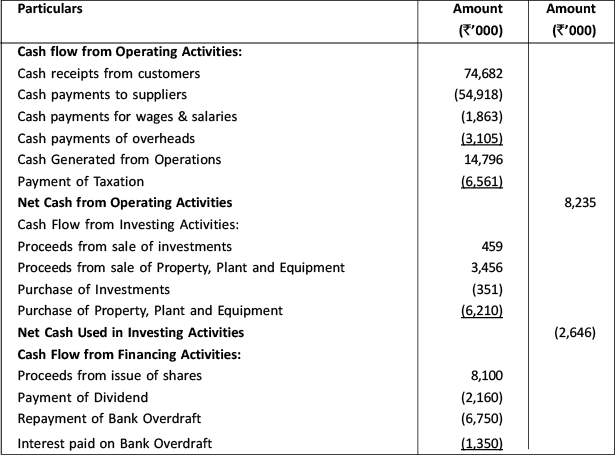

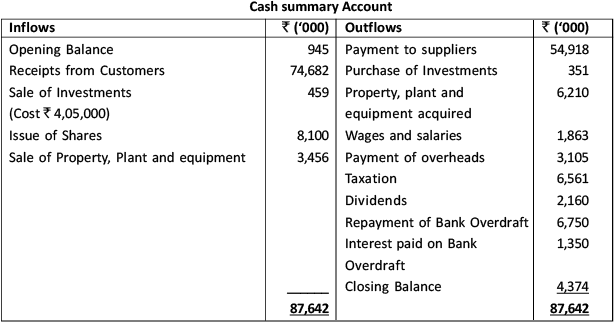

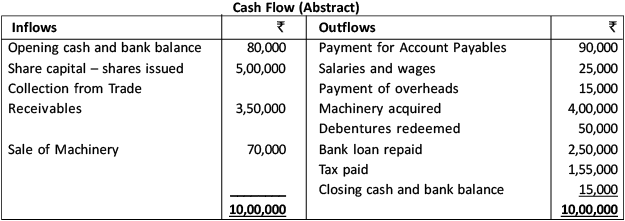

Q4: Prepare cash flow statement of Gama Limited for the year ended 31st March, 2021 in accordance with AS-3(Revised) from the following cash account summary:

Ans: Gama Limited

Cash Flow Statement

For the Year Ended 31st March 2021

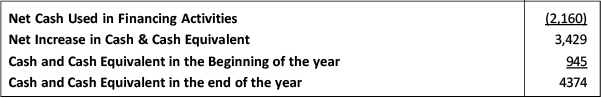

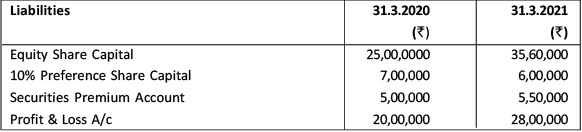

Q5: Equity Share Capital for the year ended 31st March, 2021 includes ₹ 60,000 of equity shares issued to Grey Ltd. at par for supply of Machinery of ₹ 60,000.

Equity Share Capital for the year ended 31st March, 2021 includes ₹ 60,000 of equity shares issued to Grey Ltd. at par for supply of Machinery of ₹ 60,000.

Profit & Loss account on 31st March, 2021 includes ₹ 50,000 of dividend received on Equity shares invested in X Ltd.

Show how the related items will appear in the Cash Flow Statement of ABC Ltd. as per AS-3 (Revised)

Ans: The related items given in the question will appear in the Cash Flow Statement of ABC Limited for the year ended 31st March, 2021 as follows:

Note:

(i) Machinery acquired by issue of shares does not amount to cash outflow, hence also not considered in the cash flow statement.

(ii) ABC Ltd. has been considered as a non-financial company in the given answer.

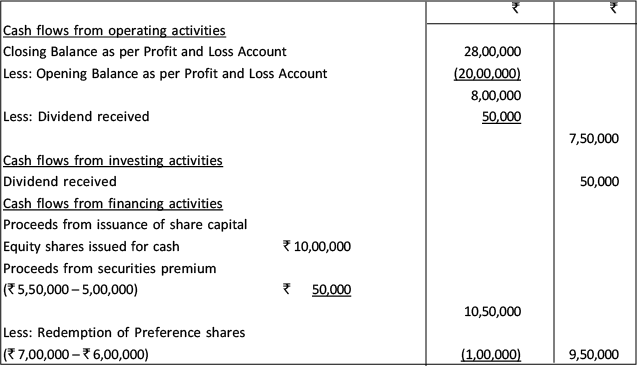

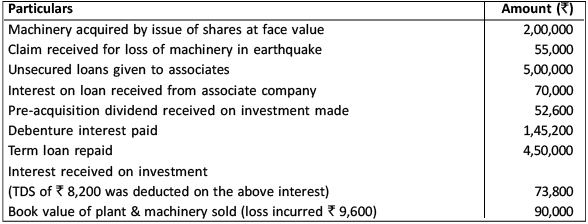

Q6: Prepare cash flow from investing activities as per AS 3 of Subham Creative Limited for year ended 31.3.2021.

Ans: Cash Flow Statement from Investing Activities of Subham Creative Limited for year ended 31-03-2019

Note:

(i) Debenture interest paid and Term Loan repaid are financing activities and therefore not considered for preparing cash flow from investing activities.

(ii) Machinery acquired by issue of shares does not amount to cash outflow, hence also not considered in the above cash flow statement.

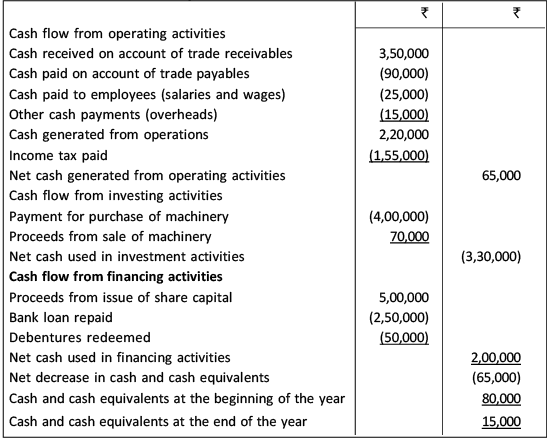

Q7: Following is the cash flow abstract of Alpha Ltd. for the year ended 31st March, 2021: Prepare Cash Flow Statement for the year ended 31st March, 2021 in accordance with AS 3.

Prepare Cash Flow Statement for the year ended 31st March, 2021 in accordance with AS 3.

Ans: Cash Flow Statement for the year ended 31.3.2021

AS-10 Property, Plant and Equipment

Q1: (a) Entity A has a policy of not providing for depreciation on PPE capitalized in the year until the following year, but provides for a full year’s depreciation in the year of disposal of an asset. Is this acceptable?

(b) Entity A purchased an asset on 1st January 2016 for ₹ 1,00,000 and the asset had an estimated useful life of 10 years and a residual value of nil. On 1st January 2020, the directors review the estimated life and decide that the asset will probably be useful for a further 4 years. Calculate the amount of depreciation for each year, if company charges depreciation on Straight Line basis

(c) The following items are given to you:

Items

(1) Costs of testing whether the asset is functioning properly, after deducting the net proceeds from selling any items produced while bringing the asset to that location and condition (such as samples produced when testing equipment);

(2) Costs of conducting business in a new location or with a new class of customer (including costs of staff training);

(3) Any costs directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management

(4) Costs of opening a new facility or business, such as, inauguration costs;

(5) Purchase price, including import duties and non–refundable purchase taxes, after deducting trade discounts and rebates.

With reference to AS 10 “Property, Plant and Equipment”, classify the above items under the following heads

HEADS

(i) Purchase Price of PPE

(ii) Directly attributable cost of PPE or

(iii) Cost not included in determining the carrying amount of an item of PPE.

Ans: (a) The depreciable amount of a tangible fixed asset should be allocated on a systematic basis over its useful life. The depreciation method should reflect the pattern in which the asset’s future economic benefits are expected to be consumed by the entity. Useful life means the period over which the asset is expected to be available for use by the entity. Depreciation should commence as soon as the asset is acquired and is available for use. Thus, the policy of Entity A is not acceptable.

(b) The entity has charged depreciation using the straight-line method at ₹ 10,000 per annum i.e (1,00,000/ 10 years). On 1st January 2020, the asset’s net book value is [1,00,000 – (10,000 x 4)] = ₹ 60,000.

The remaining useful life is 4 years. The company should amend the annual provision for depreciation to charge the unamortized cost over the revised remaining life of four years. Consequently, it should charge depreciation for the next 4 years at ₹ 15,000 per annum i.e. (60,000 / 4 years). Depreciation is recognized even if the Fair value of the Asset exceeds its Carrying Amount. Repair and maintenance of an asset do not negate the need to depreciate it.

(c) (1) Costs of testing whether the asset is functioning properly, after deducting the net proceeds from selling any items produced while bringing the asset to that location and condition (such as samples produced when testing equipment) will be classified as “Directly attributable cost of PPE”.

(2) Costs of conducting business in a new location or with a new class of customer (including costs of staff training) will be classified under head (iii) as it will not be included in determining the carrying amount of an item of PPE.

(3) Any costs directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management will be included in determination of Purchase Price of PPE

(4) Costs of opening a new facility or business, such as, inauguration costs will be classified under head (iii) as it will not be included in determining the carrying amount of an item of PPE.

(5) Purchase price, including import duties and non–refundable purchase taxes, after deducting trade discounts and rebates will be included in determination of Purchase Price of PPE.

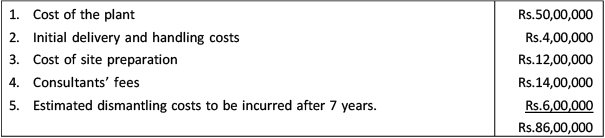

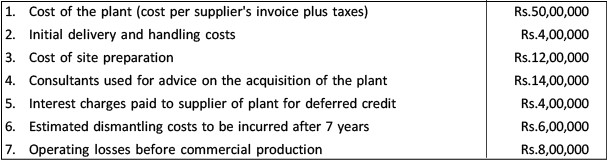

Q2: Preet Ltd. is installing a new plant at its production facility. It has incurred these costs: Please advise Preet Ltd. on the costs that can be capitalised in accordance with AS 10 (Revised).

Please advise Preet Ltd. on the costs that can be capitalised in accordance with AS 10 (Revised).

Ans: According to As 10 (Revised), these costs can be capitalised:

Note: Interest charges paid on "Deferred credit terms" to the supplier of the plant (not a qualifying asset) of Rs.4,00,000 and operating losses before commercial production amounting to Rs.8,00,000 are not regarded as directly attributable costs and thus cannot be capitalised. They should be written off to the Statement of Profit and Loss in the period they are incurred.

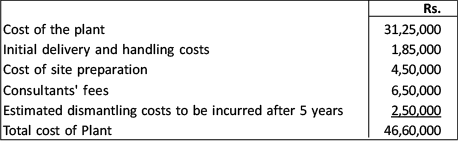

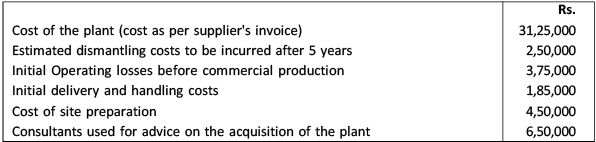

Q3: ABC Ltd. is installing a new plant at its production facility. It provides you the following information: You are required to compute the costs that can be capitalised for plant by ABC Ltd., in accordance with AS 10: Property, Plant and Equipment.

You are required to compute the costs that can be capitalised for plant by ABC Ltd., in accordance with AS 10: Property, Plant and Equipment.

Ans: According to AS 10 on Property, Plant and Equipment, the costs which will be capitalized by ABC Ltd. :

Note: Operating losses before commercial production amounting to Rs.3,75,000 will not be capitalized as per AS 10. They should be written off to the Statement of Profit and Loss in the period they are incurred.

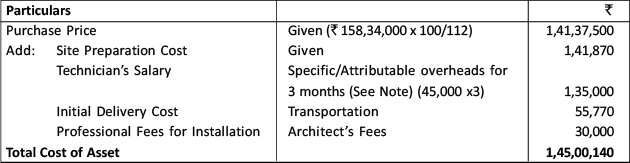

Q4: Shrishti Ltd. contracted with a supplier to purchase machinery which is to be installed in its Department A in three months' time. Special foundations were required for the machinery which were to be prepared within this supply lead time. The cost of the site preparation and laying foundations were ₹ 1,41,870. These activities were supervised by a technician during the entire period, who is employed for this purpose of ₹ 45,000 per month. The technician's services were given by Department B to Department A, which billed the services at ₹ 49,500 per month after adding 10% profit margin.

The machine was purchased at ₹ 1,58,34,000 inclusive of IGST @ 12% for which input credit is available to Shrishti Ltd. ₹ 55,770 transportation charges were incurred to bring the machine to the factory site.

An Architect was appointed at a fee of ₹ 30,000 to supervise machinery installation at the factory site. Ascertain the amount at which the Machinery should be capitalized under AS 10 considering that IGST credit is availed by the Shristhi Limited. Internally booked profits should be eliminated in arriving at the cost of machine.

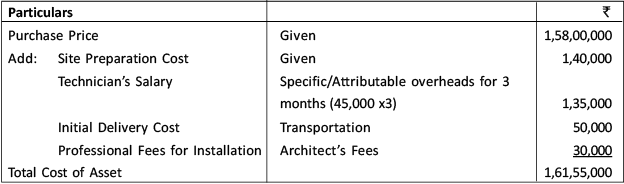

Ans: Calculation of Cost of Fixed Asset (i.e. Machinery)

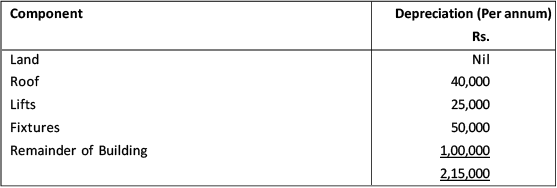

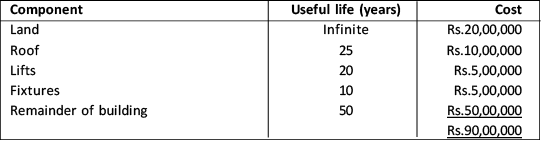

Q5: In the year 2016-17, an entity has acquired a new freehold building with a useful life of 50 years for Rs.90,00,000. The entity desires to calculate the depreciation charge per annum using a straight-line method. It has identified the following components (with no residual value of lifts & fixtures at the end of their useful life) as follows: You are required to calculate depreciation for the year 2016-17 as per componentization method.

You are required to calculate depreciation for the year 2016-17 as per componentization method.

Ans: Statement showing amount of depreciation as per Componentization Method

Note: When the roof requires replacement at the end of its useful life the carrying amount will be nil. The cost of replacing the roof should be recognized as a new component.

Q6: (i) Entity A carried plant and machinery in its books at ₹2,00,000 which were destroyed in a fire. These machines were insured ₹New for old’ and were replaced by the insurance company with new machines of fair value ₹20,00,000. The old destroyed machines were acquired by the insurance company and the company did not receive any cash compensation. State, how Entity A should account for the same?

(ii) Omega Ltd, a supermarket chain, is renovating one of its major stores. The store will have more available space for store promotion outlets after the renovation and will include a restaurant. Management is preparing the budgets for the year after the store reopens, which include the cost of remodelling and the expectation of a 15% increase in sales resulting from the store renovations, which will attract new customers.

Decide whether Omega Ltd. can capitalize the remodelling cost or not as per provisions of AS 10 “Property plant & Equipment”.

Ans: (i) Entity A should account for a loss in the Statement of Profit and Loss on de-recognition of the carrying value of plant and machinery in accordance with AS 10 on Property, Plant and Equipment. Entity A should separately recognize a receivable and a gain in the income statement resulting from the insurance proceeds once receipt is virtually certain. The receivable should be measured at the fair value of assets provided by the insurer.

(ii) The expenditure in remodelling the store will create future economic benefits (in the form of 15% of increase in sales). Moreover, the cost of remodelling can be measured reliably, therefore, it should be capitalized in line with AS 10.

Q7: Omega Ltd. contracted with a supplier to purchase machinery which is to be installed in its one department in three months’ time. Special foundations were required for the machinery which were to be prepared within this supply lead time. The cost of the site preparation and laying foundations were ₹ 1,40,000. These activities were supervised by a technician during the entire period, who is employed for this purpose at ₹ 45,000 per month.

The machine was purchased at ₹ 1,58,00,000 and ₹ 50,000 transportation charges were incurred to bring the machine to the factory site. An Architect was appointed at a fee of ₹ 30,000 to supervise machinery installation at the factory site.

You are required to ascertain the amount at which the Machinery should be capitalized under AS 10.

Ans: Calculation of Cost of Machinery:

Q8: A property costing ₹ 10,00,000 is bought on 1.4.2020. Its estimated total physical life is 50 years. However, the company considers it likely that it will sell the property after 25 years.

The estimated residual value in 25 years’ time, based on current year prices, is:

Case (a) ₹ 10,00,000

Case (b) ₹ 9,00,000

You are required to compute the amount of depreciation charged for the year ended 31.3.2021.

Ans: Case (a): The company considers that the residual value, based on prices prevailing at the balance sheet date, will equal the cost.

There is, therefore, no depreciable amount and depreciation is zero.

Case (b): The company considers that the residual value, based on prices prevailing at the balance sheet date, will be ₹ 9,00,000 and the depreciable amount is, therefore, ₹ 1,00,000.

Q9: You are required to give the correct accounting treatment for the following in line with provisions of AS 10:

Trozen Ltd. operates a major chain of supermarkets all over India. It acquires a new store in Pune which requires significant renovation expenditure. It is expected that the renovations will be done in 2 months during which the store will be closed. The budget for this period, including expenditure related to construct ion and remodelling costs (₹ 18 lakhs), salaries of staff (₹ 2 lakhs) who will be preparing the store before its opening and related utilities costs (₹ 1.5 lakhs), is prepared. The cost of salaries of the staff and utilities are operating expenditures that would be incurred even after the opening of the supermarket. What will the treatment of all these expenditures in the books of accounts?

Ans: Trozen Ltd. should capitalize the costs of construction and remodelling the supermarket, because they are necessary to bring the store to the condition necessary for it to be capable of operating in the manner intended. The supermarket cannot be opened without incurring the remodelling expenditure.

Therefore, this construction and remodelling expenditure of ₹ 18 lakh should be considered as part of the cost of the asset. However, the cost of salaries of the staff ₹ 2 lakh and utilities cost ₹ 1.5 lakh are operating expenditures that would be incurred even after the opening of the supermarket. Therefore, these costs are not necessary to bring the store to the condition necessary for it to be capable of operating in the manner intended by the management and should be expensed.

Q10: ABC Ltd is setting up a new refinery outside the city limits. In order to facilitate the construction of the refinery and its operations, ABC Ltd. is required to incur expenditure on the construction/development of railway siding, road and bridge. Though ABC Ltd. incurs the expenditure on the construction/ development, it will not have ownership rights on these items and they are also available for use to other entities and public at large. Can ABC Ltd. capitalize expenditure incurred on these items as property, plant and equipment (PPE)?

Ans: AS 10 states that the cost of an item of property, plant and equipment shall be recognized as an asset if, and only if:

(a) it is probable that future economic benefits associated with the item will flow to the entity; and

(b) the cost of the item can be measured reliably.

Further, the standard provides that the standard does not prescribe the unit of measure for recognition, i.e., what constitutes an item of property, plant and equipment. Thus, judgement is required in applying the recognition criteria to an entity’s specific circumstances. The cost of an item of property, plant and equipment comprise any costs directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management.

In the given case, railway siding, road and bridge are required to facilitate the construction of the refinery and for its operations. Expenditure on these items is required to be incurred in order to get future economic benefits from the project as a whole which can be considered as the unit of measure for the purpose of capitalization of the said expenditure even though the company cannot restrict the access of others for using the assets individually. It is apparent that the aforesaid expenditure is directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management.

In view of this, even though ABC Ltd. may not be able to recognize expenditure incurred on these assets as an individual item of property, plant and equipment in many cases (where it cannot restrict others from using the asset), expenditure incurred may be capitalized as a part of overall cost of the project. From this, it can be concluded that, in the given case the expenditure incurred on these assets, i.e., railway siding, road and bridge, should be considered as the cost of constructing the refinery and accordingly, expenditure incurred on these items should be allocated and capitalized as part of the items of property, plant and equipment of the refinery.

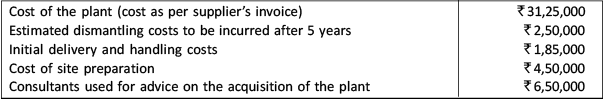

Q11: Arush Ltd. is installing a new plant in its factory. It provides you the following information: You are required to advise Arush Ltd. on the costs that can be capitalised for plant in accordance with AS 10 ‘Property, Plant and Equipment’.

You are required to advise Arush Ltd. on the costs that can be capitalised for plant in accordance with AS 10 ‘Property, Plant and Equipment’.

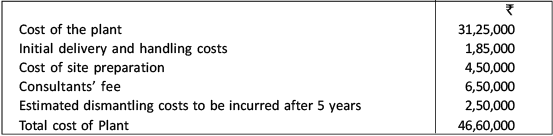

Ans: According to AS 10 ‘Property, Plant and Equipment’, following costs will be capitalized by Arush Ltd .:

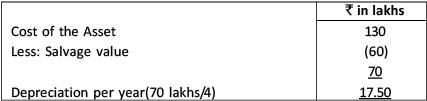

Q12: Darshan Ltd. purchased a Machinery on 1st April, 2016 for ₹ 130 lakhs (Useful life is 4Years). Government grant received is ₹ 40 lakhs for the purchase of above Machinery.

Salvage value at the end of useful life is estimated at ₹ 60 lakhs.

Darshan Ltd. decides to treat the grant as deferred income.

Your are required to calculate the amount of depreciation and grant to be recognized in profit & loss account for the year ending 31st March, 2017, 31st March, 2018, 31st March, 2019 & 31st March, 2020.

Darshan Ltd. follows straight line method for charging depreciation.

Ans: As per 12 “Accounting for government grants”, grants related to depreciable assets, if treated as deferred income are recognized in the profit and loss statement on a systematic and rational basis over the useful life of the asset.

Amount of depreciation and grant to be recognized in the profit and loss account each year Depreciation per year:

₹ 17.50 Lakhs depreciation will be recognized for the year ending 31st March, 2017, 31st March, 2018, 31st March, 2019 and 31st March, 2020.

Amount of grant recognized in Profit and Loss account each year :

40 lakhs /4 years = ₹ 10 Lakhs for the year ending 31st March, 2017, 31st March, 2018, 31st March, 2019 and 31st March, 2020.

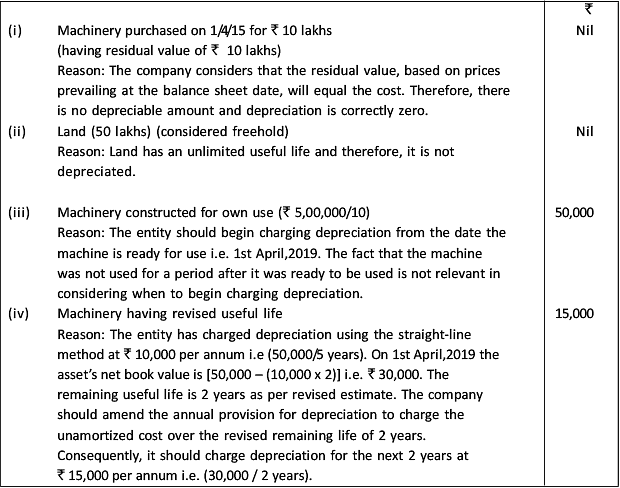

Q13: A Ltd. had following assets. Calculate depreciation for the year ended 31st March, 2020 for each asset as per AS 10 (Revised):

(i) Machinery purchased for ₹ 10 lakhs on 1st April, 2015 and residual value after useful life of 5 years, based on 2015 prices is ₹ 10 lakhs.

(ii) Land for ₹ 50 lakhs.

(iii) A Machinery is constructed for ₹ 5,00,000 for its own use (useful life is 10 years). Construction is completed on 1st April, 2019, but the company does not begin using the machine until 31st March, 2020.

(iv) Machinery purchased on 1st April.2017 for ₹ 50,000 with useful life of 5 years and residual value is NIL. On 1st April, 2019, management decided to use this asset for further 2 years only.

Ans: Computation of amount of depreciation as per AS 10

Q14: A Ltd. has incurred the following costs. Determine if the following costs can be added to the invoiced purchase price and included in the initial recognition of the cost of the item of property, plant and equipment:

1. Import duties paid

2. Shipping costs and cost of road transport for taking the machinery to factory

3. Insurance for the shipping

4. Inauguration costs for the factory

5. Professional fees charged by consulting engineer for the installation process

6. Costs of advertising and promotional activities

7. Administration and other general overhead costs

8. Cost of site preparation.

Ans: Included in Cost: Point no. 1, 2, 3, 5, 8

Excluded from Cost: Point no. 4, 6, 7

Q15: Mohan Ltd. has an existing freehold factory property, which it intends to knock down and redevelop.

During the redevelopment period the company will move its production facilities to another (temporary) site.

The details of the incremental costs which will be incurred are: Setup costs of ₹ 5,00,000 to install machinery in the new location; Rent of ₹ 15,00,000; Removal costs of ₹ 3,00,000 to transport the machinery from the old location to the temporary location.

Mohan Ltd. wants to seek your guidance as whether these costs can be capitalized into the cost of the new building. You are required to advise in line with AS 10 “Property, Plant and Equipment”.

Ans: Constructing or acquiring a new asset may result in incremental costs that would have been avoided if the asset had not been constructed or acquired. These costs are not be included in the cost of the asset if they are not directly attributable to bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management. The costs to be incurred by the company are in the nature of costs of reducing or reorganizing the operations of the company. These costs do not meet that requirement of AS 10 “Property, Plant and Equipment” and cannot, therefore, be capitalized.

Q16: (i) Entity A carried plant and machinery in its books at ₹ 2,00,000 which were destroyed in a fire. These machines were insured ‘New for old’ and were replaced by the insurance company with new machines of fair value ₹ 20,00,000. The old destroyed machines were acquired by the insurance company and the company did not receive any cash compensation. State, how Entity A should account for the same?

(ii) Omega Ltd, a supermarket chain, is renovating one of its major stores. The store will have more available space for store promotion outlets after the renovation and will include a restaurant. Management is preparing the budgets for the year after the store reopens, which include the cost of remodelling and the expectation of a 15% increase in sales resulting from the store renovations, which will attract new customers.

Decide whether Omega Ltd. can capitalize the remodelling cost or not as per provisions of AS 10 “Property Plant & Equipment”.

Ans: (i) Entity A should account for a loss in the Statement of Profit and Loss on de-recognition of the carrying value of plant and machinery in accordance with AS 10 on Property, Plant and Equipment. Entity A should separately recognize a receivable and a gain in the income statement resulting from the insurance proceeds once receipt is virtually certain. The receivable should be measured at the fair value of assets provided by the insurer.

(ii) The expenditure in remodelling the store will create future economic benefits (in the form of 15% of increase in sales). Moreover, the cost of remodelling can be measured reliably, therefore, it should be capitalized in line with AS 10.

Q17: ABC Ltd. has entered into a binding agreement with XYZ Ltd. to buy a custom-made machine amounting to ₹ 4,00,000. As on 31st March, 2021 before delivery of the machine, ABC Ltd. had to change its method of production. The new method will not require the machine ordered and so it shall be scrapped after delivery. The expected scrap value is ‘NIL’. Show the treatment of machine in the books of ABC Ltd.

Ans: A liability is recognized when outflow of economic resources in settlement of a present obligation c an be anticipated and the value of outflow can be reliably measured. In the given case, ABC Ltd. should recognize a liability of ₹ 4,00,000 payable to XYZ Ltd. When flow of economic benefit to the enterprise beyond the current accounting period is considered improbable, the expenditure incurred is recognized as an expense rather than as an asset. In the present case, flow of future economic benefit from the machine to the enterprise is improbable. The entire amount of purchase price of the machine should be recognized as an expense. Hence ABC Ltd. should charge the amount of ₹ 4,00,000 (being loss due to change in production method) to Profit and loss statement and record the corresponding liability (amount payable to XYZ Ltd.) for the same amount in the books for the year ended 31st March, 2021.

AS-11 The Effects of Changes in Foreign Exchange Rates

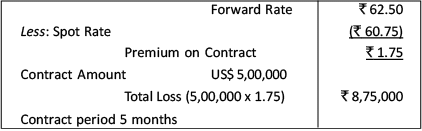

Q1: (i) AXE Limited purchased fixed assets costing $ 5,00,000 on 1st Jan. 2018 from an American company M/ s M&M Limited. The amount was payable after 6 months. The company entered into a forward contract on 1st January 2018 for five months @ ₹ 62.50 per dollar. The exchange rate per dollar was as follows:

On 1st January, 2018 ₹ 60.75 per dollar

On 31st March, 2018 ₹ 63.00 per dollar

You are required to state how the profit or loss on forward contract would be recognized in the books of AXE Limited for the year ending 2017-18, as per the provisions of AS 11.

(ii) Assets and liabilities and income and expenditure items in respect of integral foreign operations are translated into Indian rupees at the prevailing rate of exchange at the end of the year. The resultant exchange differences in the case of profit, is carried to other Liabilities Account and the Loss, if any, is charged to revenue. You are required to comment in line with AS 11.

Ans: (i) As per AS 11 “The Effects of Changes in Foreign Exchange Rates”, an enterprise may enter into a forward exchange contract to establish the amount of the reporting currency required, the premium or discount arising at the inception of such a forward exchange contract should be amortized as expenses or income over the life of the contract.

3 months falling in the year 2017-18; therefore loss to be recognized in 2017-18 (8,75,000/5) x 3 = ₹ 5,25,000. Rest ₹ 3,50,000 will be recognized in the following year 2018-19.

(ii) Financial statements of an integral foreign operation (for example, dependent foreign branches) should be translated using the principles and procedures described in paragraphs 8 to 16 of AS 11 (Revised 2003). The individual items in the financial statements of a foreign operation are translated as if all its transactions had been entered into by the reporting enterprise itself. Individual items in the financial statements of the foreign operation are translated at the actual rate on the date of transaction. The foreign currency monetary items (for example cash, receivables, payables) should be reported using the closing rate at each balance sheet date. Non-monetary items (for example, fixed assets, inventories, investments in equity shares) which are carried in terms of historical cost denominated in a foreign currency should be reported using the exchange date at the date of transaction. Thus the cost and depreciation of the tangible fixed assets is translated using the exchange rate at the date of purchase of the asset if asset is carried at cost. If the fixed asset is carried at fair value, translation should be done using the rate existed on the date of the valuation. The cost of inventories is translated at the exchange rates that existed when the cost of inventory was incurred and realizable value is translated applying exchange rate when realizable value is determined which is generally closing rate. Exchange difference arising on the translation of the financial statements of integral foreign operation should be charged to profit and loss account.

Thus, the treatment by the management of translating all assets and liabilities; income and expenditure items in respect of foreign branches at the prevailing rate at the year end and also the treatment of resultant exchange difference is not in consonance with AS 11 (Revised 2003).

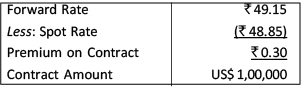

Q2: Rau Ltd. purchased a plant for US$ 1,00,000 on 01st February 2016, payable after three months. Company entered into a forward contract for three months @ Rs.49.15 per dollar. Exchange rate per dollar on 01st Feb. was Rs.48.85. How will you recognise the profit or loss on forward contract in the books of Rau Ltd.?

Ans:

Two falling the year 2016-17; therefore loss to be recognised (30,000/3) x 2 = Rs.20,000. Rest Rs.10,000 will be recognised in the following year.

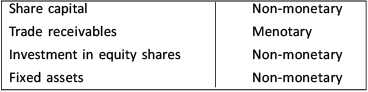

Q3: (i) Classify the following items as monetary or non-monetary item:

Share Capital

Trade Receivables

Investment in Equity shares

Fixed Assets.

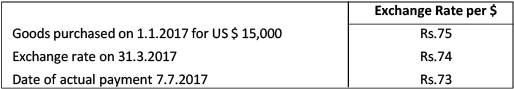

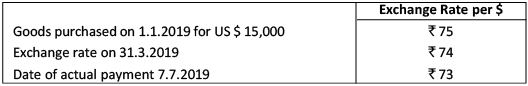

(ii) You are required to ascertain the loss/gain for financial years 2016-17 and 2017-18, also give their treatment as per AS 11.

You are required to ascertain the loss/gain for financial years 2016-17 and 2017-18, also give their treatment as per AS 11.

Ans:

(i)

(ii) As per AS 11 on The Effects of Changes in Foreign Exchange Rates', all foreign currency transactions should be recorded by applying the exchange rate on the date of transactions. Thus, goods purchased on 1.1.2017 and corresponding creditor would be recorded at Rs 11,25,000 (i.e. $15,000 x Rs. 75)

According to the standard, at the balance sheet date all monetary transactions should be reported using the closing rate. Thus, creditors of US $15,000 on 31.3.2017 will be reported at Rs. 11,10,000 (i.e. $15,000 x Rs. 74) and exchange profit of Rs. 15,000 (i.e. 11,25,000 - 11,10,000) should be credited to Profit and Loss account in the year 2016-17.

On 7.7.2017, creditors of $15,000 is paid at the rate of Rs.73. As per AS 11, exchange difference on settlement of the account should also be transferred to Profit and Loss account. Therefore, Rs.15,000 (i.e. 11,10,000 - 10,95,000) will be credited to Profit and Loss account in the year 2017-18.

Q4: (i) Trade receivables as on 31.3.2019 in the books of XYZ Ltd. include an amount receivable from Umesh ₹ 5,00,000 recorded at the prevailing exchange rate on the date of sales, i.e. at US $ 1= ₹ 58.50. US $ 1 = ₹ 61.20 on 31.3.2019.

Explain briefly the accounting treatment needed in this case as per AS 11 as on 31.3.2019.

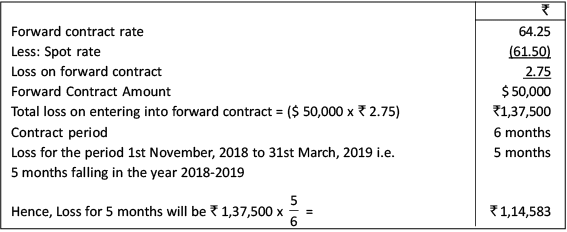

(ii) Power Track Ltd. purchased a plant for US$ 50,000 on 31st October, 2018 payable after 6 months. The company entered into a forward contract for 6 months @₹ 64.25 per Dollar. On 31st October, 2018, the exchange rate was ₹ 61.50 per Dollar.

You are required to recognise the profit or loss on forward contract in the books of the company for the year ended 31st March, 2019.

Ans:

(i) As per AS 11 “The Effects of Changes in Foreign Exchange Rates”, exchange differences arising on the settlement of monetary items or on reporting an enterprise’s monetary items at rates different from those at which they were initially recorded during the period, or reported in previous financial statements, should be recognized as income or as expenses in the period in which they arise.

Accordingly, exchange difference on trade receivables amounting ₹ 23,076 {₹ 5,23,076(US $ 8547* x ₹ 61.20) less ₹ 5,00,000} should be charged to profit & Loss account.

(ii) Calculation of profit or loss to be recognized in the books of Power Track Limited:

Thus, the loss amounting to ₹ 1,14,583 for the period is to be recognized in the year ended 31st March, 2019.

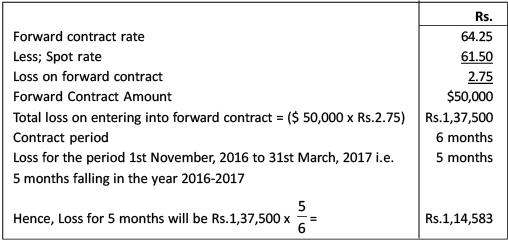

Q5: Power Track Ltd. purchased a plant for US$ 50,000 on 31st October, 2016 payable after 6 months. The company entered into a forward contract for 6 months @ Rs.64.25 per Dollar. On 31st October, 2016, the exchange rate was Rs.61.50 per Dollar.

You are required to calculate the amount of the profit or loss on forward contract to be recognized in the books of the company for the year ended 31st March, 2017.

Ans: Calculation of profit or loss to be recognized in the books of Power Track Limited:

Thus, the loss amounting to Rs. 1,14,583 for the period is to be recognized in the year ended 31st March, 2017.

Q6: Om Ltd. purchased an item of property, plant and equipment for US $ 50 lakh on 01.04.2019 and the same was fully financed by the foreign currency loan [US $] repayable in five equal instalments annually. (Exchange rate at the time of purchase was 1 US $ = ₹ 60]. As on 31.03.2020 the first instalment was paid when 1 US $ fetched ₹ 62.00. The entire loss on exchange was included in cost of goods sold. Om Ltd. normally provides depreciation on an item of property, plant and equipment at 20% on WDV basis and exercised the option to adjust the cost of asset for exchange difference arising out of loan restatement and payment. Calculate the amount of exchange loss, its treatment and depreciation on this item of property, plant and equipment.

Ans: Exchange differences arising on restatement or repayment of liabilities incurred for the purpose of acquiring an item of property, plant and equipment should be adjusted in the carrying amount of the respective item of property, plant and equipment as Om Ltd. has exercised the option and it is long term foreign currency monetary item. Thus, the entire exchange loss due to variation of ₹ 20 lakh on 31.03.2020 on payment of US $ 10 lakh, should be added to the carrying amount of an item of property, plant and equipment and not to the cost of goods sold. Further, depreciation on the unamortized depreciable amount should also be provided.

Calculation of Exchange loss:

Foreign currency loan (in ₹) = (50 lakh $ x ₹ 60) = ₹ 3,000 lakh

Exchange loss on outstanding loan on 31.03.2020 = ₹ 40 lakh US $ x (62.00-60.00) = ₹ 80 lakh. So, ₹ 80 lakh should also be added to cost of an item of property, plant and equipment with corresponding credit to outstanding loan in addition to ₹ 20 lakh on account of exchange loss on payment of instalment. The total cost of an item of property, plant and equipment to be increased by ₹ 100 lakh. Total depreciation to be provided for the year 2019 - 2020 = 20% of (₹ 3,000 Iakh + 100 lakh) = ₹ 620 lakh.

Q7: Classify the following items as monetary or non-monetary item:

Share Capital

Trade Receivables

Investment in Equity shares

Fixed Assets.

Ans: Share capital-Non-monetary

Trade receivables-Monetary

Investment in equity shares-Non-monetary

Fixed assets-Non-monetary

Q8: You are required to ascertain the loss/gain to be recognized for financial years 2018-19 and 2019-20 as per AS 11.

You are required to ascertain the loss/gain to be recognized for financial years 2018-19 and 2019-20 as per AS 11.

Ans: As per AS 11 on ‘The Effects of Changes in Foreign Exchange Rates’, all foreign currency transactions should be recorded by applying the exchange rate on the date of transactions. Thus, goods purchased on 1.1.2019 and corresponding creditors would be recorded at ` 11,25,000 (i.e. $15,000 × ₹ 75)

According to the standard, at the balance sheet date all monetary transactions should be reported using the closing rate. Thus, creditors of US $15,000 on 31.3.2019 will be reported at ₹ 11,10,000 (i.e. $15,000 × ₹ 74) and exchange profit of ₹ 15,000 (i.e. 11,25,000 – 11,10,000) should be credited to Profit and Loss account in the year 2018-19.

On 7.7.2019, creditors of $15,000 is paid at the rate of ₹ 73. As per AS 11, exchange difference on settlement of the account should also be transferred to Profit and Loss account. Therefore, ₹ 15,000 (i.e. 11,10,000 – 10,95,000) will be credited to Profit and Loss account in the year 2019-20.

Q9: Mona Ltd. purchased a plant for US$ 1,00,000 on 01st December 2020, payable after three months.

Company entered into a forward contract for three months @ ₹ 49.15 per dollar. Exchange rate per dollar on 01st December was ₹ 48.85. How will you recognize the profit or loss on forward contract in the books of Mona Ltd for the year ended 31st March, 2021?

Ans:

Total Loss (1,00,000 x 0.30) ₹ 30,000 to be recognized in year ended 31.3.2021.

Q10: Classify the following items into Monetary and Non-monetary:

(i) Share capital;

(ii) Trade Payables;

(iii) Cash balance;

(iv) Property, plant and equipment

Ans: (i) Share capital - Non-monetary;

(ii) Trade Payables - Monetary

(iii) Cash balance – Monetary;

(iv) Property, plant and equipment - Non-monetary

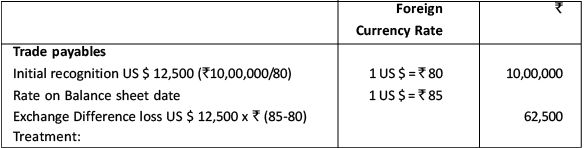

Q11: Trade payables of CAT Ltd. include amount payable to JBB Ltd., ₹ 10,00,000 recorded at the prevailing exchange rate on the date of transaction, transaction recorded at US $1 = ₹ 80.00. The exchange rate on balance sheet date (31.03.2020) was US $1 = ₹ 85.00. You are required to calculate the amount of exchange difference and also explain the accounting treatment needed for this as per AS 11 in the books of CAT Ltd.

Ans: Amount of Exchange difference and its Accounting Treatment:

Debit Profit and Loss A/c by ₹ 62,500 and Credit Trade Payables

Thus, Exchange Difference on trade payables amounting ₹ 62,500 is required to be transferred to Profit and Loss.

Q12: Shan Builders Limited has borrowed a sum of US $ 10,00,000 at the beginning of Financial Year 2019-2 0 for its residential project at 4 %. The interest is payable at the end of the Financial Year. At the time of availment, exchange rate was ₹ 56 per US $ and the rate as on 31st March, 2020 ₹ 62 per US $. If Shan Builders Limited had borrowed the loan in India in Indian Rupee equivalent, the pricing of loan would have been 10.50%. You are required to compute Borrowing Cost and exchange difference for the year ending 31st March, 2020 as per applicable Accounting Standards.

Ans: (i) Interest for the period 2019-20

= US $ 10 lakhs x 4% × ₹ 62 per US $ = ₹ 24.80 lakhs

(ii) Increase in the liability towards the principal amount

= US $ 10 lakhs × ₹ (62 - 56) = ₹ 60 lakhs

(iii) Interest that would have resulted if the loan was taken in Indian currency

= US $ 10 lakhs × ₹ 56 x 10.5% = ₹ 58.80 lakhs

(iv) Difference between interest on local currency borrowing and foreign currency borrowing

= ₹ 58.80 lakhs - ₹ 24.80 lakhs = ₹ 34 lakhs.Therefore, out of ₹60 lakhs increase in the liability towards principal amount, only ₹ 34 lakhs will be considered as the borrowing cost. Thus, total borrowing cost would be ₹ 58.80 lakhs being the aggregate of interest of ₹ 24.80 lakhs on foreign currency borrowings plus the exchange difference to the extent of difference between interest on local currency borrowing and interest on foreign currency borrowing of ₹ 34 lakhs. Hence, ₹ 58.80 lakhs would be considered as the borrowing cost to be accounted for as per AS 16 “Borrowing Costs” and the remaining ₹ 26 lakhs (60 - 34) would be considered as the exchange difference to be accounted for as per AS 11 “The Effects of Changes in Foreign Exchange Rates”.

|

53 videos|134 docs|6 tests

|

FAQs on Important Questions & Answers: Introduction to Accounting Standards - Advanced Accounting for CA Intermediate

| 1. What are accounting standards and why are they important? |  |

| 2. What is the role of the International Financial Reporting Standards (IFRS) in accounting? |  |

| 3. How do Indian Accounting Standards (Ind AS) differ from IFRS? |  |

| 4. What is the significance of the convergence of accounting standards? |  |

| 5. How can CA Intermediate students prepare for accounting standards in their exams? |  |