Cheatsheet: Profit & Loss | General Aptitude for GATE - Mechanical Engineering PDF Download

| Table of contents |

|

| Introduction |

|

| Some Important Definitions |

|

| Formulae |

|

| Tips |

|

Introduction

Profit & Loss is an easy topic in the quantitative section. Every year, a small number of questions from this section appear, and students should aim to get all the questions from this topic right. The number of concepts in these topics is limited, and most of the problems can be solved by applying the formulae directly.

Some Important Definitions

Cost Price (C.P.) – Price at which an item is purchased.

Selling Price (S.P.) – Price at which an item is sold.

Profit (Gain) – Amount by which S.P. exceeds C.P.

Profit = S.P. – C.P.Loss – Amount by which C.P. exceeds S.P.

Loss = C.P. – S.P.Marked Price (MP) – Price marked on an item before discount.

Discount – Reduction from M.P.

Discount = M.P. – S.P.Profit and Loss Statement: A summary showing revenue, expenses, and net result over a given period.

Formulae

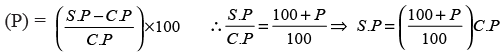

(i) Profit per cent

(ii) Similarly, loss per cent

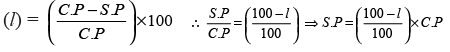

(iii) If an article is sold for two different prices (S.P1 and S.P2), there will be two profit percentages (P1 and P2) respectively.

Note: In case of loss, treat that loss as negative profit.

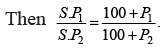

(iv) If the Cost price of M articles is equal to the selling price of N articles, then the profit percentage is given by

If (M–N) is negative, then treat profit as a loss.

(v) If an article is sold after allowing a certain discount (d%) on the marked price (M.P.) then the selling price (S.P.) is given by S.P. = (100 – d)% × M.P

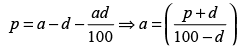

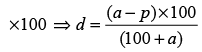

(vi) If the marked price of an article is a% above the cost price and a discount d% is allowed, then the profit per cent (p) would be

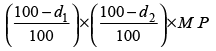

(vii) If an article is sold after allowing two successive discounts of d1% and d2% then the selling price (S.P.) is given by S.P. =

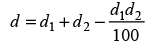

(viii) Two successive discounts of d1 and d2 are equivalent to a single discount of

Tips

Find CP and SP first: Always check which is the Cost Price and which is the Selling Price. Mixing them up is a common mistake.

Use multipliers for quick work: Example: 20% profit means SP = 1.2 × CP, 15% loss means SP = 0.85 × CP.

Be careful with multiple changes: If there are two profits or losses in a row, use:

Net% = x + y + (x × y / 100)

(Here, x and y are the percentages.)Apply a discount on the Marked Price: A discount is always calculated on the Marked Price unless the question says otherwise.

Look for hidden clues: Sometimes the question says things like “profit is 1/5 of CP.” Turn this into numbers before solving.

Do a quick check: Estimate your answer to see if it looks right before finalising it.

Solved Example

|

193 videos|169 docs|152 tests

|

FAQs on Cheatsheet: Profit & Loss - General Aptitude for GATE - Mechanical Engineering

| 1. What is a profit and loss statement in banking? |  |

| 2. How is net income calculated in a profit and loss statement for banking? |  |

| 3. What are the key components of a profit and loss statement for banking? |  |

| 4. Why is a profit and loss statement important for banks? |  |

| 5. How can banks use profit and loss statements for financial analysis? |  |