Cheatsheet: Interest | General Aptitude for GATE - Mechanical Engineering PDF Download

Theory

Simple Interest is the interest earned when the borrower usually pays a fee to the lender each year and that fee is usually a percentage of amount borrowed at the start.

Compound Interest is the interest earned on the initial principal plus the interests earned over the previous periods of the loan.

Formula

- If a sum of money becomes x-times of itself in T-years @ R% p.a. S.I. then (x -1)100 = T×R

- If a sum of money becomes x1-times of itself in a time of T1-years @ R1% p.a.

S.I. it becomes x2-times of itself in T2-years @ R2% p.a. S.I. then

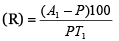

- A sum (P) of money becomes an amount of A1 in T1 years at a certain rate and the same sum becomes an amount of A2 in T2 years (T2 > T1). Then P =

and the rate

and the rate

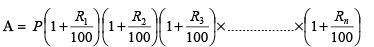

- If the rates of compound interest are R1 , R2 , R3 ……….. Rn for n-successive years then

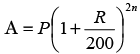

- If a sum of Rs P is lent out at R% p.a. compound interest for n-years then

, if the interest is compounded half-yearly

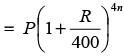

, if the interest is compounded half-yearly , if the interest is compounded quarterly

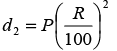

, if the interest is compounded quarterly - The difference between compound interest and simple interest on a sum of Rs P for 2-years at R% p.a. is given by

Also , where S.I is simple interest for 2 years

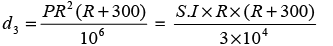

, where S.I is simple interest for 2 years - The difference between compound interest and simple interest on a sum of Rs P for 3 years at R% p.a. is given by

where S.I. is simple interest for 3-years

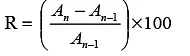

where S.I. is simple interest for 3-years - If a sum of money amounts to An−1 and to An in (n – 1) and n years respectively then

Solved Example

A father left a will of Rs.5 lakhs between his two daughters aged 10 and 15 such that they may get equal amounts when each of them reach the age of 21 years. The original amount of Rs.5 lakhs has been instructed to be invested at 10% p.a. simple interest. How much did the elder daughter get at the time of the will?

The compound interest on a certain sum for 2 years is Rs. 786 and S.I. is Rs. 750. If the sum is invested such that the S.I. is Rs. 1296 and the number of years is equal to the rate per cent per annum, Find the rate of interest?

Hari took an educational loan from a nationalized bank for his 2 years course of MBA. He took the loan of Rs.5 lakh such that he would be charged at 7% p.a. at CI during his course and at 9% CI after the completion of the course. He returned half of the amount which he had to be paid on the completion of his studies and remaining after 2 years. What is the total amount returned by Hari?

|

193 videos|169 docs|152 tests

|

FAQs on Cheatsheet: Interest - General Aptitude for GATE - Mechanical Engineering

| 1. What is interest banking? |  |

| 2. How does interest banking work? |  |

| 3. What are the benefits of interest banking? |  |

| 4. How do banks determine interest rates in interest banking? |  |

| 5. What risks are associated with interest banking? |  |