SSC CGL Exam > SSC CGL Notes > SSC CGL Tier 2 - Study Material, Online Tests, Previous Year > Mind Map: Money & Banking

Mind Map: Money & Banking | SSC CGL Tier 2 - Study Material, Online Tests, Previous Year PDF Download

The document Mind Map: Money & Banking | SSC CGL Tier 2 - Study Material, Online Tests, Previous Year is a part of the SSC CGL Course SSC CGL Tier 2 - Study Material, Online Tests, Previous Year.

All you need of SSC CGL at this link: SSC CGL

|

1334 videos|1437 docs|834 tests

|

FAQs on Mind Map: Money & Banking - SSC CGL Tier 2 - Study Material, Online Tests, Previous Year

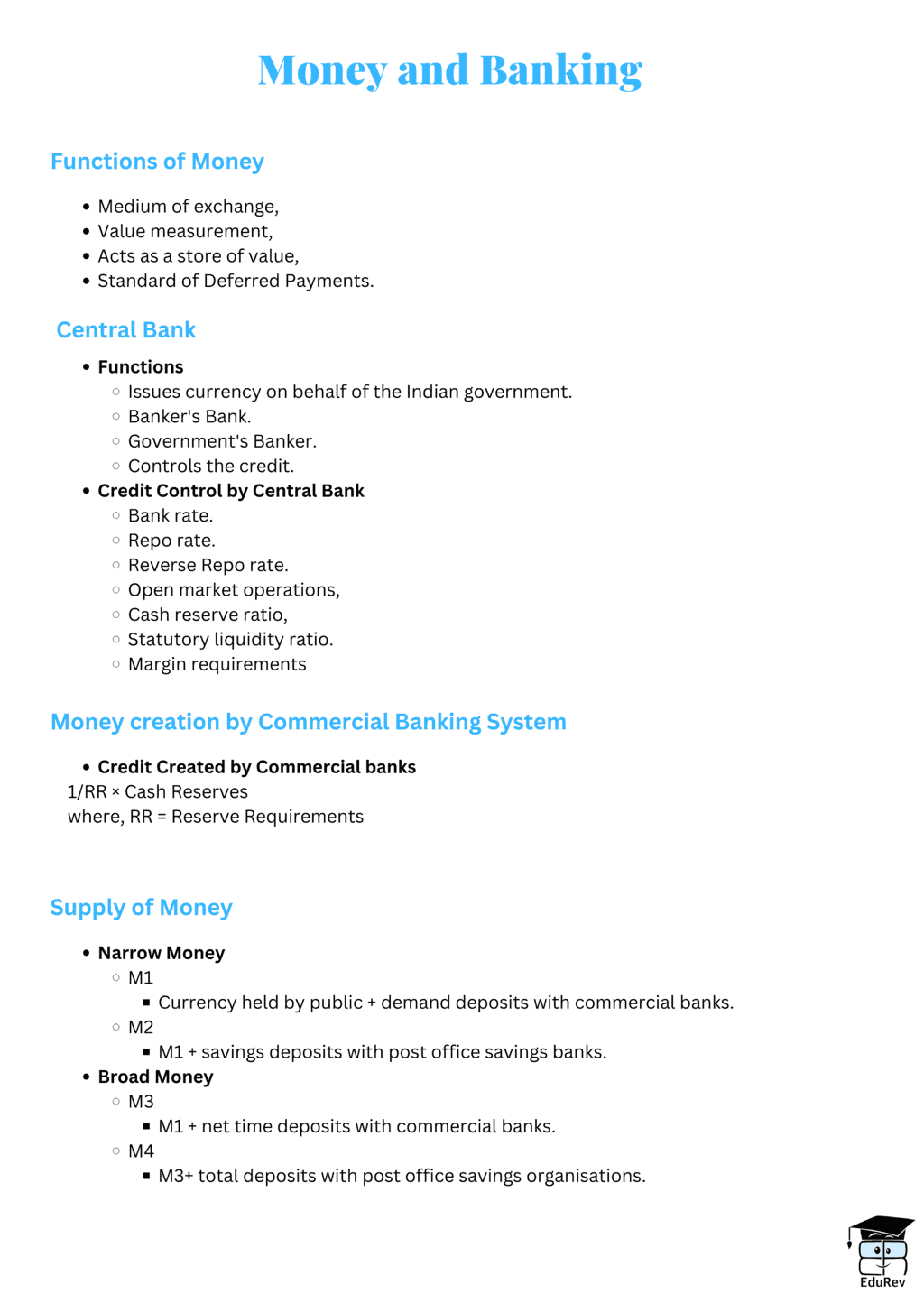

| 1. What is the role of central banks in the banking system? |  |

Ans. Central banks play a crucial role in the banking system. They are responsible for controlling the money supply, maintaining price stability, and regulating commercial banks. Central banks also act as lenders of last resort to provide liquidity to the banking system during financial crises.

| 2. How does inflation impact the value of money? |  |

Ans. Inflation erodes the value of money over time. As the general price level rises, each unit of currency can buy fewer goods and services. This means that the purchasing power of money decreases, and people need more money to maintain the same standard of living.

| 3. What are the main functions of commercial banks? |  |

Ans. Commercial banks perform several essential functions. They accept deposits from individuals and businesses, provide loans and credit facilities, facilitate international trade through letters of credit, and offer various financial services such as wealth management and foreign exchange.

| 4. What is the difference between a checking account and a savings account? |  |

Ans. A checking account is primarily used for daily transactions. It allows easy access to funds through checks, debit cards, and online transfers. On the other hand, a savings account is designed for long-term saving. It typically offers higher interest rates but may have limitations on the number of withdrawals.

| 5. How does the fractional reserve banking system work? |  |

Ans. The fractional reserve banking system allows banks to lend a portion of the deposits they receive. Banks are required to keep only a fraction of customers' deposits as reserves, typically set by the central bank. The rest of the deposits can be used for lending, which expands the money supply and stimulates economic activity.

|

1334 videos|1437 docs|834 tests

|

Download as PDF

Related Searches