UPSC Daily Current Affairs- 20th February 2023 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

GS-I

Rajgad Fort

Why in News?

The results of a 14-month-long faunal survey indicated the presence of 496-odd unique species in Velhe Forest, located in the foothills of the Rajgad Fort.

About Rajgad Fort:

- Rajgad Fort, also known as the Ruling Fort, was the capital of the Maratha Empire under the rule of Chhatrapati Shivaji Maharaj for almost 26 years, after which the capital was moved to the Raigad Fort.

- Location:

- It is a hill fort situated in the Pune district of Maharashtra.

- It is located in the Sahyadri mountain ranges at an elevation of 1,395 meters above sea level.

- Features:

- It comprises three terraces (machis) and a citadel (Balekilla).

- There are four gates called Gunjavane, Pali, Alu, and Kaleshwari or Dindi gate.

- The diameter of the base of the fort was about 40 km (25 mi) which made it difficult to lay siege on it, which added to its strategic value.

- The fort’s ruins consist of palaces, water cisterns, and caves.

- Rajgad boasts the highest number of days stayed by Chhatrapati Shivaji Maharaj on any fort.

- The Rajgad Fort was also one of the 17 forts Chhatrapati Shivaji Maharaj kept when he signed the Treaty of Purandar in 1665 with the Mughal general Jai Singh I, leader of the Mughal forces.

- Apart from the Maratha empire, Rajgad Fort has been a part of the Adilshahi dynasty, Nizamshahi dynasty, Mughal empire, and others. After everyone else, the British empire owned the fort.

Source: PIB

Chhatrapati Shivaji Maharaj

Why in News?

Prime Minister of India has paid homage to Chhatrapati Shivaji Maharaj on his Jayanti.

About Chhatrapati Shivaji:

- The founder of the Maratha Kingdom, Shivaji was born to be a natural leader and fighter on 19th February, 1630 in the prestigious Shivneri Fort.

- He was known as the Father of Indian Navy, Shivaji was the first to realise the importance of having a naval force, and therefore he strategically established a navy and forts at the coastline to defend the Konkan side of Maharashtra.

- The secular ruler was very accommodating of all religions. He had numerous Muslim soldiers in his army.

- Shivaji was a dependable supporter of women and their honour. Anyone under his rule caught violating woman's rights was severely punished.

- He had a council of ministers (Asht Pradhan) to advise him on the matters of the state but he was not bound by it.

- He was called as the 'Mountain Rat' and was widely known for his guerrilla warfare tactics. He was called so because of his awareness in geography of his land, and guerrilla tactics like raiding, ambushing and surprise attacks on his enemies.

Source: PIB

GS-II

GST Appellate Tribunal gets nod

Why in News?

The GST Council reached a broad consensus on setting up GST Appellate Tribunal; likely to be included in Finance Bill 2023.

What is GST Appellate Tribunal?

- The GST Appellate Tribunal is a quasi-judicial body proposed to be established to resolve disputes related to the Goods and Services Tax (GST) in India.

- It will function as an independent body to hear appeals against orders passed by the GST authorities or the Appellate Authority.

- The tribunal will be composed of a national bench and various regional benches, headed by a chairperson appointed by the central government.

- The proposed tribunal is expected to help expedite the resolution of disputes related to GST and reduce the burden on the judiciary.

Under GST, if a person is not satisfied with the decision passed by any lower court, an appeal can be raised to a higher court, the hierarchy for the same is as follows (from low to high):

- Adjudicating Authority

- Appellate Authority

- Appellate Tribunal

- High Court

- Supreme Court

Why need such Tribunal?

- Unburden judiciary: GST Appellate Tribunal will help resolve the rising number of disputes under the 68-month old indirect tax regime that are now clogging High Courts and other judicial fora.

- Improve efficiency of GST System: Overall, the establishment of the GST Appellate Tribunal is expected to improve the efficiency and effectiveness of the GST system in India.

- Independent mechanism: The proposed Tribunal will provide an independent and efficient mechanism for resolving disputes related to GST.

- Avoid tax evasion: It will help to expedite the resolution of disputes, reduce the burden on the judiciary, and promote greater certainty and predictability in the GST system.

Issues with present litigation

- Compliance issues: The GST system is relatively new in India, having been implemented in 2017, and there have been several issues with compliance and interpretation of rules and regulations.

- Complex adjudication hierarchy: The current dispute resolution mechanism involves multiple layers of adjudication, starting with the GST officer and as mentioned above.

- Time consuming process: This process can be time-consuming, costly, and burdensome for taxpayers, especially small and medium-sized enterprises.

How is it being established?

- The proposed GST Appellate Tribunal is expected to be included in the Finance Bill 2023.

- This means that it will become a part of the central government’s budget, and will have legal standing.

What is a Finance Bill?

- A Finance Bill is a proposed legislation that is introduced by the government to implement the financial proposals of the Union Budget for the upcoming financial year in India.

- It is a comprehensive document that outlines the government’s revenue and expenditure for the year, including changes in tax laws, tariffs, customs duties, and other fiscal measures.

- Since the Union Budget deals with these things, it is passed as a Finance Bill.

Types of Finance Bills

- There are different kinds of Finance Bills — the most important of them is the Money Bill. The Money Bill is concretely defined in Article 110.

In India, there are three types of Finance Bills that can be introduced in the Parliament:

- Annual Finance Bill: This is the most common type of Finance Bill and is introduced by the government every year to give effect to the tax proposals announced in the Union Budget. It contains provisions related to taxation, expenditure, and revenue collection for the upcoming financial year.

- Finance Bill (Money Bill): A Money Bill is a type of Finance Bill that contains only provisions related to taxation and expenditure, but does not include any other matter. Money Bills are deemed to be passed by the Lok Sabha, the lower house of Parliament, and do not require approval from the Rajya Sabha, the upper house of Parliament.

- Finance Bill (Non-Money Bill): This type of Finance Bill contains provisions related to taxation and other matters, such as changes in the structure of regulatory bodies or the introduction of new policies. Unlike Money Bills, Non-Money Bills must be passed by both the Lok Sabha and the Rajya Sabha to become law.

How is money bill different from Finance Bill?

- A Money Bill is certified by the Speaker as such — in other words, only those Financial Bills that carry the Speaker’s certification are Money Bills.

- Article 110 states that a Bill shall be deemed to be a Money Bill if it contains only provisions dealing with all or any of the following matters:

- (a) the imposition, abolition, remission, alteration or regulation of any tax;

- (b) the regulation of the borrowing of money or any financial obligations undertaken

- (c) the custody of the consolidated Fund or the Contingency Fund of India, the payment of moneys into or the withdrawal of moneys from any such Fund;

- (d) the appropriation of moneys out of the consolidated Fund of India;

- (e) the declaring of any expenditure to be expenditure charged on the Consolidated Fund of India or the increasing of the amount of any such expenditure;

- (f) the receipt of money on account of the Consolidated Fund of India or the public account of India or the custody or issue of such money or the audit of the accounts of the Union or of a State; or

- (g) any matter incidental to any of the matters specified in sub clause (a) to (f)

Source: The Hindu

Organ transplant rules In India: A Significant Step

Why in News?

The changes to the organ transplant rules announced by the Union health ministry last week, are small, but significant, steps towards giving a new lease of life to many people with failing organs. Despite of performing the third-the greatest number of transplants in the world, only about 0.01 percent of Indians donate their organs after death, according to the World Health Organization.

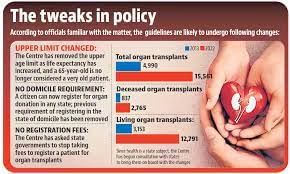

What are the changes introduced?

- No age ceiling for organ receivers: With the new changes, patients who are 65 years and older can now register for receiving organs from a deceased donor. Now an individual of any age can register for organ transplant.

- Previously: Previously, the upper age limit for registering patients requiring organs from deceased donors was 65 years, but this ceiling has now been removed.

- No domicile criteria for receivers: Eliminate the domicile criterion for registering to receive organs, so that patients in need can register in any state.

- Previously: Currently, certain states restrict registration for deceased organ donors to only those who are domiciled in the state or give them preference. Organs harvested in one state are first shared with other hospitals within the same state, then in the region and then share nationally on the occasion that no match was found.

- No registration fees: The ministry has also requested that states not impose any fees on patients seeking registration for organ transplantation, as it violates the 2014 Transplantation of Human Organs and Tissues Rules.

- Previously: States such as Maharashtra, Kerala, Gujarat, and Telangana charge between Rs 5,000 and Rs 10,000 to register patients who need an organ replacement. The health ministry has rightly directed these states to stop charging this fee.

Where does India stand?

- Third Highest number of transplants in the world: India conducts the third highest number of transplants in the world every year. Yet barely four per cent of the patients who require a liver, heart or kidney transplant manage to get one.

- Organ transplants has significantly increased over the past decade: According to latest available official data, the number of organ transplants has significantly increased over the past decade. In 2013, there were 4,990 organ transplants, whereas in 2022, there were 15,561 a jump of 211 percent.

- Kidney transplants: Specifically, the number of kidney transplants from living donors increased by approximately 181 percent from 3,495 in 2013 to 9,834 in 2022. The number of kidney transplants from deceased donors increased by approximately 193 percent from 542 in 2013 to 1,589 in 2022.

- Liver transplants: The total number of liver transplants from living donors increased by approximately 350 percent from 658 in 2013 to 2,957 in 2022, and from deceased donors, it increased by approximately 217 percent from 240 in 2013 to 761 in 2022. Deceased donors account for nearly 17 percent of all transplants in India.

- Heart and Lung transplants: The total number of heart transplants increased by approximately 733 percent from 30 in 2013 to 250 in 2022, while lung transplants increased by approximately 500 percent from 23 to 138.

- Government hospitals fall behind: Furthermore, private hospitals lead in organ transplants while numbers in government hospitals remain relatively low, sources said.

Challenges to Organ Donation in India

- Lack of awareness: There is a lack of awareness among the general public about the importance of organ donation, the legal framework governing it, and the procedures involved. This can limit the number of potential donors.

- Cultural beliefs and superstitions: In India, there are several cultural beliefs and superstitions that discourage organ donation. Some people believe that organ donation is against religious beliefs, or that it can impact the soul or afterlife.

- Lack of infrastructure: India faces a shortage of hospitals and medical facilities that are equipped to handle organ transplantation. This can limit the availability of organs for transplantation.

- Regulatory bottlenecks: While the legal framework exists, there is a lack of implementation and enforcement of the law. This can lead to issues such as organ trafficking and black-market activities.

What is National Organ and Tissue Transplant Organization (NOTTO)?

NOTTO is a national level organization set up under Directorate General of Health Services, Ministry of Health and Family Welfare, Government of India.

It has following two divisions:

- National Human Organ and Tissue Removal and Storage Network: It functions as apex Centre for All India activities of coordination and networking for procurement and distribution of Organs and Tissues and registry of Organs and Tissues Donation and Transplantation in the country

- National Biomaterial Centre: The main thrust & objective of establishing the centre is to fill up the gap between ‘Demand’ and ‘Supply’ as well as ‘Quality Assurance’ in the availability of various tissues. The centre will take care of the Tissue allografts such as Bone and bone products, Skin graft, Cornea and Heart valves and vessel.

Conclusion

The percentages are very likely to go up once the changes in the rules announced last week take effect. The organ shortage problem is, however, a complex one, that continues to confound planners, even in nations whose healthcare systems are far better equipped than that of India’s. There is a need to expand the number of institutions where surgeries and transplants are undertaken. A uniform policy, will help patients in seeking transplant from deceased donors at any hospital in the country, giving them a lot of flexibility.

Source: Indian Express

Digital Competition Panel

Why in News?

The first meeting of the digital competition law committee will be held on February 22.

About Digital Competition Panel:

- The Government of India has constituted a committee to study the requirement of the digital competition law and give suggestions regarding competition norms.

- The panel will be headed by the secretary of the Ministry of Corporate Affairs (MCA).

- Committee Members: It is a 16-member committee of union secretaries, law experts, and industry stakeholders.

- The Competition Commission of India (CCI) will provide secretarial and research assistance and logistic support to the panel.

- Functions of the Panel: Review whether the Competition Act, 2002, and the rules framed under it are sufficient to deal with challenges posed by the digital economy.

Key facts about the Competition Commission of India:

- The Competition Commission of India has been established to enforce the competition law under the Competition Act of 2002.

- The Commission consists of a Chairperson and not more than 6 Members appointed by the Central Government.

- It works as a quasi-judicial body.

- Nodal Ministry: The Ministry of Corporate Affairs

Source: PIB

GS-III

How is the Stock Market regulated in India?

Why in News?

The Supreme Court asked the Securities and Exchange Board of India (SEBI) and the government to produce the existing regulatory framework in place to protect investors from stock market volatility.

Central idea

- After short-seller Hindenburg Research published a report accusing the Adani Group of stock market manipulation and accounting fraud, its shares plummeted.

- Investors were reported to have lost lakhs of crores.

Laws governing the Indian Stock Market

The securities market in India is regulated by four key laws —

- Securities and Exchange Board of India Act, 1992 (SEBI Act)

- Securities Contracts (Regulation) Act, 1956 (SCRA) and

- Depositories Act, 1996

- Companies Act, 2013

The framing of these laws reflect the evolution and development of the capital market in India.

Brief explanation of each acts-

Securities and Exchange Board of India Act, 1992 (SEBI Act)

- The SEBI Act empowers SEBI to protect the interests of investors and to promote the development of the capital/securities market, besides regulating it.

- SEBI was given the power to register intermediaries like stock brokers, merchant bankers, and portfolio managers and regulate their functioning by prescribing eligibility criteria, conditions to carry on activities and periodic inspections.

- It also has the power to impose penalties such as monetary penalties, including suspending or cancelling the registration.

- Securities Contracts (Regulation) Act, 1956 (SCRA)

- The SCRA empowers SEBI to recognise (and derecognise) stock exchanges, prescribe rules and bye laws for their functioning, and regulate trading, clearing and settlement on stock exchanges

- Depositories Act, 1996

- As part of the development of the securities market, Parliament passed the Depositories Act and SEBI made regulations to enforce the provisions.

- This Act introduced and legitimised the concept of dematerialised securities being held in an electronic form.

- Today almost all the listed securities are held in dematerialised form.

- Companies Act, 2013

- It is an Act of the Parliament on Indian company law that regulates incorporation of a company, responsibilities of a company, directors, and dissolution of a company.

- It stipulates the type of Companies that can be formed such as- Public Ltd., Pt. Ltd., One Person Company ex.

Key role-player: SEBI

SEBI set up the infrastructure for doing this by registering depositories and depository participants.The depository regulations empower SEBI to regulate functioning of depositories and depository participants by prescribing eligibility conditions, periodic inspections and powers to impose penalties including suspending or cancelling the registration as well as monetary penalties.

Can SEBI step in to curb market volatility?

- No direct meddling: While SEBI does not interfere to prevent market volatility, exchanges have circuit filters — upper and lower — to prevent excessive volatility.

- Issue directions: SEBI can issue directions to those who are associated with the market, and has powers to regulate trading and settlement on stock exchanges. Using these powers, SEBI can direct stock exchanges to stop trading, totally or selectively.

- Instant regulation: It can also prohibit entities or persons from buying, selling or dealing in securities, from raising funds from the market and being associated with intermediaries or listed companies.

What about stock exchanges?

- The SCRA has empowered SEBI to recognise and regulate stock exchanges and later commodity exchanges in India; this was earlier done by the Union government.

- In fact, the term “securities” is defined in the SCRA and powers to declare an instrument as a security remain vested in SEBI.

- The rules and regulations made by SEBI under the SCRA relate to listing of securities like equity shares, the functioning of stock exchanges including control over their management and administration.

- These include powers to determine the manner in which a settlement is done on stock exchanges (and to keep them with the times for e.g. T+1) etc.

- It seeks to protect the interests of investors by creating an Investor Protection Fund for each stock exchange.

Safeguards against fraud

Fraud undermines regulation and prevents a market from being fair and transparent. To prevent the two key forms of fraud, market manipulation, and insider trading, SEBI notified-

- Prohibition of Fraudulent and Unfair Trade Practices Regulations, 1995

- Prohibition of Insider Trading Regulations, 1992

- These regulations, read with provisions of the SEBI Act, define species of fraud, who is an insider and prohibit such fraudulent activity and provide for penalties including disgorgement of ill-gotten gains.

- It must be noted that violation of these regulations are predicate offences that can lead to a deemed violation of the Prevention of Money Laundering Act.

Source: Indian Express

Govt. taps consultants to kick-start land Monetization

Why in News?

The National Land Monetisation Corporation (NLMC) has decided to involve international property consultancy firms to speed up the process of making money by selling or leasing the land owned by the government.

What is NLMC?

- NLMC is a Special Purpose Vehicle (SPV) announced in the Union Budget 2021-22 to carry out monetisation of government and surplus land holdings of public sector undertakings (PSU).

- It falls under the administrative jurisdiction of the Ministry of Finance and is set up with an initial authorised share capital of ₹5,000 crore and a paid-up capital of ₹150 crore.

- It is a firm, fully owned by the government, to carry out the monetisation of government and public sector assets in the form of surplus, unused or underused land assets.

Aims and objectives

- Monetize underutilised or unused land parcels of Central Public Sector Enterprises (CPSEs)

- Facilitate the monetisation of assets belonging to PSUs that have ceased operations or are in line for a strategic disinvestment.

How would it work?

- Transfer of revenue rights: When the government monetises its assets, it essentially means that it is transferring the revenue rights of the asset (could be idle land, infrastructure, PSU) to a private player for a specified period of time.

- Govt as facilitator: In such a transaction, the government gets in return an upfront payment from the private entity, regular share of the revenue generated from the asset, a promise of steady investment into the asset, and the title rights to the monetised asset.

Significant outcomes of land monetization

- Maximum value realization: It will help monetise them in an efficient and professional manner, maximizing the scope of value realisation.

- Speed up the process: The setting of the NLMC will speed up the closure process of the CPSEs and smoothen the strategic disinvestment process.

- Capitalize land assets: It will also enable productive utilisation of these under-utilized assets by setting in motion private sector investments.

- Economic revitalization: It will boost new economic activities such as industrialisation, boosting the local economy by generating employment and generating financial resources for potential economic and social infrastructure.

- Advisory to the govt: Besides managing and monetising, the NLMC will act as an advisory body and support other government entities and CPSEs in identifying their surplus non-core assets.

Need for land monetization

There are different reasons why the government monetizes its assets.

- New sources of revenue: One of them is to create new sources of revenue essential to fulfil the government’s target of achieving a $5 trillion economy.

- Plummeting underutilized assets: Monetisation is also done to unlock the potential of unused or underused assets by involving institutional investors or private players.

- Capital generation: It is also done to generate resources or capital for future asset creation, such as using the money generated from monetisation to create new infrastructure projects.

How much land is currently available for monetization?

- According to the Economic Survey 2021-2022, as of now, CPSEs have put nearly 3,400 acres of land on the table for potential monetization.

- They have referred this land to the Department of Investment and Public Asset Management (DIPAM).

- As per the survey, monetisation of non-core assets of PSUs such as MTNL, BSNL, BPCL, B&R, BEML, HMT Ltd, Instrumentation Ltd etc. are at different stages.

Possible challenges for NLMC

- Volatile market situation

- The performance and productivity of the NLMC will also depend on the government’s performance on its disinvestment targets.

- In FY 2021-22, the government has hardly been able to raise expected amounts through various forms of disinvestment.

- Issues with transfer of rights

- The process of asset monetisation does not end when the government transfers revenue rights to private players.

- Identifying profitable revenue streams for the monetised land assets, ensuring adequate investment by the private player and setting up a dispute-resolution mechanism are also important tasks.

- Unattractiveness of PPP Model

- Posing as another potential challenge would be the use of Public Private Partnerships (PPPs) as a monetisation model.

- For instance, the results of the Centre’s PPP initiative launched in 2020 for the Railways were not encouraging.

- Red tapism

- The success of the initiative will depend on a range of factors, including the availability of suitable land parcels, market demand etc.

- It will be highly dependent upon the ability of the government to execute the transactions efficiently.

Conclusion

- The government’s move to monetize its vast land assets is aimed at reducing the fiscal burden and boosting infrastructure development in the country.

- By bringing in international property consultants to help with the process, the government hopes to improve efficiency and transparency, and maximize the returns on its land assets.

- If successful, the government’s land monetization drive could provide a much-needed boost to the economy and create new opportunities for private investment in the real estate sector.

Source: The Hindu

Harike Wetland

Why in News?

According to the recent water bird census, the Harike wetland witnessed a decline in migratory birds' arrival this year.

About Harike wetland:

- Harike Wildlife Sanctuary also locally known as "Hari-ke-Pattan" is one of the largest wetlands in northern India.

- It is situated at the confluence of two major rivers of Punjab Sutlej and Beas.

- Harike wetland came into existence in 1953 due to the construction of a barrage on River Sutlej.

- It has been designated as one of the Ramsar sites in India.

- This is a man-made, riverine wetland spreads across three districts of Punjab e., Tarn Taran, Ferozepur and Kapurthala.

Source: The Hindu

|

44 videos|5271 docs|1113 tests

|

FAQs on UPSC Daily Current Affairs- 20th February 2023 - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly

| 1. What is the significance of GS-I, GS-II, and GS-III in UPSC exams? |  |

| 2. What is the purpose of UPSC Daily Current Affairs? |  |

| 3. What are Frequently Asked Questions (FAQs) in the context of UPSC Daily Current Affairs? |  |

| 4. How can I ensure that my Frequently Asked Questions (FAQs) are relevant and valuable for UPSC exam preparation? |  |

| 5. Are there any guidelines for the complexity of the questions and answers in UPSC Daily Current Affairs? |  |