Theory of Consumer Behaviour Class 12 Economics

| Table of contents |

|

| Consumer Behaviour |

|

| Utility |

|

| Indifference Curve |

|

| Consumer Budget |

|

| Consumer’s Optimum Choice |

|

| Demand |

|

| Market Demand |

|

Consumer Behaviour

Consumer behavior is the examination of how individuals, groups, or organizations choose, purchase, utilize, and discard goods, services, and ideas to satisfy their needs and desires. It pertains to the actions of consumers in the market and the reasoning behind those actions.

Utility

Utility is the ability of a product to satisfy a particular need. The greater the utility derived from an item, the stronger the desire or need for it. Utility is a subjective concept and can vary from person to person. Different individuals can derive different levels of utility from the same item. A consumer's level of desire for a product is typically determined by the utility or satisfaction they obtain from it.

Types of Utility

- Cardinal Utility Analysis: According to this analysis, it is possible to assign numerical values to utility. This involves quantifying the level of satisfaction resulting from the consumption of goods or services using measurable units.

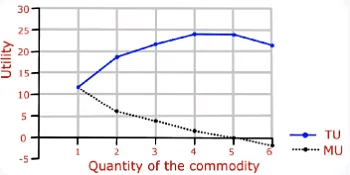

There are two types of utility measures, including:- Total Utility (TU): Total utility refers to the overall satisfaction obtained from consuming a specific amount of a product at a given time. Another way to put it is that total utility is the sum of marginal utility.

TU = ∑ MU ORTU = MU1 + MU2 + MU3 + ... + MUn - Marginal Utility (MU): Marginal utility refers to the increase in total utility resulting from consuming an additional unit of a product. In other words, it is the value gained from each extra unit consumed.

MUn = TUn - TUn-1

- Total Utility (TU): Total utility refers to the overall satisfaction obtained from consuming a specific amount of a product at a given time. Another way to put it is that total utility is the sum of marginal utility.

- Ordinal Utility Analysis: This theory posits that it is impossible to measure the level of satisfaction resulting from consuming goods or services. However, these items can be ranked in order of preference. The utility of a product is determined by its level of satisfaction, making it a more rational and practical approach.

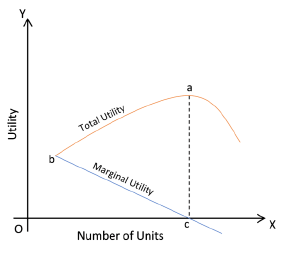

Relationship Between TU And MU

- The total utility increases proportionally to the increase in commodity consumption as long as the marginal utility is positive.

- The rate of increase in total utility slows down as the marginal utility from each additional unit of the commodity decreases.

- The marginal utility reaches zero when the total utility reaches its maximum value, which is referred to as the point of satiety. (This occurs at point c on the diagram)

- When consumption surpasses the point of satiety, the marginal utility becomes negative and the total utility starts to decline. (This occurs after point c on the diagram)

Law of Diminishing Marginal Utility

- The law of diminishing marginal utility asserts that the marginal utility derived from consuming each additional unit of a product decreases as the consumption of that product increases, assuming that the consumption of other products remains constant.

- According to this law, the marginal utility becomes zero at a point where the total utility remains constant. In the given example, the total utility does not change at the consumption of the fifth unit, resulting in MU5 being equal to zero. After this point, the total utility begins to decrease, causing the marginal utility to become negative.

Indifference Curve

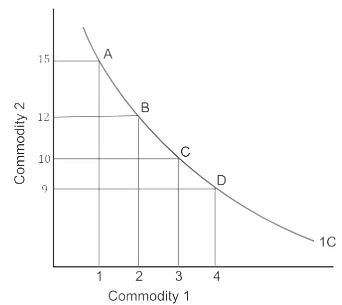

- An indifference curve is a graphical representation that displays combinations of two products that yield equal satisfaction and utility to the consumer.

- The quantitative measurement of utility is challenging and, at best, can only be ranked in terms of the greater or lesser utility of various alternative combinations of goods consumed.

- The indifference curve connects all points that represent different combinations of goods in which the consumer is indifferent, meaning the total utility derived from each combination is the same.

- The slope of an indifference curve is downward, indicating that to maintain the same level of total utility, the quantity of one good must decrease as the quantity of the other good increases.

- A higher indifference curve indicates a greater level of utility.

- Two indifference curves can never intersect each other.

Characteristics of the Indifference Curve

- Indifference curves slope downwards from left to right.

- Indifference curves are convex towards the origin due to diminishing marginal rate of substitution.

- Indifference curves never intersect each other as two different indifference curves cannot represent the same level of satisfaction.

- A higher level of satisfaction is depicted by a higher indifference curve.

Consumer Budget

- Budget constraint represents the various possible combinations of goods and services that a consumer can buy, based on their current prices and the consumer's income.

- The consumer's budget refers to their real purchasing power, which they can use to buy different bundles of two goods at a given price. This implies that a consumer can only purchase combinations of goods (bundles) that cost less than or equal to their income.

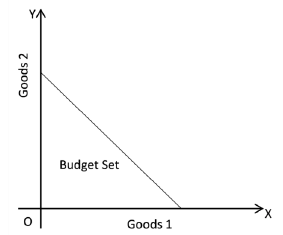

Budget Set

- The set of affordable combinations of goods and services that a consumer can purchase with their current income and prevailing market prices is known as the budget set.

- The budget set represents the limits of a consumer's purchasing power and includes all possible bundles of goods and services that can be purchased within those limits.

- In essence, the budget set of a consumer encompasses all the feasible combinations of goods and services that can be bought with their available income.

⇒ p1x1 + p2x2 ≤ M

Budget Line

The budget line represents a visual depiction of the affordable bundles of goods and services for a consumer at given commodity prices, and it connects all the bundles that can be purchased with the consumer's income. The budget line shows the possible combinations of two goods that can be purchased with the consumer's income.

PXQX + PYQY = S

Here,

PX = Price of commodity X

QX = Quantity of commodity X

PY = Price of commodity Y

QY = Quantity of commodity Y

S = Consumer Income

Attainable and Non Attainable Combinations

A consumer can purchase any combination of goods within the budget line area, as it represents all attainable combinations that are within their income and the price of goods. On the other hand, any point outside the budget line area represents a non-attainable combination of goods, which the consumer cannot afford to purchase.

Budget Constraint

The budget constraint encompasses various combinations of goods or products that an individual can purchase based on the prices of goods and their income.

Changes or Shifts in Budget Line

- The consumer's budget line may shift leftward or rightward due to changes in income or commodity prices.

- An increase in income causes the budget line to shift rightward, while a decrease in income shifts it leftward.

- A change in the price of one good leads to a rotation of the budget line. When the price falls, the budget line rotates outward, indicating increased purchasing power, and vice versa.

Changes in Budget Set

- The combinations of goods a consumer can purchase depend on the prices of those goods and the consumer's income.

- Changes in commodity prices or the consumer's income can lead to a different set of affordable bundles.

- The bundles of goods that a consumer can buy are determined by the prevailing prices and the consumer's budget, which may change with income fluctuations or price shifts.

Assume the customer's earnings increase from N to N′ while the prices of the two commodities stay unchanged. The customer will be able to purchase all bundles with his new earnings ( x1 , x2) such as p1x1 + p2 x2 ≤ N'

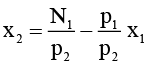

The budget line's equation is now:

p1x1 + p2x2 = N'

The above equation can also be written as

It is worth noting that the slope of the new budget line is identical as it was before the customer's earnings changed.

Consumer’s Optimum Choice

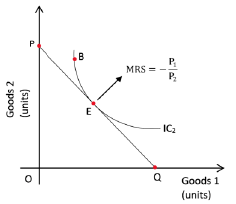

- The optimal choice of two goods for a consumer can be explained using the Indifference Curve and Budget Line.

- The Indifference Curve represents the satisfaction curve, while the Budget Line represents the budget constraint.

- When given a budget constraint, a consumer seeks to maximize their utility by choosing the highest possible Indifference Curve within their financial means.

- Consumer equilibrium is achieved when the IC is convex to the point of equilibrium, and the slope of the IC equals the slope of the Budget Line.

At the point where the indifference curve and budget line intersect, i.e., point E, the slope of both curves is equal to each other. This point represents the optimal choice and consumer equilibrium, where the consumer achieves maximum satisfaction within the given budget constraint.

At the point where the indifference curve and budget line intersect, i.e., point E, the slope of both curves is equal to each other. This point represents the optimal choice and consumer equilibrium, where the consumer achieves maximum satisfaction within the given budget constraint.

Demand

The term that describes the amount of a product or service that a consumer is willing and able to buy at a given price and during a specific period is called "quantity demanded".

Demand Function

The demand function describes the mathematical relationship between the quantity of a commodity that is demanded and its various determinants.

Dx = f(Px, PR, Y, T, E)

Here,

Dx = Quantity Demand

f = Functional Relationship

Px = Own price of good

PR = Related price of good

Y = Income

T = Taste and Preferences

E = Expectations

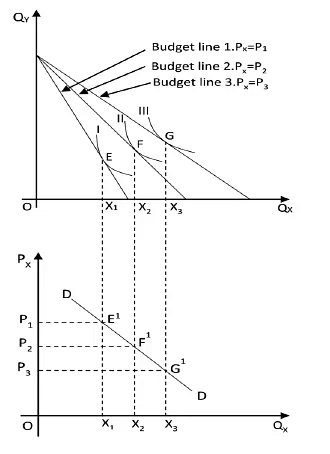

Derivation of Demand Curve

The IC analysis suggests that a consumer can maximize their utility by choosing a combination of two goods that is also affordable within their budget. This can be used to derive a commodity's demand curve.

- Consider the following two items: X and Y. Let the two items' prices be Px and Py , and the monetary income will be ‘M.’

- At the point where the consumer's budget line intersects the indifference curve, he can maximise his utility. In the diagram, this would be point ‘E.' X1 is the amount of X consumed.

- We now modify the price level of good X while maintaining the price of good Y and the amount of money income constant.

- Allow Px to fall. With the same amount of money, the consumer's real purchasing power has increased.

- Because ‘M’ remains constant, the greatest amount of good X he can buy grows as Px declines.

- As a result, the budget line's horizontal intercept changes (shifts to the right). However, the vertical intercept remains unchanged since ‘M’ and Py remain constant.

- As a result, as Px declines, the budget line must pivot away from the origin along the horizontal axis.

Law of Demand

The law of demand describes the impact of price changes on the quantity of a good demanded, stating that as the price of a good decreases, the quantity demanded of it increases, while as the price of a good increases, the quantity demanded of it decreases. This means that, holding all other factors constant, there is an inverse relationship between the price of a good and the quantity demanded of it.

Exception to the Law of Demand

There are some exceptions to the general rule that the quantity demanded of a good decreases as its price increases (and vice versa). These exceptions include:

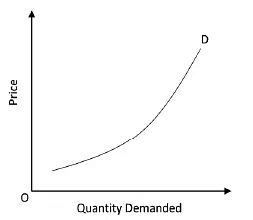

- Distinctive Items: The demand for distinctive items may rise as the price increases, as they are seen as status symbols. Examples include precious jewels and antique pieces. Furthermore, the demand for these goods may be solely due to their high prices.

- Necessities: The demand for necessities may increase even if the price increases, as the goods are essential.

- Giffen Goods: When a Giffen good is considered, the demand may increase as the price increases.

Types of Goods

- Normal Goods: These are goods whose demand increases when the consumer's income increases.

- Inferior Goods: These are goods whose demand decreases when the consumer's income increases. In other words, people tend to switch to higher-quality goods when they can afford to.

- Giffen Goods: These are low-income, non-luxury items that defy the typical economic and consumer demand theories. When the price of Giffen goods increases, the demand for these items also increases, and when the price decreases, the demand for Giffen goods decreases.

- Substitute Goods: These are goods that can be used interchangeably to some extent, such as tea and coffee. An increase in the price of one substitute good leads to an increase in demand for the other substitute good.

- Complementary Goods: These are goods that are often consumed together and enhance the use of each other, such as a car and petrol. An increase in the price of one complementary good reduces the demand for both goods.

Movement along the Demand Curve

The demand curve exhibits how the quantity demanded and price change relative to each other. It shows the variation in both the price and the quantity demanded as it moves from one position to another. Movement along the curve occurs when the quantity demanded changes due to a change in the price of the product or service. This movement can either be upward or downward.

Market Demand

Market demand refers to the sum of quantities of a product or service that all consumers in a market are willing and able to purchase at different prices at a particular time.

Elasticity of Demand

- The concept of price elasticity of demand refers to the responsiveness of the quantity demanded of a product to a change in its price.

- Price elasticity of demand is a measure of how sensitive the demand for a product is to changes in its price.

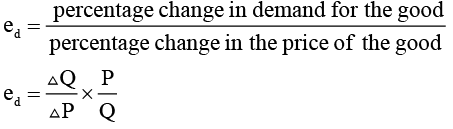

- To calculate price elasticity of demand, you divide the percentage change in the quantity demanded of a product by the percentage change in its price. This method is also known as the percentage method of elasticity of demand.

Here,

ed = Elasticity of demand

ΔQ = Change in quantity

ΔP = Change in price

P = Initial price

Q = Initial Quantity

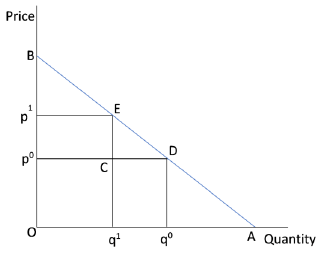

Geometric Method of Elasticity of Demand:

To measure the elasticity of demand at a particular point, the lower segment of the demand curve is divided by the upper segment of the demand curve at that point. At the midpoint of a linear demand curve, the elasticity of demand is one. The elasticity of demand for a linear demand curve can be determined graphically by calculating the ratio between the lower and upper segments of the demand curve at each point.

Total Expenditure Method of Elasticity of demand

- The expenditure method measures the price elasticity of demand by examining the change in total expenditure, which is the product of price and quantity, incurred by a household on a commodity due to a price change.

- There is an inverse relationship between the price of a commodity and its demand.

- Whether the expenditure on a commodity increases or decreases due to a price increase depends on how responsive the demand for the commodity is to price changes.

Factors that influence price elasticity of demand

- The availability of close substitutes: Commodities that have close substitutes generally have more elastic demand than goods with no alternatives. For example, Coca-Cola, Pepsi, and Limca are all suitable replacements for one another, making the demand for these beverages more elastic. In contrast, the demand for electricity is less elastic because there are no close substitutes available.

- The nature of the commodity: The demand for essential goods such as medicines and food grains is less elastic as they are necessary for survival and cannot be replaced by other goods. Conversely, the demand for luxury items such as refrigerators and air conditioners is more elastic as their consumption can be postponed if their prices increase.

- The price level: The demand for higher-priced goods such as air conditioners and automobiles is often more elastic than the demand for lower-priced goods like matchboxes or pencils.

- The income level: Consumers with higher income have less elastic demand for goods than those with lower income. For instance, if the price of a commodity increases, a wealthy consumer is less likely to reduce their demand, while a poor consumer may need to cut their demand due to budget constraints.