Partnership | CSAT Preparation - UPSC PDF Download

Introduction

When two or more people invest their money in a business, persons are called Partners, their relationship is Partnership and money is Capital.

- If they invest money for the same time, it is called a Simple partnership.

- If they invest money for a different time, it is called a Compound partnership.

Partnership Problems

Profit is directly proportional to Time and Investments.

Profit ∝ Time Profit ∝ Investments

Profit ∝ (Time × Investments)

Solved Examples

Example 1: Three partners A, B, and C invest Rs.1500, Rs.1200, and Rs.1800 respectively in a company. How should they divide a profit of Rs.900?

Given, there is no time given, we can say profit is proportional to investment.

Ratio of profit = ratio of investment

Profit ratio of A:B:C = 1500:1200:1800 = 5:4:6

so, total profit is 5+4+6 = 15 i.e. equal to 900

profit of A = (5/15)× 900 = 300

profit of B = (4/15)× 900 = 240

profit of C = (6/15)× 900 = 360

Example 2: In a company, A invested Rs.1500 for 4 months and B invested Rs.1200 for 6 months and C invested Rs.3600 for 2 months. If a company has a profit of Rs.680. What will be the share of A, B, and C?

Ratio of profit A:B:C = (1500 × 4):(1200 × 6):(3600 × 2)

= 60:72:72

= 5:6:6

total profit is 5+6+6 = 17 i.e. equal to 680.

we can say, 17 = 680

1 = 40

profit of A is 5, so 5× 40 = 200

profit of B is 6, so 6× 40 = 240

profit of C is 6, so 6 × 40 = 240

Example 3: A and B enter into a partnership with Rs.50000 and Rs.75000 respectively in a company for a year. After 7 months, C gets into a partnership with them with Rs.30000 and A withdraws his contribution after 9 months. How would they share their profit of Rs.2600 at the end of the year?

A, B, and C do business for 1 year but, A contributed Rs.50000 for 9 months, B contributed 75000 for 12 months and C invested Rs.30000 for 5 months, not for 7 months.

So the ratio of profit A:B:C = 50×9: 75×12: 30×5

= 15 : 30 : 5

Hence total profit is (15+30+5) = 50 which is equal to 2600

So share of A = (15/50)× 2600 = 780

share of B = (30/50)× 2600 = 1560

share of C = (5/50) × 2600 = 260

Example 4: A, B and C started a company in which A invested (1/3)rd of the capital for (1/4)th of the time, B invested (1/2)nd of the capital for (1/6)th of the time and C invested the remaining capital for the whole of the time. If the profit at the end of the year is Rs.1200. How would they share it?

A invested (1/3)rd of the capital and B invested (1/2)nd of the capital

So, remaining capital invested by C = 1-((1/3)+(1/2)) = 1/6

The ratio of profit A: B:C = (1/3)× (1/4): (1/2)× (1/6): (1/6)× 1

= (1/12):(1/12):(1/6)

= 1 : 1 : 2

A’s share = (1/4)× 1200 = 300

B’s share = (1/4)× 1200 = 300

C’s share = (1/2)× 1200 = 600

Example 5: A and B rent a field for 11 months. A puts 100 bags for 9 months. How many bags can be put by B for 3 months if the ratio of their rent is 2:3?

Let B puts X bags.

the ratio of rent of A: B is 2: 3

so, (100×9) : (X × 3 ) = 2 : 3

X = 450 bags

Example 6: If A and B entered into a partnership and invested their capital in the ratio of 19:15. At the end of 19 months, B withdraws his capital. If they share profit in the ratio of 3:2, then for how many months A invested his ratio?

Let A invested for X months.

Ratio of profit A : B = X × 19 : 19 × 15

So, 19X : 19×15 = 3:2

X = 22(1/2) months

Example 7: Sandeep, Vineet and Shekhar are three partners. Sandeep receives 1/5 of the profit and Vineet and Shekhar share the remaining profit equally. If Vineet’s income is increased by Rs.650 when the profit rises from 10% to 15%. Find the capitals invested by Sandeep, Vineet and Shekhar and total capital invested.

As given, the profit share of Sandeep is 1/5, remaining profit (1-1/5) = 4/5 is shared between Vineet and Shekar equally.

So, the profit share of Vineet = 2/5 and profit share of Shekhar = 2/5

when profit % increases, Vineet’s income increase by Rs.650

(15%-10%) = 5% = 650

100% = 13000

So, Vineet’s capital = 13000

i.e (2/5) of total capital = 13000

total capital = 32500

and Shekhar’s capital = 13000

Sandeep’s capital i.e (1/5) of total capital or ½ of (Vineet or Shekhar’s Capital) = 6500

Example 8: A and B are partners in a business. They invest in the ratio 5: 6, at the end of 8 months B withdraws. If they receive profits at the end of the year in the ratio of 5: 9, find how long A’s investment was used?

Let A’s investment used for X months.

Given, the ratio of invest (A: B) = 5: 6

ratio of time = X : 8

the ratio of profit = 5X: 6×8 and given ratio of profit = 5: 9

so 5X/48 = 5/9

X = 48/9

X = 16/3 months

Example 9: A, B, and C started a business with their investments in the ratio 1: 2: 4. After 6 months A invested the half amount more as before and B invested the same amount as before while C withdrew (1/4)th of his investment after the 9 months. Find the ratio of their profits at the end of the year.

Ratio of investments A:B:C = 1:2:4, there are no changes in the investment of A and B up to 6 months and in the investment of C up to 9 months.

At the end of 6 months, A invested half the amount more as before so A’s investment = 1 +(1/2)

Similarly B invest the same amount more as before = 2 + 2 = 4

But, C withdraw the (1/4)th of the amount after 9 months = 4 – 1 = 3

ratio of profit = (1×6 + (3/2)× 6) : (2× 6 + 4× 6) : (4× 9+3× 3)

= 15 : 36 : 45

= 5 : 12 : 15

Example 10: A sum of money is divided amongst P, Q and R in the ratio of 3: 4: 5. Another amount is divided amongst A and B in the respective ratio of 2: 1. If B got Rs. 1050 less than Q, what is the amount received by R?

Let the sum of money divided amongst P, Q and R is 3x, 4x and 5x respectively and the sum of money divided amongst A and B is 2y and y respectively.

4x – y = 1050

another relation between x and y cannot be established. So, it cannot be determined.

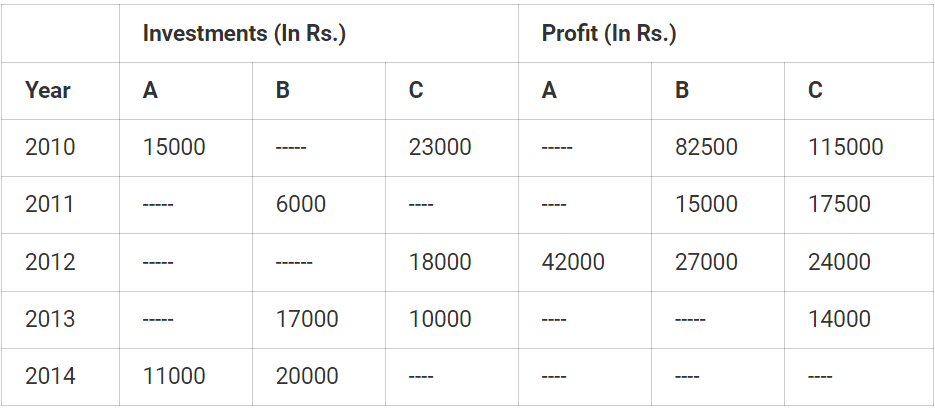

Directions (11-15): In the following table, the investments and profit of three persons is given for different years in a joint business.

Note:

Note:

1. Except for the year 2012, they invested the amounts for the same period.

2. Some values are missing. You have to calculate these values per given data.

Example 11: If the total profit in 2011 is 45000, then find the ratio of the investment of B in 2010 to the investment of A in 2011.

profit of A in 2011 is 45000-(15000+17500) = 12500

B makes the profit of 15000 by investing 6000

So, investment of A in 2011 = (6000/15000)× 12500 = 5000

In 2010, 23000 investment of C makes the profit of Rs.115000

So, investment of B = (23000/115000)× 82500 = 16500

required ratio of (B:A) is 16500:5000 = 33:10

Example 12: If the total investment in 2014 is 46000, then the ratio of profit in 2014 is?

investment of C is 46000 – (20000+11000) = 15000

The time period is the same, so the ratio of profit will be also the same as the ratio of investment = 11:20:15

Example 13: In the year 2012 total investment of A and B is 30000, A and B invested their amount for 4 months and 6 months respectively then find the number of months that C invested his amount?

Ratio of profit (A:B) = 42000: 27000

A× 4 : B× 6 = 42000 : 27000

A : B = 21 : 9 = 7 : 3

So, investment of A is 21000 and investment of B is 9000.

let C invest 18000 for X months.

So, (18000× X) : (21000 × 4) = 24000 : 42000

X = (8/3) months, Hence C invested for 8/3 months.

|

205 videos|264 docs|136 tests

|

FAQs on Partnership - CSAT Preparation - UPSC

| 1. What is a partnership? |  |

| 2. What are the different types of partnerships? |  |

| 3. How do partnerships differ from other business structures? |  |

| 4. What are the advantages of forming a partnership? |  |

| 5. What are the potential disadvantages of partnerships? |  |