Economic Development: March 2023 UPSC Current Affairs | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

Har Payment Digital Mission

Why in News?

At the launch of the ‘Har Payment Digital’ mission during the Digital Payments Awareness Week (DPAW) 2023, the Reserve Bank of India (RBI) has launched a programme to adopt 75 villages and convert them into digital payment enabled villages in observance of 75 years of independence.

What is this Initiative?

- About & Aim:

- Under the initiative, Payment System Operators (PSOs) will adopt these villages across the country and conduct camps in each of these villages with an aim to improve awareness and onboard merchants for digital payments.

- PSOs are entities authorised by RBI to set up and operate a payment system.

- As of February 2023, there are 67 PSOs under various categories such as retail payments organisations, card payment networks, ATM networks, prepaid payment instruments, etc.

- Significance:

- The Har Payment Digital campaign by RBI aims at reinforcing the ease and convenience of digital payments and facilitate onboarding of new consumers into the digital fold.

- Various campaigns highlighting the digital payment channels available are being planned by the banks and non-bank payment system operators.

- This will further encourage and support the adoption of digital payments in the country.

Social Stock Exchange

Why in News?

National Stock Exchange of India received final approval from SEBI to set up the Social Stock Exchange (SSE).

What is a Social Stock Exchange?

- About:

- The SSE would function as a separate segment within the existing stock exchange and help social enterprises raise funds from the public through its mechanism.

- It would serve as a medium for enterprises to seek finance for their social initiatives, acquire visibility and provide increased transparency about fund mobilisation and utilisation.

- Retail investors can only invest in securities offered by for-profit social enterprises (SEs) under the Main Board.

- In all other cases, only institutional investors and non-institutional investors can invest in securities issued by SEs.

- Eligibility:

- Any non-profit organisation (NPO) or for-profit social enterprise (FPSEs) that establishes the primacy of social intent would be recognised as a SE, which will make it eligible to be registered or listed on the SSE.

- 17 plausible criteria under SEBI’s ICDR Regulations, 2018 include serving to eradicate hunger, poverty, malnutrition, promoting education, employability, equality, and environmental sustainability among others

- Ineligibility:

- Corporate foundations, political or religious organisations, professional or trade associations, infrastructure and housing companies (except affordable housing) would not be identified as SE

- NPOs would be deemed ineligible if dependent on corporates for more than 50% of its funding.

- NPO Money Raising:

- NPOs can raise money either through issuance of Zero Coupon Zero Principal (ZCZP) Instruments from private placement or public issue, or donations from mutual funds.

- ZCZP bonds differ from conventional bonds in the sense that it entails zero coupon and no principal payment at maturity.

- For ZCZP issuance, the minimum issue size is presently prescribed as Rs 1 crore and minimum application size for subscription at Rs 2 lakhs.

- Also, Development Impact Bonds are available upon completion of a project and delivered on pre-agreed social metrics at pre-agreed costs/rates.

- FPSE Money Raising:

- FPEs need not register with SSE before raising funds through SSE.

- It can raise money through issue of equity shares or issuing equity shares to an Alternative Investment Fund including Social Impact Fund or issue of debt instruments.

India’s Sugar Exports

Why in News?

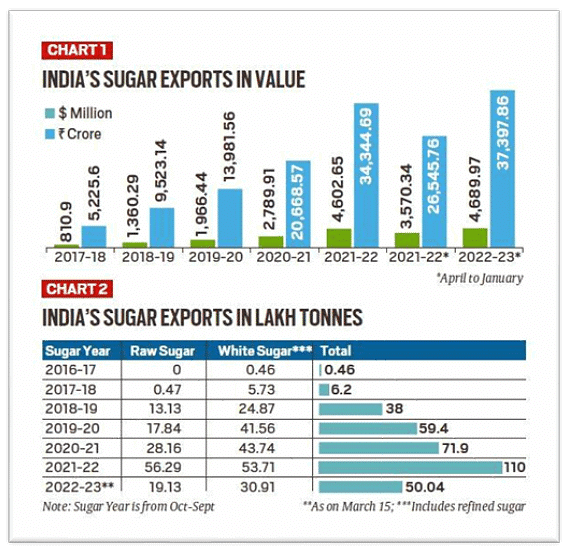

India has gone from being a marginal sugar exporter five years ago to No. 2 in the world, behind only Brazil. Between 2017-18 and 2021-22, exports have soared from USD 810.9 million to USD 4.6 billion.

- Sugar exports may cross USD5.5 billion in the current fiscal year.

What is the Status of the Sugar Industry in India?

- About:

- Sugar industry is an important agro-based industry that impacts the rural livelihood of about 50 million sugarcane farmers and around 5 lakh workers directly employed in sugar mills.

- In (Oct-Sep) 2021-22 India emerges as the world’s largest producer and consumer of sugar and world’s 2nd largest exporter of sugar.

- Distribution:

- Sugar industry is broadly distributed over two major areas of production- Uttar Pradesh, Bihar, Haryana and Punjab in the north and Maharashtra, Karnataka, Tamil Nadu and Andhra Pradesh in the south.

- South India has a tropical climate which is suitable for higher sucrose content giving a higher yield per unit area as compared to north India.

- Geographical Conditions for the Growth of Sugar:

- Temperature: Between 21-27°C with hot and humid climate.

- Rainfall: Around 75-100 cm.

- Soil Type: Deep rich loamy soil.

What is the Status of Sugar Exports?

- Background:

- Till 2017-18, India hardly exported any raw sugar (produced after the first crystallisation of cane juice).

- It mainly shipped plantation white sugar (produced by refining of raw sugar) with 100-150 ICUMSA value (International Commission for Uniform Methods of Sugar Analysis). This was referred to as low-quality whites or LQW in international markets.

- ICUMSA is a measure of purity. The lower the value, the more the whiteness.

- Current Status:

- Out of India’s total 110 lakh tonnes(lt) sugar exports in 2021-22, raws alone accounted for 56.29 lt.

- The biggest importers of Indian raw sugar were Indonesia (16.73 lt), Bangladesh (12.10 lt), Saudi Arabia (6.83 lt), Iraq (4.78 lt) and Malaysia (4.15 lt).

- Reasons for Rising Exports:

- Free of Bacterial Compound: Indian raw sugar is free of dextran, a bacterial compound formed when sugarcane stays in the sun for too long after harvesting.

- Indian cane is crushed within 12-24 hours of harvesting while it takes around 48 hours in Brazil.

- High Sucrose Content: Indian raw sugar has a higher polarization (98.5-99.5%) compared to other producers like Brazil, Thailand, and Australia, making it easier and cheaper to refine.

- Polarisation is the percentage of sucrose present in a raw sugar mass.

- Cap on Exports:

- Lower stocks and production dipping in 2021-22 has led the government to cap India’s exports in the current sugar year to 61 lakh tonnes to ensure domestic availability.

- The government did it to ensure domestic availability and contain food inflation but overseas markets once lost aren’t easy to regain.

PM MITRA Park Scheme

Why In News?

Recently, the State Governments have been requested to send their proposals for PM MITRA Parks Scheme by 15th March 2022.

PM MITRA

- About:

- The seven Mega Integrated Textile Region and Apparel (PM MITRA) parks will be set up at Greenfield or Brownfield sites located in different states.

- It is in line with the vision of ‘Atma Nirbhar Bharat’ and to position India strongly on the Global textiles map.

- It will be developed by a Special Purpose Vehicle (SPV), which will be owned by the State Government and the Government of India in a Public-Private Partnership (PPP) Mode.

- It is inspired by the 5F vision of the Prime Minister of India. The ‘5F’ Formula encompasses - farm to fibre; fibre to factory; factory to fashion; fashion to foreign.

- Core infrastructure:

- It will include an incubation centre and plug and play facility, developed factory sites, roads, power, water and waste-water system, common processing house and CETP and other related facilities like design centre, testing centres, among others.

- These parks will also have support infrastructures like workers’ hostels and housing, logistics park, warehousing, medical, training and skill development facilities.

- The Scheme shall be implemented on a pan-India basis and is intended for the holistic development of the Textile sector.

- Significance

- It will reduce logistics costs and strengthen the value chain of the textile sector to make it globally competitive.

- It will lead to increased investments (FDI and local) and enhanced employment opportunities.

- It will give domestic manufacturers a level-playing field in the international textiles market & pave the way for India to become a global champion of textiles exports across all segments.

Other related initiatives

- The Government has approved the Production Linked Incentive (PLI) Scheme for Textiles for promotion of Man-Made Fibre(MMF) Apparel, MMF Fabrics and products of Technical Textiles.

- Benefits of PLI will be available to eligible companies in PM MITRA parks also.

- However, the Competitive Incentive Support (CIS) under PM MITRA Parks Scheme will only be available to those manufacturing companies who are not availing benefits of Production Linked Incentive (PLI) for Textile Scheme.

- A National Technical Textiles Mission has already been launched to promote research and development in that sector.

Foreign Contribution Regulation Act

Why in News?

Recently, the Ministry of Home Affairs suspended the Foreign Contribution Regulation Act (FCRA) licence of the Centre for Policy Research (CPR).

- CPR (not-for-profit society), along with Oxfam India and the Independent and Public-Spirited Media Foundation (IPSMF), was surveyed by the Income Tax department earlier.

What is the Foreign Contribution Regulation Act?

- About:

- FCRA was enacted during the Emergency in 1976 amid apprehensions that foreign powers were interfering in India’s affairs by pumping money into the country through independent organisations.

- The law sought to regulate foreign donations to individuals and associations so that they functioned in a manner consistent with the values of a sovereign democratic republic.

- Amendments:

- An amended FCRA was enacted in 2010 to “consolidate the law” on utilisation of foreign funds, and “to prohibit” their use for “any activities detrimental to national interest”.

- The law was amended again in 2020, giving the government tighter control and scrutiny over the receipt and utilisation of foreign funds by NGOs.

- Criteria:

- The FCRA requires every person or NGO seeking to receive foreign donations to be:

- registered under the Act

- to open a bank account for the receipt of the foreign funds in State Bank of India, Delhi

- to utilize those funds only for the purpose for which they have been received and as stipulated in the Act.

- FCRA registrations are granted to individuals or associations that have definite cultural, economic, educational, religious, and social programmes.

- Exceptions:

- Under the FCRA, the applicant should not be fictitious and should not have been prosecuted or convicted for indulging in activities aimed at conversion through inducement or force, either directly or indirectly, from one religious faith to another.

- The applicant should also not have been prosecuted for or convicted of creating communal tension or disharmony.

- Also, should not be engaged or likely to be engaged in the propagation of sedition.

- The Act prohibits the receipt of foreign funds by candidates for elections, journalists or newspaper and media broadcast companies, judges and government servants, members of legislature and political parties or their office-bearers, and organisations of a political nature.

- Validity:

- FCRA registration is valid for 5 years, and NGOs are expected to apply for renewal within six months of the date of expiry of registration.

- The government can also cancel the FCRA registration of any NGO if it finds that the NGO is in violation of the Act, if it has not been engaged in any reasonable activity in its chosen field for the benefit of society for two consecutive years, or if it has become defunct.

- Once the registration of an NGO is cancelled, it is not eligible for re-registration for three years.

- FCRA 2022 Rules:

- In July 2022, the MHA effected changes to FCRA rules which increased the number of compoundable offences under the Act from 7 to 12.

- The other key changes were exemption from intimation to the government for contributions less than Rs 10 lakh – the earlier limit was Rs 1 lakh — received from relatives abroad, and increase in time limit for intimation of opening of bank accounts.

MSME Competitive (LEAN) Scheme

Why In News

The Union Minister for Micro, Small and Medium Enterprises launched the MSME Competitive (LEAN) scheme.

- About

- The Scheme is a business initiative to reduce "waste" in manufacturing.

- It provides for building awareness of lean manufacturing practices in MSME clusters as well as cost sharing of consultant’s fees with MSME units who opt for such interventions.

- Under the scheme, the Centre's contribution will be 90 per cent of the implementation cost for handholding and consultancy fees as against 80 per cent previously.

- Lean Manufacturing Techniques are adopted with the objective of

- reducing waste,

- increasing productivity,

- introducing innovative practices for improving overall competitiveness,

- inculcating good management systems and imbibing a culture of continuous improvement.

- The Pilot Phase of Lean Manufacturing Competitiveness Scheme (LMCS) was approved in 2009 for 100 Mini Clusters.

- Under the scheme, MSMEs will implement LEAN manufacturing tools like 5S, Kaizen, KANBAN, Visual workplace, Poka Yoka etc under the guidance of trained and competent LEAN Consultants to attain LEAN levels like Basic, Intermediate and Advanced.

- Nodal Agency: National Productivity Council (NPC)

- Eligibility: The Scheme is open to Micro, Small or Medium as per the definition of the MSME Act. (The Micro, Small and Medium Enterprises Development Act, 2006.)

- The units are required to form a Mini Cluster of 10 or so units.

Benefits

- Under the Scheme, MSMEs are assisted in reducing their manufacturing costs, through proper personnel management, better space utilization, scientific inventory management, improved processed flows, reduced engineering time and so on.

- LMCS (Lean Manufacturing Competitiveness Scheme) also brings improvement in the quality of products and lowers costs, which are essential for competing in national and international markets.

Challenges

- The larger enterprises in India have been adopting LMCS to remain competitive, but MSMEs have generally stayed away from such programs as they are not fully aware of the benefits.

- Besides these issues, experienced and effective Lean Manufacturing Counsellors or Consultants are not easily available and are expensive to engage and hence most MSMEs are unable to afford LMCS.

Liquidation process under the Insolvency and Bankruptcy Code (IBC)

In News

Recently, the National Company Law Appellate Tribunal (NCLAT) ruled that the liquidation process of a company under the Insolvency and Bankruptcy Code (IBC) holds precedence over the outcome of an arbitration proceeding.

About Liquidation and its process

- Liquidation is the winding up of a corporation or incorporated entity under the supervision of a person or “liquidator” and they are empowered under the law for such operation, for distribution of proceeds to the various creditors as per an agreed formula.

- Only firms can be liquidated. Defaulting individuals cannot be liquidated.

- Insolvency is the trigger which causes a bankruptcy or liquidation and when the debtor goes into liquidation, an insolvency professional administers the liquidation process.

- Proceeds from the sale of the debtor’s assets are distributed in the following order of precedence:

- insolvency resolution costs, including the remuneration to the insolvency professional,

- secured creditors, whose loans are backed by collateral, dues to workers, other employees,

- unsecured creditors,

- dues to the government,

- priority shareholders and

- equity shareholders.

What is the waterfall mechanism for liquidation?

- The waterfall mechanism under Insolvency and Bankruptcy Code gives priority to secured financial creditors over unsecured financial creditors.

- Under Section 53 of the IBC, which deals with waterfall mechanism, the topmost priority is given to costs which are related to the liquidation process and dues of workmen of the corporate debtor. The dues of the workmen include all their salaries, provident, pension, retirement and gratuity fund, as well as any other funds maintained for the welfare of the workmen.

What is the Insolvency and Bankruptcy Code (IBC) 2016?

- Insolvency and Bankruptcy Code 2016 was implemented through an act of Parliament.

- The law was necessitated due to a huge pile-up of non-performing loans of banks and delay in debt resolution.

- Companies have to complete the entire insolvency exercise within 180 days under IBC and the deadline may be extended if the creditors do not raise objections to the extension.

- Insolvency and Bankruptcy Board of India has been appointed as a regulator and it can oversee these proceedings. IBBI has 10 members( from the Ministry of Finance, Ministry of Law & Justice and the Reserve Bank of India).

- Aims and objectives- IBC apply to companies, partnerships and individuals and It provides a time-bound process to resolve insolvency. When a default in repayment occurs, creditors gain control over debtor’s assets and must make decisions to resolve insolvency. Under IBC debtor and creditor both can start ‘recovery’ proceedings against each other.

Who adjudicates over the proceedings?

- The proceedings of the resolution process will be adjudicated by the National Companies Law Tribunal (NCLT), for companies and the Debt Recovery Tribunal (DRT) for individuals.

- The courts approve initiating the resolution process, appointing the insolvency professional and giving nod to the final decision of creditors. The Insolvency and Bankruptcy Board regulates insolvency professionals, insolvency professional agencies and information utilities set up under the Code.

About National Company Law Appellate Tribunal (NCLAT:

- National Company Law Appellate Tribunal (NCLAT) was constituted under Section 410 of the Companies Act, 2013 for hearing appeals against the orders of National Company Law Tribunal(s) (NCLT), with effect from 1st June 2016.

- It is also the Appellate Tribunal for hearing appeals against the orders passed by NCLT(s) under Section 61 of the Insolvency and Bankruptcy Code, 2016 (IBC) and it is also the Appellate Tribunal for hearing appeals against the orders passed by Insolvency and Bankruptcy Board of India under Section 202 and Section 211 of IBC.

- It is also the Appellate Tribunal to hear and dispose of appeals against any direction issued or decision made or order passed by the Competition Commission of India (CCI) as per the amendment brought to Section 410 of the Companies Act, 2013 by Section 172 of the Finance Act, 2017.

Startups in Emerging Technology

Why in News?

Recently, the Government unveiled an Action Plan for Startup India which laid the foundation of Government support, schemes and incentives envisaged to create a vibrant startup ecosystem in the country.

What are Details of Programs to Support Startups?

- Startup India Action Plan:

- The Action Plan comprises of 19 action items spanning across areas such as “Simplification and handholding”, “Funding support and incentives” and “Industry-academia partnership and incubation”.

- Fund of Funds for Startups (FFS) Scheme:

- The Government has established FFS with a corpus of Rs. 10,000 crore, to meet the funding needs of startups.

- Department for Promotion of Industry and Internal Trade (DPIIT) is the monitoring agency and Small Industries Development Bank of India (SIDBI) is the operating agency for FFS.

- It has not only made capital available for startups at early stage, seed stage and growth stage but also played a catalytic role in facilitating raising of domestic capital, reducing dependence on foreign capital and encouraging home grown and new venture capital funds.

- Credit Guarantee Scheme for Startups (CGSS):

- The Government has established the CGSS for providing credit guarantees to loans extended to DPIIT recognized startups by Scheduled Commercial Banks, Non-Banking Financial Companies (NBFCs) and Venture Debt Funds (VDFs) under SEBI registered Alternative Investment Funds.

- Ease of Procurement:

- Government e-Marketplace (GeM) Startup Runway has been developed which is a dedicated corner for startups to sell products and services directly to the Government.

- Support for Intellectual Property Protection:

- The Government launched Start-ups Intellectual Property Protection (SIPP) which facilitates the startups to file applications for patents, designs and trademarks through registered facilitators in appropriate IP offices by paying only the statutory fees.

- The Government bears the entire fees of the facilitators for any number of patents, trademarks or designs, and startups only bear the cost of the statutory fees payable.

- Startups are provided with an 80% rebate in filing of patents and 50% rebate in filing of trademark vis-a-vis other companies.

- Self-Certification under Labour and Environmental laws:

- Startups are allowed to self-certify their compliance under 9 Labour and 3 Environment laws for a period of 3 to 5 years from the date of incorporation.

- Income Tax Exemption for 3 years:

- Startups incorporated on or after 1st April 2016 can apply for income tax exemption.

- The recognized startups that are granted an Inter-Ministerial Board Certificate are exempted from income-tax for a period of 3 consecutive years out of 10 years since incorporation.

- International Market Access to Indian Startups:

- This has been done through international Government to Government partnerships, participation in international forums and hosting of global events.

- Startup India has launched bridges with over 15 countries that provides a soft-landing platform for startups from the partner nations and aid in promoting cross collaboration.

- Faster Exit for Startups:

- The Government has notified Startups as ‘fast track firms’ enabling them to wind up operations within 90 days vis-a-vis 180 days for other companies.

- Startup India Hub:

- The Government launched a Startup India Online Hub in 2017 which is one of its kind online platforms for all stakeholders of the entrepreneurial ecosystem in India to discover, connect and engage with each other.

- National Startup Advisory Council:

- The Government in January 2020 notified the constitution of the National Startup Advisory Council to advise the Government on measures needed to build a strong ecosystem for nurturing innovation and startups in the country to drive sustainable economic growth and generate large scale employment opportunities.

- Besides the ex-officio members, the council has a number of non-official members, representing various stakeholders from the startup ecosystem.

- Startup India Seed Fund Scheme (SISFS):

- The Scheme aims to provide financial assistance to startups for proof of concept, prototype development, product trials, market entry and commercialization. Rs. 945 crore has been sanctioned under the SISFS Scheme for a period of 4 years starting from 2021-22.

- National Startup Awards (NSA):

- National Startup Awards is an initiative to recognize and reward outstanding startups and ecosystem enablers that are building innovative products or solutions and scalable enterprises, with high potential of employment generation or wealth creation, demonstrating measurable social impact.

- States’ Startup Ranking Framework (SRF):

- States’ Startup Ranking Framework is a unique initiative to harness the strength of competitive federalism and create a flourishing startup ecosystem in the country.

- The major objectives of the ranking exercise are facilitating states to identify, learn and replace good practices, highlighting the policy intervention by states for promoting startup ecosystems and fostering competitiveness among states.

- Startup India Innovation Week:

- The Government organises Startup India Innovation week around the National Startup Day i.e., 16th January.

- TIDE 2.0 Scheme:

- Technology Incubation and Development of Entrepreneurs (TIDE 2.0) Scheme was initiated by Ministry of Electronics and Information Technology (MeitY) in the year 2019 to promote tech entrepreneurship through financial and technical support to incubators engaged in supporting ICT startups using emerging technologies such as IoT, AI, Block-chain, Robotics etc.

- The Scheme is being implemented through 51 incubators through a three-tiered structure with an overarching objective to promote incubation activities at institutes of higher learning and premier R&D organisations.

- Domain specific Centres of Excellence (CoEs):

- MeitY has operationalised 26 CoEs in diverse areas of national interest for driving self-sufficiency and creating capabilities to capture new and emerging technology areas.

- These domain specific CoEs act as enablers and aid in making India an innovation hub in emerging through democratisation of innovation and realisation of prototypes.

- SAMRIDH Scheme:

- MeitY has launched the ‘Start-up Accelerator Programme of MeitY for Product Innovation, Development and Growth (SAMRIDH)’ with an aim to support existing and upcoming Accelerators to further select and accelerate potential software product-based startups to scale.

- Next Generation Incubation Scheme (NGIS):

- NGIS has been approved to support the software product ecosystem and to address a significant portion of National Policy on Software Product (NPSP) 2019.

- Biotechnology Industry Research Assistance Council (BIRAC):

- An industry-academia interface agency of Department of Biotechnology, Ministry of Science & Technology is supporting biotech startups in all biotech sectors including clean energy and emerging technologies.

- Project based funding is provided to startups and companies for product/technology development under its key Schemes including Biotech Ignition Grant (BIG), Small Business Innovation Research Initiative (SBIRI) and Biotechnology Industry Partnership Programme (BIPP).

- Incubation support to the startups and companies is also provided through Bioincubators Nurturing Entrepreneurship for Scaling Technologies (BioNEST) Scheme.

|

38 videos|5288 docs|1117 tests

|

FAQs on Economic Development: March 2023 UPSC Current Affairs - Current Affairs & Hindu Analysis: Daily, Weekly & Monthly

| 1. What is the objective of the Har Payment Digital Mission? |  |

| 2. What is the Social Stock Exchange in India? |  |

| 3. What are India's Sugar Exports? |  |

| 4. What is the PM MITRA Park Scheme? |  |

| 5. What is the purpose of the Foreign Contribution Regulation Act (FCRA)? |  |