Diconsa Case Interview | Case Studies - Interview Preparation PDF Download

Client Goal

The Bill & Melinda Gates Foundation is a private organization with vast ambitions; one of its goals is to reduce extreme poverty worldwide. The foundation has asked McKinsey to design a basic financial-services offering for residents in remote communities in Mexico.

Situation Description

The majority of Mexico’s rural population is relatively poor, relying in part on government benefits for their livelihood. Since they tend not to have bank accounts, they usually collect those benefits in cash from a limited number of state-owned bank branches. These branches are often a long way from where the recipients live, so it can take a lot of time and effort to collect benefits. In addition, while traveling to the branches, people can be at risk of falling victim to crime.

The Mexican government also owns and operates a chain of 22,000 stores throughout Mexico, called Diconsa, which provide basic food, clothes, and other essential goods to rural populations. These stores are supplied through a network of central and regional warehouses and several thousand delivery trucks.

McKinsey Study

McKinsey has been asked to investigate and assess the possibility of using the Diconsa network to provide a set of basic financial services to supplement the limited number of state-owned bank branches. This would start with dispensing benefit payments and would gradually grow to include savings accounts, bill payments, insurance, loans, and other financial products.

Helpful hints

- Write down important information.

- Feel free to ask the interviewer to explain anything that is not clear to you.

Q.1. What should the team investigate to determine whether the Diconsa network could and should be leveraged to provide a range of basic financial services to Mexico’s rural population?

Some of the factors you might discuss with your interviewer could include:

(i) Benefits to the rural population: In addition to the benefits mentioned in the summary, such as shorter travel times and greater access to financial services, there could be other advantages to the rural population. For example, having a broader range of financial services could provide them with more options for saving, investing, and managing their money. It could also improve the security of their money by reducing the need to carry cash or rely on informal methods of banking. These factors could lead to greater financial stability and prosperity for the rural population.

(ii) Benefits to the government, state bank, and Diconsa network: The government could benefit from increased compliance with benefit programs and lower administration costs, as well as improved financial management among the rural population. The state bank could benefit from increased business and greater efficiency, since the Diconsa network would be able to distribute benefit payments and financial services in areas that are currently underserved. The Diconsa network itself could benefit from offering additional services, which could increase its revenue and help it to better serve its customers.

(iii) Potential risks of the venture: One potential risk of expanding financial services through the Diconsa network is that it may not have the capacity or ability to deal with financial payments and products. Similarly, the state bank may not have the capacity to operate financial services across a much larger network of outlets. This could lead to delays or errors in processing payments, which could have negative consequences for the rural population. There is also a greater risk of fraud or theft due to less centralized control of benefit payments, which could be a significant concern for both the government and the Diconsa network.

Q.2. The team has estimated that it currently costs a family 50 pesos per month in transportation and food to make the journey to collect benefit payments. The team also estimates that if benefits were available for collection at local Diconsa stores, the cost would be reduced by 30 percent.

Twenty percent of Mexico’s population is rural, and of that number, half currently receive state benefits.

You can assume that Mexico has a population of 100 million.

You can also assume that families in Mexico have an average four members, and that this does not vary by region.

If every family could collect state benefits at their local Diconsa stores, how much in total per year would be saved across all Mexican rural families receiving state benefits?

One possible approach to discuss with your interviewer could be:

(i) Rural Mexico has approximately five million families.

(ii) Of these, 50% or 2.5 million families currently receive benefits.

(iii) Each family spends 600 pesos per year to receive benefits, which is equivalent to 50 pesos per month multiplied by 12 months.

(iv) Therefore, in total, these families spend 1.5 billion pesos per year to receive benefits.

(v) If the proposed changes could reduce the cost of delivering benefits by 30%, it could result in savings of 450 million pesos per year.

(vi) To arrive at the 30% reduction, the calculation was done as follows: 20% of the 5 million families is 1 million families, multiplied by 50 pesos per month equals 50 million pesos saved per month. 50 million pesos saved per month times 12 months equals 600 million pesos saved per year. 600 million pesos saved per year divided by the current cost of 1.5 billion pesos equals 0.4 or 40%. Therefore, the proposed changes could potentially result in a 40% reduction in costs. However, in the given scenario, the reduction has been assumed to be 30%.

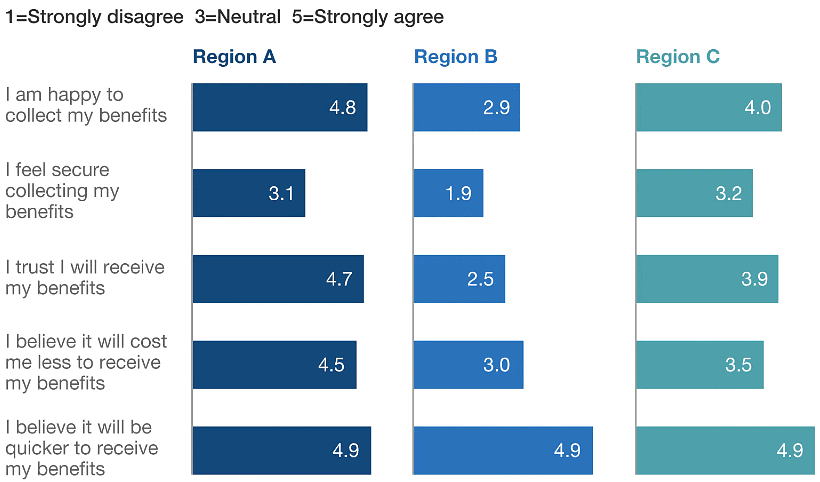

Q.3. The team conducted a survey on a sample of the rural population in three different regions of Mexico. Participants were shown several statements about the concept of collecting benefits at their nearest Diconsa store and asked how much they agreed with each statement. The average response to some of the questions in each region is shown below:

Result of rural population survey on concept of using Diconsa Stores for dispensing benefits payments

|

16 docs

|