Economic Development: June 2023 UPSC Current Affairs | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

Current Global Trade Momentum

Context

India’s merchandise exports shrunk by 12.7% year-on-year basis in April as a result of slowing economy, inflationary setting and tighter monetary controls across the world.

More on the News

- India’s merchandise export numbers fell to $34.66 billion in April, which is a six-month low. During the same period, imports fell by 14% to $49.90 billion.

- The trend of the fall in imports and exports is not just limited to India as other countries have also recorded similar declines, indicating a slowing global demand.

Major reasons for slowdown of Global Economy

- Covid-19 pandemic: The covid-19 pandemic affected economic growth, widened fiscal deficit, disrupted supply chains and reduced manufacturing output. The aftermath of pandemic was decline in household income, increase in inflation and weak consumer sentiments.

- The Ukraine war: The crisis in Ukraine increased energy and food prices. The supply chain of vital products such as gems, fertilizers, defence, rare earth minerals etc was affected.

- Climate emergency: The existing conditions were exacerbated through climate-induced crisis, including floods, droughts, marine heatwaves, cyclones etc.

- Economic crisis in China: Recession in China has been a result of zero-Covid policy. Stringent rules have affected the nation’s real estate, manufacturing and services. This also affected global economy.

Current trends in Global Trade

- Economic slowdown: The observed trends across the world include weaker economic activities, inflation and tightening of monetary policies, disrupted supply chains due to Russia-Ukraine conflict and financial instability due to failure of financial institutions in advanced economies.

- Rise in food and energy prices: The conflict in Eastern Europe has a bearing on the prices of energy, food and commodities. Even though food and energy prices receded from their peaks, they still remain high by historical standards.

- The impact was strongest during the winter months in Europe as Russia was among the largest suppliers of energy to Europe.

- To compensate for the loss of gas shipments from Russia, Europe shifted to other suppliers, including the U.S., Qatar, Norway and Algeria.

- This led to increase in LNG prices in other countries such as Japan, where prices doubled.

- Collapse of financial institutions: Financial institutions such as Silicon Valley Bank, Signature Bank and First Republic Bank witnessed collapse. This has worsened the already precarious situation.

What could be the future economic trends?

- Recession fear in EU: The European Economic Forecast says that the region would narrowly escape the recession that had begun around September.

- Inflationary pressure in US: Even though inflation pressure in the US has moderated, it continues to run high with expectations of it receding to 2% soon looking bleak.

- Business conditions: The Global Manufacturing Purchasing Managers’ Index (PMI) indicates a marginal deterioration of business conditions, especially in manufacturing.

- International trade: In current state, the international trade (imports and exports) have fallen sharply as overall demand for goods and services stand reduced.

- The decision to postpone spending on some postponable expenditures have led to fall in exports of engineering goods, gems and jewellery, chemicals, and readymade garments and plastics.

- Low economic growth: Inflation of food and energy erodes the purchasing power of an individual. It also will affect the flow of capital to developing countries, thereby causing reduced growth.

Impact of adverse economic conditions on India

- Reduced trade with major markets: Demand from markets like the EU and the US looks bleak. To sustain the exports momentum, the government will be looking to initiate inter-ministerial talks.

- Even though merchandise exports will be affected, services exports will hold the fort.

- Imports may remain low as commodity prices and rupee value stabilizes. However, the growth in non-crude non-jewellery segment imports indicates robust domestic demand.

- Decline in investments: Weakened economic sentiments are likely to reduce the inflow of investments in India. This could have a bearing on foreign exchange.

- Inflation: Imported inflation may impact domestic economy, especially in sectors dependent on raw materials. The rise in prices of imported goods can adversely affect economic growth.

G-Sec Yields

Why in news?

The government said that it had decided to keep interest rates on small savings instruments unchanged for the July-September quarter given the sharp rise in government security (G-sec) yields over the last three months.

What are Government securities?

- G-secs- Government Securities or government bonds, are instruments that governments (Central Government or the State Governments) use to borrow money.

- Governments routinely keep running into deficits thereby spending more than they earn via taxes.

- Investors in government securities will either hold them to maturity or sell them to other investors on the secondary bond market.

- Classification of G-secs - Government Securities are

- Short term (usually called treasury bills, with original maturities of less than one year)

- Long term (usually called Government bonds or dated securities with original maturity of one year or more)

- In India, the Central Government issues both, treasury bills and bonds or dated securities while the State Governments issue only bonds or dated securities, which are called the State Development Loans (SDLs).

What is unique about G-secs?

- Risk-free gilt-edged instruments- G-secs carry the lowest risk of all investments as the chances of the government not paying back your money are almost zero.

- Lower interest rate- The tradeoff of buying risk-free securities is that they tend to pay a lower rate of interest than corporate bonds.

- Calculation of G-sec yields- Every G-sec has a face value, a coupon payment and price.

- The price of the bond may or may not be equal to the face value of the bond.

- At this point, the face value of this G-sec is equal to its price, and its yield (or the effective interest rate).

How do G-sec yields go up and down?

- If the government floats just one G-sec, and two people want to buy it, competitive bidding will ensue, and the price of the bond may rise.

- However, the coupon payment on the G-sec is still the same.

- If the price of the bond goes up, then the yield will fall.

- For instance, if a bond is bought at Rs 100 and the yield is 5%, but if the price of the bond goes up to Rs 105 then the yield will fall to 4.76%.

What do G-sec yields show?

- G-sec yields are a good way to figure out the broader trend of interest rates in the economy.

- Demand from private- If G-sec yields are going up, it would imply that lenders are demanding even more from private sector firms or individuals because anyone else is riskier when compared to the government.

- Risk-As such, if G-sec yields start going up, it means lending to the government is becoming riskier.

- The G-sec yields are going up, it suggests that the bond prices are falling because fewer people want to lend to the government.

- Ability of the government to pay back- And that in turn happens when people are worried about the government’s finances.

- The government’s finances may be in trouble because the economy is faltering and it is unlikely that the government will meet its expenses.

Greedflation

Why in news?

There is a growing consensus across the world that corporate turns crisis into an opportunity for businesses to make supernormal profits.

How inflation is contained in an economy?

- Inflation - It is the rate of increase in prices over a given period of time.

- There are two main ways in which inflation happens.

- Cost-push inflation - Prices get pushed up because input costs have risen.

- Demand-pull inflation - Prices are pulled up because there is excess demand.

- Containing inflation - Central banks use monetary policy to contain the inflation.

- It raise interest rates to bring overall demand in line with overall supply containing demand-pull inflation.

- It raise interest rates to contain demand which in turn contains cost-push inflation.

- In case of Greedflation, the whole monetary policy prescription becomes more unjust and ineffective.

- Because it is neither due to higher input cost nor due to excess demand.

What is Greedflation?

- Greedflation is the exploitation of inflation by corporates to create excessive profits.

- It simply means (corporate) greed fuelled inflation.

- In normal inflation situation, corporates go for the wage-price spiral, in Greedflation corporates choose the profit-price spiral.

- Wage-price spiral - A cyclical condition where the rise in wages leads to increased prices, resulting in inflation.

- Profit-price spiral - Companies exploit the existing inflation by putting up their prices way beyond just covering their increased costs.

- This is used to maximise their profit margins that, in turn, further fuelled inflation.

- Greedflation happens in two scenarios.

- When the price mark-up is far in excess of the increase in inputs.

- When businesses do not bring down the market prices even when the input prices fall.

What are the implications of greedflation?

- Less likeliness to spend money will lead to reduced economic activity.

- Reduces the purchasing power of the people making even basic needs hard to afford.

- Creates social unrest due to raising cost of living.

- On the corporates’ side it affects the business as well as loss of customer trust.

- Forces governments to intervene like windfall tax to contain inflation.

Is Greedflation happening in India?

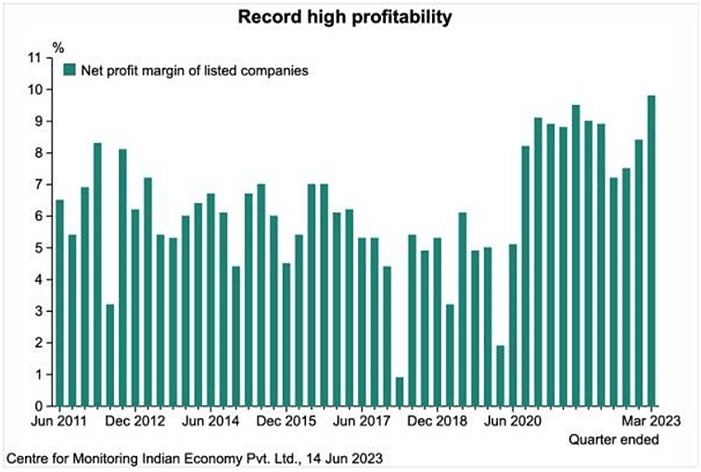

According to the Centre for Monitoring Indian Economy (CMIE), ‘60% of the growth in net profit can be attributed entirely to the increase in profit margin.’

- Net profits of 4,293 listed companies reached Rs.2.9 trillion in the March 2023 quarter.

- This spike in profits is over 3.5 times the average quarterly profit earned by listed companies till before the pandemic of 2020.

- The data shows the Indian corporate sector has generated superlative profits in the post pandemic period.

- The sharp spike in profits depicts there is a very good chance that corporate greed also played a role in spike the inflation rate in India.

Foreign Direct Investment Inflows

Why in News?

Foreign Direct Investment (FDI) inflows into India have experienced a notable downturn in the fiscal year ending March 2023.

- FDI inflows on a gross basis stood at USD 71 billion in FY23, reflecting a decline of 16% compared to the previous fiscal year, marking the first decrease in FDI inflows in the country in the past decade.

What is Foreign Direct Investment (FDI)?

- Foreign direct investment (FDI) is a type of cross-border investment in which an investor from one country establishes a lasting interest in an enterprise in another country.

- FDI can take various forms, such as acquiring shares, establishing a subsidiary or a joint venture, or providing loans or technology transfers.

- FDI is considered to be a key driver of economic growth, as it can bring in capital, technology, skills, market access and employment opportunities to the host country.

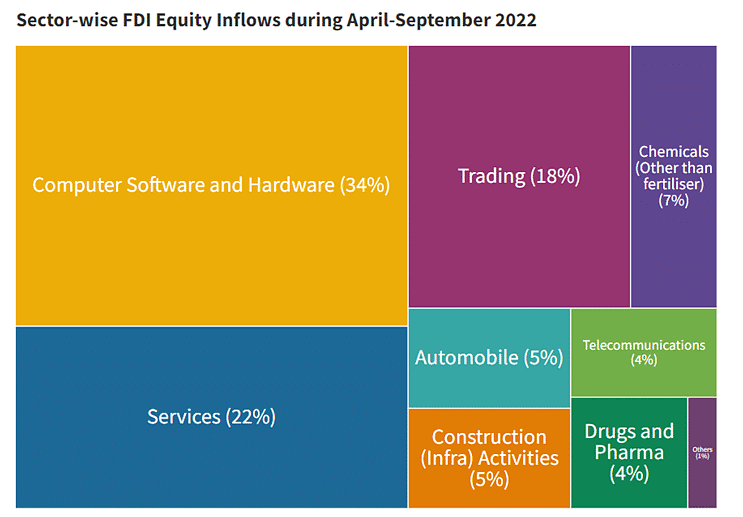

What are the Trends and Patterns of FDI Inflows in India?

- About

- India has been one of the most attractive destinations for FDI in recent years, owing to its large and growing domestic market, favourable demographics, political stability, liberalised policy framework and improved ease of doing business.

- According to the Department for Promotion of Industry and Internal Trade (DPIIT), India’s cumulative FDI inflow stood at USD 871.01 billion between April 2000-June 2022.

- According to the World Investment Report 2022, India has ranked 7th among the top 20 host economies for 2021.

- India received the highest-ever FDI inflows of USD 84.8 billion including USD 7.1 billion FDI equity inflows in the services sector in FY22.

- Country-wise FDI Equity Inflow FY-2021-22:

- Singapore (27.01%), USA (17.94%), Mauritius (15.98%), Netherland (7.86%) and Switzerland (7.31%) emerge as top 5 countries for FDI equity inflows.

What are the Challenges Related to FDI inflows in India?

- Taxation and Regulatory Compliance: India's tax regime has undergone several reforms in recent years, but complexities and uncertainties still exist.

- Frequent changes in tax laws, multiple layers of taxation, and disputes over tax assessments create challenges for foreign investors in terms of compliance and tax planning.

- Competition from Other Emerging Markets: India faces competition from other emerging markets, such as China, Vietnam, and Indonesia, in attracting FDI.

- These countries offer competitive advantages, including lower costs of production, better infrastructure, and more investor-friendly policies.

- Infrastructure Deficit: Despite ongoing efforts to improve infrastructure, India still faces significant gaps in areas such as transportation, logistics, power, and telecommunications.

- Insufficient infrastructure hampers the ease of doing business and raises operational costs for foreign investors.

What Measures can be Taken to Boost FDI Inflows in India?

- Simplify and Streamline Regulatory Processes: India can further simplify and streamline its regulatory processes, including licensing, permits, and approvals. Implementing a single-window clearance system or a digital platform for regulatory compliance can reduce bureaucracy and enhance the ease of doing business.

- Improve Infrastructure Development: Focus on improving infrastructure across sectors such as transportation, logistics, power, and digital connectivity.

- Developing world-class infrastructure facilities and industrial clusters will attract foreign investors looking for efficient and well-connected business environments.

- Enhance Investor Protection Mechanisms: Strengthening investor protection mechanisms, including robust intellectual property rights (IPR) enforcement, contract enforcement, and dispute resolution mechanisms, will instil confidence in foreign investors.

- This can be achieved through judicial reforms, specialised commercial courts, and alternative dispute resolution methods.

- Promote Sector-Specific Investment Policies: Formulate sector-specific investment policies and incentives to attract FDI in key sectors such as manufacturing, renewable energy, healthcare, technology, and e-commerce.

- Tailoring policies to address the specific needs and requirements of each sector can encourage foreign investors to invest in those areas.

National E-Commerce Policy

Why in News?

The Indian government is set to introduce a national e-commerce policy that aims to create a favorable environment for the development of the sector and drive exports.

- The e-commerce policy was first proposed in 2018 and in 2019, a draft of the e-commerce policy was released.

- Department for Promotion of Industry and Internal Trade (DPIIT), the Ministry of Commerce and Industry emphasized the need for a streamlined regulatory framework, technological advancements, and efficient supply chain integration.

What are the Key Points About the Upcoming E-Commerce Policy?

- Aim:

- The national e-commerce policy aims to establish a regulatory framework that facilitates ease of doing business in the sector.

- Boosting Exports:

- The policy recognizes the significant export potential of India's e-commerce sector.

- By 2030, India's e-commerce export potential is estimated to range between 200 billion USD to 300 billion USD annually.

- With global cross-border e-commerce exports projected to reach 2 trillion USD by 2025, India aims to capitalize on this growth opportunity.

- The policy recognizes the significant export potential of India's e-commerce sector.

- Regulatory Body and FDI:

- The possibility of establishing a regulator for the e-commerce sector is being considered, but its implementation may take time.

- Local traders' associations have been advocating for an empowered regulatory body to enforce e-commerce rules and curb violations.

- While 100% foreign direct investment (FDI) is allowed in the marketplace model, FDI is not permitted in the inventory-based model.

- Addressing Trader Concerns:

- Traders have expressed concerns regarding the violation of e-commerce rules, such as deep discounts and preferences given to select sellers.

- The policy intends to clarify these issues and provide greater transparency in the rules governing FDI in e-commerce.

- The Consumer Protection (e-commerce) Rules 2020 and proposed amendments will be aligned with the e-commerce policy for consistency.

- Comprehensive Framework:

- The e-commerce policy will serve as an overarching framework for the sector, ensuring coherence among various governing acts.

- The sector is governed by the FDI policy, the Consumer Protection Act, of 2019, the Information Technology Act of 2000, and the Competition Act, of 2002.

- The policy aims to streamline these regulations and create a conducive environment for the growth of the e-commerce industry.

- The e-commerce policy will serve as an overarching framework for the sector, ensuring coherence among various governing acts.

What are the Other Related Indian Government's e-commerce Initiatives

- Launching the BharatNet project:

- Provide internet connectivity in local bodies in every Panchayat, which will increase the reach and access of e-commerce in rural areas.

- Open Network for Digital Commerce (ONDC):

- A network that aims to provide equal opportunities for Micro, Small and Medium Enterprises (MSME) to thrive in digital commerce and democratize e-commerce

- Digital India initiative:

- The Digital India initiative has provided solid impetus to other government-led initiatives, including Start Up India and Aatmanirbhar Bharat, which have great potential to translate into global success.

Compromise Settlement of Willful Defaulters

Context

The Reserve Bank of India (RBI) has recently issued a circular that allows banks to settle loans under a compromise with willful defaulters and fraudsters. This means that banks can accept a partial payment from these borrowers and write off the remaining amount as a loss. The RBI claims that this move will help banks recover some of their dues and clean up their balance sheets.

Details

- RBI has recently issued a circular that allows banks to offer compromise settlements to willful defaulters, i.e., borrowers who can repay their loans but deliberately avoid doing so. This move has sparked a debate among experts and stakeholders on its merits and demerits.

- This move has been widely criticized by experts and activists, who argue that it will have negative consequences for the banking sector and the economy.

- They point out that by allowing willful defaulters and fraudsters to settle loans under the compromise, the RBI is effectively condoning their actions, placing the burden of their misdeeds on the shoulders of ordinary citizens.

Some of the possible impacts of this move are

Erode the credibility and accountability of the banking sector

- It will erode the credibility and accountability of the banking sector. By letting willful defaulters and fraudsters off the hook, the RBI is sending a signal that there are no serious consequences for violating the law and ethics.

- This will undermine the trust and confidence of depositors, investors, and regulators in the banking sector.

Encourage more willful defaults and frauds

- It will encourage more willful defaults and frauds in the future. By offering an easy way out for willful defaulters and fraudsters, the RBI is creating a moral hazard and an incentive for them to repeat their offences.

- This will increase the risk and cost of lending for banks and ultimately affect their profitability and stability.

Hurt the public interest and social justice

- It will hurt the public interest and social justice. By allowing wilful defaulters and fraudsters to settle loans under the compromise, the RBI is shifting the losses from them to the public. The public will have to bear the brunt of higher taxes, lower interest rates, reduced credit availability, and lower economic growth.

- This move will also widen the gap between the rich and the poor, as wilful defaulters and fraudsters are often wealthy and influential individuals or corporations.

[Intext Question]

Willful defaulters

- Willful defaulters are those who have defaulted on their loans despite having adequate cash flows or assets to repay them. They may also have diverted the funds for purposes other than those specified in the loan agreement, sold or disposed of the assets without the bank’s consent, or falsified their accounts or documents.

- The RBI has prescribed various measures to deal with such borrowers, such as declaring them ineligible for further credit facilities, initiating criminal proceedings against them, and publishing their names and photographs in newspapers.

- However, these measures have not been very effective in recovering the dues from wilful defaulters. According to a report by TransUnion CIBIL, only 17% of the wilful default cases filed by banks between 2014 and 2019 resulted in recovery.

- The legal process involved in these cases is often lengthy and cumbersome, involving multiple forums such as debt recovery tribunals, high courts and the Supreme Court.

- Some wilful defaulters may have fled the country or declared bankruptcy, making it difficult for banks to trace them or attach their assets.

The RBI has permitted banks to offer compromise settlements to such borrowers, subject to certain conditions. These include:

- The compromise settlement should be based on the net present value (NPV) of the recoverable amount from the borrower, taking into account the likely recovery through legal means and the cost and time involved in the process.

- The compromise settlement should be approved by a committee of senior officials of the bank and should be in line with the bank’s board-approved policy on compromise settlements.

- The compromise settlement should be reported to the RBI and other regulatory authorities as per the prescribed norms.

- The compromise settlement should not affect the borrower’s status as a willful defaulter, and the bank should continue to pursue other legal actions against the borrower as per the existing guidelines.

- The compromise settlement should not be construed as a waiver of any rights or claims of the bank against the borrower or any third parties.

The RBI’s move has been welcomed by some experts and bankers as a pragmatic and realistic approach to resolving the NPA problem. They argue that:

- The compromise settlement will help banks recover some of their dues from wilful defaulters in a timely and cost-effective manner, rather than writing them off as losses or provisioning for them indefinitely.

- It will free up capital and liquidity for banks, which can be used for lending to productive sectors and supporting economic growth.

- It will also benefit willful defaulters who are willing to cooperate with banks and settle their dues amicably, rather than facing legal hassles and reputational damage.

- It will not dilute the accountability or deterrence effect of the existing measures against willful defaulters, as they will remain ineligible for further credit facilities and face criminal proceedings.

Some examples of compromise settlements that have been offered by banks to willful defaulters are

- In 2019, the State Bank of India (SBI) settled its Rs 4100 crore loan exposure to Bhushan Steel Ltd., a steel company that was declared insolvent under the Insolvency and Bankruptcy Code (IBC), for Rs 931 crore under a one-time settlement scheme.

- In 2020, Punjab National Bank (PNB) settled its Rs 1200 crore loan exposure to Winsome Diamonds and Jewellery Ltd., a diamond exporter that was accused of fraud and money laundering by CBI and ED, for Rs 580 crore under a bilateral agreement.

- In 2021, the Bank of Baroda (BoB) settled its Rs 900 crore loan exposure to Reliance Communications Ltd. (RCom), a telecom company that was undergoing insolvency proceedings under the IBC, for Rs 550 crore under a resolution plan approved by the National Company Law Tribunal (NCLT).

The RBI’s move has also been criticized by some experts and activists as a lenient and unfair treatment of willful defaulters. They contend that:

- The compromise settlement will encourage moral hazard and adverse selection among borrowers, who may deliberately default on their loans in anticipation of getting a discount from banks later.

- It will undermine the rule of law and the principle of equality before the law, as it will create a distinction between honest and dishonest borrowers and reward the latter at the expense of the former.

- It will erode public trust and confidence in the banking system, as it will create a perception that banks are colluding with willful defaulters and letting them off lightly.

- It will also have fiscal implications, as it will reduce the tax revenue for the government and increase the burden on the public exchequer, which has to recapitalize the banks to cover their losses

- The RBI’s circular on compromise settlement for willful defaulters is a bold and controversial move that has both pros and cons. It is too early to judge its impact on the banking sector and the economy, as it will depend on how banks implement it in practice and how borrowers respond to it.

Some possible suggestions to improve the policy are

- The RBI should monitor and evaluate the performance of banks in offering compromise settlements to willful defaulters, and ensure that they follow the prescribed guidelines and criteria transparently and consistently.

- The RBI should review and revise the existing guidelines and measures against willful defaulters, and make them more stringent and effective, such as by imposing higher penalties, enhancing information sharing and coordination among banks and regulators, and expediting the legal process.

- The RBI should educate and sensitize the public about the rationale and objectives of the compromise settlement policy, and address any misconceptions or misgivings that may arise among various stakeholders.

- The RBI should complement the compromise settlement policy with other reforms and initiatives to prevent and resolve NPAs, such as by strengthening credit appraisal and monitoring systems, improving corporate governance and accountability, promoting alternative dispute resolution mechanisms, and facilitating asset reconstruction and resolution.

Conclusion

The compromise settlement for willful defaulters is a novel and innovative policy that aims to balance the interests of banks, borrowers and the economy. It has the potential to enhance the efficiency and effectiveness of NPA recovery and resolution, but it also poses some risks and challenges that need to be carefully managed. The success of this policy will depend on how well it is designed, implemented and communicated by the RBI and the banks.

Surplus Liquidity in Banking System

Context

As per the Reserve Bank of India (RBI’s) data release, Surplus liquidity in the banking system has declined 42.9 per cent due to advance tax payments.

About

About the information:

- The surplus liquidity is reflected by the amount of money absorbed by the Reserve Bank of India (RBI) which was fallen after the deadline for advance tax payout.

- Liquidity in the banking system is the difference between incremental credit and deposits.

- The current fall in (surplus) liquidity is a case of deposits coming down because of advance tax payments.

What is Surplus liquidity?

- Liquidity in the banking system refers to readily available cash that banks need to meet short-term business and financial needs.

- On a given day, if the banking system is a net borrower from the RBI under Liquidity Adjustment Facility (LAF), the system liquidity can be said to be in’ deficit’ and if the banking system is a net lender to the RBI, the system liquidity can be said to be in ‘surplus’.

- The LAF refers to the RBI’s operations through which it injects or absorbs liquidity into or from the banking system.

Why do Banks see surplus liquidity ‘beneficial’?

- Commercial banks have current accounts with central banks.

- All (excess) liquidity is held either in these central bank current accounts or in the deposit facility.

- In other words, excess liquidity by definition stays with the central bank.

- An individual bank can reduce its excess liquidity, for example by lending to other banks, purchasing assets or transferring funds on behalf of its clients.

Consequences of excess liquidity

- As a consequence of excess liquidity, market interest rates will remain low.

- This means it is cheaper for companies and people to borrow money, thus helping the economy recover from the financial and economic crisis, and allowing the banking system to build up liquidity buffers.

Evergreening of Loans

Why in News?

The Governor of the Reserve Bank of India (RBI), recently addressed bank boards and expressed concerns about banks adopting over-aggressive growth strategies and engaging in the evergreening of loans.

- The governor emphasized the need for robust corporate governance and highlighted instances of concealing the true status of stressed loans.

What is the Evergreening of Loans?

- About:

- Evergreening loans, a form of zombie lending, is a practice of extending new or additional loans to a borrower who is unable to repay the existing loans, thereby concealing the true status of the non-performing assets (NPAs) or bad loans.

- Approaches Utilised for Evergreening Loans:

- Selling and buying back loans or debt instruments between two lenders to avoid classifying them as NPAs.

- Persuading good borrowers to enter into structured deals with stressed borrowers to hide their default.

- Using internal or office accounts to adjust the repayment obligations of borrowers.

- Renewing or disbursing new loans to stressed borrowers or related entities closer to the repayment date of earlier loans.

- Impact:

- Evergreening loans can create a false impression of the asset quality and profitability of banks and delay the recognition and resolution of stressed assets.

- It can also undermine the credit discipline and moral hazard among borrowers, and erode the trust and confidence of depositors, investors and regulators.

- Loan write-off Vs. Evergreening:

- Loan write-offs are a process of removing bad loans from the books of banks after making adequate provisions for them. Loan write-offs do not mean that the borrowers are relieved of their repayment obligations or that the banks stop pursuing recovery from them. Loan write-offs are done to clean up the balance sheet of banks and reflect their true financial position.

- Write-off exercise has enabled banks to reduce their non-performing assets, or defaulted loans, by Rs 10,09,510 crore ($123.86 billion) in the last five years.

- Evergreening of loans, on the other hand, is a practice of extending new or additional loans to a borrower who is unable to repay the existing loans, thereby concealing the true status of the non-performing assets (NPAs) or bad loans.

- Initiatives by RBI:

- The RBI has cautioned banks against adopting over-aggressive growth strategies, underpricing or over-pricing of products, concentration or lack of diversification in deposit or credit profile, which can expose them to higher risks and vulnerabilities.

- The RBI has also implemented various measures to support the banking sector, including providing liquidity support, regulatory forbearance, the establishment of an asset reconstruction company (ARC), and the resolution framework.

- However, the RBI has highlighted that these measures alone are insufficient if banks do not improve their risk management and governance practices.

- Several banks have faced penalties imposed by the RBI for violating various norms related to KYC (Know Your Customer), customer grievance redressal, fraud reporting, etc.

- Supervisory action has also been initiated by the RBI against some large private sector banks for governance lapses.

How can Evergreening of Loans be Controlled?

- Enhanced Risk Assessment: Financial institutions should adopt robust risk assessment practices to evaluate the creditworthiness of borrowers accurately.

- This involves conducting thorough due diligence, analyzing repayment capacity, and assessing the viability of the borrower's business model. By accurately identifying potential risks, lenders can avoid the need for evergreening loans.

- Transparent Reporting and Disclosure: Transparency is crucial in preventing evergreening of loans. Lenders should provide accurate and timely information on their loan portfolios, including non-performing loans (NPLs) and loan restructuring.

- Clear and transparent disclosure requirements enable regulators, investors, and other stakeholders to assess the financial health of banks and identify any potential evergreening practices.

- Asset-liability Management: There is a need to lay emphasis on the importance of asset-liability management (ALM),

- ALM involves assessing and monitoring the potential risks arising from the maturity mismatch between assets and liabilities, interest rate fluctuations, and other market risks.

- Banks have been advised to promptly interact with the media in order to dispel any misinformation or rumours on social media that can trigger panic among depositors.

- ESG (Environmental, Social, and Governance) Norms: There is a need for banks to comply with ESG (Environmental, Social, and Governance) norms as they are becoming increasingly relevant for investors and stakeholders.

- Banks should adopt sustainable business practices, disclose their ESG performance, and align their lending policies with national and international goals on climate change and social welfare.

- ESG goals are a set of standards for a company’s operations that force companies to follow better governance, ethical practices, environment-friendly measures and social responsibility.

- Recommendations of P J Nayak Committee:

- According to the Committee to Review Governance of Boards of Banks in India, wherever significant evergreening in a bank is detected by the RBI, penalties should be levied through cancellations of unvested stock options and claw-back of monetary bonuses on officers concerned and on all whole-time directors, and the Chairman of the audit committee be asked to step down from the board.

|

38 videos|5166 docs|1086 tests

|