UPSC Daily Current Affairs- 30th July 2023 | Current Affairs & Hindu Analysis: Daily, Weekly & Monthly PDF Download

GS-I

Aravalli Range

Subject: Geography

Why in News?

A seven-member team called the "Aravalli Rejuvenation Board" was recently formed to curb illegal mining in the protected Aravallis region.

About Aravalli Range:

- It is one of the oldest fold mountains of the world.

- It runs approximately 670 km (430 mi) in a south-west direction, starting near Delhi, passing through southern Haryana and Rajasthan, and ending in Gujarat.

- The highest peak is Guru Shikhar at 1,722 metres (5,650 ft). Guru is a peak in the Arbuda Mountains of Rajasthan.

- Rivers: Three major rivers and their tributaries flow from the Aravalli, namely Banas and Sahibi rivers which are tributaries of Yamuna, as well as Luni River which flows into the Rann of Kutch.

- Formation:

- It is part of the Aravalli-Delhi orogenic belt, which is a large and complex geological structure formed due to the collision of tectonic plates during the Proterozoic era.

- It is part of the Indian Shield that was formed from a series of cratonic collisions.

- In ancient times, Aravalli were extremely high but since have worn down almost completely by millions of years of weathering.

- The range is rich in mineral resources like copper, zinc, lead, and marble.

- It is divided into two sections: the Sambhar-Sirohi ranges, taller and including Guru Shikhar; and the Sambhar-Khetri ranges, consisting of three ridges that are discontinuous

Source: The Hindu

Permafrost

Why in News?

Scientists recently revived a worm that was frozen 46,000 years ago below the surface in the Siberian permafrost.

About Permafrost:

- Permafrost is any ground that remains completely frozen—32°F (0°C) or colder—for at least two years straight.

- Global Distribution:

- These permanently frozen grounds are most common in regions with high mountains and in Earth’s higher latitudes—near the North and South Poles.

- Permafrost covers large regions of the Earth. Almost a quarter of the land area in the Northern Hemisphere has permafrost underneath.

- Composition:

- Permafrost is made of a combination of soil, rocks and sand that are held together by ice. The soil and ice in permafrost stay frozen all year long.

- Near the surface, permafrost soils also contain large quantities of organic carbon—a material leftover from dead plants that couldn’t decompose, or rot away, due to the cold.

- Lower permafrost layers contain soils made mostly of minerals.

- A layer of soil on top of permafrost does not stay frozen all year. This layer, called the active layer, thaws during the warm summer months and freezes again in the fall.

Source: The Hindu

GS-II

National Dental Commission Bill, 2023

Why in News?

The Lok Sabha passed the National Dental Commission Bill, 2023.

About

- The ultimate goal of the bill is to regulate the dental profession, provide quality dental education, and make high-quality oral healthcare more accessible to the public.

- The Bill repeals the Dentists Act, 1948 and constitutes:

- the National Dental Commission,

- the Dental Advisory Council and

- three autonomous Boards for regulating dental education and standards of dentistry.

Key features of the Bill are:

- National Dental Commission: The proposed bill aims to replace the existing Dental Council of India with a new body called the National Dental Commission. The primary objectives of the commission include formulating policies and maintaining high-quality standards for dental education and the dental profession in the country.

- The Chairperson will be appointed by the central government, upon the recommendation of a search-cum-selection committee chaired by the Cabinet Secretary.

- Ex-officio members of the Commission include: (i) Presidents of the three autonomous Boards, (ii) the Director General of Health Services, (iii) Chief of the Centre for Dental and Educational Research, All India Institute of Medical Sciences.

- Autonomous boards: The bill outlines the creation of three autonomous boards under the National Dental Commission's purview:

- Undergraduate and Postgraduate Dental Education Board: This board will be responsible for setting standards and guidelines for dental education institutions.

- Dental Assessment and Rating Board: The board's role will be to assess and rate dental institutions, publish assessment reports and ratings, and have the authority to recognize or de-recognize degrees.

- Ethics and Dental Registration Board: This board will maintain an online and live national register for dentists, regulate ethics in dental practices, and ensure professional conduct.

- Regulation of fees: The bill regulates 50 percent of seats in private dental colleges to ensure more accessible and affordable dental education.

- Establishment of a Dental Advisory Council: It would be established by the central government. The council's primary function will be to advise the National Dental Commission and serve as a platform for states and Union territories to express their views on dental education and examination.

- State Dental Council: The state governments are required to institute State Dental Councils. The Councils are required to receive grievances related to professional/ethical misconduct against registered dentists.

- Entrance examinations: Admission to the Bachelor of Dental Surgery course will be done through NEET. The Commission will specify the manner of conducting common counselling for undergraduate and postgraduate admissions.

- A National Exit Test (Dental) will be held in the final undergraduate year for: (i) granting licence to practice dentistry, (ii) enrolment in state/national registers, and (iii) for admission to postgraduate dental education. Until the passage of the Bill, postgraduate admissions in Master of Dental Surgery (MDS) will be conducted through NEET.

Source: The Print

Indian Institutes of Management (Amendment) Bill

Subject: Polity

Why in News?

The Union Education Minister introduced the Indian Institutes of Management (Amendment) Bill.

About Indian Institutes of Management (Amendment) Bill

- It proposes to amend the 2017 Act so that the Visitor can nominate the Chairperson of the Board of Governors of IIMs .

- Section 16 of the Act will be amended to provide more powers to the Visitor in the appointment of IIM Directors.

- It proposes to make the President as the Visitor of all IIMs.

- A new Section, 10A, would be added so that the President shall be the Visitor of every Institute.

- It will empower the Central government to constitute an interim Board in case of suspension or dissolution of the said Board of Governors.

Key Highlights

- The Director will be appointed out of the panel of names recommended by a search-cum-selection committee to be constituted by the Board consisting of the Chairperson of the Board, who shall be the Chairperson of the search-cum-selection committee, one member to be nominated by the Visitor and two Members chosen from amongst eminent administrators, industrialists, educationists, scientists, technocrats and management specialists.

- The Bill is also to change the National Institute of Industrial Engineering, Mumbai as the Indian Institute of Management, Mumbai.

- Section 17 of the Act, that gives powers to the Board for initiation of inquiry against the Director, has been deleted in the Bill.

- Section 29 of the present Act on “Coordination Forum of the Institute” will also be amended so that an eminent person to be nominated by the Visitor shall be the Chairperson of the Forum.

Concerns

- IIMs were opposed to the idea because they feared that this would encroach upon their autonomy.

- They yielded when the Bill provided them complete autonomy in all matters, including the appointment of the Directors. Their boards were empowered. Now they have lost all of those things and will now be governed the way the IITs, NITs and the Central Universities are.

Conclusion

- The amendments will have an impact on the autonomy of IIMs and they will be governed the way Central Universities are governed.

Source: The Hindu

Charting the Path for the Sixteenth Finance Commission

Subject: Polity

Why in News?

Many critical changes have taken place since the constitution of the Fifteenth Finance Commission in November 2017 and the Sixteenth Finance Commission is due to be set up shortly.

- The 16th FC will primarily determine how much of the Centre’s tax revenue should be given away to States (the vertical share) and how to distribute that among States (the horizontal share).

Fifteenth Finance Commission Recommendations (applicable from 2021 to 2026)

- Distribution of Tax Proceeds: The Commission has recommended a fair distribution of tax proceeds between the central government and the states, ensuring a balanced fiscal sharing mechanism.

- Impact of GST

- The FC emphasises the need to study the impact of the Goods and Services Tax (GST) on the economy.

- This assessment aims to understand the implications of GST implementation and its effects on various sectors.

- Performance-based Incentives: These incentives would be based on the efforts of the States to address issues such as population control, ease of doing business, and other relevant factors.

- Grants to States

- The FC has proposed the provision of revenue deficit grants, grants to local bodies, and disaster management grants to the states.

- These grants aim to support the financial needs of the states and ensure effective governance.

Critical Changes Since the Constitution of 15th FC

- The biggest challenge and change were the pandemic COVID-19 and the subsequent geopolitical challenges i.e., China’s aggression on LAC.

- The combined government debt-GDP ratio had shot up close to 90% at the end of 2020-21.

- Many States are facing large fiscal imbalances.

Expected Deliberations upon the Constitution of the 16th Finance Commission

- Assessment of the Vertical and Horizontal Distribution

- The 14th Finance Commission had raised the share of States in the divisible pool of central taxes (Vertical Distribution) to 42% from 32%.

- This was revised to 41% when the number of States in India was reduced to 28.

- It is likely that during the deliberation on 16th FC, states will demand that this proportion be raised, but there is not much room for stretching this further given the Centre’s expenditure needs and the constraints on its borrowing limit.

- Therefore, much of the debate will centre on the horizontal distribution formula (Distribution among states).

- Discussion on Cesses and Surcharges

- During 2020-21 to 2023-24, the effective share of States in the Centre’s gross tax revenues (GTR) averaged close to 31%, which was significantly lower than the corresponding share of nearly 35% during 2015-16 to 2019-20.

- This was due to the inordinate increase in the share of cesses and surcharges to 18.5% of the Centre’s GTR during 2020-21 to 2023-24 (BE) from 12.8% during 2015-16 to 2019-20.

- This heavy reliance on cesses and surcharges requires scrutiny by the 16thFinance Commission.

- One option is to freeze the share of cesses and surcharges to some base number.

- Under the 13th Finance Commission, this share was just 9.6%.A 10% upper limit of the share of cesses and surcharges as a percentage of Centre’s GTR may be recommended.

- The share of States must be increased if the proportion crosses 10%.Thus, there will be one proportion, say 42%, if cesses and surcharges exceed 10%, and another share of 41% if they are 10% or below.

- The formula may be nuanced by the 16thFinance Commission with the help of the latest data.

- Decline in Total Divisible Pool

- The share of individual States in the Centre’s divisible pool of taxes is determined by a set of indicators that includes population, per capita income, area, and incentive-related factors such as forest cover and demographic change.

- In the case of per capita income, it is the distance of a State’s per capita income from a benchmark, usually kept at the average per capita income of the top three States that is used as a determining factor.

- This distance criterion implies relatively larger shares for relatively lower income States. At present, it has the highest weight of 45% — it had an even higher weight previously.

- Many of the richer States have argued for a lowering of the weight given to this criterion.

- However, due attention needs to be paid to the needs of the lower income States.

- These States are expected to provide a relatively larger share of ‘demographic dividend’ to India in future provided attention is paid to the educational and health needs of their populations.

Possible Recommendations for the 16th FC

- Re-examination of 2018 Amendment to the Centre’s FRBM

- This was also recommended by the 15thFinance Commission.

- The debt-GDP ratio for the combined account of central and State governments had peaked at 89.8% in 2020-21, of which the Centre’s debt-GDP ratio excluding any on-lending to the States amounted to 58.7%, and that of States was 31%.

- While these numbers have begun coming down, these are still considerably above the corresponding Fiscal Responsibility and Budget Management (FRBM) norms of 40% and 20%, as in the 2018 amendment.

- In 2020-21, the Centre’s fiscal deficit had shot up to 9.2% of GDP and that of States to 4.1%.

- In view of the large departures of the debt and fiscal deficit to GDP ratios from their corresponding norms and the reduction of the States’ debt-GDP target to 20%, the 2018 amendment to the Centre’s FRBM needs to be re-examined.

- Restraint on Freebies

- A few State governments appear to have relatively larger debt and fiscal deficit numbers relative to their GSDPs.

- In this context, two concerns appear: these relate to the proliferation of subsidies and the re-introduction of the old pension scheme in States without a clear identification of the sources of financing and the resultant fiscal burdens.

- Often, such subsidies are sought to be financed by raising the fiscal deficit.

- All political parties are guilty on this count, some more than others, but trying to apportion blame will be a wrong start.

- In a poor country, where millions of households struggle for basic human needs, it sounds cruel to argue against safety-nets for the poor.

- But it is precisely because India is a poor country, we need to be more cautious about freebies.

- The next Finance Commission should issue clear guidelines in the interest of long-term fiscal sustainability and the spending on freebies.

Reform Needed to Restrain Freebies

- One innovation which may be relevant in this context is to set up a loan council, as recommended by the 12thFinance Commission.

- This independent body should oversee the loan magnitudes and profiles of the central and State governments.

- The 16thFinance Commission should examine the subject of non-merit subsidies in detail.

- The Finance Commission should be strict about States maintaining fiscal deficit within limits.

- It should incentivise States maintaining fiscal deficit (for example including fiscal performance as a criterion in horizontal distribution) and sticks for those that exceed fiscal deficit limits (by suitably acting on the extent of borrowing allowed).

Conclusion

- In the pre-reform period, the Finance Commission recommendations were not that critical because the Centre had other ways to compensate States.

- But after abolition of Planning Commission, Finance Commission remains virtually the sole architect of India’s fiscal federalism. Its responsibility and influence are, therefore, much larger.

- The recommendation made by 16thFC will be crucial as India is moving towards becoming the world’s third largest economy.

Source: The Hindu

GS-III

Biosimilars

Subject: Science and Technology

Why in News?

The health ministry plans to revamp guidelines for approving biosimilar drugs to make the regulatory pathway more robust and sync it with the rapidly evolving global landscape.

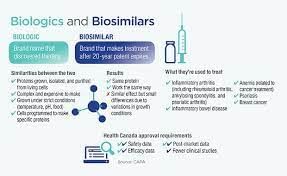

What are Biologics?

- Medicines known as biologics or biological products are created using living organisms through extremely intricate production procedures.

- The term "biologics" refers to a broad range of goods, including vaccines, therapeutic proteins, monoclonal antibodies, and gene and cell therapies.

What are Biosimilars?

- A biosimilar is a biologic that is "similar" to another biologic medication.

- Biosimilars and reference products are very similar in terms of safety, purity, and potency, but may differ somewhat in clinically inactive components.

- They are duplicates of biologic medications that have been utilized to treat a variety of diseases and disorders rather than brand-new pharmaceuticals.

- Every biosimilar is produced utilizing the same amino acid starting materials and exact, step-by-step procedures as its reference medicine, a well-researched, widely-used biologic drug that has been available for years. Biosimilars are all prescribed medications.

- The same raw materials and production techniques as the original biologic are used to create biosimilars. They are created and developed to be close to the original medication on which they are based.

- Examples include Semglee (insulin glargine-yfgn), Amjevita (adalimumab-atto), and Inflectra (infliximab-dyyb).

- Biosimilars are usually lower-cost alternatives to their original biologic.

Prospects of Biosimilars

- The growth of the market for biologics used to treat cancer (monoclonal antibodies), diabetes (insulin), and numerous other autoimmune diseases has opened up new opportunities for biosimilars worldwide.

- A large number of pharmaceutical companies in India are investing significantly in the creation of biosimilars.

- The first biosimilar version of trastuzumab emtansine, not only inhibits the growth of cancer cells (trastuzumab), but also delivers a cytotoxic agent to the cancer cell and aids in its destruction.

- The market for biosimilars is expanding because they are less expensive than biologics, whose high price puts them out of reach for many patients.

- The complex generics and biosimilars are intended to treat non-communicable diseases like cancer, asthma, and arthritis, encouraging their manufacturing can have a beneficial development impact.

Challenges of Biosimilars

- The pricey and drawn-out development process might take up to six or seven years.

- The temperature has a significant impact on the maintenance of biosimilars because of their great sensitivity. They must therefore be distributed via a cold chain network.

- Biosimilars and generic products differ significantly in terms of manufacturing costs and the required capital expenditures for machinery, buildings, and other assets.

State of Biosimilar in India

- The Regulation and Development of Biosimilars come under:

- Department of Biotechnology (DBT)

- Central Drugs Standard Control Organization (CDSCO)

- Indian council of Medical Research (ICMR)

- Institutional Biosafety Committee (IBC)

- National Control Laboratory Biosafety Committee

- The various Acts and Guidelines that Biosimilar comes under:

- Drugs and Committee Act (1940)

- Drugs and Cosmetics Rules (1945)

- Environment Protection Act (1986)

- Recombinant DNA Safety Guidelines (1990)

- Guidelines for preclinical and clinical data for rDNA vaccines, diagnostics and other biologicals (1999)

- CDSCO guidance for Industry (2008)

Way Forward

- To ensure unfair and unethical practices, a regulatory structure must be put in place, and proper monitoring must be carried out.

- India needs to invest in fundamental research and education to grow its ecosystem for biological research.

Source: The Hindu

International Tiger Day: How Project Tiger saved the big cat in India

Subject: Environment and Ecology

Why in News?

About the International Tiger Day:July 29 is celebrated world over as the International Tiger Day in a bid to raise awareness on various issues surrounding tiger conservation.

- It was first instituted in 2010 at the Tiger Summit in St Petersburg, Russia when the 13 tiger range countries came together to create Tx2, the global goal to double the number of wild tigers by the year 2022.

- However, the designated date for achieving the goals of Tx2 saw uneven progress.

- As per the World Wildlife Fund (WWF), while countries in Southeast Asia struggled to control population decline, India fared much better.

- According to the Wildlife Institute of India's (WII) 5th tiger census (quadrennial), India’s tiger population increased to 3,682 in 2022 (revised from 3,167 recently), up from 1,411 in 2006.

- In 2022, the maximum number of tigers (785) were reported to be in MP, followed by Karnataka (563), Uttarakhand (560), and Maharashtra (444).

- Nearly a quarter of the tigers were reportedly outside protected areas.

- This is made possible because of political commitment, which led to governments, communities, conservation organisations, etc., working together.

- The successes in India can be attributed largely to the success of Project Tiger, which celebrated its 50th anniversary earlier this year (2023).

- Project Tiger was launched by the Central government on April 1, 1973, at the Jim Corbett National Park (Uttarakhand) to promote conservation of the tiger.

- According to reports, while there were 40,000 tigers in the country at the time of the Independence, they were soon reduced to below 2,000 by 1970 due to widespread hunting and habitat destruction.

- In 1970, the IUCN declared the tiger as an endangered

- The programme was initially started in 9 tiger reserves of different States such as Assam, Bihar, Karnataka, MP, Maharashtra, Odisha, Rajasthan, UP and West Bengal, covering over 14,000 sq km.

- Notably, Project Tiger didn’t just focus on the conservation of the big cats. It also ensured the preservation of their natural habitat as tigers are at the top of the food chain.

- The number of tigers in India began to rise and by the 1990s, their population was estimated to be around 3,000.

- However, the success story of Project Tiger suffered a major setback when the local extermination of tigers in Rajasthan’s Sariska made headlines in 2005.

- This led to the setup of a task force and the government reconstituted Project Tiger and established the National Tiger Conservation Authority (NTCA) in 2005.

- The NTCA had more power to check poaching and preserve the tiger population by setting up the Tiger Protection Force and funding the relocation of villages from the protected areas.

- Today, there are 54 tiger reserves across India, spanning 75,000 sq km.

- Nearly 75% of the global tiger population (in the wild) can today be found in India.

- The goal of Project Tiger is to have a viable and sustainable tiger population in tiger habitats based on a scientifically calculated carrying capacity.

- This means the tiger population of the country cannot be increased at the same pace because that will result in an increase in conflict with human beings.

Source: The Hindu

|

38 videos|5293 docs|1118 tests

|