Class 1 Exam > Class 1 Notes > Mathematics for Class 1 > Worksheet: Money - 2

Money - 2 Class 1 Worksheet Maths Chapter 12

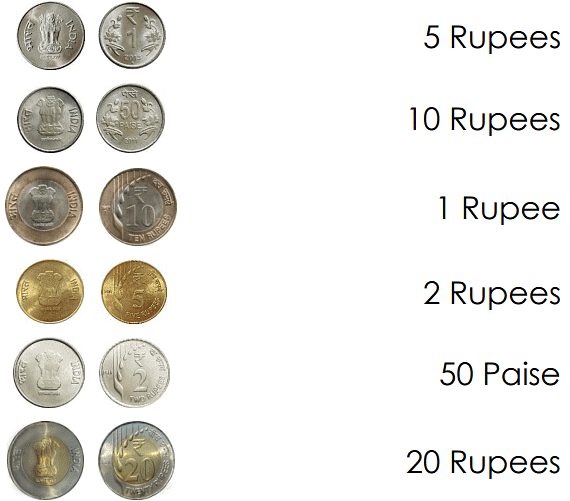

Q1: Draw a line to match each coin with its name.

Q2: Draw and label the 6 coins.

Q3: Draw a line to match each coin with its value.

Q4: Draw the 6 coins in order from least valuable to most valuable.

Q5: Which of the following you can buy from  note?

note?

(a)

(b)

(c)

(d)

Q6: Which set of coins shows Rs. 5?

(a)

(b)

(c)

(d)

Q7: Mohan has four Rs. 5 coins, out of which he gave 3 Rs. 5 coins to buy a toy. How much money, he is left with?

(a) Rs.2

(b) Rs.5

(c) Rs.10

(d) Rs.1

You can access the solutions to this worksheet here.

The document Money - 2 Class 1 Worksheet Maths Chapter 12 is a part of the Class 1 Course Mathematics for Class 1.

All you need of Class 1 at this link: Class 1

|

16 videos|223 docs|23 tests

|

FAQs on Money - 2 Class 1 Worksheet Maths Chapter 12

| 1. What are the different types of money? |  |

Ans. There are several different types of money, including cash, coins, checks, credit cards, and electronic forms of payment such as mobile wallets and online banking.

| 2. How does inflation affect the value of money? |  |

Ans. Inflation can decrease the value of money over time. When there is inflation, the prices of goods and services increase, meaning that each unit of currency can buy less compared to before.

| 3. What is the difference between fixed and variable interest rates on loans? |  |

Ans. A fixed interest rate on a loan remains the same throughout the entire loan term, while a variable interest rate can change over time based on market conditions. Fixed rates provide stability, while variable rates can offer the potential for lower or higher payments.

| 4. How does compound interest work? |  |

Ans. Compound interest is when interest is calculated on the initial amount of money deposited (or borrowed) as well as the accumulated interest from previous periods. This means that the interest earned (or owed) increases over time, resulting in faster growth (or accumulation) of funds.

| 5. What is the difference between a debit card and a credit card? |  |

Ans. A debit card allows you to spend money from your bank account directly, deducting the amount from your available balance. A credit card, on the other hand, allows you to borrow money from a credit card issuer up to a certain credit limit, which you must repay later with interest if not paid in full.

Related Searches